Zakah Execution and Its Influence on the Recipients as Perceived by

the Fire Personnel of Lanao del Sur

Naim S. Noor and Monara M. Maruhom

Mindanao State University, Marawi City, Philippines

www.msumain.edu.ph

Keywords: Zakah, Execution, Fire Personnel.

Abstract: This study investigated the extent of execution of Zakah and its contribution onits recipients. (1) The

respondents of this study were the 100 Fire Personnel including the 12 Fire Marshals under the Bureau of Fire

Protection of Lanao del Sur composed of 15municipalities that have fire departments. Cross-sectional survey

design was utilized and qualitative descriptive approach has been used in the interpretation of data. (2)

Specifically, the study answered the following questions: 1. what is the profile of the respondents in terms of

their personal data, 2. what are their practices in the execution of Zakah as perceived by the respondents in

the aspects of its legal rulings, its purpose and recipients? And 3. what are the contributions of Zakah on its

recipients as perceived by the respondents in the aspect of improving the life of the recipients and in alleviating

poverty? (3) from the data gathered, a typical fire officer in Lanao del Sur belonged to the age range of 29-35

years old, male, married, bachelors’ degree holder, ibtidai graduate, served for less than five years, with FO1

position, and a monthly net income of P29,668.00. It is concluded that the respondents agreed on all the

indicators given in the purpose of Zakah, improving the life of the recipients and alleviating poverty. (4)

moreover, it was disclosed that respondents agreed that Zakah is compulsory to Muslims who are financially

capable. However, they were undecided whether Zakah to be paid after one year (Hawl) and reached (Nisab),

if items for personal use are exempted from Zakah payment; and if Zakah is applicable only on people of the

Islamic faith. As to the purpose of Zakah, the respondent agreed that giving Zakah is an act of worship, on

the recipients of Zakah, respondents that they give it to the recipients. (4) From the findings it is recommended

that massive information drives thru books, videos, lectures ad strengthening Arabic teaching must be

undertaken to name a few. Further studies on Zakah with broader scope must be conducted by future

researchers.

1 INTRODUCTION

The Philippine is a democratic country that is

composed of 108,000,000 and 11% of which are

Muslims who are greater in Bangsamoro

Autonomous Regions in Muslim Mindanao and

scattered across the regions of the country. Being a

democratic country and Christian dominated country,

Zakah is not institutionalized being a religious

commitment by able Muslims. There are religious

organizations in the country who established

Baytuzzakah but few Muslims are supporting them

because it is most enforce by the Philippine Law.

It is a practice of the Muslims in the Philippines

to pay their Zakah according to their preference like

close relatives and friends. It is the battle cry of the

Muslim Relilgious Leaders (MRLs) to have it

institutionalized to distribute it to the right recipients

as clearly stated in the Holy Quran.

Now that the BangsamoroAutonomous Regiions

in Muslim Mindanao has replaced the former

Autonomous Regions in Muslim Mindanao

(ARMM), the Muslims are hoping that Zakah be

institutionalized so that its purpose in alleviating

poverty and improving the lives of the poor and needy

be achieved. Its possible implementation depends

much on the commitment of the present BARMM

leadership to eradicate poverty which is the major

cause of crimes in the Muslim communities.

Muslims must be fully aware that Zakah is

mandatory to be paid to the prescribed recipients

specified by Allah SWT. In other words its

importance is next to Salah (Regular 5x prayers

everyday). Its payment is rewarded by Allah SWT

and its omission by financially able Muslims is

punishable by Shariah.

212

Noor, N. and Maruhom, M.

Zakah Execution and Its Influence on the Recipients as Perceived by the Fire Personnel of Lanao del Sur.

DOI: 10.5220/0010120700002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 212-217

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

2 LITERATURE REVIEW

This study was based on the statement of Allah SWT:

“Take from their wealth a charity in order to

purify them and sanctify them with it, and invoke

(Allah’s Blessings) upon them. Verily your

invocations are a source of security for them, and

Allah is All-Hearer, All Knower.” (Holy Qur’an,

9:103)

Allah SWT further said:

“My mercy encompasses all things, but I will

specify ot for the righteous whogive Zakat.” (Holy

Qur’an, 7:156)

As to its recipients Allah SWT made it clear in His

statement:

“Zakah expeditures are only for the poor and for

the needy and for those employed to collect (Zakah)

and for bringing hearts together (for Islam) and

freeing captives (or slaves) and for those in debt and

for cause of Allah and for the (stranded) traveller -

an obligation imposed by Allah. And Allah is

Knowing and Wise.” (Holy qur’an, 9:60)

In the context of development, the main purpose

of Zakah is to eliminate poverty and to develop

mutual support between the poor and the rich. An

impoverished society is prone to all forms and kinds

of crimes like terrorism, robbery, corruption and etc.

Nowadays, terrorism is the number one enemy of the

world because children of poor families are usually

the victims of massive recruitment of terrorist groups.

In the Malaysian experience, poverty incidence is

almost zero because the institutionalization of Zakah

has been utilized in improving the lives of its people.

Micro financing is properly established and

thoroughly monitored by the government to ensure

that people who are operating businesses through it

shall be Zakah payer in the coming years. This

economic activity must be adopted by the BARMM

to minimize if not eradicate poverty.

2.1 Religio – Economics

Alvin and Heidi Toffler in their Revolutionary wealth

theories opined that while the rate of increase in

global population is slowing, the rates of growth

claimed for the world’s two biggest religions,

Christianity and Islam are escalating. Both will be

influenced by technology and the radical

redistribution of world wealth in the decades to come.

The connection between religion and money

currently receiving the most attention has had to do

with the costs of terrorism. The 9/11 attacks by

terrorists cost the United States economy more than

onetrillion dollars. Aftershocks were felt in foreign

equity markets in tourism and travel, in consumer

altitudes, and in temporary capital flights.

In the case of the BARMM, if terrorism shall

vanish, religion will have substantial impacts on the

global economy in decades to come. Like for example

the very beautiful lake of Lanao del Sur which is the

second largest lake in the Philippines, can be a tourist

haven for both national and international. Tourists

investors will be attracted on it and eventually

economic life of the people around the lake improves

gradually.

2.2 Islam and Development

Islam can accept change provided that it is oriented

towards the fulfillment of the Divine prescriptions,

thus enabling both individual and society to conform

with the Divine plan. All change and development

must be viewed within this system. Thus the values

regarding change and development cannot be viewed

along secular lines but must become meaningful

within a religious framework. By way of illustrations,

Muslims must consider it a religious or moral duty to

develop their intellect, study science, develop

technology, pursue the professions, secure their

physical or material and spiritual well-being, and

strengthen society. In effect, the fulfilment of this

duty is part of worship or service (ibadat) to Allah

SWT.

2.3 Methodology

This study utilized the CrossSectional Survey Design

using qualitative descriptive in analyzing the data.

The descriptive method was used to evaluate the

demographic profile of the respondents, their

practices in the execution of zakah and the

contributions of zakah to the recipients.

The researcher made use of cross-sectional survey

design using qualitative descriptive in the analysis of

data. Crosssectional survey design defined by Cherry

(2018) cited, by Lumabao (2018) involves looking at

people who differ on one key characteristic at one

specific point in time. The data are collected at the

same time from people who have similar in other

characteristics but different in a key factor of interest

such as age, income levels, or geographic location. A

cross-sectional survey collects data to make

inferences about a population of interest (universe) at

one point in time.

Cross sectional surveys have been described as

snapshots of the populations about which they gather

data. Cross-sectional surveys may be repeated

periodically; however, in a repeated crosssectional

Zakah Execution and Its Influence on the Recipients as Perceived by the Fire Personnel of Lanao del Sur

213

survey, respondents to the survey at one point in time

are not intentionally sampled again, although a

respondent to one administration of the survey could

be randomly selected for a subsequent one. Cross-

sectional surveys can thus be contrasted with panel

surveys, for which the individual respondents are

followed over time. Surveys usually are conducted to

measure change in the population being studied.

(Lumabao 2018) Also, Cross-Sectional Survey

Design according to Eric (2018) involves using

different groups of people who differ in the variable

of interest but share other characteristics, such as

socio-economic status, educational background, and

ethnicity.

2.4 Locale and Setting of the Study

This study was conducted in BFP Lanao del Sur.

Fifteen (15) of its covered fire stations located in

different municipalities are included in this study,

namely: Bacolod Kalawi, Bayang, Balabagan,

Balindong, Binidayan, Lumba a Bayabao, Madalum,

Malabang, Marantao, Marawi City, Masiu, OPFM-

Marawi, Piagapo, Poona Bayabao, Ramain Ditsaan,

and Saguiaran. Officially, the Province of Lanao del

Sur, is a province in the Philippines located in the

Bangsamoro Autonomous Region in Muslim

Mindanao (BARMM). The capital is the city of

Marawi, and it borders Lanao del

Norte to the north, Bukidnon to the east, and

Maguindanao and Cotabato to the south. To the

southwest lies Illana Bay, an arm of the Moro Gulf.

Situated in the interior of Lanao del Sur is Lanao

Lake, the largest in Mindanao.

Prior to the arrival of Islam, the region already had

a sophisticated culture, as embodied in various

Maranao epics, chants, and recorded history. During

this era, various cultural icons developed, such as the

torogan, the singkil dance, the darangen epic, the

unique Maranao gong and metal craft culture, the

sarimanok, the okir motif, and an indigenous suyat

script.

In 1959, Lanao was divided into two provinces,

Lanao del Norte and Lanao del Sur, under Republic

Act No. 2228. Marawi was designated as the capital

of Lanao del Sur. The city was renamed the "Islamic

City of Marawi" in 1980, and is currently the

Philippines' only city having a predominantly Muslim

population.

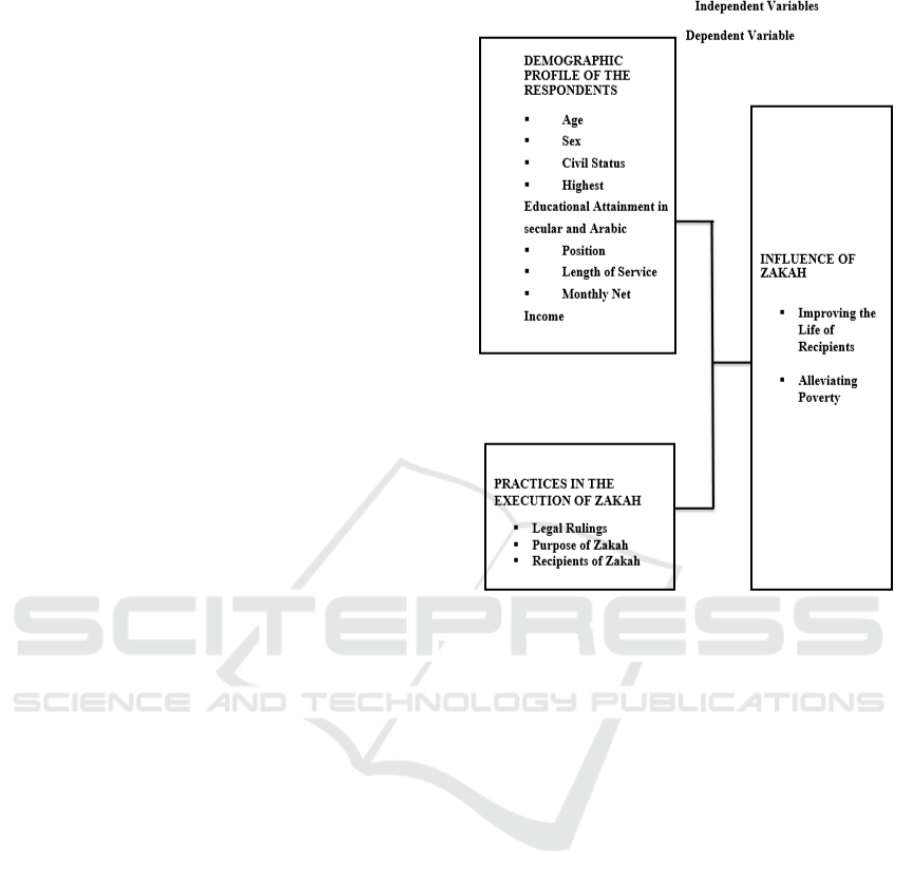

Figure 1: Conceptal Model.

3 RESULTS AND DISCUSSIONS

In depth of analysis of the data, it brings forth the

following major findings of the study. The findings

on the respondents’ demographic revealed that

majority (60%) of the respondents’ age ranges

between 29 to 35 years of age; majority (78%) of the

respondents were male; majority (73%) of the

respondents was Bachelor’s degree; may (54%) of the

respondents finished Ibtidai (primary) level;;

majority (67%) of the respondents had been in the

service for less than five years; majority (66%) of the

respondents are Fire officers 1 and majority (66%) of

the respondents have monthly net income of P29,668.

On the other hand as to the practices of Zakah

execution as perceived by the Fire personnel the

following findings surfaced: the respondents

disclosed that first and foremost they agreed that

Zakah is compulsory on evry financially capable

Muslims including those who are not employed as

long as ther net yearly savings meet or exceed nisab

(minimum amount of wealth). Secondly, they agreed

that Zakah is obligatory (Fardh) to all Muslims who

meet or exceed the minimum amount of wealth

(nisab) required to pay Zakah. But, they were

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

214

undecided if Zakah is to be paid after one full lunar

Year (hawl); if items for personal use such as:

house,cars and clothing are exempt from Zakah; if

Zakah is not required for the disbeliever; and

undecided if Zakah is applicable only onpeople of the

Islamic faith.

As to the purposes of Zakah, the respondents

agreed that giving Zakah s an act of worship and that

Zakah purifies the human soul from the vices of

greed, stinginess, covetousness, and the like.

Also, among the recipients of Zakah, the

respondents divulged that they always give zakah to

the needy, poor, and mujahideen(Islamic warriors);

sometimes give Zakah to the the recent converts of

Islam, and disbeliever expecting to embrace Islam;

but never give Zakah to the ones who does not pray,

to the strong person who is capable of earning, to the

one who disrespects the symbols of Islam and to the

wealthy person.

In the same vein that as on the influence of Zakah

on the recipients as perceived by the Fire Personnel:

first, in terms of improving the life of the Zakah

recipients, the respondents agreed that Zakah gives

the recipients a chance to start a small livelihood for

hala earnings. Second, the respondents agreed that

Zakah strengthen the bond between the poor and the

rich; Zakah reduces the financial struggles of the poor

and needy; and Zakah lessens the suffering of people

from poverty.

In a nutshell, it can be forwarded that: A typical

fire officer in BFP Lanao del Sur belonged to the age

range of 29-35 years old, married, bachelor’s degree

holder, ibtidai graduate, served for less than five

years, with FO1 position, and a monthly net income

of P29,668. Further, it is concluded that the

respondents agreed on all the indicators given in the

purposes of Zakah, improving the life of the

recipients, and in alleviating poverty. It is further

concluded that the respondents were undecided with

some of the indicators in the legal rulings of zakah.

And the top three recipients that are always given

Zakah are the needy,poor, and the Islamic Warriors

or Mujahideen.

3.1 Implications

From the summary and major findings, the data

implied that the BFP fire personnel of Lanao del Sur

try to fulfill are mindful of their religious obligations

but still needs perpetual exposure to Islamic teachings

to deeply understand and broaden their knowledge on

Islamic rulings and principles.

It is also implied that the respondents prioritize

the secular education over Islamic Education which is

a disappointing part because a Muslim is obliged to

be knowledgeable in Islam. Therefore, they must do

something tp compensate for that shortcoming.

Another implication is that regardless of being

undecided with some of the rulings of Zakah, the

respondents were firmed in their belief that Zakah is

an act of worship and that it is obligatory to all

Muslims who are financially capable in order to

purify and protect the wealth and cleanse human soul.

It is also implied that the respondents lack

knowledge pertaining to the eight categories of

recipients of Zakah mentioned in the Holy Qur’an.

3.2 Recommendations

In great consideration of the major findings and

implications of the study, the following

recommendations were developed:

Because the respondents only attained primary

level of Islamic Education, it is recommended that

Islamic Books, videos and audios appropriate this 21

st

century must be designed and be readily accessible to

enlighten the present generation in order for them to

be knowledgeable in Islam and apply Islamic rules

correctly. Moreover, Islamic seminars must be

organized properly for different agencies within

Lanao del sur to reawaken the Meranaos about their

religion enable them to live an Islamic way of Life.

Hence, Muslim parents and teachers must not limit

their attention on the academic growth of their

children/learners. They must also stretch equal

attention in keeping the children/learners build a

strong foundation of Islamic knowledge that will

guide them throughout their lifetime. As a

consequence, they will be an asset to humanity in

general.

Since the respondents differ in some aspects such

as age, educational attainment, civil status, and many

other things, it is recommended that lectures in

Islamic seminars must use a variety of approaches in

consideration with the diversity of the participants. If

possible, the lecturers may also attend seminars on the

proper ways of delivering a lecture to effectively

covey a message to the different types of audience to

avoid misunderstanding of Islamic principles.

Everyone should invest much effort to continue his

pursuit of knowledge pertaining to Islam enable them

to execute Islamic principles appropriately in various

aspects of life.

Being undecided with some of the rulings of

giving Zakah needs immediate solution. For this, it is

recommended to use multiple ways of learning the

Islamic rules and principles and make sure to

implement and impart it to others. This way, every

Zakah Execution and Its Influence on the Recipients as Perceived by the Fire Personnel of Lanao del Sur

215

individual will be aware on how to fulfil their

religious obligations that will help other Muslim in

their community. Furthermore, proper

implementation of the Arabic subject in the

curriculum of elementary and secondary level of

education must be strictly monitored. It should be

made sure that teachers handling the Arabic subject

are highly qualified and globally competent to

achieve the goal of including it in the curriculum.

Since the respondents agreed on all the indicators

given in the purposes of Zakah, improving the life of

the recipients, and in alleviating poverty, it is

recommended that they encourage other to practice

giving zakah through sharing validated information

on the rulings, purposes, and influence of Zakah to its

recipients.

One of the findings of the study is that the

respondents always give Zakah to people who are

obliged for them to spend on like parents, children

and the like. These people are not included to the

eight groups established in the Holy Qur’an to be the

recipients of Zakah and it is highly recommended to

strictly follow the teachings of Islam particularly

those mentioned clearly in the Holy Qur’an.

Similar studies but with broader or more

ambitious scope must be conducted by future

researchers for further and more comprehensive

findings. More zones on this matter need further

scrutiny for better understanding of everyone

concern.

ACKNOWLEDGMENTS

The researchers are highly indebted to the Graduate

School of the university for the moral support in

motivating the researchers to pursue the study. The

entire officials of the university headed by the

dynamic president dr. Habib W. Macaayong for all

the support and to all the financial managers of the

campus like Atty. Saadudin M. Alauya, Jr., CPA for

his commitment in helping the researchers in the

realization of this study.

REFERENCES

Abdullah, Ismail and Manas, Shayuti A. (2007).

Introduction to the Sciences of Hadith. International

Islamic University Malaysia Press. Malaysia, Second

Print

Abdul Rahman, Jashim A. (2017) Islamic Jurisprudence, A

comprehensive Reviewer. Integrated Shariah Bar of the

Philippines ISBN 971-735-072-62 Ivory Printing and

Publishing house

Ali, A. Yusuf. (1989)The Holy Qur’an text, Translation and

Commentary: Brentwood, Marylad, U.S.A: Amana

Corporation

Al-Jaza-iri, Abu Bakr Jabir. (2001) Minhaj Al Muslim; (A

book of Creed, Manners, Character, Acts of Worship

and Other Deeds). (vol.II); Riyadh: Darussalam Global

Leader in Islamic Books

Arabani, Bensaudi I. (2011) Commentaries on the Code of

Muslim Personal Laws of the Philippines with

Jurisprudence and Special Procedure. Rex Book Store.

Manila, Philippines. Second Edition

Astih Abdulmajid J. and Baraacal Amer M. (1998) Muslim

Law on Personal Status in the Philippines. Central

Professional Books, Inc. Quezon City, Philippines,

First Edition

Badawi, Dr. Abdul-Azeem and Zarabozo, Jamall Al-Din.

(2007). The Concise Presentation of The Fiqh Of the

Sunnah and the Noble Book. International Islamic

Publishing House, Riyadh, Saudi Arabia

Denffer, Ahmad Von. Ulum Al Qur’an An Introduction to

the sciences of the Qur’an. Leicester. Ramadan. No

Date of Publication (Soft Copy) Dr. Yusuf Al

Qardawi.Fiqh Al Zakah (Vol. 1),

Kamali, Mohammad Hashim. Principles of Islamic

Jurisprudence. Pelanduk Publications, Selangor, darul

Ehsan, Malaysia, 1989.

Lumabao,Mifia B. (2018). Institutionalizing Zakat As

Substitute To Withholding Tax Among MSU

Employees With A Salary Of Salary Grade 22.

Unpublished Master’s Thesis, MSU, Marawi City.

Majul, C. (1990). Islam and development: A collection

of essays. OCIA Publications.

Maududi, Abul Ala (1980). Fundamentals of Islam. Islamic

Publications (Pvt.) Ltd. Lahore. Pakistan

Mufti, Imam Kamil (2006). An Introduction To The Third

Pillar Of Islam, The Compulsory Charity Or Zakah,

The Spiritual Dimensions Of Zakah And Charity, And

How Islam Views Money In General. (on line article)

Omar, AbdulKadir T. (2015). Institutionalization of

Baituzzakat in Cotabato City: Problems and Prospects.

Unpublished Master’s Thesis, MSU, Marawi City.

Philips, Abu Ameenah Bilal. The Evolution of Fiqh

(Islamic Law and the Madh-habs) International Islamic

Publishing House (Softcopy/E-Book) Usool Al-

Hadeeth: The Methodology of Hadith Evaluation.

International Islamic Publishing House (Softcopy/E-

Book)

Powell, Russel. (2010). Zakat: Drawing Insights for legal

Theory and Economic Policy from Islamic

Jurisprudence, University of Pittsburgh Tax Review. 7

(43). SSRN 1351024

Radiamoda, Anwar M. (2015) Glimpse in Islamic

Economics and political System. ISBN 971-735-068-

56 Ivory Priting and Publishing House, Quezon Av.

Ext., Pala-o, Iligan City.

Sabiq, As-Sayyid. (1991). Fiqh Us-Sunnah. American

Trust Publications, Washington Street Indianapolis,

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

216

Indiana 46231-USA; Al-Haramain Islamic Foundation

USA

Sadlaan, Dr. Saalih Ibn Ghaanim and Zarabozo, Jamall Al-

Din. (1980). Fqh Made Easy. Muhammad Ibn Saud

Islamic University. Riyadh Saudi Arabia

Toffler, A. & H. (2006). Revolutionary Wealth. United

States of America: Doubleday.

Bearman, Peri. (2012). Encyclopaedia of Islam, Second

Edition. Brill Online

Zakah Execution and Its Influence on the Recipients as Perceived by the Fire Personnel of Lanao del Sur

217