Implementation of Activity based Costing System in Real Price

Calculation of Cost of Goods Manufactured for the Determination of

the Selling Pricing for Start-up Business: Fruit Combining

C. Susi Maryanti

1

, Roesfiansjah Rasjidin

1

, Semerdanta Pusaka

1

and Arief Kusuma Among Praja

2

1

Faculty of Economics and Business, Esa Unggul University – Jakarta

2

Faculty of Technique, Esa Unggul University – Jakarta

Keywords: Activity Based Costing System, Cost of Goods Manufactured, Determination of The Selling Pricing

Abstract: This study discusses the relationship between the activity based costing system as the dependent variable in

the actual cost calculation of fruit combining product and the determination of the selling price as the

independent variable. The research method used is descriptive analytic research method, that is research

done by collecting data of cost incurred at a start-up business, so as to give description about the assumption

of situation of the start-up business, whether the start-up business correctly classify cost. It also carries the

cost of data analysis so as to produce a more precise cost and selling price calculation of fruit combining

product. Then, from analysing the conclusions and suggestions drawn. The results show that the start-up

business has classified the cost incurred by the right party. In addition, the start-up business has calculated

the product cost correctly because it charges the cost of each product. This product cost calculation resulted

in the start-up business having a correct selling price base. The start-up business sets the selling price by

marking up enough to cover production costs. Calculations using an activity-based costing system can result

in more precise production costs that can be a good basis for determining product selling prices.

1 INTRODUCTION

Price competition, quality, and so make some

companies must fix various aspects in the company

to be able to face the competition. Companies are

always required to be able to take the right decisions

for the company to survive in the business world.

Companies need excellence in the face of intense

competition in the industry. Increased competition in

similar industries causes the market for the industry

to be price sensitive, where a relatively small

increase or decrease in price can result in a

significant impact on sales. Therefore, the selling

price is one of the most important factors to survive

in the industry. To be able to achieve excellence, the

company must be able to calculate the selling price

correctly. The selling price should not be too low to

cover all costs incurred by the company and provide

the desired profit, nor should it be too high for the

company to compete with its competitors.

The company can set the selling price correctly if

the company can calculate the cost of the product

properly so that the product is not overcosted and

not undercosted (charged less than it should). PT

Redceri Indonesia as one of the startup companies

will implement Activity-based costing system.

Activity-Based Costing (ABC) has a more

comprehensive cost-tracking implementation than

traditional cost accounting (Martusa et al., 2010). PT

Redceri Indonesi determines the cost of the product

using Activity-based costing system to help set the

selling price correctly.

Research conducted on PT Redceri Indonesia

which produces and sells Redceri Pure Fruit Jelly.

The company produces goods on a regular basis

with the capacity of PT Redceri Indonesia

amounting to 61,440 Redceri Pure Fruit Jelly / day

products with 5 working days per week for non-shift

working time. The number of workers in PT Redceri

Indonesia is 40 people. PT Redceri Indonesia

products are Redceri Orange and Redceri Carica.

Selling price is an important thing to be

consideration of buyers of the company's products

considering the situation of competition in Indonesia

is quite tight. Even small price changes will have a

huge impact on sales in large quantities. If there is

an error in determining the selling price then the

company can lose in large amount. Increased

2706

Maryanti, C., Rasjidin, R., Pusaka, S. and Kusuma Among Praja, A.

Implementation of Activity based Costing System in Real Price Calculation of Cost of Goods Manufactured for the Determination of the Selling Pricing for Start-up Business: Fruit Combining.

DOI: 10.5220/0009951127062712

In Proceedings of the 1st International Conference on Recent Innovations (ICRI 2018), pages 2706-2712

ISBN: 978-989-758-458-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

competition in this industry, requires the company to

have the advantage to be able to keep his life and

enlarge his business. For that, the company must be

able to set a reasonable selling price by stipulating

the cost of the product properly. The cost of the

products discussed in this research is full costing so

as to cover production and non-production costs.

The main purpose in establishing a company is to

get the optimal profit to maintain the company's

survival. The main source of company revenue is

usually derived from the sale of products, both

goods and services that the amount can be measured

by loading to the buyer. The company must set a

reasonable price to earn a substantial income. In

determining the reasonable selling price, the

company needs to get information about the cost of

the product accurately because the information can

have an effect in the decision making process.

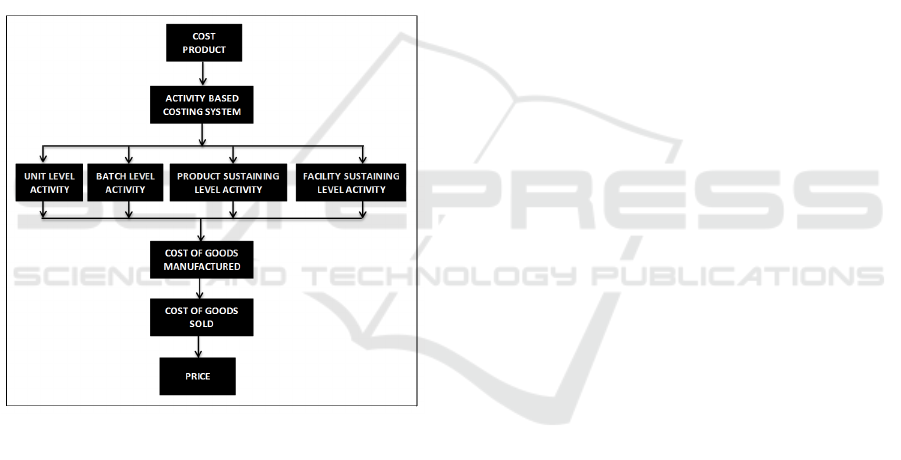

Figure 1. Chart of Framework

2 COST OF GOODS

According to Hilton (2005) defines the cost of the

product as follows:

"The total cost of direct material, direct labor, and

manufacturing overhead transferred from work-in-

process inventory to finished-goods inventory."

Hariadi (2002) put forward the concept of

different cost for different purposes. This concept

underlies the meaning of cost of goods, that is,

depends on what interests the management uses the

information. On the basis of the traditional concept

intended for the purposes of the preparation of

financial statements states that the so-called cost of a

product only includes the cost of raw materials,

direct labour costs, and factory overhead costs.

Meanwhile, on the basis of contemporary concepts,

for the interests of tactical operational management,

the meaning of the cost of a product is in addition to

covering traditional production costs also includes

marketing costs and service costs to consumers.

According to Mulyadi (2001), the cost of

products can be calculated by two approaches,

namely by using full costing and variable costing.

Full Costing is a method of determining the cost

of production which takes into account all the

elements of production cost into the cost of

production, which consists of raw material costs,

direct labour costs, and factory overhead costs, both

of which behave as well as variable. The cost of the

products calculated by the full costing approach

consists of the elements of cost of production (raw

material costs, direct labour costs, variable factory

overhead costs, and fixed factory overhead costs)

plus non-production costs (marketing costs,

administrative costs and general)

Variable Costing is method of determining the

cost of production that only takes into account the

cost of production that behaves variable into the cost

of production, which consists of raw material costs,

direct labour costs, and variable factory overhead

costs. The cost of the product calculated by the

variable costing approach consists of elements of the

cost of production of variables (raw material costs,

direct labour costs, and variable factory overhead

costs) plus variable non-production costs (variable

marketing costs, administrative costs and general

variables) And fixed costs (fixed factory overhead

costs, fixed marketing costs, general administrative

and fixed costs).

The cost of the product is set when, according to

Hansen and Mowen (2006) actual costing: An actual

cost system use actual costs for direct materials,

direct (manufacturing) labour, and (manufacturing)

overhead. These actual costs are then used to

determined the unit cost.According to Horngren et

al. (2006) actual costing: A costing system that

traces direct costs to a cost object by using the

actual direct-cost rates times the actual quantities of

the direct- cost inputs. In actual costing, the cost of

the product is calculated at the end after the finished

product is made because the actual cost is incurred

to make the new product known after the finished

product is made. The goal is to calculate the actual

resources used / consumed to produce a particular

product.

According to Horngren et al. (2006) normal

costing: Normal costing is a costing method that

Implementation of Activity based Costing System in Real Price Calculation of Cost of Goods Manufactured for the Determination of the

Selling Pricing for Start-up Business: Fruit Combining

2707

traces direct costs to a cost object by using the

actual direct-cost inputs, and allocates indirect costs

based on the budgeted indirect-cost rates times the

actual quantity of the cost-allocation bases. The

difficulty of calculating actual (actual) cost of fees

per week or even per month makes the new

company able to calculate the cost at the end of the

year. This may result in the information being

delayed. To overcome the delay, the normal costing

of product cost is determined when the finished

product is made, not waiting until the end of the year

due to the indirect cost of the magnitude can not be

known then for the calculation of the cost of goods

used indirect cost tariff budgeted by the company

management. How to calculate it is by dividing the

indirect cost budgeted per year by the basic quantity

of budgeted allocations per year.

The process of indirect cost charging on the

product can use 2 approaches, that is with traditional

system and Activity-based Costing system.In

traditional cost systems, the cost drivers used are

based only on a unit basis or are called unit-level

activity drivers. The trigger of the unit's basic

activity is the factors that cause the cost changes

when the number of units generated changes. The

use of these cost drivers in charging the overhead

costs of the product means that the overhead has a

very close correlation with the number of units

produced. So far, there are three gradual levels that

have been practiced in the cost system to charge

overhead costs on products: (1) Single rate

applicable to entire factory; (2) Some different rates

apply to each department; (3) Implementation of the

ABC system by using different tariffs applicable to

each activity

The limitation of traditional basic cost

calculation, that is can cause distortion overhead

loading. This is because the proportion of overhead

costs unrelated to the number of units over total

overhead is significant, and the type of product

produced varies greatly (Hariadi, 2002).

3 ACTIVITY-BASED COSTING

SYSTEM (ABC)

Garrison and Noreen (2003: 96) define Activity-

based costing system (ABC) as follows:

"A costing method that is designed to provide

managers with cost information for strategic and

other decisions that potentially affect capacity and

therefore "fixed" costs"

The essence of Activity-based costing system (ABC)

revealed by Mulyadi (2001), namely in generating

cost object (product or service), resources issued by

the company in the form of costs based on activities

undertaken by the company.

PT Redceri Indonesia calculates the cost of

production per unit with ABC (Activity Based

Costing) system. In the traditional cost system

charging costs on production costs (Raw Material

Cost, Direct labour costs and Factory Overhead

Cost). The production cost component of ABC

system is almost the same as traditional system, but

in ABC Factory Overhead Cost search is more

accurate.

Overhead budget is a budget that plans costs in

the factory issued by the company in the course of

the production process except for direct raw material

costs and direct labour. This budget is useful as a

basis for preparing the cost of goods manufactured

budget, the cost of goods sold and the cash budget.

The benefits of this budget are to know the cost of

use more efficiently, to determine the cost of the

product more precisely, to know the allocation of

factory overhead cost in accordance with the place

(department) where the cost is charged and as a

control tool overhead factory cost.

PT Redceri Indonesia created a Factory

Overhead Cost budget with Activity Based Costing

System (ABC System). This is because the ABC

system based on activities that use cost drivers more

than the traditional system. Using the ABC system

allows management to make cost savings by

eliminating non value-added activities. An error in

charging a product will result in over costing or

under costing resulting in an error in decision

making.

The stages of preparing the Factory Overhead

Cost Budget of PT Redceri Indonesia with ABC

System begins with the process of identifying

activities. The identification of activities requires

that there be a list of the types of jobs within the

company related to the production process. Then

charge the activities. Each time an activity is set, the

cost of implementing the activity is determined.

The next step is to determine the activity driver

for each activity that is the controlling factor of the

activities and determine the tariff and charge the

product. In determining this rate, the total cost of

each activity is divided by the total activity of the

driver used for the activity. The next step is to

multiply the rate obtained for each activity with the

driver activity consumed by each type of product

produced and then divide by the number of units

produced for each product.

ICRI 2018 - International Conference Recent Innovation

2708

Unit-level activities are activities that are done

every time a unit of product is produced, the size of

this activity is influenced by the number of units

produced. For example, direct power, machine

clock, and electrical clock (energy) are used every

time a unit of product is produced.

Batch-level activities are activities performed

each time a product batch is produced, the size of the

activity is affected by the number of batches of

manufactured products. Examples of activities

included in this group are setup activities,

production scheduling activities, material

management activities (material movement and

purchase orders), inspection activities.

Product-level activities are activities undertaken

to support the various products produced by the

company. This activity consumes input to develop

the product or enable the product to be produced and

sold. Examples of activities included in this group

are product research and development activities,

process engineering, product specifications,

engineering changes, and product upgrades.

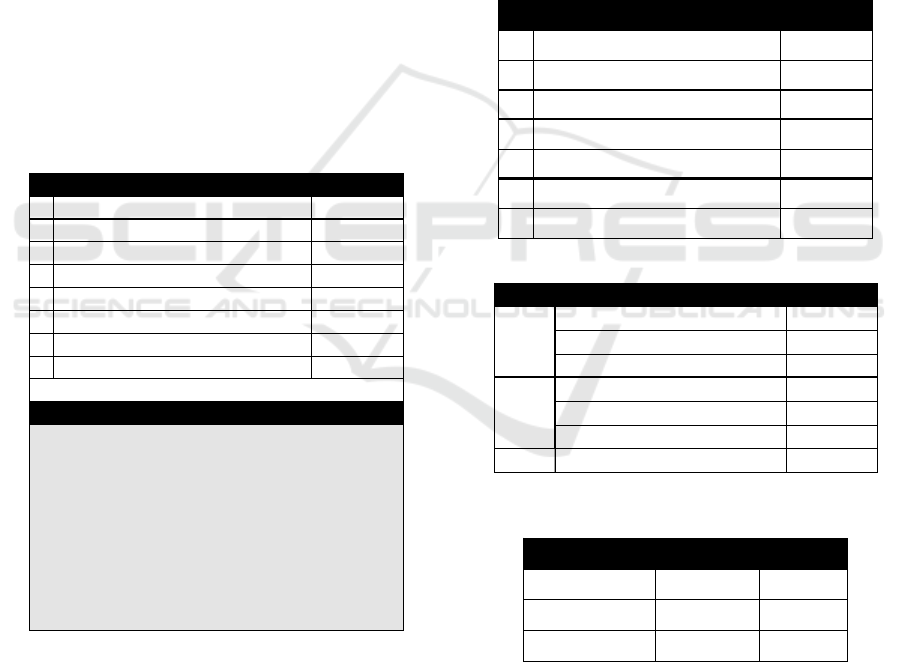

Table 1. Factory Overhead Cost &Calculation Assumption

Facility-level activities include activities to

support general manufacturing processes that are

required to provide facilities or plant capacity to

produce products but many of these activities are not

related to the volume or mix of manufactured

products. Examples of these activities include for

example: plant management, building maintenance,

security, landscaping, factory lighting, hygiene, land

and building tax, and factory depreciation.

Cost Pool is a group of costs caused by activity

along with a cost driver basis. Cost pool is useful to

determine the cost pool rate which is the factory

overhead cost per unit cost driver calculated for each

activity group. The group rate is calculated by the

formula of total overhead for a given activity group

divided by the basis of the group's activity

measurement.

Cost drivers or cost drivers are used to charge

activity costs to outputs that are structurally different

from those used in conventional cost systems. Or

causal factors that explain overhead consumption.

Cost drivers are the basis used to charge the costs

accumulated on the cost pool to the product.

Table 2. Identification of Factory Overhead

Cost Into Activity Category

Table 3. Production Cost Activity

Table 4. Allocation of Calculation of Activity Based

Costing System (ABC)

4 BUDGET COST OF GOODS

MANUFACTURED

The cost of production calculated for a certain

period of time is useful for management to establish

No. CostType Amount

1 IndirectLaborCost 659.600.000

2 BuildingRentCo st 200.000.000

3DepreciationCost 232.068.500

4 ElectricityFactoryCost 142.349.460

5Fuel&GasCo st 5.628.493

6 Maintenance&Sparepart 7.415.000

7OtherOverheadCost 60.000.000

TOTAL 1.307.061.453

Assumption

Installedcapacity(cup/hour) 9600

Capacityusedfromins talled 80%

Weekdayspermonth(days) 22

Workinghoursperday(hours) 8

THRfrommonthlysalaryvalue 100%

Maximumbonusfromsalaryvaluepermonth 400%

Cos t

ofbuildingrentalperyear 200.000.000Rp

OtherOverheadCost/mon th 5.000.000Rp

No. CostDriver

1 IndirectLabor UnitLevel

2FactoryElectricity UnitLevel

3Fuel&gas UnitLevel

4 Maintenance&Sparepart BatchLevel

5OtherFactoryOverhead BatchLevel

6 Building RentCost FacilityLevel

7DepreciationCos tofMachinery&Equipmen

t

FacilityLevel

FactoryOverheadCost

CostPool CostDriver

I IndirectLa bor Tota lProdu ction

Maintenance&Sparepart TotalProd u ction

OtherFactoryOverhead TotalProd u ction

II Factor yElectricity MachineHours

Fuel&gas M achineHours

DepreciationCostofMachinery&Equipmen

t

MachineHours

III BuildingRentCost FacilityLevel

Typ eofFactoryOverh eadCost

RedceriOrange RedceriCarica

TotalProduction(unit) 10,493,036.00 6,995,357.00

MachineHours(Hours) 1,267.20 844.80

SquareArea(M2) 303.60 202.40

Description

Implementation of Activity based Costing System in Real Price Calculation of Cost of Goods Manufactured for the Determination of the

Selling Pricing for Start-up Business: Fruit Combining

2709

the selling price of the product. Estimated

production cost information per unit to be issued to

produce the product within a certain period of time

can be used as a basis for determining the selling

price per unit of product to be charged to the buyer.

In determining the selling price of the product,

production cost per unit is one of the information

considered in addition to other cost information as

well as non-fee information.

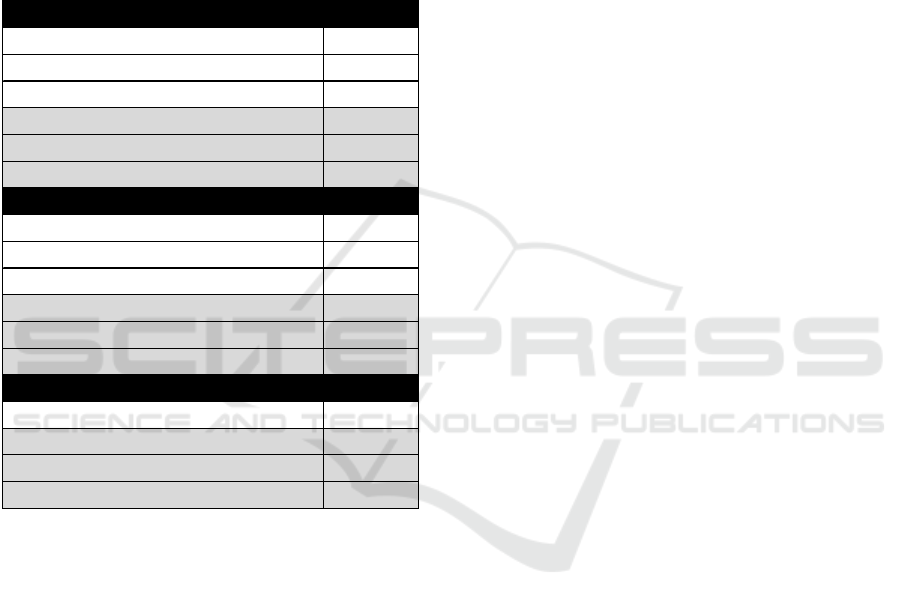

Table 5. Factory Overhead Rates

With Activity Based Costing System (ABC)

In addition, Cost of Goods Manufactured is

useful to monitor the realization of production costs.

Management requires information on actual

production costs incurred in the implementation of

the production plan. This information is useful to

monitor whether the production process consumes

the total cost of production in accordance with the

previous calculation.

Cost of Goods Manufactured is also useful for

calculating the company's profit and loss.

Management requires information on production

costs that have been incurred to produce the product

within a certain period. This information is useful to

know whether the production and marketing

activities within a certain period able to generate

gross profit or even result in gross loss.

The cost of goods manufactured also determines

the cost of the inventory of the finished product and

the product in the process presented in the balance

sheet. When management makes periodic financial

accountability, management must present financial

statements in the form of a balance sheet and income

statement. In the balance sheet, management should

present the cost of the inventory of the finished

product and the cost of the product at which the

balance sheet is still in process.

PT Redceri Indonesia calculates the cost of

production per unit with ABC (Activity Based

Costing) system. In the traditional cost system

charging costs on production costs (Raw Material,

direct Labour, Factory Overhead). The production

cost component of ABC system is almost the same

as traditional system, but in ABC Factory Overhead

Cost search is more accurate.

From the calculation of cost of goods

manufacture for Redceri Orange then obtained the

total production cost of Rp19,004,352,914.11. With

the number of products produced for 10,493,036

units, the cost of production per unit is Rp1,811.14.

As for the cost of production Redceri Carica

obtained total production costs of

Rp12,186,899,232.84. With the number of products

produced amounted to 6.995,357 units, the cost of

production per unit is Rp1,742.14.

5 PROJECTED COST OF GOODS

SOLD

In determining the cost of goods sold, the

conventional cost accounting system is no longer

appropriate to be applied in today's modern

technological era. Because this system has several

weaknesses. Among them is providing distorted cost

information. Distortions arise because of

inaccuracies in charging costs, resulting in costing,

decision-making, planning, and control errors. The

distortion also results in under cost / over cost of the

product (Hansen & Mowen, 2004). The existence of

various weaknesses can be overcome by the use of

Activity-Based Costing method.

Companies can use Activity Based Costing

(ABC) system to analyse activities. The

implementation of ABC is an innovation, one of

which is to reduce non value-adding activities, add

value to products / services to be produced, and

eliminate activities that are not in accordance with

the wishes of customers or who do not create added

value. Activity Based Costing is a costing pricing

method that tracks costs to activities, then to

products. The main difference between the cost of

product costing between conventional cost

IndirectLabor 659.600.000

Maintenance&Sparepart 7.415.000

OtherFactoryOverhead 60.000.000

TotalCost(Rp) 727.015.000

TotalProduction(Unit) 17.488.393

FactoryOverheadCostRates‐CostPoolI(Rp) 41,57

FactoryElectricity 142.349.460

Fuel&gas 5.628.493

Depreci a tionCos tofMachinery&Equipment 232.068.500

TotalCost(Rp) 380.046.453

MachineHours(Hours) 2.112

FactoryOverheadCostRates‐CostPoolII(Rp) 179.946,24

Bui ldingRentCost 200.000.000

TotalCost(Rp) 200.000.000

SquareArea(M2) 506,00

FactoryOverheadCostRates‐CostPoolIII(Rp

)

395.256,92

CostPoolI

CostPoolII

CostPoolIII

ICRI 2018 - International Conference Recent Innovation

2710

accounting and ABC is the amount of cost drivers

used in the ABC method more than in conventional

cost accounting systems.

Table 6. Calculation of Cost of Goods Manufactured per

Unit with Activity Based Costing System (ABC) For

Redceri Orange

Table 7. Calculation of Cost of Goods Manufactured per

Unit with Activity Based Costing System (ABC) for

Redceri Carica

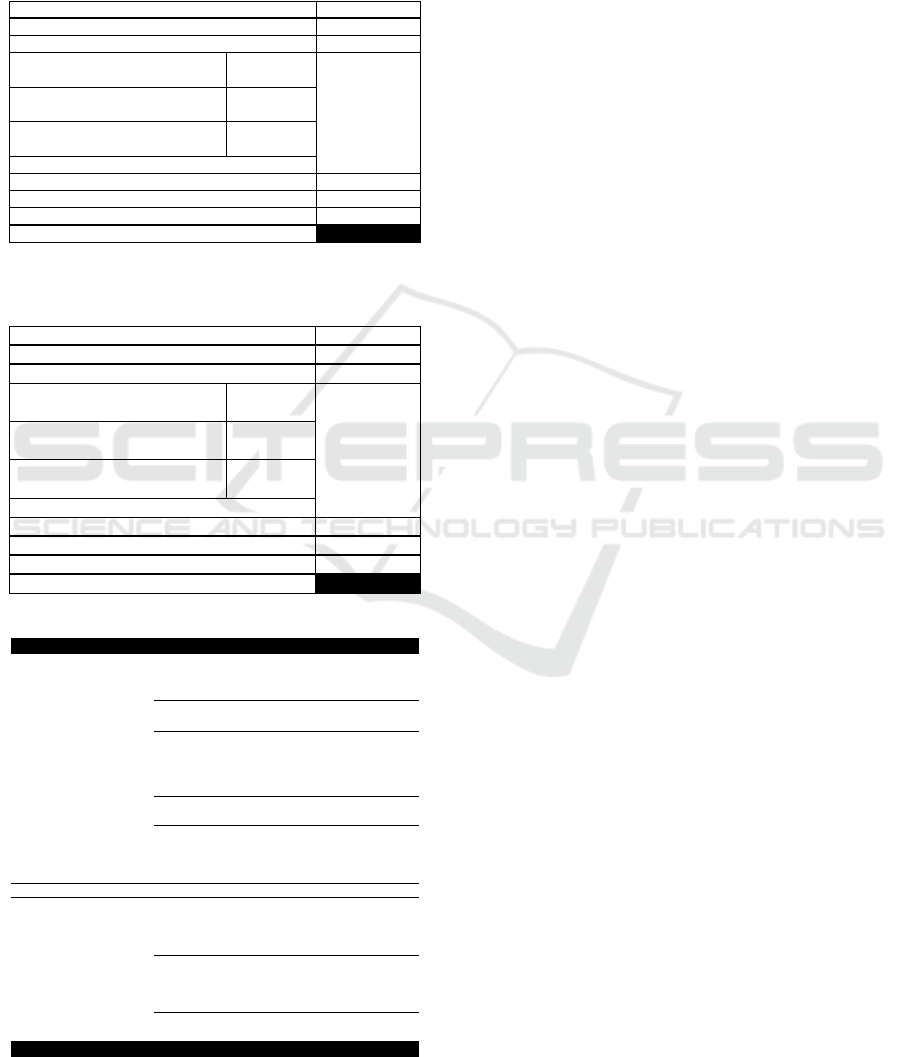

Table 8. Projected Cost of Goods Sold Y0-Y5

Companies can use Activity Based Costing

(ABC) system to analyse activities. The

implementation of ABC is an innovation, one of

which is to reduce non value-adding activities, add

value to products / services to be produced, and

eliminate activities that are not in accordance with

the wishes of customers or who do not create added

value.

More accurate per-unit pricing is important for

management as a basis for decision-making.

Management can be made easier in making

decisions, among others in determining the selling

price, considering refusing or accepting an order,

monitoring the realization of costs, calculating the

profit / loss of each order and determining the cost

of the finished product and product inventory in the

process to be presented on the balance sheet.

Determination of cost of goods sold in industrial

companies, generally on the initial inventory of

finished products coupled with the amount of

production price (cost of goods manufactured) and

reduced by the end product inventory. So the notion

of cost of goods sold, based on Accounting

Principles Indonesia explains that the beginning

balance of inventory plus the cost of goods

purchased for sale, minus the final inventory

amount. For industrial enterprises in cost of goods

sold including all direct wages and materials costs

plus all factory costs (production) is not directly

corrected by the number of beginning and ending

inventory balances.

The calculation of cost of goods sold can not be

separated from the total cost of raw materials, direct

labour, and overhead. However, excludes counting

of operational costs such as marketing,

administration and general costs. Cost of goods sold

also involves all costs used for employee wages and

the cost of direct production materials and indirect

factory production costs.

Cost of goods sold has three basic structural

elements: (1) Inventory; (2) direct labour costs; (3)

Overhead (overhead cost). The inventory element

includes raw materials inventory, work in process

inventory or WIP and stock of finished goods

(inventory).

The company uses Activity Based Costing

(ABC) system to analyse the activity. From the pre-

made budget planning covering the sales budget,

production budget, raw material budget, indirect

labour budget, factory overhead budget and cost of

product cost for each product type, it can be

projected cost of goods sold (cost of goods sold) As

in Table 8.

RawMaterialCost(Rp) 18.029.163.394,99

DirectLaborCost(Rp) 190.952.639,00

FactoryOverheadCost:

CostPoolI

41,57Rp x 10.493.036 un it 436.209.008,31

CostPoolII

179.946,24Rp x1.267 jam 228.027.871,80

CostPoolII

395.256,92Rp x304 M2 120.000.000,00

TotalofFactoryOverheadCost(Rp) 784.236.880,11

TotalofProductionCost(Rp) 19.004.352.914,11

TotalofProductsManufactured(Units) 10.493.036,00

CostofGoodsManufacturedPer

Unit(Rp) 1.811,14

RawMaterialCost(Rp) 11.549.503.079,95

DirectLaborCost(Rp) 114.571.5 80,00

FactoryOverheadCost:

CostPoolI

41,57Rp x 6.995.357 unit 290.805.991,69

CostPoolII

179.946,24Rp x 845 jam 152.018.581,20

CostPoolII

395.256,92Rp x 202 M2 80.000.000,00

TotalofFactoryOverheadCost(Rp) 522.824.572,89

TotalofProductionCost(Rp) 12.186.8 99.232,84

TotalofProductsManufactured(Units) 6.995.357,00

CostofGoodsManufacturedPer

Unit(Rp) 1.742,14

NO Y0 Y1 Y2 Y3 Y4 Y5

IRAWMATERIAL

InitialSuppliesof RawMaterials ‐ ‐ ‐ ‐ ‐ ‐

PurchaseofRawMaterials 24.744.032.817 27.583.688.314 33.762.434.496 43.047.103.983 57.080.459.881 75.688.689.490

Total RawMaterial 24.744.032.817 27.583.688.314 33.762.434.496 43.047.103.983 57.080.459.881 75.688.689.490

FinalInventoryofRawMaterials ‐ ‐ ‐ ‐ ‐ ‐

UsedRawMaterials 24.744.032.817 27.583.688.314 33.762.434.496 43.047.103.983 57.080.459.881 75.688.689.490

II AUXILIARY

InitialSuppliesof Auxiliary ‐ ‐ ‐ ‐ ‐ ‐

PurchaseofAuxiliary 4.834.633.658 5.389.462.138 6.467.354.565 8.084.193.207 10.509.451.169 13.662.286.463

Total Auxiliary 4.834.633.658 5.389.462.138 6.467.354.565 8.084.193.207 10.509.451.169 13.662.286.463

FinalInventoryofAuxiliary ‐ ‐ ‐ ‐ ‐ ‐

UsedAuxiliary 4.834.633. 658 5.389.462.138 6.467.354.565 8.084.193.207 10.509.451.169 13.662.286.463

III DIRECTLABOR 305.524.219 360.621.055 432.745.266 540.931.583 703.211.058 914.174.371

IV FACTORYOVERHEADCOST 1.307.061.453 1.471.346.342 1.765.615.611 2.207.019.513 2.869.125.367 3.729.862.962

TOTALPRODUCTIONCOST(I+II

+III+IV) 31.191.252.147 34.805.117.849 42.428.149.939 53.879.248.286 71.162.247.475 93.995.013.286

VWORKINPROCESS

InitialInventoryofWorkInProcess ‐ ‐ ‐ ‐ ‐ ‐

FinalInventoryofWorkInProcess ‐ ‐ ‐ ‐ ‐ ‐

Invent oryofWorkInProcess ‐ ‐ ‐ ‐ ‐ ‐

VI FINISHEDGOODS

InitialInventoryofFinis hedGoods ‐ 112.828 530.920 637.104 796.380 1.035.294

FinalInventoryofFi nishedGoods 112.828 530.920 637.104 796.380 1.035.294 1.345.882

Invent oryofFinishedGoods 112.828 643.748 1.168.024 1.433.484 1.831.674 2.381.176

COSTOFGOODSSOLD 31.191.364.975 34.805.761.597 42.429.317.963 53.880.681.770 71.164.079.149 93.997.394.462

KETERANGAN

Implementation of Activity based Costing System in Real Price Calculation of Cost of Goods Manufactured for the Determination of the

Selling Pricing for Start-up Business: Fruit Combining

2711

6 PRICE DETERMINATION

Companies generally specify the goods and

services they offer based on the cost of goods sold.

Companies can be specific to know how much the

right price to be charged to the buyer.

Based on calculations performed with Activity

Based Costing (ABC) system, PT Redceri Indonesia

can determine the Factory SellPrice to Distributor of

Redceri Orange is Rp4,055.91 with profit 17% from

total cost and Factory SellPrice to Distributor of

Redceri Carica is Rp 4,057.31 with profit 19.35%

from total cost.

The Factory Sell Price to Retailer of Redceri

Orange is Rp4,583.17 with profit 32.21% from total

cost and Factory Sell Price to Retailer of Redceri

Carica is Rp 4,584.76 with profit 34.86% from total

cost.Selling price of PT Redceri Indonesia’s product

can be seen in table 9.

Table 9. Price Determination

7 CONCLUSION

Product cost calculation resulted in the start-up

business having a correct selling price base. The

start-up business sets the selling price by marking up

enough to cover production costs. Calculations using

an activity-based costing system can result in more

precise production costs that can be a good basis for

determining product selling prices. To set an

appropriate selling price, mark the right to consider

the competitive situation and the purchasing power

of the customer.

Conventional cost systems are less able to meet

management needs in an accurate product cost

calculation, especially when it involves substantial

indirect production costs and product diversity. This

results in improper decision making by the

management in relation to pricing.

Implementation of Activity Based Costing

System in real price calculation of Cost of Goods

Manufactured also helps the company to know

which products are more profitable, so it becomes a

consideration to determine which products will be

maintained and which are not. Redceri Carica is

more profitable than Redceri Orange.

REFERENCES

Garrison, R. H., dan E. W. Noreen (2003). Managerial

Accounting. 10th Edition. New York: McGraw Hill,

Inc.

Hansen, D. R., dan M. M. Mowen (2006). 7th Edition.

Management Accounting. Thomson: Southwestern

Publishing, Co.

Hariadi, B. (2002). Edisi 1. Akuntansi Manajemen: Suatu

Sudut Pandang. Yogyakarta: BPFE

Hilton, R. W. (2005). International Edition. Managerial

Accounting. New York: McGraw Hill, Inc.

Horngren, C. T.; G. Foster, dan S. M. Datar (2006). 12th

Edition. Cost Accounting: Managerial Emphasis. New

Jersey: Prentice Hall, Inc.

Martusa, R., S. R. Darma, dan V. Carolina. 2010. Peranan

Metode Activity Based Costing dalam Menentukan

Cost of Goods Manufactured. Akurat Jurnal Ilmiah

Akuntansi, Nomor 02 Tahun ke-1 Bulan Mei-Agustus,

Hal. 39-60.

Mulyadi. (2001). Edisi 3. Akuntansi Manajemen:

Konsep, Manfaat, dan Rekayasa. Jakarta: Salemba

Empat.

DESCRIPTION REDCERI REDCERI

ORANGE CARICA

Cost:

RawMaterial 1.442,30 1.373,76

Auxiliaries 275,90 277,26

Directlabor 18,20 16,38

FactoryOverheadCost 74,74 74,74

MarketingExpenses 1.306,58 1.306,58

Adm in&GeneralExpenses 74,71 74,71

Depreci ationofOfficeSupplies 94,20 94,20

Inter est 82,73 84,63

IncomeTax 97,22 97,22

TotalCost: 3.466,59 3.399,49

Profit17%and19.35% 589,32 657,82

FactorySalePricetoDistribut or 4.055,91 4.057,31

Profit32.21%and34.86% 1.116,59 1.185,28

Factory

SalePricetoRetailer 4.583,17 4.584,76

Profit32.21%and34.86% 1.116,59 1.185,28

FactorySalePricetoSchool&Hospital 4.583,17 4.584,77

ICRI 2018 - International Conference Recent Innovation

2712