Efficiency of Pesantren’s Baitul Maal Wa Tamwil (BMT): An Effort

towards Islamic Microfinance Institution

Atika Rukminastiti Masrifah

1

and Hendri Tanjung

2

1

Faculty of Economics and Management, University of Darussalam Gontor, Indonesia

2

Ibn Khaldun University, Bogor, Indonesia

Keywords: Pesantren, Baitul Maal Wa Tamwīl, Micro Enterprises, Efficiency.

Abstract: Pesantren and Baitul Maal wa Tamwil (BMT) are not seemingly equal things to compare, ones are filled with

spiritual and religious knowledge, where the other are located in economic environment. But time proves that

Pesantren are really serious in developing an economic network among students, through Baitul Maal wa

Tamwil. BMT based on Pesantren has an important role in driving the poor and micro enterprises (MEs) to

empower them, alleviate poverty, reduce unemployment, as well as enhance economic development in

Indonesia, especially Pesantren environment. Pesantren’s BMT should be sustainable, effective, efficient and

affordable to be able to serve the poor and MEs with excellence, so that the analysis of their efficiency is a

must. The main aim of the paper is to analyze the technical efficiency (including pure technical and scale

efficiencies) of some Pesantren’s BMT using Data Envelopment Analysis (DEA). The results show that,

generally the efficiency of Pesantren BMTs is relatively high. Scale efficiency also indicates that operating

of BMTs are close to optimal scale. This result suggests that most Pesantren BMTs still focus on baitut tamwil

activities, extending financing as their main business. While the future, BMTs should play a more active role

in baitul maal activities as their main business.

1 INTRODUCTION

Islamic microfinance provides various instruments

and ethical schemes that can be adopted and advanced

for the purpose of micro enterprises (Rahman and

Rahim, 2007). Islamic microfinance in Indonesia

keep growing, especially BMTs and Cooperatives

(Muchtar and Taufiq, 2013). That fact cannot be

ignored as representation of economic impact, which

keeps better in the grass-root level, especially in

villages. Islamic microfinances do not purpose to the

poverty reducement in financial aspect only but they

also attempt to motivate the micro enterprise to

empower their social capital.

It’s time for those Pesantren’s BMT to speak up

in national economy stage. Pesantren’s BMT are not

home boarders, but they are not guests in this country

also, thus they should be equated with other national

economy contributors. Some Pesantren’s BMT even

felt unusual with their new big status. Same other

management considered their BMT should not even

appear in big level, because a proud of managing

BMT is measured from satisfaction and prosperity of

its members. Various reason emerged, but in Auhtor’s

understanding, there are those who are not ready to be

published, due to its traditional managements and

organizations. Most of the Pesantren’s BMT listed in

this research were already computer-literate and

familiar with use of internet, but there are also those

which were still off-line.

In accordance with its identity, Pesantren’s BMT

has a system of values and principles that are different

from other business entity. It is a democratically

managed enterprise to meet the aspirations and needs

of members in economic, social and cultural aspects.

A lot of Pesantren’s BMT has a unique management

process.

This research aimed to disclose a new map about

economy potential of Pesantren’s BMT that until this

time remained almost unheard. A business entity

labeled BMT is often equated with petty business and

not even mentioned in increase to gross domestic

products. In fact, performance of Pesantren’s BMT

was surprisingly good with total asset of IDR 342.43

billion. That number was the result of pesantren’s

BMT survey.

Masrifah, A. and Tanjung, H.

Efficiency of Pesantren’s Baitul Maal Wa Tamwil (BMT): An Effort towards Islamic Microfinance Institution.

DOI: 10.5220/0010114800002898

In Proceedings of the 7th ASEAN Universities International Conference on Islamic Finance (7th AICIF 2019) - Revival of Islamic Social Finance to Strengthen Economic Development Towards

a Global Industrial Revolution, pages 59-66

ISBN: 978-989-758-473-2

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

59

2 LITERATURE REVIEW

Pesantren’s BMT is a cooperative that develops due

to the process of continuous educations, since the

establishment, on the process of business

development as well as in controlling their business

activities. Pesantren’s BMT has an emotional

connection, trust and openness between managers

and members. Such relationship resulted from the

process of education and communications which are

developed on an ongoing basis (Masrifah 2016).

Pesantren’s BMT is also a cooperative that

develops because of the power of leadership and

charisma of the leader. The members became very

loyal to participate in BMT activities since they are

benefited from the leader influence of loyalty in

providing care and services to its members

(Masrifah, 2020). Uniqueness is wealth. With the

unique opportunity Pesantren’s BMT is open to

synergize and enhance business productivity in the

scale of local, regional and international levels.

The role of Pesantren’s BMT in sustainable

development is believed to be more relevant in the

future because Pesantren’s BMT concept is to rely on

the entranced power of social networking. There are

many financial institutions that were oriented to

produce material benefits, without sufficient concern

for environmental degradation and social problems

such as unemployment, poverty, illiteracy,

malnutrition, maternal and child mortality. Business

is considered successful if it can produce maximum

profit, even though sometimes it is causing an

environmental damage and social problems. BMTs

were developed instantly and only pursuing profit

target material by misusing his identity, it never

developed in a sustainable manner.

The added value is resulted from the cooperative

joint venture that is based on shared value, honesty

and responsibility as well as caring. The process is

based on the principle that relies on independence,

participation, transparency, education, training, and

collaboration. The application of Pesantren’s BMT

value and principles consistently determine the

productivity and security of future business BMT.

Expanding the financial institutions at Pesantren’s

environment it is really not an easy job, furthermore,

if Pesantren do it with a small budget. Pesantren’s

BMT usually find a fissure wormholes business that

can be expanded to the various places in regencies.

Their business unit is not only in save and loan

business but also in food and agriculture business

such as bread and rice productions.

Moreover, the success of Pesantren’s BMT was

also helped by alumnus networking whom spread in

various areas. Even though sometime, some of BMT

Pesantren, they are still using an emotional market

method. The Pesantren’s BMT which in the beginning

only scoped just at the regency level must have

changed it into province scope.

The difference between this study and previous

research is in the selection of case studies, namely

pesantren’s BMT. The reason for choosing

pesantren’s BMT as a case study in this study is the

potential of Islamic Economics. Pesantrens have great

economic potential, namely the strength of the alumni

network (Winarsih, et al., 2019), pesantren social

capital and the existence of BMT which is very close

to the community, so that it will encourage the rapid

growth of pesantren’s BMT. In addition, the selection

of ZISWAF collection and distribution variables that

are used as input variables and intermediary output of

BMT pesantren.

In line with DEA approach, this study uses annual

data from balance sheet, income statement in 2009-

2014. This research was conducted in Bogor,

Bandung, Solo, Yogyakarta and Sidogiri, where there

were pesantren BMTs representing each region. The

study was conducted from September 2015 to

December 2015.

The population is pesantren’s BMT in the

provinces of West Java, Central Java, Yogyakarta and

East Java. Considering that the BMT distribution data

is not accurately available, then to get an adequate

sample number is calculated based on information

obtained from several data sources, especially from

several BMT advisory institutions, such as Inkopsyah

and Pinbuk. The sample includes Pesantren’s BMT

without any specific limitations, both in terms of

operational area, size of assets and capital, types of

microfinance service products as well as targets in the

economic sector.

This study applies intermediation approach in

calculating the efficiency of Pesantren’s BMT, since

this approach is the suitable to measure the efficiency

of Pesantren’s BMT due to its role as an intermediary

between the borrowers and BMT. DEA method

requires the input and output variables to measure the

efficiency. Input variables include total third-party

funds, total asset, operational cost and collection of

ZISWAF fund, while output variables include total

financing, total income and distribution of ZISWAF

fund. These inputs and outputs will be analysed to

measure Pesantren BMT’s efficiency by using DEA

method. The definition of inputs and outputs that

proposed by this study are as follows:

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

60

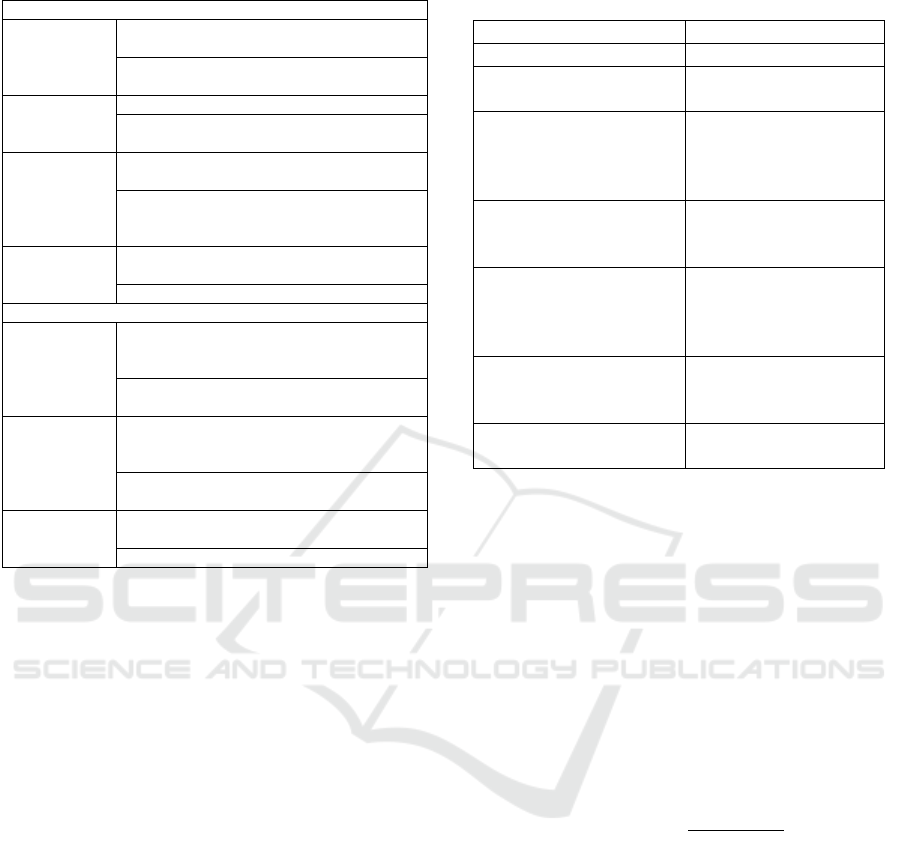

Table 1: Input and Output Variables.

Intermediation Input

Total Third-

Party Funds

Amount of Savings (general and

Mudharabah futures)

Abidin & Endri (2009); Ascarya &

Yumanita (2009);

Total Asset

Total fixed assets

Abidin & Endri (2009); Ascarya &

Yumanita (2009);

Operational

Cost of BMT

Total operational costs, including

administrative costs and labo

r

costs

Hassan & Sanchez (2009); Haq, et al.

(2010); Abidin & Endri (2009); Ascarya &

Yumanita (2009);

Collection of

ZISWAF

Amount of Zakat, Infaq, Sadaqah and Waqf

funds collected

b

y BMT

Additional fro

m

the Autho

r

Intermediation Output

Total

Financing

Total receivables (BBA), Financing

(Musyarakah and Mudharabah), Receivables

(Murabahah) and loans (Qord and others)

Qayyum & Munir (2008); Ahmad (2011);

Kablan (2012);

Total Income Total income, both margin & profit sharing

as well as other income (provision, etc. and

assets

b

etween BMT units)

Hassan & Sanchez (2009); Abidin & Endri

(2009);

Distribution

of ZISWAF

Amount of Zakat, Infaq, Sadaqah and Waqf

funds distributed

b

y BM

Additional fro

m

the Autho

r

Tools to measure efficiency could be parametric

and non-parametric. The parametric methods have

advantages relative to the non-parametric methods of

allowing for random error. These methods are less

likely to misidentify measurement error, transitory

differences in cost, or specification error for

inefficiency (Bauer, et al., 1998). However, a

disadvantage of the parametric methods is that they

impose more structure on the shape of the frontier by

specifying a functional form for it. There are three

parametric econometric approaches, namely: 1)

Stochastic frontier approach (SFA); 2) Thick frontier

approach (TFA); and 3) Distribution-free approach

(DFA). Parametric approach to measuring efficiency

uses stochastic econometric and tries to eliminate the

impact of disturbance to inefficiency.

Meanwhile, non-parametric approach is used to

measure the efficiency using non-stochastic approach

and tends to combine disturbance into inefficiency.

One of the non-parametric approaches, known as data

envelopment analysis (DEA), is a mathematical

programming technique that measures the efficiency

of a decision-making unit (DMU) relative to other

similar DMUs with the simple restrictions that all

DMUs lie on or below the efficiency frontier (Seiford

and Thrall, 1990).

Table 2: Difference Between Nonparametric and

Parametric Approach.

Nonparametric Parametric

Deterministic Stochastic

Based on external

observation

Based on central

tendencies

Analyses each vector

(DMU) separately,

individual measure

A single estimated

regression equation

applies to each

observation vector

No assumption on

production function, no

misspecification

Have to impose the

functional form

Random error does not exist,

sensitive to extreme obs. and

measurement error

Allows for random

error, minimize

specification error for

Efficiency

Efficient frontier produced

is relative to other DMUs

Efficient frontier

produced is relative to

other DMUs

Identifies the source of

inefficiency

N/A

In 1978, DEA was first introduced by Charnes,

Cooper, and Rhodes. DEA does not require an a priori

assumption about the analytical form of the

production function so imposes very little structure on

the shape of the efficient frontier. DEA can be applied

to analyse different kind of input and output without

initially assigning weight. The efficiency produced is

a relative efficiency based on observed data. DEA

does not need assumption of the production function

and preference of decision maker can be

accommodated in the model. Besides producing

efficiency value for each DMU, DEA also determines

DMUs that are used as reference for other inefficient

DMUs.

∑

∑

DMU = decision making unit

n = number of DMU evaluated

m = different inputs

p = different outputs

= number of input i consumed by DMUj

= number of output k produced by DMUj

There are two DEA models that are most

frequently used, namely, the CCR model and BCC

model. CCR model was developed by Charnes,

Cooper, and Rhodes in 1978. The CCR assumes that

each DMU operates with constant return to scale.

CCR model measure the OVERALL efficiency (OE

= TE x SE). Overall Efficiency (OE) = Allocative

Efficiency (AE) x Technical Efficiency (TE).

Efficiency of Pesantren’s Baitul Maal Wa Tamwil (BMT): An Effort towards Islamic Microfinance Institution

61

max

,

μ

.

1

μ

0 1,…,

μ

Ɛ,

Ɛk 1,…,p

i 1,…,m

: number of input i consumed by DMUj

: number of output k produced by DMUj

BCC model was developed by Banker, Charnes,

and Cooper in 1974. The BCC assumes that each

DMU can operate with variable return to scale. BCC

model measures the TECHNICAL efficiency (TE).

Technical Efficiency can be broken down into Pure

Technical Efficiency (PTE) and scale efficiency (SE),

so that Technical Efficiency (TE) = Pure Technical

Efficiency (PTE) x Scale Efficiency (SE). Therefore,

OE = AE x PTE x SE.

max

,

μ

.

1

μ

μ

0,1,…

μ

Ɛ,

Ɛk 1,…,p

i1,…,m

: number of input i consumed by DMUj

: number of output k produced by DMUj

The efficiency measurement of financial

institution can be approached from their activities.

There are three main approaches to explain the

relationship between input and output of banks,

namely production approach, intermediation

approach, and modern (or assets) approach (Freixas

and Rochet, 1998). This study uses the intermediation

approach to measure the efficiency of Pesantren’s

BMT.

The intermediation approach describes banking

activities as intermediary in charge of transforming

the money borrowed from depositors (surplus

spending units) into the money lent to borrowers

(deficit spending units). According to Freixas and

Rochet, (1998), the intermediation approach is

complimentary to the production approach and is

more appropriate to the case of a main branch, which

is not directly in contact with customers.

3 ANALYSIS MODEL

There are five Pesantren’s BMTs in the sample,

including BMT Maslahah Sidogiri, BMT Ta’awun

Ngruki Surakarta, BMT Barakah Yogyakarta, BMT

Ghozaly Bogor and BMT Daarut Tauhid Bandung,

with data period 2009-2014. Some indicators to be

discussed include total third-party funds, total asset,

operational cost and collection of ZISWAF fund, total

financing, total income and distribution of ZISWAF

fund. Mostly, the rapid growth of Pesantren’s BMT

was supported by its network of Pesantren alumni

who have been spread in many provinces of

Indonesia.

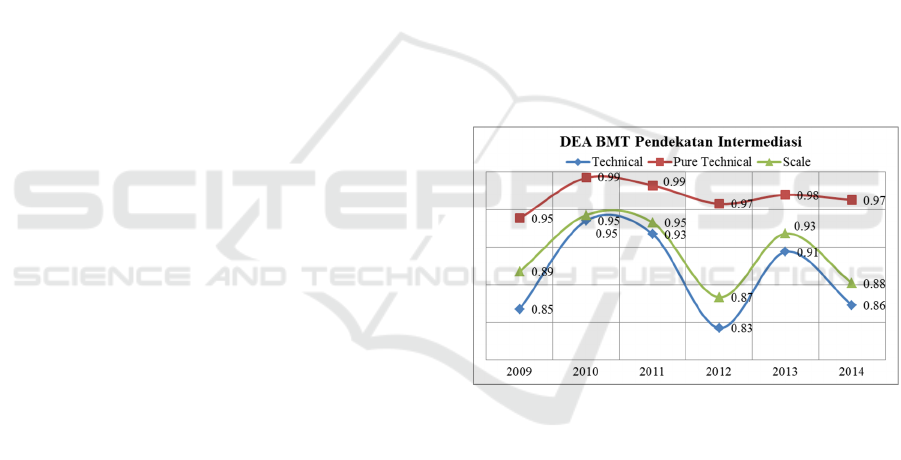

DEA method delivers three efficiency

measurements: 1) Technical Efficiency-TE; 2) Pure

Technical Efficiency-PTE; and 3) Scale Efficiency-

SE, where TE is a multiplication of PTE and SE. TE

of BMTs in 2009-2014 has been slightly fluctuating,

but has been significantly increasing in 2012-2013 to

reach 91% in 2013 (see figure 1). Fluctuation of TE

in Pesantren’s BMT has been contributed also by PTE

fluctuation.

Figure 1: Efficiency of Pesantren’s BMT.

Technical efficiency of five Pesantren’s BMT on

average has been increasing from 85.4% in 2009 to

94.8% in 2010, and then has been decreasing to reach

84.4% in 2012. The best performer was BMT

Ta’awun Ngruki with scored 100% in four years,

followed by BMT Maslahah Sidogiri with only

scored less than 100% in 2010 and 2013. However,

most Pesantren’s BMT should be alerted, since their

technical efficiencies decreased to less than 100% in

2014.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

62

TE 2009

2010

2011

2012

2013 2014

Maslahah 68.16

100

89.68 81.15

100

75.46

Ngruki 100 92.87

100

100

100 100

Barakah

100

77.19 62.78 69.66 65.91

Ghozaly

85.90

100

85.74 87.71 93.11

DT 88.04 95.20 99.95 87.33

100

94.63

TE 85.40 94.79 93.36 83.40 91.47 85.82

Figure 2: Technical Efficiency.

Figure 3: Pure Efficiency.

Pure technical efficiency of five Pesantren’s

BMTs has been steadily increasing from 95% in 2007

to reach 99.4% in 2010 and then has been decreasing

to reach 97% in 2014. The best performer was BMT

Ta’awun Ngruki with scored 100% in all 6 years,

followed by BMT Maslahah Sidogiri and BMT

Ghozaly Bogor with scored 100% in all 4 years. All

BMTs have reached 100% PTE in 2013-2014.

Meanwhile, BMT Barakah Yogya seemed struggle

with its PTE in 2013-2014 due to their investment in

new headquarter office building. BMT Maslahah

started with low PTE in 2007 (89%) but it has been

improving steadily to reach 100% in 2010 until 2014.

SE 2009 2010 2011 2012

2013

2014

Maslahah 76.32 100 89.68 85.22

100

75.46

Ngruki

100

92.87 100 100

100

100

Barakah

100 83.31 62.78 79.43 77.56

Ghozaly

87.59 100 85.74 87.71 93.11

DT 91.88 96.47 99.95 99.52

100

94.63

SE 89.40 95.39 94.59 86.65 93.43 88.15

Figure 4: Scale Efficiency.

Meanwhile, scale efficiency of five Pesantren’s

BMTs has slightly increased from 89.4% in 2007 to

reach 95.4% in 2010 with a decrease to 86.7 % in

2012 and further increase to 93.4% in 2013. The best

performer was BMT Ta’awun Ngruki with 5 year

scored 100%, followed by BMT Maslahah with only

two year scored 100% in 2010 and 2013. BMT

Ghozaly and Daarut Tauhid has only one year

reached 100% in scale efficiency, due to their

expanding units. Meanwhile, BMT Barakah should

be given a warning, since its scale efficiencies slid to

83% in 2011 and 77% in 2014 from previously 100%

in the previous first years.

Return to scale (RTS) shows if a Pesantren’s BMT

still in increasing stage (increasing return to scale or

IRS, where one additional input resulted in more than

one output), optimum stage (constant return to scale

or CRS, where one additional input resulted in one

output), or decreasing stage (decreasing return to

scale or DRS, where one additional input resulted in

less than one output). RTS of five Pesantren’s BMTs

have been fluctuate in 2009-2014, but they have been

stagnant in 2013 to 2014, where all five Pesantren’s

BMTs have reached CRS in all years, which means

all BMTs have reached the optimal stage.

Efficiency of Pesantren’s Baitul Maal Wa Tamwil (BMT): An Effort towards Islamic Microfinance Institution

63

Figure 5: Return to Scale Pesantren’s BMT.

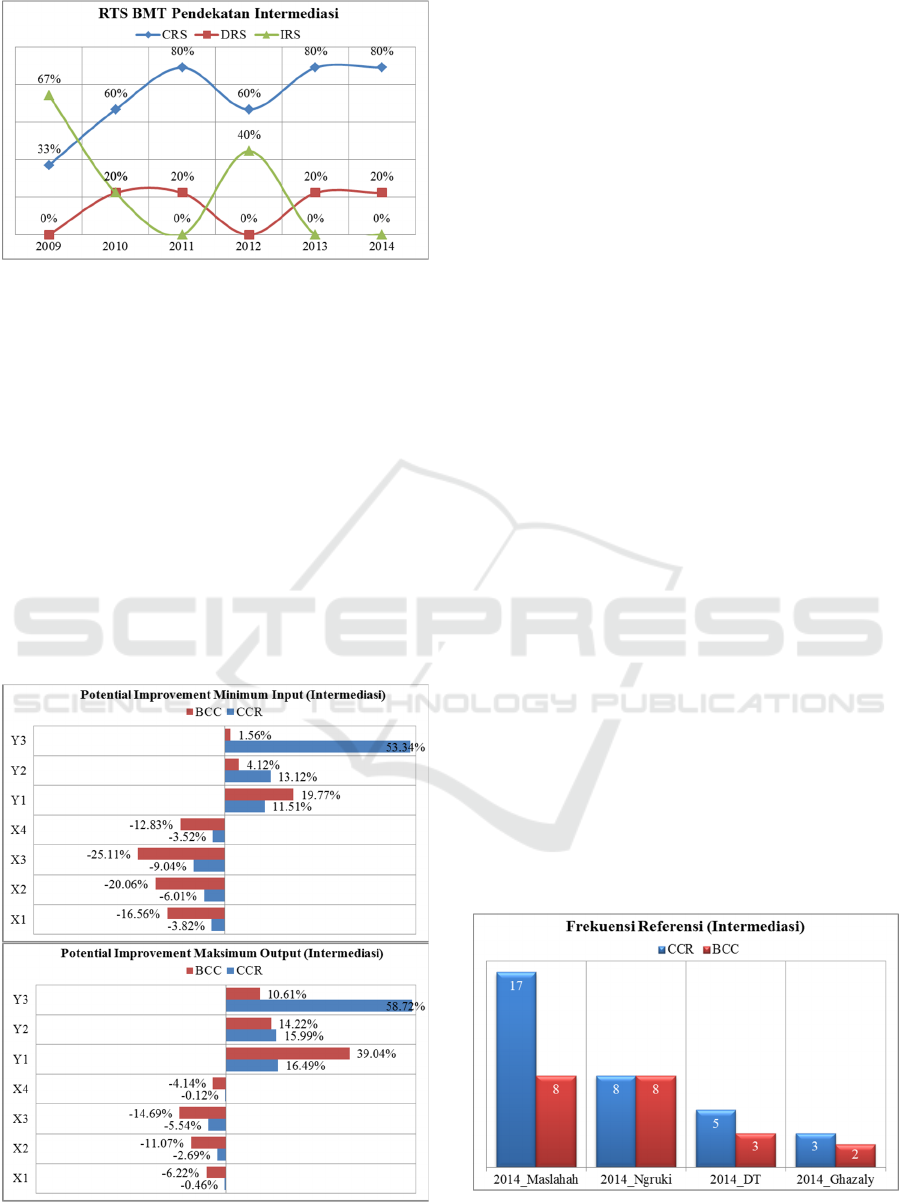

In 2009-2014, Pesantren’s BMT suffers weakness

in some aspect, mostly third-party funds, total asset,

operational cost and collection of ZISWAF fund. This

inefficiency basically can be refined, because it can

be used to measure the level of efficiency, this

method can also be used to determine the potential

improvements of each pesantren BMT by referring to

the BMT pesantren which is already efficient or

benchmarking. Based on the results of processing

data in Figure 4, it appears that the number of

financing customers and total financing must be

increased to improve their efficiency. In addition,

from the input side, the number of employees and

total assets can still be reduced to increase the

efficiency of pesantren’s BMT.

Figure 6: Potential Improvement of Pesantren’s BMT.

Moreover, based on figure 4, it appears that total

financing, operating income and ZISWAF fund

disbursement must be increased by 11.51%, 13.12%

and 53.34% respectively to improve the efficiency

value. In addition, from the input side, the total third-

party funds, total assets, operational costs and

ZISWAF fund raising can still be reduced to increase

the efficiency of pesantren BMT, by 3.82%, 6.01%,

9.04% and 3.52% respectively.

In 2014, the total distribution of ZISWAF funds

had a development potential of 53.34%, so that the

output could still be improved with an increase in the

amount of ZISWAF funds disbursed by 53.34%, from

the average amount of funds disbursement, due to get

the optimum output with the standard number of

inputs.

Interpretation of the potential for input

development with the intermediation approach is also

seen negatively. If in 2014 operating costs have a

development potential of 9.04%, then the input can

still be increased efficiency by reducing the amount

of operating costs by 9.04% from the average amount

of operating costs per period in that year, due to

minimize input to get the optimum results output. In

contrast to maximizing output with reasonable input,

the reduction in operational costs is only 5.54% of the

average operating cost per period in that year.

Reference Frequencies on input-output

processing using the DEA method shows what

pesantren BMTs are used as benchmarks by BMT

pesantren that are not efficient yet. In Figure 4, it can

be seen that based on the intermediation approach, the

Pesantren’s BMT referred in 2014 were BMT

Maslahah, BMT Ngruki, BMT DT and BMT

Ghozaly. The Maslahah BMT was referred by 17

other pesantren’s BMTs. Then BMT Ngruki was

referred by 8 other pesantren’s BMTs. The BMT DT

was referred by 5 other pesantren’s BMT, while BMT

Ghozaly was referred by 3 others.

Figure 7: Reference Frequencies on input-output processing

using the DEA method.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

64

The role of Pesantren’s BMT in sustainable

development is believed to be more relevant in the

future because Pesantren’s BMT concept is to rely on

the entranced power of social networking.

Development of BMT is also felt very potential if

using this pesantren network. Based on education

statistics in 2012/2013, the Ministry of Religion of the

Republic of Indonesia, the number of students in the

pesantren around 3,65 million. While the number of

pesantren themselves in 2013 totaled approximately

27,290. This amount is very large if it could be used

to BMT development. The approach that must be

done is to get approval from the kiai in each

pesantren. When the kiai agrees, the santri can

certainly be agreed. This is due to the pesantren

culture which is very obedient to the words of the kiai.

Economic actors in pesantren can be taken from the

officials, while the manager is the leader of the

pesantren, the kiai, the ustadz, and even his students

can become managers.

4 CONCLUSIONS

Every research is supported with valid and accurate

field research data would ended-up useful to its

readers. To Pesantren’s BMT enthusiasts, this result

would grow more confidence in them that Pesantren’s

BMT as socio-economy institution based on family

principle is already running on the right track. To

non-Pesantren’s BMT enthusiasts, especially banking

sector, this result could be their refence library in

assessing credible and business-worth partner BMT.

In terms of intermediation, technical efficiency,

pure technical and scale are only reflected in the 10

BMT pesantren or 43% of the total BMT pesantren.

While 39% of pesantren BMTs only experience pure

technical efficiency, the remaining 17% is an

inefficient BMT pesantren. This means that as much

as 17% of pesantren BMTs have not performed their

functions as intermediaries or intermediation

optimally. Based on the development potential to

achieve more efficient conditions, operational income

and ZISWAF BMT Pesantren fund disbursement can

still be increased.

REFERENCES

Abdelkader, I. B., Hathroubi, S., & Jemaa, M. M. (2014).

Microfinance Institutions’ Efficiency in the MENA

Region: a Bootstrap-DEA Approach. Research Journal

of Finance and Accounting, Vol.5, No.6,, 179-191.

Abidin, Z., & Endri. (2009). Kinerja Efisiensi Teknis Bank

Pembangunan Daerah: Pendekatan Data Envelopment

Analysis (DEA). Jurnal Akuntansi dan Keuangan, Vol.

11, No. 1, 21-29.

Ahmad, U. (2011). Efficiency Analysis of Microfinance

Institutions in Pakistan. Munich Personal RePEc

Archive, Paper No. 34215.

Ali, M., & Ascarya. (2010). Analisis Efisiensi Baitul Maal

wat Tamwil dengan Pendekatan Two Stage Data

Envelopment Analysis (Studi Kasus Kantor Cabang

BMT MMU dan BMT UGT Sidogiri). Tazkia Islamic

Finance & Business Review, Vol. 5, No. 2, August -

December, 110-125.

Ascarya, & Yumanita, D. (2009). Intermediation Efficiency

Analysis of Islamic Rural Banks In Indonesia: Two

Stage Dea Approach. Centre for Central Bank

Education and Studies Working Paper.

Bassem, B. S. (2008). Efficiency of Microfinance

Institutions in the Mediterranean: An Application of

DEA. Mediteranean & Middle East Papers: Transition

Studies Review, Vol. 15, Iss: 2, 343-354.

Bauer, Paul W., Berger, Allen N., Ferrier, Gary D., and

Humphrey, David B. (1998), “Consistency Conditions

For Regulatory Analysis of Financial Institutions: A

Comparison of Frontier Efficiency Methods”, Financial

Services Working Paper, 02/97, Federal

ReserveBloem, J. (2012). Micro, Small Medium

Enterprise (MSME) Definitions. Partners Worldwide,

Vol. Summer.

Coelli, T., Rao, D. P., O'Donnell, C. J., & Battese, G. E.

(2005). An Introduction to Efficiency and Productivity

Analysis: Second Edition. USA: Springer.

Danuri, O., & Fadlan, M. (2015). Pesantren-Pesantren

Berpengaruh di Indonesia. Jakarta: Erlangga.

Freixas, Xavier and Rochet, Jean-Charles. (1998).

Microeconomics of Banking, The MIT Press,

Cambridge, Massachusetts, London, England

Haq, M., Skully, M., & Pathan, S. (2010). Efficiency of

Microfinance Institutions: A Data Envelopment

Analysis. Asia-Pacific Financial Markets,

Forthcoming.

Hassan, M., & Sanchez, B. (2009). Efficiency Analysis of

Microfinance Institutions in Developing Countries .

Networks Financial Institute Working Paper 12.

Jayamaha, A. (2012). Efficiency of Small Financial

Institutions in Sri Lanka using Data Envelopment

Analysis. Journal of Emerging Trends in Economics

and Management Sciences, Vol. 3, No. 3, 565-573.

Kablan, S. (2012). Microfinance Efficiency in the West

African Economic and Monetary Union: Have Reforms

Promoted Sustainability or Outreach? Munich Personal

RePEc Archive, Paper No. 39955.

Karim, A. (2014). Kajian Pengembangan Islamic Financial

Inclusion. Jakarta: Karim Consulting Indonesia.

Masrifah, A. R. (2016). Efisiensi BMT Pesantren dalam

Pengelolaan Harta Usaha Mikro (Doctoral

dissertation, Tesis. Sekolah Tinggi Ekonomi Islam

Tazkia. Tidak diterbitkan).

Masrifah, A. R. (2020). Efisiensi Baitul Māl wat Tamwīl

(BMT) Pesantren di Indonesia. Islamic Economics

Journal, 6(1), 75-100.

Efficiency of Pesantren’s Baitul Maal Wa Tamwil (BMT): An Effort towards Islamic Microfinance Institution

65

Muchtar, I., & Taufiq, M. (2013). 100 Koperasi Besar

Indonesia. Jakarta: Peluang.

Qayyum, A., & Ahmad, M. (2008). Efficiency and

Sustainability of Microfinance. Munich Personal

RePEc Archive, Paper No. 11674.

Rahman, A & A. Rahim. (2007). Islamic Microfinance: A

Missing Component in Islamic Banking. Kyoto Bulletin

of Islamic Area Studies, 1-2: 38-53.

Singh, S., Goyal, S., & Sharma, S. K. (2013). Technical

Efficiency and Its Determinants in Microfinance

Institutions in India: A Firm Level Analysis. Journal of

Innovation Economics, Vol. 1, No.11, 15-31.

Seiford, L.M. and R.M. Thrall. (1990). Recent

Developments in DEA: the Mathematical Programming

Appoach to Frontier Analysis. Journal of

Econometrics, 4: 7-38.

Undang-Undang Republik Indonesia Nomor 20. (2008).

Undang-Undang RI No.20 tentang Usaha Mikro, Kecil

dan Menengah. Retrieved from

http://www.bi.go.id/id/tentang-bi/uu-

bi/Documents/UU20Tahun2008UMKM.pdf

Undang-Undang Republik Indonesia Nomor 25. (2002).

Undang-Undang RI No.25 tentang Perkoperasian.

Retrieved from

http://www.depkop.go.id/phocadownload/regulasi/uu/

uu%201992%2025%20perkoperasian.pdf

Widayati, T. (2003). Peran Perbankan dalam

Pengembangan Keuangan Mikro. In Bunga Rampai

Lembaga Keuangan Mikro (pp. 10-18). Bogor:

Business Innovation Center of Indonesia.

Widiyanto, & Ismail, A. G. (2008). Sustainability of BMT

Financing for Developing Micro Enterprises. MPRA

Paper No. 7434, 1-30.

Winarsih, R., Masrifah, A. R., & Umam, K. (2019). The

Integration Of Islamic Commercial And Social

Economy Through Productive Waqf To Promote

Pesantren Welfare. Journal of Islamic Monetary

Economics and Finance, 5(2), 321-340.

Yumanita, D., & Ascarya. (2005). Analisis Efisiensi

Perbankan Syariah di Indonesia. PPSK Working Paper

Series No: WP/01/05, 1-60.

7th AICIF 2019 - ASEAN Universities Conference on Islamic Finance

66