Analysis of the Influence of Capital Structure on Corporate Values

Irhaz Aulianandatama Sundoro and Oman Sukirman

1

Management Postgraduate Program, Padjajaran University,Bandung,Indonesia Catering Industry Management

2

Padjajaran University Indonesia University of Education , Bandung, Indonesia

Keyword: Firm Values, Capital Structure, Price to Book Value, Debt to Assets Ratio, Restaurants, Hotels, and

Tourism

Abstract: High firm value creation is the duty of a company's financial managers. The firm value need to be reviewed

any factors that influence it. Therefore, this study aimed to determine the influence of capital structure

towards the corporate value. The study conducted on a sub-sector of restaurants, hotels, and tourism along

with the development of tourism industry in Indonesia. In this study, the data used in the form of secondary

data taken from the company's financial statements last 7 years, the year of 2012-2018. The data used for

capital structure is the ratio of total debt to total assets (debt to assets ratio/ DAR) and the corporate value

using the ratio of the stock market price to book value (price to book value/ PBV). Both ratios arranged in

the form of pool data (time series and cross-section). Descriptive and verification analyze by EViews

version 9, a specialized software for pool data processing. The results from the research found that the

capital structure influential positively and significantly to the firm value. The influence magnitude of the

capital structure to the corporate value amounted to 72% in favor of Modigliani & Miller’s Capital Structure

theory and in line with the results of Hermuningsih’s research about the influence of profitability, growth

opportunity, and capital structure toward the corporate value at public companies in Indonesia.

1 INTRODUCTION

Tourism continues to be one of the economic sectors

in the best position to foster inclusive socioeconomic

growth, reduce sustainable unemployment, foster

peace and can help protect environmental

sustainability (UNWTO, 2018).

Tourism is the biggest source of income

contribution to the country's GDP (Gross Domestic

Product). Total tourism revenue is increasing every

year. In 2016, tourism revenue reached US $

11,933.61 million , in 2015 it was US $ 11,760.74

million, and in 2014 it was 11,166.67 million. This

means that tourism income in Indonesia always

increases by around 1 % (Kemenpar, 2018) .

The results of the Indonesian Central Statistics

Agency (BPS) show that the number of foreign

tourist arrivals in Indonesia during 2018 was 15 . 81

million visits. Whereas in the previous year, 2017

was 14.04 million visits, meaning the number of

foreign tourists visiting Indonesia increased by 12.58

percent from the previous year.

Some companies engaged in the tourism sector

in Indonesia are currently advancing because they

can compete with other companies and have good

financial performance in the sense that the company

gets an adequate profit. There are also companies

that experience setbacks, because they cannot

compete with other companies and have poor

financial performance in the sense that the company

suffers losses.

The purpose of this study is to analyze the

company's financial performance to determine the

effect of capital structure on firm value in the

restaurants, hotels and tourism sub-sector companies

.

This paper was prepared under the title

"ANALYSIS OF THE INFLUENCE OF CAPITAL

STRUCTURES ON CORPORATE VALUES",

Case Study of Restaurant, Hotel and Tourism Sub

Sector Companies Listed on the Indonesia Stock

Exchange for the 2012-2018 Period, which is

expected to broaden knowledge about financial

management and be beneficial for the development

of financial management. business in restaurants,

hotels and tourism .

Sundoro, I. and Sukirman, O.

Analysis of the Influence of Capital Structure on Corporate Values.

DOI: 10.5220/0010224501770181

In Proceedings of the 1st NHI Tourism Forum (NTF 2019) - Enhancing Innovation in Gastronomic for Millennials, pages 177-181

ISBN: 978-989-758-495-4

Copyright

c

2021 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

177

2 LITERATURE REVIEW

2.1 Tourism, Restaurants and Hotels

According to the Law of the Republic of Indonesia

Number 10 Year 2009 concerning tourism. Tourism

is a variety of tourism activities and is supported by

various facilities and services provided by the

community, business people, government, and local

government.

According to the Regulation of the Minister of

Tourism and Creative Economy of the Republic of

Indonesia Number 11 Year 2014 concerning

Standards of Restaurant Business, Restaurant

Business is a business providing food and beverage

services equipped with equipment and equipment for

the process of making, storing and serving in a fixed

place that is not moved with the aim obtain profits.

According to the Regulation of the Minister of

Tourism and Creative Economy of the Republic of

Indonesia Number 53 of 2013 concerning Hotel

Business Standards, Hotel Business is a business

providing accommodation in the form of rooms in a

building, which can be equipped with food and drink

services, entertainment activities and / or other

facilities on a daily basis with the aim of making a

profit.

2.2 Financial Management

Financial management is a matter related to effective

fund management in business. Put simply, Financial

Management is like what is done by a business

company that can be referred to as a Finance

Corporation or Business Finance (Paramasivan &

Subramanian, 2009).

Effective and efficient procurement of financial

use leads to the use of finance with business

attention. This is an important part of financial

managers. Therefore, financial managers must

determine the basic objectives of financial

management. The objectives of financial

management are broadly divided into two sections

such as (Paramasivan & Subramanian, 2009):

Profit maximization

Wealth maximization .

2.3 Capital Structure

Capital structure is defined as the combination of

debt and equity used to finance real investment. The

capital structure reflects the company's financing

strategy, for example, the overall debt-equity ratio

target, and financing tactics, for example, managing

the time of a particular debt problem (Myers, 2000).

According to Modigliani and Miller (MM)

theory , some of the main problems faced by

financial managers are how the right step of the

company can finance its assets in order to increase

the value of the company. Do you use the source of

funds from debt or by issuing shares (Wiyono &

Kusuma, 2017).

2.4 Corporate Value

Company Value is a perception of investors on the

level of success of the company and is usually

associated with stock prices. High stock prices make

the value of the company high too, and can increase

market confidence, company performance, and

company prospects in the future (Riadi, 2017).

2.5 Hypothesis

The hypothesis in this study is that based on

previous research, that capital structure has a

significant positive effect on firm value. , by

conducting a Case Study of Restaurant, Hotel and

Tourism Sub Sector Companies Listed on the

Indonesia Stock Exchange for the 2012-2018 Period.

3 RESEARCH METHODS

The object of this research is financial statement

data related to capital structure and firm value. The

method used in penelit ian This is a descriptive

method, namely p enelitian describes the conditions

actually occur on the object of research, by

collecting, analyzing, and menginterpetasikan the

data obtained and draw conclusions from the results

penelit ian them. The implementation of descriptive

research method in this study is to illustrate the

effect of capital structure on firm value using the

company's annual financial statements and a

summary of the company's performance listed on the

Indonesia Stock Exchange in the 2012-2018

restaurant, hotel and tourism sub-sectors.

The sampling technique in this study used the

purposive sampling technique. The author will take

a total of 16 samples from a total of 25 companies

with the consideration of the company that will be

analyzed to make an initial public offer (IPO) of at

least 7 years of the research year and have complete

financial data.

NTF 2019 - The NHI Tourism Forum

178

In this study, the authors use quantitative data in

the form of source data which is data obtained in the

form of publication results. The data source used in

this study is secondary data and panel data type

(combined time series with cross section). The

author analyzes panel data using EViews version 9

software.

Both variables will be analyzed descriptively

statistically first, aiming to find out the value of the

variables in this study aimed at discussing how the

influence of capital structure on firm value in the

restaurant, hotel and tourism sub-sectors listed on

the Indonesia Stock Exchange in 2012- 2018. To

find out the average (mean), the highest value, and

the lowest value from the data collected.

Furthermore, to determine the relationship and

influence between variables will be tested using a

regression estimation model. In regression analysis,

will determine a linear model between one or more

independent variables (independent) against one or

more of the dependent variable ( dependent)

(Pramesti, 2018) .

Mathematically, the equation of the simple linear

regression analysis model can be described as

follows:

In this study, consisting of 2 variables, it will use

a simple linear regression method. Then will test

Anova (test F), the coefficient of determination (R-

Squared), cationation (R), and the correlation

coefficient (t test) The analyzed data is panel data on

16 companies in a period of 7 years (2012-2018).

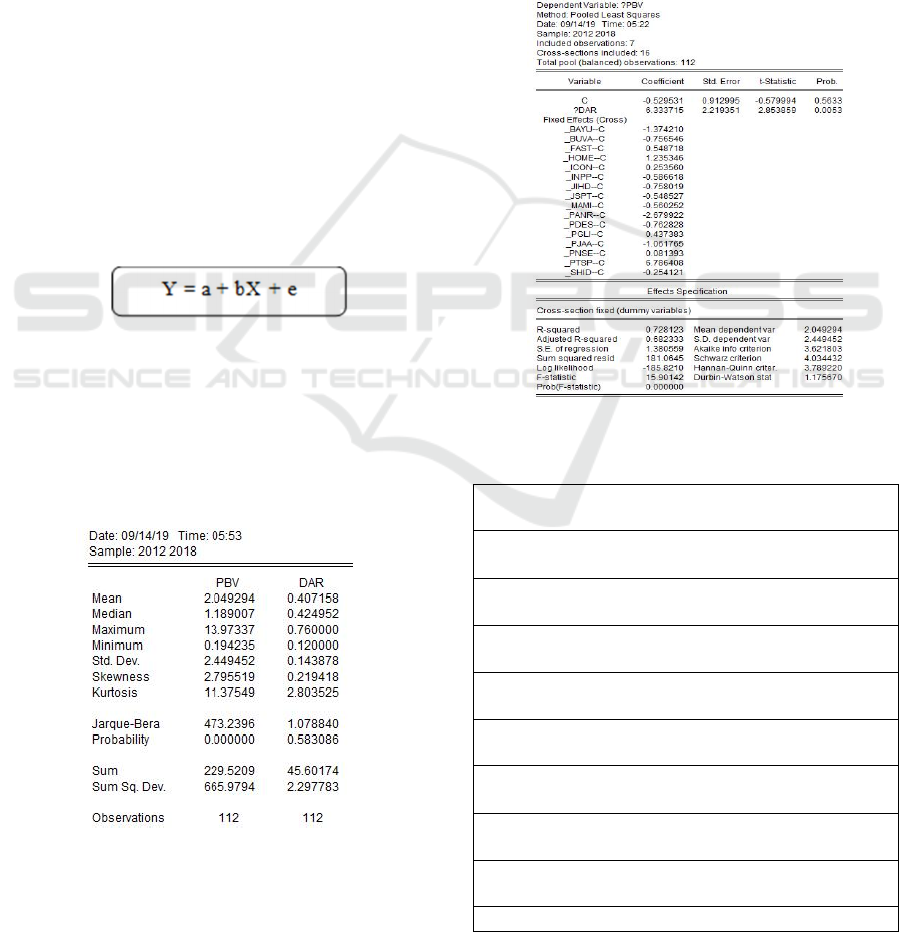

Table 1: Output of Analysis Descriptive Statistic

Source: Data Process, 2019

4 RESEARCH RESULTS AND

DISCUSSION

4.1. Data Processing Results

EViews data processing is carried out to test the

regression between capital structure and company

value in the restaurant, hotel and tourism sub-sector

companies listed on the Indonesia Stock Exchange

in the 2012-2018 period. The test results can be seen

in the following output:

Table 2: Output of Regression Estimation

Source: Data Process,2019

Table 3: Output of Regression Equation

_BAYUPBV = -1.37420992315 -

0.529531424584 + 6.33371477535*

_

BAYUDAR

_BUVAPBV = -0.756545861646 -

0.529531424584 + 6.33371477535*

_

BUVADAR

_FASTPBV = 0.548718206194 -

0.529531424584 + 6.33371477535*

_

FASTDAR

_HOMEPBV = 1.2353455268 - 0.529531424584

+ 6.33371477535*

_

HOMEDAR

_ICONPBV = 0.253560268395 -

0.529531424584 + 6.33371477535*

_

ICONDAR

_INPPPBV = -0.586618066506 -

0.529531424584 + 6.33371477535*

_

INPPDAR

_JIHDPBV = -0.758018899319 -

0.529531424584 + 6.33371477535*

_

JIHDDAR

_JSPTPBV = -0.548527469727 -

0.529531424584 + 6.33371477535*

_

JSPTDAR

_MAMIPBV = -0.560252005763 -

0.529531424584 + 6.33371477535*

_

MAMIDAR

_

PANRPBV = -2.67992156065 -

Analysis of the Influence of Capital Structure on Corporate Values

179

0.529531424584 + 6.33371477535*

_

PANRDAR

_PDESPBV = -0.762827924256 -

0.529531424584 + 6.33371477535*

_

PDESDAR

_PGLIPBV = 0.437383135042 - 0.529531424584

+ 6.33371477535*

_

PGLIDAR

_PJAAPBV = -1.0617650351 - 0.529531424584

+ 6.33371477535*

_

PJAADAR

_PNSEPBV = 0.0813929003004 -

0.529531424584 + 6.33371477535*

_

PNSEDAR

_PTSPPBV = 6.78640770294 - 0.529531424584

+ 6.33371477535*

_

PTSPDAR

_SHIDPBV = -0.254120993553 -

0.529531424584 + 6.33371477535*

_

SHIDDAR

Source: Data Process 2019

4.2. Discussion

Based on the data obtained in table 1, the average

DAR value in the restaurant, hotel and pariwi sata

sub-sector for the 2012-2018 period was 0.407,

meaning that the average of all restaurant, hotel and

tourism sub-sector companies or using debt. as much

as 40.7 % in the composition of capital and the rest

comes from own capital, such as shares and retained

earnings. The highest value is the value of 0.76,

meaning that there are companies in the capital mem

il iki debt composition by 76 %. Its low point with a

value of 0.12, meaning that there are companies in

the capital mem il iki debt composition by 12 %.

Based on the data obtained in table 1 as well, the

average PBV value in the restaurants, hotels, and

pariwi sata sub-sectors for the 2012-2018 period is

2.05, meaning that the average investors are willing

to pay for shares 2.05 times that of company book

value. The highest value is the ICON company in

2012 with a value of 13.97, meaning that the storers

are willing to pay for shares 13.97 times the book

value of the company. The lowest value is the

MAMI company in 2014 with a value of 0.19,

meaning that investors are only willing to pay for

shares 0.19 times the book value of the company.

Based on results in Table 2, shows the flood wa

F-statistic value of 15.90 with a value (Prob) 0.000

<0.05 significance level. Then H

0

is rejected and

can be interpreted variable capital structure have a

linear relationship to the variable corporate value.

The values of coefficient determination ( R-

Squared ) by 0.728 or 72.8%. This shows that the

corporate value (PBV) can be influenced by the

capital structure (DAR) of 72.8% and the rest is

27.2% is influenced by other things in the restaurant,

hotel and tourism sub-sector companies.

Furthermore, the results show that DAR has a

significant positive effect on PBV.

To determine the correlation (R) between

variables, can be done by way of rooting the results

of R-Squared ( √ R ), can be obtained by the R value

of 0.853 with a sense of direction both variables

have a relationship / strong positive influence. shows

that the t-statistic value is 2.85 with a value (Prob)

0.0053 <significant level 0.05. Then H

0

is rejected

and can be interpreted variable capital structure

significantly influence the variable value of the

company.

Table 3 shows the regression equations for each

company.

5 CONCLUSIONS

Based on the results of the study , it can be

concluded that the capital structure of the restaurant,

hotel and tourism sub-sector companies listed on the

Indonesia Stock Exchange in the 2012-2018 period

varied in determining the composition of debt as a

source of capital. The value of the company in the

restaurant, hotel and tourism sub-sector companies

listed on the Indonesia Stock Exchange for the

period 2012-2018 varies, which means that investors

are able to pay shares several times the company's

book value. Furthermore, the capital structure has a

linear relationship and has a significant positive

effect on firm value in the restaurant, hotel and

tourism sub-sectors listed on the Indonesia Stock

Exchange in the 2012-2018 period.

REFERENCES

Bursa Efek Indonesia. (2019). Financial Statement.

Diakses dari: //www.idx.co.id//.

Hermuningsih, S. (2013). Pengaruh Profitabilitas, Growth

opportunity, Struktur Modal terhadap Nilai

Perusahaan Pada Perusahaan Publik di Indonesia.

Buletin Ekonomi Moneter Dan Perbankan, 18(1), Hal.

127-145.

https://doi.org/10.1177/027046769801800106

Kementrian Pariwisata. (2018). Statistical Report on

Visitor Arrival to Indonesia 2016: Distribusi

Pendapatan Pariwisata. Diakses dari:

//www.kemenpar.go.id//.

Myers, S. C. . (2000). Capital Structure : Some Legal and

Policy Issues by Professor Stewart C . Myers MIT

Sloan School of Management Company Law Reform

in OECD Countries A Comparative Outlook of

Current Trends Stockholm, Sweden 7-8 December

2000, (December). Hal 2.

Paramasivan, C., & Subramanian, T. (2009). Financial

Management. Hal. 3, 5, 47.

NTF 2019 - The NHI Tourism Forum

180

Peraturan Menteri Pariwisata dan Ekonomi Kreatif

Republik Indonesia Nomor 53 Tahun 2013 tentang

Standar Usaha Hotel

Peraturan Menteri Pariwisata dan Ekonomi Kreatif

Republik Indonesia Nomor 11 Tahun 2014 tentang

Standar Usaha Restoran

Peraturan Undang-undang Republik Indonesia No.10

Tahun 2009 Tentang Kepariwisataan.

Pramesti, G. (2018). Mahir Mengolah Data Penelitian

dengan SPSS 25. Jakarta: Elex Media Komputindo.

Hal. 115.

Riadi, M. (2017). Pengertian, Jenis dan Pengukuran Nilai

Perusahaan. Diakses January 5, 2019, dari

www.kajianpustaka.com

Saham Ok. (2018). Sub Sektor Restoran, Hotel dan

Pariwisata BEI (94). Diakses dari:

https://www.sahamok.com/emiten/sektor-

perdagangan-jasa-investasi/sub-sektor-hotel-restoran-

pariwisata/

Tampubolon, P. D. M. P. (2013). MANAJEMEN

KEUANGAN (1st ed.). Jakarta: Mitra Wacana Media.

Hal. 3, 163.

UNWTO. (2018). UNWTO Annual Report 2017, Hal. 5,

25, 27. https://doi.org/10.18111/9789284419807

Wiyono, G., & Kusuma, H. (2017). Manajemen Keuangan

Lanjutan : Berbasis Corporate Value Creation.

Analysis of the Influence of Capital Structure on Corporate Values

181