Trading of Shares via Salam Contract: An Exploratory Study

Silmi Binti Mohamed Radzi

International Shari’ah Research Academy for Islamic Finance (ISRA), Malaysia

Keywords: Salam Contract, Shares, Islamic Capital Market.

Abstract: In 2018, it was reported that Islamic capital market (ICM) leads the Islamic finance industry growth with

Sukuk grew by CAGR of 9% and Islamic funds grew by CAGR of 16%. Due to the rapid growth of ICM in

Muslim countries, there is a need for more innovative products and services to meet the necessity of both

investors and players. In correspondence to that, there have been debates on whether share can be traded

using Salam contract in the secondary market. Using qualitative and quantitative method, this paper

examines the applicability of shares to be traded using Salam contract from Shariah perspective. It is

apparent that Salam in blue-chip shares could be a boon for a more innovative products in Islamic capital

market.

1 INTRODUCTION

Salam contract refers to a sale of deferred goods

with advance payment and is typically used for

financing agricultural products. However, there have

been numerous discussions by the classical scholars

exploring the possibilities to expand the application

of Salam contract in different type of commodities.

Share on the other hand is something that represent

ownership share in a corporation. In recent years,

corresponding with the development of Islamic

capital market in Muslims countries, there have been

debates on whether share can be traded using Salam

contract. Salam in shares is considered as nawazil

(contemporary issues) as it had never been discussed

by any classical scholars in the past.

Share as a Salam commodity is unique and

seemingly attractive to financial institutions. While

banks usually dispose exchanged commodity using

Parallel Salam or tawarruq arrangement (which

makes the trade seems superficial), with share, banks

can actually acquire and hold it to make profit out of

it. Such characteristic makes Salam in share a

potential alternative for the never-ending debates of

the commodity murabaha/tawarruq arrangement

and a boon for a more innovative product in Islamic

capital market.

This paper explores fiqhi (juristic) analysis on

whether share fulfills the requirements of muslam fih

(underlying asset of Salam contract). To date, there

are two authorized institutions namely Malaysian

Shariah Advisory Council (SAC) of Securities

Commission (SC) and Accounting and Auditing

Organization for Islamic Financial Institutions

(AAOIFI) which had issued resolutions on Salam in

shares. Interestingly, these two influential

institutions had a contradictory opinion towards the

subject matter. Thus this paper is an attempt to

deliberate and scrutinize existing opinions and

investigate the best approach to the issue of Salam in

shares.

2 LITERATURE REVIEW

Contemporary scholars dispute on the permissibility

of share as muslam fih in Salam contract. AAOIFI

(2017, p. 575) prohibited Salam in shares for four

reasons. The primary basis for the impermissibility

is that shares of corporations are ascertained thing

(‘ayn mu’ayyan) thus cannot be a liability.

Moreover, Salam in shares implies selling an

ascertained item that are not owned and this is not

permitted. Further, looking from the market

condition, one cannot guarantee the constant

availability and ability to deliver shares. These

elements failed shares from fulfilling muslam fih

requirements.

In addition to those arguments, Dr Mubarak Bin

Sulayman Aal Sulayman (2015, p.1478) pointed out

in his research presented to AAOIFI that shares are

exposed to sudden increase and decrease in price.

Radzi, S.

Trading of Shares via Salam Contract: An Exploratory Study.

DOI: 10.5220/0010120000002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 193-201

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

193

This high level of volatility in shares will let either

one of the parties be in a great chance of loss. He

also repudiated the analogic extrapolation of Salam

in shares with Salam in commodity from a specific

place arguing that shares are not a product of a

company rather they are part of the company itself,

unlike the extrapolated situation.

Taking into account both of the opinions that

recognise share as commodity and the other that see

share as representing a company’s asset, Dr Ahmad

bin Muhammad al-Khalil (2003, p.244 & 245) in his

book al-Ashum wa al-Sanadat wa Ahkamuha fi al-

Fiqhi al-Islamiy views that shares comply with all

the muslam fih requirements including the ability to

determine its attributes, availability and ability to

deliver. The only requirements that shares fail to

comply are the element of ascertainment and its

limitation in quantity. Interestingly, in contrast with

Dr Mubarak, Dr Ahmad equalises Salam in shares

with Salam in commodity from a specific

place/orchard though he is at the view that Salam in

commodity from a specific place is impermissible

hence Salam in shares carry the same ruling.

On the other side of the fence, the Shariah

Advisory Council (SAC) of Malaysian Securities

Commission (SC) (2009, vol.4, no.1, p.2-5) ruled

that shares satisfy the criteria of muslam fih. On the

issue of ‘ayn mu’ayyan, according to the SAC of SC,

mentioning the name of share is for the purpose of

distinguishing it from other shares and this is in

agreement with the muslam fih condition which

requires the muslam fih’s attribute to be specified.

However, there are circumstances that can render

shares to be ‘ayn mu’ayyan e.g. when buyer requests

to purchase shares from a specific person. The table

below explain some differences between unspecific

shares (ʿayn ghayr muʿayyan) and specific shares

(ʿayn muʿayyan):

Table 1: Comparison Between Unspecific Shares and

Specific Shares.

Source: Quarterly Bulletin of Malaysian ICM, 2009.

Further, on the deliverability of shares, they

claimed that delivery of shares at the promised date

can be ascertained based on what is already being

practised in regulated short selling (RSS).

Dr Ali bin Abdullah al-Wasabi (2017) in his

paper presented at “The 10th Future of Islamic

Banking Conference” entitled al-Salam fi al-Ashum

wa Qardhiha wa Ijaratiha wa I’aratiha wa Rahniha

concluded that Salam in shares is permissible. As

long as it’s a big, stable company, he opined that

specifying shares should not be a hindrance for

shares to be traded using Salam contract. This is

because the chances for such company to default in

delivery is low. Touching on the share’s price

volatility, he stated that it could happen to other type

of muslam fih as well and that minor disparity in the

attribute i.e. price is forgiven.

Another proponent of Salam in shares is Dr

Khalid Bin Muhammad al-Sayari (2017). He argued

that the basis for disallowing Salam in fruits from a

small and specific orchard is because the fear that

the fruit production may halt thus triggering default

in delivery. Relying on this argument, if the

company is big and the period of Salam is short it

will guarantee the delivery of shares hence it should

be permissible. Having said that, he outlined three

conditions to safeguard the

permissibility of Salam

in shares; 1) the period of Salam must be short term

according to the market custom, 2) the quantity of

the trading shares must be numerous and logically

able to be delivered and 3) the price paid must not in

a form of share to prevent from usury.

Methodology

This paper explores the applicability of trading share

using Salam contract from Shariah point of view.

Using qualitative analysis, data pertaining to muslam

fih requirements collected from primary and

secondary sources such as hadith and classical texts

are examined thoroughly. Different from previous

studies which focus on qualitative approach, this

paper attempts to delineate and analyze scholarly

write-ups and fatwas issued in both qualitative and

quantitative manner. Quantitative approach such as

calculating shares’ volatility using Standard

Deviation method.

3 DISCUSSION

In order to address and resolve the issue of Salam in

shares in the best manner, one must first

comprehend muslam fih’s requirements. Thus, a

section is dedicated to discuss the requirements of

muslam fih in the light of the four schools of

thought.

Unspecific Shares Specific Shares

Example Telekom shares listed on Bursa Malaysia Telekom shares listed on Bursa Malaysia but

belonging to Mr A

SAC of SC

Malaysia’s

views

The shares are not ‘ayn mu’ayyan because:

1 They are available

2 They are deliverable

3 Clearing and settlement are regulated

This is ‘ayn mu’ayyan because:

1 The request is very specific

2 There is a risk of non-delivery

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

194

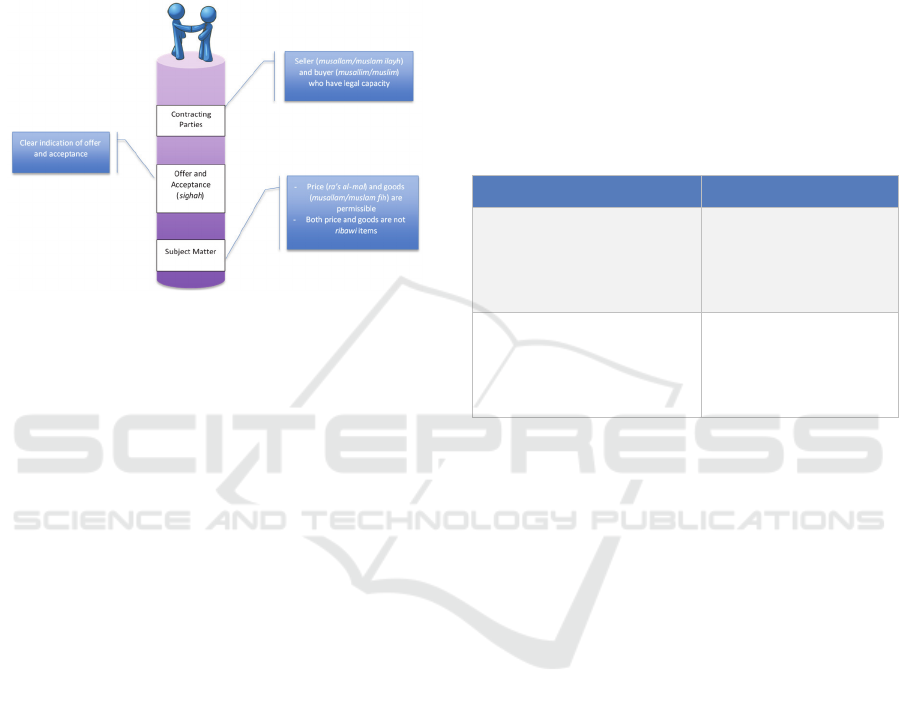

Requirements for Subject Matter in Salam

Contract

Salam, like other contracts of exchange (bai’),

comprises three pillars: (i) contracting parties, (ii)

form of the contract (offer and acceptance), and (iii)

subject matter of the contract. Figure 1 summarises

these pillars and their general conditions.

Figure 1: Pillars of Bai’.

This paper focuses mainly on the conditions of

Salam’s subject matter which refers to the

exchanged items, i.e. price (ra’s al-mal) and goods

(musallam/muslam fih). Different from other sale

contracts, there are additional specific conditions

and requirements that the subject matter of Salam

must adhere to. These conditions are vital in

promoting justice and fairness among the

contracting parties of the transaction. The following

subsection discusses the major requirements

stipulated for both price and goods.

Requirements of Ra’s Al-Mal

Ra’s al-Mal or price is a crucial element in any

exchange contract. It is a consideration for the

object/item/good sold. Scholars from the four

schools of Islamic jurisprudence agree that payment

in Salam must be done in advance to avoid the event

of selling debt for debt that is prohibited.

Nonetheless, there is a leniency in Maliki’s opinion

to postpone the payment. Khalīl ibn Ishaq (2005, p.

162) when mentioning about Salam’s condition

stated:

ﻁﺮﺸﺑ ﻮﻟﻭ ﺎﺛﻼﺛ ﻩﺮﻴﺧﺄﺗ

ْ

ﻭ

َ

ﺃ

ِ

ﻪ

ِ

ّ

ﻠ

ُ

ﻛ

ِ

ﻝﺎ

َ

ﻤ

ْ

ﻟﺍ

ِ

ﺱ

ْ

ﺃ

َ

ﺭ

ُ

ﺾْﺒ

َ

ﻗ :

ِ

ﻢ

َ

ﻠ

ﱠ

ﺴﻟﺍ

ِ

ﻁ

ْ

ﺮ

َ

ﺷ

“Condition of Salam contract: receive full

payment of the price or delay it up to three days

regardless if it is stipulated.”

The basis for allowing the delay in payment is

the maxim

‘ﻪﻤﻜﺣ ﻲﻄﻌﻳ ءﻲﺸﻟﺍ ﺏﺭﺎﻗ ﺎﻣ

’ which means

‘something that is close, take the same judgement’.

Relying on this maxim, Maliki scholars allow the

delay up to three days from the contracting day.

However, such relaxation is not permissible if the

period of Salam (i.e. delivery of the goods) is lesser

than the extended three days as it would not serve

the purpose of doing Salam contract (al-Dusuqi,

n.d.). Error! Reference source not found.

summarises the opinion of Malikis on this matter.

Table 2: Malikis Opinion on Delayed Payment of Ra’s al-

Mal.

Scenario Ruling

1 Transaction date: 1

st

July 2018

Delivery date: 31

st

July

2018

Delay in paying ra’s

al-mal is allowed up to 3

days

2 Transaction date: 1

st

July 2018

Delivery date: 3

rd

July

2018

Delay in paying ra’s

al-mal is NOT allowed

Requirements of Muslam Fih

Salam contract is actually an exception from the

general prohibition of sale of non-existent goods

(Bai’ Ma’dum). The hadith below depicts the

permissibility of Salam contract:

ﻰ

ﱠ

ﻠ

َ

ﺻ

ﱡ

ﻲ

ِ

ﺒ

ﱠ

ﻨﻟﺍ

َ

ﻡ

ِ

ﺪ

َ

ﻗ :

َ

ﻝﺎ

َ

ﻗ ،ﺎ

َ

ﻤ

ُ

ﻬ

ْ

ﻨ

َ

ﻋ

ُ

ﱠ

َ

ﻲ

ِ

ﺿ

َ

ﺭ

ٍ

ﺱﺎ

ﱠ

ﺒ

َ

ﻋ

ِ

ﻦْﺑﺍ

ِ

ﻦ

َ

ﻋ

ِ

ﻦْﻴ

َ

ﺘَﻨ

ﱠ

ﺴﻟﺍ

ِ

ﺮ

ْ

ﻤ

ﱠ

ﺘﻟﺎ

ِ

ﺑ

َ

ﻥﻮ

ُ

ﻔ

ِ

ﻠ

ْ

ﺴ

ُ

ﻳ

ْ

ﻢ

ُ

ﻫ

َ

ﻭ

َ

ﺔَﻨﻳ

ِ

ﺪ

َ

ﻤﻟﺍ

َ

ﻢ

ﱠ

ﻠ

َ

ﺳ

َ

ﻭ

ِ

ﻪْﻴ

َ

ﻠ

َ

ﻋ

ُ

ﷲ

،

ٍ

ﻡﻮ

ُ

ﻠ

ْ

ﻌ

َ

ﻣ

ٍ

ﻞْﻴ

َ

ﻛ ﻲ

ِ

ﻔ

َ

ﻓ ،

ٍ

ء

ْ

ﻲ

َ

ﺷ ﻲ

ِ

ﻓ

َ

ﻒ

َ

ﻠ

ْ

ﺳ

َ

ﺃ

ْ

ﻦ

َ

ﻣ»:

َ

ﻝﺎ

َ

ﻘ

َ

ﻓ ،

َ

ﺙ

َ

ﻼ

ﱠ

ﺜﻟﺍ

َ

ﻭ

ٍ

ﻡﻮ

ُ

ﻠ

ْ

ﻌ

َ

ﻣ

ٍ

ﻞ

َ

ﺟ

َ

ﺃ ﻰ

َ

ﻟ

ِ

ﺇ ،

ٍ

ﻡﻮ

ُ

ﻠ

ْ

ﻌ

َ

ﻣ

ٍ

ﻥ

ْ

ﺯ

َ

ﻭ

َ

ﻭ»

Ibn Abbas r.a narrated: The Prophet p.b.u.h

came to Medina and the people used to pay in

advance the price of dates to be delivered within two

or three years. He said (to them), "Whoever pays in

advance the price of a thing to be delivered later

should pay it for a specified measure at specified

weight for a specified period (al-Bukhari, 1422H,

vol. 3, p. 85).

It is believed that the wisdom behind the

prohibition of Bai’ Ma’dum is to prevent from

ambiguity and uncertainty (gharar) in transaction

which may lead to dispute between counterparties.

Salam contract on the other hand, is deemed

permissible - despite the absence of goods during the

transaction - to alleviate hardship and facilitate

financing for entrepreneurs that need capital to

Trading of Shares via Salam Contract: An Exploratory Study

195

operate their business. Therefore, to avoid dispute

which is the reason of the impermissibility of Bai’

Ma’dum, there are several conditions relating to the

muslam fih that must be adhered to.

Deriving from the abovementioned hadith, there

are two key conditions for muslam fih:

1. Its specification must exactly be known to both

parties; and

2. It must be capable to be delivered in the future.

The following paragraphs provide more detailed

explanation of these two requirements.

1. Specification of Muslam Fih

(a) Muslam fih must be a debt, and hence its

attributes must be precisely defined

(

ﻑﺎﺻﻭﺃ ﺔﻄﺒﻀﻨﻣ) to avoid any dispute in

the future.

This includes specifying the type of the

commodity, category, features, quality,

weight, measurement, etc. Ibn Qudamah

(1994, vol.2, p.62) explained the general

requirement of the specification:

ﻒﻠﺘﺨﻳ ﻲﺘﻟﺍ ﺕﺎﻔﺼﻟﺎﺑ ﻂﺒﻀﻨﻳ ﺎﻤﻣ ﻥﻮﻜﻳ ﻥﺃ

ً

ﺍﺮﻫﺎﻅ ﺎﻬﻓﻼﺘﺧﺎﺑ ﻦﻤﺜﻟﺍ

‘It should be an item/object which can be

specified via description of those features

due to the variance of which the price

changes.’

Some Hanafi jurists stipulated that the

subject matter of Salam must be a fungible

(mithliyyah) item. Al-Kasani (1986, vol. 5,

p. 218) stated:

،

ِ

ﺏﺎ

َ

ﻴ

ِ

ّ

ﺜﻟﺎ

َ

ﻛ

ُ

ﺕﺎ

ﱠ

ﻴ

ِ

ﻋ

ْ

ﺭ

ﱠ

ﺬﻟﺍ" ،

ِ

ﺮﻴ

ِ

ﺼ

َ

ﺤ

ْ

ﻟﺍ

َ

ﻭ ،

ِ

ﻂ

ُ

ﺴ

ُ

ﺒ

ْ

ﻟﺍ

َ

ﻭ

ُ

ﻢ

َ

ﻠ

ﱠ

ﺴﻟﺍ َﺯﻮ

ُ

ﺠ

َ

ﻳ

َ

ﻻ

ْ

ﻥ

َ

ﺃ

ُ

ﺱﺎ

َ

ﻴ

ِ

ﻘ

ْ

ﻟﺎ

َ

ﻓ ﺎ

َ

ﻫ

ِ

ﻮ

ْ

ﺤَﻧ

َ

ﻭ ﻱ

ِ

ﺭﺍ

َ

ﻮ

َ

ﺒ

ْ

ﻟﺍ

َ

ﻭ

"...

ِ

ﻝﺎ

َ

ﺜ

ْ

ﻣ

َ

ْ

ﻷﺍ

ِ

ﺕﺍ

َ

ﻭ

َ

ﺫ

ْ

ﻦ

ِ

ﻣ

ْ

ﺖ

َ

ﺴْﻴ

َ

ﻟ ﺎ

َ

ﻬ

ﱠ

ﻧ

َ

ِ

ﻷ ؛ﺎ

َ

ﻬﻴ

ِ

ﻓ

[Things that are measured by] arm’s

length like garment, carpet, mat, bawari

and et cetera are not allowed to do Salam

because these are not fungible items…

(b) Muslam fih should NOT be a specifically

identified and ascertained item )

ﻦﻴﻌﻣ ﻦﻴﻋ( .

Although muslam fih must be specified, it

cannot be too specific as it will bring

difficulty for the seller to fulfill the

request, thus triggering the element of

gharar when the seller is not able to

deliver the ‘debt’. The Shari’ah basis for

this requirement is the hadith of ‘Haʾiṭ

Banī Fulān’ (Orchard of the Kin of So and

So) narrated by Ibn Majah (n.d, vol. 2, p.

765), which mentions:

،

َ

ﻢ

ﱠ

ﻠ

َ

ﺳ

َ

ﻭ

ِ

ﻪْﻴ

َ

ﻠ

َ

ﻋ

ُ

ﷲ ﻰ

ﱠ

ﻠ

َ

ﺻ

ِ

ّ

ﻲ

ِ

ﺒ

ﱠ

ﻨﻟﺍ ﻰ

َ

ﻟ

ِ

ﺇ

ٌ

ﻞ

ُ

ﺟ

َ

ﺭ

َ

ءﺎ

َ

ﺟ

ﺍﻮ

ُ

ﻤ

َ

ﻠ

ْ

ﺳ

َ

ﺃ

ٍ

ﻥ

َ

ﻼ

ُ

ﻓ ﻲ

ِ

ﻨ

َ

ﺑ

ﱠ

ﻥ

ِ

ﺇ :

َ

ﻝﺎ

َ

ﻘ

َ

ﻓ-

ِ

ﺩﻮ

ُ

ﻬ

َ

ﻴ

ْ

ﻟﺍ

َ

ﻦ

ِ

ﻣ

ٍ

ﻡ

ْ

ﻮ

َ

ﻘ

ِ

ﻟ-

ﱠ

ﻧ

ِ

ﺇ

َ

ﻭ

ﱡ

ﻲ

ِ

ﺒ

ﱠ

ﻨﻟﺍ

َ

ﻝﺎ

َ

ﻘ

َ

ﻓ ،ﺍﻭ

ﱡ

ﺪ

َ

ﺗ

ْ

ﺮ

َ

ﻳ

ْ

ﻥ

َ

ﺃ

ُ

ﻑﺎَﺧ

َ

ﺄ

َ

ﻓ ،ﺍﻮ

ُ

ﻋﺎ

َ

ﺟ

ْ

ﺪ

َ

ﻗ

ْ

ﻢ

ُ

ﻬ

ٌ

ﻞ

ُ

ﺟ

َ

ﺭ :

َ

ﻝﺎ

َ

ﻘ

َ

ﻓ «؟

ُ

ﻩ

َ

ﺪ

ْ

ﻨ

ِ

ﻋ

ْ

ﻦ

َ

ﻣ» :

َ

ﻢ

ﱠ

ﻠ

َ

ﺳ

َ

ﻭ

ِ

ﻪْﻴ

َ

ﻠ

َ

ﻋ

ُ

ﷲ ﻰ

ﱠ

ﻠ

َ

ﺻ

ﺍ

َ

ﺬ

َ

ﻛ

َ

ﻭ ﺍ

َ

ﺬ

َ

ﻛ ﻱ

ِ

ﺪ

ْ

ﻨ

ِ

ﻋ :

ِ

ﺩﻮ

ُ

ﻬ

َ

ﻴ

ْ

ﻟﺍ

َ

ﻦ

ِ

ﻣ-

ُ

ﻩﺎ

ﱠ

ﻤ

َ

ﺳ

ْ

ﺪ

َ

ﻗ

ٍ

ء

ْ

ﻲ

َ

ﺸ

ِ

ﻟ-

َ

ﻭ ﺍ

َ

ﺬ

َ

ﻛ

ِ

ﺮ

ْ

ﻌ

ِ

ﺴ

ِ

ﺑ

ٍ

ﺭﺎَﻨﻳ

ِ

ﺩ

ِ

ﺔ

َ

ﺋﺎ

ِ

ﻤ

ُ

ﺛ

َ

ﻼ

َ

ﺛ :

َ

ﻝﺎ

َ

ﻗ

ُ

ﻩﺍ

َ

ﺭ

ُ

ﺃ

ْ

ﻦ

ِ

ﻣ ﺍ

َ

ﺬ

َ

ﻛ

ِ

ﻪْﻴ

َ

ﻠ

َ

ﻋ

ُ

ﷲ ﻰ

ﱠ

ﻠ

َ

ﺻ

ِ

ﱠ

ُ

ﻝﻮ

ُ

ﺳ

َ

ﺭ

َ

ﻝﺎ

َ

ﻘ

َ

ﻓ ،

ٍ

ﻥ

َ

ﻼ

ُ

ﻓ ﻲ

ِ

ﻨ

َ

ﺑ

ِ

ﻂ

ِ

ﺋﺎ

َ

ﺣ

، ﺍ

َ

ﺬ

َ

ﻛ

َ

ﻭ ﺍ

َ

ﺬ

َ

ﻛ

ِ

ﻞ

َ

ﺟ

َ

ﺃ ﻰ

َ

ﻟ

ِ

ﺇ ﺍ

َ

ﺬ

َ

ﻛ

َ

ﻭ ﺍ

َ

ﺬ

َ

ﻛ

ِ

ﺮ

ْ

ﻌ

ِ

ﺴ

ِ

ﺑ» :

َ

ﻢ

ﱠ

ﻠ

َ

ﺳ

َ

ﻭ

«

ٍ

ﻥ

َ

ﻼ

ُ

ﻓ ﻲ

ِ

ﻨ

َ

ﺑ

ِ

ﻂ

ِ

ﺋﺎ

َ

ﺣ

ْ

ﻦ

ِ

ﻣ

َ

ﺲْﻴ

َ

ﻟ

َ

ﻭ

A man came to the Prophet (peace be upon

him) and said: ‘The kin of so and so from

the Jews had embraced Islam. However,

they are hungry, and I am afraid they may

become

apostates’. The Prophet (peace be

upon him) asked the people around him;

‘Who has something [money]?’ One Jew

said: ‘I have so and so (he mentioned a

sum of money), maybe he said; “I have

three hundred dinars and I will pay such

and such price for the products of the farm

of the kin of so and so’. The Prophet

(peace be upon him) said: “[buy] with

such and such price to be delivered after

such and such period, but not for the

products of the kin of so and so’.

Based on this hadith, Error! Reference

source not found. illustrates some

examples of specification of muslam fih

that are allowed and disallowed.

Table 3: Types of Specification in Muslam Fih.

Scenario Status of specification

1 (i) I want to buy a gold iPhone7 Plus with

the serial number x431278901

Too specific as only one iPhone will have that serial number

(ii) I want to buy a gold iPhone 7 Plus with

a storage of 128GB

Attributes and characteristics are defined but NOT too specific

2 (i) I want to buy 100kg of green apple from

a tree located in orchard A of Cameron

Highland

Too specific as there is only one orchard A in Cameron Highland

(ii) I want to buy 100kg of green apple from

an orchard located in Cameron Highland

Attributes and characteristics are defined but NOT too specific

3 (i) I want to buy Proton’s SUV model X70,

Premium 2WD, Snow White colour from

Car Dealer A in Kuala Lumpur

Too specific as there is only one car dealer A in Kuala Lumpur

(ii) I want to buy Proton’s SUV model X70,

Premium 2WD, Snow White colour

Attributes and characteristics are defined but NOT too specific

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

196

From these examples, it is apparent that

mentioning the name of a manufacturer or a

supplier is deemed too specific like ‘the fruit of

particular tree’ or ‘the product of a particular

farm’ as mentioned in the hadith of Haʾit Bani

Fulan. However, there is a commentary from

Imam Malik r.a (1994, vol. 3, p. 56) which

states:

َ

ﻼ

َ

ﻓ

ِ

ﻪﻴ

ِ

ﻓ

َ

ﻒ

ِ

ّ

ﻠ

ُ

ﺳ ﻱ

ِ

ﺬ

ﱠ

ﻟﺍ

ُ

ﻂ

ِ

ﺋﺎ

َ

ﺤ

ْ

ﻟﺍ

َ

ﻚ

ِ

ﻟ

َ

ﺫ ﻰ

َ

ﻫ

ْ

ﺯ

َ

ﺃ ﺍ

َ

ﺫﺇ

ٍ

ﻂ

ِ

ﺋﺎ

َ

ﺣ

ِ

ﺮ

َ

ﻤ

َ

ﺛ ﻲ

ِ

ﻓ

َ

ﻒ

ِ

ﻠ

ْ

ﺴ

ُ

ﻳ

ْ

ﻥ

َ

ﺃ

ُ

ﺢ

ُ

ﻠ

ْ

ﺼ

َ

ﻳ

َ

ﻻ

َ

ﻭ

َ

ﻚ

ِ

ﻟ

َ

ﺬ

ِ

ﺑ

َ

ﺱ

ْ

ﺄ

َ

ﺑ

.

َ

ﻲ

ِ

ﻫ

ْ

ﺰ

ُ

ﻳ

ْ

ﻥ

َ

ﺃ

َ

ﻞْﺒ

َ

ﻗ

ِ

ﻪ

ِ

ﻨْﻴ

َ

ﻌ

ِ

ﺑ

If the orchard has blossomed, then there is

nothing wrong to do Salam with it, but if it is yet

to blossom, it is not appropriate to do Salam

with fruits from a specific orchard.

Ibn Rushd (2004, vol. 3, p. 221) states that

Imam Malik allows mentioning the name of

village which the subject matter is produced if

the existing of the subject matter is guaranteed

upon the time of delivery;

ﻢﻠﺴﻟﺍ ﻚﻟﺎﻣ ﺯﺎﺟﺃﻭ :ﻦﻴﻌﻣ ﻲﻓ ﻥﻮﻜﻳ ﻻ ﻪﻧﺃﻭ

،ﺔﻧﻮﻣﺄﻣ ﺖﻧﺎﻛ ﺍﺫﺇ ﺔﻨﻴﻌﻣ ﺔﻳﺮﻗ ﻲﻓ ﺎﻫﺁﺭ ﻪﻧﺄﻛﻭ

ﺔﻣﺬﻟﺍ ﻞﺜﻣ

The subject matter cannot be specified:

However, Imam Malik permitted specifying a

village if it is safe [minimal risk of delivery

failure], as if he considered it tantamount to

[any other specify] liability.

Thus, based on some Malikis’ opinion, it is

permissible to specify the producer of the item or

the place where the item is produced if its

production is guaranteed and is being able to be

delivered on the agreed date.

2. Deliverability of Muslam Fih

(a) Date of delivery

It is clearly mentioned in the hadith of Ibn

‘Abbas that along with the criteria of

muslam fih, date or time of delivery must

be known to both parties. There is no

dispute on this.

(b) Availability of Muslam Fih

The opinions of scholars vary when it

comes to availability of the commodity.

Hanafi’s requirement is the most stringent

whereby the muslam fih must be available

on the transaction day until the date of

delivery. According to Ibn Mazah (2004,

vol.7 p.71), commodity that is inconsistent

in its availability is not allowed to be

traded by Salam contract:

ﻰﻟﺇ ﺪﻘﻌﻟﺍ ﺖﻗﻭ ﻦﻣ

ً

ﺍﺩﻮﺟﻮﻣ ﻪﻴﻓ ﻢﻠﺴﻤﻟﺍ ﻥﻮﻜﻳ ﻥﺃ

ﺯﻮﺠﻳ ﻻ ﻊﻄﻘﻨﻤﻟﺍ ﻲﻓ ﻢﻠﺴﻟﺍ ﻥﺃ ﻰﺘﺣ ﻞﺟﻷﺍ ﻞﺤﻣ ﺖﻗﻭ

ﺎﻨﺒﻫﺬﻣ ﺍﺬﻫﻭ.

The muslam fih must be in existence from

the day of the contract [is concluded] until

the day of delivery. To do Salam on things

that is intermittent in its existence is not

allowed and this is our mazhab.

Scholars from Hanbali stipulated that the

muslam fih must usually be safe from

shortage. Ibn Qudamah (1994, vol.2, p.65)

says:

ﻥﻮﻜﻳ ﻥﺃ ،ﻪﻠﺤﻣ ﻲﻓ ﺩﻮﺟﻮﻟﺍ ﻡﺎﻋ ﻪﻴﻓ ﻢﻠﺴﻤﻟﺍ

ﻪﻴﻓ ﻉﺎﻄﻘﻧﻻﺍ ﻥﻮﻣﺄﻣ

The muslam fih must be normally existent

and safe from shortage.

It is justified that the condition provides

assurance in the deliverability of muslam

fih.

Unlike Hanafi and Hanbali, Shafi’i and

Maliki scholars view that the commodity

does not necessarily has to be in presence

throughout the period of Salam but enough

to be available at the time of delivery. The

ability to deliver, as mentioned by Imam

al-Nawawi (1991, vol.4, p.11) means the

ability to perform delivery on the day

promised;

ِ

ﻪ

ِ

ﺑﻮ

ُ

ﺟ

ُ

ﻭ

َ

ﺪ

ْ

ﻨ

ِ

ﻋ

ِ

ﻢﻴ

ِ

ﻠ

ْ

ﺴ

ﱠ

ﺘﻟﺍ ﻰ

َ

ﻠ

َ

ﻋ

ُ

ﺓ

َ

ﺭ

ْ

ﺪ

ُ

ﻘ

ْ

ﻟﺍ

ُ

ﺮ

َ

ﺒ

َ

ﺘ

ْ

ﻌ

ُ

ﺗ ﺎ

َ

ﻤ

ﱠ

ﻧ

ِ

ﺇ

َ

ﻭ .

The ability to deliver means [the ability to

deliver] when it is obligatory.

Trading of Shares via Salam Contract: An Exploratory Study

197

Al-Dusuqi (n.d. vol.3, p.211) further

delineates Maliki opinion on this as he

says:

(

ِ

ﻞ

َ

ﺟ

َ

ْ

ﻷﺍ

ِ

ﻊﻴ

ِ

ﻤ

َ

ﺟ ﻲ

ِ

ﻓ

ُ

ﻩُﺩﻮ

ُ

ﺟ

ُ

ﻭ

ُ

ﻁ

َ

ﺮ

َ

ﺘ

ْ

ﺸ

ُ

ﻳ

َ

ﻻ

َ

ﻭ

ُ

ﻪ

ُ

ﻟ

ْ

ﻮ

َ

ﻗ)

ُ

ﻁ

ْ

ﺮ

ﱠ

ﺸﻟﺍ

ْ

ﻞ

َ

ﺑ

ْ

ﻱ

َ

ﺃ

ِ

ﻪ

ِ

ﻠﻴ

ِ

ﺼ

ْ

ﺤ

َ

ﺗ ﻰ

َ

ﻠ

َ

ﻋ

ُ

ﺓ

َ

ﺭ

ْ

ﺪ

ُ

ﻘ

ْ

ﻟﺍ

ْ

ﻱ

َ

ﺃ

ُ

ﻩُﺩﻮ

ُ

ﺟ

ُ

ﻭ

ْ

ﻞ

َ

ﺑ

ِ

ﻞ

َ

ﺟ

َ

ْ

ﻷﺍ

ِ

ءﺎَﻨ

ْ

ﺛ

َ

ﺃ ﻲ

ِ

ﻓ

َ

ﻊ

َ

ﻄ

َ

ﻘ

ْ

ﻧﺍ

ْ

ﻮ

َ

ﻟ

َ

ﻭ

ِ

ﻞ

َ

ﺟ

َ

ْ

ﻷﺍ

ِ

ﻝﻮ

ُ

ﻠ

ُ

ﺣ

َ

ﺪ

ْ

ﻨ

ِ

ﻋ

ِ

ﺾْﺒ

َ

ﻘ

ْ

ﻟﺍ

ِ

ﺖ

ْ

ﻗ

َ

ﻭ ﺍ

َ

ﺪ

َ

ﻋ ﺎ

َ

ﻣ

ِ

ﻪ

ِ

ﻣﺎ

َ

ﻤ

َ

ﺘ

ِ

ﺑ

ِ

ﻞ

َ

ﺟ

َ

ْ

ﻷﺍ ﻲ

ِ

ﻓ

َ

ﻊ

َ

ﻄ

َ

ﻘ

ْ

ﻧﺍ

ْ

ﻮ

َ

ﻟ

َ

ﻭ

(He said that the existence [of muslam fih]

is not stipulated to be throughout the

entire period [of Salam contract]) this

means that the condition of existence

means the ability to receive [the muslam

fih] at the promised time regardless if its

existence ceased [sometimes] within the

period or even throughout the whole

period [of Salam contract] but not on the

day of the delivery.

In a nutshell, Salam commodity should

under normal circumstances be available

in the place/market and it is safe from

being unavailable or short of supply.

Certainly, it must be present at the date of

delivery.

(c) Mode of delivery

With regard to the mode of delivery, all

the three schools of thought namely

Hanafi, Maliki and Hanbali require the

commodity to be delivered on a deferred

basis. According to Al-Sarkhasī (1993,

vol.12, P.128):

َ

ﻻ

ُ

ﻪ

ﱠ

ﻧ

َ

ﺃ ﺎَﻨ

ْ

ﻓ

َ

ﺮ

َ

ﻌ

َ

ﻓ

ً

ﻼ

ﱠ

ﺟ

َ

ﺆ

ُ

ﻣ

ﱠ

ﻻﺇ

ُ

ﺯﻮ

ُ

ﺠ

َ

ﻳ

َ

ﻻ

ُ

ﻢ

َ

ﻠ

ﱠ

ﺴﻟﺍ

َ

ﻭ

ﺎ

َ

ﻤ

ﱠ

ﻧ

ِ

ﺇ

َ

ﻭ

ٍ

ﻝﺎ

َ

ﺤ

ِ

ﺑ

ِ

ﻪﻴ

ِ

ﻓ

ِ

ﺪ

ْ

ﻘ

َ

ﻌ

ْ

ﻟﺍ

َ

ﺐﻴ

ِ

ﻘ

َ

ﻋ

ُ

ﻢﻴ

ِ

ﻠ

ْ

ﺴ

ﱠ

ﺘﻟﺍ

ﱡ

ﻖ

َ

ﺤ

َ

ﺘ

ْ

ﺴ

ُ

ﻳ

...

ِ

ﻞ

َ

ﺟ

َ

ْ

ﻷﺍ

ِ

ﻝﻮ

ُ

ﻠ

ُ

ﺣ

َ

ﺪ

ْ

ﻨ

ِ

ﻋ

ِ

ﻢﻴ

ِ

ﻠ

ْ

ﺴ

ﱠ

ﺘﻟﺍ

ُ

ﻕﺎ

َ

ﻘ

ْ

ﺤ

ِ

ﺘ

ْ

ﺳﺍ

And Salam contract is impermissible

except [that it must be] in deferred. Thus,

we knew that delivery cannot be done

immediately after the contract [concluded]

but it must be delivered when the time due.

Meanwhile, Imam al- Shafiʿi in his book,

al-Umm allows and even encouraged

muslam fih delivery to be on the spot

(1990, vol.3, p.97):

َ

ﻥﻮ

ُ

ﻜ

َ

ﻳ

ْ

ﻥ

َ

ﺃ

َ

ﻭ َﺯﺎ

َ

ﺟ

ٍ

ﻞ

َ

ﺟ

َ

ﺃ ﻰ

َ

ﻟﺇ

َ

ﻥﻮ

ُ

ﻜ

َ

ﻳ

ْ

ﻥ

َ

ﺃ

َ

ﺭﺎ

َ

ﺘ

ْ

ﺧﺍ

ْ

ﻥ

ِ

ﺈ

َ

ﻓ

َﺯﻮ

ُ

ﺠ

َ

ﻳ

ْ

ﻥ

َ

ﺃ ﻰ

َ

ﻟ

ْ

ﻭ

َ

ﺃ

ﱡ

ﻝﺎ

َ

ﺤ

ْ

ﻟﺍ

َ

ﻥﺎ

َ

ﻛ

َ

ﻭ

ﻻﺎ

َ

ﺣ…

If he choses [to deliver] on a certain date

then it is permissible or if it is now, then

[to deliver] now is more appropriate to be

allowed…

Imam al- Shafiʿi mentioned two bases

for his argument. First because Salam al-

Hal or Salam with spot delivery is more

guaranteed and hence, the earlier the buyer

receive his goods, the smaller the chance

of getting involve with uncertainties.

However, this come with a condition that

the muslam fih must be available on the

time of transaction (Mughni al-Muhtaj, al-

Sharbini, 1994, vol.3 p. 8).

After having robust understanding on

the requirements and conditions of muslam

fih, the proceeding section will examine

whether shares―being a financial

instrument that has not been mentioned in

any classical texts―qualify to becoming

an object of sale in Salam.

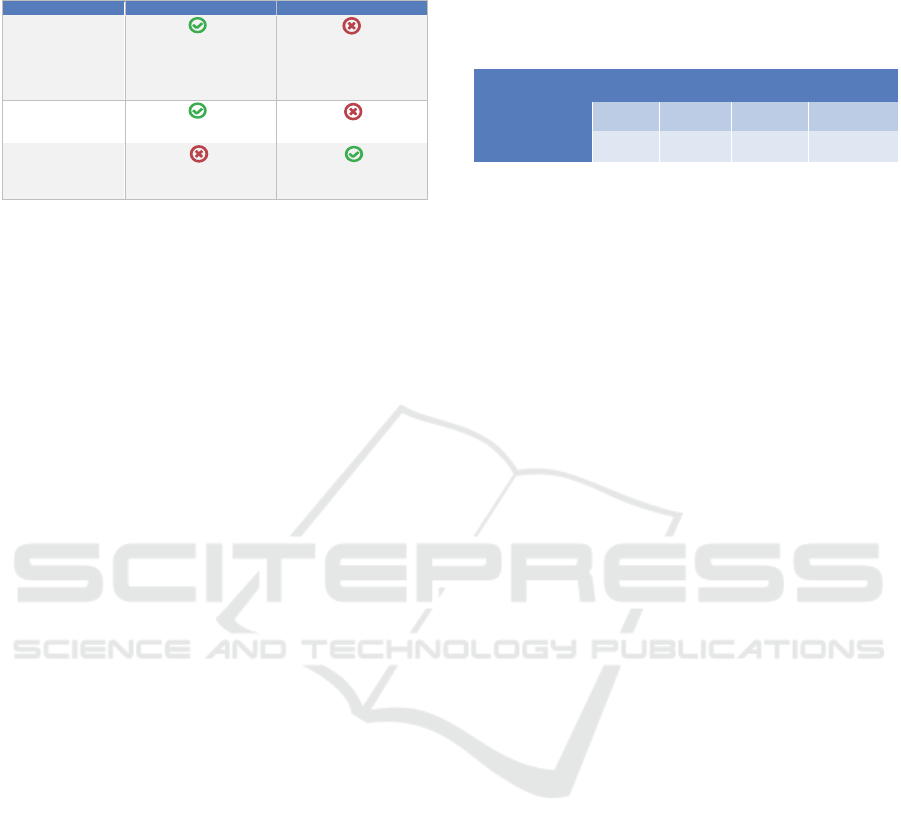

Author’s View

First, from the contemporary scholars’ opinion on

Salam using shares, the author deduced that their

arguments revolve around the same issues but from

different perspectives as summarised in

From the author’s viewpoint, the key raison

d’etre in prohibiting Salam in shares is due to high

possibility of delivery failure which may arise either

because it is too specific or because of its shortage

or non-availability. Consequently, this gharar would

lead to disagreement and dispute between

contracting parties in the future.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

198

Table 4: Justifications on the Permissibility and

Impermissibility of Salam Using Shares.

Source: Author’s own.

Nevertheless, if this ‘illah of prohibition can be

eliminated or at least minimised, shares should be

allowed for trading in Salam. This is based on the

legal maxim that says

‘ﻉﻮﻨﻤﻤﻟﺍ ﺩﺎﻋ ،ﻊﻧﺎﻤﻟﺍ ﻝﺍﺯ ﺍﺫﺇ’

which means ‘when the impediment is removed, the

original Shari’ah rule is restored to full effect’ (al-

Zarqa, 1989, p. 191). The following paragraphs

provide justifications to support and establish this

argument.

1. Shares and Specification

As mentioned earlier, the most debatable issue

regarding the permissibility of Salam using

shares is whether they are considered as

specific items or not. While the AAOIFI

classifies shares as specific items because the

company’s name is specified in the transaction

hence, it cannot be traded using Salam

contract, the SAC of SC Malaysia argues that

stating the company’s name is not deemed as

too specific. It is when the owner’s name being

mentioned that the share is considered as too

specific.

Based on all the justifications given above, it

can be concluded that there is a positive

possibility of letting Salam to be used in shares

particularly blue-chip shares. It has also been

proven that shares issued by big companies are

capable of becoming liability thus, the issue of

‘ayn mu’ayyan is solved.

Now based on that, does specifying shares

triggers uncertainty in delivery? The following

section will continue to discuss.

2. Availability of Shares

In the previous quote of Imam Malik regarding

specification, it is understood that specifying a

village of muslam fih is permissible if it is safe

from delivery failure. In terms of availability of

shares, large and stable companies i.e. blue-

chip companies, and large stock exchanges

often have a dynamic movement in shares

trading compared to the smaller one. This is

evident by the comparison of Average Trading

Volume (ATV) for Blue-Chip and Non Blue-

Chip Company as below:

Table 5: Example of Average Trading Volume for Blue-

Chip and Non Blue-Chip Company.

Source: finance.yahoo.com, 2019.

ATV is the average number of shares traded

in a particular time frame. The low and high of

the trading volume reflects the liquidity,

competitivity and also the volatility of shares.

As seen in Table 5, the ATV for Tenaga

Nasional Berhad (TNB) and Al-Rajhi are more

vibrant and higher compared to the Non Blue-

Chip companies. This indicates that both shares

are more liquid, competitive and stable in

comparison to Focus Point and Tihama.

With regards to deliverability of shares, a

research held by Kasri & Lukman (2017) on

Bursa Malaysia exchange discovers that the

default risk in shares delivery is notably trivial.

It is quoted that:

In 2015, out of 2,378,328 registered stock

trades, only 56 transactions went into default

due to seller’s failure to deliver the securities

on the settlement date. The clearing house was

also not able to deliver the securities via the

buying-in mechanism and thus had to go

through the cash settlement mechanism. The 56

failed transactions represent about

0.002354595% of the total transactions in

2015.

Based on all the justifications given above,

it can be concluded that there is a positive

possibility of letting Salam to be used in shares

particularly blue-chip shares. It has also been

proven that shares issued by big companies are

capable of becoming liability thus, the issue of

‘ayn mu’ayyan is solved.

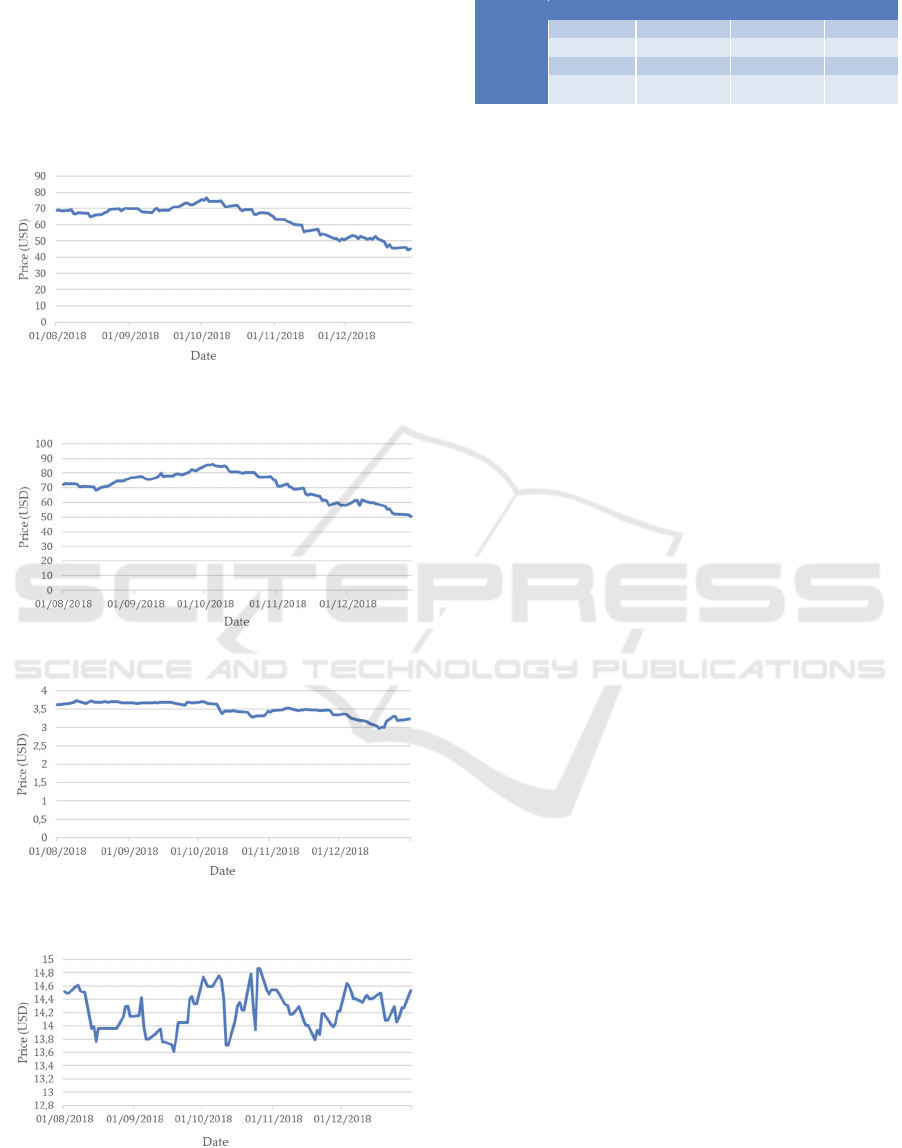

3. Price Fluctuation in Shares

Next, the ever-fluctuating behavior in share’s price.

As highlighted in the previous section, price

fluctuation happens in other commodity as well. Oil

for example has high volatility yet it is permissible

to be used as the underlying asset for Salam

Justifications Opponents Proponents

Shares being specific items

(ʿayn muayyan)

Mentioning the company’s name is

considered as specific

Mentioning the company’s name is part of

identifying share’s attribute. It is rather

mentioning the name of the share’s owner

that is deemed as specific.

Risks due to price fluctuation

Shares in general are high in volatility

Price fluctuation is normal in goods

Deliverability of shares

Deliverability can’t be guaranteed as it is

prone to supply shortage.

Stock market high regulation minimize the

risk of default.

Company

Blue-chip Company Non Blue-chip Company

TNB Al-Rajhi Focus Point Tihama

Average Trading Volume 9, 065, 320 7, 109, 422 643, 134 146, 292

Trading of Shares via Salam Contract: An Exploratory Study

199

transaction. Charts 1 and 2 depict the daily price

fluctuation in oil i.e. Western Texas Intermediate

(WTI) and Brent Crude Oil. Whilst charts 3 to 6

show daily price fluctuation in blue-chip shares i.e.

Tenaga Nasional Berhad and Al-Rajhi as well as non

blue-chip shares i.e. Gamuda Bhd and IJM

Corporation Bhd from the month of August until

December 2018

.

Chart 1: Western Texas Intermediate. Source: U.S. Energy

Information Administration, 2018.

Chart 2: Brent Crude Oil. Source: Macrotrends, 2018.

Chart 3: Tenaga Nasional Berhad. Source: Bloomberg,

2019.

Chart 4: Al-Rajhi Bank. Source: Bloomberg, 2019.

Table 6.

The table above depicts the daily variance, daily

volatility and annualized volatility occur in all the

four shares. TNB shares’ daily and annualized

volatility is the lowest compared to the rest variables

(smaller number indicates more stability in price i.e.

low volatility). Interestingly, even though Al-Rajhi’s

chart seems fluctuating vigorously, the standard

deviation calculation proves the otherwise. WTI

apparently has the highest volatility followed by

Brent Crude Oil and Al-Rajhi in those five months.

Although this finding challenges the mentioned

argument, it is irrefutable that price fluctuation in

blue chip stocks is lower compared to stocks of

smaller companies. The latter is more volatile, hence

exposing to a greater risk.

As an addition, both of the counterparties in

shares trading are equally exposed and well

informed on the shares’ pricing and risk associated.

This further reduces the element of gharar in the

transaction. Ibn Sirin and al-Sya’bi when they were

asked about Bai’ Gharar both agreed that

information is an essential criterion that determine

the legality of a transaction:

َ

ﻳ ﻰ

ﱠ

ﺘ

َ

ﺣ

ُ

ﻪ

ُ

ﻌْﻴ

َ

ﺑ

ُ

ﺯﻮ

ُ

ﺠ

َ

ﻳ

َ

ﻻﻱ

ِ

ﺮ

َ

ﺘ

ْ

ﺸ

ُ

ﻤ

ْ

ﻟﺍ

ُ

ﻢ

َ

ﻠ

ْ

ﻌ

َ

ﻳ ﺎ

َ

ﻣ

ُ

ﻊ

ِ

ﺋﺎ

َ

ﺒ

ْ

ﻟﺍ

َ

ﻢ

َ

ﻠ

ْ

ﻌ.

The trade is not permissible until the seller knows

what buyer knows (Abu Bakar, 1409H, vol.4, p.312)

4 CONCLUSION

This paper discussed Fiqh’s stance on Salam in

shares. It finds that there is dispute between

contemporary scholars on the permissibility of

trading shares using Salam contract. The dispute

revolves mainly among the following issues (i)

ascertainment of the subject matter; (ii)

inconsistency of its attributes; (iii) volatility in price;

and (iv) high probability to default in delivery.

These disputed areas

(ﻉﺍﺰﻨﻟﺍ ﻞﺤﻣ)

in determining

muslam fih, have always been a nonunanimous issue

since the time of the classical scholars. To address

these issues in shares, the paper had looked into both

classical texts and real data to then compare it with

the concerns raised. Accordingly, this paper finds

that blue-chip stock fairly comply with muslam fih’s

Oil Blue Chip Company

Name WTI Brent Crude Oil TNB Al-Rajhi

Daily variance 0.049102% 0.041807% 0.015988% 0.020475%

Daily volatility 2.215893% 2.044688% 1.264421% 1.430923%

Annualized

volatility

35.04% 32.33% 19.99% 22.62%

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

200

requirement and inclines toward allowing Salam in

it.

In conclusion, Salam contract was first approved

to remove hardship and protect the maslahah of

farmers. This beautiful form of consideration and

compassion should not be limited to support

agriculture activities only. Especially in this modern

and complex era, any commodity that complies with

the requirements should be considered to use Salam

contract. Hopefully, this fiqhi position will bring the

current divergence in Salam in shares ruling to a

point of convergence and sparks more innovations in

Islamic capital market.

REFERENCES

Abu Bakar, A.S. (1409), Musnaf Ibn Abi Syaibah,

Maktabah al-Rusyd, Riyadh.

Accounting and Auditing Organization for Islamic

Financial Institutions (AAOIFI) (2017), Shari’ah

Standards, AAOIFI, Bahrain.

Al-Bukhari, M.I. (1422H), Sahih al-Bukhari, Dar Tawq al-

Najah, Beirut.

Al-Dusuqi, M.A. (n.d), Hashiyah al-Dusuqi ‘ala al-

Shyarhi al-Kabir, Dar al-Fikr, (n.p.)

Al-Kasani, A. (1986), Badaie’ al-Sonaie’ fi Tartib al-

Sharaie’, Dar al-Kutub al-‘Ilmiyyah, (n.p).

Ahmad bin Muhammad alAl-Khalil, A. (2003), al-Ashum

wa al-Sanadat wa Ahkamuha fi al-Fiqhi al-Islamiy,

Dar Ibn al-Jauzy, Saudi Arabia.

Al-Nawawi, Z.M. (1991), Raudhah al-Tolibin wa

‘Umdatu al-Muftin, al-Maktab al-Islamiy, Beirut.

Al-Sarkhasi, M.A. (1993), al-Mabsuṭ, Dar al-Maʿrifah,

Beirut.

Khalid bin Mohamed Al-Sayari, K. (2017), “al-Mithly wa

al-Qimiy wa ‘Alaqatihima bi al-Ashum”, paper

presented at “The 10

th

Future of Islamic Banking

Conference”, Jeddah, pp. 51-76.

Al-Shafiʿi, M.I. (1990), al-Umm, Daār al-Maʿrifah, Beirut.

Al-Sharbini, M. (1994), Mughni al-Muhtaj ila Ma’rifati

Ma’ani Alfadz al-Minhaj, Dar al-Kutub al-Ilmiyyah,

Beirut.

Ali bin Abdullah Aal-Wasabi, A. (2017), “al-Salam fi al-

Ashum wa Qardhiha wa Ijaratiha wa I’aratiha wa

Rahniha”, paper presented at “The 10

th

Future of

Islamic Banking Conference”, Jeddah, pp. 124-168.

Bloomberg. (2019) Bloomberg Professional. Available

at: Subscription Service (Accessed: March 2019).

Ibn Majah, M.Y. (n.d), Sunan Ibn Majah, Dar Ihya al-

Kutub al-‘Arabiyyah, (n.p.).

Ibn Mazah B.M. (2004), al-Muhit al-Burhani fi al-Fiqh al-

Nu’mani, Dar al-Kutub al-‘Ilmiyyah, Beirut.

Ibn Qudamah A. (1994), al-Kafi Fi Fiqh al-Imam Ahmad,

Dar Kutub al-Ilmiyyah, (n.p).

Ibn Rushd M.A. (2004), Bidayah al-Mujtahid Wa Nihayah

al-Muqtasid, Dar al-Hadith, Cairo.

Kasri N.S., Lukman B. (2017), “Contra Trading in Bursa

Malaysia Securities Berhad: A Shari’ah and Legal

Appraisal”, International Shariah Research Academy

for Islamic Finance (ISRA), Kuala Lumpur, Malaysia.

Khalil ibn Ishaq, (2005), Mukhtaṣar Khaliīl, Dar al-

Hadith, Cairo.

Macrotrends (2018), “Brent Crude Oil Prices – 10 Year

Daily Chart”, available at:

https://www.macrotrends.net/2480/brent-crude-oil-

prices-10-year-daily-chart (accessed 2018).

Malik bin Anas (1994), al-Mudawwanah, Dar al-Kutub al-

‘Ilmiyyah, Beirut, Lebanon.

Mubarak bin Sulaiman Aal Sulaiman (2015), Dirasat al-

Ma’ayir al-Syar’iyyah, AAOIFI, Bahrain.

Securities Commission (2009), Quarterly Bulletin of

Malaysian Islamic Capital Market, Securities

Commission Malaysia, Kuala Lumpur, Malaysia.

U.S. Energy Information Administration (2018), “Crude

Oil Prices: West Texas Intermediate (WTI) - Cushing,

Oklahoma [DCOILWTICO]”, available at:retrieved

from https://www.eia.gov/dnav/pet/hist/RWTCD.htm.

(accessed 2018)

Yahoo Finance (2019), “Al Rajhi Banking and Investment

Corporation”, available at:

https://finance.yahoo.com/quote/1120.SR/ (accessed

22 October 2019).

Yahoo Finance (2019), “FOCUSP”, available at:

https://finance.yahoo.com/quote/0157.kl/ (accessed 22

October 2019).

Yahoo Finance (2019), “Tenaga Nasional Berhad”,

available at:

https://finance.yahoo.com/quote/5347.KL?p=5347.KL

(accessed 22 October 2019).

Yahoo Finance (2019), “Tihama Advertising and Public

Relations Co.”, available at:

https://finance.yahoo.com/quote/4070.SR/ (accessed

22 October 2019).

https://www.investing.com/equities/ijm-corporation-bhd-

historical-data

https://www.investing.com/equities/gamuda-bhd-

historical-data

Trading of Shares via Salam Contract: An Exploratory Study

201