Achieving the Maqasid of Islamic Finance through Social Impact

Bonds (SIB) and Sustainable and Responsible Investment (SRI)

Sukuk

Syed Marwan

1

, Aslam Haneef

2

, Engku Rabiah Adawiah

1

and Suhaiza Ismail

2

1

IIUM Institute of Islamic Banking and Finance (IIiBF), Malaysia

2

IIUM Kulliyyah of Economics and Management Science, Malaysia

Keywords: Social Impact Bond (SIB), Sustainable and Responsible Investment (SRI) Sukuk, Social Finance, Maqasid

Al-Shari‘Ah, Maslahah.

Abstract: This paper looks into the underlying principles of Social Impact Bond (SIB) and Sustainable and

Responsible Investment (SRI) sukuk as compared to the values embodied within maqasid al-Shari‘ah and

maslahah. Through a critical review of literature related to SIB, SRI sukuk, maqasid al-Shari'ah and

maslahah, the paper attempts to delineate the elements embedded within these financial tools from an

Islamic perspective. The paper explicates that SIB and SRI sukuk are financial mechanisms that epitomises

the ethical and moral framework of the Shari‘ah as their underlying principles are congruent with the

concepts within maqasid al-Shari'ah and maslahah. Thus, the SIB and SRI sukuk models should be given

more attention by Islamic banks and Islamic financial institutions whose philosophical foundation is built

upon the principles of maqasid al-Shari'ah and maslahah.

1 INTRODUCTION

In recent years, the Social Impact Bond (SIB) and

Sustainable and Responsible Investment (SRI) sukuk

models have been receiving increasing global

interest, especially from governments which are

looking to find alternative financing models to help

cover their dwindling resources. Many countries

including the UK and the US have adopted the SIB

model for a variety of social programmes that cover

issues such as poverty, homelessness, care for

orphans and elderly, youth unemployment, criminal

reoffending, and healthcare. While SRI sukuk was

just recently launched in Malaysia in May 2015 by

Khazanah National Berhad (Ghani, 2015). Various

literatures have argued that the SIB and SRI sukuk

models provide more efficiency, emphasises on

transparency, encourages cooperation and resource

sharing, as well as providing an avenue to link

private corporations with their social responsibility

(Center for American Progress, 2012; Cox, 2012;

Liebman, 2011; RAM Ratings, 2015a; Ronicle et al.,

2014; So & Jagelewski, 2013). From these

perspectives, we can see that the characteristics of

SIB and SRI sukuk serve noble and honourable

objectives, congruent with Islamic principles.

Thus, this paper offers an insight into the SIB

and SRI sukuk model from the Islamic perspective,

in particular with regards to the concepts of maqasid

al-Shari'ah and maslahah. By doing so, we may shed

some light on the similarities of SIB and SRI sukuk

principles with the values that Islam brings through

the principles of maqasid al-Shari'ah. By doing so,

this can potentially attract more interest from

organisations such as Islamic financial institutions

and Islamic banks towards the development of SIB

and SRI sukuk as they seek to fulfil their social aims

without sacrificing their business-side operations.

This paper is conceptual but may have some

practical relevance, serving as a guide for interested

parties. Mostly, the paper fills an essential gap

within the literature of SIB and SRI sukuk, maqasid

Shari'ah, as well as maslahah. The structure of the

paper is as follows: The following section explains

what is a Social Impact Bond (SIB), its objectives,

and the social areas of its implementation. This will

be followed by a section regarding SRI sukuk - in

particular Ihsan SRI sukuk in Malaysia. Following

that, the paper talks about the fundamentals of

152

Marwan, S., Haneef, A., Adawiah, E. and Ismail, S.

Achieving the Maqasid of Islamic Finance through Social Impact Bonds (SIB) and Sustainable and Responsible Investment (SRI) Sukuk.

DOI: 10.5220/0010118500002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 152-159

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

maqasid al-Shari'ah and the concept of maslahah.

The paper then delineates the concept of SIB and

SRI sukuk from the perspective of maqasid al-

Shari'ah and maslahah, taking into consideration of

the foundations that underlie these models. Finally, a

conclusion and some suggestions will be provided in

the final section.

2 LITERATURE REVIEW

2.1 The ‘Social Impact Bond’ (SIB)

Model

SIBs can be understood as contractual relationships

between the government and private enterprises

which aims to deliver positive social outcomes

(Center for American Progress, 2012). While Kohli

et al. (2012) defines SIB as “an arrangement

between one or more government agencies and an

external organization where the government

specifies an outcome (or outcomes) and promises to

pay the external organization a pre-agreed sum (or

sums) if it is able to accomplish the outcome(s)”.

The SIB model was borne out of the growing

acknowledgement that existing social programmes

especially the government-funded ones, are not

efficient and not being managed well enough

(Liebman, 2011). This has prompted a growing

number of private organisations such as

philanthropic foundations, non-governmental

organisations (NGOs), policymakers, social service

providers, and researchers to initiate their own social

services. However, despite their socially driven

motivation, these organisations face quite a

challenge to search and acquire funds needed for

long-term social intervention programmes. SIB

provides them with the avenue and opportunity to

attract funds from the private sector and channel

them towards programmes that seek to improve

social outcomes. This may include programmes that

seek; to improve the livelihood of homeless people;

to help care of foster children, elderly, and

chronically sick; to improve socioeconomic

conditions of the poor and needy; provide training

for ex-prisoners, unemployed, and the youth; as well

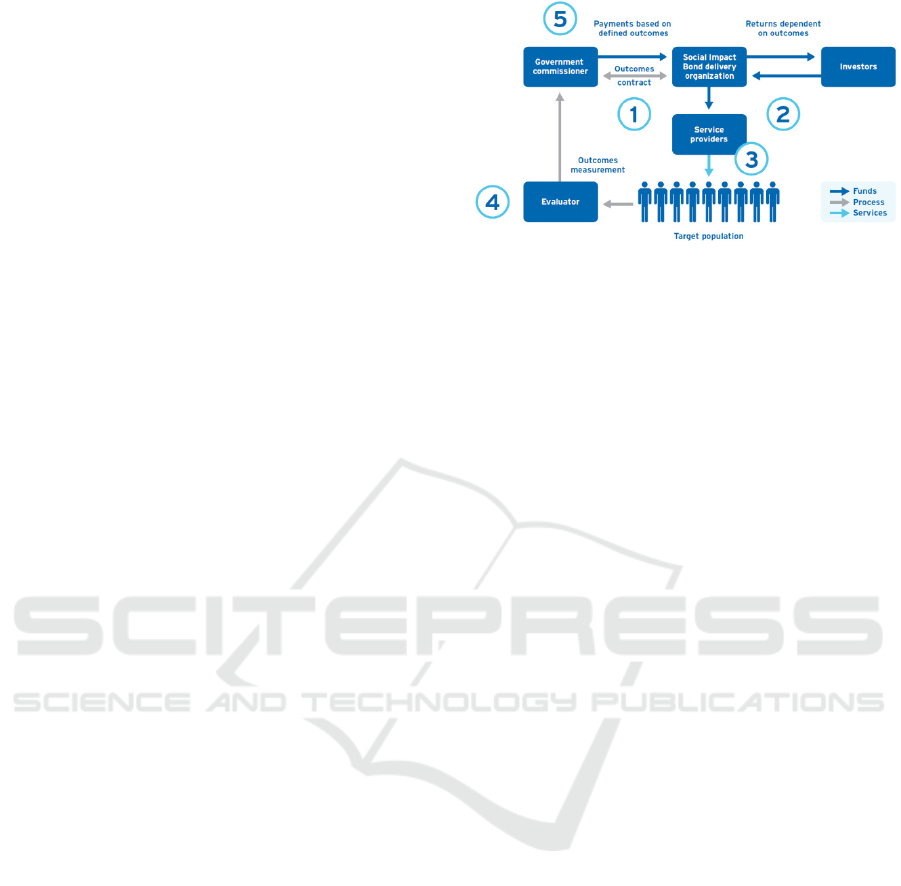

as many more (Finance For Good, 2017). Figure 1

below illustrates the general model of Social Impact

Bond.

Figure 1: The Social Impact Bond Model. Source: So and

Jagelewski (2013).

As illustrated in figure 1, there are a number of

parties involved in the SIB organisational structure.

The model itself involves a multifaceted set of

agreements and guarantees to ensure that the

programme can be carried out effectively. Firstly,

the government identifies that there is a social

problem that may be solved through an effective

social programme. The government then contracts

with a SIB delivery organisation (intermediary) from

the private sector where certain outcomes are

determined. Secondly, the intermediary raises initial

capital by issuing bonds to private investors. These

investors invest by buying the bonds in exchange for

future payments plus additional returns which are

dependent on the success of the programme. Their

motivation to invest may not be purely financial but

also “philanthropic” – as investors seek to contribute

towards the betterment of society (Ciufo &

Jagelewski, 2013).

Some investors may utilise their existing CSR or

grant funds. Thirdly, the funds obtained from the

bonds are then used by the intermediary to hire

social service providers that are deemed likely to

succeed in achieving the predetermined objectives.

The objectives are structured specifically for the

target population that are in need. Fourthly, in order

to assess the success of the programme, external-

independent-evaluators are selected. They will do

the necessary appraisal and report the success, or

failure, of the programme to all the parties. The

evaluations are undertaken with a high degree of

scientific accuracy, usually involving control groups

and intervention (Warner, 2013). Fifthly, once the

report is received, the necessary funds channelled

from the government can be paid to the investors.

However, if the programme is not successful, the

investors may not get any return at all. Several

benefits can be gained from the successful

implementation of SIB, as seen in Table 1 below:

Achieving the Maqasid of Islamic Finance through Social Impact Bonds (SIB) and Sustainable and Responsible Investment (SRI) Sukuk

153

Table 1: Benefits of SIBs to Stakeholders.

Stakeholders Benefits

Non-profit

organisations

Provides access to capital that is

needed to scale up operation

Stable and predictable stream of

funds without the need for

intensive fundraising processes.

SIBs facilitates coordination

between organisations working on

overlapping social problems.

Increase the size of the pool of

capital that can use fund social

interventions.

Investors

Provides the avenue to achieve

financial returns together with

social impact.

Offers participation in a new asset

class that can be used to diversify

the portfolio.

Government

SIBs provides an accountability

mechanism for taxpayers’ funds.

SIB increases the supply of

effective services without the

financial risks.

Create better market discipline

and transparency.

Align government funds directly

with improved social outcomes

and successful results.

SIBs allow for more rapid learning

about what works.

Reduces the cost of policing and

law enforcement.

Communities

Provide access to an increased

supply of adequate social services.

May reduce the need for crisis-

driven intervention.

Less societal illness and crime.

Sources: Liebman (2011), Social Finance (2011), Social

Finance (2012)

The social financing tool is generally known as

“Social Impact Bonds” (UK and Canada), “Pay for

Success Bonds” (US) and “Human Capital

Performance Bonds” (US), and “Social Benefit

Bonds” (Australia). There are many variations of the

SIB model in different counties, but they share the

same philosophy in terms of social impact, payment

by results, evidence-based approach, and multi-

stakeholder involvement.

The world’s first SIB was implemented in the

UK in 2010 to address the issue of recidivism

(released prisoners reoffending). The SIB managed

to raise £5 million from the private sector to fund the

programme (Disley et al., 2011). The programme

was assessed to be successful in reducing the

reoffending rates before its full tenure and was then

implemented nationwide because of its effectiveness

(Eccles, 2014; Ministry of Justice, 2014).

Since then, the SIB model has been implemented

in other areas such as programmes for children from

broken families or orphans; programmes to improve

outcomes for homeless people; programmes to

increase the quality of education; programmes to

improve health of people with asthma and many

more. There are also researches ongoing that suggest

that SIB should be implemented to support early

childhood development, improve education and

literacy, increase awareness to reduce diseases such

as HIV/AIDs and Tuberculosis, and programmes to

improve mental health and addictions (Social

Finance, 2019).

The applications of SIBs are vast and flexible to

accommodate different target areas. These areas

mentioned are just the ‘tip of the iceberg’ of the

many pertinent societal issues that need to be

addressed in order to ensure a brighter future for the

community. Most recently, The SIB database by

Social Finance (2019) reports that approximately

137 SIB programmes have been implemented

around the world including in countries such as

India, South Africa, Cameroon, Congo, Mali, and

Colombia. The database estimates that the total

capital raised from the SIB contracts to be USD440

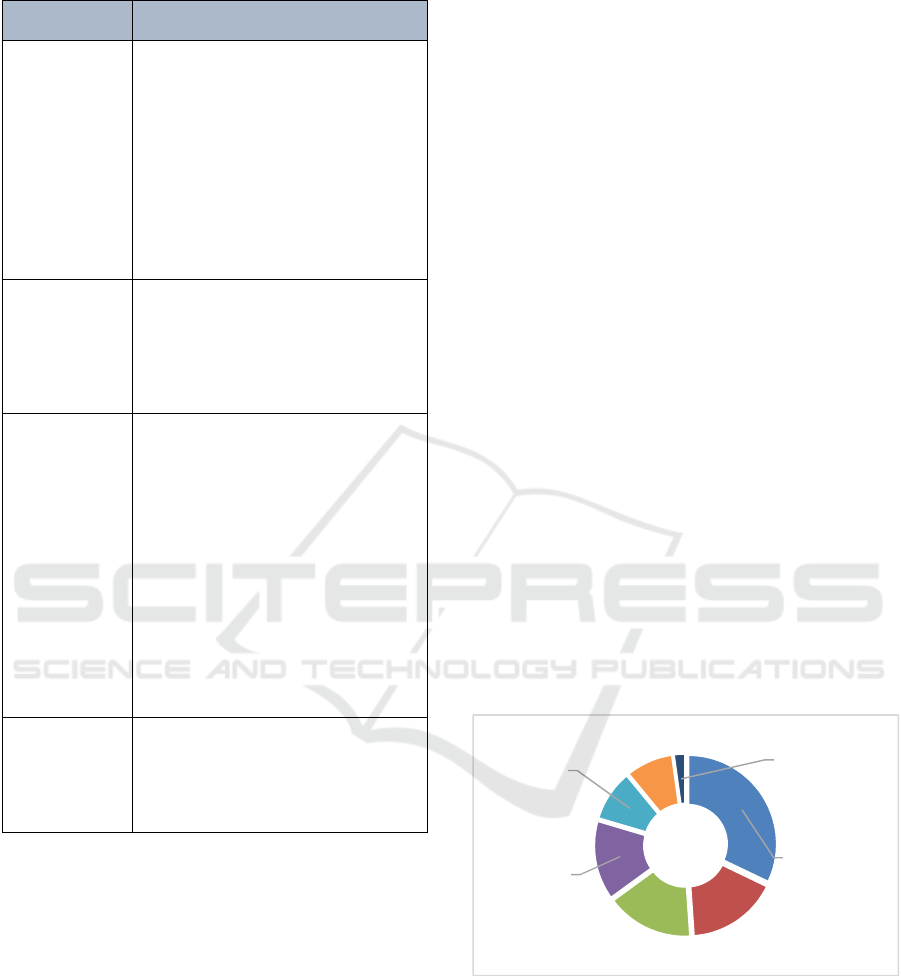

million. The figure below illustrates the SIB social

areas and the number of SIBs implemented in that

area.

Figure 2: SIB Implementation Areas. Source: Social

Finance (2019).

2.2 The Sri Sukuk Model

“SRI” is a generic terminology that can be denoted

as “sustainable and responsible investment” as well

as “socially responsible investment”. This

terminology is used for any type of investment

process that combines investors’ financial objectives

Workforce

Development;

44

Housing/

Homelesness;

23

Health;

22

Childand

Family

Welfare;

20

Education

andEarly

Years;13

Criminal

Justice;

12

Povertyand

Environment;

3

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

154

with their concerns towards issues of environment,

society, and governance (ESG) (Moghul & Safar-

Aly, 2014). The awareness and interest for SRI is

growing globally as evidenced by the likes of

supranational organisations such as the World Bank

that has issued green and socially responsible

investment bonds amounting to USD8.5 billion since

2008 (World Bank, n.d.). The World Bank has also

issued Vaccine sukuk together with the International

Finance Facility for Immunization (IFFIm) worth

USD 500 million (Bennet, 2015).

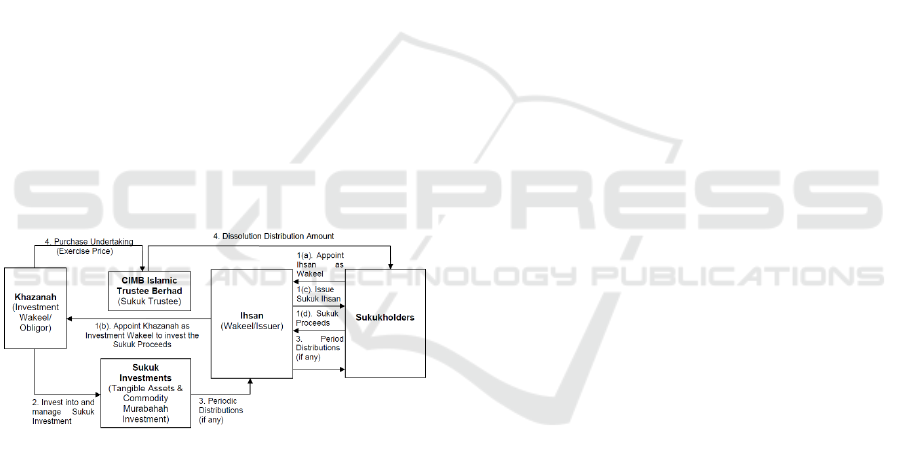

In Malaysia, the government’s strategic

investment company, Khazanah, issued the “Ihsan

SRI sukuk” in May 2015 worth RM 100 million.

This issuance part of a more significant SRI sukuk

programme worth of RM1 billion. The aim of the

SRI sukuk is to improve the quality of education in

Malaysia through various KPIs that have been set.

The SRI sukuk programme has a 7-year tenure with

a distribution rate of 4.3% per annum (The Star

Online, 2015). The SRI sukuk was given a AAA(s)

rating by credit rating agency, RAM (RAM Ratings,

2015b). The structure of the SRI sukuk was based on

the Islamic principle of Wakalah Bi Al-Istithmar

(investment agency), as per the guidelines on sukuk

by Securities Commission Malaysia (2014). The

following figure shows the SRI sukuk structure in

further detail:

Figure 3: Ihsan SRI Sukuk Structure. Source: CIMB

(2015).

The proceeds from the sukuk is given to

Yayasan Amir, a non-profit foundation under

Khazanah that goes into a Public-Private Partnership

with the Ministry of education with the aim to

improve the quality of education in government

schools around Malaysia.

Although the SRI sukuk structure is somewhat

different from the typical SIB, RAM Ratings

(2015a) have argued that it is a form of SIB. This is

because under the sukuk mechanism, “the issuer’s

obligation to pay is dependent on the performance of

the relevant SRI project against a targeted

benchmarks aimed at a better social outcome”

(RAM Ratings, 2015a). Indeed, this is a significant

characteristic inherent in the SIB model. Therefore

SRI sukuk can be said to a form of SIB.

3 ANALYSIS MODEL

3.1 The Underlying Objectives of the

Shari‘Ah (Maqasid Al-Shari‘Ah)

and the Public Interest (Maslahah)

“Maqasid” is an Arabic word that is plural of

“maqsad”, which brings the meanings of; the

straightness of a path, justice and balance, and a

directive destination (Al-Kaylani, 2009 in Laldin &

Furqani, 2013). While “Shari‘ah” is translated as a

source of water or a path towards it. The Shari’ah

epitomises the teachings of Islam, which establishes

a set of norms, values, and laws that governs every

single aspect of life. In other words, the Shari’ah

establishes rulings which covers the whole belief

system, the concept of morality and ethics, the

relationship between man and God, and the

relationship established between man and man

(Laldin & Furqani, 2013). Together, “maqasid al-

Shari'ah” can be loosely translated as “the higher

objectives of Islam”.

Under traditional classifications, maqasid is

divided into three levels: necessities (daruriyyat),

needs (hajiyyat), and luxuries (tahsiniyyat). While

Abu Hamid al-Ghazali, as quoted in Dusuki and

Bouheraoua (2011) classifies five fundamental

necessities under the Shari’ah (Al-Dharuriyyat al-

Khams), namely: safeguarding the faith of the

people (deen), their lives (nafs), their intellect (‘aql),

their posterity (nasl), and their wealth (mal).

According to Auda (2008), some jurists adds another

dimension, which is “the preservation of honour”.

These necessities are considered essential to

promote the well-being of people. In Phar (2009),

Ibn Tamiyyah expanded the work of Al-Ghazali by

broadening the list of maqasid al-Shari'ah to things

such as fulfilling contracts, preserving ties of

kinship, honouring the right of neighbours,

honouring he acts for love of God, sincerity,

trustworthiness, and moral purity. Abu Zaharah, in

Amin et al. (2013) also widened al-Ghazali’s scope

of maqasid to include education, justice, and public

interest (Maslahah). He explained that Islam’s focus

is on the development and education of the

individual in order to build a good society.

Additionally, he sees justice as a noble objective of

Islam and expands it to include judicial justice,

social justice, and economic justice.

Achieving the Maqasid of Islamic Finance through Social Impact Bonds (SIB) and Sustainable and Responsible Investment (SRI) Sukuk

155

Ibnu Ashur, in Dusuki and Bouheraoua (2011)

explains that the overall objective of the Shari'ah is

to promote the well-being and virtue of human being

so that the social order of the community may be

preserved and progress healthily. He continues that

the virtues consists of the soundness of intellect,

righteousness of deeds, and the goodness of the

things of the world which we live and at our

disposal. Ashur (2006) also explains that in order to

protect the well-being of the world, the Shari'ah has

enclosed the essential welfares of human beings with

eternal means of protection, even where there is no

benefit. Even the life of an ignorant, weak, senile,

and diseased man with no outward benefit to the

society must be protected and sanctified as the

preservation of the order of the world depend on the

sanctity of the human souls under any circumstances

Therefore, maqasid al-Shari’ah incorporates all

the principles, values, and messages provided by the

divine revelation (wahy) together with the various

dimensions of human needs in order to achieve

human wellbeing (maslahah) at the micro-level of

the individual as well as at the macro-level of the

society (Laldin & Furqani, 2013).

The word “maslahah” means utmost

righteousness and goodness (Ashur, 2006) and is

plural for “masaalih”, which is a synonym to

manfa’aah (benefit, utility, welfare, or interest) in

the Arabic language. According to Dusuki and

Bouheraoua (2011), maslahah can be translated as

seeking benefit and repelling harm as directed by the

Lawgiver. Al-Ghazali, in Dusuki and Bouheraoua

(2011) defines maslahah as “an expression for the

acquisition of benefit or the repulsion of injury or

harm, but that is not what we mean by it, because

acquisition of benefits and the repulsion of harm

represent human goals, that is, the welfare of

humans through the attainment of these goals. What

we mean by maslahah, however, is the preservation

of the Shari`ah’s objectives”. Al-Ghazali

emphasises that maslahah’s fundamental meaning is

for the preservation of Shari‘ah, which includes the

preservation of the five key elements of faith, life,

posterity, intellect, and wealth, as defined earlier.

While Al-Shatibi, in Ashur (2006) defined

maslahah as “that which produces benefit for people

at the collective or individual level and is acceptable

to the human beings because of its importance for

their lives”. As such, maslahah encompasses the

public and private interest (maslahah ‘aamah and

maslahah khaassah). We can clearly see that

maslahah is deeply rooted in Shari'ah’s objective of

ensuring that the society’s interest is guarded and

preserved in order to gain goodness in this life, and

the hereafter.

Scholars have used the terms of ‘maqasid’ and

‘maslahah’ almost interchangeably as both may

imply the same meaning. According to Dusuki and

Abdullah (2007), both concepts are established by

upholding the public interest, which is considered to

be an embodiment the Shari’ah’s

emphasis on

compassion. In the following section, the paper

discusses maqasid al-Shari'ah and maslahah and its

relation with SIB.

3.2 Social Impact Bonds and SRI

Sukuk in Light of Maqasid

Al-Shari'ah and Maslahah

In this section the paper seeks to bring forward the

notion that the SIB and SRI sukuk models are

concepts that embodies the philosophy of socially

responsible financing and in extension, the values of

maqasid al-Shari'ah and maslahah. Dusuki and

Abdullah (2007) defines corporate social

responsibility as “denoting corporate activities

beyond making profits, such as protecting the

environment, caring for employees, being ethical in

trading, and getting involved in the local

community”. This socially-responsible investment

concept is not alien in Islamic philosophy. In fact,

these concepts are very much in line with the

“Objectives of Shari‘ah” (Maqasid Shari‘ah) and

“The Public Good” (Maslahah) which embodies the

philosophical foundations and raison d’etre of

Islamic economics and finance (Laldin & Furqani,

2013). According to Ashur (2006), the Shari'ah’s

main objective is to establish a stable society with a

strong and steady community and promotes an

orderly function of its affairs by attaining

comprehensive welfare and preventing evil.

Therefore, anything that operates towards building a

better society, creates an environment for social

welfare and removes societal harm fulfils Shari'ah’s

objective, which is also the case for SIB and SRI

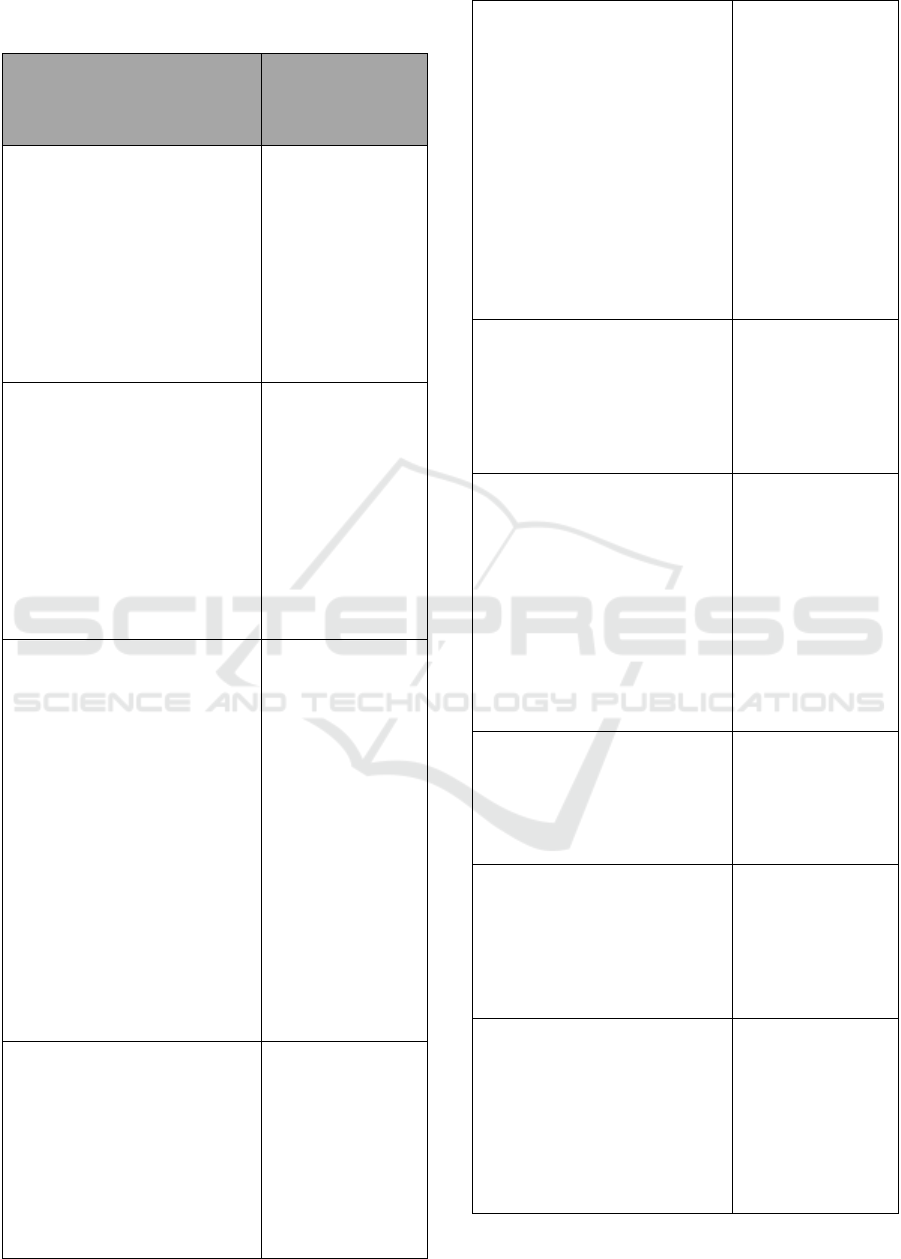

sukuk. In the following table, we recapitulate several

elements and applications of SIB and SRI sukuk and

match them with components of maqasid and

maslahah as summarised from the previous section.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

156

Table 2: SIB Elements and Maqasid Al-Shari'ah and

Maslahah Components.

SIB and SRI elements and

theoretical applications

Matching Maqasid

al-Shari’ah/

Maslahah

components

The act of socially conscious

investment, charitable giving, and

helping the society which is

encouraged by the development

of SIB and SRI sukuk enriches

the spirituality of the giver.

Furthermore, it embraces good

moral standards and promotes

transparency and accountability

which are a personification of a

sound faith.

Hifz deen:

Preservation of Faith

SIB and SRI sukuk areas of

implementation may include the

care for homeless people, children

and orphans, the elderly and the

chronically sick. While there have

also been SRI sukuk that

addresses environmental concerns

(green bonds) and health (vaccine

sukuk). These services are an

epitome of preserving the life of

people by providing them with

the basic needs to continue living.

Hfz nafs:

Preservation of

Soul/Life

Area of SIB and SRI sukuk

implementation include

developing the Intellect through

physical development of the brain

by providing medication for

pregnant women to help the

physical development of the

unborn child, and provision for

milk for kindergarten children to

help their development. Another

area of application is tackling

mental health and drug addiction

which aims to preserve the sound

mind of the human being. The

Ihsan SRI sukuk aimed at

improving the quality of

education can also be said to help

preserve the mind through the

improvement of knowledge.

Hifz ‘aql:

Preservation of

Mind/Intellect

SIB and SRI sukuk areas of

implementation include providing

counselling services for families,

vaccination programmes for

children, caring for orphans, and

children from broken families.

These programmes not only

ensures the survival and progress

of the family but also protect and

nurture the future generation.

Hifz nasl,

Preservation of

Offspring/Posterity,

Preserving ties of

kinship

SIB and SRI sukuk provides the

avenue of preservation of wealth

through its circulation by

realigning them for the benefit of

people in need. Additionally, SIB

may prevent the cost to the

society in the form of damage of

public property. We draw an

example from a hypothetical

situation where a criminal who

stole, would not have done so if

he had a job by entering into a

SIB intervention programme that

provided training and job

opportunities from him.

Hifz mal:

Preservation of

Wealth

SIB and SRI sukuk programmes

that targets the poor, homeless,

disabled, or psychologically

impaired people may provide

them with the essentials needed

for them to live in a dignified

manner.

Preservation of

Honour

The nature of SIB and SRI sukuk

programmes as a means for social

interventions may provide public

security and stability in terms of

less crime. Intervention

programmes provided may also

protect from harm that may occur

if the problem is not solved

earlier. For example, providing

education for disadvantaged

young people may repulse them

from doing a crime in the future.

Repulsion of harm

SIB and SRI sukuk programmes

in mental and physical health,

provide various benefits and helps

solve societal problems for the

wellbeing of the society. The

benefits can be seen above.

Acquisition of

benefit, Promoting

the well-being of the

human being

By targeting root of social

problems and providing

intervention, SIB and SRI sukuk

strive to put things in the right

place and to preserve social order

to create an environment that is

healthy for the community.

Justice (Public,

social, economic)

SIB and SRI sukuk embraces the

ethical-moral standards and

promotes transparency and

accountability through its

reporting and practices. The

independent-external evaluator

will report the progress of the

programmes to the stakeholders

in order to ensure this.

Ethics & Morality

Achieving the Maqasid of Islamic Finance through Social Impact Bonds (SIB) and Sustainable and Responsible Investment (SRI) Sukuk

157

Based on the points in the table above, the paper

reiterates the notion that the overall philosophy and

objectives of the SIB model embodies, in spirit,

theory, and practice, the objectives (maqasid) of

Shari'ah and strives for the better rule for public

good (maslahah).

4 CONCLUSION

This paper provides an insight into innovative social

financing models: the Social Impact Bond (SIB) and

SRI sukuk. From the discussion, the paper has

highlighted the philosophy and objectives of SIB

and SRI sukuk from its mechanisms, theoretical

perspective, its areas of implementation, as well as

the other potential areas that it can be developed.

These objectives include: (i) To provide an

avenue to increase the size and stabilise the stream

of funds that can be channelled for social

programmes. (ii) To encourage cooperation between

organisations to be involved in the social sector. (ii)

To provide better market discipline that promotes

effective social programmes, and remove the

ineffective ones. (iii) To promote improved social

outcomes by directly linking government resources

to them. (iv) To provide an accountability and

transparency mechanism of the use of taxpayers’

money. (v) Reduce the need for crisis-driven

intervention by tackling the root of the social

problems.

While the areas of implementation of SIB and

SRI sukuk cover a wide range of societal issues such

as recidivism, crime prevention, childcare, orphan

care, education, youth empowerment, employment

training, healthcare, homelessness, welfare issues,

and community outreach. These objectives and areas

of implementation comprehensively matched the

elements of the maqasid al-Shari'ah and maslahah.

As such, the paper argues that SIB and SRI sukuk

can be said to be financial models that epitomises

the ethical and moral framework of the Shari‘ah. Not

only do they provide social impact, they also provide

an opportunity for investors to diversify their

portfolio and fulfil their business-side

responsibilities.

As innovative financing models, SIB and SRI

sukuk are still in a developmental stage but is

steadily attracting interest from institutions around

the world. Unfortunately, apart from Malaysia, other

Islamic countries, Islamic institutions and Islamic

banks, have not yet developed and utilised SIB and

SRI sukuk to its full potential. As such, this paper is

a humble attempt to elucidate the idea of SIB and

SRI sukuk, and serve as a guide to attract Islamic

institutions in fulfilling the maqasid al-Shari'ah and

maslahah, without abandoning its business side and

investment elements.

REFERENCES

Amin, R. M., Yusof, S. A., Haneef, M. A., Muhammad,

M. O., & Oziev, G. (2013). The Integrated

Development Index (I-DEX): A New Comprehensive

Approach to Measuring Human Development. Paper

presented at the International Conference on Islamic

Economics and Finance - Growth, Equity and

Stability: An Islamic Perspective, Istanbul, Turkey.

Ashur, M. A.-T. I. (2006). Ibn Ashur: Treatise on Maqasid

al-Shari'ah. London: International Institute of Islamic

Thought.

Auda, J. (2008). Maqasid Al-Shariah: an Introductory

Guide. Retrieved from https://www.jasserauda.net/

new/pdf/maqasid_guide-Feb_2008.pdf

Bennet, M. (2015, 29 October 2015). Vaccine Sukuks:

Islamic Securities Deliver Economic and Social

Returns. Retrieved from http://blogs.worldbank.org/

arabvoices/vaccine-sukuks-islamic-securities-deliver-

economic-and-social-returns

Center for American Progress. (2012). Frequently Asked

Questions: Social Impact Bonds (pp. 40): Center for

American Progress.

CIMB. (2015). Ihsan Sukuk Berhad: Information

Memorandum. Malaysia: CIMB.

Ciufo, G., & Jagelewski, A. (2013). Social Impact Bonds

in Canada: Investor Insights. Retrieved from Canada

Cox, B. R. (2012). Financing Homelessness Prevention

Programs with Social Impact Bonds. Review of

Banking & Financial Law, 31.

Disley, E., Rubin, J., Scraggs, E., Burrowes, N., Culley,

D., & RAND. (2011). Lessons Learned From the

Planning and Early Implementation of the Social

Impact Bond at HMP Peterborough. Ministry of

Justice.

Dusuki, A. W., & Abdullah, N. I. (2007). Maqasid al-

Shari'ah. Maslahah, and Corporate Social

Responsibility. The American Journal of Islamic

Social Sciences, 24(1), 25-44.

Dusuki, A. W., & Bouheraoua, S. (2011) The Framework

of Maqasid Al-Shariah (Objectives of Shariah) and its

Implications for Islamic Finance. Vol. 22 (pp. 38).

Malaysia: International Shari'ah Research Academy

for Islamic Islamic Finance

Eccles, T. (2014, April 25, 2014). Peterborough SIB –

A Success or A Failure?

Finance For Good. (2017, 2016). Finance for Good Social

Impact Bond Tracker. Retrieved from http://finance

forgood.ca/social-impact-bond-resources/sib-tracker/

Ghani, M. I. (2015). The World's First Ringgit-

Denominated SRI Sukuk. In T. Reuters (Ed.),

Thomson Reuters - RFI Responsible Finance Report

2015: The Emerging Convergence of SRI, ESG and

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

158

Islamic Finance. Edinburgh: Thomson Reuters.

Kohli, J., Besharov, D., & Costa, K. (2012). What Are

Social Impact Bonds? - An Innovative New Financing

Tool for Social Programs (pp. 11). US: Center for

American Progress.

Laldin, M. A., & Furqani, H. (2013). Developing Islamic

Finance in the Framework of Maqasid al-Shari'ah.

INternational Journal of Islamic and Middle Eastern

Finance and Management, 6(4), 278-289.

doi:10.1108/IMEFM-05-2013-0057

Liebman, J. B. (2011). Social Impact Bonds - A Promising

New Financing Model to Accelerate Social Innovation

and Improve Government Performance Retrieved from

Ministry of Justice. (2014). Peterborough Social Impact

Bond, HMP Doncaster. Payment by Results pilots:

Final re-conviction results for cohorts 1. Retrieved

from UK: https://www.gov.uk/government/uploads/

system/uploads/attachment_data/file/341682/pbr-pilot

s-cohort-1-results.pdf

Moghul, U. F., & Safar-Aly, S. H. K. (2014). Green

Sukuk: The Introduction of Islam's Environmental

Ethics to Contemporary Islamic Finance. The

Georgetown International Environmental Law

Review, 27(1), 1-60.

Phar, K. B. (2009). Islamic Statehood and Maqasid Al-

Shariah in Malaysia: A Zero Sum Game? Chiang Mai,

Thailand: Silkworm Books.

RAM Ratings. (2015a). Credit FAQs: Rating Khazanah's

Sukuk Ihsan. Kuala Lumpur: RAM Holdings.

RAM Ratings. (2015b). RAM Ratings assigns AAA(s)

preliminary rating to Malaysia's first SRI sukuk

programme [Press release]. Retrieved from

http://www.ram.com.my/pressReleaseView.aspx?ID=

18c18604-695e-4d6c-b5b6-62d958a70c79

Ronicle, J., Stanworth, N., Hickman, E., & Fox, T. (2014).

Social Impact Bonds: The State of Play. Retrieved

from

Securities Commission Malaysia. (2014). Guidelines on

Sukuk.

So, I., & Jagelewski, A. (2013). Social Impact Bond:

Technical Guide for Service Providers. Retrieved from

Otario, Canada:

Social Finance. (2011). A Technical Guide to Developing

Social Impact Bonds. Retrieved from UK:

Social Finance. (2012). A New Tool for Scaling Impact:

How Social Impact Bonds Can Mobilize Private

Capital to Advance Social Good. Retrieved from

Social Finance. (2019). Impact Bond Global Database.

Retrieved from https://sibdatabase.socialfinance. org.uk/

The Star Online. (2015). Khazanah’s RM100m

Sustainable Sukuk Priced at 4.3%. Retrieved from

http://www.thestar.com.my/Business/Business-News/

2015/06/04/Khazanah-RM100m-sustainable-Sukuk/?

style=biz

Warner, M. E. (2013). Private Finance for Public Goods:

Social Impact Bonds. Journal of Economic Policy

Reform, 16(4), 303-319.

World Bank. (n.d.). About World Bank Green Bonds.

Retrieved from http://treasury.worldbank.org/cmd/

htm/WorldBankGreenBonds.html

Achieving the Maqasid of Islamic Finance through Social Impact Bonds (SIB) and Sustainable and Responsible Investment (SRI) Sukuk

159