Financing Model of Profit and Loss Sharing Management

System for Halal Creative Economy

Ahmad Fauzul Hakim Hasibuan, Fuadi and Ichsan

Lecturer of Islamic Economic Department, Faculty of Economics and Business,

Universitas Malikussaleh, Aceh, Indonesia

Ichsan84@unimal.ac.id

Abstract. Islamic financial institutions exist as partners for those who need

funding to support investments that have been planned, both individually and in

groups. Financing is funding provided to support investments that have been

planned in advance. The terminology of financing means I trust, I believe, I put

trust. In other words, financial institutions as sahibul al-mal give trust to

customers called mudarib to use these funds as well as possible in a fair, honest

manner accompanied by clear ties and mutual benefits for both parties. Based

on seeking the pleasure of Allah SWT for the good of the world and the

hereafter, Islamic financial institutions offer several financing products both in

profit-sharing and buying and selling. The profit-sharing agreement is

considered suitable with the financing philosophy inherent in the partnership

system. With the strengthening of the principle of profit-sharing financing

agreement is expected to encourage the halal creative economic efforts to be

able to contribute to economic development in Indonesia.

Keywords: Islamic Financing ꞏ Profit and Loss Sharing Management System ꞏ

Halal Creative Economy

1 Preliminary

Economic growth in the first quarter 2018 amounted to 5.09 per cent higher compared

with the first quarter of economic growth in 2017 by 5.01 percent. Government

presents a new discourse of the creative economy is dominated by the SME sector.

The government has launched a creative economy sector's contribution to national

GDP is very real that is about 6.3% (in 2007), and in 2011 rose to about 8.9%. 2014

GDP creative economy sector amounted to Rp 784.82 trillion and increased to Rp

852.24 trillion in 2015 or rose to 4.38%, which accounted for 7.38% then increased

7.44 percent or Rp 922.58 trillion to the national economy and could continue to

increase to 1.000 trillion with an increase of 0.06% in 2017.

The Government is aware of the creative economy very strategic position as one

of the pillars of the national economy which is supported by the halal industry which

continues to grow. This is attested by the changing in nomenclature ministry of the

Ministry of Culture and Tourism into the Ministry of Tourism and Creative Economy,

and many goals and targets to be achieved through this ministry program. Halal

industry was becoming a mainstay in the industry which is bringing in foreign

Hasibuan, A., Fuadi, . and Ichsan, .

Financing Model of Profit and Loss Sharing Management System for Halal Creative Economy.

DOI: 10.5220/0010524900002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 699-710

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

699

exchange in many countries. This is evident from the export of halal products

Indonesia increased in 2015 to reach USD 30 billion, then in 2016 decreased to USD

29 billion, and in 2017 increased to reach USD 35 billion, this value is 21 percent of

total exports in 2017. To support the development of the halal creative economy

industry must be supported by easy access to capital from islamic financial

institutions which are expected to become partners for the creative economy industry.

The presence of Islamic financial institutions is expected to be a partner for the

development of the halal creative economy industry. Islamic financial institutions

have developed very rapidly. This is because Islamic financial institutions have a

great influence on economic growth. Islamic financial institutions offer the principle

of profit-sharing financing that is expected to be able to obtain funding-based creative

industry partnerships by instilling the trust aspect (trust) to produce maximum benefit

by seeking the pleasure of Allah SWT.

Islamic financial institutions as business partners can increase economic growth

starting from the real sector which is expected to be able to get the business

opportunities of the creative economy industry. By offering financing products with

the principle of profit-sharing, it is expected to be able to answer all the needs of the

community, especially SMEs engaged in the halal creative industry, with the principle

of mutual trust to benefit both sides. If the community needs increase, accordingly the

business institutions will increase their production and development to meet the needs

of customers, while earning profits (Griffin and Elbert, 1996: 5).

Islamic financial institutions in conducting business with profit-sharing financing

products as activities that offer cooperation with customers to obtain benefits for both

parties. This business product can be carried out by business corporation

organizations that have legal entities, companies that have business entities, and

individuals who do not have legal entities or business entities. A corporation or

company in the scope of the halal creative economy industry can be said to generate

profits if the total revenue in a given period (total revenues) is greater than the total

cost in the same period. Profit is the main attraction in conducting business activities,

so that through the profit of business people especially those engaged in a halal

creative economy is expected to develop their business scale to increase greater

profits that have the potential to increase future economic growth.

2 Methodology

This research is qualitative. The research method used in this study is a literature

review of various studies that have been done before. Data collection methods used

are secondary data sourced from journals, documentation books, and the internet.

Some data are published by institutions that have credible credibility, such as the data

from Financial Services Authority (OJK), the Central Statistics Agency (BPS), and

Thomson Reuters.

Method of data analysis in this study was conducted by a descriptive analysis

method. The data that has been obtained is analyzed by descriptive analysis method.

The descriptive analysis method is compiling the data obtained and then interpreted

and analyzed to provide information for solving the problem encountered.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

700

3 Discussion

3.1 Financing Concepts

In addition to recognizing debts, Indonesian people are also known as loans in

conventional practice and financing in islamic practices. Debt is used in granting

loans to others. Someone who lends his wealth to others is called the person that gives

debt to others. The term credit is better known among the people as buying something

that is not paid in cash. In general credit or financing is not much different because

the practices that have been used in the community are the same.

Financing is always related to business activities. For this reason, before entering

into the problem of understanding financing, we need to know what business is.

Business is an activity that leads to an increase in added value through the process of

delivering services, trading or processing goods (production). In other words, business

is an activity in the form of developing economic activities in services, trade, and

industry to optimize the value of profits (Muhammad: 2005). Financing is funding

provided by one party to another party to support planned investments, both carried

out alone or institution. In other words, financing is funding spent to support planned

investments (Muhammad: 2005).

In Constitution Number 10 Year 1998, stated that financing based on Islamic

principles is the provision of money or claims equivalent to that based on an

agreement between the bank and another parties that requires the financed party to

return the money or the bill after a certain period time with compensation or profit-

sharing.

While credit in Banking Constitution No.10 1998 is the provision of money or

bills that can be equated with it based on the agreement or loan agreement between

the bank and another party that requires the borrowing party to repay its debt after a

certain period of time with interest.

The term financing means I believe, I Trust, I put trust. The term financing means

that the financial institution as sahib al-mal puts trust in someone to carry out the

mandate given. These funds must be used properly, fairly, and must be accompanied

by ties and clear and mutually beneficial terms for both parties (Veithzal Rivai and

Andria Permata Veithzal, 2008)

Financing in the conventional principle is by lending money to those in need by

taking profits in the form of interest and the provision of the proceeds lent. The

principle of negating this kind of transaction and turning it into financing by not

lending some money to the customer, but financing the customer's project. In this

case, the bank functions as money intermediary without lending money and lending

money. Instead, financing the customer's business can be done by buying goods

needed by the customer, then the bank

resells the customer, or can also include

capital in the customer's business (Veithzal Rivai and Andria Permata

Veithzal, 2018)

In financing principle, there are three types of schemes in performing financing

agreement, namely:

Financing Model of Profit and Loss Sharing Management System for Halal Creative Economy

701

a. The Principle of Profit-sharing

Financing facilities provided in the form of money or goods valued in cash.

When viewed from the side of the amount can provide up to 100% of the

capital needed, or only partly depends on agreement, analysis and customer

needs. This can be seen from the side of the results that are divided into 2

types, namely revenue sharing and profit-sharing. The percentage results are

referred to as the specified ratio and according to their respective agreements.

Here covenants used in the principle of profit-sharing

1. Mudaharabah, namely a business cooperation agreement between two

parties where the first party (sahib al-mal) provides all (100%) of capital,

while the other party becomes the manager. Mudaraba business profits are

divided according to the agreement set forth in the contract, whereas if the

loss is borne by the owners of capital loss was not due to negligence

manager. If the loss was due to fraud or negligence of a manager, then the

manager should be responsible for such losses (Antonio, 2001)

2. Musyarakah, namely a contract of cooperation between two or more

parties, for a particular business in which each party contributes funds (or

charity) with the agreement that the benefits and risks will be borne

together in accordance with the agreement (Antonio, 2001).

3. Muzara'ah, a contract of cooperation or mixing of agricultural processing

between the landowner and the cultivator with a production sharing system

based on the yield of the crop. As for the types of muzara'ah are: (a)

muzara'ah, which is management cooperation of the farm where the seeds

come from the landowner; (b) mukhabarah, namely cooperation in the

management of land where the seeds come from cultivators.

b. The Principle of Buying and Selling

This principle is a system that implements the procedure of buying and selling,

which the bank will buy the goods needed first or appoint the customer as an

agent of a financial institution to purchase goods on behalf of the financial

institution, then the financial institution sells the goods to the customer at a

purchase price plus profit (margin/mark-up) (Muhammad, 2006). This

principle is used because there is a transfer of ownership of goods or objects.

The profitability of financial institutions is determined in advance and

becomes a part of the price of goods traded. This principle is in the product:

1. Bai 'al-Murabahah, namely the buying-selling agreement of certain items.

In the transaction, the seller clearly states the goods being traded, including

the purchase price and the profits taken.

2. Bai 'al-muqayyada, namely buying and selling which is an exchange

between goods and goods (barter). Buying and selling applications of this

kind can be done as a way out for export transactions that cannot generate

foreign exchange.

3. Bai 'al-mutlaqah, namely the exchange between goods or services with

money. Money acts as a medium of exchange. This kind of buying and

selling is found in all financial institution products that are based on the

principle of buying and selling.

4. Bai 'as-salam namely buying and selling agreement where the buyer pays

money (at the price) for the goods whose specifications have been

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

702

mentioned, while the goods being bought and sold will be submitted later,

namely on the agreed date.

5. Bai 'al-istisna, namely a sale and purchase contract in which the price of

the item is paid first, but can be paid in installments according to the

schedule and terms agreed upon, while the goods purchased are produced

and delivered later (Arifin, 2006).

c. Rental Principle

In addition to the contract previously explained, there is also a contract in the

form of leases that are used in Islamic financial institutions. This principle

consists of two types of contracts, namely:

1. The ijarah agreement, namely the contract for transferring the use rights of

goods or services through payment of rental wages without being followed

by the transfer of ownership (milkiyah) of the goods themselves.

2. The ijarah muntabihabi at-tamlik contract, which is a kind of combination

between a selling-buying contract and a lease or rather a lease agreement

that ends with ownership of the goods in the hands of the lessee. The nature

of the transfer of ownership is also a sign of ordinary ijarah (Antonio,

2008)

3.2 Philosophy Financing

The relationship between financial institutions and money in a business unit is

important. However, in practice, it must eliminate injustice, dishonesty, and

exploitation from one party to another. The position of financial institutions

concerning customers is as an investor partner to produce a fair level of profit.

In each of its activities, Islamic financial institutions aim to seek the pleasure of

Allah to obtain virtue in the world and the hereafter. Therefore, the practices adopted

by Islamic financial institutions do not deviate from religious guidance. The following

is a philosophy that must be applied by Islamic financial institutions in carrying out

its operations.

a. Abstain from Elements of Usury, by:

1) Does not justify the determination of the success of a business in advance

with certainty. Following the word of Allah SWT in Q.S Luqman [31]: 34:

ﱠ

ﻥ

ِ

ﺇ

َ

ﱠ

ٱ ۥ

ُ

ﻩ

َ

ﺪﻨ

ِ

ﻋ

ُ

ﻢ

ۡ

ﻠ

ِ

ﻋ

ِ

ﺔ

َ

ﻋﺎ

ﱠ

ﺴﻟٱ

ُ

ﻝ

ِ

ّ

ﺰَﻨ

ُ

ﻳ

َ

ﻭ

َ

ﺚ

ۡ

ﻴَﻐ

ۡ

ﻟٱ

ُ

ﻢ

َ

ﻠ

ۡ

ﻌ

َ

ﻳ

َ

ﻭ ﺎ

َ

ﻣ

ﻲ

ِ

ﻓ

ۖ

ِ

ﻡﺎ

َ

ﺣ

ۡ

ﺭ

َ

ۡ

ﻷٱ ﺎ

َ

ﻣ

َ

ﻭ ﻱ

ِ

ﺭ

ۡ

ﺪ

َ

ﺗ

ٞ

ﺲ

ۡ

ﻔَﻧ ﺍ

َ

ﺫﺎ

ﱠ

ﻣ

ُ

ﺐ

ِ

ﺴ

ۡ

ﻜ

َ

ﺗ

ۖ

ﺍ

ٗ

ﺪَﻏ ﺎ

َ

ﻣ

َ

ﻭ ﻱ

ِ

ﺭ

ۡ

ﺪ

َ

ﺗ

ۢ

ُ

ﺲ

ۡ

ﻔَﻧ

ِ

ّ

ﻱ

َ

ﺄ

ِ

ﺑ

ٖ

ﺽ

ۡ

ﺭ

َ

ﺃ

ۚ

ُ

ﺕﻮ

ُ

ﻤ

َ

ﺗ

ﱠ

ﻥ

ِ

ﺇ

َ

ﱠ

ٱ

ٌ

ﻢﻴ

ِ

ﻠ

َ

ﻋ

ۢ

ُ

ﺮﻴ

ِ

ﺒَﺧ ٣٤

"Verily, with Allah alone is the knowledge of the Hour. And He sends

down the rain, and He knows what is in the wombs. And no soul knows

what it will earn tomorrow, and no soul knows in what land it die. Surely,

Allah is All-Knowing, All-Aware "

2) Does not justify the percentage system as the imposition of fees on debt or

the provision of compensation for deposits that have an element to

automatically multiply the debt/deposit due to the passage of time. As

explained in the word of Allah SWT in Q.S. Ali Imran [3]: 130:

ﺎ

َ

ﻬ

ﱡ

ﻳ

َ

ﺄ

ٓ

ٰ

َ

ﻳ

َ

ﻦﻳ

ِ

ﺬ

ﱠ

ﻟٱ

ْ

ﺍﻮ

ُ

ﻨ

َ

ﻣﺍ

َ

ء

َ

ﻻ

ْ

ﺍﻮ

ُ

ﻠ

ُ

ﻛ

ۡ

ﺄ

َ

ﺗ

ْ

ﺍ

ٓ

ٰ

ﻮ

َ

ﺑ

ِ

ّ

ﺮﻟٱ ﺎ

ٗ

ﻔ

ٰ

َ

ﻌ

ۡ

ﺿ

َ

ﺃ

ۖ

ٗ

ﺔ

َ

ﻔ

َ

ﻌ

ٰ

َ

ﻀ

ﱡ

ﻣ

ْ

ﺍﻮ

ُ

ﻘ

ﱠ

ﺗٱ

َ

ﻭ

َ

ﱠ

ٱ

ۡ

ﻢ

ُ

ﻜ

ﱠ

ﻠ

َ

ﻌ

َ

ﻟ

َ

ﻥﻮ

ُ

ﺤ

ِ

ﻠ

ۡ

ﻔ

ُ

ﺗ ١٣٠

Financing Model of Profit and Loss Sharing Management System for Halal Creative Economy

703

"O you who believe, devour not interest involving diverse additions; and

fear Allah that you may prosper"

3) Prohibit of trading / renting of usury goods in exchange for other usury by

obtaining excess, both in quantity and quality

4) Does not justify the use of a system that establishes additional upfront debt

that is not on an initiative that has debt voluntarily.

b. Using a profit-sharing system in trading transactions in accordance with the

word of Allah SWT Q.S. al-Baqarah [2]: 275:

ِ

ﺬ

ﱠ

ﻟٱ

َ

ﻦﻳ

َ

ﻥﻮ

ُ

ﻠ

ُ

ﻛ

ۡ

ﺄ

َ

ﻳ

ْ

ﺍ

ٰ

ﻮ

َ

ﺑ

ِ

ّ

ﺮﻟٱ

َ

ﻻ

َ

ﻥﻮ

ُ

ﻣﻮ

ُ

ﻘ

َ

ﻳ

ﱠ

ﻻ

ِ

ﺇ ﺎ

َ

ﻤ

َ

ﻛ

ُ

ﻡﻮ

ُ

ﻘ

َ

ﻳ ﻱ

ِ

ﺬ

ﱠ

ﻟٱ

ُ

ﻪ

ُ

ﻄ

ﱠ

ﺒَﺨ

َ

ﺘ

َ

ﻳ

ُ

ﻦ

ٰ

َ

ﻄ

ۡ

ﻴ

ﱠ

ﺸﻟٱ

َ

ﻦ

ِ

ﻣ

ۚ

ِ

ّ

ﺲ

َ

ﻤ

ۡ

ﻟٱ

َ

ﻚ

ِ

ﻟ

ٰ

َ

ﺫ

ۡ

ﻢ

ُ

ﻬ

ﱠ

ﻧ

َ

ﺄ

ِ

ﺑ

ْ

ﺍ

ٓ

ﻮ

ُ

ﻟﺎ

َ

ﻗ ﺎ

َ

ﻤ

ﱠ

ﻧ

ِ

ﺇ

ُ

ﻊ

ۡ

ﻴ

َ

ﺒ

ۡ

ﻟٱ

ُ

ﻞ

ۡ

ﺜ

ِ

ﻣ

ۗ

ْ

ﺍ

ٰ

ﻮ

َ

ﺑ

ِ

ّ

ﺮﻟٱ

ﱠ

ﻞ

َ

ﺣ

َ

ﺃ

َ

ﻭ

ُ

ﱠ

ٱ

َ

ﻊ

ۡ

ﻴ

َ

ﺒ

ۡ

ﻟٱ

َ

ﻡ

ﱠ

ﺮ

َ

ﺣ

َ

ﻭ

ۚ

ْ

ﺍ

ٰ

ﻮ

َ

ﺑ

ِ

ّ

ﺮﻟٱ ﻦ

َ

ﻤ

َ

ﻓ ۥ

ُ

ﻩ

َ

ء

ٓ

ﺎ

َ

ﺟ

ٞ

ﺔ

َ

ﻈ

ِ

ﻋ

ۡ

ﻮ

َ

ﻣ ﻦ

ِ

ّ

ﻣ ۦ

ِ

ﻪ

ِ

ّ

ﺑ

ﱠ

ﺭ

ٰ

ﻰ

َ

ﻬ

َ

ﺘﻧﭑ

َ

ﻓ ۥ

ُ

ﻪ

َ

ﻠ

َ

ﻓ ﺎ

َ

ﻣ

َ

ﻒ

َ

ﻠ

َ

ﺳ

ٓ

ۥ

ُ

ﻩ

ُ

ﺮ ۡﻣ

َ

ﺃ

َ

ﻭ ﻰ

َ

ﻟ

ِ

ﺇ

ۖ

ِ

ﱠ

ٱ

ۡ

ﻦ

َ

ﻣ

َ

ﻭ

َ

ﻋ

َ

ﺩﺎ

َ

ﻚ

ِ

ﺌ

ٓ

ٰ

َ

ﻟ

ْ

ﻭ

ُ

ﺄ

َ

ﻓ

ُ

ﺐ

ٰ

َ

ﺤ

ۡ

ﺻ

َ

ﺃ

ۖ

ِ

ﺭﺎ

ﱠ

ﻨﻟٱ

ۡ

ﻢ

ُ

ﻫ ﺎ

َ

ﻬﻴ

ِ

ﻓ

َ

ﻥﻭُﺪ

ِ

ﻠ

ٰ

َﺧ ٢٧٥

"Those who devour interest do not rise except as rises one whom Satan has

smitten with insanity. That is because they say: Trade also is like interest;

whereas Allah has made lawful and made interest unlawful. So he to whom

an admonition comes from his Lord and he desists, then will that which he

received in the past be his; and his affair is with Allah. And those who

revert to it, they are the inmates of the Fire; therein shall they abide"

Then the Surat an-Nisa '[4]: 29:

َ

ﺄ

ٓ

ٰ

َ

ﻳ ﺎ

َ

ﻬ

ﱡ

ﻳ

َ

ﻦﻳ

ِ

ﺬ

ﱠ

ﻟٱ

ْ

ﺍﻮ

ُ

ﻨ

َ

ﻣﺍ

َ

ء

َ

ﻻ

ْ

ﺍ

ٓ

ﻮ

ُ

ﻠ

ُ

ﻛ

ۡ

ﺄ

َ

ﺗ ﻢ

ُ

ﻜ

َ

ﻟ

ٰ

َ

ﻮ ۡﻣ

َ

ﺃ ﻢ

ُ

ﻜَﻨ

ۡ

ﻴ

َ

ﺑ

ِ

ﻞ

ِ

ﻄ

ٰ

َ

ﺒ

ۡ

ﻟﭑ

ِ

ﺑ

ٓ

ﱠ

ﻻ

ِ

ﺇ ﻥ

َ

ﺃ

َ

ﻥﻮ

ُ

ﻜ

َ

ﺗ

ً

ﺓ

َ

ﺮ

ٰ

َ

ﺠ

ِ

ﺗ ﻦ

َ

ﻋ

ٖ

ﺽﺍ

َ

ﺮ

َ

ﺗ

ۚ

ۡ

ﻢ

ُ

ﻜﻨ

ِ

ّ

ﻣ

َ

ﻻ

َ

ﻭ

ْ

ﺍ

ٓ

ﻮ

ُ

ﻠ

ُ

ﺘ

ۡ

ﻘ

َ

ﺗ

َ

ﺴ

ُ

ﻔﻧ

َ

ﺃ

ۚ

ۡ

ﻢ

ُ

ﻜ

ﱠ

ﻥ

ِ

ﺇ

َ

ﱠ

ٱ

َ

ﻥﺎ

َ

ﻛ

ۡ

ﻢ

ُ

ﻜ

ِ

ﺑ ﺎ

ٗ

ﻤﻴ

ِ

ﺣ

َ

ﺭ ٢٩

“O you who believe, devour not your property among yourselves by

unlawful means, except that you earn by trade with mutual consent. And

kill not yourselves. Surely, Allah is Merciful to you”.

Every Islamic institutional transaction must be based on a profit-sharing and

trading system or the transaction is based on the exchange of money with goods. As a

result, the mu'amalah principle applies to the existence of goods/services money with

goods, so that it will encourage the production of goods/services, encourage the

smooth flow of goods/services can avoid the misuse of credit, speculation, and

inflation (Muhammad, 2005)

In the implementation of financing, Islamic banks must meet two very important

aspects, namely:

a. Islamic aspects, wherein every financing realization to customers, islamic

banks must continue to be guided by Islamic values, which do not contain

elements of maysir, garar, usury, and their business must be halal.

b. Economic aspects, which is by considering the benefits, both for sharia banks

and for sharia bank customers (Muhammad, 2005)

3.3 Creative Economy and Halal Products

Changes in the economic sector of the agriculture-based economy, industry-based,

then based on information technology that occurs in the world at this time. Nowadays

we are presented with the awesomeness of an information technology-based

economic wave, which coincides with the emergence of a new concept called the

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

704

Creative Society, which is a group of people based on individual creativity as their

livelihood, then the term creative economy emerges.

The creative economy is a concept in a new era that intensifies information and

creativity by relying on ideas and knowledge from human resources as the main

factors of production. This concept will usually be realized and supported by the

existence of creative industries. "The creative era is marked by the development of

creative industries that use individual ideas and skills as the main capital. So the

creative industry no longer fully relies on large capital and production machinery.

According to John Howkins, in his book The Creative Economy, people who have

ideas will be stronger than people who work with production machines, or even the

owners of machines themselves ", (Amelia, 2016).

The Trading Indonesian Ministry stated that, "the creative economy is an industry

that from the using of individual creativity, skills, and talents to create prosperity and

employment by producing and exploiting the creative power and creativity of the

individual". In reference to the plan for the Indonesian Creative Economy 2009-2015,

creative economy is defined as "A new era of economics after agricultural economics,

industrial economics, and information economy, which intensifies information and

creativity by relying on ideas and knowledge from human resources as the main

production factors in activities its economy. "Classification of the creative economy

According to the Ministry of Trade of the Republic of Industry in the book

Developing Creative Industries Towards the Vision of the Creative Economy 2025,

the creative industries can be grouped into 15 sub-sectors, and in its are added one

sub-sector namely advertising, architecture, markets for art goods, crafts, design,

fashion, video, film and photography, interactive games, music, performing arts

(showbiz), publishing and printing, computer services and software, television &

radio (broadcasting), research and development (R&D), culinary. "

The potential of the creative economy continues to experience growth, including

the presence of creative industry players collaborating with halal products that are

starting to interest the community. Based on data from the State of the global

economy in 2017-2018 Indonesia has the largest Muslim food consumption market in

the world with an achievement of USD 169 in 2016, and global halal food

consumption expenditure of USD 1,245 or 17% of global expenditure, it is estimated

that this figure will continue to grow amounting to 1,930 in 2022.

According to Islamic economist researchers, the potential of the domestic halal

industry is able to increase the State Budget (APBN) if it is managed optimally. The

government, through the Ministry of Industry, has carried out a strategic plan with the

establishment of the halal industrial estate targeted to be completed before 2022. This

is carried out with the high demand for halal products in the world. This Halal

Industrial Estate will be chosen in the Java region because the industrial goods sector

is already available. As for the management, the government will hand it over to one

of the entrepreneurs who already knows the standards for halal production that are

good (http://www.kemenperin.go.id).

Knowing that the huge potential of the creative economy industry of halal

products, it is felt necessary to have collaboration between the government, the

community and Islamic financial institutions as partners in developing halal creative

economy business. Islamic financial institutions act as partners by offering financing

products that are suitable to the needs of the community for the advancement of the

halal creative industry and are also supported by the government and its stakeholders.

Financing Model of Profit and Loss Sharing Management System for Halal Creative Economy

705

3.4 Islamic Financial Institutions as Halal Creative Economy Business

Partners

The system of financial institutions or the so-called rules concerning financial aspects

in the state financial mechanism has become an important thing for the success of the

development of a nation. Islamic law offers an acceptable economic system for people

who are able to manage all aspects of public finance. However, in the course of

human life, sometimes shackled in a capitalist economic system.

The presence of financial institutions in the country has gained a strong law after

the birth of banking constitution No. 7 of 1992 which was revised through

constitution Number 10 of 1998, which expressly acknowledges the existence and

functioning of the Islamic Profit Sharing Banks or Islamic Banks. Thus, this bank is

operating with the principle of profit sharing. Profit-sharing is the principle of

muamalah based on Islamic value in conducting bank business activities.

The Islamic financial sector occupies a strategic position in mediating the needs of

the community related to investment capital in the real sector, especially in enhancing

the halal creative economy which has considerable potential. Islamic financial

institutions and the community occupy the same position as business partners to

increase business partners, as well as Islamic financial institutions as an increase in

the business of Islamic financial institutions.

The presence of halal creative industries can be a great opportunity not only for

state revenue but also for Islamic financial institutions. Islamic financial institutions

and the financial industry can become partners with the creative industry, with a profit

loss and sharing management system model combined with management functions

namely planning, organization, actuating, controlling, evaluating. This model will be

a solution for financial institutions and customers able to apply together.

3.5 Model of Profit and Loss Sharing Management System in Islamic

Financing

Currently, Indonesian Muslims, as well as other Islamic countries, have implemented

economic systems based on Islamic values and principles to be applied in all aspects

of business life and economic transactions of the Ummah. This desire is based on

awareness to implement Islam fully and totally as confirmed by Allah SWT. in the

Qur'an.

"Do you believe in some parts of the Book (Torah) and deny other parts?

There is no repayment for those who do this than you, but contempt in the life

of the world, and on the Day of Judgment they are returned to a very severe

punishment. Allah is not unaware of what you do. "(QS. Al-Baqarah: 85).

An institution really needs management, because with the management of all the

activities of the institution will lead to efforts to achieve the goals set, so that all

elements in an institution will try to work following the provisions of the institution.

Therefore, the management process requires planning, organizing, budgeting,

leadership, and control.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

706

Management according to James F. Stoner (1982) quoted by Handoko (1993: 8) is

a process of planning, organizing, directing, and supervising members and other

resources to achieve the stated organizational goals. Here J.F. Stoner stressed that

management focused on processes and systems. Therefore if in the process and

system of planning, organizing, directing, budgeting, and supervision are not good,

then the overall management process is also not good.

While according to O.R.Terry quoted by Hadi (1990: 2) states that management is

an effort to achieve the goals set by using the expertise of others. In this case, Terry

does not explain what elements are needed by management so that the process of

achieving goals can run smoothly.

The Indonesian National Encyclopedia Vol. 16 (1990: 115) states that

management is a process of planning, organizing, and monitoring human resources

and other resources to achieve goals or targets effectively and efficiently. In this

sense, management will be good if an organization/institution has clear goals and

objectives and is known by all those involved in the activities of that organization.

After that, steps are arranged to achieve the goal by utilizing all resources (human,

funds, facilities, opportunities, natural resources, etc.) in an optimal, efficient and

effective manner. Activities and elements need to be regulated so that they do not

overlap so leadership and supervision are needed in their implementation.

In defining management, there are groups that emphasize fund management

activities, and groups that emphasize management functions. Groups that emphasize

management activities include Hein Weinrich and Harold Kosutz (1993) stating in

management: a global perspective management is the process of designing and

maintaining environment in which individuals, working together in groups, efficiency

accomplish selected aims. This group is supported by other experts such as Paul

Hersey, Kenneth H. Blanchard, Andrew N. Sziloggi and Bernard Keys.

Then groups that emphasize management functions include George Terry (1977)

stating: “Management is a distinct process consisting of planning, organizing,

actuating, and controlling, performed to determine and accomplish stated objectives

by the use of human being and other resources”. Also supported by experts include

Don Heleroegel, James A.F Stones and Donald C. Mosky.

The author is interested in describing management theory according to Frederick

W. Taylor and Henry Fayol who are scientific management figures. Both are

graduated from engineering (Siagian, 1994: 39). Frederick W. Taylor came from

America while Henry Fayol from France. They lived during the industrial revolution,

which brought big changes in various parts of the world, especially Europe and North

America. The change concerns management, especially regarding the concepts of

efficiency and effectiveness in the performance of organizations, industries, and

institutions. At that time many large companies engaged in the economy, industry,

mining, and trade. this progress has an extraordinary influence on the development of

management, especially on human resource management. Even though they have

written almost the same time, their ideas are different. If F.W. Taylor's ideas are based

on scientific research, Fayol wrote based on his years of experience as an executive

practitioner. Fayol tried to develop general principles that can be applied to all

managers at all levels of the organization and explains the functions that must be

performed by a manager. While Taylor focused on the lowest level of the

management organization, which is the lowest level of a factory (shop level

management).

Financing Model of Profit and Loss Sharing Management System for Halal Creative Economy

707

Frederick W. Taylor (1856-1915) known as the "Father of Scientific

Management" stated that scientific management is the application of scientific

methods to the study, analysis, and problem-solving in organizations. Taylor applied

the stages of science in solving problems in the company. From the results of his

research and analysis, several principles were replaced which replaced the old

principles of trial and error. This management is an effort to increase the productivity

of the workers. He argues that waste often occurs in production activities because the

workers often waste time due to inefficient performance. Taylor is also a manager and

corporate advisor.

In this case, the author tries to provide a model that combines Islamic financing in

a unified with a good management system called the profit and loss sharing

management system with mudharabah contracts.

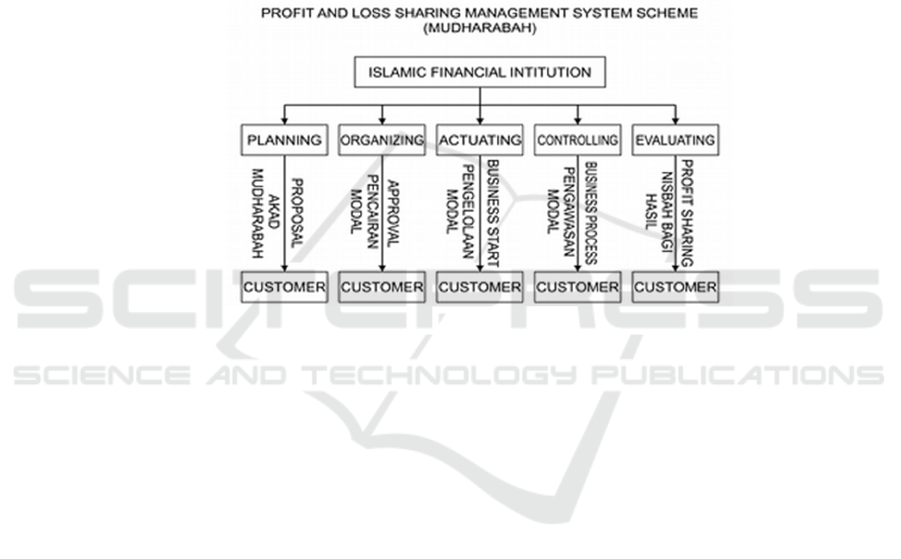

Fig. 1. profit and loss sharing management system with contract of Mudharabah.

The profit and loss sharing management system offers profit-based financing with the

addition of modern management elements to reduce the risks of financial institutions

and customers concerned.

This model directly contributes to Islamic financial institutions starting from the

planning, organizing, actuating, controlling and evaluating stages. The planning

function must be applied when submitting a mudharabah financing proposal to an

Islamic finance institution, so that the mudharabah agreement is approved by sohibul

maal. Furthermore, the organizing function is carried out at the time of approval

(disbursing funds) by regulating the feasibility of capital disbursement. The next

function is actuating, which must be attached to and implemented by Islamic financial

institutions in customer businesses that have not yet been started or are already

running. The function that must be significant is the supervisory function on business

supervision to avoid the achievements or bankruptcy of the business. Islamic financial

institutions in this case must participate directly in overseeing the customer's business.

And next is the evaluating function, that Islamic finance institutions and customers

evaluate the results of operations.

Then in this case the authors also formulated a model that combines Islamic

finance with a good management system called the profit and loss sharing

management system with the musyarokah contract.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

708

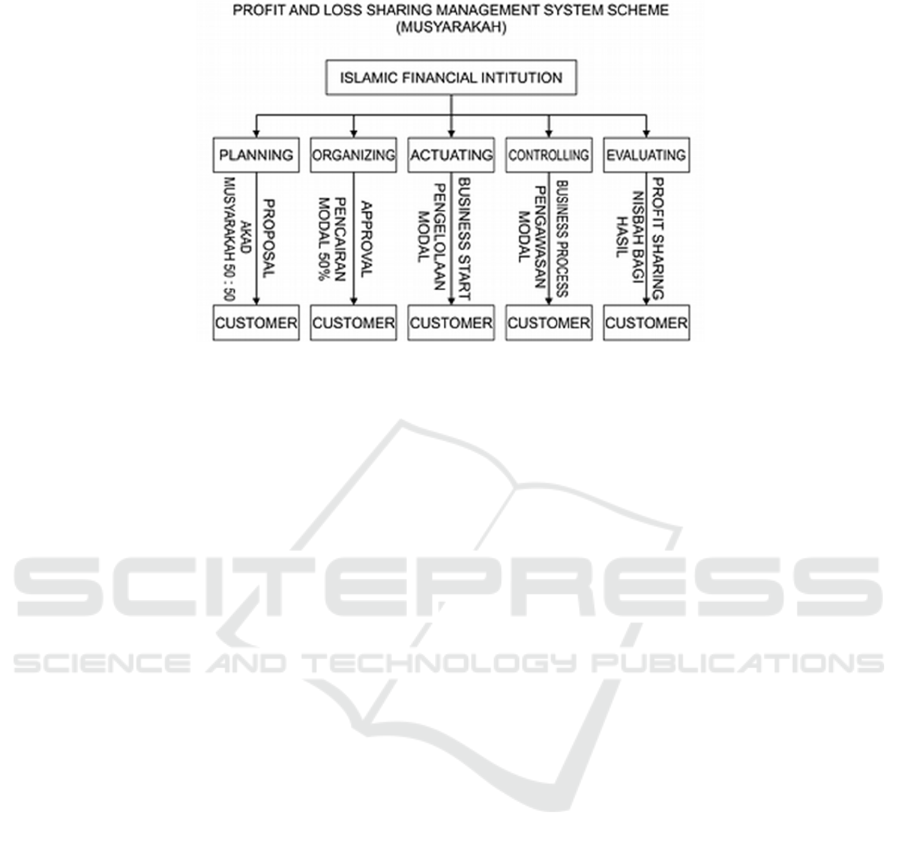

Fig. 2. profit and loss sharing management system with contract Musyarokah.

Not much different from mudharabah financing, musyarakah financing with a

profit and loss sharing management system offers profit-sharing based financing with

the addition of modern management elements to reduce the risks that are feared by

financial institutions and customers.

This model offers the contribution of Islamic financial institutions directly which

starts from the planning, organizing, actuating, controlling and evaluating stages. The

planning function must be carried out starting when submitting a Musyarakah

financing proposal of 50 percent or a specified portion of the financing proposal.

Furthermore, the organizing function will function at the time of approval

(disbursement of funds) by 50% and regulate the feasibility of capital disbursement.

The next function is actuating, this function must be attached and implemented by

Islamic financial institutions where the customer's business will be started or already

running. The function that must be significant is the function of supervision or

assessment in business supervision to avoid the achievements or bankruptcy of the

business. Islamic financial institutions in this case must participate directly in

overseeing the customer's business. And next is the evaluating function that Islamic

finance institutions and customers evaluate the results of operations.

4 Conclusion

The authors conclude, among others:

1. Mudaharabah, namely a contract of business cooperation between two parties

where the first party (sahib al-mal) provides all (100%) capital, while the other

party becomes the manager. Mudharabah business profits are divided

according to the agreement set forth in the contract, whereas if the loss is borne

by the owner of the capital as long as the loss is not due to negligence of the

manager. If the loss is caused due to fraud or negligence of the manager, then

the manager must be responsible for the loss;

Financing Model of Profit and Loss Sharing Management System for Halal Creative Economy

709

2. Musyarakah, namely a cooperation agreement between two or more parties for

a certain business in which each party contributes funds (or charity) with an

agreement that the benefits and risks will be borne together following the

agreement;

3. Creative economy is a concept in a new era that intensifies information and

creativity by relying on ideas and knowledge from human resources as the

main production factor;

4. Mudharabah and musyarakah financing models with a good management

system will increase the trust of Islamic financial institutions for customers

because Islamic financial institutions participate directly in business

management of customers;

5. Profit and loss sharing management systems offer trust from both parties

because this system will create checks and balances to avoid the customer's

business performance or bankruptcy.

References

Anshori, Abdul Ghofur, Capita Selecta Islamic Banking in Indonesia, Yogyakarta: UII Press,

2008.

_______, Establishment of Islamic Banks Through Acquisition and Conversion Approaches

Positive Law and Islamic Law, Yogyakarta: UII Press, 2010.

Antonio, Muhammad Shafi, Bank Syariah: from Theory to Practice, Jakarta: Gema Insani

Press, 2001.

Arifin, Zainul, Fundamentals of Bank Management Shariah, Jakarta: Pustaka Alvabet 2006.

Ascarya, Akad and Islamic Banking Products, Jakarta: RajaGrafindo Persada 2011.

Dunil, Z., Dictionary of Banking Terms Indonesia, Jakarta: Gramedia 2004.

Karim, Adiwarman, Bank Islam: Fiqh and Financial Analysis, Jakarta: RajaGrafindo Persada

2006.

Muhammad (ed.), Islamic Banking: Analysts Strengths, Weaknesses, Opportunities, and

Threats, Yogyakarta: Ekonosia 2006.

Muhammad, Sharia Bank Management, Yogyakarta: UPP AMP YKPN 2005.

_______, Islamic Banking Funds Management, Yogyakarta: Ekonosia 2005.

_______, Bank Syariah Financing Management, Yogyakarta: UPP AMP YKPN 2005.

Perwaatmadja, Karnaen and Muhammad Shafi Antonio, What and How Islamic Bank,

Yogyakarta: Yasa Prima Bhakti Fund, 1992.

Rival, Veithzal and Andria Permata Veithzal, Islamic Financial Management, Jakarta:

RajaGrafindo Persada 2008.

Rival, Veithzal and Arviyan Arifin, Islamic Banking: A Theory, Concepts and Applications,

Jakarta: Earth Akasara 2001.

Law No. 10 Year 1998 on the Amendment to Law No. 7 of 1992 on Banking.

Zulkifli, Suhartono, Practical Guide to Islamic Banking Transactions, Jakarta: Judge Zikrul

2003.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

710