The Impact of Audit Quality on Auditor Litigation

in Indonesia

Andi Agus

1

and Nurna Aziza

2

1

STIEM Bongaya, Makassar, Indonesia

2

Bengkulu University, Bengkulu, Indonesia

Abstract. This paper attempts to empirically examine the impact of audit quality

on auditor litigation. This study considers a sample of 170 auditors working in

public accounting firms using random survey methods. The main technique for

analyzing data in Structural Equation Modeling (SEM) through AMOS IBM

version 22. The test results show that the client pressure has a negative and

significant effect on audit quality, while auditor quality has not negative and

significant effect on auditor's litigation. The findings emphasize the disturbance

of the client pressure aspects on auditors' during the audit. Audit quality in this

study was not unable to reduce the potential for litigation.

Keywords: Client Pressure ꞏ Audit Quality ꞏ Litigation

1 Introduction

The auditor is legally responsible for the quality of audits produced or the auditor may

be subject to lawsuits (litigation) to the low quality of audits produced [1]. This

statement is following the United States Supreme Court decision that the auditor is

legally responsible for losses resulting from misleading financial statements, even

though the financial statements have been prepared following GAAP [2]. The statement

reflects the auditor's high legal obligations over audit quality. Low audit quality has the

potential to lead to capital market penalties and auditor litigation.

Cases of capital market penalty and auditor litigation can be seen in the case of

Arthur Andersen in the United States [3], KMPG in the United States

(AccountingWeb.com. December 14, 2006), and Chuo Aoyama in Japan [1].

Specifically, in Indonesia, a similar case can be seen in the case of KAP HTM, which

did not reveal the profit inflation and the inventory value of PT. Kimia Farma. KAP

JAS who made an audit error in the financial statements of PT. Great River International

Tbk. KAP TSFB which did not reveal the profit markups of PT. Garuda Indonesia.

These cases show the high capital market penalty and auditor litigation, the low quality

of audits produced by the auditor, and the strong client pressure on the auditor to be

involved in hiding the fraud committed by the client.

[4] The public accounting profession is a profession associated with stressful work.

[5] Auditors are vulnerable to client pressure in a conflict about accounting issues. [6]

Client pressure aims to prevent auditors from acting professionally when conflicts of

interest arise between management and the auditor. Client pressure on the auditor at the

time of the audit can negatively affect audit quality and increase the potential for capital

Agus, A. and Aziza, N.

The Impact of Audit Quality on Auditor Litigation in Indonesia.

DOI: 10.5220/0010524300002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 673-680

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

673

market penalties and auditor litigation. This paper empirically examines the influence

of client pressure on audit quality and its impact on auditor litigation.

2 Literature Review and Hypothesis

2.1 Client Pressure and the Audit Quality

Users of financial statements, consider auditors vulnerable to client pressure [7]. Client

pressure can be: (a) Personal pressures, such as granting luxury facilities to auditors

when conducting audits [8] and providing guidance to clients [9], (b) Emotional

pressures such as intimidation of dismissal and replacement of auditors [10], (c)

Financial dependencies such as the provision of non-audit services [11] and large audit

fees [12]. These three pressures can disrupt auditor independence and result in a

decrease in audit quality.

[13], [14] Found that client pressure influences auditor decisions as a function of

individual factors related to auditory sensitivity to client pressure. [15], [16], [17]

Provide evidence that client pressure influences auditor behavior in carrying out audit

tasks. Strong client pressure can cause auditor dysfunctional behavior in reaction to

audit work environment factors that have an impact on deteriorating audit quality.

H1. Client pressure has a negative and significant influence on audit quality

2.2 Client Pressure and Litigation

Client pressure arises in situations of conflict between the auditor and the client. A

conflict of interest causes management pressure, whether actual or perceived to prevent

the auditor from acting independently and professionally [6]. [17] Define client

pressure as pressure to follow client desires or influence auditors. Therefore, the client

tries to influence the financial testing and reporting function by the auditor by pressing

the auditor to take actions that violate the professional standards for public accountants,

the professional code of ethics, and financial accounting standards.

Violations of the professional standards for public accountants, professional

code of ethics, and financial accounting standards reduce the auditor's ability to find

and disclose fraud and thus potentially lead to litigation. [18] Found that auditor

litigation is related to the auditor's reporting back on the audited client's annual financial

statements because the auditor did not reveal any errors, errors, or fraud. [19] Found

that auditor litigation stems primarily from technical standard violations, failure to

detect fraud or failure of disclosure that should be present in audit reports.

H2. Clien Pressure has a positive and significant influence on litigation

2.3 Audit Quality and the Auditor Litigation

[20] Auditors improve audit quality to avoid litigation risk. [21] High audit quality

decreases the auditor's mitigation potential. [22] High audit quality preserves the

benefits of financial statements and avoids capital market penalties. [23], [24] High

audit quality can increase the credibility of financial statements, investor confidence in

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

674

financial statements, client confidence in auditors, and avoid clients and auditors from

capital market penalties and litigation from third parties who feel disadvantaged.

[3] Auditors who produce low audit quality are reflected in the legal case or

litigation faced. [25] Litigation or lawsuits that have befallen the auditor mostly stems

from issues of published financial statements. The main cause is low audit quality or

audit failure. [26] Audit failures occur when auditors submit audit opinions that are not

appropriate because they do not meet established audit standards. [1] Auditors are

legally responsible for the quality of audits produced or auditors may be subject to

litigation for the low quality of audits produced.

H3. Audit quality has a negative and significant influence on auditor litigation

2.4 Mediation Effects of Audit Quality

During the audit, the auditor is faced with various pressures that might affect the

attitudes, behavior, and actions of the auditor. When the auditor understands his

professional responsibilities, the auditor may choose to act ethically to obtain a positive

work assessment. When the auditor is stressful, the auditor may act unethically to

produce low audit quality. [20] Explain that financial statements containing material

misstatements are generally seen as low audit quality.

[27], [28] The potential risk of litigation is triggered by the potential inherent in the

company related to the unmet interests of investors and creditors. Stakeholders'

interests are; (a) There is a guarantee that the financial statements do not have material

misstatements and do not commit fraud [29], (b) The financial statements are free from

management interest bias and are neutral for the interests of various user groups, present

important information, and contain as much possible relevant data [30]. This can be

interpreted that stakeholders have a high interest in audit quality and can sue the auditor

if they feel disadvantaged by accounting information that results from low audit quality.

H4. Audit quality mediates the effect of client pressure on the auditor litigation

3 Methodology

The data used in this study are primary data obtained from the results of questionnaire

surveys on respondents, namely auditors who work in the Public Accounting Firm

(KAP) registered at the IAI-KAP Directory in 2013. The population of the study is the

auditor who works for KAP in Indonesia. Based on the 2013 IAI-KAP Directory, there

were 409 KAP in all regions of Indonesia [31]. The sampling technique was carried out

with nonprobability sampling techniques, namely purposive sampling with the type of

judgment sampling with certain criteria.

The minimum sample size for SEM analysis with the Maximum Likelihood

estimation method is 100 to 200 [32]. The number of samples used in this study is 220

samples, which means the number of samples has exceeded the sufficient number of

samples in SEM analysis. The number of samples in this study was 170 auditors who

worked in public accounting offices in several major cities in Indonesia. Survey method

by sending questionnaires to respondents who are used to collect data about; client

pressure, audit quality, and auditor litigation.

The Impact of Audit Quality on Auditor Litigation in Indonesia

675

The main technique for analyzing data is a structural equation modeling (SEM).

Data processing is done using the Statistical Package for Social Science (SPSS)

application program version 22 and Analysis of Moment Structure (AMOS) version 22.

4 Result

4.1 Normality Test

The normality test in SEM analysis is intended to determine the normal distribution of

research for each variable. Normality evaluation is carried out using the criterion of

critical skewness value, data is said to be normally distributed if the value of the critical

ratio skewness value is below the absolute price of 2.58 [32], while [33] States that the

value of C.R multivariate below 8 is acceptable and the analysis can still be continued

as long as all indicators have a C.R kurtosis value -2.58 < z < 2.58.

The results of the normality test show that the research data is normally distributed

because the univariate C.R skewness values of all variables have been in the interval of

-2.58 < z < 2.58 so it can be concluded that the data analyzed has met univariate

normality, furthermore, the multivariate C.R value has also been being in the range of

-2.58 < z < 2.58 so that multivariate can be declared normal, thus it can be concluded

that the research data also fulfills the assumption of multivariate normality.

4.2 Tes the Validity of Exogenous Constructs

Exogenous construct validity test is done by looking at the value of the Loading Factor

of each indicator in the exogenous construct. In this test, the indicator is declared valid

if it has the value of Loading Factor > 0.5, while the exogenous construct reliability test

is done by calculating the AVE value and C.R exogenous construct. In this test, the

exogenous construct is declared reliable if the AVE model > 0.5 and C.R model > 0.7.

Moreover, the results of structural model estimates show that model modification has

a probability above 0.05, thus, the model has been used properly to test the hypothesis

in this study.

4.3 Goodness of Fit Indices

Goodness of fit is done to evaluate the suitability of the model by examining various

criteria. A model is said to be fit if the matrix covariance of a model is the same as the

data matrix covariance. Evaluation of goodness of fit is to assess whether the data to be

processed meets the assumptions of structural equation models. Three basic

assumptions must be met to be able to use structural equation models, namely: (1)

Independent data observation, (2) Respondents taken randomly, (3) Have a linear

relationship. Before the data is processed, it is necessary to test whether there are data

outliers and the assumption the normality of data.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

676

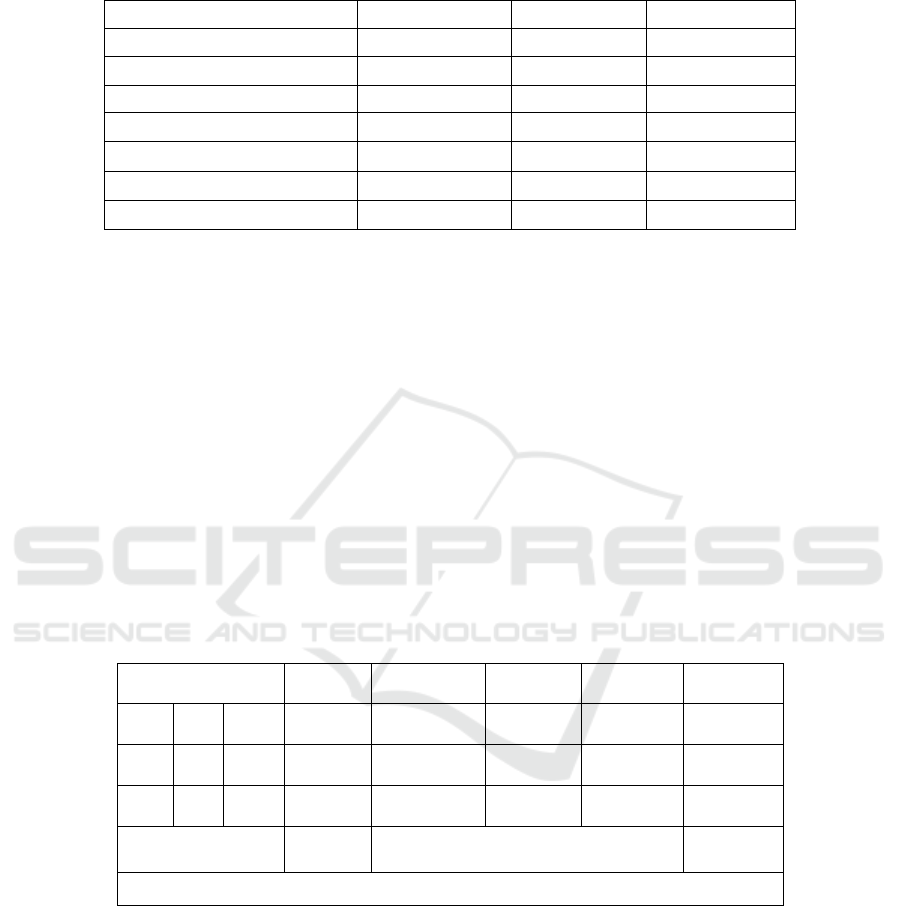

Table 1. Goodness of Fit.

Index Cut-off value Results Infor

m

ation

Chi-s

q

uare 170,809 233,168 Mar

g

inal

Significance Probability

0.05

0,00 Marginal

CMIN/DF ≤ 2.00 1,64 Goo

d

TLI

0.90

0,96 Good

GFI

0.90

0,90 Good

AGFI

0.90

0,84 Marginal

RMSEA

0.08

0,06 Good

Based on the test results, the Chi-square value is 233,168, the significance probability

of 0,000 is considered marginal because it is below the cut-off value nilai 0.05, CMIN

/ DF 1,64 (≤2,00), TLI 0,955 (≥0.90), GFI 0,90 (≥0.90), AGFI 0,84 (≥0.90), and

RMSEA 0,06 (≤0.08). Based on these results, the model in this study is fit.

4.4 Hypothesis Testing

Hypothesis testing is done by testing the level of significance aimed at testing whether

there is a significant effect of endogenous variables on endogenous variables. The

hypotheses built in this test are as follows:

Ho: There is no significant effect of exogenous variables on endogenous variables.

Ha: There is a significant effect of exogenous variables on endogenous variables.

With a significant level of 0.05, Ho will be rejected if the significant value (P)<0.05

and C.R>1.96, whereas if the value is significant (P)>0.05 and C.R<1.96 then Ho is not

rejected.

Table 2. Regression Weights.

Variabel Hipotesis C.R. p Estimasi Ket

CP → AQ H1 (-) -2,047 0,041* -0,167

Accepted

CP → AL H2 (+) 3,553 0,000* 0,437 Accepted

AQ → AL H3 (-) 1,314 0,189 0,156

Rejected

CP → AQ → AL H4

Indirect effect = (-0,167) (0,156)

= -0,0261 < 0,437

N

on si

g

nificance

Rejected

Note: AL: Auditor Litigation; AQ: Audit Quality; CP:Clien Pressure

Based on the results of statistical calculations, the value of p-value influence the client

pressure variable on audit quality (CP AQ) is significant (0,041*) with C.R marked

negative at -2,047. Therefore, the p-value obtained <0.05 and C.R is positive and

>1.96. The implication is that client pressure has a negative and significant effect on

audit quality, the stronger the client pressure, the lower the audit quality. So, the first

hypothesis is accepted.

The Impact of Audit Quality on Auditor Litigation in Indonesia

677

Furthermore, the second hypothesis analyzes the positive influence of client pressure

on auditor litigation. The results of the statistical test show the value of p-value the

effect of the client pressure variable on auditor litigation (CP AL) is significant

(0,000***) with C.R marked positive at 3,553. Because the value of the p-value

obtained <0.05 and C.R is positive and the absolute value is C.R>1.96. Thus, client

pressure has a positive and significant influence on auditor litigation, the stronger the

client pressure, the higher the auditor litigation. This means that the second hypothesis

is accepted.

The third states that there is a negative influence of audit quality on auditor

litigation. The test results show the value of p-value the influence of audit quality

variable on auditor litigation (AQ AL) is not significant with C.R positive sign of

1,314. Because the p-value obtained >0.05 and C.R is positive and the absolute value

is C.R<1.96. This means that auditor quality does not have a negative and significant

effect on auditor litigation. Poor audit quality is not the cause of auditor litigation in

Indonesia. So, the second hypothesis is rejected.

The third hypothesis The fourth hypothesis analyzes the role of audit quality

mediating client pressure on auditor litigation. Based on the path analysis shows the

estimated value of the direct effect of client pressure on auditor litigation is higher by

0.437 compared to through audit quality (indirect effect) of -0.0261 namely (-0.167) x

(0.156), but the probability value of the influence of client pressure on auditor litigation

(direct effect) is significant at 0,000 below 0.05. Likewise, the indirect effect of client

pressure on audit quality is significant (0.041 <0.05) and audit quality on auditor

litigation is not significant (0.189> 0.05). Thus, the results of the study indicate that

audit quality has not been proven to mediate the effect of client pressure on auditor

litigation. This means that client pressure cannot cause the auditor to potentially cause

auditor litigation even though the auditor produces low audit quality.

5 Conclusion

The results revealed that there was a negative and significant influence of client

pressure on audit quality. The next finding is that audit quality does not have a negative

and significant effect on auditor litigation. Furthermore, in the relationship between

client pressure and litigation, the findings also reveal that client pressure has a positive

and significant influence on auditor litigation. The theoretical implication of this

finding is that the stronger the client pressure, the lower the audit quality. The stronger

the client pressure, the higher the auditor litigation potential. While audit quality does

not have a negative and significant effect on auditor litigation. To examine the effect of

auditor quality mediation variables in the relationship between client pressure and

litigation, the statistical results show that audit quality does not mediate the effect of

client pressure on auditor litigation. Theoretically, the stronger the client pressure, the

lower the audit quality which will encourage high auditor litigation.

This finding emphasizes aspects of client pressure on the auditor. The findings show

that the client pressure experienced by the auditor at the time of the audit reduces audit

quality. The stronger the client pressure, the lower the audit quality. Auditors who

experience client pressure can behave dysfunctionally by ignoring integrity and

objectivity in conducting audits. The findings also show that client pressure increases

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

678

the potential for auditor litigation, but audit quality does not mediate the effect of client

pressure on auditor litigation.

References

1. Skinner, D.J. and Srinivasan, S. 2012. Audit Quality and Auditor Reputation: Evidence from

Japan. The Accounting Review, 87(5), 1737-1765.

2. Ball, R., 2009. Market and political/regulatory perspectives on the recent accounting

scandals, Journal of Accounting Research, Vol. 47 (2), pp. 277-323.

3. Barton, J. 2005. Who Cares about Auditor Reputation? Contemporary Accounting Research

22 (3), 549-586.

4. Weick, K. E. 1983. Stress in accounting systems, Accounting Review, Vol. 58, pp. 350-369.

5. Knapp, M. C. 1987. An Empirical Study of Audit Committee Support for Auditors Involved

in Technical Disputes With Client Management, The Accounting Review. Vol. July. Pp. 578-

588.

6. International Federation of Accountants (IFAC). 2012. Handbook of International Auditing,

Assurance, and Ethics Pronouncements: 2007 edition

7. Rhode, J. G. 1978. The Independent Auditor’s Work Environment: A Survey. Commission

on Auditors’ Responsibilities Research Study No. 4. New York, NY: AICPA.

8. Davis, L. R, Soo, B. S, dan Trompeter, G. M. 2009. Auditor Tenure and the Ability to Meet

or Beat Earnings Forecasts, Contemporary Accounting Research, Vol. 26, pp. 517-548.

9. Lindsay, D. 1989. Financial Statements Users’ Perceptions of Factors Affectivity the Ability

of Auditors to Resist Client Pressure in a Conflict Situation, Accounting, and Finance

(November): pp. 1-18.

10. Goldman, A., dan Barlev, B. 1975. The Auditor-Firm Conflict of Interest-its Implication for

Independence, The Accounting Review, Vol. 49, pp. 707

11. Frankel, R. M., Johnson, M. F., dan Nelson. K. K. 2002. The Relation Between Auditors’

Fees for Non-Audit Services and Earnings Management, The Accounting Review, Vol. 77,

pp. 71-105.

12. Harhinto, T. 2004. Pengaruh Keahlian dan Independensi Terhadap Kualitas Audit Studi

Empiris Pada KAP di Jawa Timur. Semarang. Tesis Maksi: Universitas Diponegoro

13. Windsor, C. A., dan Ashkanasy, N. M. 1995. “The Effect of Client Management Bargaining

Power, Moral Reasoning Development, and Belief in a Just World on Auditor

Independence”, Accounting, Organizations & Society, Vol.20 (7/8), pp. 701-720.

14. Tsui, J. S. L., dan Gul, F. A. 1996. “Auditors’ Behavior in an Audit Conflict Situation: A

Research Note on The Role of Locus of Control and Ethical Reasoning”, Accounting,

Organizations, and Society. Vol. January, pp. 41-51.

15. Lazarus, R. S. 1995. Psychological Stress in The Workplace. In Crandall, R. and P. L.

Perrewe (eds.). Occupational Stress: A Handbook. Washington, D.C.: Taylor and Francis.

16. Summers, T. P., DeCotiis, T. A., dan DeNisi, A. S. 1995. A Flied Study of Some Antecedents

and Consequences of Felt Job Stress. In Crandall, R. and P. L. Perrewe (eds.). Occupational

Stress: A Handbook. Washington, D.C: Taylor and Francis.

17. DeZoort, F. T., dan Lord, A. T. 1997. A Review and Synthesis of Pressure Effects Research

in Accounting, Journal of Accounting Literature, Vol. 16, pp. 28-85.

18. Demirkan, S dan Fuerman, R. D. 2014. Auditor Litigation: Evidence That Revenue

Restatements are Determinative. Research in Accounting Regulation. Vol. 26. pp 164-174.

19. Anderson and Wolfe (2002)

20. DeFond, M., dan Zhang, J. 2014. A Review of Archival Auditing Research, Journal of

Accounting and Economics. Vol. 58, pp. 275-326.

21. Hogan, C. E. 1997. Cost and Benefits of Audit Quality in the IPO Market: A Self Selection

Analysis, The Accounting Review. Pp. 67 - 86.

The Impact of Audit Quality on Auditor Litigation in Indonesia

679

22. Hannes, K., Leone, A., and Miller, B. 2008. The Importance of Distinguishing Errors from

Irregularities in Restatement Research: The Case of Restatements and CEO/CFO turnover.

The Accounting Review, 83(6), 1487-1520.

23. Piot, C., dan Piera, F. M. 2002. “ Corporate Governance, Audit Quality and The Cost of Debt

Financing of French Listed Companies. SSRN: http://ssrn.com.

24. Hakim, F. 2017. The Influence of non-performing loan and loan to deposit ratio on the level

of conventional bank health in Indonesia. Arthatama: Journal of Business Management and

Accounting, 1(1), 35-49.

25. Lastanti, S.H. 2005. Review of Competence and Independence of Public Accountants:

Reflections on Financial Scandals. Media Riset Akuntansi, Auditing, dan Informasi 5(1), 85-

97.

26. Arens, A. A., Elder, R. J., Beasley, M. S., dan A. A. Jusuf. 2011. Auditing and Assurance

Service an Integrated Approach-An Indonesia Adaptation. Jakarta: Penerbit Salemba Empat.

27. Johnson, M. F., Kasznik, R., dan Nelson, K. K. 2001. The Impact of Securities Litigation

Reform on the Disclosure of Forward-Looking Information by High Technology Firms,

Journal of Accounting Research, Vol. 39 (2), pp. 297-327.

28. Qiang dan Xinrong. 2003. The Economic Determinants of Self-imposed Accounting

Conservatism. Dissertation, Ph.D. Candidate in the accounting Department of Accounting

and Law School of Management State University of New York at Buffalo.

29. Epstein, M. J., dan Geiger, M. A. 1994. Investor Views of Audit Assurance: Recent Evidence

of The Expectation Gap. Journal of Accountancy, Vol. 177, pp. 60-66.

30. Boynton, W. C., Johnson, R. N., dan Kell, W. G. 2003. Modern Auditing, Sixth Edition, John

Wiley & Son, Inc, New York.

31. Institut Akuntan Publik Indonesia (IAPI). 2013. Standar Audit 200 Tujuan Keseluruhan

Auditor Independen and Pelaksanaan Audit Berdasarkan Standar Audit. Salemba Empat:

Jakarta.

32. Ghozali, I. 2011. Model Persamaan Struktural Konsep and Aplikasi dengan Program Amos

19. Badan Penerbit Universitas Diponegoro, Semarang.

33. Ferdinand, A. 2002. Structural equation modeling dalam penelitian manajemen. Semarang:

Baand Penerbit Universitas Diponegoro.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

680