Do Bank Customers Prefer Profit Sharing Investment Accounts?

A Proposed Conceptual Framework

Romzie Rosman, Isah Ya’u and Anwar Hasan Abdullah Othman

IIUM Institute of Islamic Banking and Finance, Malaysia

Keywords: Islamic Banks, Investmment Account Holders, Investment, Profit Sharing, Islamic Finance.

Abstract: The concept of sharing profit earned by Islamic banks with their investors is one of the distinguishing

features that set Islamic banks apart from their conventional counterparts. The contract of mudarabah is

used by Islamic banks to mobilise funds with the objective to share profit with the investors. Any financial

losses incurred by the banks in the course of their financing or investment is to be borne entirely by the

depositors, except in cases of negligence and breach of contract. Based on literature that investigated the

factors effecting the adoption of Islamic banking and finance products, the factors differ based on countries.

It is found that GCC countries showed that religious factor in terms of compliance with the provisions of

Shariah by the Islamic banks is the most important factor that influences the selection of Islamic banking

products in the GCC countries. However, in the MENA region, it could be observed that religious belief and

compliance with Shariah by Islamic banks were not the major factors that influence customer’s choice of

Islamic banks unlike in the GCC countries. Not only that, it is also found that the factors that influence the

choice of Islamic banks amongst customers in Asia were not consistent. Whereas some studies show

religious inclination as the most important factor in choosing Islamic banks by customers especially in some

studies in Malaysia, other studies show that high profit and low-cost service as the most important selection

criteria. Hence, the proposed conceptual framework that integrated both the Theory of Reasoned Action

(TRA) and Theory of Planned Behaviour (TPB) together with the unique elements of religiosity and risk

tolerance are expected to predict the behaviour of profit sharing investment account holders.

1 INTRODUCTION

The Islamic financial services industry continues to

record impressive growth as at the end of the 2018

financial year as reported by various reports that

track developments in the industry. According to the

Thomson Reuters’ Islamic Finance Development

Report (Reuters, 2018) Islamic finance is currently

present in 56 countries with Iran, Saudi Arabia and

Malaysia rated as the largest markets dominating for

65% of the total market Share in 2017, while

Cyprus, Nigeria and Australia recorded the fastest

growth in Islamic finance assets in 2018. The

Islamic finance industry assets grew by a compound

annual growth rate (CAGR) of 6% to US$2.44

trillion in 2017 from 2012 with the banking sub-

sector contributing US$1.72 trillion or about 70% of

the total asset of the industry. The Islamic banking

assets was estimated to have expanded at a CAGR of

8.8% between 4Q 2013 and 2Q 2017 (IFSB, 2018).

Financing recorded a CAGR of 8.8% between 4Q

2013 and 2Q 2017 and annual growth rates of 6.8%

in 2Q 2017 while deposits on the other hand

recorded a CAGR of 9.4% with an annual growth

rate of 9.2% (IFSB, 2018). From the statistics, the

Islamic banking industry tends to attract deposit at a

rate faster than the rate at which the banks are

willing to extend financing to their clients.

The nature of Islamic finance and conventional

finance are different. In spite of that the notable

difference between Islamic banks and conventional

bank is that Islamic banks are Shariah compliant

while conventional banks applied charging and

received interest which is riba and hence not

compliant to Shariah. Furthermore, conventional

finance is almost void of risk sharing. On the

resource mobilization side, fund owners provide

their financial resources on the basis of the classical

loan contract. Accordingly, banks taking deposits

would guarantee both principal and interest on their

customers’ deposits (Ali Al-Jarhi & Ali Al, 2017).

This is not the case with Islamic banks as observed

by (Ramli, 2014) a major distinctive feature between

Islamic banks and conventional banks is profit-and-

Rosman, R., Ya’u, I. and Othman, A.

Do Bank Customers Prefer Profit Sharing Investment Accounts? A Proposed Conceptual Framework.

DOI: 10.5220/0010115700002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 115-126

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

115

loss sharing (PLS) paradigm, which is primarily

based on the concepts of mudarabah (profit sharing

and loss bearing) and musharakah (joint venture) of

Islamic investment contracting. Hence, it becomes

imperative on Islamic banks to pay more attention

on these very important and distinct sources of

funding their activities. Among the two profit and

loss sharing contracts (i.e. musharakah and

mudarabah), where mudarabah is commonly used as

the underlying contract for both the restricted and

unrestricted investment account by Islamic banks for

the mobilization of resources (ISRA, 2018).

Moreover, Islamic banks which are similar to

their conventional counterparts also rely on monies

from depositors as their major source of funding and

the share of unrestricted investment accounts in the

total deposit of Islamic Banks varies considerably

from near zero to over 80% in some banks (M.

Iqbal, Ali, & Muljawan, 2012). As such, it is critical

for the management of Islamic banks to know the

factors that influence customers’ decision making in

investing their money with Islamic banks. This is

particularly important if we consider the risk

appetite of the investment account holders (IAHs).

As explained by (Alhammadi, 2016), unrestricted

investment account holders (UIAHs) are typically

risk averse and would normally seek a low-risk low

return deposit-like account. Understanding the

savings and investment culture and factors that

influence the savings behaviour of the UIAHs would

assist the management of the Islamic banks to

develop strategies to attract and retain the

investments. It would equally assist regulators

ensure that the rights of this class of depositors is

protected by the Islamic banks.

2 DISCUSSION

Unique Nature of Islamic Banks

The major differences in the mode of operations are:

(i) Islamic banks do not operate on interest as riba is

prohibited in Islam. (ii) The avoidance of interest

leads Islamic banks to the development of risk

sharing contracts namely musharaka and mudarabah

contracts where there is no predetermined fixed

interest as sources of funds mobilisation and fees

generation(Samad, 2014). Another major difference

between the two forms of banking as observed by

(Karim & Ali, 1989) is that unlike in conventional

banking where depositors are guaranteed a fixed

interest payment, Islamic banks operate on an

equity-based system in which economic agents are

not guaranteed a predetermined rate of return,

instead depositors share in the profits made by the

bank as well as in the losses that may be incurred by

it.

Islamic banks’ depositors can be compared to

investors or shareholders of companies, who receive

dividends when the bank makes a profit or lose part

of their economies if the business makes a

loss(Khaldi & Amina, 2018). Also, Islamic banks

are not permitted to offer a fixed and predetermined

interest rate on deposits, and cannot charge interest

on loans(Toumi, Viviani, & Belkacem, 2011).

Unlike in the conventional banking space where

the principal banker-customer relationship is that of

a debtor-creditor(Campbell, LaBrosse, Mayes, &

Singh, 2009), several contractual relationships exist

between Islamic banks and their customers including

being that of partners, investors and traders, as well

as buyer and seller(Mahinar, Bakar, Mohd Yasin, &

Teong, 2019).

The concept of sharing profit earned by Islamic

banks with their depositors is one of the

distinguishing features that set Islamic banks apart

from their conventional counterparts. The contract of

mudarabah is used by Islamic banks to mobilise

funds with the objective to share profit with the

depositors. Any loss incurred by the banks in the

course of their operations is to be borne entirely by

the depositors, except in cases of negligence and

breach of contract. Hence a financier-entrepreneur

relationship exists between the depositors as rabbul

mal (i.e. investors) and the bank as mudarib (i.e.

fund manager/entrepreneur). The investment account

holders are no longer creditors like the depositors in

conventional banks but investors with the right to

claim profits and shoulder the risk of having low, or

even no return on their investment(Alaeddin,

Archer, Karim, & Mohd. Rasid, 2017) . However, as

observed by Muneeza et al, (2011) as cited by

(Mahinar et al., 2019), all the rights and obligations

of a banker and customer in conventional banks are

also applicable in Islamic banks, except that some

rights and duties of banker and customer are a bit

different from that of conventional banks depending

on which contract or product is being considered. It

is obvious that various customers of Islamic banks

may patronise them for different reasons and are

thus likely to be influenced by different factors in

patronising the Islamic banks.

CIMA (2007) explains the key differences in the

banker-customer relationship that subsist between

Islamic banks and conventional banks and their

customers in Table 1.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

116

Table 1: Banker-Customer Relationship Between Islamic

Banks and Conventional banks.

PRODUCT

TYPE

TYPE OF RELATIONSHIP

Conventional

Banks

Islamic Banks

Deposit/

Liability

Lender-Borrower

Depositor-

custodian

Lender-borrower

(but free from

interest)

Investor-

entrepreneur

Financing/

Asset

Borrower-Lender

Purchaser-seller

Lessee-lessor

Principal-agent

Entrepreneur-

investor

Source: CIMA 2017

The basic relationship between conventional

banks and their customers are that of debtor-creditor

and vice versa whereas Islamic banks have many

different relationships between them and their

clients. All these go to show that customers of

Islamic banks may have different motives for

patronise them based on the contractual relationship

that subsist between the Islamic banks and their

clients. However, the existing literatures on factors

that influence customers’ decisions to patronise

Islamic banks do not take into account these obvious

differences in contractual relationships that exist

between Islamic banks and their clients.

Profit Sharing Investment Accounts

Profit Sharing Investment Accounts (PSIAs) offered

by Islamic banks operate fully under the profit and

loss sharing (PLS) scheme where neither capital is

guaranteed no any pre-fixed returns(Kaleem & Md

Isa, 2003). Unrestricted Investment Accounts (UIAs)

is one of the two variants of mudaraba accounts used

by Islamic banks in the mobilization of funds the

other being restricted investment account (RIA).

(SUNDARARAJAN, 2007) observed that Islamic

banks mobilise over 60% of their funds from PSIAs

which shows the importance of such source of funds

to the soundness and stability of Islamic banks.

Mudarabah is a partnership in profit whereby

one party provides capital (i.e. Rab al-Mal) and the

other party provides labour (i.e. Mudarib)(AAOIFI,

2015). AAOIFI Shari’ah Standard No. (40) 2/1/1

defines Unrestricted Investment Accounts (UIA) as

amounts received from investors who authorize the

institution to invest their funds on the basis of

Mudarabah without restricting the investment of

such funds to a specific project or investment

program. The holders of the accounts and the

institution share the profit, if any, according to the

ratio specified for each of them either in the

Mudarabah contract or in the application for opening

the account. The holders of the accounts bear all the

losses in proportion to their respective shares in the

capital, except losses arising from transgression,

negligence or breach of the contract, which have to

be borne by the institution. (Moha-Karim,

Muhammad, 2010) opined that, in order to give the

mudarabah contract legal backing, the parties must

agree on the following important elements of the

contract prior to consummating the contract which

are: (i) amount of investment, (ii) tenure of the

investment, and (iii) profit-sharing ratio (PSR).

Here, all parties must abide with these important

elements of the contract to ensure full-compliance

with Shariah principles and would also prevent

dispute between the Islamic bank and the PSIA

Holders.

PSIAs held by IAHs constitute about 62 percent

of assets on average for a sample of Islamic banks in

12 countries in the Middle East and South East Asia

(Archer, Ahmed Abdel Karim, & Sundararajan,

2010). Also, (Yahaya, 2013)in his study of the

implication of PSIA for liquidity risk management

for sample of 14 Islamic banks drawn from 8

countries with well developed Islamic banking and

markets shows that the average percentage of

investment accounts in relation to total deposit of the

sampled banks was around 53% while the

combination of investment accounts and savings

accounts which are mostly based on mudarabah

contracts and can be classified as investment

accounts too averaged 72%.This shows the

importance of PSIAs as a major source of funding

for Islamic banks. (Lahrech, Lahrech, & Boulaksil,

2014), opined that PSIAHs try to choose among

Islamic banks based on the level of confidence in

banking competencies and abilities to realize returns

from the invested capital where the lack of such

confidence will drive PSIAHs to switch to less-

opaque Islamic banks.

Importantly, PSIAs do not meet the basic

characteristics of depositors(Lahrech et al., 2014) .

This is because neither their capital investment nor

return on their investement is guaranteed by the

bank. In the same vein, they do not meet the

definition of shareholders, because whereas

shareholders have the right to vote in general

meetings, to elect the members of the Board of

Do Bank Customers Prefer Profit Sharing Investment Accounts? A Proposed Conceptual Framework

117

Directors (BOD), and thus typically have a powerful

influence to appoint or dismiss senior management

through their control of the BOD (Alhammadi,

2016). Also, unlike shareholders who can sell their

shares in the capital when they are dissatisfied with

the operations of the bank, UIAHs can only

withdraw their monies when dissatisfied with

Islamic banks operations with a possible loss of any

profit that would be due to them if they withdraw

before the maturity of the contract.

In principle, under the mudarabah contract that

typically governs the PSIA, all losses on investments

financed by these funds due to credit and market

risks are to be borne by IAH, while the profits on

these investments are shared between the IAH and

the Islamic banks as manager of the investments

(mudarib) in the proportions specified in the

contract. However, any loss due to misconduct and

negligence (i.e. operational risk) should be borne by

the Islamic banks, under the shariah principles

applying to mudarabah contracts(Archer et al.,

2010). However, in practice, Islamic banks engage

in various practices aimed at cushioning the returns

paid to PSIAHs in order to protect the cash flows

due to the PSIAHs against variability and volatility

and to ensure that they get returns that are closely

related to what other Islamic banks and even

conventional banks pay their depositors in the

market (SUNDARARAJAN, 2007). This practice of

maintaining the returns paid out to PSIAHs by

Islamic at a certain rate is called “income

smoothening” and exposes the banks to displaced

commercial risk (DCR).

(IFSB, 2015) defines DCR as the additional risks

that the shareholders of Islamic banks borne as a

result of assuming all the commercial risks

associated with the performance of the assets

financed by the deposits of PSIAHs at the expense

of the returns (i.e. dividend) due to the shareholders.

To guard against the risk of withdrawal of deposits

by PSIAHs, Islamic banks use different methods to

smoothen the returns of PSIAHs in order to make it

competitive and to also guard it against volatility.

(IFSB, 2015). based on a survey of the practice of

income smoothening by Islamic banks across

different jurisdictions identified the following

income smoothening practices:

i. Adjusting the bank’s share as a muḍarib:

Islamic banks smooth returns paid to PSIAHs

by temporarily reducing their share as

muḍarib below the agreed contractual ratio.

This reduces the returns due to the bank’s

shareholders. This method is used only as an

income smoothening mechanism but not as a

loss-absorbing product. This is because

investment losses on PSIA funds are to be

borne by the IAH themselves, while the

Islamic banks receive no share of profit as

mudarib.

ii. Transferring from shareholders’ funds:

Management of Islamic banks may sometimes

with the approval of their shareholders donate

some portion of the income due to the

shareholders to IAHs on the basis of hibah

(gift). This is often done in order to offer the

IAHs a level of return close to the market

benchmark level, when the overall investment

returns of the IIFS are lower than the average

rate offered in the market.

iii. Maintaining a Profit Equalisation Reserve

(PER): Islamic banks often establish PER by

setting aside amounts from the investment

profits realized from their respective

investment pools before allocation between

the shareholders and the UIAHs and the

calculation of the IB’s share of profit as a

Mudarib. The PER is used to smooth the

profit attributable to UIAHs when investment

returns decline or are not at par with the

market benchmark.

iv. Establishing an Investment Risk Reserve

(IRR): IBs also maintain a reserve called the

IRR by setting aside amounts from the

investment profits attributable to the UIAHs,

after deducting the Islamic bank’s share as a

Mudarib. The IRR belongs entirely to the

UIAHs and can be used only to supplement

losses if any incurred by the UIAHs.

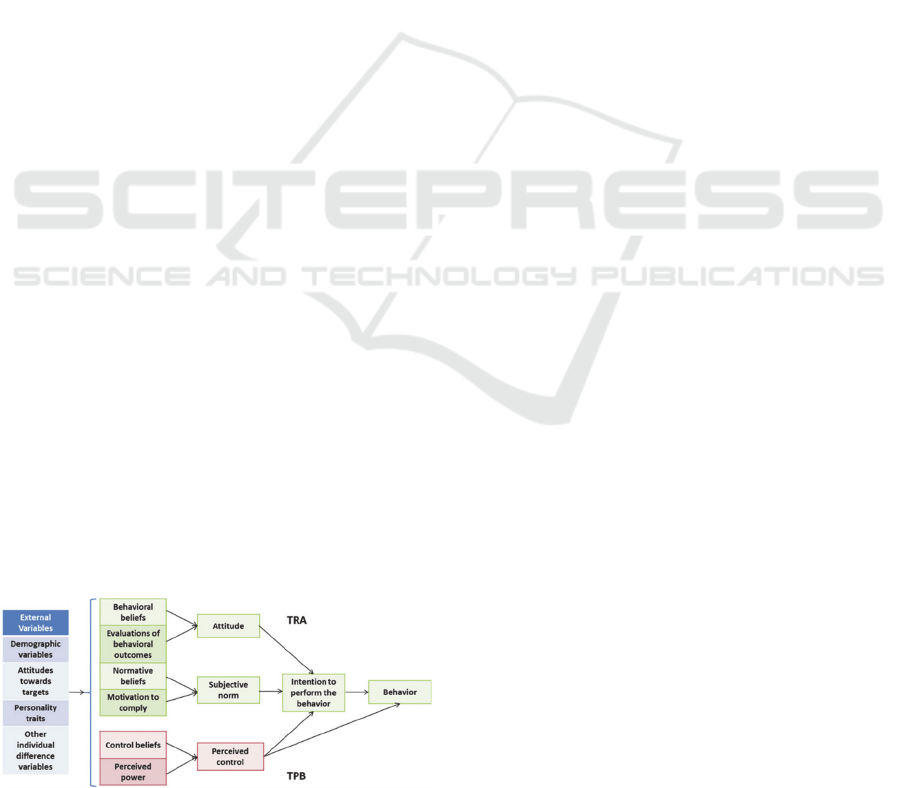

Theory of Reasoned Action and Theory of Planned

Behaviour

In making the decision of what portion of their

income is to be consumed immediately and what

portion to save for the future, different individuals

are influenced by different factors and variables. The

Theory of Reasoned Action (TRA) and the Theory

of Planned Behaviour (TPB) as in Figure 1 emphasis

on theoretical constructs that is concerned with

individual motivational factors as determinants of

the likelihood of performing a specific behaviour

(Montano & Kasprzyk, 2008).

TRA was introduced in 1967 by Martin Fishbein,

and was extended by Fishbein and Icek Ajzen (e.g.

Fishbein & Ajzen 1975; Ajzen & Fishbein 1980). It

assumed the best predictor of a behaviour is

behavioural intention, which in turn is determined

by attitude towards the behaviour and social

normative perceptions regarding it. According to

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

118

TRA, the intention to perform a given behaviour is

viewed as a function of two basic factors: the

person’s attitude toward performing the behaviour

and/or the person’s subjective norm concerning his

or her performance of the behaviour (Fishbein,

2008). In essence, the more one believes his

performance of certain action would lead to positive

outcome or would at least prevent negative

consequences, the more one is inclined to pursue and

perform such action. TRA have shown that it is

critical to have a high degree of correspondence

between measures of attitude, norm, perceived

control, intention, and behaviour in terms of action,

target, context and time (e.g Montano & Kasprzyk,

n.d.; Montano & Kasprzyk, 2008). Man Kit Chang,

(1998) observed that attitude towards behaviour is a

function of the product of one’s salient belief that

performing the behaviour will lead to certain

outcomes, and an evaluation of the outcomes.

Subjective norm on the other hand was defined as a

function of the product of one’s normative belief

which is the person’s belief that the salient referent

thinks he should or should not perform the

behaviour (Ajzen and Fishbein, 1980) as cited by

(Montano & Kasprzyk, 2008) and his motivation to

comply to that referent.

In 1985, Ajzen extended TRA by introducing

“perceived behavioural control” as an antecedent to

behavioural intentions and called it Theory of

Planned Behaviour (TPB)(Madden, Ellen, & Ajzen,

1992). Ajzen introduced the concept of perceived

behavioural control as a predictor of both intention

and behaviour(Fishbein, 2008). Ajzen’s inclusion of

perceived control was based in part on the idea that

behavioural performance is determined jointly by

motivation (intention) and ability (behavioural

control)(Montano & Kasprzyk, 2008). Ajzen

believes the more resources and opportunities

individuals think they have, the more their perceived

behavioural control over the behaviour(Madden et

al., 1992). That is the more people believe they have

little or no resources to control a behaviour, the less

inclined they would be to perform such action and

vice versa.

Figure 1: TRA and TPB.

Source: Ajzen (1992).

Empirical Evidence on Why Customers Choose

Islamic Banks

Empirical studies have shown that different factors

influence clients of both conventional and Islamic

banks when selecting which bank to patronize and

save their funds.(Naude, 2015) Naude, (2015)

interrogated customers’ selection criteria around the

globe using a generation theory perspective. Her

study found that bank selection criteria were

dependent on the age and generation of the

customers. Older generations were found to be

influenced by such factors as, reputation and

availability of credit, location, convenience,

recommendation by parents, friends and family,

interest rates and reputation; while the younger ones

were found to be influenced more by factors

including: price, convenience, product type, service,

competence and recommendation by parents, good

customer service incorporated with convenience,

recommendation free banking or bank charges,

international debit card, distribution channel –

internet banking and host of other factors.(Al-

Tamimi, Anood, & Kalli, 2009) found that

religiosity, reputation of the firm, perceived ethics of

the firm, and diversification purpose were the top

four most influencing customers to patronize banks

in South Africa. (Bashir, Hassan, Nasir, Baber, &

Shahid, 2013) found that gender and age play

important role in the people of Pakistan when

making their decisions on banks’ patronage.

(Gait & Worthington, 2008) found religiosity,

bank reputation, service quality, pricing and cost of

finance as important factors that influence Islamic

banks’ customers in selecting a financial

institution’s products and services. However, several

other studies found different factors as influencers of

the choice of Islamic banks by their respective

customers. For example,(Erol & El‐Bdour, 1989)

found that profit motivation and peer group

influence and not religiosity were the key factors

that influence Jordanians in patronizing Islamic

banks. In the same vein. (Akbar, Zulfiqar Ali Shah,

& Kalmadi, 2012) in their study on the consumer

criteria for the selection of an Islamic bank in

Pakistan found that high profit & low service

charges were the main factors that influenced

customers’ selection of Islamic banks and not

religious criteria.

The empirical studies reviewed investigated the

rationale behind customers’ choice of Islamic banks

without segregating the customers into different

categories based on the relationships that subsists

between the Islamic banks and their customers. This

is important when we consider the fact that unlike in

Do Bank Customers Prefer Profit Sharing Investment Accounts? A Proposed Conceptual Framework

119

conventional banking where the banker-customer

relationship is mainly based on debtor-

creditor(Ahmad & Hassan, 2007) in Islamic banking

various relationships subsists between the bank and

their customers and each class of customers have

their unique characteristics. As was observed by

(Mahinar et al., 2019), one of the distinctive feature

of Islamic banking is the multiple contractual

relationships that exist between Islamic banks and

their customers which could be that of partners,

investors and traders, as well as buyers and sellers.

(Metawa & Almossawi, 1998) surveyed 300

customers of the only existing Islamic banks then in

Bahrain namely Bahrain Islamic Bank and the Faisal

Islamic Bank with the aim of understanding their

banking habits and their selection criteria. The result

of their study shows that religious factor was the

most important consideration in Bahrain in the

selection of Islamic banks, next to it was the rate of

return offered by the banks, reference by family and

friends was the third most important factor, while

convenience of bank location was the fourth

important factor. The result of this study shows the

importance of religiosity as well as rate of return in

the selection of Islamic banks in Bahrain. In a more

recent study by(Al-Hadrami, Hidayat, & Al-Sharbti,

2017) on the important selection criteria in choosing

Islamic banks in Bahrain has confirmed the findings

by Metawa & Almossawi (1998) on the centrality of

religious belief as the most important criteria in

Islamic bank selection in Bahrain.

(Shome, Jabeen, & Rajaguru, 2018), surveyed a

total of 367 undergraduate students from Abu Dhabi

on the factors that influence their decisions to

patronize Islamic banks. The result of the study

shows that the expectation that a bank will act in

conformity with Islamic principles is the most

important factor that influences the respondents to

patronize Islamic banks. This was followed by

fluency in Arabic language by the staff of the banks.

The study found no significance between

respondent’s’ level of education, gender, nationality

and familiarity with Islamic banking products. The

result of another study conducted by(Kaakeh,

Hassan, & Van Hemmen Almazor, 2019) of 178

customers of Islamic and conventional banks

residing in the UAE shows that attitude and

awareness affect intention directly, while image,

awareness, Shariah compliance and individualism

affect attitude directly and intention indirectly

mediated by attitude as factors that affect the choice

of Islamic banks over conventional by the

respondents.

(Sayani, 2015) surveyed a total of 319

respondents in the UAE on the factors that

influenced their selection of both Islamic and

conventional banks. The respondents were asked

questions about efficiency in handling transaction on

the phone, confidentiality, knowledge and

friendliness of personnel, quality of advice provided

by the personnel, reputation, management, range of

products and services, location and number of

branches, operation hours, as well as transaction

costs. Islamic bank customers were also asked to

rate their satisfaction on the Shariah supervisory

board. The result of the study shows that Islamic

banks’ customers were satisfied with the Shariah

Advisory Board, convenience-related factors such as

number of branches, and efficiency- related factors

like handling issues on the phone. However, an

inverse relationship is found between advice by the

personnel and length of association with the bank.

On the other hand, the importance of reputation and

efficient handling of issues on the phone were

highlighted with respect to conventional banks.

(Hegazy, 1995), in his empirical study on the

selection criteria for Islamic and commercial banks

in Egypt, found that the speed of banking services,

the bank vision of serving the community

(regardless of expected profitability), the bank name

and image, the internal design and comfort of the

bank, friendliness of personnel, equity financing, the

bank architectural design, magazines advertising,

and the prior experience of a family member were

important selection attributes in selecting Islamic

banks among Egyptian customers. In their study of

the role of awareness in Islamic bank patronizing

behaviour of Mauritanians using the Theory of

Reasoned Action (TRA), Mahmoud & Abduh,

(2014) found that intention of Mauritanians to

patronize Islamic bank was influenced by their

subjective norm, attitude and awareness upon

Islamic banking products and practices.

(Erol & El‐Bdour, 1989)in their study to

determine the attitudes of bank customers towards

Islamic banks and the unique characteristics of

Islamic banks as perceived by their customers in

Jordan, found that religious motives did not stand

out as being the major significant motive which

contradicts the general perception prevailing in most

Muslim countries which emphasizes religious

motives as being the major promoting factor of the

Islamic banking movement. The second important

result relates to the opening of new branches of

Islamic banks. The other major findings are that peer

group influence plays an important role in selecting

Islamic banks and that there is a high degree of

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

120

awareness on the part of bank customers of the

advantages related to the profit-loss-sharing modes

of the investments and income distributional role of

the Islamic banking system.

(Mahadin & Akroush, 2018) found that attracting

new customers and retaining the current ones depend

on the perceived benefits in the areas of service

quality, convenience and several value aspects.

Factors such as staff readiness, knowledge,

attentiveness and proficiency, the variety of services

offered, confidentiality of the bank, availability of e-

banking services and ease of use are the major

factors that attract Islamic banks customers.

Religious motives have a positive but non-

significant effect on perceived value for Islamic

banks’ customers. This shows that being consistent

and compliant with the Shariah law is not the

deciding factor when customers make the decision to

deal with an Islamic bank by Jordanians.

(Idris et al., 2011) in their study of 250 Islamic

bank customers in seven Malaysian Public

Institutions of Higher Learning found that religious

value appears to be the most important factor in

selecting which Islamic bank to patronise. Other

factors perceived to be important include ATM

services, financial security, cost and benefit and

attractiveness. On their part, (Suhartanto, Gan,

Sarah, & Setiawan, 2019) who studied 412 Islamic

bank customers from Indonesia found that customer

loyalty towards Islamic banks is driven more by

emotional attachment and religiosity rather than by

perceived service quality. In his study of customers’

determinant factors in the selection of Islamic banks

in Indonesia, (Krisnanto, 2011) found that secondary

factors such as recommendation from friends and

family members were the major factors that motivate

people to patronize Islamic banks in Indonesia.

(Bin et al., 2019) who studied the factors that

persuade individuals’ behavioural intention to opt

for Islamic banks’ services in Malaysia found that

attitude, subjective norms and perceived behavioural

control has significant influence on the behavioural

intention of the depositors to choose Islamic bank

services. (Selvanathan, Nadarajan, Farzana, Zamri,

& Suppramaniam, 2018) in their study that aimed to

determine and identify the factors that influence

consumers of Selangor area of Malaysia to choose

Islamic banking products and services found bank

reputation, religious and cost benefit factors as the

most significant factors that influence customers’

selection of Islamic banks. They found a positive

relationship between a bank’s reputation and cost

benefit on customer’ choice of an Islamic bank,

while religious belief does not much influence.

(Fadhli Bassir, Zakaria, Hasan, & Alfan, 2014) who

studied factors that influence the adoption Islamic

home finance in Malaysia found that religiosity was

the main influencing factor for the adoption of

Islamic home financing among Muslims in

Malaysia. Other influencing factors based on the

results of their study include the brand/reputation of

the financial institution, cost of financing and

knowledge and awareness. The result of the study by

(Selamat, K. and Abdul Kadir, 2012) who studied

the selection criteria used by Muslim and non-

Muslim in a dual banking system in Malaysia found

a contrary result to that obtained by Fadhli et al

(2014), the result of their study shows that the most

important selection factor in the adoption of Islamic

bank in Malaysia was fast and efficient service

delivery, followed by confidentiality of the bank and

banks’ image and reputation but not religious

motivation.

(Akif Hasan, Imtiaz Subhani, & Osman, 2012)

investigated the criteria used in the selection of

Islamic banks in Karachi, Pakistan. Their study

found that high profit & low service charges is the

most important factor followed by religious motives

and quality of service for selecting Islamic banks by

consumers. On their part, (Awan & Shahzad

Bukhari, 2011) found product features and quality of

service to be the major factors that influence their

respondents to patronize Islamic banks in Pakistan

while religious beliefs tend to have less influence on

the population of their study.

Majority of the study on GCC countries showed

that religious factor in terms of compliance with the

provisions of Shari’ah by the IB is the most

important factor that influences the selection of IBs

in the GCC. This should not come as a surprise

when we consider the fact that the GCC is a

predominantly Muslim region that are known to be

conservative and that adhere to the teachings of

Islam. However, in the MENA region, it could be

observed that religious belief and compliance with

Shariah by Islamic banks were not the major factors

that influence customer’s choice of Islamic banks

unlike what obtains in the GCC. The most important

factors were the perceived quality of service that the

banks could offer as well as the reputation of the

banks. This perhaps might be due to the fact that

unlike in the GCC where the people are known to be

very conservative and the Islamic financial system is

very dominant, in the MENA region Islamic finance

is still at its growing stage and the Islamic banks

have to compete with the conventional ones in order

to attract and keep their customers. There seems not

to be consistency in the factors that influence the

choice of Islamic banks amongst customers in Asia.

Whereas some studies show religious inclination as

Do Bank Customers Prefer Profit Sharing Investment Accounts? A Proposed Conceptual Framework

121

the most important factor in choosing Islamic banks

by customers especially in some studies in Malaysia,

others show high profit and low-cost service as the

most important selection criteria. However, one

thing that stands out is the fact that in all the studies

reviewed above, religious motive plays a significant

role in the selection of Islamic banks among Asians.

Empirical Evidence on Why Customers Deposits

and Invest in Investment Accounts of Islamic

Banks?

A number of studies abound in the field of Islamic

finance and also on the factors that motivate

customers of Islamic banks to patronize such banks.

However, as observed by (Tahir, 2007), most of the

intellectual work in Islamic finance were geared

towards developing Shariah-compliant alternative

financing products with little attention paid to

deposit mobilization by Islamic banks. The few

researches on Islamic banking deposits only discuss

Islamic banking products and services in general

terms using secondary data without segregating the

depositors into different categories based on the type

of relationships between the clients and the Islamic

banks. Also, most of the studies conclude that

Islamic banking depositors like their conventional

counterparts are attracted by the prospect of returns.

The segregation is important because in Islamic

finance, each type of deposit is devised using

different approved Islamic banking contract such as

qard or wadiah for demand and savings deposits,

while mudarabah is offered for investment

deposits(Yusoff & Wilson, 2005). It is important to

study the behavioural pattern of each of this

category of depositors in order to have a good

understanding of what really motivate them to

patronize Islamic banks.

As was observed by (Karim, 2001) the total

investment portfolio of Islamic bank is mostly

financed by IAH’s funds. It is then imperative to

both the management of Islamic banks as well the

regulators to understand the behavioural patterns of

this very important category of depositors. Islamic

banks receive funds from their customers on the

basis of mudarabah and are allowed to use the funds

in any activity that the bank deems appropriate, so

long as the activities do not contravene the

provisions by Islamic laws (Olson & Zoubi, 2008).

(Karim, 2001) observed that the total investment

portfolio of an Islamic bank is mostly financed by

IAHs’ funds, in addition to other sources like

shareholders’ funds and others. IAHs’ funds could

be either restricted or unrestricted. RIAs are

mudaraba accounts whose holders authorize the

Islamic banks to invest their funds either on

mudarabah or wakala basis with certain restrictions

as to where, how and for what purpose the funds are

to be invested(IFSB, 2018). Under RIAs, Islamic

banks are constrained by the IAHs as to which

sectors and sometimes even locations they could

invest their funds. Unrestricted Investment Accounts

(URIAs) on the other hand is a mudaraba contract

whereby the capital providers IAHs permits the

Islamic banks as the mudarib to invest their funds as

the bank deems fit without any restriction on the

type of investment to be undertaken, the location,

time, comingling of the funds(ISRA, 2018). Under

URIA contract, the IB has a wide range of choices as

to the type of trade to undertake, with whom to trade

and in which location to undertake such trade.

Losses if any is borne by the PSIAHs except in

proven cases of negligence or breach of contract on

the part of the bank as a mudarib.

The share of unrestricted investment accounts in

the total deposit of Islamic banks varies considerably

from near zero to over 80% in some banks(Iqbal,

Ali, & Muljawan, 2012) Islamic banks like their

conventional counterparts rely on monies from

depositors as their major source of funding. As such,

it behoves on the management of Islamic banks to

know the factors that influence customers’ decision

making in depositing their money with Islamic bank

(Haron & Ahmad, 2000).

This is particularly important if we consider the

risk appetite of the UIAHs. As was expounded by

(Alhammadi, Archer, Padgett, Ahmed, & Karim,

2018), UIAHs are typically risk averse and would

normally seek a low-risk low return deposit-like

account. Understanding the savings and investment

culture and factors that influence the savings

behaviour of IAHs would assist the management of

the Islamic banks to develop strategies to attract and

retain such clients. It would equally assist regulators

ensure that the rights of this class of depositors is

protected by the Islamic banks.

A number of Islamic economists and researchers

conducted numerous studies on Islamic banking

deposits and the behavioural patterns of depositors

of Islamic banks mostly by using secondary time

series data. (Haron & Ahmad, 2000) who studied the

effects of conventional interest rates and rate of

profit on funds deposited with Islamic banking

system in Malaysia confirms the negative effect of

conventional interest rates on the deposit

mobilisation by Islamic banks, such that any

increase in the interest rates paid by conventional

banks to their depositors leads to an increase in their

conventional total deposits but leads to a decrease in

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

122

the total deposits of Islamic banks. Another study by

(Kaleem & Isa, 2003) on the causal relationship

between Islamic and conventional banking

instruments in Malaysia found a strong relationship

between Islamic and conventional term deposit

returns. Kaleem et al (2003) then concludes that

Islamic banks in Malaysia consider interest rates

offered by conventional banks before adjusting their

deposits returns. This confirms the influence of

conventional interest rates on the deposit of Islamic

banks in Malaysia. The findings by Kaleem et al

(2003) and Haron and Ahmad (2000) were further

corroborated by other studies by (Bacha,

2004)(Chong & Liu, 2009) who studied the impact

of interest rate risk on Islamic banks operating in a

dual banking environment such as Malaysia.

In their study of the determinants of savings in

Islamic banks in Indonesia, (Kasri & Kassim, 2010)

found that depositors of Islamic banks were

influenced by the return they receive from their

savings as well as the interest paid by conventional

banks, such that depositors in Islamic banks are

willing to transfer their savings to conventional

banks when the conventional banks offer rates that

are higher than what the Islamic banks are offering.

The results of the above reviewed studies are

another proof that depositors of Islamic banks are

motivated by the profit maximization motive

because they are easily swayed by the prospect of

increase in interest rates by conventional banks and

are ready to move their funds there except if the

Islamic banks are ready to also increase their rate of

return to match that which the conventional banks

are paying. Other studies that confirm the influence

of conventional banks’ interest on Islamic banks’

deposits and that depositors of Islamic banks are

motivated by the profit they expect to receive from

their respective banks include (e.g. (Anuar,

Mohamad, & Shah, 2014), (Arshad, Zakaria, &

Irijanto, 2014), (Akhtar, Akhter, & Shahbaz, 2017),

(Haron & Nursofiza Wan Azmi, 2008) and (Meutia,

2016).

Other studies on the determinant of factors

influencing deposits in Islamic banks show that

depositors of Islamic banks are influenced more by

their religious believes than by profit motive.

(Akhtar et al., 2017) in their study of the

determinants of deposits in conventional and Islamic

banking in Pakistan shows that the most important

factor that attract customers to deposit with Islamic

banks is religious belief.

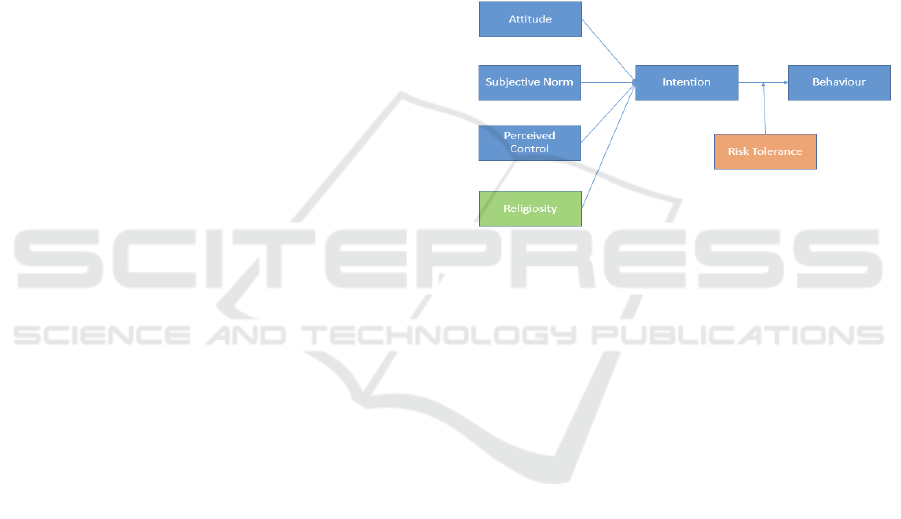

Proposed Conceptual Framework

The critical literature reviews on both factors

influencing customers choose Islamic banking

products and specifically factors influencing

customer to choose deposits in Islamic banks as

compared to conventional banks. Because of the

unique characteristic of PSIA, the common model of

TRA and TPB to understand the behaviour of

customer’s deposit in PSIA need to be modified.

Hence, Figure 1 proposed the conceptual

framework. In addition to Attitude, Subjective

Norm; and Perceived Control; Religiosity variable is

added to the model. Moreover, variable on risk

tolerance acts as a moderating variable for Intention

to Behaviour.

Figure 1: Proposed Conceptual framework.

3 CONCLUSION

With the exception of (Moha-Karim, Muhammad,

2010) who examined the level of awareness,

knowledge, perceptions, and attitude of the Islamic

banking depositors in Malaysia towards the

characteristics of profit-sharing deposits accounts

using primary data, to the best of the researcher’s

knowledge , no other research has attempted to study

the behavioural pattern of IAHs using primary data

obtained directly from the IAHs, majority of the

studies reviewed used secondary time series data to

analyse the behaviour of depositors in Islamic banks.

Hence, this is among the first model that integrate

TRA and TPM with two unique factors which are

risk tolerance and religiosity to explain on why

customers choose PSIA.

Therefore, this study is considered unique and

distinct from previous studies that considered only

secondary data to determine the behavioural pattern

of IAHs. It aims to fill the gap in the existing

literature. Firstly, it would contribute to the body of

knowledge on factors that influence IAHs to

patronise IBs and would also provide an insight as to

the understanding by the IAHs of mudarabah as the

Do Bank Customers Prefer Profit Sharing Investment Accounts? A Proposed Conceptual Framework

123

underlying contract in Investment account.

Considering the importance of deposits to banks, the

study would benefit the regulatory body that is

charged with the responsibility of supervising and

regulating Islamic banks to understand the factors

that influence customers of Islamic banks to

patronise them, which would assist them in making

policies that have implication for financial system

stability in the banking sector.

REFERENCES

AAOIFI. Accounting and Auditing Organisation Of

Islamic Financial Institutions Shari’ah Standards. ,

(2015).

Ahmad, A. U. F., & Hassan, M. K. (2007). Regulation and

performance of Islamic banking in Bangladesh.

Thunderbird International Business Review, 49(2),

251–277. https://doi.org/10.1002/tie.20142

Akbar, S., Zulfiqar Ali Shah, S., & Kalmadi, S. (2012). An

investigation of user perceptions of Islamic banking

practices in the United Kingdom. International

Journal of Islamic and Middle Eastern Finance and

Management, 5(4), 353–370.

https://doi.org/10.1108/17538391211282845

Akhtar, B., Akhter, W., & Shahbaz, M. (2017).

Determinants of deposits in conventional and Islamic

banking: a case of an emerging economy.

International Journal of Emerging Markets, 12(2),

296–309. https://doi.org/10.1108/IJoEM-04-2015-

0059

Akif Hasan, S., Imtiaz Subhani, M., & Osman, A. (2012).

Consumer Criteria for the Selection of an Islamic

Bank: Evidence from Pakistan Consumer Criteria for

the Selection of an Islamic Bank: Evidence from

Pakistan. International Research Journal of Finance

and Economics, (94). Retrieved from

https://mpra.ub.uni-

muenchen.de/40384/1/MPRA_paper_40384.pdf

Al-Hadrami, A. H., Hidayat, S. E., & Al-Sharbti, M. I.

(2017). The Important Selection Criteria in Choosing

Islamic Banks: A Survey in Bahrain. Al-Iqtishad:

Journal of Islamic Economics, 9(2), 165–184.

https://doi.org/10.15408/aiq.v9i2.4635

Al-Tamimi, H. A. H., Anood, A., & Kalli, B. (2009).

Financial literacy and youth entrepreneurship in South

Africa. African Journal of Economic and Management

Studies, 10(5), 164–182.

https://doi.org/10.1108/15265940911001402

Alaeddin, O., Archer, S., Karim, R. A. A., & Mohd. Rasid,

M. E. S. (2017). Do Profit-sharing Investment

Account Holders Provide Market Discipline in an

Islamic Banking System? Journal of Financial

Regulation, 3(2), 210–232.

https://doi.org/10.1093/jfr/fjx006

Alhammadi, S. (2016). Corporate Governance Dilemma

with Unrestricted Profit Sharing Investment Accounts

in Islamic Banks The effect of conflict of interest

between UPSIA holders and shareholders. Retrieved

from

http://centaur.reading.ac.uk/68415/1/20029404_Alham

madi_thesis.pdf

Alhammadi, S., Archer, S., Padgett, C., Ahmed, R., &

Karim, A. (2018). Journal of Financial Regulation and

Compliance Perspective of corporate governance and

ethical issues with profit sharing investment accounts

in Islamic banks Article information. Journal of

Financial Regulation and Compliance, 26(3), 406–

424. https://doi.org/10.1108/JFRC-01-2017-0014

Ali Al-Jarhi, M., & Ali Al, M. (2017). An economic

theory of Islamic finance. ISRA International Journal

of Islamic Finance, 9(2), 117–132.

https://doi.org/10.1108/IJIF-07-2017-0007

Anuar, K., Mohamad, S., & Shah, M. E. (2014). Are

deposit and investment accounts in Islamic banks in

Malaysia interest free? Journal of King Abdulaziz

University, Islamic Economics, 27(2), 27–55.

https://doi.org/10.4197/Islec.27-2.2

Archer, S., Ahmed Abdel Karim, R., & Sundararajan, V.

(2010). Supervisory, regulatory, and capital adequacy

implications of profit-sharing investment accounts in

Islamic finance. Journal of Islamic Accounting and

Business Research, 1(1), 10–31.

https://doi.org/10.1108/17590811011033389

Arshad, N. C., Zakaria, R. H., & Irijanto, T. (2014).

Determinants of Displaced Commercial Risk in

Islamic Banking Institutions : Malaysia Evidence.

Trikonomika, 13(2), 205–217.

Awan, H. M., & Shahzad Bukhari, K. (2011). Customer’s

criteria for selecting an Islamic bank: evidence from

Pakistan. Journal of Islamic Marketing, 2(1), 14–27.

https://doi.org/10.1108/17590831111115213

Bacha, O. I. (2004). Dual Banking Systems and Interest

Rate Risk for Islamic Banks. (12763). Retrieved from

http://mpra.ub.uni-muenchen.de/12763/

Bashir, T., Hassan, A., Nasir, S., Baber, A., & Shahid, W.

(2013). Gender Differences in Saving Behavior and its

Determinants: Patron from Pakistan. IOSR Journal of

Business and Management (IOSR-JBM, 9(6), 74–86.

Retrieved from www.iosrjournals.org

Bin, A., Pitchay, A., Asmy, M., Mohd, B., Thaker, T.,

Azhar, Z., … Thaker, M. T. (2019). Factors persuade

individuals’ behavioral intention to opt for Islamic

bank services Malaysian depositors’ perspective.

Emerald Insight. https://doi.org/10.1108/JIMA-02-

2018-0029

Campbell, A., LaBrosse, J. R., Mayes, D. G., & Singh, D.

(2009). A new standard for deposit insurance and

government guarantees after the crisis. Journal of

Financial Regulation and Compliance, 17(3), 210–

239. https://doi.org/10.1108/13581980910972214

Chong, B. S., & Liu, M. H. (2009). Islamic banking:

Interest-free or interest-based? Pacific Basin Finance

Journal, 17(1), 125–144.

https://doi.org/10.1016/j.pacfin.2007.12.003

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

124

CIMA. (2007). Islamic Finance. Islamic Finance: The

Regulatory Challenge, 282–291.

https://doi.org/10.1002/9781118390443.ch15

Erol, C., & El‐Bdour, R. (1989). Attitudes, Behaviour, and

Patronage Factors of Bank Customers towards Islamic

Banks. International Journal of Bank Marketing, 7(6),

31–37. https://doi.org/10.1108/02652328910132060

Fadhli Bassir, N., Zakaria, Z., Hasan, H. A., & Alfan, E.

(2014). Factors Influencing The Adoption Of Islamic

Home Financing In Malaysia. Univerity of Malaya.

Retrieved from

https://umexpert.um.edu.my/file/publication/00005702

_116246_63971.pdf

Fishbein, M. (2008). Reasoned Action, Theory of. In The

International Encyclopedia of Communication.

https://doi.org/10.1002/9781405186407.wbiecr017

Gait, A., & Worthington, A. (2008). An empirical survey

of individual consumer, business firm and financial

institution attitudes towards Islamic methods of

finance. International Journal of Social Economics,

35(11), 783–808.

https://doi.org/10.1108/03068290810905423

Haron, S., & Ahmad, N. (2000). The Effects Of

Conventional Interest Rates And Rate Of Profit On

Funds Deposited With Islamic Banking System In

Malaysia. In International Journal of Islamic

Financial Services (Vol. 1). Retrieved from

https://s3.amazonaws.com/academia.edu.documents/3

3013938/haron_ahmad.pdf?response-content-

disposition=inline%3B

filename%3DTHE_EFFECTS_OF_CONVENTIONA

L_INTEREST_RAT.pdf&X-Amz-Algorithm=AWS4-

HMAC-SHA256&X-Amz-

Credential=AKIAIWOWYYGZ2Y53UL3A%2F2019

0709%2Fus-

Haron, S., & Nursofiza Wan Azmi, W. (2008).

Determinants of Islamic and conventional deposits in

the Malaysian banking system. Managerial Finance,

34(9), 618–643.

https://doi.org/10.1108/03074350810890976

Hegazy, I. A. (1995). An Empirical Comparative Study

Between Islamic And Commercial Banks’ Selection

Criteria In Egypt. International Journal of Commerce

and Management, 5(3), 46–61.

https://doi.org/10.1108/eb047313

Idris, R., Nik Muhammad Naziman, K., Sarah Januri, S.,

Fizari Abu Hassan Asari, F., Muhammad, N., Md

Sabri, S., & Jusoff, K. (2011). Religious Value as the

Main Influencing Factor to Customers Patronizing

Islamic Bank. Special Issue on Bolstering Economic

Sustainability, 12, 8–13. Retrieved from

https://pdfs.semanticscholar.org/d017/d2bc2b4b91f8b

ec970dc52fb765a47f4b75b.pdf

IFSB. IFSB-15 Revised Capital Adequacy Standard for

Institutions Offering [ Excluding Islamic Insurance (

Takāful ) Institutions and Islamic Collective

Investment Schemes ]. , Islamic Financial Services

Board § (2015).

IFSB. (2018). Islamic Financial Services Industry Stability

Report. Retrieved from https://www.ifsb.org/

Iqbal, M., Ali, S. S., & Muljawan, D. (2012). Advances in

Islamic Economics and Finance: Proceedings of 6th

International Conference on Islamic Economics and

Finance. 88(1036), 57–58.

ISRA. (2018). Islamic Financial System: Principles &

Operations (Second Edi). International Shari’ah

Research Academy for Islamic Finance.

Kaakeh, A., Hassan, M. K., & Van Hemmen Almazor, S.

F. (2019). Factors affecting customers’ attitude

towards Islamic banking in UAE. International

Journal of Emerging Markets.

https://doi.org/10.1108/IJOEM-11-2017-0502

Kaleem, A., & Isa, M. M. (2003). Causal relationship

between Islamic and Conventional Banking

Instruments in Malaysia. International Journal of

Islamic Financial Services, 4(4), 1–8.

Kaleem, A., & Md Isa, M. (2003). Causal Relationship

Between Islamic And Conventional Banking

Instruments In Malaysia. International Journal of

Islamic Financial Services, 4(4).

Karim, R. A. A. (2001). International accounting

harmonization, banking regulation, and Islamic banks.

The International Journal of Accounting, 36(2), 169–

193. https://doi.org/10.1016/S0020-7063(01)00093-0

Karim, R. A. A., & Ali, A. E. (1989). Determinants of the

Financial Strategy of Islamic Banks. Journal of

Business Finance & Accounting, 16(2), 193–212.

https://doi.org/10.1111/j.1468-5957.1989.tb00013.x

Kasri, R., & Kassim, S. (2010). Empirical Determinants of

Saving in the Islamic Banks: Evidence from

Indonesia ﻦﻣ ﺔﻟﺩﺃ :ﺔﻴﻣﻼﺳﻹﺍ ﻙﻮﻨﺒﻟﺍ ﻲﻓ ﺭﺎﺧﺩﻼﻟ ﺔﻴﺒﻳﺮﺠﺘﻟﺍ ﺕﺍﺩﺪﺤﻤﻟﺍ

ﺎﻴﺴﻴﻧﻭﺪﻧﺇ. Journal of King Abdulaziz University-Islamic

Economics, 22(2), 181–201.

https://doi.org/10.4197/islec.22-2.7

Khaldi, K., & Amina, H. (2018). Islamic Financial

Intermediation : Equity , Efficiency and Risk 1.

(October).

Krisnanto, U. (2011). The Customers’ Determinant

Factors of the Bank Selection. International Research

Journal of Busineee Studies, 4(1).

Lahrech, N., Lahrech, A., & Boulaksil, Y. (2014).

Transparency and performance in Islamic banking

Implications on profit distribution. 7(1), 61–88.

https://doi.org/10.1108/IMEFM-06-2012-0047

Madden, T. J., Ellen, P. S., & Ajzen, I. (1992). A

Comparison of the Theory of Planned Behavior and

the Theory of Reasoned Action. Personality and

Social Psychology Bulletin, 18(1), 3–9.

https://doi.org/10.1177/0146167292181001

Mahadin, B. K., & Akroush, M. N. (2018). A study of

factors affecting word of mouth (WOM) towards

Islamic banking (IB) in Jordan. International Journal

of Emerging Markets. https://doi.org/10.1108/IJOEM-

10-2017-0414

Mahinar, N., Bakar, A., Mohd Yasin, N., & Teong, N. S.

(2019). Banker-Customer Relationship in the

Conventional and Islamic Banks in Malaysia,

Revisited. International Journal of Accounting, 4(17),

8–21. Retrieved from www.ijafb.com

Do Bank Customers Prefer Profit Sharing Investment Accounts? A Proposed Conceptual Framework

125

Man Kit Chang. (1998). Predicting Unethical Behavior: A

Comparison of the Theory of Reasoned Action and the

Theory of Planned Behavior. Retrieved from

https://link.springer.com/content/pdf/10.1023%2FA%

3A1005721401993.pdf

Metawa, S. A., & Almossawi, M. (1998). Banking

behavior of Islamic bank customers: Perspectives and

implications. International Journal of Bank

Marketing, 16(7), 299–313.

https://doi.org/10.1108/02652329810246028

Meutia, I. (2016). 2016 empirical-research-on-rate-of-

return-interest-rate-and-mudharabah-deposit.

International Journal of Accounting Research.

Moha-Karim, Muhammad, S. (2010). Profit-Sharing

Deposit Accounts in Islamic Banking : Analysing the

Perceptions and Attitudes of the Malaysian

Depositors. 92–93. Retrieved from

http://etheses.dur.ac.uk/520/

Montaño, D. E., & Kasprzyk, D. (n.d.). Theory Of

Reasoned Action, Theory Of Planned Behavior, And

The Integrated Behavioral Model. Retrieved from

https://www.researchgate.net/profile/Danuta_Kasprzy

k/publication/288927435_Health_Behavior_and_Healt

h_Education_Theory_Research_and_Practice/links/56

eabb1008ae95fa33c851df.pdf

Montano, D., & Kasprzyk, D. (2008). Theory of reasoned

action, theory of planned behavior, and the integrated

behavior model 86 PUBLICATIONS 3,538

CITATIONS SEE PROFILE. Retrieved from

https://www.researchgate.net/publication/233894824

Naude, P. M. P. (2015). Factors contributing to bank

selection choices: a generation theory

perspective" Retrieved from

https://businessperspectives.org/images/pdf/applicatio

ns/publishing/templates/article/assets/6383/BBS_en_2

015_01_Msweli.pdf

Olson, D., & Zoubi, T. A. (2008). Using accounting ratios

to distinguish between Islamic and conventional banks

in the GCC region. International Journal of

Accounting, 43(1), 45–65.

https://doi.org/10.1016/j.intacc.2008.01.003

Ramli, J. A. (2014). Managing the Risks of Mudharabah

contract in Malaysian Islamic Banks: An Examination

of Issues. Retrieved from

https://www.researchgate.net/publication/273634793

Reuters, T. (2018). Islamic Finance Development Report

2018 Building Momentum.

Samad, A. (2014). Commercial Bank Non-Interest Fee

Charges: Are Fee Charges Different Between Islamic

Banks And Conventional Banks? Evidence From

Bangladesh. In Asian Economic and Financial Review

(Vol. 4). Retrieved from

http://www.aessweb.com/journals/5002

Sayani, H. (2015). Customer satisfaction and loyalty in the

United Arab Emirates banking industry. Marketing

Intelligence and Planning, 33(3), 351–375.

https://doi.org/10.1108/IJBM-12-2013-0148

Selamat, K. and Abdul Kadir, H. (2012). Attitude and

Patronage Factors of Bank Customers in Malaysia :

Muslim and non-Muslim Views. Journal of Islamic

Economics, Banking and Finance, 8(4), 87–100.

Selvanathan, M., Nadarajan, D., Farzana, A., Zamri, M., &

Suppramaniam, S. (2018). An Exploratory Study on

Customers ’ Selection in Choosing Islamic Banking.

11(5), 42–49. https://doi.org/10.5539/ibr.v11n5p42

Shome, A., Jabeen, F., & Rajaguru, R. (2018). What

drives consumer choice of Islamic banking services in

the United Arab Emirates? International Journal of

Islamic and Middle Eastern Finance and

Management, 11(1). https://doi.org/10.1108/IMEFM-

03-2017-0066

Suhartanto, D., Gan, C., Sarah, I. S., & Setiawan, S.

(2019). Loyalty towards Islamic banking: service

quality, emotional or religious driven? Journal of

Islamic Marketing. https://doi.org/10.1108/JIMA-01-

2018-0007

Sundararajan, V. (2007). Profit Sharing Investment

Accounts-- Measurement and Control of Displaced

Commercial Risk ( Dcr ) in Islamic Finance. Islamic

Economic Studies, 19(1), 41–62.

Tahir, S. (2007). Islamic Banking Theory And Practice: a

Survey And Bibliography Of The 1995-2005

Literature. Banking, 1, 1–72. Retrieved from

http://www.sesric.org/pdf.php?file=ART06100101-

2.pdf

Toumi, K., Viviani, J. L., & Belkacem, L. (2011). Actual

risk sharing measurement in Islamic banks. Critical

Studies on Corporate Responsibility, Governance and

Sustainability, 2(October), 325–347.

https://doi.org/10.1108/S2043-9059(2011)0000002021

Yahaya, I. O. (2013). Profit Sharing Investment Accounts :

Implications of liquidity risk managment.

Yusoff, R., & Wilson, R. (2005). An econometric analysis

of conventional and Islamic Bank deposits in

Malaysia. Review of Islamic Economics., 91(1), 31–

49.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

126