Analysis of Financial Performance Assessment using

Economic Value Added (EVA) Method in Listed

Company at Jakarta Islamic Index

Wuryaningsih Dwi Lestari, Sisilia Reviera Ramadhani Saputri,

and Muhammad Sholahuddin

*

Management Department, Faculty of Economics and Business,

Universitas Muhammadiyah Surakarta, Indonesia

Abstract. This research aimed to analyze financial performance in listed

company at Jakarta Islamic Index (JII) during 2015 until 2017 period by using

the method of Economic Value Added (EVA). This research is descriptive

research with quantitative approach. The data used in this research was secondary

data from official website of BEI,www.idx.co.id. The sampling technique in this

research used purposive sampling technique. The total of sample were 17

companies.The data analysis was started from calculating NOPAT, IC, WACC,

CC, and the last was EVA. The result of this research showed that from 17

companies, 16 companies had positive value of EVA during period of research

that means the company already been able to produce economic value added, and

just one company that had negative value of EVA namely PT. Kalbe Farma Tbk

in 2015, that means in that year, the company didn’t able to produce economic

value added yet. The company that has the best average value of EVA was PT.

Telekomunikasi Indonesia Tbk, meanwhile, the company that had the lowest

average value of EVA was PT. London Sumatra Indonesia Tbk. For the investors

, the analysis result of EVA can be used as consideration in determining which

company that has good performance so that deserved to be given an investment.

For company, the rank list of EVA value can be used as reference to develop its

performance in order to become the first rank in value acquisition of EVA.

Keyword: Financial Performance ꞏ WACC ꞏ Economic Value Added (EVA)

1 Introduction

1.1 Research Background

The tight of business competition in this digital era encourages company to maximalize

the performance by applying various strategy. One of them is by increasing the

company’s performance so that make investors interest to invest in the company. The

performance assessment is very important to be performed by every company. One of

the main function in performance assessment is to determine the company’s success in

achieving its purpose which is to maximalize the value of company or the value of

stakeholder indirectly (Yusbardini, 2017).

630

Lestari, W., Saputri, S. and Sholahuddin, M.

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index.

DOI: 10.5220/0010524100002900

In Proceedings of the 20th Malaysia Indonesia International Conference on Economics, Management and Accounting (MIICEMA 2019), pages 630-650

ISBN: 978-989-758-582-1; ISSN: 2655-9064

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Until now, the various criteria is presented for examining the company’s performance.

One of them is by using traditional approach with ratio analysis. The problem from

this approach is most of them depends on historical value. The value resulted from

various accounting convention. All of this convention are for auditing than for the

assessment of company’s performance. Besides, some other issue show that traditional

approach not explicitly facing managment risk and capital investment in the future.

Calculation by using ration analysis just focused on final result of company’s income

without noticing the risk that may be charged by company. (Walsh, Ciaran, 2014).

Good company uses Value Based Management (VBM) as the basic of measuring

performance. VBM has two important elements, namely value creation of stakeholder

and also informant for mangement about company’s performance. The criteria that

related with added value is the most important thing. For the very first time , this criteria

was suggested by Stren-Stewart. According to Stewart, the criteria of measuring other

company’s performance which is not perfect yet, meanwhile the criteria of value added

that related with the changing of stakeholder’s properties is the right measurement for

evaluating the company’s performance. (Jamkarani and Banafi, 2017).

Economic Value Added (EVA) is value added to stakeholder that is given during

certain period. EVA focuses on managerial effectivity in certain year. (Eugene and

Hauston, 2001). EVA is the only one right measurement to calculate all component that

involved in value creation, that is why this measurement is right to determine purpose,

evaluate performance, determine bonus, communicate with investor, budget the capital

also the other assessments. EVA is deviation between capital return and capital cost,

multiply by the capital of book value that is used for producing capital cost. However,

this method served the changing of increasing residual income, that defined as

Operating income minus by capital cost. Mathematically, EVA gives the same result

such as the assessment with Discounted Cash Flow (DCF), or Net Present Value

(NPV), since a long time ago and generally is approved as the best tool to analyze

theoritically from stakeholder’s prespective (Sabol and Sverer, 2017).

EVA gives good matrix about whether the company already given the value added

for stakeholder. Therefore, if the manager focuses on EVA, itwill visible whether

company already operated consistently for maximalizing the value of stakeholder.

EVA also can be used for analyzing division or whole company, so that EVA can give

the beneficial basic in determining of management compensation in all level. Until now,

there are many company that already used EVA as basic in determining of management

compensation. (Eugene and Hauston, 2001).

Analysis that was conducted by Wahyu (2017) stated that the EVA’s result are

always positive showed that repayment that is accepted by company is bigger than

capital cost and debt. This thing was good for the consideration of prospective

investors. (Wahyu, 2017). This research was conducted by Titik Inayati, et.al (2014)

showed that BMT can create the value ofNet Operating Profit After Tax (NOPAT)

increased significantly than capital funds. The profit is higher from accounting income

showed that BMT had good performance. The capital that consist of debt and equity

already used effeciently and effectively so that can increase the profit (Inayati, 2014).

The research that was conducted by Muhammad Khaddafi and Mohd. Heikal

(2014) showed that the company’s performance had negative value in average. Only

PT. Ades Waters Indonesia that had positive value. This thing was caused by the capital

fund that was higher than net income after tax, so that the company financial

performance was not good because they could not maximilize the value of stakeholder

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index

631

(Khaddafi and Heikal, 2014). Based on reasearch by Wahyu (2017), Inayati (2014),

and Khaddafi dan Heikal (2014), it can be concluded that EVA is not always produce

the same value. Positive and negative value of EVA give different description through

company financial performance.

Research problem in this paper are : (1) How the financial performance in company

that listed in Jakarta Islamic Index (JII) on 2015-2017 period if it was analyzed by

using Economic Value Added (EVA)?; (2) How the list of company’s rank in Jakarta

Islamic Index (JII) based on the analysis of financial performance by using the method

of Economic Value Added (EVA)?

The purposes of this paper were : (1) To analyze the financial performance in

company that listed in Jakarta Islamic Index (JII) during 2015-2017 period by using

the method of Economic Value Added (EVA); (2) To identify the rank of company in

Jakarta Islamic Index (JII) based on the result of financial performance analysis by

using the method of Economic Value Added (EVA).

2 Literature Review

2.1 Theoretical Basis

1. Analysis of Financial Performance

Financial Performance of Company can be defined as manager’s work in doing their

task, that related with company financial management. Financial company performance

can be shown by company’s financial statement during certain period. (Sidharta and

Affandi, 2016).

a. Analysis of Financial Ratio

Ratio can be defined as proportion numbers from one to another. (Fahmi, 2017:

107). Ratio analysis is analysis through simple arithmatic operations by connecting

between two quantity mathematically. Ratio analysis is popular and mostly used

(Sirait, 2017: 36). Hanafi and Halim, (2009) in book “ Analisis Laporan

Keuangan”, classified ratio analysis into 5 categories, they are:

1) Liquidity ratio is ratio that measure the ability of company in fulfilll its

short-term liability.

2) Activity Ratio , ratio that measure how far the effectivity of use assets by

seeing the asset’s activity.

3) Solvency Ratio, is ratio that measure how far the ability of company in

fulfilling long- term liability .

4) Profitability Ratio, is ratio that see the ability in producing profit.

5) Market Ratio is Ratio that see the development of company’s relative value

through book value’s company

According to Sofan Syafri Harahap from book entitled” Analisis Laporan

Keuangan” (Fahmi, 2017: 109), stated that ratio analysis has some benefit such as :

1) Financial ratio that contains numbers and statistical summary that is

readable.

2) Asimple replacement form of finansial statement.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

632

3) Understanding about the position of company’s financial in the middle of

other industry.

4) Very Useful as a material of decision making.

5) Standardize the size of company

6) Easier than other company or see the development of company periodically.

7) Easier to see company’s trend and also to predict the future.

Besides has advantages, Murhadi (2013) stated that there are some things that must

be noticed in using the analysis of financial ratio, such as :

1) Financial Ratio cannot be seen isolatedly. This ratio only can give benefit if

compared with other company in same industry or compared with other

period.

2) Remember that every company use different method of accounting and

different division, so it will influence to ratio that will be analyzed, so that

for comparing with other company it will be difficult.

3) In application of analysis ratio, conclusion cannot be taken based on only

one ratio, however must consider all of ratio. In a case some ratio showed

that the company is healthy but the other are opposite. This thing is more

difficult in decision making.

4) Every data that is obtained and used in analyzing is source from company’s

financial statement. So, it is very possible if the data, the numbers don’t have

high accuracy or the data must be changed as needs. Later, this thing will

influence the ratio that being compared. (Fahmi, 2017: 110)

b. Balance Scorecard (BSC)

Balance Scorecard is a system of performance management system for organization

to translate strategies in form of activity through various indicator of comprehensive

performance measurement. (Riswanto, 2018). According to Alimudin (2017),

balance scorecard is a system of management strategy that describe vision and

strategy that owned by company with operational purpose based on the matrix from

several perspective, namely financial perspective, customer perspective, internal

business process perspective, and learning and growth perspective. Balance

scorecard helps management to see business from four perspective, namely

financial perspective, internal business proess perspective, customers perspective,

dan learning and growth perspective (Hidayat, 2008).

The calculation of performance using those four perspectives make this method

has benefit than using traditional measurement. Erwin (2015), stated the benefit of

BSC such as:

1) BSC can be used as the tool for communicating strategy for stakeholders in

an organization, so that it can reduce the obstacles in achievi

ng the vision.

2) BSC enables the management for mapping all of main factor in organization,

both of visible or invisible. Meanwhile, in other method usually only focus

to visible factor. This thing can reduce the obstacles in organization

management.

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index

633

3) Besides supporting in preparation of organizational strategy planning, BSC

by using key performance indicator can be used for monitoring the strategy

achievement.

4) BSC has cause and effect concept, this thing can strengthen the team work

in organization indirectly, so that it can reduce the obstacles for person and

management.

5) BSC can help in organization budgeting.

2. Economic Value Added (EVA)

EVA term was popularized by Stren Seward Manangement Service, is an consultant

company in USA during 90’s. EVA is one of way to measure the financial performance

(Dewi, 2017). Economic Value Added (EVA) according to Widjaya and Tjun (2009)

as internal indicator that measures the stakeholder’s property in one company in certain

period. EVA measures how efficient of company uses the capital for creating Economic

Value Added. Economic Value Added is created if company produce return is bigger

than cost of capital.

EVA is based on economic profit which states that property only created if a

company consist of operating expenses and cost of capital (Young and O’Byrne, 2001:

17). EVA is difference between income every unit than come from company’s

operational or Net Operating Profit After Tax (NOPAT) and cost of capital for every

unit that caused by using of credit limit. Next, EVA can be defined as Net Income After

Taxes and after capital cost (Sabol dan Andrija, 2017). The capital consists of cash,

stock, and credit or working capital with other instrument. Capital cost is return rate

that needed by stakeholder and lender for funding the business operational. If income

exceeds operating expenses and cost of capital, thismeans the company already been

able to create property for stakeholders.

EVA is indicator about additional value in an investment. Positive EVA shows

return rate of capital is higher than cost of capital, this means company is able to create

Value added for company’s owner with increasing property. Meanwhile, negative EVA

means the performance of financial company is not good, the total of capital cost

company is higher than Net Income After Tax , so that the performance of financial

company is not good. (Widjaya, 2009).

Therefore EVA is more superior than accounting income as the measurement of

value creation because EVA covers cost of capital and operational risk. Perception of

EVA is based on the principle of effective economy that is value of company only

increase if able to create surplus on cost of capital. According to Iramani and Febrian

(2005), EVA ‘s benefit are :

1) EVA focuses on value added with still calculate expense as risk from an

investment.

2) EVA’s concept in measuring expectation is seen from economic aspect,

which is paying attention to expectation of all funders fairly. The

measurement of this fairness is stated by weighted size from capital structure

based on market value not book value.

3) The calculation of EVA can be used independently without comparison data

such as industry data or other company’s data as concept of assessment.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

634

4) EVA ‘s concept pararelled with stakeholders satisfaction concepts, because

it can be used as giving bonus for employee especially division that has

important role in increasing EVA’s result.

5) The easiness of EVA’s application shows that EVA is practically, easy to

calculate and easy to use so that can be used as fast decision making.

But, besides the benefits above, EVA still has some weakness such as :

1) EVA only measures the final result without seeing other certain activity.

2) EVA is too dependent on belief that investors just rely on the fundamental

approach in analyzing and determining the decision of buying and selling

certain share, whereas the other factor can be more dominant (Iramani dan

Febrian, 2005).

The supporting component for obtaining EVA’s calculation are as follows:

1) NOPAT (Net Operating Profit After Tax)

NOPAT is Income after tax and measure the profit of company in clean

operational (Young dan O’Byrne, 2001). According to Tunggal (2001: 5),

NOPAT is profit that obtained from company’s operational after minus by

income tax, but included financial cost and non cash bookkeeping entries

like depreciation. Meanwhile, According to Dwitayanti (in Karamoy,

2016), NOPAT is sum of Income after tax and interest fee from company.

2) Invested Capital (IC)

Tunggal (2005: 5) defined invested capital as the total of company’s loan

outside non interest liabilities, such as account payable, accrual payable,

advance from customer, etc Capital that invested same with the total of

company’s asset, where the company must expend cost to obtain.

3) Weighted Average Cost of Capital (WACC)

Nuzula (in Hidayati, 2015), stated that WACC is weighted cost from various

source of capital based on each composition of capital kinds WACC is used

for evaluating the result of project. WACC is sum of multiplication for each

kind capital with capital cost. According to Young and O’Byrne (2001: 149),

WACC is the same with the amount of cost from capital component includes

Long term liabilities,Short-term liabilities and equity of stakeholder that

scaled by relative proportion in structure of capital company in market value.

2.2 Theoritical Framework

Economic Value Added (EVA) is analysis tool that is used for measuring the Value

Added of Company that is conducted by calculating all of capital cost, both from

stakeholder or loan. The company that will be examined is listed company in Jakarta

Islamic Index (JII) for 2015-2017 period. EVA or Economic Value Added is obtained

from deviation between Net Operating Profit After Tax (NOPAT) with capital cost.

The result of positive EVA shows that return rate on capital is still higher than the

capital cost. This thing shows that company can create the Economic Value Added that

is shown by the increasing of property. On the other hand, if EVA’s result shows

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index

635

negative value so the return rate on capital is lower than the cost of capital level or the

cost of capital is higher than Operation Income After Tax. That means company is

unable to create Economic Added Value and to increase the property.

Based on the explanation above, so it can be arranged into theoritical framework for

analyzing the performance of financial company by using EVA method as follows:

Fig. 1. Theoritical Framework Perusahaan yang terdaftar di JII Periode 2015-2017= The

company that listed in JII on 2015-2017 period Laporan Keuangan= Financial Statement.

Pengukuran Kinerja Keuangan dengan Metode Perhitungan NOPAT, IC, WACC, IC, dan EVA

= The Measurement of Financial Performance by Calculation Method of NOPAT, IC, WACC,

IC and EVA.

3 Research Method

3.1 Research Type

This research used descriptive research by using quantitative approach. Descriptive

research generally has main purpose for describing fact and characteristic object

systematically and the right subject (Neolaka, 2014: 21). Quantitative Data is data that

served in numbers, so that at a glance it is easy to recognize the differences from other

data (Subagyo, 2015: 97). This research analyzed the data of company’s financial

statement that listed in Jakarta Islamic Index (JII) on 2015-2017 period, for knowing

the performance of company by using method of Economic Value Added (EVA).

Perusahaan yang terdaftar

di JII periode 2015-2017

.

Laporan Keuangan

Pengukuran Kinerja

Keuangan dengan

Metode EVA

Perhitungan: NOPAT, IC,

WACC, IC dan EVA

Hasil

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

636

3.2 Type and Source of Data

1. Type of Data: This research used secondary data. Secondary data was ready-made

data.Previously, this data was already collected and processed by other party then

being published for certain purpose. (Suryani and Hendryadi, 2018: 171).

2. Source of Data: The Data of this research had a source from written document about

profile and finansial statement of company that listed in JII during 2015 until 2017

period period that already publieshed by each companies through official website

of Bursa Efek Indonesia (BEI) is www.idx.co.id.

3.3 Method of Data Collection

For obtaining relevant data, in this research the writer used the method of data collection

as follows :

1. Documentation Method: Decomentation method consist of the activity of

seeking, collecting, recording and analyzing data that needed from other source

such as document, newspaper, and etc . Data from this research was financial

statement of company that listed in JII 2015-2017 period that come from official

website of BEI is www.idx.co.id.

2. Library Research: Seeking, collecting, and analyzing problems, theoretical basis

that support this research such as journals, books, expert’s opinion, article, and

other data that is needed in research.

3.4 Design of Sample Collection

1. Population: Population is generalization area that consist of subject or object that

have amount and certain characteristic that is determined by the researcher to be

examined further and concluded. (Sugiyono, 2015: 135). Population in this research

was all of company that listed in Jakarta Islamic Index (JII) during 2015-2017

period , amounted to 41 companies.

2. Sample: Sample is part and characteristic of population (Sugiyono, 2015: 136). The

technique of sample collection used purposive sampling. Purposive sampling is

technique of sample collection based on the certain criteria that already determined

before. (Jogiyanto, 2014: 98). The criteria of collecting based on idea or knowledge

and understanding of sample collector through population (Nursiyono, 2015: 25).

The criteria of collecting sample in this research were : (1) Listed company in

Jakarta Islamic Index (JII) during 2015 until 2017 period period, there were 41

companies; (2) Consistent company that listed in JII during 2015 until 2017 period.

In this research, there were 20 companies; (3) The company publish financial

statement consistenly in JII during 2015 until 2017 period. In this criteria there

were 20 companies; (4) The company uses rupiah in financial report . The company

that fulfill all criteria were 17.

From several of criteria sample that already determined, there were 17 companies that

fulfill the requirement as research data. The 17 companies were: Astra Agro Lestari

(AALI), AKR Corporindo (AKRA), Astra Internasional (ASII), PT Bumi Serpong

Damai (BSDE), Indofood CBP Sukses Makmur (ICBP), Kalbe Farma (KLBF), Lippo

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index

637

Karawaci (LPKR), PT London Sumatra Indonesia (LSIP), PT PP (Persero) (PTPP),

Semen Indonesia (Persero) (SMGR), PT Summarecon Agung (SMRA), PT Sawit

Sumbermas Sarana (SSMS), PT Telekomunikasi Indonesia (Persero) (TLKM), United

Tractors (UNTR), Unilever Indonesia (UNVR), Wijaya Karya (WIKA) (www.idx.co.id)

3.5 Methode of Data Analysis

The processing data that already collected was conducted by analyzing the result of

company financial performance descriptively using the method of Economic Value

Added (EVA). According to Dwitayanti, 2005 (in Karamoy, 2016), EVA can be

calculated by the steps and formula as follows :

1. Calculate NOPAT (Net Operating Profit After Tax), is used for calculating profit

level that is obtained from capital investment and the cost of capital . NOPAT is

obtained fromformula:

NOPAT = EAT + Interest Expense

2. Calculate Invested Capital (IC)

Invested Capital = (Total liabilities + Total Equity) – Short Term liabilities

3. Calculate Weighted Average Cost of Capital (WACC), by using formula:

WACC = {D x rd (1-T) + (E x re)}

when:

a. D = Capital Rate from Debt

x 100%

b. rd = The cost of Short term liabilities

x100%

c. T = Tax Rate

x100%

d. Re = cost of equity

x100%

e. E = Capital level from equity

x100%

4. Calculate Capital Charge (CC)

Capital Charge = WACC x Invested Capital (IC)

5. Analysis of EVA, by using formula:

EVA = NOPAT – Capital Charge (CC)

Total Hutang = Total liabilities

Total Hutang + Ekuitas =Total liabilities + Equity

Beban bunga = Interest Expense

Beban pajak = Tax Expense

Laba Sebelum Pajak = Income before tax

Laba bersih setelah pajak =Income After Tax

Total Ekuitas =Total Equity

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

638

From the calculation above, it can be obtained conclusion with interpretation as

follows: If EVA’s value is positive (EVA > 0), shows that the company performance

during this time is able to produce Economic Added Value from the result of

operational . If EVA’s value equals with zero (EVA = 0),so the the company condition

is break even because the income already used for paying the obligation to funder.

Meanwhile if EVA’s value is negative (EVA < 0), shows that the company is not able

to produce Economical Value and failed to satisfy investmest’s expectation.

4 Research Result and Disscussion

4.1 Data Analysis

Below is calculation result of Economic Value Added (EVA) from 17 companies that

contained the value of Net Operating Profit After Tax (NOPAT), Invested Capital (IC),

Weighted Average Cost of Capital (WACC), EVA, and the explanation of calculation

result.

1. PT. Astra Agro Lestari Tbk

Table 1.1. shows that the calculation result of EVA in PT. Astra Agro Lestari Tbk. It

can be known that the value of EVA always increase every research year. In 2015

EVA’s value was 171.459, then in 2016 EVA’s value increased to 387.148, and in

2017 , EVA’s value increased to 581.895. This thing shows the financial performance

of PT. Astra Agro Lestari Tbk during 2015-2017 period was well. Besides, the postive

value of EVA means that PT. Astra Agro Lestari Tbk already success to create

Economic Added Value and give prosperity for stakeholder.

2. PT. AKR Corporindo Tbk

Table 1.2. shows the calculation result of EVA in PT. AKR Corporindo Tbk. It can be

known that EVA ‘s value was fluctuation every research year. In 2015 EVA’s value

was 395.663, then in 2016, EVA’s value increase became 418.532, and in 2017 EVA’s

value increased to 456.177. This thing shows the financial performance of PT. AKR

Corporindo during period 2015-2017 was well. Besides, positive EVA’s value means

PT. AKR Corporindo Tbk already successed and give prosperity for stakeholder.

3. PT. Astra International Tbk

Table 1.3. shows the research result about calculation result of EVA in PT. Astra

International Tbk. It can be known that EVA’s value was fluctuated during research

year. In 2015 EVA’s value was 5.181.181, then in 2016 EVA’s value increased to

7.161.191,and in 2017 EVA’s value decreased to 4.932.231. This thing shows that the

financial performance of PT. Astra International during period 2015-2017 was well.

Meanwhile, in 2017 the EVA’s value was decreased but still in positive value. The

positive value of EVA showed that PT. Astra International Tbk already successed to

create Economic Value Added and give prosperity for stakeholder.

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index

639

4. PT. Bumi Serpong Damai

Table 1.4. shows the research result of EVA in PT. Bumi Serpong Damai Tbk. It can

be known that EVA’s value was fluctuated during research year. In 2015 EVA’s value

was 512.262, and then in 2016 , EVA’s value decreased to 431.782, and in 2017

EVA’s value increased to 945.541. This thing showed that the financial performance

of PT. Bumi Serpong Damai during period 2015-2017 was well, because , although

the condition was fluctuative , EVA’s value was always positive. The positive value of

EVA showed that PT. Bumi Serpong Damai Tbk already successed to create Economic

Value Added and give the prosperity for all stakeholder.

5.PT. Indoofood CBP Sukses Makmur

Table 1.5. shows the calculation result of EVA in PT. Indoofood CBP Sukses Makmur

Tbk, it can be known that EVA’s value was fluctuated during research year. In 2015

EVA’s value was 769.645, and then in 2016 EVA’s value was increased to 889.721,

and in 2017 EVA’s value decreased to 823.271. This thing showed that the financial

performance of PT. Indoofood CBP Sukses Makmur during period 2015-2017 was

well, because, although the condition was fluctuative , EVA’s value was always

positive. The positive value of EVA showed that PT. Indoofood CBP Sukses Makmur

already successed to create Economic Value Added and give the prosperity for all

stakeholder.

6. PT. Indoofood Sukses Makmur Tbk

In table 1.6 shows that the calculation result of EVA in PT. Indoofood Sukses Makmur

Tbk. It can be known that EVA’s value was fluctuacted during research year. In 2015

EVA’s value was 1.811.993, and then in 2016 EVA’s value increased to 2.016.705,

and in 2017 EVA’s value decreased to 1.949.419. This thing showed that the financial

performance of PT. Indoofood Sukses Makmur Tbk during period 2015-2017 was well,

because, although the condition was fluctuative, EVA’s value was always positive. The

positive value of EVA showed that PT. Indofood Sukses Makmur Tbk already

successed to create Economic Value Added and give the prosperity for all stakeholder.

7. PT. Kalbe Farma Tbk

Table 1.7 shows that the calculation result of EVA in PT. Kalbe Farma Tbk. It can be

known that EVA’s value was fluctuacted during research year. In 2015 EVA’s value

was -322.104, and then in 2016 EVA’s value was increased became 369.889, and in

2017 EVA’s value decrease again became 340.938. This thing showed that the

financial performance of PT. Kalbe Farma during period 2015-2017 was good enough

, although during period 2015-2017 company showed various EVA’s value. In 2015

EVA’s value was negative , This thing caused by NOPAT’s value in that year was

lesser than Capital Charge’s value. The negative EVA’s value showed that the

company could not be able to create Economic Value Added yet and give worth return

for stakeholder. In 2016 and 2017 EVA’s value was positive. The positive value of

EVA showed that PT. Kalbe Farma Tbk already successed to create Economic Value

Added and give the prosperity for all stakeholder.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

640

8. PT. Lippo Karawaci

Table 1.8. shows the calculation research of EVA in PT. Lippo Karawaci Tbk. it can

be known that EVA’s value was fluctuacted during research year. In 2015 EVA’s value

was 1.377.506, and then in 2016 EVA’s value decreased to 599.349, and in 2017

EVA’s value decreased again to 568.917. This result showed that the financial

performance of PT. Lippo Karawaci during period 2015-2017 was well , because

EVA’s value was always positive. The positive EVA’s value showed that PT. Lippo

Karawaci Tbk already successed to create Economic Value Added and give the

prosperity for all stakeholder.

9. PT. London Sumatra Indonesia Tbk

Table 1.9. shows that the calculation research of EVA in PT. London Sumatra

Indonesia Tbk. It can be known in 2015 EVA’s value was 63.005, and then in 2016

EVA’s value increased to 75.029, and then in 2017 EVA’s value decreased to 56.405.

The result showed the financial performance of PT. London Sumatra Indonesia Tbk

during 2015-2017 period was well although was decreased, EVA’s value was always

positive. The positive EVA’s value showed that PT. London Sumatra Indonesia

Tbkalready successed to create Economic Value Added and give the prosperity for all

stakeholder.

10. PT. PP (Persero)

Table 1.10.shows that the calculation research of EVA in PT. PP (Persero) Tbk. it can

be known that EVA’s value was fluctuacted during research year. In 2015 EVA’s value

was 473.792, and then in 2016 EVA’s value increased to 794.666, and in 2017 EVA’s

value increased again to 1.190.135. The result showed that the financial performance

of PT. PP (Persero) during period 2015-2017 was well. This things due to during period

2015-2017 the company always had Positive EVA’s value , and increased every year.

The positive EVA’s value showed that PT. London Sumatra Indonesia Tbk already

successed to create Economic Value Added and give the prosperity for all stakeholder.

11. PT. Semen Indonesia (Persero) Tbk

Table 1.11.shows that the calculation result of EVA in PT. Semen Indonesia (Persero)

Tbk. It can be known that EVA’s value was fluctuacted during research year. In 2015

EVA’s value was 1.209.003, In 2016 EVA’s value decreased to 885.872, and in 2017

EVA ‘s value decreased again to 565.902. The result showed that the financial

performance of PT. Semen Indonesia (Persero) Tbk during period 2015-2017 was well,

because EVA’s value was always positive. The positive EVA’s value showed that PT.

Semen Indonesia (Persero) Tbk already successed to create Economic Value Added

and give the prosperity for all stakeholder.

12. PT. Summarecon Agung Tbk

Table 1.12. shows the calculation result of EVA in PT. Summarecon Agung Tbk. It

can be known that EVA’s value was fluctuacted during research year. In 2015 EVA’s

value was 473.042, and then in 2016 EVA’s value decreased to 381.676, and in 2017

EVA’s value increased to 457.110. This result showed that financial performance of

PT. Summarecon Agung Tbk during period 2015-2017 was well. This thing due to

during 2015-2017 period, company produced positive value of EVA. , although the

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index

641

value was decreased in 2016. The positive EVA’s value showed that PT. Summarecon

Agung Tbk already successed to create Economic Value Added and give the prosperity

for all stakeholder.

13.PT. Sawit Sumbermas Sarana Tbk

Table 1.13. shows the calculation result of EVA in PT. Sawit Sumbermas Sarana Tbk.it

can be known that EVA’s value was fluctuacted during research year. In 2015 EVA

‘s value was 162.240, in 2016 EVA’s value increased to 766.367, and in 2017 EVA’s

value increased again to 1.037.212. This things showed that the financial performance

of PT. Sawit Sumbermas Sarana Tbk during period 2015-2017 was well. This thing

due to during period 2015-2017 company produced positive value of EVA, and

increased every year. The positive EVA’s value showed that PT. Sawit Sumbermas

Sarana Tbk already successed to create Economic Value Added and give the prosperity

for all stakeholder

14. PT. Telekomunikasi Indonesia (Persero)

Table 1.14. shows the calculation result of EVA in PT. Telekomunikasi Indonesia

(Persero) Tbk. In 2015 EVA’s value was 6.051.404, In 2016 EVA’s value increased to

7.633.895, and in 2017 EVA’s value increased again to 8.764.506. This result showed

that the financial performance of PT. Telekomunikasi Indonesia (Persero) during 2015-

2017 period was well. This thing due to during 2015-2017 period company produced

positive value of EVA , and increased every year. The positive EVA’s value showed

that PT. Telekomunikasi Indonesia (Persero)already successed to create Economic

Value Added and give the prosperity for all stakeholder

15. PT. United Tractors Tbk

Tabel 1.15. shows the calculation result of EVA in PT. United Tractors Tbk. In 2015

EVA’s value was 64.967, In 2016 EVA’s value decreased to 1.505.136, and in 2017

EVA’s value increased again to 2.734.347. This result showed that the financial

performance of PT. United Tractors Tbk during 2015-2017 period was well. This

thing due to during 2015-2017 period, company produced positive value of EVA ,and

increased every year.The positive EVA’s value showed that PT. United Tractors Tbk

already successed to create Economic Value Added and give the prosperity for all

stakeholder.

16. PT. Unilever Indonesia

Table 1.16. shows the calculation result of EVA in PT. Unilever Indonesia Tbk. In 2015

EVA ‘s value was 3.566.100, and then in 2016 EVA’s value increased to 4.708.612,

and in 2017 EVA’s value increased again to 4.919.791. This result showed the financial

performance of PT. Unilever Indonesia Tbk during 2015-2017 period was well. This

thing due to during 2015-2017 period, company produced Positive value of EVA ,and

increased every year.The positive EVA’s value showed that PT. Unilever Indonesia

Tbkalready successed to create Economic Value Added and give the prosperity for all

stakeholder.

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

642

17. PT. Wijaya Karya Tbk

Table 1.17.shows the calculation result of EVA in PT. Wijaya Karya Tbk. In 2015

EVA’s value was 699.320, then in 2016 EVA’s value was increased to 805.030, and

in 2017 EVA’s value increased again to 1.259.521. This thing due to during 2015-2017

period,company produced positive value of EVA ,and increased every year.The

positive EVA’s value showed that PT. Wijaya Karya Tbk already successed to create

Economic Value Added and give the prosperity for all stakeholder.

Table 1. Hasil Perhitungan EVA PT. Astra Agro Lestari Tbk. (Dalam Jutaan Rupiah).

Tahun

NOPAT IC WACC CC EVA

Keter

angan

1. Astra Agro Lestari (AALI)

2015 810.112 17.990.238 3,55% 638.653 171.459 Positif

2016 2.262.453 20.283.155 9,29% 1.884.305 387.148 Positif

2017 2.198.272 18.536.438 8,72% 1.616.377 581.895 Positif

2. PT. AKR Corporindo Tbk

2015 1.180.874 10.331.728 7,60% 785.211 395.663 Positif

2016 1.119.584 10.015.033 7% 701.052 418.532 Positif

2017 1.393.880 11.393.718 8,23% 937.703 456.177 Positif

3. PT. Astra International Tbk

2015 16.331.000 169.193.000 6,59% 11.149.819 5.181.181 Positif

2016 20.344.000 172.776.000 7,63% 13.182.809 7.161.191 Positif

2017 21.336.000 196.924.000 8,33% 16.403.769 4.932.231 Positif

4. PT Bumi Serpong Damai

2015 2.991.949 29.875.745 8,3% 2.479.687 512.262 Positif

2016 2.865.670 32.845.986 7,41% 2.433.888 431.782 Positif

2017 5.731.823 38.382.371 12,47% 4.786.282 945.541 Positif

5. PT. Indoofood CBP Sukses Makmur

2015 3.177.020 20.558.280 11,71% 2.407.375 769.645 Positif

2016 3.808.145 22.432.163 13,01% 2.918.424 889.721 Positif

2017 3.666.905 24.791.926 11,47% 2.843.634 823.271 Positif

6. PT. Indoofood Sukses Makmur Tbk

2015 5.221.588 66.723.988 5,11% 3.409.595 1.811.993 Positif

2016 6.845.359 62.955.074 7,67% 4.828.654 2.016.705 Positif

2017 6.530.868 66.301.725 6,91% 4.581.449 1.949.419 Positif

7. PT. Kalbe Farma Tbk

2015 2.082.235 11.330.537 21,22% 2.404.339 (322.104)

N

e

g

atif

2016 2.383669 12.908.847 15,6% 2.013.780 369.889 Positif

2017 2.489.201 14.388.90 14,93% 2.148.263 340.938 Positif

8. PT. Lippo Karawaci

2015 1.888.081 36.469.674 4,14% 510.575 1.377.506 Positif

2016 2.485.859 38.737.374 4,87% 1.886.510 599.349 Positif

2017 2.009.724 48.026.930 3% 1.440.807 568.917 Positif

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index

643

Table 1. Hasil Perhitungan EVA PT. Astra Agro Lestari Tbk. (Dalam Jutaan Rupiah) (cont.).

Tahun NOPAT IC WACC CC EVA Keter

an

g

an

9. PT. London Sumatra Indonesia Tbk

2015 700.383 8.277.630 7,70% 637.378 63.005 Positif

2016 677.314 8.678.461 6,94% 602.285 75.029 Positif

2017 851.161 9.328.123 8,52% 794.756 56.405 Positif

10. PT. PP (Persero)

2015 1.211.141 8.388.500 8,79% 737.349 473.792 Positif

2016 1.557.575 15.350.287 4,97% 762.909 794.666 Positif

2017 2.377.106 21.082.966 5,63% 1.186.971 1.190.135 Positif

11. PT. Semen Indonesia (Persero)Tbk

2015 5.209.899 31.553.929 13,25% 4.180.896 1.209.003 Positif

2016 4.713.462 36.075.310 10,61% 3.827.590 885.872 Positif

2017 2.553.818 40.159.926 4,95% 1.987.916 565.902 Positif

12. PT. Summarecon Agung Tbk

2015 1.550.446 14.384.576 7,49% 1.077.404 473.042 Positif

2016 1.181.456 16.592.948 4,82% 799.780 381.676 Positif

2017 1.106.437 15.386.884 4,22% 649.327 457.110 Positif

13. PT. Sawit Sumbermas Sarana Tbk

2015 708.582 5.677.280 9,5% 539.342 162.240 Positif

2016 828.360 5.848.392 1,06% 61.993 766.367 Positif

2017 1.134.126 8.501.257 1,14% 96.914 1.037.212 Positif

14. PT. Telekomunikasi Indonesia (Persero)

2015 25.940.000 130.760.000 15,21% 19.888.596 6.051.404 Positif

2016 32.627.000 139.939.000 17,86% 24.993.105 7.633.895 Positif

2017 35.834.000 153.108.000 17,68% 27.069.494 8.764.506 Positif

15. PT. United Tractors Tbk

2015 2.862.982 43.435.114 4,60% 1.998.015 864.967 Positif

2016 5.192.467 45.635.281 8,08% 3.687.331 1.505.136 Positif

2017 7.837.307 53.885.531 9,47% 5.102.960 2.734.347 Positif

16. PT. Unilever Indonesia

2015 5.972.332 5.602.403 42,95% 2.406.232 3.566.100 Positif

2016 6.533.916 4.704.391 38,80% 1.825.304 4.708.612 Positif

2017 7.132.244 6.374.109 34,71% 2.212.453 4.919.791 Positif

17. PT. Wijaya Karya Tbk

2015 1.134.414 8.464.872 5,14% 435.094 699.320 Positif

2016 1.585.025 16.490.377 4,73% 779.995 805.030 Positif

2017 2.034.052 19.708.157 3,93% 774.531 1.259.521 Positif

Sumber: Data sekunder (diolah)

Keterangan:

NOPAT: Net Operatimg Profit After Tax

IC : Invested Capital

WACC: Weighted Average Cost of Capital

CC : Capital Charges

EVA: Economic Value Added

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

644

4.2 Disscussion

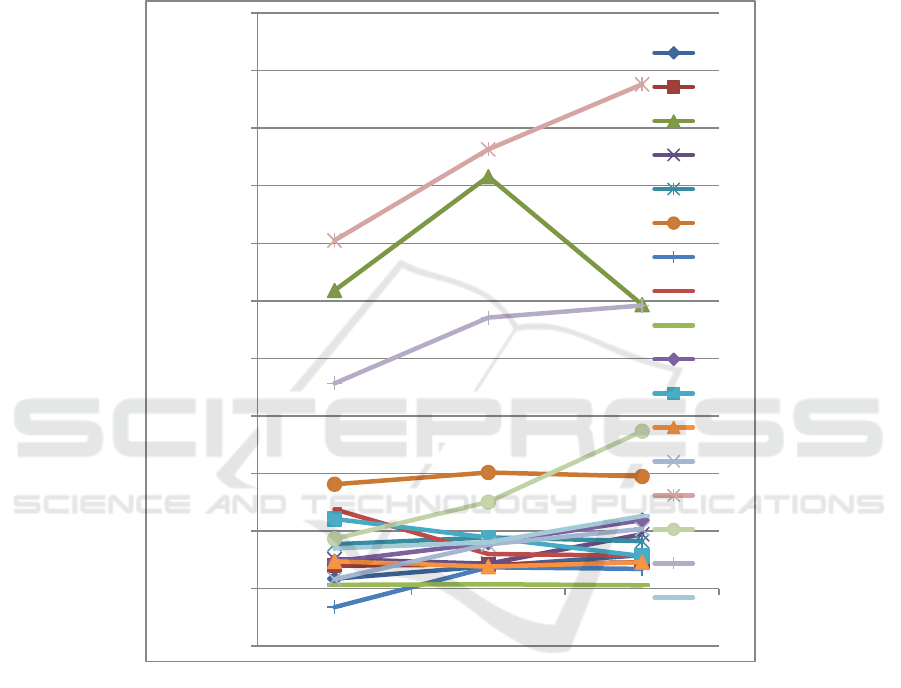

Based on the calculation of research and the previous analysis, generally can be known

that the EVA ‘s value in listed company at Jakarta Islamic Index (JII) period 2015 until

2017 were different and fluctuated every year. Below will be presented the chart of

EVA’s result comparison from each company.

Source: Secondary data (processed data)

Fig. 2. EVA’s value from each company that listed in JII period 2015-2017 (In million rupiahs).

Based on figure 2 is known that from 17 companies that was used as research data, 16

companies were fluctuated and always had positive value of EVA which means that

company had good financial performance, because they created Economic Value

Added for company and guarantee return rate to stakeholder. The 16 companies were

PT. AKR Corporindo Tbk, PT. Astra International Tbk, PT. Bumi Serpong Damai Tbk,

PT. Indofood CBP Sukses Makmur Tbk, PT. Indofood Sukses Makmur, PT. Lippo

Karawaci Tbk, PT. London Sumatra Indonesia Tbk, PT. PP (Persero) Tbk, PT. Semen

Indonesia Tbk, PT. Summarecon Agung Tbk, PT. Sawit Sumbermas Sarana Tbk, PT.

Telekomunikasi Indonesia (Persero) Tbk, PT. United Tractors Tbk, PT. Unilever

‐1000000

0

1000000

2000000

3000000

4000000

5000000

6000000

7000000

8000000

9000000

10000000

2015 2016 2017

AALI

AKRA

ASII

BSDE

ICBP

INDF

KLBF

LPKR

LSIP

PTPP

SMGR

SMRA

SSMS

TLKM

UNTR

UNVR

WIKA

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index

645

Indonesia Tbk, and PT. Wijaya Karya Tbk. Meanwhile only one company,PT. Kalbe

Farma Tbk that had negative value of EVA in one research year, in 2015. This result

showed in that year the company had bad financial performance, because didn’t able to

create Economic Value Added for company yet and guarantee the stakeholders.. EVA

had negative value due to the value of Capital Charges that was higher than NOPAT’s

company, so EVA’s value will be positive if the value of NOPAT is higher than the

value of Capital Charges.

The decreasing of NOPAT’s company is caused by the decreasing of profit before

interest and tax. This thing influenced through EVA’s value, where the high value of

NOPAT will can cover the cost of capital that already invested , so that able to create

Value Added for company.

After seeing chart of EVA’s value from each company, it will be presented the rank

table of EVA’s Value from 17 companies that listed in JII on 2015 until 2017 period.

Table 2. The Rank of EVA’s result from 17 companies.

Company Code

EVA (2015-2017 Period)

In million rupiahs

Rank

TLKM 7.487.268 1

ASII 5.578.201 2

UNVR 4.398.168 3

INDF 1.926.039 4

UNTR 1.701.486 5

WIKA 921.290 6

SMGR 886.926 7

LPKR 848.591 8

ICBP 827.546 9

PTPP 819.531 10

SSMS 655.276 11

BSDE 629.863 12

SMRA 437.276 13

AKRA 423.457 14

AALI 380.167 15

KLBF 129.574 16

LSIP 64.813 17

Source : Secondary Data (Proccessed Data)

Based on the table 2 shows that the company with best value of EVA was PT.

Telekomunikasi Indonesia (Persero) Tbk, with average of EVA’s value from three

years research was Rp 7.483.268.000.000,00, showed that PT. Telekomunikasi

Indonesia (Persero) Tbk as the company with the best financial performance. This thing

was in line with the research by Dwi Lestari Wuryaningsih and Rinda Safitri (2014)

entitled” Pengukuran Kinerja Keuangan Menggunakan Rasio Keuangan dan

Economic Value Added (EVA) Studi Kasus pada Perusahaan PT. Telkom Indonesia

Tbk yang Terdaftar di Bursa Efek Indonesia Periode 2008-2012”, showed that the

performance of PT. Telkom Indonesia Tbk was in well condition, because EVA had

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

646

positive value. The positive value of EVA showed that the company was able to give

value added for company and also able to fulfill the expectation of stakeholder.

The second highest rank was PT. Astra Internasional Tbk with the average of

EVA’s value was Rp 5.578.201.000.000,00. the third rank by PT. Unilever Indonesia

Tbk with the average of EVA’s value was Rp 4.398.168.000.000,00. the fourth rank

was PT. Indofood Sukses Makmur Tbk with the average of EVA’s value was Rp

1.926.039.000.000,00. The fifth rank was PT. United Tractors Tbk with the average of

EVA’s value was Rp 1.701.486.000.000,00. The sixth rank was PT. Wijaya Karya Tbk

with the average of EVA’s value was Rp 921.290.000.000,00. The seventh rank was

PT. Semen Indonesia (Persero) Tbk with the average of EVA’s value was Rp

886.926.000.000,00. The eighth rank was PT. Lippo Karawaci Tbk with the average of

EVA’s value was Rp 848.591.000.000,00. The ninth rank was PT. Indofood CBP

Sukses Makmur Tbk with the average of EVA’s value was Rp 827.546.000.000,00.

The tenth rank was PT. PP (Persero) Tbk with the average of EVA’s value was

Rp 819.531.000.000,00. The eleventh rank was PT. Sawit Sumbermas Sarana Tbk with

the average of EVA’s value was Rp 655.276.000.000,00. The next rank was PT. Bumi

Serpong Damai Tbk with the average of EVA’s value was Rp 629.863.000.000,00. The

next rank was PT. Summarecon Agung Tbk with the average of EVA’s value was Rp

437.276.000.000,00. The next rank was PT. AKR Corporindo Tbk with the average of

EVA’s value was Rp 423.457.000.000,00. The next rank was PT. Astra Agro Lestari

Tbk with the average of EVA’s value was Rp 380.167.000.000,00. The next rank was

PT. Kalbe Farma Tbk with the average of EVA’s value was Rp 129.574.000.000,00.

Meanwhile, the company with the lowest rank of EVA’s Value was PT. London

Sumatra Indonesia Tbk, with the average of EVA’s value in three years research was

Rp 64.813.000.000,00.

4.3 Conclusion

1. The result of calculation and analysis that already performed showed that all of the

listed company in Jakarta Islamic Index (JII) had a good financial performance.

This thing can be seen from 17 companies that used as object of the research during

three research years, 2015 until 2017, 16 companies had EVA’s Value that always

positive although the value was upside down and only one company that had

negative value in one of research year was PT. Kalbe Farma Tbk ins 2015.

2. Based on the list rank of EVA ‘s value that had been made, it can be seen that PT.

Telekomunikasi Indonesia (Persero) Tbk had the best financial performance,

because had the highest average of EVA’s value for three research years.

Meanwhile, PT. London Sumatra Indonesia was the lowest rank of EVA’s value.

On the other side, from 17 companies that were used as the research object, all of

them had the positive EVA ‘s average value .That means although the amount were

different but all of the company already been able to create the Economic Value

Added.

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index

647

5 Research Limitation

3. Lack of deep discussion about the analysis of financial performance using EVA.

4. Period of research just only three years, 2015 until 2017.

5. The research only limited in JII’s index.

5.1 Suggestion

1. For company that already able to produce positive EVA’s value and always increase

every year, needs to keep the performance, and for the company that always

decrease EVA’s value even negative is expected to be able to increase the

performance through operating cost and (cost of capital) in order to achieve positive

EVA’s value every year.

2. For investor, based on the purpose of investing fund that is for getting the high

return rate, so it is expected that investors can filter which company will be chosen,

especially the company with positive EVA’s value. And always increase every year.

3. For the next researcher, it is expected to examine further this research by deeping

on theory in different study case.

5.2 The Implication of Research Result

1. The result of EVA can be used by investor as consideration in choosing company

that will give return rate, because this method is very accurate in measuring good

or bad the financial performance of company that listed in JII.

2. The rank list of EVA’s value had already made can be used by company as reference

for increasing the performance in producing the Economic Value Addes so that

become the best.

3. This research can give contribution for science that EVA’s method can be used to

assess the company performance that listed in JII.

References

Alimudin, Arasy. (2017). Analisis Pencapaian Strategi Menggunakan Balance Scorecard. Jurnal

Pendidikan Ekonomi dan Bisnis. Vol 5. No 2.

Damanik, Yessy Kartika, Nengah Sudjana, MG Wi Endang NP. (2016). Analisis Pengukuran

Kinerja Perusahaan dengan Metode Balance Scorecard untuk Menilai Tingkat Kesehatan

BUMN (Studi pada PT. PLN (Persero) Area Pelayanan dan Jaringan Malang Periode 2013-

2015). Jurnal Administrasi dan Bisnis. Vol 35. No 2.

Dewi, Meutia. (2017). Penilaian Kinerja Keuangan Perusahaan dengan Menggunakan Metode

EVA (Economic Value Added) (Studi Kasus pada PT Krakatau Steel Tbk Periode 2012-

2016). Jurnal Manajemen Keuangan. Vol 6. No 1.

Erwin, Hartiwi Prabowo. (2015). Analisis Pengukuran Kinerja Menggunakan Metode Balance

Scorecard pada PT Bahtera Utama. Binus Business Revier. Vol 6. No 1.

Eugene, B., dan Hauston J. 2001. Manajemen Keuangan Edisi Delapan. Jakarta: Erlangga.

Fahmi, Irham. 2017. Analisis Laporan Keuangan. Bandung: Alfabeta

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

648

Hanafi, M., dan Halim A. 2009. Analisis Laporan Keuangan Edisi Keempat. Yogyakarta: UPP

STIM YKPN.

Hartono, Jogiyanto. 2014. Metode Penelitian Bisnis Edisi 6. Yogyakarta: Universitas Gadjah

Mada.

Hery, S.E.,M.Si. 2012. Analisis Laporan Keuangan. Jakarta: PT Bumi Aksara.

Hidayat, Rachmad. (2008). Perspektif Balance Score-Card dalam Pengukuran Produktivitas

Organisasi. Jurnal Ekuitas. Vol 12. No 2.

Hidayati, I.W., N.D. (2015). Analisis Economic Value Added (EVA) dan Financial Value Added

(FVA) Sebagai Salah Satu Alat Ukur Kinerja Keuangan Perusahaan. Jurnal Administrasi dan

Bisnis. Vol 25. No 2.

Inayati, T., Subroto, B., Fachan, A., Djazuli, A. (2014). Analyzing Islamic Micro Finance

Performance With Economic Value Added (EVA): Learning From Baitul Wat Tamwil

(BMT) Usaha Gabungan Terpadu Sidogiri Indonesia. Bussines Management Horizon. Vol 2.

No 29.

Iqbal, M., Hidayat R.R., dan Sulasmiyati S., (2015). Penilaian Kinerja Keuangan Perusahaan

dengan Analisis Rasio Keuangan dan Metode Economic Value Added (EVA) (Studi Pada

PT. Jasa Marga (Persero) Tbk. dan Anak Perusahaan yang Terdaftar di Bursa Efek Indonesia

Periode 2011-2014. Jurnal Admiistrasi dan Bisnis. Vol 25. No 1.

Iramani, R, Erie Febrian. (2005). Financial Value Added: Suatu Paradigma dalam Pengukuran

Kinerja dan Nilai Tambah Perusahaan. Jurnal Akuntansi dan Keuangan. Vol 1. No 1.

Jamkarani, R.G., dan Banafi M. (2017). Sticky of Selling, General and Administrative Expenses:

The Role in Market Value Added and Economic Value Added. International Journal Of

Economic Perspectives. Vol 11. Issue 3.

Karamoy, J., Dolina L Tampi, dan Danny DS Mukuan. (2016). Analisis Economic Value Added

(EVA) pada PT Bank Negara Indonesia Tbk. Jurnal Administrasi dan Bisnis. Vol 4. No 2.

Kasmir. 2014. Analisis Laporan Kuangan Edisi Pertama. Jakarta: PT Rajagrafindo Persada.

Khaddafi, M., dan Heikal M. (2014). Financial Performance Analysis Using Economic Value

Added in Consumption Industry in Indonesia Stock Exchange. American International

Journal of Social Science. Vol 3. No 4.

Murhadi, W.R. 2013. Analisis Laporan Keuangan, Proyeksi dan Valuasi Saham. Jakarta:

Salemba Empat.

Neolaka, A. 2014. Metode Penelitian Dan Statistik. Bandung: PT Remaja Rosdakarya.

Nursiyono, J.A. 2015. Kompas Teknik Pengambilan Sampel. Bogor: In Media.

Nurwahyuni, R., M. Saifi, dan Zahro ZA. (2017). Analisis Rasio Keuangan dan Metode

Economic Value Added (EVA) untuk Menilai Kinerja Keuangan Perusahaan (Studi Kasus

pada PT. Astra Otoparts, Tbk dan PT. Gajah Tunggal Tbk yang Terdaftar di Bursa Efek

Indonesia Periode 2013-2015. Jurnal Administrasi dan Bisnis. Vol 47. No 1.

Prabowo, S.C.B., dan Faculty of Economics and Business. (2017). Financial Performance

Analysis Using Economic Value Added and Market Value Added Method in PT Gudang

Garam Tbk, PT Hanjaya Mandala Sampoerna Tbk and PT Bentoel Internasional Investama

Tbk. Jurnal Aplikasi Manajemen. Vol 15.

Prastowo, D. 2015. Analisis Laporan Kuangan Konsep dan Aplikasi Edisi Ketiga. Yogyakarta:

UPP STIM YKPN.

Riswanto, Anang Yudi, Indupurnahayu, dan Akhmad Bakhtiar Amin. (2018). Implementasi

Konsep Balance Scorecard (BSC) Berbasis Syariah dalam Pengukuran Kinerja. Jurnal

Manajemen. Vol 9. No 1.

Sabol, A., dan Sverer F. (2017). A Review Of The Economic Value Added Literature And

Application. UMTS Journal of Economics. Vol 8. No 1.

Sholahuddin, Muhammad. 2005. Analisis Informasi Keuangan. Surakarta Fakultas Ekonomi

Universitas Muhammadiyah Surakarta.

Sidharta, I., Affandi A. (2016). The Empirical Study On Intellectual Capital Approach Toward

Financial Performance On Rural Banking Sectors in Indonesia. International Journal of

Economics and Financial Issues. Vol 6. No 3.

Analysis of Financial Performance Assessment using Economic Value Added (EVA) Method in Listed Company at Jakarta Islamic Index

649

Sirait, P. 2017. Analisis Laporan Keuangan. Yogyakarta: Ekuilibria.

Subagyo, J. 2015. Metode Penelitian Dalam Teori dan Praktik. Jakarta: PT Rineka Cipta.

Sugiyono. 2015. Metode Penelitian dan Pengembangan Research and Development. Bandung:

Alfabeta.

Sujarweni, W. 2017. Analisis Laporan Keuangan Teori, Aplikasi dan Hasil Penelitian.

Yogyakarta: Pustaka Baru Press.

Suryani, Hendryadi. 2018. Metode Riset Kuantitatif Edisi Kedua. Jakarta: Prenadamedia Group.

Tunggal, Amin Widjaja. 2001. Pengukuran Kinerja Keuangan dengan Balance Scorecard.

Jakarta: Harvarindo.

Wahyu, D.R. 2017. Economic Value Added and Financial Ratio Analysis Implementation On

Tobacco Company. European Journal Business Management. Vol 9. No 6.

Walsh, Ciaran. 2014. Key Management Ratios Edisi Keempat. Jakarta: Erlangga.

Wijaya, Harris Hansa, dan Lauw Tjun Tjun. (2009). Pengaruh Economic Value Added Terhadap

Tingkat Pengembalian Saham pada Perusahaan yang Tergabung dalam LQ-45. Jurnal

Akkuntansi. Vol 1. No 2.

Young, D., dan O’Byrne S. 2001. EVA dan Manajemen Berdasarkan Nilai. Jakarta: Salemba

Empat.

Yusbardini, Y. (2017). Economic Value Added vs Firm Performance. International Journal of

Economic Perspectives. Vol 11. Issue 1.

www.idx.co.id

www.sahamok.com

www.britama.com

MIICEMA 2019 - Malaysia Indonesia International Conference on Economics Management and Accounting

650