Challenges Faced by Malaysian Islamic Banks in Treating Shariah

Non-compliance Events

Hani Nabila Omar and Rusni Hassan

IIUM Institute of Islamic Banking and Finance, Malaysia

Keywords: Shariah Non-compliance, Shariah Non-Compliance Event, Shariah Non-compliance Reporting, Islamic

Banks, BNM Guidelines.

Abstract: Islamic finance in Malaysia has been growing rapidly in the past 30 years and continues to thrive in many

countries. In 2019, a total of 16 Islamic banks (IBs) is listed and supervised by Bank Negara Malaysia (BNM)

with 5 banks being foreign entities. In view of the rivalry with the conventional banking sector, Islamic banks

(IBs) offer new innovative Islamic products and financial projects which may lead to greater risk of Shariah

non-compliance (SNC) exposure to the Islamic Financial Institutions (IFIs) in its effort to stay competitive.

This study intends to review the challenges faced by IBs in treating the SNC and propose recommendations

for the existing policy to enhance the treatment of SNC. This study adopts qualitative research method by

conducting semi-structured in-depth interviews with Islamic banking professionals targeting five IBs. Both

the primary and secondary sources are used for data collection. The finding shows that there are a lot of minor

concerns and challenges faced by IBs in managing SNC events in the industry. The finding of this study would

contribute positively in terms of facilitating policy makers and regulators on enhancing the regulations and

practices in ensuring zero SNC events. Simultaneously, enriching and contributing to the existing literature

on the SNC practices by IBs so that more researchers can have larger resource of reference to diversify the

topics related to this study.

1 INTRODUCTION

The push for innovation to fulfil commercial purposes

has led many Islamic financial institutions (IFIs) to

adopt conventional principles and instruments.

However, this may expose the IFIs towards the risk

of Shariah Non-compliance (SNC), as all financial

transaction, projects and activities must comply with

the law of Shariah. BNM has issued a Shariah

Governance Framework in 2011 to be complied by all

IFIs that include established core functions that would

guide the Islamic Banks in achieving effective

operational excellence and concurrently adhering to

the Shariah principles.

Nonetheless, despite the BNM framework and

guidelines, SNC risks can potentially arise when there

is a mistake made in the documentation process in

dealing with a certain contract. Apart from that,

conflicts appear when the Islamic products are

improperly managed although the terms and

conditions in place have already been stipulated to be

in line with Shariah. According to Islamic Financial

Services Board (IFSB), SNC risk is defined as “The

risk that arises from the bank’s failure to comply with

rules and principles determines by the relevant

Shariah regulatory councils”.

Shariah compliance is the core element and the

most predominant factor in operations of the Islamic

banking and finance business. Failure to adhere to

Shariah principles and values in carrying out the

financial activities, business and operations may lead

the Islamic bank to be exposed to the risk of non-

compliance. SNC risk is considered as the unique risk

of Islamic banks and IFIs compared to the

conventional counterparts.

Management of non-compliance issue is crucial in

ensuring customers’ faith and confidence in the

Islamic banking and finance. Hence, monitoring of

SNC events has to be on continuous basis and

transparent in establishing credibility of the banks in

their transactions. Therefore, this study intends to

explore the concerns and challenges of SNC issues

faced by Islamic banks. Subsequently, this study will

take the current practices into consideration to

propose recommendations on how to improve and

256

Omar, H. and Hassan, R.

Challenges Faced by Malaysian Islamic Banks in Treating Shariah Non-compliance Events.

DOI: 10.5220/0010145100002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 256-264

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

enhance the treatment of Malaysian Islamic Banks

towards SNC events.

The significances of this study include enriching

the existing literature on this topic and increasing the

awareness among the beneficiaries and the regulators

to better improve the policy and guidelines on SNC

event in Malaysia. The scope of this study is limited

to Malaysian Islamic banks practices on SNC

treatment, which is regulated by Bank Negara

Malaysia (BNM).

This study is structured as follows: Section two

discusses the overview of Islamic banking industry in

Malaysia, Shariah Governance Framework, and

Statutory requirement on Shariah Non-compliance

(SNC) event; Section three describes briefly about the

methodology used; Section four presents the analysis

and findings; Section five provides conclusions.

2 LITERATURE REVIEW

2.1 Islamic Banking Industry in

Malaysia

Islamic finance and banking industry in Malaysia has

been rapidly growing and increasing remarkably

since more than 30 years ago. Malaysian model of

Islamic banking today is one of the most advanced

Islamic banking systems in the world (Marimuthu et

al, 2010). In order to differentiate Islamic from

conventional banking, we should begin by defining

Islamic banking. According to Bank Negara Malaysia

(BNM), Islamic banking is a banking system that

complies with Islamic law. The underlying principles

that govern Islamic banking are mutual risk and profit

sharing between parties involved, the assurance of

fairness for all and the transactions involve an asset

and ownership or an underlying business activity that

does not contradict with Shariah. Islamic banks offer

facilities with a various financing arrangement with

the contractual terms used between the bank and the

customers as partners, buyer and seller, wakil (agent),

fund provider and entrepreneur. Meanwhile

conventional banks offer facilities based on loan

arrangement and interest with the contractual term

used between the bank and the customers are as

borrower and lender.

The first Islamic commercial bank in

Malaysia, Bank Islam Malaysia Berhad (BIMB) was

established and started its operations in July 1

st

1983.

BIMB operated as the only Islamic bank in Malaysia

for 10 years before the government allowed Islamic

Windows Operation, also known as ‘Window’ to be

offered by other conventional banks. Islamic

Financial Board Services (IFSB) defined Islamic

Window Operation as “A part of a conventional

financial institution (which may be a branch or

dedicated unit of that institution) that provides both

fund management (investment accounts) financing,

and investment that are Shariah compliance, with a

separate fund” (IFSB, 2017). Window operation has

contributed to the growth of Islamic banking and

finance in Malaysia as the conventional banks started

offering Islamic financing product to the customers.

The numbers of Islamic banks in Malaysia keep

growing and currently there are a total of 16 Islamic

banks that are supervised by Bank Negara Malaysia

including several foreign owned entities. Table below

shows the latest list of all Islamic banks in Malaysia

retrieved from BNM website.

Table 1: List of Islamic Banks in Malaysia.

Name Ownership

Affin Islamic Bank Berhad Local

Al Rajhi Banking & Investment Corporation

(Malaysia) Berhad

Foreign

Alliance Islamic Bank Berhad Local

AmBank Islamic Berhad Local

Bank Islam Malaysia Berhad Local

Bank Muamalat Malaysia Berhad Local

CIMB Islamic Bank Berhad Local

HSBC Amanah Malaysia Berhad Foreign

Hong Leong Islamic Bank Berhad Local

Kuwait Finance House (Malaysia) Berhad Foreign

MBSB Bank Berhad Local

Maybank Islamic Berhad Local

OCBC Al-Amin Bank Berhad Foreign

Public Islamic Bank Berhad Local

RHB Islamic Bank Berhad Local

Standard Chartered Saadiq Berhad Foreign

Sources: Bank Negara Malaysia (BNM) 2018.

2.2 Shariah Governance Framework

In 2010, Shariah Governance Framework (SGF) was

introduced by Bank Negara Malaysia and being

implemented starting on January 1

st

2011 by IFIs. The

Shariah Governance Framework plays an important

role in supporting the robust development of the

Islamic finance industry and promoting end-to-end

Shariah compliance in Malaysia (BNM, 2017). The

objectives of Shariah Governance Framework are,

firstly to provide the guidelines on Shariah

governance structures, processes and arrangements

for all Islamic banks and IFIs to ensure the Shariah

compliance in the entire business operations and

activities. Secondly to provide comprehensive

guidance of Shariah Committee and the management

of IFIs in their business conduct or, anything related

to Islamic financial matters. Lastly, to highlight the

four (4) Shariah Governance Framework key

functions such as Shariah risk management, Shariah

review, Shariah research and Shariah audit.

Challenges Faced by Malaysian Islamic Banks in Treating Shariah Non-compliance Events

257

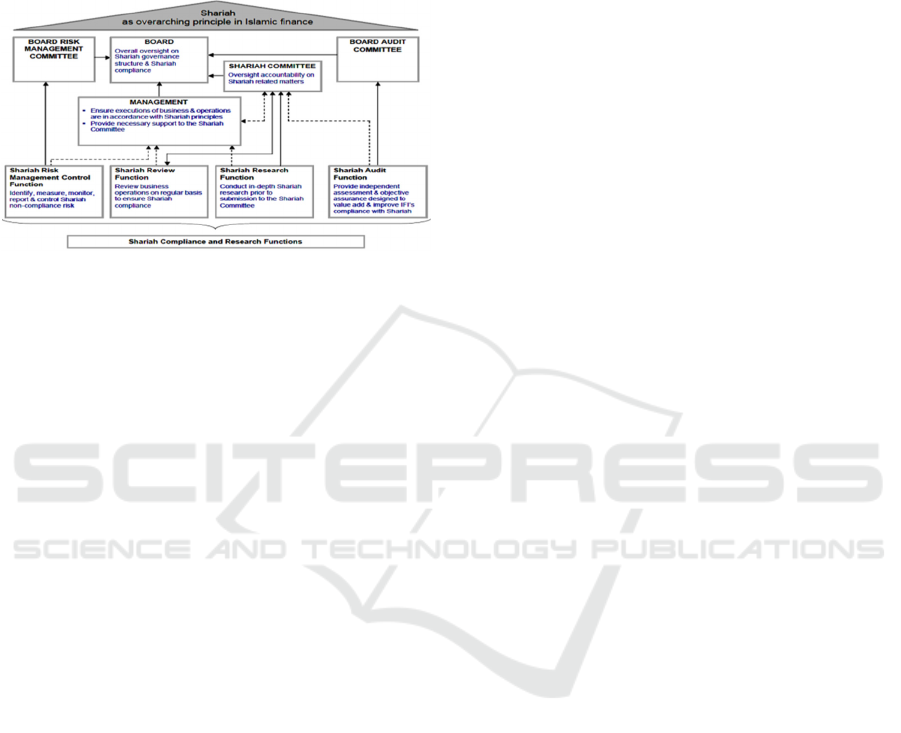

Figure 1 below shows the reconstructed

illustration adapted from Shariah Governance

Framework policy document published by BNM on

the model structure of roles, functions and

relationships between the key organs in the

governance framework of IFIs:

Figure 1: Model of Shariah Governance Framework for

Islamic Financial Institutions.

Source: Bank Negara Malaysia (BNM), 2018

The IFIs shall ensure that the reporting on Shariah

matters is carried out effectively in an orderly manner

on regular basis. The Shariah Committee of IFIs shall

report to the Board of Directors on Shariah related

matters. The Shariah review function shall

simultaneously report to the Shariah Committee and

the IFIs management. Meanwhile, the Shariah audit

function shall report to the Shariah Committee and

Board Audit Committee on the Shariah matters. All

SNC events that have been identified via several

channel by any means with sources shall be reported

to the Board of Directors and also the Bank (BNM).

Shariah Governance Framework’s core functions

Shariah risk management, Shariah review and

Shariah audit are required to be performed on

continuous basis to ensure an effective management

within the bank

2.3 Statutory Requirement on Shariah

Non-compliance Event

In Malaysia, there are comprehensive regulation

made to ensure IFIs do not contradict the Shariah

principles in overall business activities. The

regulation is Islamic Financial Services Act (IFSA)

that came into force in 2013 as an omnibus act,

consolidating the Islamic Banking Act 1983 &

Takaful Act 1984 and repealing both. IFSA 2013

introduces end-to-end Shariah compliance regulatory

framework for IFIs. The act was enacted to provide:

i. The comprehensive regulation and supervision of

Islamic financial institutions, payment systems

and other relevant entities in Malaysia to ensure

all the activities, product and services offered

complies with Shariah

ii. The oversight of the Islamic money market and

Islamic foreign exchange market

iii. To promote financial stability and IFIs

compliance with Shariah laws and principles

(IFSA 2013)

The important provisions of IFSA on Shariah

Requirement for Islamic Banks and IFIs are Section

28 (1) & (2) of IFSA 2013. It states that IFIs shall

ensure that its aims and the entire operations,

business, and activities are in accordance with

Shariah rules at all times. Compliance with any ruling

and decision made by the Shariah Advisory Council

(SAC) in respect of any particular aim and operation,

business, affair or activity by shall be deemed to be

Shariah compliance. It shows that starting from the

beginning until the end of the agreement, the

requirements of Shariah must be fulfilled

(Kunhibava, 2015).

Should there be any disregard on Shariah

principles or any breach of contract with regards to

the Shariah compliant requirement or it contains any

standards against BNM guidelines, the Islamic banks

and IFIs will be exposed to the risk of SNC. BNM

also provides guidelines on the reporting process of

SNC event in Operational Risk Integrated Online

Network (ORION) revised policy document

published in 2018. The guidelines include the

reporting types and timeline on SNC event. The

financial institutions or Islamic Banks that are

exposed to SNC will be required to undergo the

rectification process in accordance with Section 28(3)

of IFSA 2013.

ORION policy document explains the process of

SNC reporting that has to be adhered by IFIs starting

from how the issue is reviewed by Qualified Shariah

Officer (QSO) before confirming that it is a Potential

SNC or non-SNC. IFIs have to report the issue in

ORION system within 1 working day after the QSO

confirmation. If QSO confirms the issue as non-SNC

related, then it will be reassess to find out if it is

related to operational risk. If the issue is operational

risk related, it will be reported in ORION system as a

general operational risk loss event.

Meanwhile, if QSO confirms it as a Potential

SNC, then it will be reported in ORION system as

Potential SNC (PSNC) and IFIs will have to get the

SC decision on the issue. SC will decide the previous

confirmed PSNC as an SNC or non-SNC in the

meeting within 14 working days. The Potential SNC

label in ORION will be updated to Actual SNC

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

258

(ASNC) when SC decides it as an SNC event and

rectification plan is required. In the case of SC

deciding it as a non-SNC, then IFIs have to update

SNC field in ORION and reassessment is needed to

find out whether the issue is an operation risk related

or non-operational risk related.

IFIs are required to propose a rectification plan

but members of SC and Board of Directors have to

give their approval before the plan being submitted in

ORION within 30 calendar days. (ORION Policy

Document, 2018)

In addition, Section 28 (3) IFSA 2013 stipulates

that, when IFIs becomes aware of the SNC event in

any of its business or activity or any disregard

towards the advice and ruling of Shariah committee

or Shariah Advisory Council, they shall:

1. Immediately notify its Shariah committee about

the event

2. Immediately notify Bank Negara Malaysia of the

event

3. Immediately stop the non-compliant act and cease

from carrying on or taking on any other similar

business, affair or activity

4. Immediately come up with a rectification plan

within 30 days after becoming aware of such non-

compliance, and submit the plan to the Bank

Negara Malaysia for the rectification process

Meanwhile, Section 28 (4) IFSA 2013 states that

the bank may be put through an assessment as it

thinks necessary to determine whether the institution

has rectified the non-compliance events or not,

referred to the subsection (3).

Failure to resolve and rectify the non-compliance

issue will result them subject to punishment either

under Section 59 (3) of Central Bank Malaysia Act

2009 or Section 28(5) or 29(6) of IFSA 2013. Any

person who contravenes or disregards the subsection

(1) or subsection (3) of Section 28 of IFSA 2013,

commits an offence and shall, on conviction, be liable

to imprisonment for a term not more than eight years

or a fine not more than twenty-five million ringgit or

be subject to both penalties. But this does not render

the transaction becomes void under Malaysian Law

and in fact it is still enforceable (Lee, 2017).

2.4 Methodology

A qualitative method is more suitable and appropriate

for a research that explores the variation and diversity

in any aspect of social life (Kumar & Ranjit, 2011).

Qualitative method is concerned with subjective

assessment of opinions, attitudes and focuses more on

naturalistic setting. This methodology is not

subjected to rigorous quantitative analysis, therefore

the data is generally expressed in words rather than

numerical analysis. The result generated will be in

non-quantitative form as it cannot be measured and

counted accurately.

As for this study, a qualitative method is deemed

to be more efficient and suitable compared to

quantitative method because the exploratory way of

acquiring information through interview will fulfil

the research objectives more comprehensively.

Therefore, qualitative research methodology that

comprises interview and document analysis is

adopted. Semi-structured interviews conducted with

the respondents aim to explore the management and

treatment of Islamic Banks towards SNC. Additional

data collected through sources such as journal articles

and web pages; complement the findings from the

interviews.

Adopting a convenience sampling method, five

(5) Islamic banks were chosen to represent the total

of 16 existing Islamic institutions supervised by

BNM. There are twelve (12) respondents that

contributed to the findings of this study. The

following table lists out the related information about

the respondents for semi-structured interviews.

Table 2: List of Respondents for Semi Structured

Interviews.

Bank Positions Nationality

Bank A Head of Shariah Review and

Assurance, Group Shariah Business

Compliance

Malaysian

Bank A Section head, Shariah Review and

Assurance, Group Shariah Business

Compliance

Malaysian

Bank B Manager , Shariah Supervisory Malaysian

Bank B Assistant Manager, Shariah

Supervisory

Malaysian

Bank C Shariah Risk Management Malaysian

Bank D Director, Islamic Banking

Compliance, Group Compliance

Malaysian

Bank D Assistant Manager, Group

Compliance

Malaysian

Bank E Head of Shariah Compliance

Review

Malaysian

Bank E Shariah Advisory Malaysian

Bank E Shariah Advisory Malaysian

Bank E Shariah Review Malaysian

Bank E Shariah Risk Management Malaysian

All the respondents have the experience of

working in the Islamic banking industry ranging from

2 years to 10+ years. The respondents are willing to

participate in the interview and give an accurate and

relevant data to contribute to the topic of this study

via their hands-on knowledge and vast experience in

the industry to support the findings.

Challenges Faced by Malaysian Islamic Banks in Treating Shariah Non-compliance Events

259

3 RESULT AND ANALYSIS

Each of the Islamic banks has developed its own

internal Shariah governance framework to ensure the

effectiveness of management within the bank and stay

in line with BNM and IFSA requirement. There are

no standardization on who should be appointed as

Qualified Shariah Officer (QSO) by each Islamic

bank. Each bank appoints different Qualified Shariah

Officer (QSO) that holds the responsibility to confirm

any Shariah issue detected. QSO appointed by Bank

A is the Head of Group Shariah Business Company.

For Bank B, the QSO is the Head of Shariah and

Shariah Review function. The QSO of Bank C is the

Chief Shariah Officer (CSO). Meanwhile, Bank D

and Bank E both have Shariah review function as

their QSO.

Furthermore, they also have different internal

timeline for QSO to give the confirmation on

Potential SNC. BNM only provides the reporting

timeline after the QSO confirmation until the

rectification plan. It has been revealed by the

respondents that the internal timeline for Bank A is

10 working days. Meanwhile, Bank B and E are 14

working days, Bank C is 2 working days and Bank D

is 7 working days (minimum internal timeline). The

Potential SNC event that has been confirmed by QSO

of the respective bank will be tabled to Shariah

Committee meeting within 14 working days after the

date of confirmation. If there is no pre scheduled

meeting that is held within the 14 days period, Islamic

banks are required to conduct an ad-hoc meeting to

discuss specifically on the Potential SNC matter. The

ad-hoc meeting may consist of a minimum required

quorum. Shariah Committee will then decide if the

event is SNC or non-SNC.

In the event when Shariah Committee confirmed

it as SNC, the actions must be stopped immediately

and cease from carrying on or taking on any other

similar business, affair or activity. The respective

business unit or the business owner shall immediately

come up with the rectification plan within 30 days.

The plan must be approved by Shariah Committee

and Board of Directors before being submitted in

ORION system. In the revised ORION policy

document, the circular resolution is no longer

allowed. All the Shariah Committee meeting and

board meeting must be a physical meeting.

Hence, some respondents said they will try to ask

for QSO confirmation for the SNC event before being

tabled to Shariah Committee and get the approval for

the rectification plan from Board of Directors, as

close as possible to the pre scheduled meetings. This

is one of the strategies to avoid calling the Shariah

Committee and Board of Directors for an inevitable

ad-hoc meeting to get their approval for the

rectification plan. This way, they may reduce the time

gap and immediately do the rectification processes

instead of stopping the whole activity after the

declaration of Actual SNC.

All the respondents said the business unit or, the

respective process owner will be responsible to

prepare the rectification plan. It will be presented

along with the evidence and documents related to

justify the event in the SC meeting. However, the plan

will be reviewed by Shariah Review to make sure it

tackles the root cause before being tabled in the

meeting. The SC and Board of Directors have to

approve the rectification plan before being submitted

to ORION within 30 calendar days after the reporting

date of Actual SNC. If, there is no pre scheduled

board meeting held within the 30 days’ period,

Islamic banks are required to conduct an ad-hoc

meeting to get the approval on the rectification plan.

The ad-hoc meeting may also consist of the minimum

required quorum.

Any income derived from the activity that is

declared as Actual SNC will be channelled to charity

or any other means as prescribed by Shariah

Committee for purification purposes.

3.1 Challenges Faced by Islamic Banks

Through the interviews, the researcher concluded that

there are no major challenges in managing the SNC

event in a full-fledged Islamic Bank. All new

financial products and services will be reviewed and

approved by Shariah Division of the bank and Shariah

Committee respectively. Subsequently, the policy,

documents, terms and conditions, agreements, and

contracts with the respective products, services and

processes must be reviewed. As such, they are able to

manage the SNC from the beginning. In addition,

periodic review is done by Shariah Review and

Shariah Audit team to detect any SNC risk.

Unfortunately, there are many minor concerns and

challenges faced in managing SNC events in the

industry. Some banks gave the same concerns with

the other. Therefore, the researcher compiled all the

challenges as follows:

1. The Business Unit or, the 1

st

line of defence

(management or internal control measures), did

not admit any SNC risks detected, and only

reported the detection as an operational risk event.

2. Lack of knowledge and skills

a. Working level: Lack of knowledge and

competency to detect SNC, analysing and

articulate the issues. The working level should

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

260

have the knowledge and understanding in the

Shariah matters. Not only the knowledge on

BNM guidelines and standards.

b. Shariah Committee: Full understanding in the

technicality of the project and transaction

before they come up with a decision.

3. Lack of independency on the working level and

Shariah Committee.

a. Working level: Working level such as Shariah

functions must be seen as independent as

possible, not wavered and being influenced in

their engagement and review. That way, the

Shariah functions of IFIs may function at the

maximum capacity.

b. Shariah Committee: Shariah Committee

member is being appointed based on their

qualification whereby the remuneration is paid

by the bank management. They should not be

influenced being in favour of the bank

management or to secure the contract. They

should have been clearer and firm in decision

making whether to agree or disagree.

4. ‘Uruf Tijari or more known as common industry

practice is a practice which is accepted by the

community and does not contradict with Shariah.

An example is the credit card. Shariah

Committees of Bank A already decided that credit

card is not allowed due to leading a non-shariah

transaction and purchases of non halal items, such

as liquor and entertainment. But, the SC decision

has been revised and credit card is allowed

because of ‘Uruf Tijari. The concern here is how

the common industry practices became the dalil

of a certain decision instead of dalil from quran

and sunnah. The Shariah Committee and Islamic

banks have the power to control the customer

from doing such transactions. They should be

firmer in giving decision on a strong reason and

hujjah. It is due to their decisions that will play a

big role in ensuring the activities of Islamic banks

in line with the Shariah principles.

5. The business owner must fully understand the

product and compliance culture to follow the

Shariah rules. For example, disbursement of

tawarruq facility. To avoid any mistakes that lead

to SNC event, the process owner must understand

that tawarruq transaction must require an aqad

and additional terms and conditions compared to

conventional disbursement facility.

6. BNM did not provide a clear definition of SNC.

Therefore, the Shariah Committee can be too rigid

or too lenient with decision-making. For example,

the customer has forgotten to complete a form in

one of Islamic transaction. By the conduct, the

contract is not void, it does not affect the

transaction but it does not follow the requirement

and procedure. With the consideration of the

Shariah Committee, it can be decided as SNC or

just an operational risk event. If the same issues

raise again in the future, the Shariah Committee

may decide it as SNC. This may lead to an

inconsistency in the decision.

7. System constraint is another issue that could

compromise SNC management. Business unit is

responsible and will have to take action on the

rectification plan of the SNC, but in the case when

the SNC arises because of the system error, the

rectification plan will be delayed until it is fixed.

8. Circular resolutions, or passing resolutions

without meetings is no longer allowed in the new

revised ORION policy document published in

2018. Bank C revealed they did not agree with the

new requirement to have physical meetings for

Shariah Committee and Board of Directors. This

is a concern to them because it is not easy to

schedule an ad-hoc physical meetings especially

the meeting to get the approval for the

rectification plan from the Board of Directors.

9. Challenge faced by the banks to retain the right

talent such as a Shariah professional that

understand and embrace the full concept of

Shariah in Islamic banking. For example, Bank D

failed to retain a talent, who is a Shariah

professional and a branch manager. He is trusted

to handle the Shariah matters but unfortunately, he

transferred to another bank after getting the job

offer.

10. The bank has to keep up with BNM new issuance

of policy requirements, SAC new requirement

process and the additional requirements. They

have to manage in understanding those

requirements as it can impact the product,

documentation, and the system that may lead to

SNC.

3.2 Recommendations to Enhance the

Existing Policy and Regulations

All respondents from the five (5) Islamic banks

agreed that the existing regulations and guidelines are

very comprehensive and the best but the problems are

in the implementation process. IFIs have the liberty to

decide the level of adherence whether to be stringent

or less. The Islamic banks can be more stringent than

BNM but should not be less than that of BNM.

Therefore, the respondents come up with the

recommendations based on standardization to better

improve the current policy. The Islamic banks will

Challenges Faced by Malaysian Islamic Banks in Treating Shariah Non-compliance Events

261

have a clearer guide to decide on the status of SNC.

The recommendations will be listed as follows:

1. BNM shall come up with the Shariah non-

compliance (SNC) definition.

2. BNM shall come up with clear criteria of SNC.

The Shariah Committee and QSO will consider

the criteria in making a decision.

3. BNM to come up with the parameters to resolve

the Shariah issues.

4. Some Shariah Committee being too lenient or too

stringent with deciding process, as there are a lot

of khilaf in fiqh muamalat. SAC of BNM should

decide and publish which opinion should be

followed by all Islamic banks for the purpose of

standardization.

5. The SNC events reported by Islamic banks should

be discussed in the meeting of Shariah Advisory

Council (SAC) of BNM and the decision shall be

published. As the ruling and decision of SAC is

binding to all IFIs Shariah Committee, including

the court and arbitrator. This will give a clear

reference for Shariah Committee to give a

decision on SNC event.

6. The respondents from Bank C and E agreed that

BNM shall provide a clear timeline during event

investigation and the process of being confirmed

by the QSO to decide whether it is a Potential

SNC or not. Each bank has their own internal

timeline, ranging from 2 working days to 1 year

or limitless (based on the complexity of the issue)

but BNM should impose a clear maximum

timeline for the QSO to come up with a decision

before reporting in ORION system.

7. Respondent from Bank C recommends the BNM

to re-allow circular resolution to get Shariah

Committee decision on SNC event and the

approval by Board of Directors on rectification

plan.

4 CONCLUSIONS

As Malaysia adopts a dual banking system, Islamic

banking industry continuously grows and pushes for

new innovation for commercial satisfaction to attract

interest of Muslim customers. This may lead many

IFIs to develop the products and services adopted

from conventional counterparts that can result in a

greater exposure towards SNC risk, as the products,

financial transaction, and overall activities of IFIs

must comply with Shariah principles.

SNC event is usually a case-to-case basis and it

does not focusing on the financial transaction only, it

goes beyond documentation, terminology and

transaction. It may also arise because of the related

governance and process. For instance, failure to

uphold Shariah governance and fail to get the

agreement of Shariah Committee on a certain deal

may also lead to SNC. The Islamic banks must

manage SNC risk as a pre-event control measure.

They must ensure all the arrangement, terms and

condition do not contradict with Shariah before the

execution with continuous review done for measuring

purpose

The legal regulations and framework is one of the

biggest factors to the robust growth of the Islamic

finance in Malaysia. The existing policy and

requirements by BNM are the most comprehensive

and effective in the global Islamic financial industry.

However, it still needs be improved especially the

SNC event aspects. Both the policy makers and

Islamic banks hold the important role in enhancing

the SNC treatment of Malaysia.

Conclusion that can be drawn from the five (5)

Islamic banks interviewed to represents all sixteen

(16) Islamic banks of Malaysia is that they faced

some minor challenges in the treatment of SNC. Each

bank treats SNC differently based on different

factors. For instance, some banks will decide certain

events as SNC but, the other bank may consider the

same event as operational risks, which are the non-

SNC events. It may lead to inconsistency in the SNC

decision on Islamic financial industry. Therefore, the

banks shall comprehend the difference between

operational risk event and SNC event. The researcher

supports the recommendation that has been put

forward by the respondents. Firstly, the regulators

shall provide a clear definition of SNC and the

parameters to resolve the SNC issues. This is

important to enhance the SNC treatment as the

regulators or the policy makers are the only with the

ability to either amend or add new guidelines and

requirements for the aspects.

Secondly, the policy makers shall provide a

maximum internal timeline to get the QSO

confirmation on the Potential SNC after the issue

detection. This is to give a clear guide for IFIs that

none of them should take advantage and turn a blind

eye on the issue for a while. Without the maximum

internal timeline, they will procrastinate in giving a

confirmation after the issue detection to have enough

time to report in ORION system and completing the

next requirement within the timeline. They will

simultaneously hold pre-scheduled SC and Board of

Directors physical meeting to get the decision and

approval of the rectification plan without the need to

arrange an ad-hoc meeting. From the Shariah

perspective, this is definitely not allowed, as the

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

262

essential foundation of Islamic finance is the Shariah

compliance with overall operations and activities. If

any possible of non-compliance is detected, they

should resolve it as quickly as possible to avoid

disobedience of Allah’s commands.

For Islamic banks, they must strengthen the

competency and independency of employees in order

to increase professionalism in managing the business

conduct and activities. This is essential since these

employees are the one who are responsible to manage

the operations of IFIs and any possible SNC events.

The Shariah Committee members also must be

genuine based on the qualification requirement

provided by BNM before a person is appointed as a

member of Shariah Committee for a certain IFIs.

They must be dependable, consistent and firm on their

decision.

Next, the Islamic banks should increase the level

of awareness on SNC risks among the business unit

and employees of the banks. This enables

identification of any SNC risk, monitoring and

systematically controlling their respective area, and

may decrease the risk of SNC. The bank must also

ensure the working level is educated on the reporting

requirement of SNC event and stay alert to new

guidelines and requirements published by BNM as it

can affect the existing documentation or system on

certain products.

In addition, it is recommended to include all BNM

guidelines, the reporting process and the actual SNC

events in the syllabus of Islamic banking lesson for

students. This is to increase the level of awareness for

students on the actual practice in the industry.

REFERENCES

Ahmed Salman, S. (2018). Shari’ah Non-Compliance Risk

Management In Takaful Industry. International

Journal on Recent Trends in Business and Tourism.

Vol. 2. Retrieved from:

http://apps.ijrtbt.org/uploadedfiles/article_pdfs/e7cf1a

9e-54d6-4e32-884a-3616d56773e1.pdf

Azeez Bello, A., & GaniyiAbdur Raheem Zubaedy, A.

(2015). Sharīʿah Governance Framework Model for

Malaysian Islamic Banking and Finance: A Critical

Analysis, 17, 9–19. https://doi.org/10.9790/487X-

171010919

Bahari, N. F., & Akhtar Baharudin, N. (n.d.). Shariah

Governance Framework: The Roles Of Shariah Review

And Shariah Auditing. Retrieved from

http://conference.kuis.edu.my/icomm/3rd/eproceeding

s/IC-037.pdf

Bank Islam Malaysia Berhad (BIMB). (2017). Bank Islam

Malaysia Berhad Annual Report 2017, 147. Retrieved

from http://www.tigerbrands-online.co.za/reports/ir-

2017/pdf/full-integrated.pdf

Binti, F., & Rahaman, A. (n.d.). SHARIAH GOVERNANCE

DISCLOSURE BY ISLAMIC BANKS IN MALAYSIA In

Partial Fulfillment of the Requirement for the Master in

Islamic Finance and Banking. Retrieved from

http://etd.uum.edu.my/4958/2/s816752_abstract.pdf

Bank Negara Malaysia (BNM). (n.d.-b). full-text.

Compliance Requirement BNM.

Bank Negara Malaysia (BNM). (n.d.-c). Shariah

Governance Framework.

Bank Negara Malaysia (BNM). (n.d.-d). Financial

Reporting for Islamic Banking Institutions. (2018).

Retrieved from

http://www.bnm.gov.my/index.php?ch=57&pg=137&

ac=28&bb=file

Bank Negara Malaysia (BNM). (2013). Islamic Financial

Services Act 2013. Retrieved October 2, 2018, from

http://www.bnm.gov.my/index.php?ch=en_legislation

&pg=en_legislation_act&ac=222&full=1&lang=en

CIMB. (n.d.). annual reports. Retrieved from

www.cimb.com

CIMB. (n.d.-b). annual report financial book. (n.d.).

Retrieved from www.cimb.com

Franzoni, S., & Allali, A. A. (2018). Principles of Islamic

Finance and Principles of Corporate Social

Responsibility: What Convergence? Sustainability,

10(3), 637. https://doi.org/10.3390/su10030637

Gait, A. H., & Worthington, A. (2009). A Primer on Islamic

Finance: Definitions, Sources, Principles and Methods.

Retrieved from

https://www120.secure.griffith.edu.au/research/file/ca

8ab8d0-e5b2-49dc-f172-e597f171688c/1/2009-09-a-

primer-on-islamic-finance-definitions-sources-

principles-and-methods.pdf

Hasan, Z. (2010). Regulatory Framework of Shari’ah

Governance System in Malaysia, GCC Countries and

the UK. Kyoto Bulletin of Islamic Area Studies (Vol.

3). Retrieved from http://www.asafas.kyoto-

u.ac.jp/kias/1st_period/contents/pdf/kb3_2/07zulkifli.p

df

Hassan, R. (2015). Shari ’ ah risk management framework

for Islamic financial institutions. Al-Shajarah: Journal

of the International Institute of Islamic Thought and

Civilization (ISTAC), (Special Issue), 67–86.

Hassan, R (2016). Shariah non-compliance Risk and Its

Effects on Islamic Financial

Institution, Al-Shajarah, Kuala Lumpur

Hazizi & Kassim, S (2016). Corporate Governance and

Financial Performance: Empirical Evidence from

Public Listed Constructive Companies in Malaysia

Hong Leong Bank Berhad (n.d.). Annual Report Hong

Leong Bank Berhad.

Islamic Financial Services Act (IFSA) 2013, 2013

IFSB 2018. (n.d.). full-text.

IFSB (2017). Islamic Financial Services Industry.

Retrieved from http://www.ifsb.org

Juventus FC. (2008). Reports and Financial Statements 30

June, (98127). Retrieved from:

http://www.juventus.com/media/native/investor-

Challenges Faced by Malaysian Islamic Banks in Treating Shariah Non-compliance Events

263

relations-docs/english/financial-statemet-and-reports/

2007-2008/Bilancio_al_30_giugno_2008_inglese.pdf

Kumar, & Ranjit. (n.d.). Research Methodology A Step-By-

Step Guide For Beginners. Retrieved from

www.sagepublications.com

Kunhibava, S. (2015). Ensuring Shariah Compliance At the

Courts and the Role of the Shariah Advisory Council in

Malaysia*. Malayan Law Journal, 3(1), 1–40.

Lee, J (2017). Islamic Banking in Malaysia: Shariah

Theories, the Laws, Current

Structures and Practices and Legal Documentation, Kuala

Lumpur

Marimuthu, M., Jing, C. W., Gie, L. P., Mun, L. P., & Ping,

T. Y. (2010). Islamic Banking : Selection Criteria and

Implications. Global Journal of Human Social Science,

10(4), 52–62.

Operational Risk Integrated Online Network (ORION).

(2018). Policy Document. Retrieved from

http://www.bnm.gov.my/index.php?ch=57&pg=543&

ac=740&bb=file

RHB. (n.d). Our Way Forward Rhb Islamic Bank Berhad.

Retrieved from https://www.rhbgroup.com/~/media/

files/malaysia/investor-relations/annual-reports/rhb-

islamic-bank-2017.ashx

Oz, E., Ali, M. M., Zahid, I., Khokher, R., & Rosman, R.

(2016). SharīʻAh Non-Compliance Risk In The

Banking Sector: Impact On Capital Adequacy

Framework Of Islamic Banks. Retrieved from

https://www.ifsb.org/docs/2016-03-30 SNCR Paper

(WP-05) (Final).pdf

Protek Group. (2018). Annual report 2017.

Report, A. (2017). Hong Leong Bank Berhad Annual

report.

https://doi.org/10.1017/CBO9781107415324.004

Rivai, V., & Arifin, A. (2010). Islamic Bank, 1082.

Shariah Governance-Exposure Draft. (n.d.). Retrieved from

http://www.bnm.gov.my/index.php?ch=57&pg=144&

ac=648&bb=file

Umar, A., Ahmad, F., & Hassan, M. K. (2014). Riba and

Islamic Banking Abu Umar Faruq Ahmad , University

of Western Sydney, (March).

Walliman, N. (2014). Research Methods: The Basics.

Research Methods: The Basics.

https://doi.org/10.4324/9780203836071

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

264