Issues and Challenges in Islamic Estate Planning in Malaysia

Azi Haslin Abdul Rahman and Rusni Hassan

IIUM Institute of Islamic Banking and Finance, Malaysia

Keywords: Islamic Estate Planning, Issues, Challenges, Malaysia.

Abstract: The Islamic estate planning is a crucial part for the wealth management cycle of a Muslim. Indeed, any Muslim

who die without any planning on their estate are not abiding to the bequest guidance as stated in Quranic

verses. Unfortunately, this good spirit of Islam is not embraced well, and many are not interested to plan on

their estate thus causing huge family disputes and increase the unclaimed property after deceased’s death. The

current affairs of Islamic estate planning in Malaysia is still not encouraging despite the efforts by relevant

institutions and industry players to improve the industry. The initiative was undertaken by the government to

form a national institution known as Amanah Raya Berhad and followed by establishment of private Islamic

estate planning companies to provide estates planning related services. However, thus far only 700,000

individuals have declared wasiyyah as compare the majority of Muslims among the 30 million Malaysians.

What are the problems faced by Islamic estate planning in Malaysia? This is the question that motivates the

researcher to study the issues in Islamic estate planning in Malaysia. The purpose of this study is to examine

the problems and challenges faced by the industry practitioners. This research is qualitative in nature relying

on the existing literatures sourced internet portal, document and library search. The scope of this study is

relevant and pertinent to the overall Islamic estate planning industry development thus, intended to put

forward recommendations for enhancement of Islamic estate planning in Malaysia including the possibility

of establishing Shariah advisory framework for the Islamic estate planning institutions.

1 INTRODUCTION

The establishment of pioneer estate planning

institutions, which is Amanah Raya Berhad, get hold

of nearly 90 years ago whereas the newer private

companies come into being within 15 years ago

which practically halve of the Islamic finance period

in Malaysia. Unfortunately, estate planning which is

equally important aspect of Islamic finance is

neglected. The Islamic finance market showing less

favourable concern on the Islamic estate planning. In

term of profit orientation and business opportunity

obviously resulting in different direction, it is likely

not comparable to the other mainstream segment of

Islamic finance, however the desires and the

importance of appropriate estate planning may ensure

the smoothness of estate distribution after one’s

passing away. Only a few talks about the Islamic

estate planning industry and again, Islamic estate

planning is always associated with wealth

management that goes back to Islamic banking and

takaful, leaving behind estate planning which is the

wealth distribution phase. The Islamic estate planning

is where the individual charting their assets and

possessions to their loved ones, designated heirs in

accordance to Islamic inheritance law or bestow it for

charitable purposes. According to the Islamic Wealth

Management Report 2016, Islamic wealth

management relatively under-developed as compared

with other sub-sectors in Islamic finance, however

Islamic wealth management has great ability for

progression. The report also stating the current

situation of limited supply of Islamic wealth

management products driven, expansion of markets

and investor base, strengthening of the supporting

infrastructure, and generating greater level of

confidence.

Islamic wealth management comprise of wealth

creation, wealth accumulation, followed by wealth

protection, then wealth distribution and lastly wealth

cleansing/purification. Thus, the scenario in the

previous report extended to the wealth distribution

stage or estate planning industry that believed to be

left behind. Because of less attention for Islamic

estate planning, significant issues raised concerning

the practices particularly as regard to Shariah

compliance aspects of Islamic estate planning. The

Rahman, A. and Hassan, R.

Issues and Challenges in Islamic Estate Planning in Malaysia.

DOI: 10.5220/0010115000002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 67-75

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

67

substance of the concern connected to the Islamic

law, therefore there are needs for a check and balance

in the practices applies in Islamic estate planning

institutions. In another perspective, as written in the

Economic Transformation Plan (ETP), “Shariah

wealth management is a largely underserved market

today that represents a unique opportunity for

Malaysia, requiring specialized knowledge such as

Shariah compliant wills and estate planning.” ETP

also realizes that building Shariah financial planning

capability is a prerequisite for the well-developed

personal wealth management industry. Obviously,

the stated statement in ETP reaffirm substance of

Shariah compliant wills and estate planning.

Establishing the intended products and services that

are fully compliant apparently needs the participation

of Shariah expertise.

In relation, the time taken for the procedures

reflecting the tedious phase that the beneficiaries need

to endure. On top of that, the practices are

unregulated, and the standard practices was not

available due to the absence of requirement by the

respected authority. Hence, the study is relevant and

pertinent to the overall Islamic estate planning

industry development thus, it is intended to put

forward recommendations for enhancement of

Islamic estate planning in Malaysia including the

possibility of establishing Shariah advisory

framework for the Islamic estate planning

institutions. The modus operandi of the study

utilizing variety of approach comprising reviewing

data from libraries either the hardcopy or softcopy

books, several journals and other publications. In

another words, it’s including of published printed

resources, published electronic resources,

government documentations and private sector

documentations that available and searchable. Apart

of that, the key information also received from

identified internet portal that highlighted the relevant

materials associated to the study objectives, existing

rules and regulations on Islamic financial institutions

and the fundamentals of Islamic inheritance law.

Source of data in this research is secondary data

where the researcher collecting a data from the

sources that already been published. Thus, this

research involves library based for the collection of

secondary data and it is known as doctrinal study.

Format of the paper will be discussing the concept of

Islamic estate planning, the current situation and

practices of Islamic estate planning in Malaysia

followed by the dominant issues highlighted in

Islamic estate planning and finally some

recommendations.

2 LITERATURE REVIEW

2.1 The Concept of Islamic Estate

Planning

Islamic estate planning stems from the Qur’an, which

is the holy book of Muslims, and its interpretations in

the hadith. The Qur’an is a 1400-year-old religious

text that has been deduced over time to be applied to

the modern age. Before the advent of Islam, women

commonly could not receive at all, even from their

spouses, and sometimes these women were part of a

man’s estate. During that time, those who are blood

relatives and adopted sons were permitted to inherit.

In a limited exception to this rule, two unrelated men

could bequest inheritance to each other via a “contract

of alliance.” Islam changed these concepts

dramatically and introduced the idea that property

ultimately belonged to God, and that people only

possessed a certain level of control of the property at

the time of their deaths (Jaafar, 2016). The money and

material property that we possess in this world is a

trust from Allah. During our lifetime, we are required

to use it in the way that is most pleasing to our Lord.

On the Day of Judgement, Allah will surely ask us

about our wealth, how did we earn it, and how did we

spend it (Al-Jibali, 1999). Therefore, the Islamic

estate planning is the administration of Muslim’s

property after passing away. Customarily, the Islamic

inheritance law branded as faraid is the existing law

that carrying out as estate planning. Majority of the

Muslims community relying on the faraid totally

without understanding the origin of the guidance as

stated in Al-Quran. Faraid is the study of the

calculation and allocation procedure of inheritance

for each of the beneficiaries according to Islamic law

(Abdul Rahman, Yaakob, Fadzil, & Shaban, 2018).

The mentioned Islamic inheritance system is clearly

the guidance by Allah S.W.T specifically based on

verses 11, 12 and 176 from Surah an-Nisa. The

necessary explanation on each of the entitlement by

the beneficiaries’ according to the condition are

elaborated in these verses. In the verse 176 of Surah

an-Nisa, Allah decrees that, “When there are brothers

and sisters, both men and women, the male’s share is

equal to that of two females...”. Faraid could be

considered as one of the asset redistribution

mechanism in Islamic law (Samori, Khalid, Yaakob,

Harun, & Hamid, 2016). The deep understanding

about the principle of the estate distribution is crucial

to ascertain individuals who will go through the

process of distribution of the estate either sooner or

later. In addition, the Prophet Muhammad (pbuh) had

ordered us to "learn the laws of inheritance and teach

them to the people for they are one-half of useful

knowledge." Holy Prophet (pbuh) had also

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

68

cautioned us "The first branch of knowledge which

will be taken away from my Ummah will be Ilmu

Faraid (knowledge pertaining to inheritance)”.

Hence, it is the duty of us Muslims to be aware of the

importance of the Islamic law of inheritance and the

consequences of an un-Islamic Will and to put to

practice the laws, to ensure the survival of the

knowledge. Knowledge and awareness about faraid

can become a great steppingstone for the smoothness

of the action required. Among others, the basic

knowledge including the right of inheritance,

property type and number, and form of the division.

This importance identification may avoid or at least

reducing the possibility of family drama caused by

arguments or dispute among family members. The

ultimate objective is to prepare the society towards

proper Islamic estate planning practices and not just

solely depending to the said law by appreciating it in

the surface only.

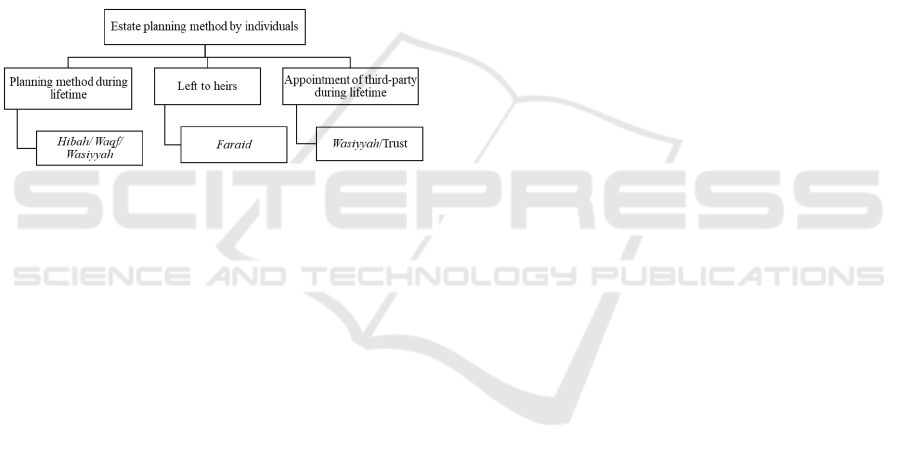

Figure 1: The Method of Estate Planning by Individual.

Sources: (Kamarudin, Mohd Hashim, Jamil, & Abdul Hadi, 2019)

with some modifications by the author.

According to (Kamarudin et al., 2019), the

common suggestion or instruments available in estate

planning can be segregated into three phases. Hibah

(Gift) for example could be discovered basically in

two types, with conditions or without conditions.

However, according to Nor Muhamad (Nor

Muhamad, 2017), the condition that made by giver

have to follow the hibah criteria in order to sustain the

validity of the contract. Further, it also suggested that

the incorrect requirement criteria will be caused

modification to the original hibah contract to

wassiyah contract, for instance, the condition of giver

is if only the ownership of wealth will be officially

owned after the death of the giver. In addition, other

estate planning instruments are waqf (endowment),

wassiyah (will), trust and the main is faraid.

2.2 Islamic Estate Planning in Malaysia

Islamic estate planning in Malaysia already in

existence for quiet sometime. However, to

comprehend the industry in general, it’s better to have

a look into the commencement of the industry way

back more than 90 years ago. Amanah Raya Berhad

is Malaysia’s premier trustee company wholly owned

by the Government of Malaysia. In year 1921, the

Department of Public Trustee and Official

Administrator was established. Then, the institution

was corporatized in year 1995. The focus of Amanah

Raya is to provide Legacy Management solutions to

the entire Malaysians through innovative products

and services. Legacy Management that was marketed

by Amanah Raya is the rebranding of the estate

planning which looks more appealing. With the

capacity of experience more than 90 years’ in the

Legacy Management industry, Amanah Raya seen to

occupy the market leader status. The uniqueness of

this pioneer institution, it has specific Act that guiding

their provisions in the legislation, it is the Public Trust

Corporation Act 1995 (Laws of Malaysia Act 532,

2008). In another perspective, at this moment, the

Amanah Raya is the only Public Trustee and

accommodating holistic solutions for everyone when

it comes to Legacy Management.

Considering the needs and complexity of the

estate planning, the arises of new private institutions

that also catering the same scope of estate planning

but in a more strategic approach comparable with the

fee charges imposed to their clients. The other player

in the industry set up within the purview of the Trust

Companies Act 1949 (Laws of Malaysia Act 532,

2008) and Companies Act 2016 (Laws of Malaysia

Act 777, 2013) . However, on a certain condition, it

is not necessarily the institutions required to become

a Trustee Company to sustain a business in estate

planning industry, despite that being a Trustee

Company is the suitable way to offer a

comprehensive business solution.

At this moment, the industry player in Islamic

estate planning in Malaysia applauded by various

institutions. Some of them cater the services all-

inclusive since they are a Trustee by operation but

some of the institutions only provide the consultation

whereas they will be employing external Trustee to

resolve the obligatory procedure. To get clearer

picture on the type of the operation of Islamic estate

planning institutions, following are the list of the

institution.

Issues and Challenges in Islamic Estate Planning in Malaysia

69

Table 1: Key Players in Islamic Estate Planning Industry.

Institution Operational Nature

Amanah Raya Berhad Public Trustee

as-Salihin Trustee Berhad* Private Trustee

Wasiyyah Shoppe Berhad Private Trustee

MyAngkasa Amanah Berhad Private Trustee

Pacific Trustees Berhad* Private Trustee

Selangor Islamic Religious Council Religious Council

Maybank Trustee Berhad* Private Trustee

CIMB Islamic Trustee Berhad* PrivateTrustee

RHB Trustee Berhad* Private Trustee

PB Trustee Services Berhad* Private Trustee

Affin Hwang Trustee Berhad* Private Trustee

Sources: Association of Trusts Companies Malaysia,

http://www.atcm.com.my accessed on 16th July 2019.

Those listed institutions in Table 1, recognized as

the main industry player in Islamic estate planning.

On top of that, there are small entity who are

promoting the products and services on behalf of

main industry player but actively carry out under their

own companies’ name. Looking into the listed

institutions, most of them, backed by the big entity in

the banking sector as they established as subsidiary

company in order to retain their own client within

their group. Once obtained the bigger picture of the

industry and tiers in it and later the players in the

industry, another information that are significant in

digesting the Islamic estate planning in Malaysia is

the administration and the distribution of a Muslim

deceased’s estates. The current practice in Malaysia,

civil law regulates the procedures of estate

administration and settlement which lead to important

impacts on estate planning (Alma'amun, 2010).

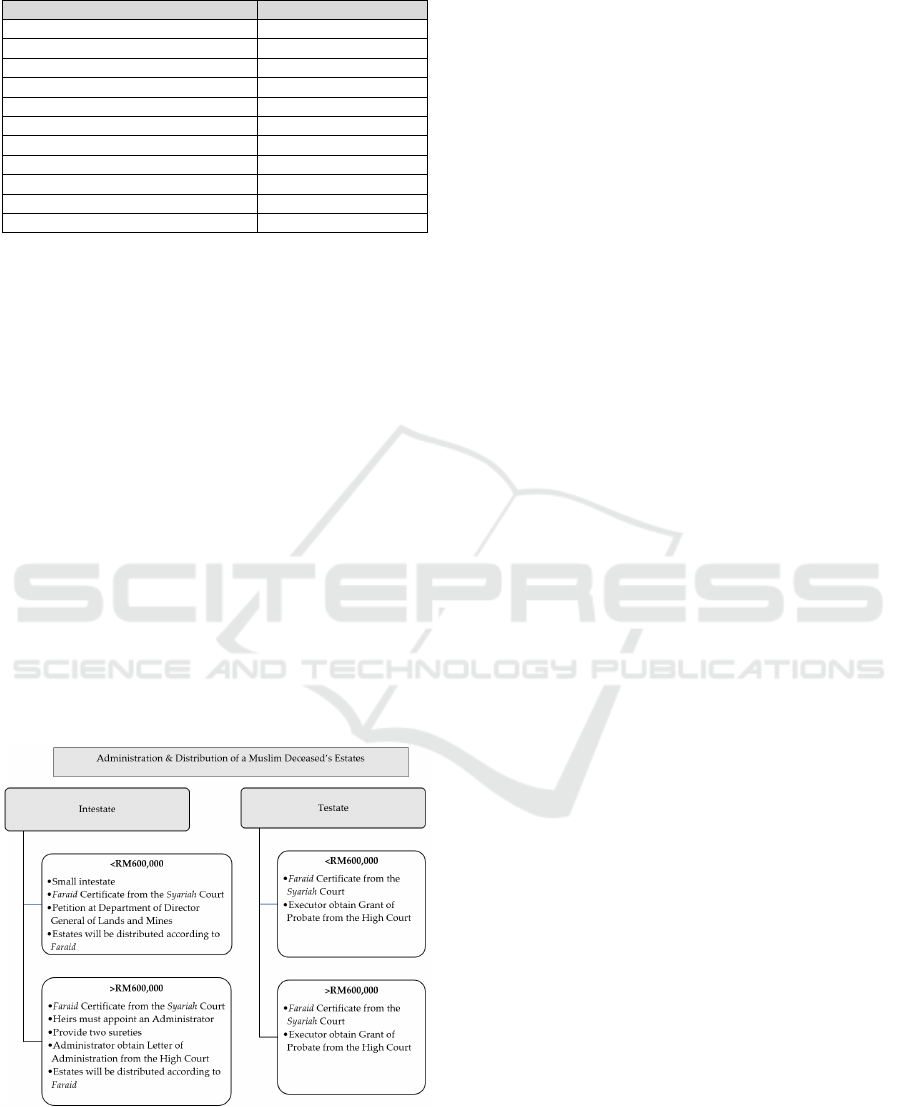

Following diagram testifying the flow and designated

authority who responsible for the activity.

Figure 2: Administration and the Distribution of a Muslim

Deceased’s Estates in Malaysia.

Sources: (Alma’amun, 2010) with some modifications by the

author.

The figure presented above explaining flow of the

administration and the distribution of Muslim

deceased’s estate in Malaysia. The procedure begins

with the discovery of either the deceased pass away

intestate or testate. The Department of Director

General of Lands and Mines responsible to handle

small intestate matters after a petition is reported by

any person declaring to have concern in the estate. In

the situation where the deceased having a wasiyyah,

the administration and distribution of an estate less

than RM600,000 will be taken to the High Court.

However, if the value of the estate exceeded

RM600,000 nevertheless the deceased died intestate

or testate, the necessary procedure required to pass

through the High Court.

The apparent disparity between both is that an

executor is required for testate scenario to obtain

Grant of Probate while an administrator is required to

obtain Letter of Administration for intestate situation.

In addition, if the person dies intestate, heirs must

provide two sureties for the estates value more than

RM600,000. Furthermore, the Court which is the

Syariah Court responsible to issue inheritance

certificate (Administration of Islamic Law (Federal

Territories) Act 1993 (Laws of Malaysia Act 505,

2006) after determining the eligible heirs and verify

their entitled shares. On top of that, from the

illustration in Figure 2, Amanah Raya Berhad (ARB)

has been given the authority to administer the

movable estate with the value is not exceeding

RM600,000. The procedures and which bodies to

approach for that administration and distribution

exercise mostly depending on the amount of the

estate. For instance, the person dies and leaving

behind some amount of cash money not exceeding

RM50,000, ARB will straightly issue Order and

deliver it to the heirs. However, if the amount of

assets more that RM50,000 but not exceeding

RM600,000, ARB will issue Declaration and

followed by pooling off the assets together in order to

determine the net estates and finally continue to have

a distribution procedure according to faraid portion.

Thus, by understanding the flow of the necessary

procedures on both situations, the main authorities

that involves in settling Islamic estate administration

and distribution are the Department of Director

General of Lands and Mines, Syariah Court and Hight

Court.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

70

3 ISSUES & CHALLENGES IN

ISLAMIC ESTATE PLANNING

IN MALAYSIA

The issues that happened in the vicinity of Islamic

estate planning in Malaysia are not new and the

existence of the issues for quiet sometimes suggesting

that it is something that should be taken care of by

stages through a proper channel and respective

authority.

3.1 Complexity, Unstandardized &

Absence of Law

The Islamic inheritance law also known as faraid or

Islamic law of succession. The Islamic law of

inheritance has been regarded by the Muslim jurists

as immutable and final considering that it consists

mainly of rules laid by the Quran and the Traditions

of the Prophet (S.A.W) (Tagoranao, 2009). The

author remark the appreciation given to this law with

respect to its completeness and comprehensiveness as

well as the achievements with which it has

accomplished to response and resolve all queries

concerning the entitlement of a person to succeed

who are bound to the deceased by mutual ties and

responsibilities which stem from blood relationship.

However, as the legislative changes all over the

world, it hits the Islamic inheritance law as well.

Those scenarios so called legislative reformation

requires a pure study in order to ensure it is within the

purview of the traditional Islamic law of succession.

An example of this is the controversial provision on

obligatory bequest, the major and important principle

introduced into the Law of Wills to some Muslim

countries (Tagoranao, 2009). In relation to the

Islamic law applies in law of inheritance, during year

2016, Asni & Sulong points out that unstandardized

Islamic laws lead to uncertainties in the

implementation of legislation and injustice. From the

legislative perspective of law, the existence of

contrary fuqaha’ opinions which directly result to

some disputes and for the matter of execution, it is

hardly to be implemented. The similar researcher also

stated that, in the administration of law and the

enforcement fatwa, only one opinion should be

selected for inclusion as the adopted opinions to

ensure consistency in the implementation of law.

The parallel study stated, at this current moment,

a special statute of hibah remains unallocated.

Therefore, outlining of the law written particularly

about the hibah or its corresponding is significant

because it will be able to incorporate all disputes and

clarifications on the issue of hibah in the form of

uniform legitimate provisions that have legislative

control. Again, Ghul, Yahya, & Abdullah (2015)

draw attention to the impediment lies in the rules and

regulations that are related to estate administration

and settlement. This kind of barrier providing a major

drawback on the development of Islamic estate

planning in Malaysia.

In recent studies, due to absence of specified law

regarding hibah, the Islamic estate planning

institutions or private estate planner have to make

reference from fatwa bodies or Syariah advisors for

reliable views or approvals (Nor Muhamad et al.,

2019). Besides that, the other common issue is about

the application of hibah. At this moment, hibah is

popular tools for estate planning, however the

possibility of hibah to function as estate planning

management, specific law should be available which

governs the substantive and procedural aspect of law.

This is because it is widely recognized that there must

be certain law in order to legalize the rule (Abdul

Rashid, Hassan, & Yaakub, 2013). However, the

writer argued that the so-called action taken by the

institutions will narrowly feed the needs of sole

institutions and unable to be implemented to the

overall states because of the issues on separation of

fatwa body coverage. The major implication out of

this scenario contribute to the failure of the Muslim

community to understand the matters related to hibah.

The long-term planning is by having a comprehensive

and uniform hibah law among states in Malaysia.

The recommendation cum wish list however

something achievable because some states in

Malaysia have formed several laws associated to waqf

(endowment) and will. Recent information, currently

there are three states having a specific substantive law

bequest which are Selangor-Muslims Will Enactment

(State of Selangor) 1999 (No. 4/1999) that effectively

started on 1

st

July 2004 [Sel P.U. 9/04], Negeri

Sembilan-Muslims Will Enactment (State of Negeri

Sembilan) 2004 (No.5/2004) which effective on 5

th

November 2004 [N.S. P.U. 20/2004], and Malacca-

Muslims Will Enactment (State of Malacca) 2005

(No. 4/2005) effective on 1

st

August 2005 [M.P.U.

37/05]. Although all of three aforementioned

enactment has been legalized, only Selangor start

practicing in total. Selangor Islamic Religious

Council also providing the will services based on the

Muslim Wills Enactment (State of Selangor) (No.

4/1999) and Rules of Wills Management (State of

Selangor) 2008 (No.13/2008) (Nor Muhamad, 2017).

Selangor became the first state in Malaysia to approve

and implement the will substantive law bequest. The

duty of providing a role as an effective wealth

planning instrument brought by Selangor Islamic

Religious Council is something that supposed

available in every state. The suggestion to legislate

hibah law has been mentioned since 2004 in various

workshops and seminars that arranged by many

Issues and Challenges in Islamic Estate Planning in Malaysia

71

parties, but until now the law has not yet to be

accomplished.

An interesting and contentious Syariah Court

verdict regarding secured property may drive the

reasoning on how and why. For the record, according

to Abdullah (2018), following are the references for

some cases. Awang bin Abdul Rahman vs.

Shamsuddin bin Awang & Anor, Syariah High Court

Kuala Terengganu decided that hibah on secured

property is invalid because the property not fully own

by the owner and it’s still under liability. In another

case, Wan Noriah binti Wan Ngah, Syariah High

Court Kuala Terengganu also refusing the application

for hibah verification on the property that still under

financing of Treasury Malaysia. However, the verdict

of the Judge is different in case of Raihanah binti

Mohd Ali vs. Kamaruddin bin Mohd Nor & Anor,

Syariah High Court Kuala Terengganu disallowing

the plaintiff request to verify the hibah made by her

brother (deceased) due to absence of evidence that the

deceased obtained the approval from the financier

(bai’ bi thaman ajil) allowing the deceased to make a

hibah property to the plaintiff. Captivatingly, the

Syarie Judge stating that hibah is allowable and valid

if written approval from financier obtained initially.

Intriguingly, in the case of Yati Suraya vs. Supiah

Binti Abu, Syariah Court of Negeri Sembilan

granting a hibah on secured property even though

without the approval of financier as long as the

secured property protected by takaful/insurance.

Thus, the verdict trend may trigger the validity as if it

varies according to the Judges preferences and

understanding of four major Islamic school of

thoughts.

3.2 Roles of Fatwa

Apart from that, a clear fatwa or ruling should be

issued by the National Fatwa Council as well to meet

the current needs and the Islamic law requirements so

it can be a clear guidance to be used and followed by

the Muslims in Malaysia (Mohd Yusof & Ahmad,

2013). As Asni & Sulong (2016) suggested a

standardized fatwa so that there is uniformity and

consistency in the enforcement of fatwa and in the

making decision regarding the hibah. It is

understandable that in Malaysia, legislative context

states that the administration of Islam in Malaysia is

under the state, this steered to divergent conducts of

administration within the country.

1

Secured property is the property bought through securing loan

from the financial institutions which always requires the property

to be charged to them.

2

Hibah is an act of transferring of ownership of an asset or usufruct

without an exchange of counter value during the lifetime of the

transferor. In current practice, there are two type of hibah which

3.3 The Dual System of Courts

Referring to Md Azmi & Mohammad (2011) and

Noordin, Shuib, Zainol, & Mohamed Adil (2012),

the unclaimed estates might be a result of the

empowerment of two courts under substantive law

and the complex procedures to be followed make the

process lengthy and costly. For example, the High

Court has been empowered to grant a Probate in

testate cases under Section 3 of Probate and

Administration Act 1959, and Letter of

Administration in intestate cases according to Section

18 of Probate and Administration Act 1959. The

period of getting a Letter of Administration is longer

than Probate for testate estates. It may take up to four

years to settle the case. Instead of concerns on period

taken in resolving the process, the epic issue in

relation to Court appearance are secured property

1

(Abdullah, 2018) and the other one is conditional

hibah

2

. Thus, this kind of issues portraying an

undesirable connotation about the existing legislative

procedure. In relation to this study, the presented

issues revealing that interrelated problems causing a

massive damage to the image of Islamic estate

planning in Malaysia. Anyhow, the personality and

the credentials of Syariah advisors if they

authoritatively appointed supposed to uphold the

estate planning industry and progressing in line with

other Islamic finance area.

he major implication of estate classification either

large or small resulting the distribution falls within

jurisdiction of two courts and two administrative

agencies (Md Azmi & Sabit Mohammad, 2011).

Corresponding to Section 25 of the Civil Law Act

1956, the administration of Muslim’s estate shall be

in accordance with the Islamic law. However, Article

74 (1) of Malaysian Federal Constitution read with

Ninth Schedule Paragraph 4 (e) (i), provides that the

Civil High Court has the jurisdiction over matters

relating to succession, testate and intestate, probate

and letters of administration. Thus, considering

Article 121A Muslims must go to Shariah and Civil

Courts for retrieving the estate of a deceased person.

Simultaneously, Section 17 (1) of Public Trust

Corporation Act 1995 (Act 532) bestows the capacity

to ARB to dispose movable possessions whether

testate or intestate which is less than RM 2 million,

while the applicant can go to the Land Office for

immovable properties which is not surpassing RM 2

million. Besides, Section 8 (1) of Small Estates

(Distribution) Act 1955 (Act 98) proposes ARB has

are hibah al-úmra and hibah ruqba. Hibah al-Úmra is hibah

which is contingent to the lifetime of either the one who makes

the gift or the receipient whilst hibah ruqba referring to a

conditional hibah stipulated by the one who makes the gift,

where the recipient will own the gift upon the death of the

former.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

72

the control in small estate distribution included

movable and immovable properties even though in

the absent of a will. This portion reveal that estates

of Muslims, movable or immovable, exceeding RM 2

million comes within the powers of High Court.

Section 77 of Probate and Administration Act 1959

(Revised-1972) (Act 97) enjoins that an executor has

unlimited power to distribute estates of a deceased

person but under this Act the executor must apply for

letter of execution from Civil High Court. Unlikely,

if the estate worth does not exceed RM 2 million, the

process for example in Land Office, can start on

without lawyers going to Court. It may incur a period

from five and a half months.

The current practice of Malaysian legal system is

a civil court and a Syariah court. It’s function as a

dual system of courts. Civil courts were set up under

article 121 of the Malaysian Constitution and

dominate the larger portion of the constitution, thus

all Malaysians are subject to this jurisdiction (Shuaib,

2008). In addition, Syariah courts were set up by the

States and these courts administer Islamic law only

on Muslims. The Federal Constitution cannot be used

to determine the authority of the Syariah courts to

issue judgments. However, there are no provisions

in the State laws to issue judgments on some cases,

thus the functions of the Syariah courts cannot be

properly executed, such as cases involving a non-

Muslim. Due to this, clients have to process their

inheritance cases through both Civil and Syariah

Courts which will cost time and money (Noordin et

al., 2012)

3.4 Lengthy and Costly Procedures

As mentioned earlier, the empowerment of two courts

under substantive law and the procedures to be

followed may be the reason for unclaimed estates

simply because the process is too lengthy and costly

(Md Azmi & Sabit Mohammad, 2011). On any

transaction or application to claim the estate,

naturally it involves costs; this may play substantial

part in making the beneficiaries refuse to proceed

with the necessary procedures, mainly when the

amount after distribution to be claim value is

relatively small. In cases where an application is

made by the beneficiaries, the time between

application and final settlement of the case will be

long and therefore the distribution of the estate will

also be long. For further contemplating, the general

concerns after all including the issues on large

quantity of wasiyyah possessions that are growing

year by year without appropriate dissemination

among the testator’s beneficiary verify that the

wasiyyah issues in Malaysia is not a clear-cut

assignment (Samori et al., 2016). In addition, lengthy

processes may extended to a number of years to clear

up the case of dying intestate resulted to a an episode

of frozen estate problems and delays in the settlement

period (Samori et al., 2016). Another researcher also

mentioning the about the time taken and comparison

of the processes endure in the case of dying intestate

and testate estate (Ghul, Yahya, & Abdullah, 2015).

3.5 Variations in Hibah Practices

According to Mohd Safie (2010), there are variety of

hibah management in Wasiyyah Shoppe Berhad and

As Salihin Trustee Berhad, thus the differences may

affecting the administration in future if there are

disputes arises. In general, hibah validation falls

under jurisdiction of Syariah High Court, however if

there is any contract or other known elements joint

together it will automatically go to the administration

under Civil Court. For instances, the elements of

hibah practices attach with trust contract will make it

falls under Civil Court prerogative. Another point to

ponder, the customers should aware on what type of

transactions that they intend to enter as it may giving

great implications of estate entitlement in near future.

3.6 Disparities of Establishment Act

Amanah Raya Berhad is a pioneer estate planning

institution in Malaysia. In year 1995, Amanah Raya

operated under Act 532, Public Trust Corporation Act

1995 (Mohd Safie, 2010). as-Salihin Trustee (as-

Salihin) is a trust company incorporated under the

Companies Act 1965 and registered under Trust

Companies Act 1949 (Laws of Malaysia Act 100,

2006). Special attributed Act for Amanah Raya make

ready to provide provisions in legislative as the first

public trustee. Furthermore, as-Salihin was

established in 2005 to meet the needs of Muslims to

preserve, protect and distribute their assets for the

benefit of their heirs once they depart for the hereafter

(Samori et al., 2016). Thus, the establishment of

Wasiyyah Shoppe Berhad solely under Companies

Act 1965 whereas as Salihin Trustee registered both

under Companies Act 1965 and Trust Companies Act

1949. Therefore, the disparity of legal jurisdiction for

both companies reflected the operational practices

that required. (Mohd Sa’afie, Muda, Mohamed Said,

& Ahmad, 2018).

3.7 Claims on Shariah Compliant

Status

The Islamic estate planning companies that exist

nowadays proudly declaring in their official portal

that their companies are Shariah compliant and

mentioned about their Shariah advisors line up. In

addition, as-Salihin aims to provide all its services

Issues and Challenges in Islamic Estate Planning in Malaysia

73

relatives to estate planning in a manner based strictly

on the shariah (Samori et al., 2016). Among others,

the companies that claims there are Shariah

compliant entities including Wasiyyah Shoppe and

My Angkasa Amanah. Bank Negara Malaysia (the

Bank) places great importance in ensuring that the

overall Islamic financial system operates in

accordance with Shariah principles. This is to be

achieved through the two-tier Shariah governance

infrastructure comprising two (2) vital components,

which are a centralized Shariah advisory body at the

Bank and an internal Shariah Committee formed in

each respective Islamic financial institution (IFI)

(BNM, 2010). However, the Islamic estate planning

industry in Malaysia did not have any kind of

structure or regulation that perform the function of

supervising or monitoring the operation of the

companies whether it is accordance to Shariah

principle or not. Thus, such assertions made by the

companies in the Islamic estate planning industry are

subject to unknown validation body. The scholars and

academic figures who appointed as Shariah advisors

may functioning according to the requirement stated

by the companies, yet their roles and practices still

subject to argument in term of standardization and

uniformity.

3.8 Lack of Understanding on the

Islamic Inheritance Terminology/

Concepts/ Procedures

In curbing the continual increase in unclaimed

properties among Muslims, it is high time to educate

Muslims in Malaysia to fully understand about the

Islamic Inheritance Law or Faraid (Zulkifli, Batiha,

& Qasim, 2018). The researcher did mention that

understanding of the Muslims society in Malaysia

still far behind and more efforts towards increasing

the knowledge about Islamic inheritance law. On the

other hands, the early picture provided by the

quantitative data shows that a majority of the

respondents (60.62%) cited family disputes and

disagreements as the reason that the transfer process

falls through. The research conducted in Felda

Settlers in Bentong indicate that a majority of these

problems are caused by the failure of the beneficiaries

to agree on a solution to divide their portion of the

land. (Mohamad, Talib, & Noor, 1998). Therefore, a

good understanding on the possible implication and

the benefit of the Islamic system supposedly being

nurtured in the beginning to prevent this kind of

situation. Furthermore, Muslim society have less

understanding about Islamic inheritance laws, despite

from their background, profession or which sectors

there are from. There are also those Muslims who

have a plan on their wealth management, but it is not

accordance with Islamic wealth distribution (Abd

Aziz, Mohamed, Mazlan, Abd Aziz, & Mohaini,

2017). In relation to the scenario abovementioned, the

awareness on Islamic estate planning still the most

important elements whether the individual opting for

Islamic wealth distribution or the other way around.

3.9 Attitude of Beneficiaries

Pertaining to the attitude dilemma whereby among

the reality is those unresolved inheritance scenarios

caused by this factor. Previous research has been

stating the same statement. The disagreements

frequently cause beneficiaries, who are often siblings,

to feud among themselves for ownership of the land

(Mohamad et al., 1998). For instance, one of the

major issues highlighted on hibah in this paper is the

dissatisfaction of the beneficiary on the distribution

of properties (Ahmad, Ab Majid, Abdullah, Minhad,

& Ismail, 2013). In addition, the negative personal

attitude displayed by the beneficiaries in a way

interrupt the smooth process of estate administration

(Muhammad Amrullah & Mohd Salim, 2018).

4 CONCLUSIONS

Conclusions may be discretionary in research articles

where consolidation of the study and general

implications are covered in the Discussion section.

However, the presentation of the issues appeared in

Islamic estate planning institutions in Malaysia

adequate to wrap up the impressions on the

significance of the overall situation. If the normal

practices carry out, the Islamic finance development

may not progress proportionately among all the

segments and create disparity which allowing the

loophole to be questioned by the customers at large

and the practitioner who may interest in all segments.

Besides that, the weaknesses in the practices may

continue discourage the Muslims to begin having

proper estate planning yet increasing the frozen assets

and eventually weakened the Muslims economy in

general. This research will open-up the possibility of

establishing or adaptation of Shariah advisory

framework which tailor to the Islamic estate planning

institutions.

REFERENCES

Abd Aziz, N. A., Mohamed, S., Mazlan, N. F., Abd Aziz,

N. A., & Mohaini, H. (2017). A Study on Perception if

Writing Wassiyah Among Muslim in Malaysia. Journal

of Applied Environmental and Biological Sciences,

7(7), 147–151.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

74

Abdul Rahman, S. F., Yaakob, A. M., Fadzil, A. A., &

Shaban, F. (2018). Asset distribution among the

qualified heirs based on Islamic inheritance.

ResearchGate, (January).

Abdul Rashid, R., Hassan, S. A., & Yaakub, N. I. (2013). A

need for legal framework of gift inter vivos (hibah) in

Malaysian state planning. International Journal of

Business, Economics and Law, 2(3), 29–31.

Abdullah, A. T. (2018). Hibah hartanah bercagar; Prinsip,

aplikasi, dan pandangan Mahkamah. Kuala Lumpur.

Ahmad, K., Ab Majid, R., Abdullah, Z., Minhad, S. F. N.,

& Ismail, S. (2013). Acceptance of hibah as an

alternative mechanism in Muslims asset management.

South East Asia Journal of Contemporary Business,

Economics and Law, 3(3), 1–5.

Al-Jibali, M. (1999). The final bequest: The Islamic will &

testament. Al-Kitaab & As-Sunnah Publishing.

Alma’amun, S. (2010). Islamic estate planning: Malaysian

experience. Kyoto Bulletin of Islamic Area Studies, 3–

2(March 2010), 165–185.

BNM. Shariah Governance Framework Bank Negara

Malaysia. , (2010).

Consulting, E. (2016). Islamic Wealth Management Report

2016. Kuala Lumpur.

Ghul, Z. H., Yahya, M. H., & Abdullah, A. (2015).

Wasiyyah (Islamic will) adoption and the barriers in

Islamic inheritance distribution among Malaysian

muslims. International Journal of Humanities Social

Sciences and Education (IJHSSE).

Jaafar, I. (2016). Practical Islamic estate planning : A short

primer. Hamline, Mitchell Review, Law, 42(3).

Kamarudin, N. S., Mohd Hashim, A. J., Jamil, N. N., &

Abdul Hadi, N. (2019). The conceptual framework of

the intention on Islamic estate planning practice among

Muslim entrepreneurs. Journal of Islamic, Social,

Economics and Development, 4(20), 69–76.

Laws of Malaysia Act 100. Trust Companies Act 1949. ,

(2006).

Laws of Malaysia Act 505. Administration of Islamic Law

(Federal Territories) Act 1993. , (2006).

Laws of Malaysia Act 532. Public Trust Corporation Act

1995. , (2008).

Laws of Malaysia Act 777. Companies Act 2016. , (2013).

Md Azmi, F. A., & Sabit Mohammad, M. T. (2011). The

causes of unclaimed, late claimed or distributed estates

of deceased Muslims in Malaysia. 2011 International

Conference on Sociality and Economics Development

,

10, 440–444.

Mohamad, Z., Talib, J., & Noor, R. (1998). Issues of land

inheritance from FELDA settlers’ perspective : A case

study among settlers in Lurah Bilut. International

Business Research Conference, 1–15.

Mohd Sa’afie, A., Muda, M. Z., Mohamed Said, N. L., &

Ahmad, M. Y. (2018). Pengendalian pengurusan

produk hibah di Wasiyyah Shoppe Berhad dan As-

Salihin Trustee Berhad. 112–119.

Mohd Safie, A. A. (2010). Penderafan dokumen wasiat

Islam di Amanah Raya Berhad: Analisis menurut

perspektif Islam (Vol. 60).

https://doi.org/10.1093/occmed/kqq062

Mohd Yusof, Y., & Ahmad, A. (2013). Hibah As an

Alternative Mechanism in Muslims Assests

Management : a. South East Asia Journal of

Contemporary Business, Economics and Law, 3(3), 1–

5.

Muhamad Asni, M. F. A. H. bin, & Sulong, J. bin. (2016a).

Fatwa concerning Qabd in Hibah and the insertion of

Qabd element in States fatwa in Malaysia. Journal of

Islamic Studies and Culture, 4(1).

https://doi.org/10.15640/jisc.v4n1a17

Muhamad Asni, M. F. A. H., & Sulong, J. (2016b). Fatwa

on wajibah will and unifomity of provision in the

Malaysian states fatwa. Al-Qanatir International

Journal of Islamic Studies, 5(1), 1–15. Retrieved from

http://al-qanatir.com/index.php/qanatir/article/view/42

Muhammad Amrullah, N., & Mohd Salim, W. N. (2018).

Administration of estates in Malaysia: Determinant of

factors behind the delay in the distribution of the

deceased’s asset. Journal of Nusantara Studies

(JONUS), 3(1), 75.

https://doi.org/10.24200/jonus.vol3iss1pp75-86

Noordin, N., Shuib, A., Zainol, M. S., & Mohamed Adil,

M. A. (2012). Review on issues and challenges in

Islamic inheritance distribution in Malaysia. OIDA

International Journal of Sustainable Development,

3(12), 29–38.

Nor Muhamad, N. H. (2017). Wasiat sebagai instrumen

perancangan harta Islam : prosedur dan pelaksanaan.

Jurnal Hadhari, 9(1), 17–32.

Nor Muhamad, N. H., Kamarudin, M. K., Abdullah, A. H.,

Sholehuddin, N., Abdul Hamid, M. F., Muhidin, I., &

Abdul Karim, K. (2019). Islamic intervivos law

challenges in Malaysia. Journal of Legal, Ethical and

Regulatory Issues, (March), 0–6.

Samori, Z., Khalid, M. M., Yaakob, M. A. Z., Harun, H. M.

F., & Hamid, N. A. (2016). Towards managing the

beneficiaries rights via writing a will. Global Journal of

Management and Business Research, 16

(No.3-G).

https://doi.org/10.17406/GJMBR

Shuaib, F. S. (2008). Powers and Jurisdiction of Syariah

Courts in Malaysia, 2nd Ed. Administration of Islamic

Law View project Medical Law View projectSufian.

(August). Retrieved from

https://www.researchgate.net/publication/327106276

Tagoranao, M. S. (2009). Problems and issues on the right

of a person to inherit the Islamic of succession. Syariah

and Law Discourse Issue, (4), 75–85.

Zulkifli, A. N., Batiha, Q. A., & Qasim, M. M. (2018).

Design and development of M-Faraid: An Islamic

inheritance mobile app. Journal of Advanced Research

in Dynamical and Control Systems, 10(10 Special

Issue), 1569–1575.

Issues and Challenges in Islamic Estate Planning in Malaysia

75