Sukuk Financing: A Viable Strategy to Finance the Recovery and

Rebuilding of Marawi after the Siege

Abdulcader M. Ayo, Atty. Saaduddin M. Alauya Jr. and Minombao Ramos-Mayo

Mindanao State University, Marawi City, Indonesia

www.msumain.edu.ph

Keywords: Sukuk Financing, Viability, Strategy, Recovery, Rebuilding.

Abstract: This study aimed to determine the perception of Internally Displaced Persons (IDP’s) who are professionals

and Ulama in Marawi City with regards to Sukuk Financing, a viable strategy to finance the recovery and

rebuilding of Marawi City after the Siege. The study made used of Cross-Sectional survey research design

and utilized qualitative descriptive Approach in the interpretation of data gathered. Purposive sampling was

used in selecting and limiting respondents to 400 who were provided answer to the survey questionnaire.

Based on the gathered data of this study, the researchers arrived at the following findings: (1) The

respondents of the study acknowledged positively that Sukuk Financing is more accommodating to them as

compared to conventional bond. This is so because respondents believed that Sukuk is a Sharia-Compliant

transaction. Likewise, respondents were convinced that Sukuk provides liquidity to the investors, rating

agencies, lead arrangers, or financial market as well as it allows corporations to have direct access to funds.

Thus, the study results led the IDP’s to believe that Sukuk can be a viable strategy for the fast recovery of

the people of Marawi City. These people can acquire certificates which reflect participation rights in an

underlying asset which they will involve themselves. (2) Moreover, the respondents also have positive

responses on the underlying concepts on key practice developments associated with Sukuk Financing

towards building an efficient corporate Sukuk Market, in driving growth and helping finance infrastructures

in several market in the world particularly the Philippines that can be adopted for the recovery and

rebuilding of Marawi after the Siege. (3) Lastly, the respondents strongly agreed on the challenges and

problems that may be encountered on establishing a Sukuk Mechanisms in terms of Muslim Cultural

Heritage, Sharia Compliant and Sourcing of Monetary Support. Thus, from the findings of this study, the

following recommendations provide direction for reform in response to the problems: (1) With the positive

responses of the respondents, it is recommended to have the Sukuk Financing in the Philippines, and/or

from Sukuk Financing institutions in abroad through BARMM initiative as a viable strategy to finance the

recovery and rebuilding of Marawi City and for sustainable growth after the Siege. (2) Also, it is

recommended to make use of the key practice development concepts in building an efficient corporate

Sukuk Market which can be adopted for the recovery of Marawi (3) Lastly, it is recommended for all

Muslims in the Philippines to support the implementation of Islamic Finance. This will surely help the

country in solving problems associated with global industry, halal marketing and Islamic financing.

1 INTRODUCTION

Many educators and scholars at present unanimously

believe that the structure of Sukuk is a viable

strategy to finance sustainable development. It is

always posited that the utility of the Structure of

Sukuk is beneficial to the economy as a source of

funds from new diverse investor base in financing

development especially for third world developing

countries like the Philippines. In addition, industry

leaders and professionals had a high expectation

onstructuring and marketing corporate Sukuk as an

alternative project financing tool for infrastructure

project.

On the basis of that premise, the Philippine

government should consider theuse of Islamic

finance-backed scheme to raise funds for the fast

recovery and in rebuilding Marawi City which has

beenseverely damaged in the five months’violent

clashes between the Philippine Army and Islamic

State (IS)-linked terrorist groups. Such a scheme

should allow reconstruction efforts mindful of the

Muslim culture and Heritage of the City, and would

240

Ayo, A., Alauya Jr., A. and Ramos-Mayo, M.

Sukuk Financing: A Viable Strategy to Finance the Recovery and Rebuilding of Marawi after the Siege.

DOI: 10.5220/0010121000002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 240-244

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

also open channels for monetary support and

participation from Muslim countries like the Middle

East and Malaysia. Destruction in Marawi City is

now substantial as lot of buildings and largeparts of

the infrastructure lie ruined until now after two

years. Around 400,000. Civilians are believed to

have been displaced until at present.

Sukuk structuring where the legal right is

conferred on the trustee and the beneficial right is

given to the Sukuk holders on a basis of trust. There

are types of Sukuk structures such as: asset-based

sukuk structure, asset-backed, and a “ passthrough”

asset-based Structure.

2 REVIEW OF LITERATURE

Graduation Model. According to this model, in the

fight against poverty, graduation models are

gradually taking stage. These models involve a

series of interventions that, when provided

successively, are expected to reduce poverty.

One complex graduation model is the

Challenging the Frontiers of Poverty Reduction:

Targeting Ultra-Poor (TUP) model of BRAC, which

utilizes a ladderized design (asset transfers, stipend,

training, healthcare, and community mobilization)

for the graduation of ultra-poor beneficiaries in a

span of two years. 8 BRAC’s activities prior to the

creation of the TUP have only benefitted the

“middle” poor and not those who need the assistance

the most (BRAC, 2013). The TUP model was then

created in 2002 out of the initiative to help the

ultrapoor in Bangladesh to graduate into a more

stable economic and social situation; the ultra-poor

are defined as households (1) with less than ten

decimals of land; (2) which get their income from

being beggars and day laborers, and/or from

domestic aid; (3) with no productive assets; (4)

whose school-aged children take up paid work; and

(5) without an active male adult household member

(Yasmin, n.d.). 9 BRAC targets these individuals

through: (1) geographical area selection and (2)

household selection. The geographical area selection

involves identifying areas and specific villages with

high ultra-poverty incidents, and conducting a

survey. Meanwhile, the household selection involves

a participatory rural appraisal (PRA) where the

communities identify its poorest members, which is

validated through the conduct of a door-to-door mini

survey. Selected households are provided with

weekly income stipend, asset transfers (e.g. cow,

goat, etc.), training to capacitate them in increasing

the asset’s value, healthcare, and community

mobilization.10

The households are also coached weekly by

BRAC program organizers in health and financial

aspects. The final months of the program are allotted

to confidence-building. In 2015, a total of 1.6

million households in Bangladesh have been reached

through the TUP program (Balboni et al., 2013).

Overall, the initial outputs and outcomes of the TUP

Program based on impact assessment are positive.

Rabbani et al. (2006) have found that compared to

nonparticipant ultra-poor households, the selected

TUP households are: (1) more likely to have more

assets regardless of those provided by BRAC, (2)

more likely to have taken a loan, (3) more likely to

be correctly informed about laws compared with

nonparticipant households, (4) with larger incomes,

(5) with fewer food shortages, and (6) almost

certainly with savings. Likewise, Balboni et al.

(2013) have found that there is an increase in

earnings by 37% and an improvement in the

consumption, savings, and asset accumulation of the

targeted households.

2.1 Labor Market Programs and Social

Safety Net Programs Aside from the already

mentioned graduation policies programs, there are

those which integrate labor market policies (LMPs)

with social safety net programs (SSNPs) ideally to

reduce poverty. The combined effects of the SSNPs

and LMPs to poverty in the long run are yet to be

seen. Nevertheless, it can be said that the added

value of LMPs to SSNPs could bring them even

closer to reaching the poverty threshold. Getting

employed would provide additional income to the

beneficiaries on top of the incentives provided to

them by the social safety net policies (e.g. cash

grants). Additionally, the LMPs could lessen the risk

of beneficiaries being too dependent on the

incentives provided by the SSNPs. The key,

therefore, is to find effective labor market policies

which would result in an increase in employment

among SSNP beneficiaries.

2.2 SLP Results Chain

The rationale for the SLP is taken from both the

graduation model and labor market programs with

social safety net. This can be presented in a results

chain showing the inputs, activities, outputs and

outcomes of the program and how these components

are linked together. The results chain as provided in

DSWD form was revised to reflect more accurately

Sukuk Financing: A Viable Strategy to Finance the Recovery and Rebuilding of Marawi after the Siege

241

the relationship of inputs, activities and outcomes

based on program concept and field observation on

program implementation. Funds are utilized for

training and other employment support to the target

participants. The personnel, meanwhile, are major

players in guiding the projects towards the

achievement of targeted outcomes.

Results chain of the Sustainable Livelihood

Program particularly indicates that among the main

activities are developing protocols for partnerships,

project review, and project approval. Additionally,

the activities to be conducted include developing

targeting and partnership mechanisms. The outputs

produced by these activities include the protocols,

and the offer of partnerships and services. When

clients and stakeholders respond to offers, the

immediate outcomes would then include (1)

partnerships formed with the other stakeholders

coming from both the public and the private sector;

(2) submitted, reviewed, and approved projects

primarily for the MD track; (3) accessing of assets

by the SLP participants; and (4) utilization of

services by the participants. The immediate

outcomes would lead to the intermediate outcome of

SLP participants engaging in livelihood and/or jobs

in the short-run. Ideally in the long run, the

participants would already be engaging in

sustainable livelihood and/or gainful jobs which

would contribute to an improvement in the economic

sufficiency of poor families.

2.3 Equity Financing and Debt

Financing in Islam

Razi Pahlavi (2018) in his lectures to MSU officials

crash program on Islamic Finance short course, he

had explained that there are two Financial Financing

(Equity Financing and Debt Financing in Islam) that

can be utilized in on financial activities. He further

explained the component of Islamic Financial

System in which one of it is Capital Markets that

involved Sukuk and equity.

2.4 Methodology

This study aimed to determine the perception of

Internally Displaced Persons (IDP’s) who are

professionals and Ulama in Marawi City with

regards to Sukuk Financing, a viable strategy to

finance the recovery and rebuilding of Marawi City

after the Siege. The study made use of Cross-

Sectional survey research design and utilized

qualitative descriptive Approach in the interpretation

of data gathered.

The Purposive sampling and stratified random

sampling were utilized in the study to get the

respondents of the study. It is purposive because the

respondents were selected professionals and Ulamah

from the 39 municipality and one city of Lanao Del

Sur as well as the Provincial Development Council.

The study result was also validated by select

members of the Provincial Development council of

Lanao del sur. Ethics consideration was also done by

asking respondents who willingly participate in the

study to fill up an informed consent form.

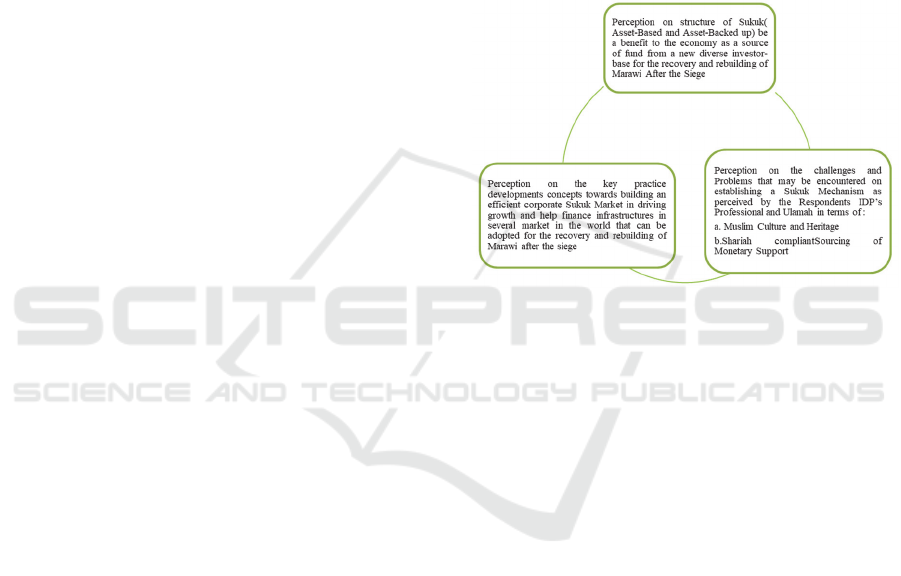

The Schema for the low of the conceptual

framework is shown below (Figure1).

Figure 1: Schema for the low of the conceptual

framework.

3 RESULTS AND DISCUSSIONS

The results show that more than a majority (70%) of

the respondents select Ulamah and professional in

Lanao del Sur have a strong conviction that the

recovery and rebuilding of Marawi City after the

siege can greatly benefit to the economy if the

structure of Sukuk particularly asset based and

Asset-backed sukuk structure can be utilized as a

source of fund from a new diverse investor –base.

This was supported by Osman Sacarcelik in his

article entitled, “ Overcoming the Divergence Gap

Between Applicable State Law and Shariah

Principles: Enhnacing Clarity, predictability an

Enforceability in Islamic Finance Transaction

Within Secular Jurisdiction as cited Umar A. Oseni

(2015) when he stated that, “ Asset-based Sukuk is a

viable financing solution for corporations and Banks

who are unwilling to dispose of their Physical assets

by way of true sale to an SPV, inter alia due to risk

management considerations. From an investor’s

perspective, asset- based Sukuk is a Shariah

compliant alternative bond. The Sukuk holder

generally has no asset risk but credit risk”.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

242

Another important finding is that a vast majority

(87%) of the respondents select Ulamah and

professional in Lanao del Sur also opine that the

practice of Malaysia towards building and Efficient

Sukuk Market in driving the growth and help

finance infrastructure is worth emulating and highly

recommended to be adopted for the recovery and

rebuilding of Marawi after the siege. Further,

Marawi City Local Government Unit may want to

bench markon some best practices of Islamic

Countries in the world on Sukuk Structures Scheme

to be adopted in the recovery and rebuilding of

Marawi City. Again Umar A. Oseni (2015) article

emphasized on AAOIFI standard gives preferences

for equity-based Sukuk structures as the best for

investors because it is Shariah compliant transaction.

Likewise, also a very critical finding arrived that

more than a majority (88%) of the respondents select

Ulamah and professional in Lanao del Sur forwarded

that there is really challenges and problems

encountered in adopting Islamic Debt Sale –Based

Financing and the rebuilding of Marawi City after

the siege. It is because of the low level of Islamic

Legal documents knowledge and understanding

among the people of the area coupled with the

absence of Islamic Finance legal Framework in the

place.

4 CONCLUSIONS

Based on the gathered data of this study, the

researchers arrived at the following findings: (1) The

respondents of the study acknowledged positively

that Sukuk Financing is more accommodating to

them as compared to conventional bond. This is so

because respondents believed that Sukuk is a Sharia-

Compliant transaction. Likewise, respondents were

convinced that Sukuk provides liquidity to the

investors, rating agencies, lead arrangers, or

financial market as well as it allows corporations to

have direct access to funds. Thus, the study results

led the IDP’s to believe that Sukuk can be a viable

strategy for the fast recovery of the people of

Marawi City. These people can acquire certificates

which reflect participation rights in an underlying

asset which they will involve themselves. (2)

Moreover, the respondents also have positive

responses on the underlying concepts on key

practice developments associated with Sukuk

Financing towards building an efficient corporate

Sukuk Market, in driving growth and helping

finance infrastructures in several market in the world

particularly the Philippines that can be adopted for

the recovery and rebuilding of Marawi after the

Siege. (3) Lastly, the respondents strongly agreed on

the challenges and problems that may be

encountered on establishing a Sukuk Mechanisms in

terms of Muslim Cultural Heritage, Sharia

Compliant and Sourcing of Monetary Support. Thus,

from the findings of this study, the following

recommendations provide direction for reform in

response to the problems: (1) With the positive

responses of the respondents, it is recommended to

have the Sukuk Financing in the Philippines, and/or

from Sukuk Financing institutions in abroad through

BARMM initiative as a viable strategy to finance the

recovery and rebuilding of Marawi City and for

sustainable growth after the Siege. (2) Also, it is

recommended to make use of the key practice

development concepts in building an efficient

corporate Sukuk Market which can be adopted for

the recovery of Marawi. (3) Lastly, it is

recommended for all Muslims in the Philippines to

support the implementation of Islamic Finance. This

will surely help the country in solving problems

associated with global industry, halal marketing and

Islamic financing.

ACKNOWLEDGMENTS

The researchers were very appreciative and

recognized the contributions of several individuals

and institutions who were involved in the study

especially President Habib W. Macaayong, DPA and

the entire officialdom of MSU Marawi for his

encouragement in supporting this endeavor. Thank

you all very much.

REFERENCES

Alhabshi, S. (2018). Accounting for Islamic Financial

Services. Al-shajarah Journal. 2015

BaBankoff, G. (2007). Dangers to Going It Alone: Social

Capital And The Origins Of Community Resilience In

The Philippines. Continuity and Change, 22(02),

pp.327-355.

Bakar, M. D. (2016). Shariah Minds in Islamic Finance.

Balboni, M. J., Sullivan, A., Amobi, A., Phelps, A. C.,

Gorman, D. P., Zollfrank, A., et al. (2013). Why

isspiritual care infrequent at the end of life? Spiritual

care perceptions among patients, nurses,

andphysicians and the role of training. Journal of

Clinical Oncology, 31(4), 461–467.

doi:10.1200/JCO.2012.44.6443

Barton, Allen H. (1969). Communities in Disaster: A

Sociological Analysis of Collective Stress Situations.

Sukuk Financing: A Viable Strategy to Finance the Recovery and Rebuilding of Marawi after the Siege

243

Garden City, New York: Doubleday and Company,

Inc.

Baum, J. A. C., T. J. Rowley, A. Shipilov, H. Rao and H.

R. Greve (2003), “Competing in groups,’Managerial

and Decision Economic. “

BRAC (2013), Annual Report 2013. Bangladesh: BRAC

Centre

El-Asher, A. and Wilson R. (2006). Islamic Economics A

Short History. Clearance Center, 222 Rosewood

Drive, Suite 911, Danvers MA 01923, USA: Hotei

Publishing, IDC Publishers, Martinus Nijhoff

Publishers and VSP.

Gineva, K. and Hamid A. (2015). Property Finance An

International Approach. United Kingdom: John Willey

and Sons Ltd, The Atrium, Southern Gate, Chichester,

West Sussex, P0198SQ.

Ketell, B.. (2011). The Islamic Banking and Finance

Workbook. United Kingdom: John Willey and Sons

Ltd, The Atrium, Southern Gate, Chichester, West

Sussex, P0198SQ.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

244