Potential of Islamic Debt Sale-based Financing in a Form of

Bai’Bithaman Ajil (BBA) and Murabahah in Reconstructing and

Rebuilding Marawi City after the Siege

Minombao Ramos-Mayo, Salma Esmael and Abdulcader M. Ayo

Mindanao State University, Marawi City, Philipines

www.msumain.edu.ph

Keywords: Islamic Debt Sale-based Financing, Bai’bithaman Ajil, Murabahah, Internally Displaced Persons.

Abstract: This study aimed to find out the views of the Internally Displaced Persons (IDP’s) regarding the potential of

Islamic Debt Sale-Based Financing in a form of Bai’bithaman Ajil (BBA) and Murabahah in the

reconstructing and rebuilding of Marawi City after the six months’ siege. The respondents of this study were

200 select professionals and Ulama of the known Islamic City of Marwari, LDS, Philippines. To collect the

necessary primary data from the respondents the researchers utilized descriptive qualitative techniques with

the help of a survey questionnaire. To determine the number of the participants, purposive sampling was

used in determining the samples, and simple random sampling in actually selecting the number of the

respondents involved in the study. The major findings of the study showed that some of the respondents

belong to the poor families, unemployed, their livelihood was unsustainable for their needs, with less than

10 thousand monthly incomes, and no available microfinancing was they can engage themselves to do small

enterprises or trading as a means of livelihood. Another significant finding is that the respondents of the

study strongly believed that if there will be an Islamic Microfinancing Institution, it can help them so that

their status of the economy will be improved. Also, most of the respondents believed that Islamic Debt Sale-

Based Financing in the forms of Bai’ Bithaman Ajil (BBA) and Murabahah have potentials in

reconstructing and rebuilding of Marawi City after the Siege. Findings further denote on the need to educate

not just enlighten the people of Marawi City on the potential of Debt Sale-Based Financing in Marawi’s

current situation. Additional findings highlighted were on the need to strengthen Islamic Finance in Marawi

City through educating its people on their knowledge and understanding of the concept. Still, another

important finding was Islamic legal documents and Islamic Finance Legal Framework were found to be part

of the challenges and problems encountered by the respondents in the implementation of Islamic Debt Sale-

Based Financing. In the light of that findings, it is hereby recommended that Islamic Finance should be

implemented as it represents the true meaning of transactions in Islam; an emphasis on Bai’Bithaman Ajil

(BBA) and Murabahah to be adopted as it will help IDP’s transform their status of living. Also, it is

recommended for public officials, especially those who are in the Bangsamoro Autonomous Region in

Muslim Mindanao (BARMM) to give full prioritization on the truest implementation of Islamic Finance in

the Philippines. Finally, a massive education and information drive or campaign on the use and

implementation of Islamic microfinancing institution’s as possible solutions for the reconstructions and

rebuilding of Marawi City after the siege should be done so that Muslim and even Non-Muslim in the

Philippines especially the Bangsamoro areas can help in the rebuilding of the place

1 INTRODUCTION

Islamic Finance is gaining momentum in the world

as a financialsystem that promotes stability as well

as economic development and growth. Islamic

finance has an important potential to act as an engine

of stability and inclusion, since investor are required

to bear losses that may arise on loans. In fact, there

is less leverage, and greater incentive to exercise

strong risk management. These risk-sharing features

also served to help ensure the soundness of

individual financial institutions, and help discourage

the types of lending booms and real estate bubbles

that were the prosecutors of financial crisis.

It can be recalled that the attempt of Islamic

State of Iraq and Syria (ISIS), wellknown violent

extremist movement, together with its local

adherents – the Maute Group (MG), Bangsamoro

Islamic Freedom Fighter (BIFF), and Abu Sayyaf

Group (ASG), to establish an Islamic caliphate in

202

Ramos-Mayo, M., Esmael, S. and Ayo, A.

Potential of Islamic Debt Sale-based Financing in a Form of Bai’Bithaman Ajil (BBA) and Murabahah in Reconstructing and Rebuilding Marawi City after the Siege.

DOI: 10.5220/0010120600002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 202-211

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Southeast Asia through laying siege to Marawi City

on May 23, 2017 evidently resulted to the longest

and bloodiest urban battle in the modern history of

the Philippines. Not to mention, this took

government forces five (5) long months of intense

urban warfare to evict the militant and desolately left

the most built-up parts of Marawi City devastated

with over P 18 billion worth of damage, over a

thousandpeople dead and hundreds thousands of

displaced families.

The Marawi siege made the center of Marawi as

ground zero with all the structures being pulverized

with bombs, guns and mortar by both the

government and the ISIS Inspired Maute-Abussayap

group. The devastating effect of the siege has left the

city in a very pitiful situation. And it is sad that

even after two years, the City still remain to be in

ashes with the slow duckling promise of

rehabilitation and recovery by the government.

Thus, countering violent extremism requires a

holistic approach and a collective effort by the

community to be successful. The researcher then is

taking her part, sharing the same cause with the

government on preventing and countering violent

extremism campaign. That is why even with this

very humble approach, the researchers hoped that

this would contribute on raising awareness. For this

study would not only be benefited by the local

government, but by the entire community in the

study area – Marawi City. Purposely, this study

would give a timely reinforcement to the local

government, other agencies concerned and

stakeholders that needs input and aid in formulating

measures and prioritizing programs which are more

responsive, inclusive and evidence-based.

2 LITERATURE REVIEW

The study was anchored on several theories: First of

these theories were Ayah from the Quraan:

But Allah hath permitted trade and forbidden usury

[2:275]

But take witness whenever ye make commercial

contract; and let neither scribe nor witness suffer

harm. If ye do (such harm), it would be wickedness

in you. [2: 282]

Other theories which this research were anchored

were the following:

2.1 Emergency Management

Disaster relief (or emergency management) refers to

the process of responding to a catastrophic situation,

providing humanitarian aid to persons and

communities that have suffered from some form of

disaster. It involves dealing with and avoiding risks

and preparing, supporting, and rebuilding society

when natural or human-made disasters occur. In

general, any emergency management is the

continuous process by which all individuals, groups,

and communities manage hazards in an effort to

avoid or limit the impact of disasters resulting from

the hazards. Effective emergency management relies

on thorough integration of emergency plans at all

levels of government and nongovernment

involvement. Activities at each level (individual,

group, community) affect the other levels. It is

common to place the responsibility for governmental

emergency management with the institutions for

civil defense or within the conventional structure of

the emergency services (Scott McNally, et al.,

2000).

While disasters are by definition tragic, resulting

in great loss of material goods and property, as well

as injury and loss of life, disaster relief is a truly

human response. When people see those in need,

even far away and in circumstances entirely foreign,

the desire to help comes from the empathy felt for

human brothers and sisters. As technology and

human consciousness continue to develop, the desire

and ability to help others, crossing geographical

distance and cultural and national boundaries, has

also developed. In terms of humanitarian response,

the world is increasingly become borderless (Scott

McNally, et al., 2000).

Disaster Relief consists of monies or services

made available to individuals and communities that

have experienced losses due to disasters such as

floods, earthquakes, drought, tornadoes, and riots. A

disaster may also be defined in sociological terms as

a major disruption of the social pattern of

individuals and groups. Most countries have

agencies that coordinate disaster relief and planning.

Many have statutes that define appropriate

procedures for disaster declarations and emergency

orders. Such statutes also empower relief agencies to

utilize local resources, commandeer private

property, and arrange for temporary housing during

an emergency (Drabek, Thomas E. ,1985).

Potential of Islamic Debt Sale-based Financing in a Form of Bai’Bithaman Ajil (BBA) and Murabahah in Reconstructing and Rebuilding

Marawi City after the Siege

203

The term disaster has been applied in a broad

sense to mean both human-made and natural

catastrophes. Human-made catastrophes include

civil disturbances such as riots and demonstrations;

warfare-related upheavals, including those created

by guerrilla activity and terrorism; refugee crises

involving the forced movements of people across

borders; and many possible accidents, including

transportation, mining, pollution, chemical, and

nuclear incidents (Drabek, Thomas E. ,1985).

The recovery phase starts when the immediate

threat to human life has subsided. In this phase, it is

recommended to reconsider the location or

construction material of the property. In long term

disasters, the most extreme home confinement

scenarios like war, famine, and severe epidemics last

up to a year. In this situation, the recovery will take

place inside the home. Planners for these events

usually buy bulk foods and appropriate storage and

preparation equipment, and eat the food as part of

normal life (Wisner et al., 2003).

2.2 Open System Theory Approach to

Relief Operation

Effective emergency response and recovery are

dependent on cooperation between local public

agencies, business enterprises, and community

groups. Shelters are often sponsored by public and

private schools and operated by the American Red

Cross. Evacuation efforts are often supported by

community transportation agencies and school

systems. Special needs shelters are often staffed by

local medical facilities, volunteers, and community

organizations. Traffic control and security is a

collaborative effort between numerous local law

enforcement jurisdictions. Coordination is critical in

linking multiple organizational efforts in a seamless

response and recovery effort.

An open system involves the dynamic interaction

of the system with its environment. This theory is

fundamental to understanding hazards and

emergency management for it maintains that

everything is related to everything else. Emergency

management has a dynamic relationship with the

environment and receives various inputs, transforms

these inputs in some way, and exports outputs.

These systems are open not only in relation to

their environment but also in relation to themselves;

the interactions between components affect the

system as a whole. The open system adapts to its

environment by changing the structure and processes

of the internal components. When organizations are

defined as ‘open systems’ the focus shifts from

formal structures to interdependencies between the

different parts of the organization and the reciprocal

ties that connect the organization to its environment,

which includes other organizations.

The environment consists of both the material-

resource environment and the institutional

environment which covers the human, political,

social, and cultural systems that shape the material-

resource environment. The environment is key to the

survival of the organization since it is the source of

energy, information and material that the

organization needs to maintain itself (Scott, 2003).

The open system perspective on organizations

highlights the diversity and complexity of groups

and organizations making up the system as well as

the looseness of connections between them, making

them loosely coupled systems (Buckley, 1967). The

open system approach to understanding

organizations, in addition to its emphasis on the

relationship of the organization to its environment,

defines an organization in terms of interrelated

subsystems which depict key patterns and

interconnections between different units, groups, and

departments within an organization (Morgan, 2006).

At the inter-organizational level, the open system

approach focuses … on understanding the

relationships and interactions within and among

aggregates of organizations (Baum and Rowley,

2002). One of the characteristics of open systems is

that it is very difficult to determine their boundaries

because they … are made up of subsystems and are

themselves subsumed in larger systems – an

arrangement that creates linkages across systems and

confounds the attempt to erect clear boundaries

around them (Scott, 2003).

This is very relevant to the study of relief

operations which are part of a global system; the

organizations that participate in relief operations are

parts of other organizations. As such, Scott’s

description of an open system as subsystems

subsumed in larger systems perfectly fits the reality

of relief operations. Given the nature of

humanitarian action, it becomes clear that the open

system approach is an appropriate approach to

understanding relief operations and the organizations

constituting them. It enables the researcher to take

into account the interaction between participants in

the relief operation and their environment and how

each shapes the other.

2.3 Theories of Poverty

Poverty is the inability to secure minimum human

needs in respect of food, clothing, housing,

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

204

education and health on account of insufficient

income or property. As insufficient income does not

allow an individual to cover basic necessities

specifically in health and education and in turn

results to poor health and inadequate education or

more likely to have low general living standards

(John Black, 1997)

Poverty is also dangerous for both body and soul.

For the body, it stunts a person’s growth in all

aspects and causes serious ailments. Even death. For

the soul, it generates envy of the rich who display

their wealth, hatred of the government for its neglect

and despair on god’s providence. It is the root cause

of many crimes (UNDP Human Development

Report, 1997).

2.4 Theories on Development

Conquering poverty has been the fundamental

development goal of every administration in many

countries. The basic task of development is to fight

poverty by building for the greatest number of the

people (Manasan, 2010). According to Todaro

(1981) development is a process of improving the

quality of all human lives especially the majority

who are poor on three equally important aspects.

These are: (1) increase and widen the distribution of

life sustaining goods like food, shelter, clothing and

health. (2) improve the levels of living through

higher income, employment opportunities and

quality education and health services, and (3)

increase people’s freedom to choose by enlarging

the range of their choice and promoting their self-

esteem through the establishment of the social,

political and economic institution and systems which

promote human dignity and respect.

In the social dimension of development, the

social development goals include eradication of

poverty, standards of living, quality of education,

and quality of health services, mortality and extent

of literacy. From social development perspective, it

means addressing poverty by focusing on

developing the human capital. Investing in human

development, particularly in education and health

significantly improves a country’s chances of

achieving long-term progress. Health and education

are integral part of social development (Todaro,

1981).

Another work written by Hammarskjold entitled

Foundation Towards Another Development (1975)

defines and elaborates another type of development.

According to the work, development must be: (1)

need oriented focused on the satisfaction of human

needs material and non-material; (2) endogenous

stemming from the heart of each society which

defines in sovereignty its values and the vision of its

future; (3) self-reliant relying on the strength and

resources of the society which pursues it, rooted at

the local level in the practice of each community; (4)

Ecologically sound-utilizing rationally available

resources in a harmonious relation with the

environment; and lastly (5) based on structural

transformations-originating in the realization of the

conditions for self-management and participation in

decision making it by all. In characterizing the need-

oriented nature of another development, it was

emphasized that, though human needs are material

and non-material, the basic needs of food, shelter,

health, and education should be satisfied on a

priority basis. But whether in food, shelter, and

education it is not the absolute scarcity of resources

which explains the sub-satisfaction of needs, it is

rather the distribution of resources. It was further

emphasized that the development must come to the

people. They must be active in development and it

should be the people themselves who would identify

their problem and not the other people.

2.5 Development Strategies

Poverty alleviation remains to be the most basic

development goals of all countries. The Philippines

government for past decades has always been

conscious about its role in realizing development,

which has poverty alleviation as a central concern.

In the Philippines, poverty level is determined using

the family income as indicator. A family poverty

threshold income is set for a family of five (e.g.

P5,000.00 per month) and then all those whose

income falls below this indicator are considered poor

(NSCB, 2009). Statistics show that majority of the

Filipinos fall below the poverty level. A World Bank

Study revealed that 55 per cent of the Filipinos who

fall below manage to live on income that fails to

meet their basic needs for food, clothing, and shelter

(World Bank, 2013).

2.6 Social Reform Agenda

The Philippine government for the past decades has

adopted different models and programs on various

strategies of development. It started with the

integrated area development, integrated rural

development, and the launched of Social Reform

Agenda (SRA) in 1995. The SRA is an integrated set

of major reforms to enable the citizens to: a) meet

their basic human needs and decent lives; b) widen

their share of resources from which they can earn a

Potential of Islamic Debt Sale-based Financing in a Form of Bai’Bithaman Ajil (BBA) and Murabahah in Reconstructing and Rebuilding

Marawi City after the Siege

205

living or increase the fruits of their labor, and c)

enable them to effectively participate in the

decision-making process that affects their rights,

interests, and welfare. These reforms are perceived

to enhance democratic processes. The Social Reform

Agenda (SRA) is composed of social reform

packages providing programs and services for

marginalized sectors of society in the country. It led

to the integration of the nine flagship programs

having impact on all target sectors and ecosystems.

The nine (9) flagship programs of the SRA are

headed by the championships- government agencies

which have a critical role in ensuring the delivery of

commitments to target beneficiaries located in

communities targeted by the program. The first

flagship program catering to social development is

the Comprehensive Integrated Delivery of Social

Services led by DSWD. These target persons with

disabilities`, the elderly, and victims of natural and

man-made calamities. The second flagship is

Socialized Housing Delivery for the urban poor

under the Housing Urban and Development

Coordinating Council (HUDCC). The third and

fourth are Agricultural Development and Aquatic

Reform under the Department of Agriculture and

Fisheries (Bautista, 1990).

The fifth is Protection of Ancestral Domain

headed by Department of Environment and Natural

Resources (DENR), this targets indigenous people.

The sixth is Workers’ Welfare and Protection under

the Department of Labor and Employment (DOLE),

the seventh is Expansion of Credit implemented by

Department of Finance (DOF) and Land Bank of the

Philippines, the eight is Livelihood Program also

dwell on workers in the informal sector under the

Department of trade and Industry (DTI) and

Department of Labor and Employment, and finally

Effective Participation in Governance led by the

Department of the Interior and Local Government

(DILG) (Bautista, 1990).

Based on the nine flagship programs, Bautista

(1990) categorized the objectives of the SRA into

four; these are: social equity which is supposed to

achieve by three flagship program- Comprehensive

and Integrated Delivery of Social Service (CIDSS),

Socialized Housing and Workers Welfare and

Protection; economic prosperity by ensuring that for

members of other disadvantaged groups such as the

women, children, youth, persons with disabilities,

the elderly, and victims of natural and manmade

calamities, workers in formal and informal sectors

have access to productive assets that allow them to

contribute to national growth; ecological prosperity

which is addressed by the program on protection of

the ancestral domain; and self-governance which is

addressed by the institution building and

participation in governance.

3 ANALYSIS MODEL

3.1 Comprehensive and Integrated

Delivery of Social Service (CIDSS)

In the case of Comprehensive and Integrated

Delivery of Social Service (CIDSS) as a strategy for

poverty alleviation, was adopted as the national

machinery mechanism for the minimum basic needs

approach upon issuance of the Executive Order 443

signed by the President Fidel V. Ramos. It aimed at

empowering the disadvantaged communities to

access services that addressed their minimum basic

needs of certain disadvantaged groups such as the

women, children, youth, and persons with

disabilities, the elderly, and victims of natural and

man-made calamities. The major programs under the

CIDSS is economic self-sufficiency, provision of

water and sanitation facilities, livelihood program,

pre-school education, provision of housing of

supplemental feeding and people empowerment. It

also serves as the core requirement for all other

sector prioritized by other programs (Bautista,

1997).

Moreover, on the selection of target areas, SRA

initially commerce with twenty (20) priority

provinces in 1995 when it was officially launched. It

later included all provinces in 1996 including 5

th

and

6

th

class municipalities in the Autonomous Region in

Muslim Mindanao. Bautista (1990) further made

clear that the areas covered by the CIDSS were

initially determined using the list of prioritized

provinces as defined by the Presidential Commission

to Fight Poverty (PCFP) and the Presidential

Council for Countryside Development (PCCD).

Selection of municipalities from the identified

provinces was done using the following criteria: (a)

most depressed municipality which has high poverty

incidence, (b) accessibility, and (c) support of the

municipal mayor.

Furthermore, Comprehensive and Integrated

Delivery of Social Services (CIDSS) was

implemented using the strategies on minimum basic

needs approach. These strategies were the focused

targeting, convergence, social mobilization,

community-based approach, and installation of a

local information system and financial management

(Bautista, 1997).

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

206

These were the core strategy in all programs and

poverty alleviation. The details of each strategy are

discussed below:

Focused Targeting. This means zeroing attention

in planning to the most deprived and poorest

individuals and families as the primary beneficiaries

of the services to be delivered at the local level.

Convergence. This means involving government

and civil society in national and local development

management to address basic needs of the people.

This is done by setting up an inter-agency committee

to enable the coordination functions and overall

planning for the program.

Social Mobilization. This is the activation of

local residents in such a way that they become aware

of their situation, learn how to prioritize them, find

ways and means of solving their problems by

themselves, and getting actively involved in issues

and activities that affect them. as a whole, the

ultimate goal of social mobilization is people

participation in development. People or beneficiary

participation in development has become popular

nowadays, because of the realization that most

development projects and programs which are

planned and implemented by agencies without the

involvement of the beneficiaries do not suit their

interest, needs, and these based are neglected and

abandoned. It leads to misuse and a waste of

resources. In the MBN approach, the aim of social

mobilization is to convince all sectors at various

levels to agree on and use a common framework, set

of guidelines, monitoring tool, training packages,

and even institutiona arrangement for MBN (DILG,

1995)

Community-based Information System. This

means that the responsibility for gathering,

processing, and utilizing the information does not

belong to government. Community residents are

encouraged to take part in process. This ensures that

they can access the information that has been

gathered and effectively they can participate in

decision-making as they are knowledgeable of the

local situation. Thus, social mobilization is directly

linked to setting up an information system since this

turn on volunteers to assist in gathering information

and people’s organization to participate in local

planning activities.

The Minimum Basic Need Approach, as a

strategy for development, revolves around the

satisfaction of basic needs of a Filipino family

pertaining to survival (food and nutrition; health;

water and sanitation; clothing), security (shelter,

peace and order; public safety; income and

livelihood) and enabling (basic education and

literacy; participation in community development;

family and psychosocial care). A total of thirty three

(33) requirements had formulated to fulfill these ten

basic needs through regional consultations

spearheaded by various institutions such as the

presidential commission to fight poverty (PCFP),

Philippine Institute for Development Studies

(PIDS), Department of Social welfare and

Development (DSWD),department of the interior

and Local Government-Local Government Academy

(DILG-LGA), university of the Philippines National

College of Public Administration and Governance

(UP-NCPAG), United Development Program

(UNDP) and the United Nations Children’s fund

(UNFPA).

3.2 Component of Islamic Financial

System

Islamic Financial System component are: Capital

Market which is divided into Sukuk and Equity;

Banking; Takaful; money market; other Market

which involve development institutions, micro-

financing, venture Capital and private Equity and

derivatives as discuss by Razi Phlavi (2018) in a

crash class for MSU officials on Islamic Finance.

Further, including in the discussion are the rules to

be observed on what to avoid in engaging into

financial transaction such as: riba (interest), gharar

(uncertainties), impure or prohibited goods,

gambling and no values/use.

Murabahah, according to Mohd Johan Lee

(2017) the word ‘Murabahah’ derives from the word

‘ribh’ which means profit or gain. Technically

Murabaha is a sale of commodity at the cost price

with the addition of mark-up price which is also

considered as a profit. The profit is known to both

the seller and the buyer.

Also Murabahah (Cost-Plus Financing) is one of

the most common modes used by Islamic Banks.

This is a deferred lump sum payment. It refers to a

sale where the seller discloses the cost of the

commodity and amount of profit charged. Therefore,

Murabahah is not a loan given on interest rather it is

a sale of a commodity at profit. The mechanism of

Murabahah is that the bank purchases the

commodity as per requisition of the client and sells

him on cost-plus-profit basis Masorong, (2019).

Under this arrangement, the bank is bound to

disclose cost and profit margin to the client.

Therefore, the bank, rather than advancing money to

a borrower, buys the goods from a third party and

sell those goods to the customer on profit. A

question may be raised that selling goods on profit

Potential of Islamic Debt Sale-based Financing in a Form of Bai’Bithaman Ajil (BBA) and Murabahah in Reconstructing and Rebuilding

Marawi City after the Siege

207

(under Murabahah) and charging interest on the loan

(as per the practice of conventional banks) appears

to be one of the same things and also produces the

same results. The answer to this query is that there is

a clear difference between the mechanism/structure

of the product Masorong, (2019).

Al-Bai Bithaman Ajil (BBA) is a differed

installment Sale. This is a contract in which the

payment of the sale price is deferred and payable at

a certain time in the future. BBA is a mechanism of

payment settlement. BBA linguistically means

Salewith subsequent payment or deferred payment.

It refers to a transaction where the transfer of

ownership is done at the time of Aqad, yet the

consideration sum is to be paid in the future.

However, the buyer and the seller must determine

the mechanism of payment during the aqad (Mohd

Johan Lee, 20 17).

3.3 Problem and Challenges on Islamic

Finance Regulatory Framework

Generally, legal and regulatory framework is always

a problem in Islamic accounting integration.

Although Islamic banks are recognized as a distinct

category of banking institution in the Philippines

under the General Banking Law of 2000, it is sad to

note that nothing comes out concerning Islamic

banks. Under the said law, the BSP, if minded to act

accordingly, can already authorize the establishment

of Islamic bank other than AIIBP, as well as Islamic

units within conventional banks. Additionally,

Morales, 2017 as cited by (Masorong, 2019) in his

article state that the absence of a legislative

framework as well as implementing rules that will

govern the operation, regulation and organization of

entities that will be authorized by the BSP to

perform banking, financing and investment

operations designed to promote and accelerate the

socio-economic development of the country,

particularly the BARMM based on Shari’ah

principles makes the problem even worse. The Al-

Amanah Bank Charter created the Bank but not a

framework for Islamic bank per se. No such

enabling law has so far been passed. In fact, the

General Banking Law (GBL) of 2000 defines

Islamic bank as specifically pertaining to Al-

Amanah Bank only. The GBL does not provide for

the creation of other Islamic banks. To date, there

was no central authority in the Philippines

responsible for ensuring that transactions and

products are Shari’ah compliant.

3.4 Methodology

This study aimed to find out the views of the

Internally Displaced Persons (IDP’s) regarding the

potential of Islamic Debt Sale-Based Financing in a

form of Bai’bithaman Ajil (BBA) and Murabahah in

the reconstructing and rebuilding of Marawi City

after the six months’ siege. The respondents of this

study were 200 select professionals and Ulama of

the known Islamic City of Marawi, Province of

Lanao Del Sur, Bnagsamoro Autonomous Region

for Muslim Mindanao, Philippines. To collect the

necessary primary data from the respondents the

researchers utilized descriptive qualitative

techniques with the help of a survey questionnaire

and validated through follow-up interview to some

key informant.

To determine the number of the participants,

purposive sampling was used in determining the

samples as only internally displaced Ulama and

professional were considered as respondents of the

study. And simple random sampling utilizing the

systematic fish ball techniques in actually selecting

the number of the respondents involved in the study.

Informed consent was done by letting the respondent

filled up the informed consent form when the

conceded to be part of the research after seeking

their permission.

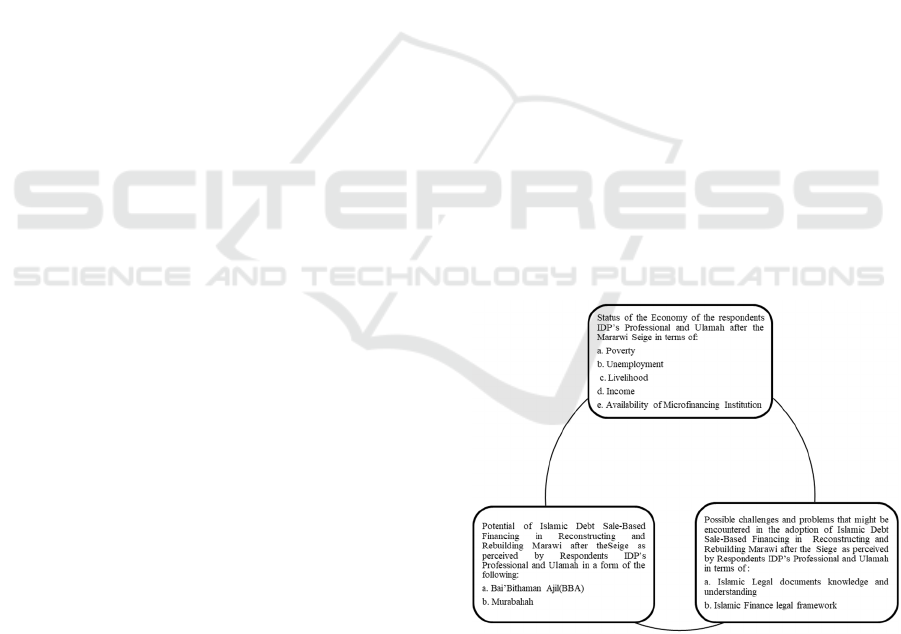

The schema that shows the conceptual paradigm

of the study is shown below (Figure 1)

Figure 1: Conceptual Paradigm.

4 RESULTS AND DISCUSSIONS

Result and Discussion As to the findings on the

status of economy of the respondents shows that a

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

208

great majority (70%) of the respondent IDP’s

professional and Ulamah belong to marginalize poor

after the siege. Another finding was that most (90%)

of the IDP’s professional and Ulamah were

unemployed. Likewise, most (90%) of the

respondents IDP’s professional and Ulamah lacked

proper livelihood which to provide the basic need of

the family. Also, most (90%) of the respondents

IDP’s professional and Ulamah claimed that they

have no sustainable income as most of them were

relying on the goods distributed by both GO’s and

NGO’s for their family daily sustenance. And

finally, most (95%) respondents IDP’sprofessional

and Ulamah were frustrated on the unavailability of

financing institution for which to loan in order to

engage in entrepreneurships. The findings, indicate

that the respondents are living on a poverty line.

This means that the respondents were in need of

livelihood with less income. This also implied that

the respondents were poor. Accordingly, Poverty is

the inability to secure minimum human needs in

respect of food, clothing, housing, education and

health on account of insufficient income or property.

As insufficient income does not allow an individual

to cover basic necessities specifically in health and

education and in turn results to poor health and

inadequate education or more likely to have low

general living standards (John Black, 1997)

Another important finding was that almost all

(98%) of the respondents IDP’s professional and

Ulamah believed and strongly recommend that both

Bai’Bithaman Ajil (BBA) and Murabahah had the

great potential as a Debt-Based Financing in

reconstructing and rebuilding Marawi City after the

Siege. According to Mohd Johan Lee (20 17),

Murabahah and BBA is a kind of financing that are

both Shariah compliant. He adds that the validity of

Murabahah is based on the general permissibility of

sale and trade in Islam as propagated by The Holy

Prophet ( pbuh) as stipulated in some Quranic verses

that promote trade.

However, the respondents IDP’s professional

and Ulamah saw the Islamic Documents Knowledge

and Understanding as well as Islamic Finance Legal

Frame work as a challenges and problem to be

encountered in the adoption of Islamic Debt Sale-

Based Financing in Reconstructing and rebuilding

Marawi City after the Siege. This implied that

respondents saw the concrete policy or legal

framework in the Philippines as a problem in

adopting Islamic finance system in the country. It

has to be recalled that although Amanah Bank was

established in the Philippines way back in 1973

under Republic Act 6848however, its progress is

very slow, principally because Muslims in our

country do not understand and appreciate the

essence and the value of Islamic banking and

finance. In fact, it is a reality that Al-Amanah

Islamic Investment Bank of the Philippines some 40

years ago marks the Philippine recognition of

Islamic banking and finance. This bank was

established largely for the benefit of the Muslim

people in the Philippines. But the bank did not

achieve its objectives as up until now it is still

mostly operating as a conventional bank more than

an Islamic Bank. This is basically due to the fact that

not only the country lacks local experts, but it also

lacks religious people who are knowledgeable in the

field of banking and financing. In the same vein as

this can also be attributed to the lack of a clear and

wor kable legal framework. Another reason is due

to the lack of awareness and perspective of Muslim

people and most especially academician and

professional in this field of endeavor Morales, 2017

as cited by (Masorong, 2019).

In the same manner as the passage of Republic

Act No. 11054, otherwise known as the Bangsamoro

Organic Law for the Bangsamoro Autonomous

Region in Muslim Mindanao (BARMM) is

expected to boost Islamic banking and finance,

considering that Article XIII Section 32 of this law

state that the Bangsamoro Government, the Bangko

Sentral ng Pilipinas, the Department of Finance, and

the National Commission on Muslim Filipinos were

mandated jointly to promote the development of

Islamic banking and finance to include among others

the establishment of a Shari’ah Supervisory Board

and the promotion and development of Shari’ah

compliant financial institutions Morales, 2017 as

cited by Masorong (2019).

5 CONCLUSIONS

It can be concluded that study showed that some of

the respondents belong to the poor families,

unemployed, their livelihood was unsustainable for

their needs, with less than 10 thousand monthly

incomes, and no available microfinancing were they

can engage themselves to do small enterprises or

trading as a means of livelihood. Another significant

finding is that the respondents of the study strongly

believed that if there will be an Islamic

Microfinancing Institution, it can help them so that

their status of economy will be improved. Also,

most of the respondents believed that Islamic Debt

Sale-Based Financing in the forms of Bai’ Bithaman

Ajil (BBA) and Murabahah have potentials in

Potential of Islamic Debt Sale-based Financing in a Form of Bai’Bithaman Ajil (BBA) and Murabahah in Reconstructing and Rebuilding

Marawi City after the Siege

209

reconstructing and rebuilding of Marawi City after

the Siege. Findings further denote on the need to

educate not just enlighten thepeople of Marawi City

on the potential of Debt Sale-Based Financing in

Marawi’s current situation. Additional findings

highlighted were on the need to strengthen Islamic

Finance in Marawi City by means of educating its

people on their knowledge and understanding on the

concept. Another important finding, was Islamic

legal documents and Islamic Finance Legal

Framework were found to be part of the challenges

and problems encountered by the respondents in the

implementation of Islamic Debt Sale-Based

Financing. In the light of that findings, it is hereby

recommended that Islamic Finance should be

implemented as it represents the true meaning of

transactions in Islam; an emphasis on Bai’Bithaman

Ajil (BBA) and Murabahah to be adopted as it will

help IDP’s transform their status of living. Also, it is

recommended for public officials, especially those

who are in the Bangsamoro Autonomous Region in

Muslim Mindanao (BARMM) to give full

prioritization on the truest implementation of Islamic

Finance in the Philippines. Thus, the Bangsamoro

Autonomous Region for Muslim Mindanao

(BARMM) is expected to play a major role in the

establishment of Islamic financial institutions.

Coupled with this was the possible passage of

Islamic Finance and Banking Law in the Congress

of the Philippines which is giving the Muslim a high

hope for the use of this system for financing and

Banking. . Finally, a massive education and

information drive or campaign on the use and

implementation of Islamic microfinancing

institution’s as possible solutions for the

reconstructions and rebuilding of Marawi City after

the siege should be done so that Muslim and even

Non-Muslim in the Philippines especially the

Bangsamoro areas can help in the rebuilding of the

place.

ACKNOWLEDGMENT

To Almighty Allah (SWT) the Most Gracious and

the Most Merciful, the researcher recognized that

without your guidance and mercy, this study would

not be possible. Thank you for giving the researcher

strength and wisdom that made this work possible.

In addition, the researchers also recognized that

behind all great endeavor are kind people whose

assistance and support be it moral, technical and

financial contribute to the quality of this research

output. Indeed the researcher will be forever

indebted to you especially to the MSU President

Habib W. Macaayong, DPA for always encouraging

the academe to soar high in research.

REFERENCES

Alhabshi, S. (2018). Accounting for Islamic Financial

Services. Al-shajarah Journal. 2015

Arata, Catalina M., J. Steven Picou, G. David Johnson and

T. Scott McNally. (2000). Coping with technological

disaster: An Application of the Conservation of

Resources Model to the Exxon Valdez Oil Spill.

Journal of Traumatic Stress.

Bakar, M. D. (2016). Shariah Minds in Islamic Finance.

Bankoff, G. (2007). Dangers To Going It Alone: Social

Capital And The Origins Of Community Resilience In

The Philippines. Continuity and Change, 22(02),

pp.327-355.

Baum, J. A. C. and T. J. Rowley, (2002), ‘The dynamics

of network moves and network strategies,’paper

presented at the Academy of Management, Denver

CO, August.

Bautista, Cynthia Banzon, ed., 1993, In The Shadow Of

The Lingering Mt. Pinatubo Disaster: Quezon City,

College of Social Sciences and Philosophy, University

of the Philippines Faculty Book Series No. 2, 291 p.

Bollettino V, Dy P, Alcayna T, Vinck P. (2015), USA:

Harvard Humanitarian Initiative DisasterNet Scoping

Study.

Buckley, W. (1967). Sociology and modern systems

theory. Prentice-Hall.

Cabacungan. Gil C. (2013). Relief aid distribution a

problem, says official. Unpublished Article, Philippine

Daily Inquirer.

David Keen. (2008). Complex Emergencies. Journal of

Refugee Studies, Volume 21, Issue 3, 1 September

2008, Pages 408–410

Denis, Hélène. (1997). Technology, Structure, and Culture

in Disaster Management. International Journal of

Mass Emergencies and Disasters.

DILG, (1995). Dropping from the rolls of atty. Jacob f.

Montesa, director iii, legal services, department of

interior and local government. Manila: Malacañang

Records Office

Drabek, Thomas E. (1985). Managing the Emergency

Response. Public Administration Review.

Drabek, Thomas E. and David A. McEntire. 2002.

Emergent Phenomena and Multiorganizational

Coordination in Disasters: Lessons from the Research

Literature. International Journal of Mass Emergencies

and Disasters.

Dynes, Russell R. (1970). Organized Behavior in Disaster.

Lexington, Mass.: Heath Lexington Books.

Dynes, Russell R. and Thomas E. Drabek. (1994). The

Structure of Disaster Research: Its Policy and

Disciplinary Implications. International Journal of

Mass Emergencies and Disasters.

Dynes, Russell R., Bruna De Marchi and Carlo Pelanda

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

210

(eds.). (1987). Sociology of Disasters: Contribution of

Sociology to Disaster Research. Milano, Italy: Franco

Angeli.

El-Asher, A. and Wilson R. (2006). Islamic Economics A

Short History. Clearance Center, 222

Enarson, Elaine, Cheryl Childers, Betty Hearn Morrow,

Deborah Thomas, and Ben Wisner. (2003). A Social

Vulnerability Approach to Disasters. Emmitsburg,

Maryland: Emergency Management Institute, Federal

Emergency Management Agency.

Farmbry, Kyle M. E. (2013) Crisis, Disaser and Risk.

Institutional Response and Emergency. Kyle Farmbry

M. E. Sharpe Armonk, New York, London, England.

George D. Haddow, Jane A. Bullock, Damon P. Coppola.

(2014) Introduction to Emergency Management, USA.

Gineva, K. and Hamid A. (2015). Property Finance An

International Approach. United Kingdom: John Willey

and Sons Ltd, The Atrium, Southern Gate, Chichester,

West Sussex, P0198SQ.

Jenkins, Philip. (2003). Image of Terror: What We Can

and Cannot Know about Terrorism. New York:

Aldine de Gruyter.

John Black, (1997). A dictionary of economics, Oxford;

New York : Oxford University Press

Kettell, B. (2011). Case Studies in Islamic Banking and

Finance.

Kramer. William, M. (2009) Disaster Planning and

Control. Fire Engineering, USA.

Kreps, Gary A. and Susan Lovegren Bosworth with

Jennifer A. Mooney, Stephen T. Russell, and Kristen

A. Myers. (1994). Organizing, Role Enactment, and

Disaster: A Structural Theory. Newark, Delaware:

University of Delaware Press.

Kreps, Gary A. and Thomas E. Drabek. (1996). Disasters

Are Non-Routine Social Problems. International

Journal of Mass Emergencies and Disasters 14:129-

153.

Lee, M. J. (2017). Islamic Banking in Malaysia.

Lin, Leo. (2017) Preparing for Disaster in the Philippines.

Unpublished Article. The Diplomat.

Mabee, Michael. (2013). Prepping for a Sub-urban or

Rural Community: Building a Civil Defense Plan for a

Long-Term Catastrophe. South Carolina.

Manasan, R. (2010). Financing the MDGs and Inclusive

Growth in the Time of Fiscal Consolidation.

Philippine Institute for Development Studies (PIDS)

Discussion Paper Series No. 201034.

Marifa Academy. (2014). Islamic Banking and Finance:

Principles and Practices.

McLaughlin, M.W. & Talbert, J.E, (2001). School

Teaching in Context. Chicago: University of Chicago

Press.

Meyer, J.W. & Rowan, B. (1978). The Structure of

Educational Organizations. In M.W. Meyer (Ed.),

Environments and organizations (pp. 78-109). San

Francisco: Jossey-Bass. Morgan, Gareth. (2006) 3rd

EDITION Images of Organization, Newbury Park,

CA: Sage Publications.

Morni, G. and Mazza, A. (2015). Property Finance An

International Approach. United Kingdom: John Willey

and Sons Ltd, The Atrium, Southern Gate, Chichester,

West Sussex, P0198SQ.

NSCB (National Statistical Coordination Board), (2009).

Human Development Report, UNDP

Pahlivi, R. (2018). ICIFE Islamic Finance Programme.

Papala P. Masorong (2019) Awareness of Islamic

Accounting among First Year Accountancy Students

in Marawi City. Mindanao State University

Pfeffer, J. & Salancik, G.R. (2003 [1978]). The External

Control of Organizations: A Resource Dependence

Perspective. Stanford: Stanford University Press

Rosewood Drive, Suite 911, Danvers MA 01923, USA:

Hotei Publishing, IDC Publishers, Martinus Nijhoff

Publishers and VSP.

Salem, R. A. (2013). Risk Management for Islamic Banks.

22 George Square, Edinburgh E#8 9LF Edinburgh

University Press Ll.d. Edinburgh University Press.

Shafili, Z. ((2011). Auditing and Governance for Islamic

Financial Institutions. T.E. Weckowicz (1989).

Ludwig von Bertalanffy (1901-1972): A Pioneer of

General Systems Theory. Working paper Feb 1989.

p.2

Sulaiman, M. (2016). Accounting for Islamic Financial

Transactions.

Todaro, Michael P. (1981). Economic Development in the

Third World. Longman

Tran, Mark. (2014). Typhoon Haiyan DisasterResponse

Philippines Relief Effort. Unpublished Article,

Philippine Daily Inquirer.

UNDP. 1997. Human Development Report 1997: Human

Development to Eradicate Poverty. http://www.hdr.

undp.org/en/content/human-development-report-1997.

World Bank, (2013), The World Bank Annual Report

2013, http://hdl.handle.net/10986/16091

Potential of Islamic Debt Sale-based Financing in a Form of Bai’Bithaman Ajil (BBA) and Murabahah in Reconstructing and Rebuilding

Marawi City after the Siege

211