Business Model in Islamic Microfinance: Case Study of Baitul Maal

Wat Tamwil (BMT) La Tansa Gontor

Fajar Surya Ari Anggara and Roghiebah Jadwa Faradisi

Department of Management, University of Darussalam Gontor, Indonesia

Keywords: Business Model, Islamic Microfinance, BMT La Tansa Gontor.

Abstract: The use of the canvas business model method in Islamic financial institutions namely BMT is considered

important to correct a possibility of an error or the need for improvement in one of the boxes of the process

of running a business model. BMT La Tansa Gontor is a business entity that has profit and social benefits.

This research is a qualitative descriptive study with a research location in BMT La Tansa Gontor Ponorogo.

A purpose of this study is to determine the concept of BMT La Tansa Gontor’s business model using the

Business Model Canvas Approach based on 9 aspects. Technique data collection through interviews and

observations. Data analysis uses interpretation qualitative and business model canvas tool method in consist

of analysis in this study is value propositions, channels, customer relationships, customer segments, revenue

streams, key resources, key activities, key partners, cost structure. The results showed that product

development innovation at BMT La Tansa focus on customer relationship for segmented customer as member

of BMT La tansa Gontor and local people. Key Assets of BMT La Tansa, by conducting training for

employees and motivate employees to continue their studies at Higher Education. BMT La Tansa customer

relationship using word of mouth strategy to support improving public understanding of Islamic social finance

service. Channels strategy of BMT La Tansa Gontor is to increasing the retention of prospective customer

and utilizing information technology for communication and marketing media. Key Activities of BMT La

Tansa Gontor is to make a list of visits of existing customers and prospects.

1 INTRODUCTION

BMT La Tansa Gontor's role in improving people's

welfare is very important with its financing products

which are very beneficial for people and especially

member of BMT La Tansa Gontor. An Islamic

financial institution must also pay attention to

regional micro small businesses which also have an

effect on improving the economy. One of the

financial institutions which is needed by micro small

businesses. The institutions that are required to obtain

business licenses through Inauguration as MFIs to

OJK no later than January 8, 2016. are Village Bank,

Village Lumbung, Market Bank, Employee Bank,

Village Credit Board (BKD), Kecamatan Credit

Board (BKK), Credit Small Business Enterprises

(KURK), Sub-district Credit Agencies (LPK),

Village Production Work Banks (BPR), and Baitul

Maal Wa Tamwil (BMT) (Mulyati & Harieti, 2018).

Micro, Small, Medium Enterprise dominates 99.75

percent, and only 0.19 percent is a large-scale

business in Indonesia. According to database of

Ministry of Cooperatives and SMEs Republik

Indonesia, there is 824 cooperatives in Ponorogo

Regency. 23 cooperatives on Mlarak Sub-District pay

attention to improving local economy which is

registered in database of Ministry of Cooperatives

and SMEs Republik Indonesia.

Business Model Innovation in order to supporting

Scaling Up Islamic Microfinance. Business model

can help people to identify opportunities to improve

Islamic microfinance business models to achieve

greater effectiveness, efficiency and scale of BMT La

Tansa Gontor. These objectives to examine the role

of business model innovation in BMT La Tansa

Gontor’s survival and growth and to identify

opportunities for continued technical assistance.

From a managerial point of view, the business model

construct offers an alternative perspective for running

key process of value creation instead of managing

activities and functions (Sainio et al., 2011).

The use of the canvas business model method in

Islamic financial institutions such as BMT is

considered important to correct a possibility of an

76

Anggara, F. and Faradisi, R.

Business Model in Islamic Microfinance: Case Study of Baitul Maal Wat Tamwil (BMT) La Tansa Gontor.

DOI: 10.5220/0010115100002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 76-82

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

error or the need for improvement in one of the boxes

of the process of running a business model, because

BMT La Tansa Gontor have business entity that has

profit and social benefits.

2 LITERATURE REVIEW

Business model canvas (BMC) has an advantage in

analysing business models that is able to describe

simply and comprehensively the current condition of

a company based on customer segments, value

offered, value offer pathways, relationship with

customers, revenue streams, vital assets, partner

partners , and the cost structure they have

(Osterwalder, Pigneur, & Smith, 2010). Business

model innovation is requires significant all

management level attention (Evans & Johnson,

2013).

Business model for social and inclusive business

models are similar in partner networks, use of

knowledge and value chain, in the development of

innovative distribution models (except for the cases

in which the market considered is not in an emerging

country) and in terms of social benefit. The social and

inclusive business models are different in terms of

value proposition, profits management model, social

risks and economic profit equation (Michelini &

Fiorentino, 2012).

Business model for Islamic Finance Institutions

such as Islamic Bank with value proposition aspect

depending on participation instead of interest-based

deposit products in collecting funds. In terms of

customer segmentation aspect, around 90% of

depositors are private sector. While using the funds,

the main preference of Islamic banks is loans,

especially Wadi’ah. Wadi’ah has been adopted as a

mode of interest-free financing by a large number of

Islamic banks to finance the purchase of the consumer

goods. Value proposition of Islamic Finance

Institutions depending on loan products, mostly

mark-up financing in using funds. Thus, revenue

streams basically depend on mark-up income instead

of interest income. Almost all of these loans are

owned by private sector, especially non-financial

companies (Muhammad Kashif, Khurrum Faisal

Jamal, 2019).

Business model for Islamic Microfinance

Institutions based on BMT Sidogiri Case Study is

formulated and implemented by applying all the

Islamic business construct contain Aqd/transaction

based sharia, fundamental prohibitions construct is

applied by studying sharia perspective deeply and

specifically, ethical construct is implemented by

providing excellent service based on example from

the Muhammad SAW and Organizational/ Islamic

relationship construct (ukhuwah) is manifested in

social activities and has good relationship with the

community (Hendratmi & Widayanti, 2017)

We strongly encourage authors to use this

document for the preparation of the camera-ready.

Please follow the instructions closely in order to make

the volume look as uniform as possible (Moore and

Lopes, 1999).

2.1 Previous Study

Research conducted by (Solihah, Hubeis, & Maulana,

2016), business model canvas (BMC) has nine

elements that are important in helping to identify

business models in KNM Fish Farm and helping to

identify elements that need improvement to help the

business continuity in the future.

Research results can be concluded that BMT

Kanindo Syariah Jatim business model has well

supported the business operation process and in

accordance with their established vision and mission.

The findings in this study is that there is a difference

between literature and fact regarding key activities

and BMT development constraints. The unit of

analysis in this study is 9 block of business model

canvas such as value propositions, channels,

customer relationships, customer segments, revenue

streams, key resources, key activities, key partners,

cost structure. (R Khairizza Mohammad, 2015)

Microfinance institutions business model

activities can be done in a conventional or sharia-

based manner, including loans / financing in a micro-

scale enterprise for capital needs in business

development, and savings management as an effort to

provide awareness to the public to enjoy saving, while

the microfinance institutions also provides business

development consultancy services The goal is

community empowerment (Mulyati & Harieti, 2018)

The conceptual and historical work results in a

process model of business model change,

demonstrating how central business units feed

strategic alternatives and capabilities to the corporate-

level transformation process. Practical implications

on Nokia Case study showed results highlight the

importance of corporate level "market mechanisms"

that allow promising strategic alternatives to emerge

and select out inferior options (Aspara, Lamberg,

Laukia, & Tikkanen, 2011)

The flexibility business models is explored

through the way organisations select and integrate

three inter-related elements to devise flexible

business models, i.e. network influence, transactional

Business Model in Islamic Microfinance: Case Study of Baitul Maal Wat Tamwil (BMT) La Tansa Gontor

77

relationships, and corporate ownership. This research

to investigate a matched pair sample of 20 high-

performing and 20 low-performing firms in the

United Kingdom (Mason & Mouzas, 2012).

The results obtained consist of nine elements in

the business model consisting of customer segments,

value propositions, customer relationships, customer

segments, channels, revenue streams, cost structures,

main activities, key resources, key partners. need to

improve strategies to increase revenue by not limiting

Customers who are entitled to join Kencleng savings

not only specifically for female customers. In the

main activity strategy Islamic microfinance such as

Koperasi Syariah Manfaat Surabaya Benefits for HR

providing training should be HR that already has the

ability, can work together with educational

institutions (Tantriana, 2018).

3 ANALYSIS MODEL

Choosing a business model is one important factor for

the success of an organization. Choosing a business

model must be innovative so that organizations are

able to survive amid rapid changes in the business

environment. One of the tools that can be used is the

Business Model Canvas (BMC) developed by

(Osterwalder et al., 2010) which supports to describe

and manipulate business models easily and simply to

open the choice of strategies to develop new business

models that are more competitive.

La Tansa Gontor BMT which under the control of

the Pondok Modern Darussalam Gontor and is

managed by the supervisor and has the Principles,

Vision and Mission to fulfill their goals. Principles of

Baitul Maal wa Tamwil La Tansa Gontor are Islamic

Sharia and Gontor Modern Pondok Rules. The vision

of Baitul Maal wa Tamwil La Tansa Gontor is to

become a healthy, thriving and trusted financial

institution, which is able to serve members and the

community, live a life full of safety, peace and

prosperity (A1). The mission of Baitul Maal wa

Tamwil La Tansa Gontor is to develop Baitul Maal

wa Tamwil as a means of empowerment and justice

movements so that the quality of the community

around Baitul Maal wa Tamwil La Tansa Gontor is

achieved which is full of safety, peace and prosperity

(A2). The purpose of Baitul Maal wa Tamwil La

Tansa Gontor is to realize the lives of family members

and the community in their surroundings which are

full of safety, peace and prosperity (A3).

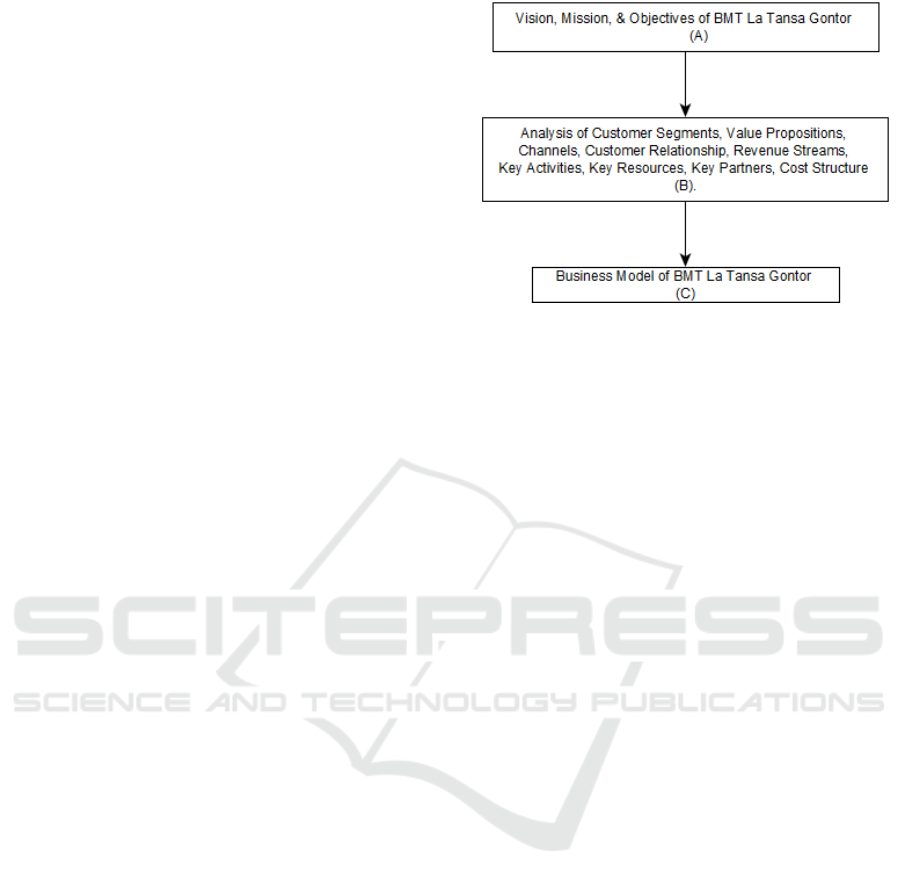

Figure 1: Analysis framework of Business Model on BMT.

An objective of this study is to determine the

concept of BMT La Tansa Gontor’s business model

using the Business Model Canvas Approach based on

9 aspects.

3.1 Aspect of Value Propositions

Value Propositions for BMT La Tansa is what should

be given to the customer, what is required by the

customer, so that the Value in BMT La Tansa can

change according to the market segments and

individual needs of each customer. Products service

cover Wadi’ah and Musawamah for Gontor people.

The Value of BMT La Tansa is a diversity of

products, ease of requirements and free of

administrative costs, shuttle service, and the size of

the ratio offered (B1).

3.2 Aspect of Customer Segments

Market Segmentation is reviewed from the regional

directly related to the main goal of BMT La Tansa

which is centered on agro-commerce business. Agro-

commerce is included in the market segment BMT La

Tansa is all kinds of agro-commerce business (fruits,

vegetables, rice, etc.). The second, because BMT La

Tansa based cooperatives (BMT) then the next

market segmentation is the small Micro

Entrepreneurs (SMEs). Third on the segmentation of

knowledge is to see how the level of understanding of

the community about the products to be offered, so

there is inequality in the BMT La Tansa Branch and

Village branch of the distribution of products. Lastly,

behavioral segmentation is also enforced by looking

at the experience of customer behaviour in some

regions (B2).

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

78

3.3 Aspect of Customer Relationships

Customer relationship at BMT La Tansa is supported

by 3 programs i.e., 1) Meet the clients directly;

2) awarding scholarships; 3) Sharia economic

counselling for the community around BMT La Tansa

Gontor (B3).

3.4 Aspect of Channels

How to distributing products? BMT La Tansa

distributes its products directly to the

community/customers without intermediaries. By

opening a branch office, and conducting a survey

around BMT La Tansa Gontor society (B4).

3.5 Aspect of Revenue Streams

Revenue streams in BMT La Tansa comes from 2

main products namely, Wadi’ah and Mudharabah.

Revenue also gained from the Mutanaqisah product

but in giving the largest proportion of profit, Wadi’ah.

(B5).

3.6 Aspect of Key Resources

BMT La Tansa has a human resource capable of

supporting it, the human resources are supported by

facilities and technology (B6).

3.7 Aspect of Key Activities

BMT La Tansa main activity includes promotion,

education, and negotiation (Akad). Promotions in

various ways include the use of media such as radio,

advertising, etc. In educational activity is about how

the role of BMT La Tansa in improving the quality of

human resources that have been listed on its mission.

At the Akad negotiations that also became the

advantage of BMT La Tansa, BMT La Tansa offers a

more profitable ratio for customers. This akad support

by Ta’awun principle. Ta'awun means that to provide

mutual financial and other forms of aid to members.

(B7).

3.8 Aspect of Key Partners

Partnerships that are collaboration with stakeholder

and also Pondok Modern Darussalam Gontor is to

establishing a Mudharabah agreement because BMT

La Tansa requires additional capital to address

financing demand (B8).

3.9 Aspect of Cost Structures

Cost structure consists of administration fee, salary

(operation), tax fee, equipment fee, and variable cost.

But the cost of forming a value propositions is an

administrative fee where the customer is not charged

an administrative fee (B9).

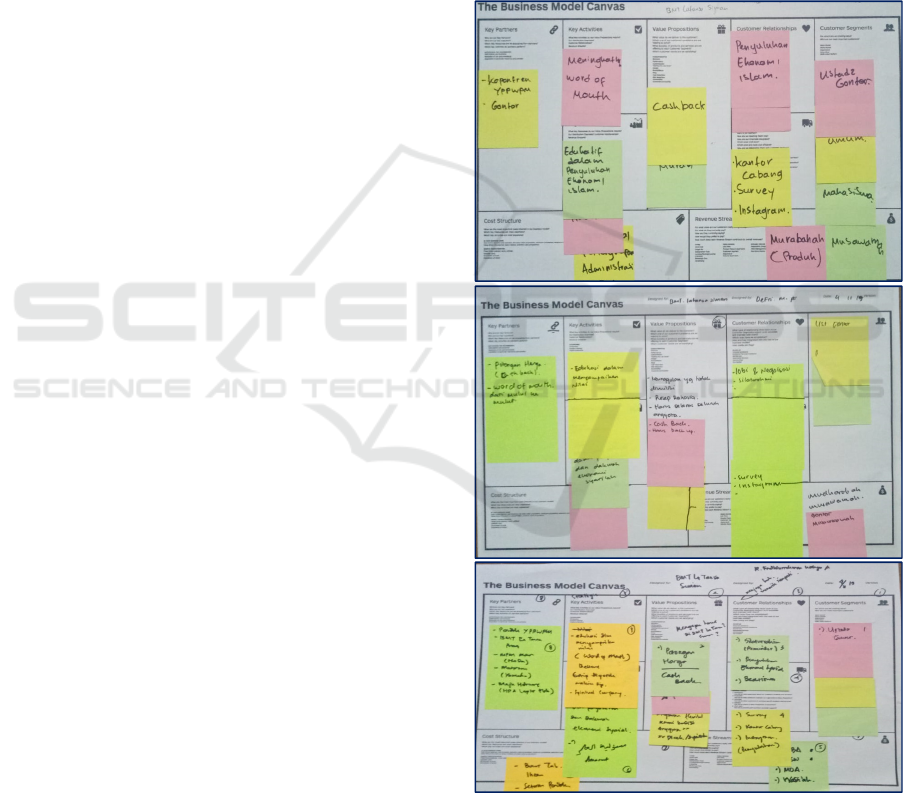

Analysis Business Model Canvas based on 9

aspects which analysed. At this step based on Focus

Group Discussion (FGD) that has been conducted

with business managers and employees, taking into

BMT La Tansa Gontor vision, mission, and purposes

(C).

Figure 2: FGD Result of BMT La Tansa Gontor Business

Model.

BMT La Tansa Gontor conducted business based

on Islamic business construct: transaction follow

aqad, practicing ethic business and high appreciation

Business Model in Islamic Microfinance: Case Study of Baitul Maal Wat Tamwil (BMT) La Tansa Gontor

79

in ukhuwah Islamiyah (network-based brotherhood in

Islam). Values impelemented on BMT La Tansa

Gontor Business Operation based on Panca Jiwa.

This Five Spirits of Pondok Modern Darussalam

Gontor as Holding Institutions cover Sincerity,

Simplicity, Self – Reliance, Islamic Brotherhood, and

Accountable Freedom (Masqon, 2014).

Business activities aspect consist of Islamic

microfinance BMT service, marketing, developing

human resources and financing showed that BMT La

Tansa Gontor conducted those activities strike to the

Islamic business construct. However, in the other side

BMT pointed out to develop from microfinance

business institution traditional approach into modern

business entity that applied Islamic value as an

innovation step ahead.

Business Model Canvas of BMT La Tansa Gontor

cover 9 aspects as improvement business operations.

In this study, the advantages offered are based on

what the market wants or what the problems are in the

market. The actual value propositions can change

depending on how the BMT La Tansa Gontor

services have good impact on consumer's perspective.

Marketing and sales area that is conducted is limited

by BMT La Tansa Gontor, namely by paying

attention to regional segmentation, profession,

knowledge, and behavior. Refer to conducted

research by (Hastuti & Anggara, 2017) values

implemented on BMT La Tansa Gontor include

Sincerity, Simplicity, Independence, Islamic Prayer,

and Freedom. In conducting business and activities,

business actors have understood and implemented

Islamic principles or values based on Al Qur’an and

Hadith. Examples in regional segmentation are

agricultural areas of Siman and Mlarak Sub District,

with the profession of teacher, farmers and ranchers.

Segments of knowledge such as educated

communities and also from community behavior.

From these segmentations BMT La Tansa Gontor can

project in what ways these market segments can be

achieved.

In this study, relating to how to maintain customer

relations or customer retention to remain loyal to the

BMT La Tansa Gontor is to stay in touch, provide

scholarships. BMT La Tansa Gontor also have

partnership strategy with University of Darussalam

Gontor to organize seminars on Islamic Financial

Literation. This program in order to educate people

about how saving utilization by peoples in supporting

local economics growth also supporting SMEs

development by islamic financial services. In this

research, channels are a way to distribute products to

the public. Word of mouth strategy also support for

this aspects. As is known in the market segment that

BMT La Tansa Gontor focuses attention on the

Pondok Modern Darussalam Gontor area and local

people. So that the chosen distribution channel is a

direct distribution channel. Direct distribution

channels are products distributed directly to end

consumers without going through intermediaries. The

main revenue streams from saving utilization by

SMEs in supporting the growth of local economics.

Refer to (Kurniawan & Irwanto, 2018) BMT La

Tansa Gontor financial services such as Funding

Products consisting of Barakah, Mahir, Mabrur, and

Amanah; and Lending Products in the form of

Wadi’ah, Mudharabah, and Musyarakah.

In this study, key resources are the driving wheel

of a company and business model. So that the

resources available at BMT La Tansa Gontor consist

of vehicle units, office equipment and buildings,

employees, major capital and third party funds,

computer units, mobile phones, and websites. BMT

La Tansa Gontor has key activities in the form of

promotion and education to get the market. In terms

of innovation, the intended innovation is not in

product innovation, but BMT La Tansa Gontor has

made innovations in each of negotiating contracts

with customers based on Panca Jiwa as

professionalism spirit implementation. Refer to

(Syamsuri & Saputro, 2019) that the results of their

study prove that the study area has a very strong

potential of five spirits to become a strategy in

economic development to overcome poverty and

transparency which has been an unresolved problem.

The partnership that was built by BMT La Tansa

Gontor with Pondok Modern Darussalam Gontor and

the other Islamic financial institutions is aimed at

obtaining additional funds in providing loan funding

needs to be provided to the public. Other financial

institutions that have partnerships with stakeholder.

The costs needed to create value for consumers are

administrative costs, salary costs called ihsan,

equipment depreciation costs, and variable costs of

BMT La Tansa Gontor.

BMT La Tansa Gontor Business Model

development also support strengthening business

units of Pondok Modern Darussalam Gontor.

According to (Daniar,Sri Iswati, 2019) Gontor has

been running this concept for more than three decades

to raise funds and build its independence. Even at the

beginning of the establishment, this concept became

the founders' ideas to address the problems of

pesantren education, particularly related to funding

sources.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

80

4 CONCLUSIONS

BMT La Tansa Gontor business model has well

supported the business operation process and in

accordance with their established vision, mission, and

purposes. BMT La Tansa Gontor developed business

based Islamic values implemented called Panca Jiwa

that manifested into 9 aspects business model.

BMT La Tansa Gontor formulated Business

Model by Focus Group Discussion with all

management level in order to reach business purposes

based on value propositions, channels, customer

relationships, customer segments, revenue streams,

key resources, key activities, key partners, cost

structure.

Customer Segmentation is reviewed from the

regional directly related to the main goal of BMT La

Tansa as Pondok Modern Darussalam Gontor

business unit to support welfare of members.

Customer relationship at BMT La Tansa is supported

by 3 programs i.e., 1) Meet the clients directly; 2)

awarding scholarships; 3) Islamic microfinance

services counselling for the community. How to

distributing products? BMT La Tansa distributes its

products directly to the community/customers

without intermediaries. By opening a branch office,

and conducting a survey.

Revenue streams in BMT La Tansa comes from 2

main products namely, Wadi’ah and Mudharabah.

Revenue also gained from the Mutanaqisah product

but in giving the largest proportion of profit, Wadi’ah

products. BMT La Tansa has a humanresources

capable of supporting it, the human resources are

supported by facilities and technology.

BMT La Tansa's main activity includes

promotion, education, and negotiation of Akad.

Promotions in various ways include the use of media

such as advertising, etc. In educational activity is

about how the role of BMT La Tansa in improving

the quality of human resources that have been listed

on its mission. At the Akad negotiations based on

ta’awun principle that also became the advantage of

BMT La Tansa, BMT La Tansa offers a more

profitable ratio for customers. Partnerships that are

woven with financial institutions BMT La Tansa

requires additional capital from Pondok Modern

Darussalam Gontor to address financing demand.

Cost structure consists of administration fee, salary

(operation), equipment fee, and variable cost.

REFERENCES

Aspara, J., Lamberg, J. A., Laukia, A., & Tikkanen, H.

(2011). Strategic management of business model

transformation: Lessons from Nokia. Management

Decision, 49(4), 622–647. https://doi.org/10.1108/

00251741111126521

Daniar,Sri Iswati, A. F. Z. (2019). Social enterprise in the

context of educational institution : Lessons from

Gontor, Indonesia Empresa social en el contexto de la

institución educativa : Lecciones de Gontor , Indonesia.

Opción, Año 35, 19(Social Humanities), 2244–2258.

Evans, J. D., & Johnson, R. O. (2013). Tools for managing

early-stage business model innovation. Research

Technology Management, 56(5), 52–56. https://doi.org/

10.5437/08956308X5605007

Hastuti, E. W., & Anggara, F. S. A. (2017). Implementation

of Islamic Business Ethics Values based on IFSB 09:

BMT La Tansa Ponorogo Experience. Al Tijarah, 3(2),

119. https://doi.org/10.21111/tijarah.v3i2.1935

Hendratmi, A., & Widayanti, M. A. (2017). Journal of

Management and Marketing Review Business Model in

Islamic Perspective: Practising of Baitul Maal

Wattamwil (BMT) UGT Sidogiri East Java Indonesia.

J. Mgt. Mkt. Review, 2(1), 43–52. https://doi.org/

10.13140/RG.2.2.30535.60329

Kurniawan, D. A., & Irwanto, M. F. (2018). Motivation

Analysis on Customer of Islamic Microfinance

Institution. Capital: Jurnal Ekonomi Dan Manajemen,

2(1), 28. https://doi.org/10.25273/capital.v2i1.3067

Mason, K., & Mouzas, S. (2012). Flexible business models.

European Journal of Marketing, 46(10), 1340–1367.

https://doi.org/10.1108/03090561211248062

Masqon, D. (2014). Dynamic of Pondok Pesantren As

Indegenous Islamic Education Centre in Indonesia.

EDUKASI: Jurnal Penelitian Pendidikan Agama Dan

Keagamaan, 12(1), 134–142. https://doi.org/10.32729/

edukasi.v12i1.78

Michelini, L., & Fiorentino, D. (2012). New business

models for creating shared value. Social Responsibility

Journal, 8(4), 561–577. https://doi.org/10.1108/17471

111211272129

Muhammad Kashif, Khurrum Faisal Jamal, M. A. R. (2019).

Journal of Islamic Accounting and Business Research

Article information. The Dynamics of Zakat Donation

Experience among Muslim:A Phenomenological Inquiry,

1–16. https://doi.org/10.1108/17590811211216041

Mulyati, E., & Harieti, N. (2018). Model of business

activities of microfinance institutions in

Indonesiafile:///C:/Users/FajarSurya/Downloads/Docu

ments/ANALISIS MODEL BISNIS PADA KNM

FISH FARM DENGAN PENDEKATAN BUSINESS

MODEL CANVAS BMC.pdf. IOP Conference Series:

Earth and Environmental Science, 175(1), 326–341.

https://doi.org/10.1088/1755-1315/175/1/012194

Osterwalder, A., Pigneur, Y., & Smith, A. (2010).

Osterwalder, Pigneur, Smith_2010_Business Model

Generation.

R Khairizza Mohammad, A. H. (2015). Business Model

Canvas Pada BMT Kanindo Syariah R Khairizza

Business Model in Islamic Microfinance: Case Study of Baitul Maal Wat Tamwil (BMT) La Tansa Gontor

81

Mohammad Achsania Hendratmi. Retrieved from

https://www.academia.edu/15435086/Business_Model

_Canvas_Pada_BMT_Kanindo_Syariah_Malang

Sainio, L. M., Saarenketo, S., Nummela, N., & Eriksson, T.

(2011). Value creation of an internationalizing

entrepreneurial firm: The business model perspective.

Journal of Small Business and Enterprise Development,

18(3), 556–570. https://doi.org/10.1108/14626001111

155709

Solihah, E., Hubeis, A. V. S., & Maulana, A. (2016).

Analisis Model Bisnis Pada Knm Fish Farm Dengan

Pendekatan Business Model Canvas (Bmc). Jurnal

Sosial Ekonomi Kelautan Dan Perikanan, 9(2), 185–

194. https://doi.org/10.15578/jsekp.v9i2.1220

Syamsuri, S., & Saputro, Y. E. (2019). Panca Jiwa As

Social Capital Approach: an Alternative Startegy for

Islamic Economic Development. Share: Jurnal

Ekonomi Dan Keuangan Islam, 7(2), 180–203.

https://doi.org/10.22373/share.v7i2.2668

Tantriana, D. (2018). Business Model Canvas Produk

Simpanan Kencleng Koperasi Syariah Manfaat

Surabaua. Seminar Nasional Dan Call for Paper :

Manajemen, Akuntansi, Dan Perbankan, 794–807.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

82