The Implementation of Financial Management at Micro,

Small and Medium Enterprises (MSMEs): Case Study at

Cak Ryan Fried Banana Business in Banda Aceh

Cut Afrianandra

1

, Jusmaidi Sahriadi

2

, and Evi Mutia

1

1

Universitas Syiah Kuala, Banda Aceh, Indonesia

2

Paragon Company, Indonesia

evimutiafe@unsyiah.ac.id

Abstract. This study aims to observe how the implementation of financial

management at Cak Ryan fried banana business adopted through planning,

recording, reporting and controlling indicators This study employs qualitative

method where the primary data is gathered from the owner of Cak Ryan fried

banana business. The findings show that the implementation of planning is

entirely implemented. Meanwhile, the implementation of recording is

sufficiently enough which more than half indicators are adopted. Furthermore,

the implementation of reporting is still less implemented which shown only half

of the indicators are adopted. Eventually, the implementation of controlling is

sufficiently adopted where more than half indicators are adopted well. Overall,

the implementation of financial managements at Cak Ryan fried banana business

are sufficiently adopted. The limitation in this study is the findings cannot be

generalized since the research object is solely at Cak Ryan fried banana business.

Keywords: Financial Management ꞏ Msmes ꞏ Qualitative Descriptive

1 Introduction

MSMEs (Micro, Small and Medium Enterprises) are contemplated as alternative

sources for developing economies in some countries (Fatoki, 2012; Cakmak, 2018).

MSMEs receive more attention compared to large business by among international

organizations since they devote potential contribution which influential for the

economy. In addition, they play a pivotal role in the poverty alleviation alike cultivate

initiatives to create jobs and increase additional labor-intensive products (Duncombe &

Richard, 2005; Ayyagari, Thorsten & Asli, 2007; Islam et al, 2011; Bhatti et al., 2012;

Talebi et al., 2012; Kazlauskaitė et al., 2015).

Manurung (2008) points out that MSMEs are small-scale business enterprises

contribute to the economic development in Indonesia. Besides being a national

economic booster and labors supplier, MSMEs play a prominent role in distributing

development outcomes. The presence of MSMEs in Banda Aceh likewise has conferred

a prominent meaning in providing the source of individuals’ workplaces. Throughout

the increasing number of unemployed in Banda Aceh which was around 12% has

pointed MSMEs as alternative jobs in Banda Aceh (Nazaruddin, 2015:4 in Nurrahman

& Fikriah, 2017:321; www.ajnn.net, 2017).

766

Afrianandra, C., Sahriadi, J. and Mutia, E.

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana Business in Banda Aceh.

DOI: 10.5220/0010528900002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 766-785

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

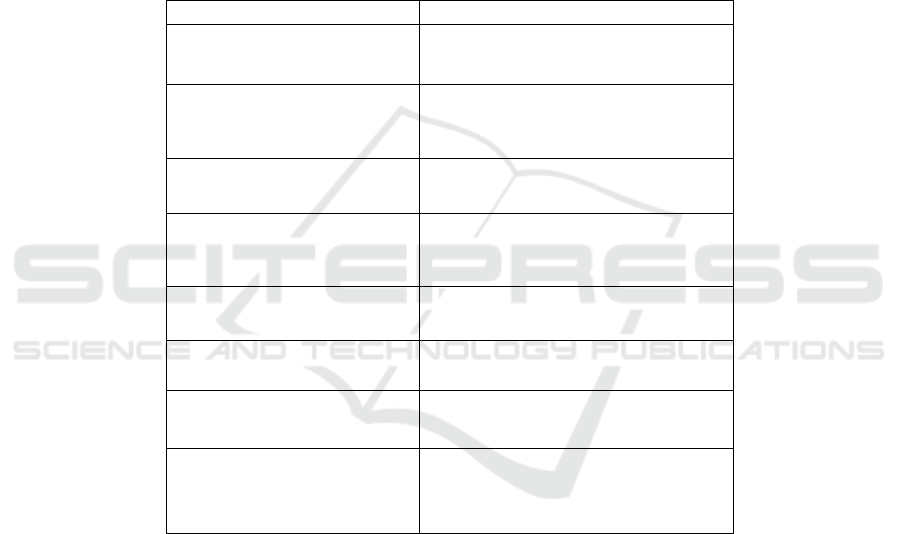

Source: Disperidagkopukm Banda Aceh, 2016

Fig. 1. Data of MSMEs Growth in Banda Aceh.

Figure 1 shows that MSMEs in Banda Aceh have been experiencing rapid growth every

year from 2009 to 2015. The increasing number of MSMEs attests that those are self-

employed and a propitious business for the unemployment to be employed. It prompts

the entrepreneurs and MSMEs’ owners to restrain in improving and competing for their

business in many sectors in Banda Aceh. Hence, it is undoubted if the existence of small

businesses greatly increment and scattered in many places, and unavoidable, from ten

emerging commodities of MSMEs which observed, one of them is the trading sectors

being popular in Banda Aceh (Serambinews.com, 2017). Mayor of Banda Aceh,

Aminullah Usman voices that the emerging commodities in Banda Aceh are in the

human resources which centered on the services and trading sectors (www.ajnn.net,

2017).

Interestingly, most of the MSMEs engaged in the trading sectors are preferred using

easy-to-find or local raw materials as the main ingredients since local raw materials are

more prevalent in the social circle and might attract them as consumers because of its

familiarity taste. One of the culinary businesses which using local raw material is fried

banana. Fried banana could be cogitated as one of the reputable snacks which only

utilizing banana and flour as its main ingredients. The taste is appetizing, sweet and

palatable. Likewise, its low-priced could easily tempt the consumers to buy

(usahakuliner.id, 2018).

As a part of MSMEs, the existence of fried banana business is manifested by the

growing business which presenting variations and innovations from “banana-based

culinary” to be processed into valuable kinds of snacks, either dissimilar or similar to

traditionally fried banana towards more valuable innovations, such as banana nuggets,

chocolate bananas, cheese bananas and others, all prove that fried banana business is a

great opportunity in Banda Aceh, hence its development could be growth rapidly

(kompas.com, 2017).

Nonetheless, despite the significant increase, there are still many MSMEs owners’

who confront the difficulty in managing their business. It could result in their business

activities not been outing well. It often happens due to less knowledge of managing

their business such as to organize financial management (Hidayat, 2008). Efficient

financial management practices in MSMEs will provide a historical analysis of the

performance of the business, which then is used to project potential future performance

(Brijlal, Enow & Isaacs, 2014). Basing on the previous studies which conducted by

0

5000

10000

2009 2010 2011 2012 2013 2014 2015

5234

5481

5801

5861

5937

5967

6636

MSMEsinBandaAceh

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana

Business in Banda Aceh

767

Fatoki (2012), Oktaviani (2015) and Diyana (2017) which indicated that most of

MSMEs do not engage financial management well. Thus, the author actuates to do

further research with the tittle “The implementation of financial management at

Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried

Banana Business in Banda Aceh”.

1.1 Research Objectives

In accordance with the problem posed in this study, the objective is to identify how the

implementation of financial management, including the planning of budget, recording,

reporting and controlling which applied by MSMEs traditional fried banana.

2 Literature Reviews and Theoretical Framework

2.1 Literature Reviews

In this chapter, a discussion regarding theories and terminologies related to this study

is provided. The theories and terminologies used for instances; financial management,

Micro, Small and Medium Enterprises (MSMEs) and MSMEs’ financial management.

This chapter also provides the theoretical frameworks used in the development of

analyzing of study.

2.1.1 Financial Management

The Conceptualization of Financial Management

Fahmi (2013:2) uncoils the concept of financial management as “a merger of science

and art that discusses, examines and analyzes how a financial manager uses all the

resources of a company to raise, manage, and distribute funds in order to afford the

profit or prosperity to shareholders and business sustainability for the company”. Horne

in Kasmir (2010:5) also defines that “financial management is all activities related to

the acquisition, funding, and management of assets with multiple objectives entirely”.

Thus entire processes are terminated to earn company revenue by minimizing costs and

allocating the funds efficiently. Thereof, it could maximize the value of the company

(Hartati, 2013).

Financial Management Function

Hartati (2013) dissevers the functions of financial management as:

a. Fundraising activities which aimed at investment decisions that generate profits.

b. The activity of allocating funds which intended to manage the use of funds in

the activities of the company.

Furthermore, Fred in Kasmir (2010:16) disparts the financial management into 4

functions, there are:

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

768

a. Forecasting and Planning the Finances

Financial management assists to forecast the conditions that would occur in the future

and which most likely impact, either directly or indirectly to the achievement of

corporate objectives. After forecasting, the planning would be primarily composed

related to the business financial condition.

b. Capital, Investment, and Growth Decisions

Financial management assists to assemble the capital needed, both short-term, such as

working capital needs, and as well as long-term. Long-term capital is likewise

indispensable to prop up the company's growth, such as increasing the capital

investment, equipment, and other assets, particularly when thus needed.

c. Controlling

Financial management assists as a controller in running the company's operations

efficiently, so that, if this does not function properly, it can be controlled con direction

as planned. Without control, the possibility of failure in achieving business goals is very

high.

d. Relationship with The Capital Market

Financial management assists as a capital market liaison which will benefit companies

because they are able to find alternative sources of funds through the capital market. As

a result, the company could obtain the funds or capital needed.

Financial Management Objectives

The objective of financial management is to achieve the level of efficiency and

effectiveness of financial use in operating its business. Those companies are foreseen

to achieve targeted goals when the efficiency and effectiveness of the value input and

output are employed (Diyana, 2017). Fahmi (2013:4) classifies several objectives of

financial management, there are maximizing company value, maintaining and

overseeing the financial stability and minimizing corporate risks in the present and the

future.

2.1.2 Financial Management Process

Financial management process is a procedure/process that is performed by business

managers in managing their finances to achieve efficiency and effective use of budget

levels, therefore, financial managers need to analyze immediately related to the process

and procedures in carrying out the objectives of financial management (Diyana, 2017).

In financial management, it discuss about how entities maximize their profit by

analyzing financial statement, measuring the risk and return of assets and equities, the

obligation, investment and also some subjects which related to the management

accounting, such as budgetting. Yet, there are four basic management frameworks

which commonly used in this study by using Kuswadi (2005) in Diyana (2017) theories

as the following:

a. Planning

Planning is the organizational goal-setting activities to opt the best practice of attaining

the goals. Planning activities on finance are one of the annual financial goals and

formulate a long-term, as well as financial budget.

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana

Business in Banda Aceh

769

b. Recording

The recording is an activity to record financial transactions that have occurred in a

certain period, then the entries are recorded chronologically and systematically.

c. Reporting

Reporting is a pace taken after the transactions are posted in the journal and general

ledger. Posting in the journal and general ledger will be closed at the end of the month,

which it will be transferred to the summary of the financial statements as the basis for

the preparation of financial statements. The financial statements consist of the Cash

Flow Statement, Income Statement, and Financial Position.

In the reporting, the adjusment will be directed by looking at SAK-ETAP (Standar

Akuntansi Keuangan – Entitas Tanpa Akuntan Publik) guidelines which guided by IAI

(Ikatan Akuntan Indonesia). SAK ETAP became effective on January 1, 2011. SAK

ETAP is a standard that describes financial regulations for small and medium

enterprises The benefits of SAK ETAP are expected with the presence of SAK ETAP,

small or medium-sized companies are able to prepare their own financial statements,

can use their financial statements as financial controllers (in terms of costs), standard

tools for earning income in the next period, and get funds from banks) business

development (Nurlela & Heny, 2016).

d. Controlling

Controlling is a process of measuring and evaluating between the planning and the

actual performance of each part of the organization. It would be necessary for the

improvement of a company. Controlling is able to ensure the company or organization

to achieve the goals set.

2.1.3 Micro, Small and Medium Enterprises (Msmes)

Based on the Law of the Republic of Indonesia Number 20 the Year 2008 on Micro,

Small and Medium Enterprises in Chapter 1 (general provisions) explains:

1. Micro Enterprise is productive business owned by individual and/or individual

business entity fulfilling the criteria of Micro Enterprises as regulated in this Law.

2. A small business is a stand-alone productive economic enterprise undertaken by

an individual or a business entity which is not a subsidiary or not a branch of a

company owned, controlled, or becomes part of, directly or indirectly, of a

Medium-Sized Enterprise or a Large Enterprise meet the criteria of Small

Business as referred to in this Law.

3. Medium Enterprise is a stand-alone productive economic enterprise, conducted

by an individual or business entity which is not a subsidiary or a branch of a

company owned, controlled or becomes part directly or indirectly with a Small or

Large Business with a net worth amount or annual sales proceeds as provided in

this Law.

The Criteria of Micro Small and Medium Enterprises in the Law of the Republic of

Indonesia Number 20 the Year 2008 are as follows:

1) Micro Business:

a. Having a net worth of at most Rp50,000,000.00 (fifty million rupiahs)

excluding land and building of business premises; or

b. Has annual sales of at most Rp300,000,000.00 (three hundred million rupiahs).

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

770

2) Small Business:

a. Having a net worth of more than Rp50,000,000.00 (fifty million rupiahs) up

to a maximum of Rp500,000,000.00 (five hundred million rupiahs) excluding land

and building of business premises; or

b. Has annual sales of more than Rp300,000,000.00 (three hundred million

rupiahs) up to a maximum of Rp2,500,000,000.00 (two billion five hundred

million rupiahs).

3) Medium Enterprises:

a. Having a net worth of more than Rp500,000,000.00 (five hundred million

rupiahs) up to a maximum of Rp10,000,000,000,000 (ten billion rupiahs)

excluding land and building of business premises; or

b. Has annual sales of more than Rp2,500,000,000.00 (two billion five hundred

million rupiahs) up to a maximum of Rp50,000,000,000.00 (fifty billion rupiahs).

2.1.4 Msmes’ Financial Management

Mubarok & Faqihudin (2011) imply that generally, the practice of MSMEs activities is

operated without relying on financial information that is arranged in an orderly manner.

Most MSMEs owners’ are able to operate its business normally without espousing

adequate financial information which usually used as a basis for decision making.

Decision making is usually terminated based on intuition and habits get through the

previous experience.

There are merits exposed by Mubarok & Faqihudin (2011):

a. Understanding the information about the financial position, financial

performance and changes in the owner's equity for the past.

b. Becomes one of the decision-making considerations.

c. Understanding the value of cash changes and their distribution.

d. Fulfill one of the conditions in applying for credit to certain capital institutions.

e. Become one of the manners for determining the selling price.

2.2 Previous Researches

There were several studies have been conducted related to the implementation of

financial management at MSMEs. Fatoki (2012) investigated the financial

management practices of new microenterprises in South Africa. This research focused

on six financial management practices namely financial planning and control, financial

analysis, accounting information, management accounting, investment appraisal, and

working capital management. The findings indicated that most new micro-enterprises

do not engage in financial planning and control, financial analysis and investment

appraisal. For accounting information, most new micro-enterprises keep certain

accounting books such as sales book and purchases book but do not keep other books

such as drawings book indicating a mixed result.

Further, Oktaviani (2015) conducted research on analisis manajemen keuangan

pada UMKM (Usaha Mikro, Kecil dan Menengah) klaster konveksi di wilayah

Kecamatan Kota Kabupaten Kudus which investigated the problems that occur in

overall SMEs convection generally associated with business expansion or business

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana

Business in Banda Aceh

771

solely to survive, this research reveals that working capital requirements are one of the

obstacles to the development of SMEs. Another limiting factor in the development of

SMEs is in the form of financial information. SMEs in Kudus have not had a financial

report, this happens because of the lack of financial management on Micro, Small and

Medium Enterprises (SMEs). The findings showed that SMEs Convection in Kota

District Kudus regency uses two sources of funding, namely internal and external

sources of funding.

2.3 Theoretical Framework

Financial management is undertaken to obtain maximum profits by allocating funds

efficiently. The allocation of funds is set in budgeting as a part of planning. The

planning is necessary to drive the company’s motion both internally and externally and

become a management evaluation tool. Afterward, the recording intends to record the

transaction occurs within a period proven by some of the pivotal documents. For

MSMEs traditional fried banana, as a micro-size business, the recording activities

might have in a simple manner such as recording in a mini-book with the simple

information. In the reporting process, it would be necessary for MSMEs traditional fried

banana to possess clarity its total profit by having an income statement. Furthermore,

controlling is necessitated to control and evaluate between the planning made and the

actual.

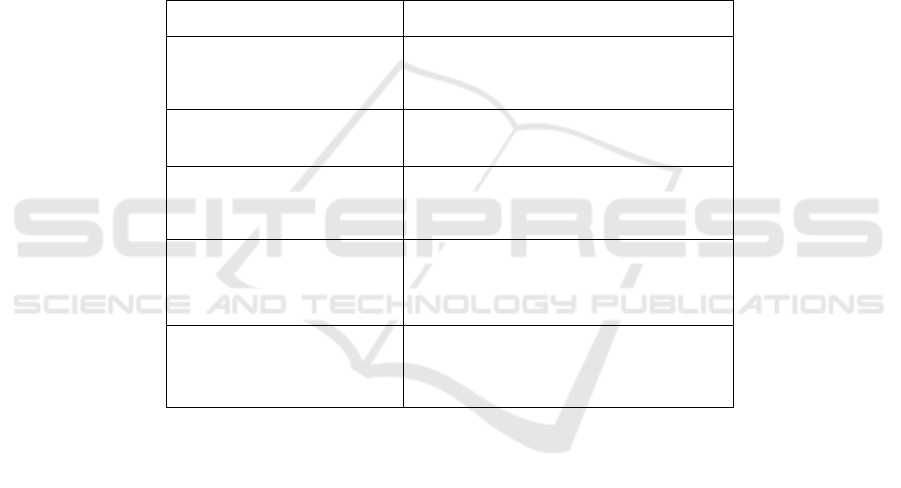

Fig. 2. Theoretical Framework.

3 Research Methodology

3.1 Research Design

Regarding the object and method of analysis used, this paper focuses on the qualitative

descriptive study. This is a case study with the minimal intervention level since it solely

gathers data by interviews and uses data from financial reports owned by Cak Ryan

fried banana. The unit of analisys in this study is on business entity, ther is solely at

Cak Ryan fried banana business in Banda Aceh. The cross-sectional time horizon is

employed in this study since the data only once collected from Cak Ryan fried banana

Planning

Recording

Reporting

Controlling

Financial

Management

MSMEs’

Cak

Ryan

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

772

in a certain period through semi-structured interviews. The semi-structured interviews

are used to provide the interviewees which allows them to respond and be questioned

with a degree of freedom, as well as to allow them to explain their thoughts in greater

depth in order to gain more in-depth information (Rahim and Goddard, 2003 in Basri,

Siti & Shabri, 2016).

3.2 Respondent Chosen Method

Since this paper employs a case study, the respondent chosen is solely at Cak Ryan

fried banana business which has five branches in Banda Aceh. The respondent of this

study is sharpen directly to the owner of Cak Ryan fried banana business to provide the

information regarding business deeply.

3.3 Source of Data and Collection Method

In this study, the data are gathered both from the primary and secondary data. The

primary data are data which obtained from the actual event occurs while secondary data

are data which obtained from the available resources before the research is conducted.

The primary data in this study was obtained directly by interviewing Cak Ryan fried

banana business owner who were sampled in this study. While secondary data related

to financial management is obtained from documents owned by Cak Ryan business

owner directly.

Data collection techniques used in this study were carried out by semi-structured

interviews, observation and documentation. Cak Ryan’s owner will be interviewed to

see responses to the implementation of financial management. The researcher also uses

documentation data collection techniques to obtain financial report data that has been

made.

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana

Business in Banda Aceh

773

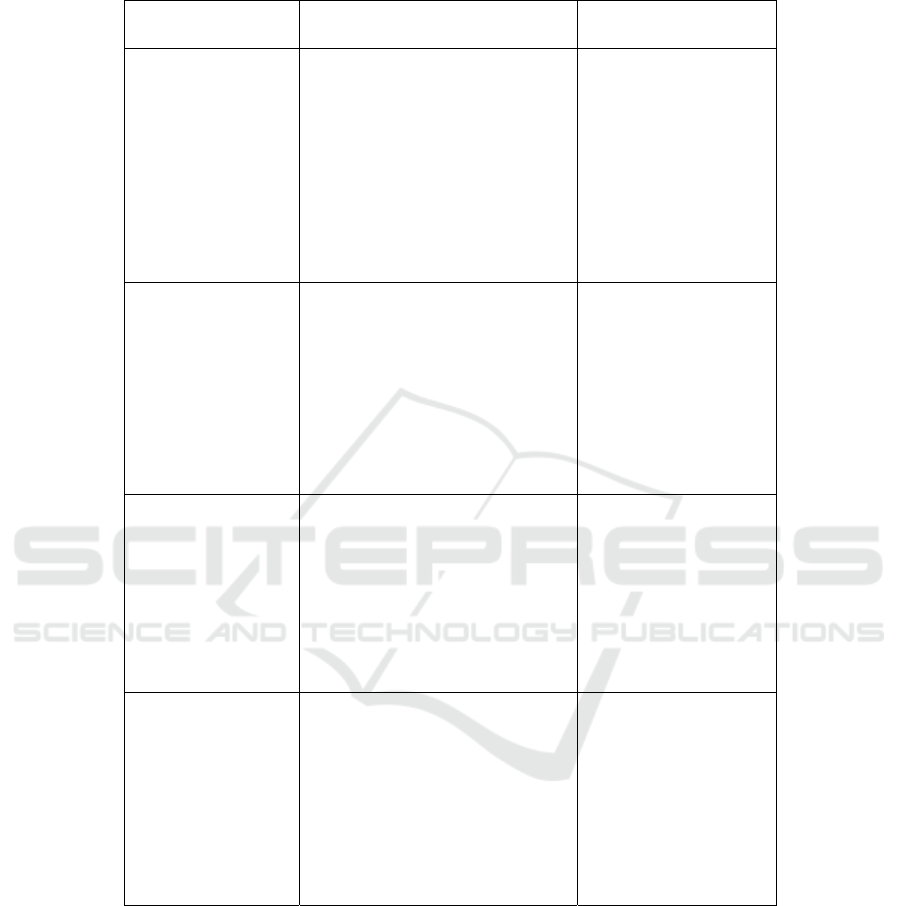

Table 1. Research Questions, Interview Questions, and Sources and Data Collection Methods.

Research

Questions

Interviews Questions

Source and Data

Collection Methods

How does Cak

Ryan set the

plannings in order

to maximize the

profit and expand

the business?

How do you plan funding or

initial capital to start a business?

How do you plan for sales and

production cost?

How do you plan for marketing

improvement?

What is the other plans do you

have for your business?

Data sources:

Primary

Data Collection

Methods:

Semi-structured

Interviews

How does Cak

Ryan record the

transactions occur

while operating its

business?

How do you record for every

transaction occurs? Could you

show the recording you have?

Do you think recording

activities is prominent to your

business? Why?

Data sources:

Primary

Secondary

Data Collection

Methods:

Semi-structured

Interviews

Financial Report

How does Cak

Ryan deliver its

reporting?

How do you report for every

transaction occurs? Could you

show the reporting you have?

How will it benefit for your

business improvement?

Data sources:

Primary

Secondary

Data Collection

Methods:

Semi-structured

Interviews

Financial Report

How does Cak

Ryan’s owner

control its business

within the

operational

period?

How do you control between

the planning and the actual

costs? Do you think controlling

is prominent in your business?

How do you separate between

the personal cash and business

cash? Do you think separating

them is prominent in your

business?

Data sources:

Primary

Secondary

Data Collection

Methods:

Semi-structured

Interviews

Financial Report

Source: Data processed, 2018

3.4 Research Instruments

This study desires to gather data by distributing semi-structured interviews as research

instruments to Cak Ryan’s owner. The semi-structured interviews are used to provide

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

774

the interviewees which allows them to respond and be questioned with a degree of

freedom, as well as to allow them to explain their thoughts in greater depth in order to

gain more in-depth information (Rahim and Goddard, 2003 in Basri, Siti & Shabri,

2016). Bungin (2013) explains that the interview method is the process of obtaining

information for research purposes in the manner of questioning while face to face

between the interviewer and respondent, with or without using interview guidelines.

Meanwhile, the semi-structured interviews are figured to resist inflexible on each

questions item. The author desires to elaborate and situate them on condition whereas

they are utilized as the guidelines.

In this study, the interviews are spotted into some parts, there are: part I is about the

general information of respondents, part II is about the general information of business

and part III is about financial managament of business. Research instrument in this

study is arranged regarding Kuswadi (2005) in Diyana (2017) who disparted the

indicator of financial managements into four basic frameworks, there are; planning,

recording, reporting and controlling.

3.5 Data Analysis Method

The data analysis technique used for this study is qualitative descriptive analysis. To

answer the formulation of the problem “how the implementation of financial

management at MSMEs by Cak Ryan fried banana”, the following stages of analysis

will be carried out as follows:

1. Doing an interview the owner of Cak Ryan fried banana business by giving a

semi-structured interview.

2. Semi-structured nterview will be written on point.

3. The semi-structured interview process will be assisted by stationary and voice

recorder, so it can provide the accurate data related to the research.

4. The result of semi-structured interview will be analyzed

5. The result of analysis of semi-structured interviews will be described.

6. Regarding to the indicators, the financial notebook will be overlooked

comprehensively.

7. From the results of analysis, the overall assumption will be drawn which apply

to the case study research sample.

4 Result and Discussion

4.1 Result

4.1.1 Business Description

In this study, the data are gathered sirectly from the owner of Cak Ryan fried banana

business. Cak Ryan fried banana business was established in 2013 by a single owner,

namely Safrijal who completed his study from diploma-II (D-II). The establishment of

Cak Ryan began after the owner worked for several years and decided to retire from a

private company where he spent dedication before. Seeing the family economic-

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana

Business in Banda Aceh

775

condition was unable to sustain and also aggravated by the number of unemployment

in the surroundings, thus incited the owner decided to have his own business. By

utilizing the amount of initial capital that approximately Rp40,000,000.- which saved

during working in the private company, later, the owner established his first business

which located in Prada, Banda Aceh and offered jobs for the people around.

Afterward, the amount of initial capital was utilized for renting a building,

purchasing equipment, and raw materials, paying the bills and other overheads and

spending for research and development of products. The detail of the initial capital used

for the first phase is shown in table 2 as follows:

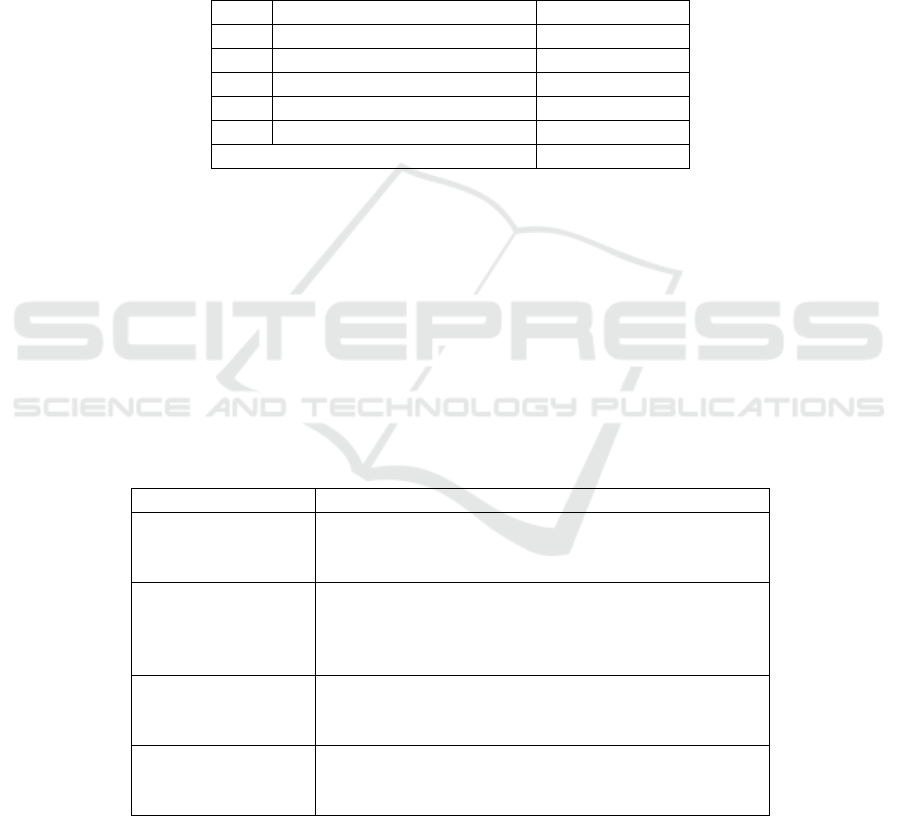

Table 2. Detail of Initial Capital Used.

No. Account Name Costs

1. Buildin

g

Rental for a

y

ea

r

Rp19,000,000,-

2. Equipments Rp16,500,000,-

3. Raw Materials Rp1,500,000,-

4. Bills and other overheads Rp2,000,000.-

5. Research and Developmen

t

Rp1,000,000,-

Total Rp40,000,000,-

Source: Cak Ryan, 2018

4.2 Discussion

4.2.1 The Implementation of Financial Management

The indicator for financial management in this study is disparted into 4 basis framework

by following the theory from Kuswadi (2005) in Diyana (2017), there are planning,

recording, reporting and controlling.

1) Planning Indicator

Planning is a tool to plan and control the earnings (Adisaputro and Anggraini, 2011).

Planning is one of the main indicator of financial management observed.

Planning Indicator The Implementation

Sales and

Production Budget

The owner prepares for sales and production planning

based on the current market situation. i.e; location,

consumers demand and the sessions.

Capital Needs

Planning;

a. Start-up

b

. Operations

The initial capital prepared approximately Rp

40,000,000, - and was utilized without taking any

loans; while the financing for the operations, the

capital needs are planned related to the historical costs.

Marketing Planning

The owner serves the products freshly after frying to

the consumers. The owner also consistently improve

the product qualit

y

for the taste and texture.

Other plans related

to the business.

For the next period, the owner has some plannings for

instances; expanding to the bigger scale business and

p

acka

g

in

g

product to compete for

b

ette

r

qualit

y

.

Source: Cak Ryan, 2018.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

776

The above table shows that the implementation of planning indicator for Cak Ryan fried

banana business has been comprehensively implemented as he positively claimed to

have applied all the information items.

In addition, in the sales and production planning item, the owner clarified that he

has already carried out the planning of the budgets issued during the business

operations. To plan how to sales the fried bananas and reach the consumers, the owner

sees the strategic locations for the business.

2) Recording Indicator

According to Andreas (2011), recording or bookkeeping is an activity in accounting to

record daily transactions. The recording indicator is important in order to assist the

owners to prepare its financial management daily and make decisions for the business.

Afterwards, the owners prepare the financial statements based on the recording results.

Recording Indicator The Implementation

Recording the sales

transactions.

Sales transactions are recorded along

with the income statement.

Sales transactions are

recorded regularly.

Sales transaction are recorded along

with the income statement.

Recording of purchase

material transactions.

Purchase material transactions are

recorded for each transaction and put at

the income statement infoermation

Tracking of purchase

material transactions

regularly.

The owner clarified that this action is

done regularly

Recapitulating the cash

receipts.

Due to the materials are bought at the

traditional market, it was not possible

to have and recapitulate the receipts for

transactions.

Cash receipts are

recapitulated regularly.

Due to the materials are bought at the

traditional market, it was not possible

to have and recapitulate the receipts for

transactions.

Sales and purchase recorded

are able to help business

financial management.

The owner uses the transaction

recorded to overlook the busines

progression.

Other transactions record

No other transaction is recorded.

Source: Cak Ryan, 2018.

The owner of Cak Ryan claimed mostly implemented the recording indicator

statements. It was revealed by the owner’s explanation, for instances; in sales

transactions, owner Cak Ryan always records every transaction of fried bananas that

occurs on the daily, weekly and monthly as regularly. The owner confirmed that the

recording prepared is very useful for calculating profits and estimating business

sustainability and further helping the owner to manage business financially.

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana

Business in Banda Aceh

777

However, in the recording process, owner Cak Ryan admitted that it was difficult

to collect valid document transactions on sales and purchase of raw materials and

overheads. This is because the typical market own is on small scale business, and the

owner confirmed that it is quite difficult to provide receipts for each sales transaction

occurs since only selling fried banana. Nevertheless, to adress it, the owner regurlary

write on his notebook for every expense and the total money earn in a day and make

the assumption about how much fried bananas have been sold daily.

3) Reporting Indicator

According to Kuswadi (2005) in Diyana (2017), the usefulness of reports prepared is

not just written numbers, yet, thus have prominent information. This is also in

accordance with the results of interviews with the owner of Cak Ryan that the report

prepared can be utilized to overlook the information of business and its sustainability.

Reporting Indicator The Implementation

The income statement is

prepared

The income statement is prepared in

a simple manner.

The income statement is

utilized to asses business

progress.

The income statement is usefull to

asses the business progress.

Balance sheet report is

prepared

Balance sheet report is prepared in a

simple manner.

Balance sheet report is

utilized to asses business

progress.

Balance sheet report is utilized to

overlook the asset owned.

Cash flows statement is

prepared.

Due to improper accounting

education, this part is missing.

Cash flow statement is used

to asses business progress

Cash flow statement is not provided.

Statement of Changes Equity

is prepared

The owner clarified he did not know

how to prepare this part.

Statement of Changes Equity

is utilized to asses business

progress.

The owner did not know how to

utilize the statement of changes

equity in the business.

Source: Cak Ryan, 2018

The data obtained show that the implementation of reporting indicator is considered

sufficient enough because the owner of Cak Ryan claims that his business prepares the

income statement and balance sheet regularly and uses both as a tool to posses the

business progress. In addition, Cak Ryan's Owner explained that "reporting made is

useful as a supporting document if the business requires capital for the future business

expansion". The owner also claimed that the income statement and balance sheet

prepared based on the guideline and information gathered from the internet,

considering he does not have proper knowledge about accounting nor training.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

778

However, the owner did not prepare a report on changes in equity and cash flow

statements as he does not have any information about the prominancy of changes in

equity and cash flow statements and nor training in how to prepare good financial

statements so that the component was ignored, while the statement of changes equity

and cash flow statements are the essential part which guided by SAK-ETAP for

MSMEs. Cak Ryan owner hopes that he will immediately get information or provided

sufficient training about financial management, notably on reporting indicator because

it is deemed necessary for business progress.

4) Controlling Indicator

Handoko (2011) defines that controlling is a tool to guarantee that the plan has been

implemented in accordance with the initial planning. Planning that is prepared at the

beginning of the business operation, will be evaluated after the business operations are

completed for daily, weekly, monthly or even yearly. The controlling can be executed

by comparing the planning and the actual cost results.

Controlling Indicator The Implementation

Notes for cash issued is

collected.

The owner clarified that no any notes

for cash issued as considered as small

business scale.

Notes for cash issued is

checked regularly.

The owner does not implement this

part.

The owner compares

between planning and

actual.

The owner admitted that he compares

the differences between them.

The owner evaluates

between planning and

actual.

The comparison between planning and

actual is regularly evaluated and

incited the owner to operate it better.

Separation of personal cash

and business cash is

undertaken.

The owner always separates between

the personal cash and business cash to

have a clear amount of income.

Source: Cak Ryan, 2018

Cak Ryan fried banana shows that its business simply applies controlling indicators.

The owner explained that the controlling process was merely directed by himself

without involving any other labors, occasionally he was assisted by his wife in the

operation of the business. The owner admitted that it was difficult to collect records of

cash received due to the small size of the business, so such records were not necessary.

However, related to this, the owner always routinely checks between the amount of

cash and records with gross estimation which prepared periodically to determine the

estimated gross profit earned.

As for the other controlling indicators, the owner claimed that he simply compares

between the plans prepared to the actual costs that occurred resulted in the variance

numbers, and evaluated them to make decisions for the improvement in the next sales

operation.

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana

Business in Banda Aceh

779

4.2.2 Analysis of the Implementation of Financial Management

1) Planning Indicator

From the data above, it shows that the owner has implemented the planning indicators

entirely. It is manifested as in the sales and production budget, the owner has prepared

sales budget forecasted, direct and indirect materials and also overhead costs which

needed as the essential parts of the budget. While in the capital needs planning, the

owner has clearly defined the capital needs for starting-up the business in the beginning

and also the financing during the operations of the business. From the data, the owner

clarified that “Cak Ryan fried banana uses historical costs to determine the operating

costs”.

For marketing planning, the owner decided to have the traditional concept which

deadly serves the fresh fried banana to the consumers. In the next period, the owner has

planning to open the business in the large scale and offers in the packaging model.

Overall, although the planning prepared does not contain the complete information, yet,

Cak Ryan fried banana has comprehensively implemented the indicators of planning.

2) Recording Indicator

As one of the prominent parts at the financial management, the recording indicator is

necessary to be implemented. From the data analyzed, the owner has implemented

about 5 out of 8 recording indicators. The owner’s clarification shows that the sales and

purchasing transaction are recorded as regularly. The owner affirmed that “the

preparation of recording for sales and purchasing transaction are beneficial to assist the

business progression financially”. While 3 out of 8 indicators are still not implemented

yet due to the business scale which still compete as the small level. The overall, the

recording indicators implemented by Cak Ryan fried banana is sufficient enough

although there are implemented in the simply manner.

3) Reporting Indicator

It reveals that the owner merely fair in preparing the reporting indicators. As guided in

SAK-ETAP which directed by IAI, it is 4 out of 8 which has been implemented simply

which manifested through the preparation of income statements and balance sheet,

whereas the changes equity and cash flow statement do not prepare due to lack of

knowledge on how to prepare those reports. In preparing the reporting indicators, the

owner considered that he still needs an adequate training as its a prominent part in the

financial management. Hence, it hopes the preparation of reporting indicator in the next

operation period will be better.

4) Controlling Indicator

In the controlling indicator, there are 3 out of 5 indicators which applied by the owner.

It displays that the owner has sufficiently supervised the business progress. The

comparison and evaluation made are beneficial to overlook the business improvement,

in addition, the sufficient controlling preparation is shwon by the separation between

the personal cash and business cash which prepared enough.

Overall, Cak Ryan fried banana business has adopted 16 of 25 points of financial

management indicators. From the data gathered, it can be concluded that Cak Ryan

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

780

fried banana has comprehensively implemented the planning indicators. Regarding the

recording and controlling indicators, although have not entirely implemented yet, Cak

Ryan fried banana has mostly adopted required indicators. Afterward, the reporting

indicator is the less implemented among others, which solely 4 of 8 indicators are

positively prepared while the others are not. One of the factors that compels the

reporting indicator quite low compared to the other indicators merely because the owner

has lack knowledge in financial management.

4.2.3 Financial Management Benefits

During the adoption of financial management, as stated at chapter 2 that financial

management has prominent benefit to the business, there are also some confirmation

given by the owner of Cak Ryan fried banana business related to the financial

management benefit during the operation of business. Regaring the planning, the owner

stated that “the planning indicators are very useful because they can help to determine

what actions need to be planned before conducting business operations. By deiciding a

good planning, it means we can estimate the amount of income and expenditure close

to the real value”.

The recording indicator has also given the benefits as stated by the owner that

“obviously, recording is very important to do, so that we know how much income is

earned and expenses spent on a single operation. That way, the amount of net income

can be well known.”

While in expanding the business, the reporting indicator is being an essential part

to espouse the business in getting loan from the credit institution, such as Bank. the

owner confirmed that “when a business needs to take loan from the Bank, the essential

part to ensure the Bank given the loan is depending on the financial report prepared”.

The controlling indicator is also usefull to be adopted in the business, though, the

owner also clarified that “the controlling is clearly useful because it becomes an

evaluation tool for the business and knows what deficiencies still need to be improved,

both in terms of planning strategies, costs, and others”.

As berdesa.com suggested that separating between personal cash and business cash

is necessary to the business, it is also manifested by the owner through the statement

“separating between personal cash and business cash has already known by the owner

of a business as its very important to be implemented. Because if there is no separation,

we do not know the real cash earned from the business”. Overall, the financial

management has big benefit and positive impact to the business in the operation, it also

includes for MSMEs, Cak Ryan fried banana business.

5 Conclusion, Limitations and Recommendation

5.1 Conclusion

After conducting research on the implementation of financial management at Cak Ryan

fried banana business for the indicators of planning, recording, reporting and

controlling, it can be concluded that:

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana

Business in Banda Aceh

781

1) In the planning indicator, Cak Ryan has comprehensively implemented its part of

financial management in the business.

2) In the recording indicator, Cak Ryan has sufficiently implemented its part of

financial management in the business.

3) In the reporting indicator, Cak Ryan shows less implemented on it. The reporting

indicators neither sufficiently well implemented nor based on SAK-ETAP.

4) In controlling indicators, Cak Ryan has sufficiently implemented its financial

management in the business.

5.2 Limitiations

Some limitations might be found in this study, there are:

1) The research was carried out merely taking samples in one business unit, namely

in the Ryan Fried Banana business. The results obtained cannot be generalized in

general.

2) The results of the study are limited to research on the application of financial

management with indicators based on the theory of Kuswadi (2005) in Diyana

(2017) with the retrieval of planning, recording, reporting and controlling

indicators.

3) Data obtained in this study may not have an accuracy level of 100% because of

the limitations of Cak Ryan’s owner in carrying out the financial management

activities of his business.

5.3 Recommendation

Based on the research that has been done and the results obtained from data analysis,

the author wants to provide some recommendations as follows:

1) As it is known that the implementation value of the reporting indicator gets the

lowest percentage and falls into the less implemented criteria, the authors suggest

Cak Ryan's owner to continue to deepen his knowledge about better financial

management, especially on reporting indicators. In addition to being useful as a

benchmark for business performance, by doing good reporting, Ryan Fried

Banana's business will be easier in terms of administration if in the future a loan

is needed to expand its business to existing credit institutions.

2) Cak Ryan's owner should arrange the business structure by using a better system,

so that the five branches can be more efficiently controlled. This is because the

Ryan fried banana business has 5 branches, but 2 of the 5 branches that are owned

do not operate optimally or are disabled.

3) For further research that examines the implementation of financial management

at MSMEs, it is better to take more research samples, expand the scope of

research, and further examine the implementation of MSMEs.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

782

References

Abanis, T et al. 2013. Financial Management Practices in Small and Medium Enterprise in

Selected District in Western Uganda. Research Journal of Finance and Accounting. 4(2): 29-

42. https://doi.org/10.5897/AJB2013.6899.

Adisaputro, G & Anggriani, Y. 2011. Anggaran Bisnis. Yogyakarta. UPP STIM YPKN

Yogyakarta.

Admin ajnn.net. 2017. Via <http://www.ajn.net/news/pengangguran-di-banda-aceh-capai-12-

persen-kemiskinan-tujuh-persen/index.html> (Retrived on May 10, 2018)

Admin Bandaacehkota.go.id. 2017. Kecamatan dan gampong. Via. http://bandaaceh

kota.go.id/p/kecamatan_gampong.html (Retrived on September 15, 2018)

Admin berdesa.com. 2015. Tips Pengelolaan Manajemen Keuangan untuk UKM. Via

<http://www.berdesa.com/tips-pengelolaan-manajemen-keuangan-untuk-ukm/> (Retrieved

on March 25,2018).

Admin usahakuliner.id. 2018. Bukan Hanya Pisang Nugget, Ini Dia Olahan Pisang yang Cocok

dijadikan Usaha Makanan Ringan Kekinian. Via <http://usahakuliner.id/usaha-makanan-

ringan-kekinian-olahan-pisang/> (Retrieved on September 12,2018).

AlKhajeh, M.H.A., & Azam, A.K. 2018. Management Accounting Practices (MAPs) Impact on

Small and Medium Enterprise Business Performances Within the Gaunteng Province of

South Africa. Journal of Accounting and Auditing: Research & Preactice, vol. 2018 (2018):

1-8. Doi:10.5171/2018.345766.

Andreas. 2011. Manajemen Keuangan UKM. Yogyakarta: Graha Ilmu.

Arikunto, Suharsimi. 2013. Suatu Pendekatan Praktik. Jakarta:Rineka Cipta.

Ayyagari, M., Thorsten, B. & Asli, D.K. 2007. Smalll and Medium, Enterprise across the globe.

Small Business Economics. 29(4): 415-434. Http:/doi.org/10.1007/s1187-006-9002-5

Bank Indonesia & LPII. 2015. Profil Bisnis Usaha Mikro, Kecil dan Menegah (UMKM). Via

<http://bii.go.id> (Retrieved on March 8,2018).

Basri, H.A.K., Siti, N & M. Sabri. A. M. 2016. Accounting and Accountability in Religius

Organizations: An Islamic Contemporary Scholars’ Perspektive. Gadjah Mada International

Journal of Business, Vol 18(2): 207-230.

Bhaiti, M., & Kumar. M. D. 2012. International Factor and Enterpreneurial perception: Indiction

from Yemen SME’s. Far East Journal of Psychology & Business. 6(1): 1-21

Brickmann, J., Salomo, S & Gemueden HG. 2011. Financial Management Competence of

Founding Teams and Growth of New Technology-based Firms. Entre Theo and Prac. 35(2):

217-243

Brijal, P., Enow, S., & Issaacs, E. B. H. 2014. The Use of Financial Management Practices by

Small, Medium, and Micro Enterprise: A Perspektive From South Africa. Industry and

Higher Education. 28(5): 341-350. Doi :10.5367/ihe.2014.0223

Bungin, B. 2011. Penelitian Kualitatif Komunikasi, Ekonomi, Kebijakan Phblik, dan Ilmu Sosial

Lainnya. Jakarta: Kencana Prenada Media Group.

___________. 2013. Metodologi Penelitian Sosial & Ekonomi. Jaka

rta: Kencana Prenada Media

Group.

Cakmak, A. 2018. Internationalization Strategies of Service Sector Small and Medium

Enterprises in Turkey. Walden Dissertation and Doctoral Studies. Walden Univeersity.

Chittithaworn, C., et al. (2011). Factors affecting business success of small & medium enterprise

(SMEs) in Thailand. Asian Social Science. 7(5): 180-190. <Https://doi.

org/10.53539/assv7n5p180>

Creswell, Jhon W. 1998. Qualitative Inquiry and Research Design, Choosing Among Five

Traditions. California: Sage Publication.

Dalberg. 2011, Report on Support to SMEs in Developing Countries Through Financial

Intermediaries. Via <http://www.eib.org/attachments/dalberg_sme-briefing-paper.pdf

>(Retrieved on September 12, 2018)

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana

Business in Banda Aceh

783

Departemen of Trade and Industry of Soouth Africa. 2013. Annual Review of Small Business in

South Africa. <Via http://www.tipa.org.za/files/2003> (Retrieved June 5, 2018)

_____. 2008. Annual Review of Small Business In South Africa. From

<http://www.dti.gov.za/sme>. (Retrieved June,5 2018)

Depkop Indonesia. 2015. <Via http://www.depkop.go.id>(retrived on March 14, 2018)

Diyana, L.Y.F. 2017. Analisis Pengelolaan Keuangan Usaha Mikro Kecil dan Menengah Studi

Kasus Pada Asosiasi Batik Mukti Manunggal Kabupaten sleman. Skripsi. Yogyakarta:

Universitas Sanata Dharma.

Duncombe, R, & Richard, H. 2005. Information & Comunication Technologies (ICTs), Poverty

Reduction and Micro, Small & Medium-scale Enterprises (MSMEs). A Frameworkk for

Understanding ICT application for MSMEs in developing countries. A Panel at the World

Summit on the Information Society, (1): 1-46

Endiras, D.T. 2010. Akuntansi dan Kinerja UMKM. Jurnal Ekonomi dan Bisnis. 2(15): 152-158.

Depok: Universitas Gunadarma. Via <http://ejournal.gunadarma.ac.id/index.php/

ekbis/article/view/331/271>. (Retrieved on September 15,2018)

Fahmi, I. 2013. Pengantar Manajemen Keuangan, Teori dan Soal Jawab. Bandung. CV. Alfabeta

Fatoki, O. 2012. An Investigation Into the Financial Management Practices of New Micro-

Enterprise in South Africa, Journal Of Social Sciences, 33(2): 179-188, DOI:

10.1080/09718923.2012.11893097.

Foley, P. & H. Green(eds).1989. Small Business Success. London: Chapman.

Handoko, H. 2011. Manajemen: 2

nd

ed. Yogyakarta: BPFE.

Hartati, S.2013. Manajemen Keuangan Untuk Usaha Mikro, Kecil dan Menengah. Via www.api-

pwu.com (Retrieved on March 20,2018).

Hidayat. I.P. 2008. Akuntansi Untuk Usaha Kecil Menengah. Via <Http://imanph.

wordpress.com> (Retrieved on March 14,2018)

Higgins, R.C. 2012. Analysis for Financial Management: 10

th

ed. New York: McGraw-Hill.

<Https://doi.org/10.1007/s13398-014-0173.2>

Islam, M.A., et al. 2001. Effect of Enterpreneur and Firm Characteristics on the Bussiness

Success of Small and Medium Enterprises (SMEs) in Bangladesh. International Jurnal Of

Business and Management. 6(3):289-299.

Kasmir. 2010. Pengantar Manajemen Keuangan. Jakarta: Kencana Prenada Media Group.

Kazlaukaite, R, et al. 2015. Network Research on Internationalization of Firm From the Emerging

Economies: Literature review and proposition. European Journal Of Business and

Economics. 10(1): 26-30.

Kompas.com. 2017. Nugget dan Aneka Olahan Pisang Yang Sedang Viral. Via

<htpps>//travel.kompas.com/read/2017/10/11/210300227/nugget-dan-aneka-olahan-pisang-

yang-sedang-viral> (Retrieved on May 10,2018)

Kuswandi. 2005. Cara Mudah Memahami Angka dan Manajemen keuangan Bagi Orang Awam.

Jakarta: Elex Media Komputindo.

Manurung, A.H. 2008. Modal Untuk Bisnis UKM. Jakarta: PT Gramedia.

Moleong, L.J. 2010. Metodologi Penelitian Kualitatif. Bandung: Remaja Rosdakarya.

Mubarok, A, & Faqihudin, M. 2011. Pengelolaan Keuangan Untuk Usaha Kecil dan Menengah.

Tanggerang: Suluh Media.

Nazaruddin, T., S. M., & Fikriah. 2017. Analisis Usaha mikro kecil dan menengah (UMKM)

sektor perdagangan di Kota Banda. Jurnal Ilmiah Mahasiswa (JIM) Ekonomi pembangunan

Fakultas Eonomi dan Bisnis Unsiyah. 2(2): 302-328.

Oktaviani, L.S. 2015. Analisis Manajemen Keuangan Pada UMKM (Usaha Mikro, Kecil dan

Menengah) Klaster Konveksi di Wilayah Kecamatan Kota Kabupaten Kudus. Skripsi. Kudus

: Universitas Muria Kudus.

Sato, Y. (2013) “social Capital”. Sociopedia.isa pp. 1-10. doi: 10.1177/205684601374.

Sekaran, U., & Bougie, R. 2013 reasearch methods for Business: A Skill Building Approach, 5

th

edition. New York: Jhon Wiley & Sons.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

784

Sener, S., M., & Aydin, O. Structure of small and medium-sized enterprises in Turkey and Global

Competitiveness Strategies, Turkey. Procedia-social Behavioral Science: 150(1) 212-221.

Doi: 10.1016/j.sbspro.20114.09.119.

Serambinews.com. 2017. B.I teliti Komoditi UMKM di Banda Aceh. http://www.tribun

news.com/2017/09/27/bi-teliti-komoditi-umkm-di-banda-aceh (Retrieved on May 09,2018)

Singarimbun, M & Efendi, S. 2006. Metode Penelitian Survei. Jakarta: Pustaka LPES.

Statistic South Africa. 2018. Quartely Labor Force Survey. From http://www.stat

ssa.gov.za./publications/PO211/P0211ndQuarter2018.pdf (Retrieved September 12, 2018).

Sugiyono. 2013. Metodologi Penelitian Kuantitatif, Kualitatif dan R&D. Bandung: Alfabeta.

Talev, K. et al. 20012. Internationalization of SMEs and organizational Factors in developing

country: A case study of ICT industry of Iran. International Journal of Academic Research

In Business and Social Scienses, 2(12): 80-96.

Tambunan, T. 2005. Promoting small and medium enterprises with a clustering approach: A.

policy experience from Indonesia. Journal of Small Business Management. 43(2):138-154.

Httpa://doi.org/1111/j.1540-627x.2005.00130.x

______. 2011.Development of Small and Medium Enterprises in A Developing Country: The

Indonesian Case Journal Of Enterprising Comunities: People and Plasces in Economy. 5(1):

68-82.

The Implementation of Financial Management at Micro, Small and Medium Enterprises (MSMEs): Case Study at Cak Ryan Fried Banana

Business in Banda Aceh

785