Productive Zakat Distribution in Determinant the

Revenue of Mustahik: Case in Baitul Mal Aceh

Evi Mutia, Lisa Annisa, Rahmawaty, Bustamam, and Meutia Fitri

Syiah KualaUniversity, Indonesia

Abstract. This study aims to determine the influence of productive zakat,

dependents of mustahik, and duration of mustahik business toward mustahik

earnings. This research is conducted by taking samples of mustahik who earn

productive zakat from Baitul Mal Aceh and chosen sample for 100 mustahik.

Data collection was used in the form of questionnaires measured on a Likert

scale. The result of the research shows that simultaneously productive zakat,

mustahik dependent, and duration of mustahik enterprises have an effect on

mustahik earnings. However partially only variable productive zakat that affect

the income of mustahik. Dependents of mustahik and duration of mustahik

business are not affect mustahik earnings.

Keywords: Productive Zakat ꞏ Dependents of Mustahik ꞏ Duration of Mustahik

Business ꞏ Mustahik Earnings

1 Introduction

Zakat is the fourth pillar of Islam, in which every Muslim whose income has reached

Nisab must carry out the pillars. Zakat does not only benefit the poor but also the rich

because their help will be appreciated by Allah SWT in the hereafter and also our form

of obedience to Allah SWT (Bashir & Ali, 2012). The purpose of the community to pay

zakat is not only to clean up the property, but the form of our obligation to Allah SWT

and also a form of our concern for fellow communities who need help. Zakat is

managed by an agency, specifically in Aceh; the zakat management agency is called

Baitul Mal. One of the goals of the distribution of zakat is to prosper the poor and the

government hopes that zakat can reduce poverty.

Reduced poverty rate is marked by increasing mustahik income. Mustahik income

can simply be interpreted as the whole result of mustahik business in the form of money

obtained by mustahik for the success of its business. There are several factors that cause

an increase in mustahik income, including productive zakat, mustahik dependency, and

mustahik business duration. According to Acting Head of Baitul Mal Aceh, each year

the number of zakat receipts in Baitul Mal Aceh continues to increase

(www.acehtrend.co, 2017). But the facts in the field show that the increasing number

of zakat receipts has not been able to reduce the number of poverty in Aceh. This is

evidenced by the information presented by the Central Statistics Agency (BPS) of

Aceh. The Aceh BPS released the increasing number of poor people in the province of

Aceh. In March 2017 the number of poor people reached 872.61 thousand people or

around 16.89 percent. Compared to the percentage of poor people in September 2016,

786

Mutia, E., Annisa, L., Rahmawaty, ., Bustamam, . and Fitri, M.

Productive Zakat Distribution in Determinant the Revenue of Mustahik: Case in Baitul Mal Aceh.

DOI: 10.5220/0010598400002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 786-796

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

there was a drastic increase in the number of poor people, reaching 31 thousand people

(Harian.analisadaily.com, 2017).

Zakat which is usually given to mustahik is consumptive zakat. However, as time

goes by, zakat is also given in a productive form. The aim of the Baitul Mal Aceh in

distributing productive zakat is helping the less fortunate to have income from their

own business. Baitul Mal also hopes that this productive zakat can change the status of

the community, which initially as mustahik will turn into muzaki. From the sources of

information obtained from the Baitul Mal Aceh, the number of mustahik who receive

productive zakat is 1,454 people, but mustahik whose income has reached Nisab after

the success of the mustahik business is only 140 people. This means that the success

rate of changing the status from Mustahik to Muzaki is only realized at 10%.

Many previous studies have been carried out, especially regarding the effect of

productive zakat on mustahik income. Arif & Ashar (2016) examined the effect of

productive zakat on the income of poor families. The results of his research show that

productive zakat affects the increase of mustahik income because there are differences

in mustahik income before and after receiving productive zakat from LAZ El-Zawa.

Muda & Arfan (2016) examined the effect of productive zakat, mustahik productive

age, and mustahik business duration on mustahik business productivity. The results of

the study showed that both the simultaneous and the partial amount of productive zakat,

the productive age of mustahik and the duration of the mustahik business had an effect

on the productivity of mustahik.

In this study the object of his research is mustahik which receives productive zakat

from Baitul Mal Aceh. The reason for choosing Baitul Mal Aceh because Baitul Mal

Aceh channeled productive zakat funds, and also provided guidance and supervision to

mustahik who received the productive zakat. The difference between this research and

previous research is that it lies in the variables and also the object of the research. The

difference in the research of Mutia & Zahara (2009), Fathullah & Hoetoro (2015), and

Arif & Ashar (2016) is the object of the research. Mutia & Zahara (2009) studied in

Bazda Jambi City, and Fathullah & Hoetoro (2015), Arif & Ashar (2016) researched at

LAZ El-Zawa Malang, while this research was conducted in Baitul Mal Aceh. The

difference between this study and the research conducted by Muda and Arfan (2016) is

the variable. Muda & Arfan (2016) examined the use of mustahik business productivity

as the dependent variable, whereas in this study the dependent variable was mustahik

income. This study aims to determine the effect of productive zakat, mustahik

dependence, and mustahik business duration on mustahik income.

2 Literature Review and Hypothesis

2.1 Mustahik Revenue

Revenue is the gross income from economic benefits during a certain period that comes

from the daily activities of an entity when the entity's inflows can increase equity, in

addition to the increase derived from the owner's equity contribution (Kieso et al., 2011:

955). Revenue can also be interpreted as an increase in owner's capital as a result of the

sale of goods / services carried out to customers (Warren et al., 2015: 56).

Productive Zakat Distribution in Determinant the Revenue of Mustahik: Case in Baitul Mal Aceh

787

While according to Soemarso (2009: 54) income is the amount of money charged

to customers for the sale of goods or services. Income can also be interpreted as gross

increase in capital derived from the sale of goods or services. Based on the above

understanding in the opinion of experts, it can be concluded that income is the amount

of money generated from an activity carried out; the activity is usually in the form of

selling certain products or services to buyers. In Act No. 23 of 2011, it is explained that

mustahik is a person who has the right to receive zakat. Mustahik income can be defined

as the amount of money received or obtained by mustahik for the results of its business

whose business capital comes from productive zakat funds.

2.2 Productive Zakat

Productive zakat is zakat distributed to mustahik which is intended to help mustahik

establish a business so that they can escape their current difficulties and may become

contributors to their own charity (Muhamat et al., 2013). Rose (2010) argues that zakat

funds must be given to provide loan capital for the benevolence or disbursement of

zakat for small businesses. This is because small businesses often find difficulties in

raising capital because of the strict requirements imposed by financial institutions to

make loans.

According to Asnaini (2008: 64) productive zakat which is zakat given to mustahik

where the zakat is not spent in one time but zakat funds are used by mustahik to run

and develop mustahik business / business, so that the business can fulfill its daily needs

day. The purpose of productive zakat assistance is to increase the revenue of salaries

through initial business capital assistance either in cash or equipment (Halim, Said &

Yusuf, 2012). Whereas according to Ayuniyyah, Pramanik, Saad, & Ariffin (2017) the

purpose of the productive zakat program is to change the status of the recipients of

zakat, it is expected that in the long run their status will change to pay zakat.

The use or utilization of zakat has been stipulated in Law Number 23 of 2011

concerning Zakat Management, namely:

a) Zakat can be utilized for productive business in the context of handling the poor

and improving the quality of the people.

b) Utilization of zakat for productive business is carried out if the basic needs of

mustahik have been fulfilled.

Mustahik income is the overall result in the form of money obtained by mustahik for

the success of the business that has been carried out. With the distribution of productive

zakat, then mustahik will have a business that it runs. With this effort, the mustahik

income will also increase. The results of research by Fathullah & Hoetoro (2015) and

Arif & Ashar (2016) show that productive zakat influences mustahik income.

H1: Productive zakat influences mustahik income

2.3 Mustahik Dependents

Dewi (2012) explained that the more the number of children, the more dependent the

burden of a family. The more number of members of the household owned, the more

cost of living must be spent, whereas if the fewer household members, the less burden

must be borne.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

788

Mustahik dependents are family members whose living expenses are borne by the

person who receives income which is usually a family head. Not only does the amount

of productive zakat affect mustahik income, but the number of mustahik dependents

can also affect mustahik income. If the number of dependents is small, it will get a large

income because the cost of living is not much and the consumption needs are not too

much. And vice versa, if the number of dependents is large, the amount of expenditure

for consumption will also be large so that it will reduce the amount of income earned.

Mutia & Zahara (2009) showed that the number of family members has an effect on

mustahik income. While the results of Rakhma & Ekawaty research show that the

number of family members does not affect the welfare of mustahik.

H2: Mustahik dependents affect mustahik income

2.4 Mustahik Business Duration

Business duration is the length of time the mustahik business is running, the length of

business can also determine how much experience mustahik has in developing his

business activities so that a statement emerges that the longer a person runs a business,

the more experience he has so that he can determine the strategy must be used so that

in the future the business is more developed and its productivity will also increase

(Rakhma & Ekawaty, 2014).

The results of research from Fathullah & Hoetoro (2015) show that the duration of

business run by mustahik affects mustahik income. While the results of Arif & Ashar's

research (2016) found that partially the duration of mustahik business did not affect

mustahik income.

H3: Business duration has an effect on mustahik income

3 Research Methods

3.1 Research Design

Research design (research design) is a plan to collect, measure, and analyze data, based

on research questions from the study (Sekaran & Bougie, 2017: 108). According to

Sekaran and Bougie (2017: 108) issues related to decisions related to study objectives

(explorative, descriptive, casual), research strategies (experiments, surveys, interviews,

case studies), research locations (study situations), the level at which the study

manipulated and controlled by the researcher (the level of the intervention of the

researcher), the level at which the data will be analyzed (unit of analysis), and the

temporal aspect (time horizon), are important in the research design.

The research design is arranged so that the research becomes directed and can run

as expected, which includes: The purpose of this study is to test the hypothesis. This

type of research is causal study where the level of intervention in this study is minimal

intervention. The situation of this research is not regulated. The unit of analysis in this

study was individuals who received productive zakat from Baitul Mal Aceh and the

data collected were the results of questionnaires distributed to mustahik who received

productive zakat in the Baitul Mal Aceh. This research is cross-sectional studies.

Productive Zakat Distribution in Determinant the Revenue of Mustahik: Case in Baitul Mal Aceh

789

3.2 Population and Research Sample

The population in this study is all mustahik who receive productive zakat funds from

the Baitul Mal Aceh, which are 1454 people. The sampling technique used is

probability sampling which uses simple random sampling by adopting the Slovin

formula which obtained 94 samples.

3.3 Sources and Data Collection Techniques

Data sources in this study are primary data. Primary data in this study were obtained

from questionnaires. The questionnaire is a list of pre-designed written statements and

questions in which respondents will record or choose their answers, usually in clearly

defined alternatives (Sekaran & Bougie, 2017: 170). The questionnaire in this study

was distributed to mustahik who received productive zakat from Baitul Mal Aceh.

3.4 Operationalization of Variables

3.4.1 Dependent Variables

The dependent variable in this study is mustahik income. Mustahik income is the

income earned by mustahik after deducting the costs or expenses used for the survival

of mustahik business. In this study the indicators used in measuring mustahik income

are fixed income, business form, adequacy, standard of living, return on loan capital,

and poverty (Amir, 2017).

3.4.2 Independent Variables

Productive Zakat

Productive zakat is zakat distributed to mustahik which is intended to help mustahik

establish a business so that they can escape their current difficulties and may become

contributors to their own charity (Muhamat et al., 2013). Indicators used in measuring

productive zakat are business development, business type, business improvement, and

motivation to work (Amir, 2017).

Mustahik Dependent

Mustahik dependents are family members whose living expenses are borne by the

person who receives income which is usually a family head. Indicators used to measure

mustahik dependents are income, increase in business and expenditure.

Mustahik Business Duration

Business duration is the period of time the mustahik business is running or how much

experience mustahik has in developing his business activities (Rakhma and Ekawaty,

2014). The indicator used to measure the variable duration of mustahik business is

increasing income, experience, quality and quantity, and professionalism (Amir, 2017).

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

790

4 Research Results and Discussion

4.1 Description of Research Objects

The data in this study are primary data using questionnaires as a means of obtaining

data. Questionnaires were distributed directly to mustahik who received productive

zakat from Baitul Mal Aceh with a total of 100 respondents. Respondents in this study

had different characteristics. Based on the results of distributing questionnaires to 100

respondents, 8% of respondents were male and the remaining 92% were female. For

the most age-based characteristics, 38% of respondents aged 41-50 years, and 35%

were aged 31-40 years.

For the characteristics of job classification, 83% is in the trade sector while 17% is

in agriculture. For the characteristics of the number of productive zakat received, most

receive Rp. 8,000,000-10,000,000, which is 37 people who receive Rp. 4,000,000-

6,000,000, totaling 33 people. For the monthly income characteristics of respondents

before earning productive zakat is dominated by those who earn income as much as

Rp500.00-1,000,000 which is 45 people.

While for the monthly income characteristics of respondents after earning

productive zakat is dominated by those who earn income of Rp1, 000,000-2,000,000

totaling 44 people. Before carrying out the research, first the data quality test is done

by testing the validity and reliability test, the next step is to analyze the data using the

classic assumption test that is normality test, multicolonearity test, and

heteroscedasticity test. Furthermore, hypothesis testing is done by t test (partial test)

and also multiple regression analysis by looking at significant values at 0.05 (5%).

4.2 Multiple Linear Regression Test Results

The output of SPSS (coefficients), can be obtained by multiple regression equation as

follows:

Y = 2,381 + 0,849X1 + 0,153X2 + 0,080X3 + e

From the regression equation, it can be seen that the results of each coefficient are for

a constant (a = 2,381), meaning that if the factors of productive zakat (X1), dependents

mustahik (X2), and the duration of mustahik (X3) are considered constant, then the

magnitude Mustahik income in Baitul Mal Aceh is 2,381. The productive zakat

regression coefficient (X1) is 0.849, meaning that every increase of one productive

zakat variable will increase the mustahik income by 84.9%. Thus the greater the amount

of productive zakat obtained, the relative will increase mustahik income that earns

productive zakat in the Baitul Mal Aceh.

Regression coefficient mustahik dependence (X2) is 0.153, meaning that every

increase of one in the dependent variable, then relatively will increase mustahik income

by 15.3%. Thus, the greater the number of mustahik dependents felt, the relative

increase in mustahik income that earns productive zakat in the Baitul Mal Aceh.

Mustahik (X3) business time regression coefficient is 0.080. This means that every

increase of one in the business duration variable, then relatively will increase mustahik

Productive Zakat Distribution in Determinant the Revenue of Mustahik: Case in Baitul Mal Aceh

791

income by 8%. Thus, the longer the running of mustahik business, it will relatively

increase mustahik income that earns productive zakat in the Baitul Mal Aceh.

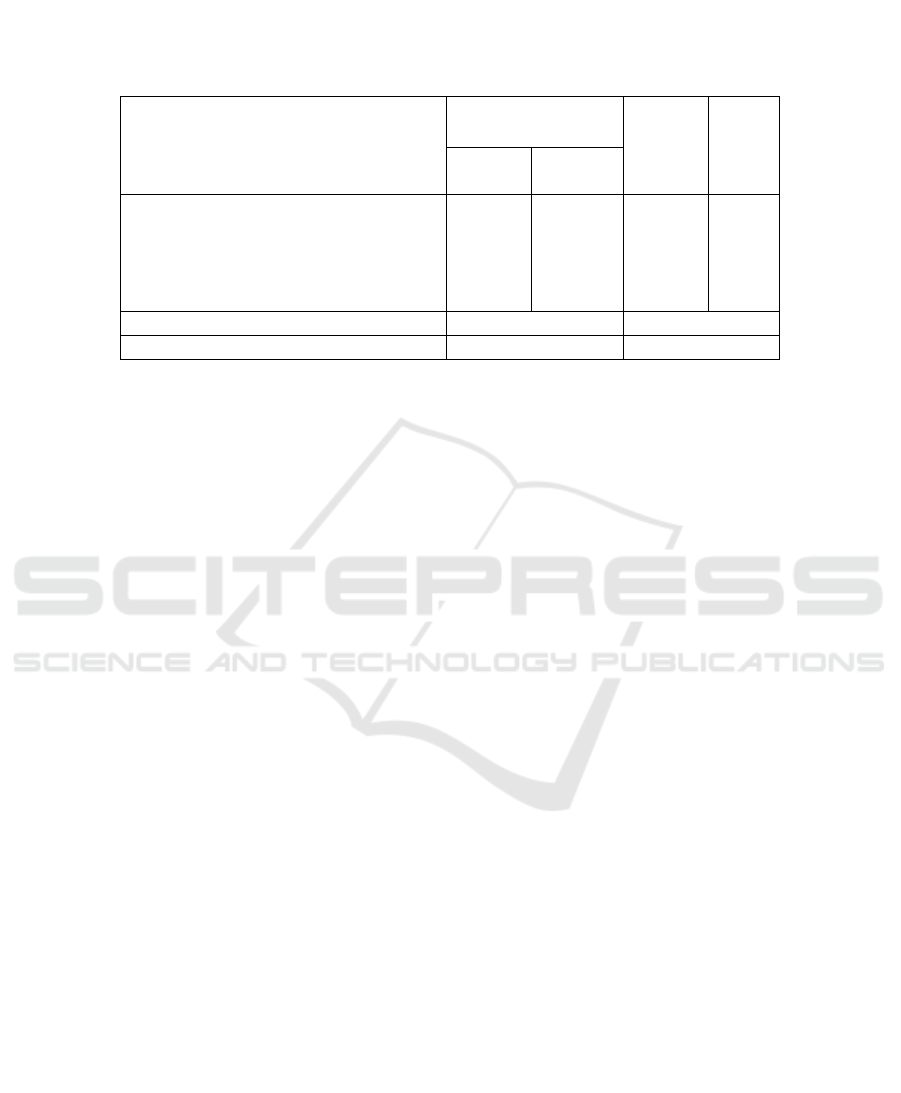

Table. Multiple Linear Regression Test Results.

Model

Understandardized

Coefficient

t Sig.

B Std.

Erro

r

1 (Constant) 2.381 2.060 1.156 .251

Productive zakat .849 .149 5.695 .000

Mustahik dependent .153 .153 1.002 .319

Duration of mustahik business .080 .134 .594 .319

Model RR Square

1 .748 .560

Then from the results of data testing can also be seen the closeness between the

independent variables (productive zakat, mustahik dependents, and mustahik business

duration) with the dependent variable (mustahik income) can be seen in the table above.

Correlation coefficient (R) of 0.745 indicates that the degree of relationship

(correlation) between the independent variable and the dependent variable is 74.5%.

This means that mustahik income has to do with productive zakat factors (X1),

mustahik dependents (X2), and mustahik (X3) business duration. Furthermore, the

coefficient of determination (R2) is 0.546, which means that 54.6% change in mustahik

income is affected by the variable productive zakat (X1), mustahik dependence (X2),

and mustahik (X3), while the rest is influenced by other variables not used in the study.

4.3 Hypothesis Testing

4.3.1 Effect of Earning Zakat, Mustahik Dependency, and Mustahik Business

Duration on Mustahik Income

From the test results for productive zakat (X1), mustahik dependents (X2), and

mustahik (X3) business duration shows the F-count value is 40.680. While the F-table

value is 2.70. This shows that F-count> F-table so that simultaneously the variables of

productive zakat (X1), mustahik dependence (X2), and mustahik business duration

(X3) significantly influence the income of mustahik (Y) who earn productive zakat in

Baitul Mal Aceh.

4.3.2 Effect of Productive Zakat on Mustahik Income

From the results of the tests carried out, the t-count of productive zakat is 5.695, while

the t-table value is 1.98. As previously explained, if t-count> t-table with a significant

level of 5% then h0 can be accepted. From the table above it can be concluded that h0

for productive zakat variables can be accepted, because 5,695> 1,98. That is, productive

zakat affects mustahik income. This is in accordance with the hypothesis that has been

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

792

made, namely productive zakat affects mustahik income. The results of this study are

the same as the results of previous studies that are used as references in this study,

namely research conducted by Fathullah & Hoetoro (2015), and Arif & Ashar (2016).

In the research Fathullah & Hoetoro and Arif & Ashar stated that productive zakat

received by mustahik affects mustahik income.

Productive zakat is considered very beneficial for mustahik, because this capital

lending system does not contain any interest at all. So that the obligation of the mustahik

only to pay the loan principal, where the principal loan is given time to pay for it for

one year. Productive zakat in the form of capital loans can be borrowed for more than

one period. Usually one period lasts for one year. When Mustahik is able to repay the

loan capital, then Mustahik wants to borrow again with a nominal value greater than

the previous loan, then the Baitul Mal Aceh will provide the loan to Mustahik with

certain considerations.

4.3.3 Effect of Mustahik Dependency on Mustahik Income

From the test results obtained obtained t-count value mustahik dependence is 1,002,

while the t-table value is 1, 98. As previously explained, if t-count> t-table with a

significant level of 5% then h0 can be accepted. So it can be concluded from the table

above, that h0 for mustahik dependent variable is rejected, because 1,002 <1, 98. This

means that the mustahik dependents do not affect mustahik income.

This is not in accordance with the hypothesis that has been made, namely mustahik

dependents affect mustahik income. The results of this study are in accordance with the

results of previous studies which are used as references in this study, namely the

research of Rakhma & Ekawaty (2014). In research Rakhma & Ekawaty stated that the

number of family members did not affect mustahik income. But the results of this study

are different from the results of Mutia & Zahara (2009) which states that the total family

members affect the increase in mustahik income.

Mustahik dependents do not have an effect on mustahik income may be caused by

data that has been obtained from research which shows that dominant mustahik agrees

even strongly agree that the number of dependents does not affect income. Mustahik

income is not affected by the size of the mustahik dependents, it is also possible that

not only mustahik business income is used to cover the living expenses of all family

members, but income from other family members also plays a role. Some mustahik can

be categorized as having good income, but the income is not comparable to the number

of mustahik family members who on average still set school.

4.3.4 Effect of Mustahik Business Duration on Mustahik Income

From the test results obtained obtained t-count value mustahik business duration is

0.594, while the t-table value is 1.98. As previously explained, if t-count> t-table with

a significant level of 5% then h0 can be accepted. So it can be concluded from the table

above, that h0 for mustahik business duration variable is rejected, because 0.594 <1.98.

That is, Mustahik Business Duration has no effect on mustahik income. This is not in

accordance with the hypothesis that has been made, namely the mustahik business

period has an effect on mustahik income. The results of this study are in accordance

with the results of previous studies which are used as references in this study, namely

Productive Zakat Distribution in Determinant the Revenue of Mustahik: Case in Baitul Mal Aceh

793

research conducted by Arif & Ashar (2016). In Arif & Ashar's research stated that

mustahik business duration did not affect mustahik income. However, this research is

inversely proportional to research conducted by Fathullah & Hoetoro (2015) which

states that mustahik business duration has an effect on mustahik income.

Baitul Mal Aceh does not provide large amounts of loans. For the first loan, Baitul

Mal only provides a loan of Rp. 1,000,000, and when Mustahik is able to repay the

loan, Mustahik can borrow another Rp. 2,000,000. Each period increases by IDR

1,000,000 if you want to borrow capital. The length of mustahik effort in this study can

be seen based on the amount of productive zakat funds lent by mustahik. For those who

get loans above Rp 6,000,000, it can be said that the business has been running for

several years. Based on the results of the characteristics of respondents, the number of

respondents who received productive zakat of Rp 10,000,000 was 38 people; this

indicates that mustahik business has been going on for a long time.

This should be a benchmark for increasing mustahik income. But the fact that

happened, although mustahik business has been going on for a long time and the income

gained also increased, but the increase in mustahik income was quite a few. This can

be seen from the income of respondents after earning productive zakat, the dominating

income of Rp. 2,000,000, which is 44 people. This shows that the length of mustahik

business does not guarantee that mustahik income will be sufficient to meet the needs

of mustahik.

The duration of mustahik business should be able to create valuable experiences

possessed by mustahik to help them in making the right decisions related to the

development of their business. The duration of mustahik business should also have an

effect in terms of increasing business in terms of quality and quantity. However, the

data obtained is the exact opposite. This may be due to Mustahik not having sufficient

capacity in developing the business, so that Mustahik is difficult in improving the

quality and quantity of its business.

5 Conclusions and Suggestions

5.1 Conclusion

1. Productive zakat, mustahik dependency and mustahik business period

simultaneously have a significant effect on mustahik income in the Baitul Mal Aceh.

2. Productive zakat has a significant effect on mustahik income in the Baitul Mal

Aceh. This means that the productive zakat given to mustahik is beneficial for

mustahik, thus affecting mustahik income.

3. Mustahik dependents do not affect mustahik income. This means that no matter how

many mustahik dependents do not affect mustahik income.

4. Mustahik business duration does not affect mustahik income. This means that even

though Mustahik has built its business for a long time, it does not affect the income

received by Mustahik.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

794

5.2 Suggestions

5.2.1 Academic Suggestions

For research to be more representative, further research is expected to increase the

number of respondents so that future research has a broader scope and produce better

research results. Subsequent research is also advised not to use the variable mustahik

dependents because the mustahik dependents are not one of the considerations of the

Baitul Mal Aceh in providing productive zakat. Subsequent research is also expected

to add variables such as business assistance, type of business and mustahik education

level.

5.2.2 Practical Suggestions

To each mustahik who earns productive zakat, it is expected that mustahik can continue

to learn from the experiences that have been gained in developing his business.

Mustahik is also expected to be able to improve the quality and quantity of the business

/ work they manage.

1. For the Baitul Mal Aceh, it is hoped that it can provide guidance to Mustahik so that

Mustahik is more professional in developing its business.

References

Ali, M. D. (1998). Sistem Ekonomi Islam Zakat dan Waqaf. Jakarta: UI Press.

Amir, M. F. (2017). Pemanfaatan Zakat Produktif serta Pengaruhnya terhadap Tingkat

Pendapatan Mustahiq Di Kota Makassar (Studi Kasus BAZNAS Kota Makassar). Universitas

Islam Negeri Sunan Kalijaga Yogyakarta.

Arif, A. H., & Ashar, K. (2016). Pengaruh Zakat Produktif Terhadap Pendapatan Keluarga

Miskin (Studi Kasus Pada Lembaga Amil Zakat El-Zawa Universitas Islam Negeri Maulana

Malik Ibrahim Malang). Jurnal Ilmiah Mahasiswa FEB Universitas Brawijaya.

Asnaini. (2008). Zakat Produktif dalam Perspektif Hukum Islam. Yogyakarta: Pustaka Pelajar.

Ayuniyyah, Q., Pramanik, A. H., Saad, N., & Ariffin, I. (2017). The Comparison between

Consumption and Production-based Zakat Distribution Programs for Poverty Alleviation and

Income Inequality Reduction. International Journal of Zakat, 2(2), 11–28.

Bashir, M. S., & Ali, N. N. H. (2012). Analysis of Zakat Management in Brunei Darussalam.

International Journal of Management Studies, 19(2), 75–102.

Dewi, P. M. (2012). Pastisipasi Tenaga Kerja Perempuan dalam Meningkatkan Pendapatan

Keluarga. Jurnal Ekonomi Kuantitatif Terapan, 5(2), 119–124.

Fathullah, H. F., & Hoertoro, A. (2015). Pengaruh Bantuan Zakat Produktif oleh Lembaga Amil

Zakat terhadap Pendapatan Mustahik (Studi Pada LAZIS Sabilillah dan LAZ El Zawa

Malang). Jurnal Ilmiah Mahasiswa FEB Universitas Brawijaya.

Halim, H. A., Said, J., & Yusuf, S. N. S. (2012). Individual Characteristics of the Successful

Asnaf Entrepreneurs: Opportunities and Solutions for Zakat Organization in Malaysia.

International Business and Management, 4(2), 41–49.

Harian Analisa. (2017). Penduduk Miskin Aceh Meningkat. Retrieved July 20, 2017, from

http://harian.analisadaily.com

Kieso, D. E., Weygandth, J. J., & Warfield, T. D. (2011). Intermediate Accounting Volume 1

IFRS Edition. United Stated of America: Wiley.

Productive Zakat Distribution in Determinant the Revenue of Mustahik: Case in Baitul Mal Aceh

795

Muda, I., & Arfan, M. (2016). Pengaruh Jumlah Zakat Produktif, Umur Mustahik dan Lama

Usaha Mustahik terhadap Produktivitas Usaha Mustahik (Studi pada Baitul Mal Kota Banda

Aceh). Jurnal Ilmiah Mahasiswa Ekonomi Akuntansi, 1(1), 318–326.

Muhamat, A. A., Jaafar, N., Rosly, H. E., & Manan, H. A. (2013). An appraisal on the business

success of entrepreneurial asnaf An empirical study on the state zakat organization (the

Selangor Zakat Board or Lembaga Zakat Selangor) in Malaysia. Journal of Financial

Reporting and Accounting, 11(1), 51–63.

Mutia, A., & Zahara, A. E. (2009). Analisis Faktor-Faktor yang Mempengaruhi Kesejahteraan

Ekonomi Mustahik Melalui Pemberdayaan Zakat (Studi Kasus Penyaluran Zakat

Produktif/Modal Usaha pada Bazda Kota Jambi). Jurnal Penelitian Sosial Keagamaan, 25(1),

1–12.

Rakhma, A. N., & Ekawaty, N. (2014). Analisis Faktor-Faktor yang Mempengaruhi

Kesejahteraan Mustahik Penerima ZIS Produktif(Studi pada Lagzis Baitul Ummah Malang).

Jurnal Ilmu Ekonomi FEB Universitas Brawijaya.

Redaksi. (2017). Penerimaan ZIS Baitul Mal 2016 Rp 237 Milyar Oleh Redaksi. Retrieved April

11, 2017, from www.acehtrend.co

Rose. (2010). Zakat Management In Brunei Darussalam: A Case Study. Proceedings of Seventh

International Conference The Tawhidi Epistimology: Zakat and Waqf Economy, 393–402.

Sekaran, U., & Bougie, R. (2017). Metode Penelitian untuk Bisnis (Edisi 6). Jakarta: Salemba

Empat.

Soemarso, S. R. (2009). Akuntansi Suatu Pengantar (5th ed.). Jakarta: Salemba Empat.

Warren, C. S., Reeve, J. M., Duchac, J. E., Suhardianto, N., Kalanjati, D. S., Jusuf, A. A., &

Djakman, C. D. (2015). PENGANTAR AKUNTANSI Adopsi Indonesia (Edisi 25). Jakarta:

Salemba Empat.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

796