Review of Zakat, Infaq, and Shadaqah as a Similar Terminology

M. Aziz Ritonga

1

and Erta Mahyudin

2

1

PhD Student Islamic University of Jakarta Indonesia

2

Islamic University of Jakarta Indonesia

Keywords: wealth, sharing, empowerment

Abstract: One form of obligation in the Islamic context is known as zakat worship which is an important

foundation in Islam. Zakat became one of the pillars of Islam which in the Qur'an verses that

became commands obligations often combined with the term prayer. Zakat is also believed to be

the basis for strengthening the economic base in Islam, because through the practice of zakat by

the affluent that is distributed to the less fortunate (dhu'afa, fakir) will be a bridge that brings

together between the two. Zakat does not stand alone, because other than that Islam also recognizes

the term infaq and shadaqah which contextually have roles and functions similar to the zakat itself.

Only, in the way of their implementation of each other has a different 'territory' of applied, but still

in the same substance, culminating in the intention: to share the good (especially the matter of

wealth) for the benefit of life among fellow human beings. This author considers that among the

three terms mentioned in the Qur'an and the hadith of Prophet Muhammad SAW are three things

that are in series and have the same depth of meaning. This is the way Allah SWT decreases the

obligatory commands for His servants, so that every Muslim has the same opportunity to do good

deeds with his possessions, so that the context of sharing is not merely a territory of the possession

of the rich. Because they can do the same practice through infaq or shadaqah.

1 INTRODUCTION

In the Islamic treasury are known three terms

associated with the context of sharing the possession

of something from someone who is handed over or

given to others. The three terms are zakat, infaq, and

shadaqah which then commonly abbreviated as

“ZIS”. Muslim societies have been familiar with with

terminology which in the context of Islam is believed

to be the foundation that strengthens the economic

building. Referred to as reinforcing the economic

foundation because through this ZIS implementation

pattern it is considered relevant to direct the purpose

of the appointment to an order of justice which is the

goal of living together in a crowd (entity) Muslim,

because there are themes of mutual help between

people between two different life groups: between the

rich and the poor.

Islam itself is understood as a religion

derived by Allah SWT (Dienullah) which regulates

human life's commitment to balance and equilibrium

in it. Through the pattern of application of zakat,

infaq, and shadaqah (ZIS) the gap between the rich

and the poor can be brought closer. Social jealousy as

a result can be eliminated by itself. For it can not be

denied that one of the fundamental problems in social

life is the economic inequality that gave birth to

various kinds of social problems, such as crime and

acts against the law, and other sociocultural vices.

The Qur'an itself mentions the terms of

zakat, infaq, and shadaqah in verses which are

repeated textually and contextually. Textual verses

are as explicitly stated in the Qur'anic verses, whereas

the contextual verse in the implicitly quoted verse is

connotative with those three terms. This is in line with

what Shaykh Mahmud Saltut

2

understands which

divides the verses of Allâh into two: Kauniah and

Qauliah verses. Verse kauniah is a verse that is

contextual while qauliyah is the opposite of the

textual. The contextual verse is a sign that Allâh SWT

not only lowered the textual verse (which is written

in the holy books), but Allâh also decreases the verses

of "signs" which He does not write but are implicitly

present in real life. In essence Allâh ordered man to

think about the meaning of the verse both from the

side of qauliyah and from the point of view kauniyah.

In the Qur'an for example found the word / phrase

Ritonga, M. and Mahyudin, E.

Review of Zakat, Infaq, and Shadaqah as a Similar Terminology.

DOI: 10.5220/0009917608010808

In Proceedings of the 1st International Conference on Recent Innovations (ICRI 2018), pages 801-808

ISBN: 978-989-758-458-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

801

aqimish-shalata wa atuz-zakata whose meaning

stands prayer and pay / release zakat. In qauliyah

(textual) both (salat and zakat) into two obligations

that must be done or fulfilled by every Muslim. Two

distinct religious obligations are in practice. While

the contextual (kauniyah) term zakat in the verse can

mean another that is not on the theme of paying /

issuing / adjusting zakah (in relation to release some

of the wealth owned for the person entitled to receive

it, mustahiq) but the obligation for the performer of

prayer (mushallin) to always cleanse his soul and

body from dishonorable, filthy or vile actions as one

of the meanings of zakah is cleansing or purifying.

Zakat in Islamic teachings is believed to be a

method in the context of sanctifying the one who

performs it because it clears the morality of the culprit

and purifies his soul from the stingy nature and the

less commendable habits. Zakat also cultivate the

behavior of the culprit so that he will have the

properties of people who are generous and like to do

good again clever grateful.

Zakat, Infaq, and Shadaqah is a sign as well as

proof of the attitude of a servant (who became the

perpetrator). By zakat, infaq, and shadaqah show that

one has positioned himself in the true faith and / or

truth of faith

Only then, from the theme of zakat, infaq, and

shadaqah it occurs vary in the perspective and

understanding of the Muslim community in general,

the three terms have become part of a different and

have a place (maqam) each of its own, so the general

impression which we can catch from the way of

understanding the community that zakat is different

from infaq, and infaq different from shadaqah, and

shadaqah is not the same with zakat. This is because

in the formulation of the ZIS there are indeed special

categories that become the basis of justification. The

intellectuals and scholars each gave ta'rif according to

context, including especially fiqh scholars who

became the reference of the Muslims in carrying out

the zakat commands.

So it is interesting for this writer to examine the

three words in this series that seem to have a common

meaning, as well as the similarity in the intent or

purpose of each of the three words / terms zakat,

infaq, shaqadah that, in its implementation applied

differently; and also interpreted differently.

2 LITERATURE REVIEW

2.1 Zakat

The word zakat derived from Arabic from the root of

the word zaka contains several meanings such as

cleaning, growing, and blessing. Etymologically

(lughawi, language) zakat means sanctification,

blessing, growing. In the context of Sharia

terminology, zakat is "worship to Allah in the form of

giving part of the property that is obliged to the

rightful according to the provisions of sharia".

Zakat means growing, developing and blessing it can

also mean to cleanse or purify, as it becomes the basis

of reference which becomes the command of zakat:

"Pick up the zakat of some of their wealth by the

charity you clean and purify them."

According to Islamic law (syara'), zakat is the name

for a certain extraction of a certain amount of wealth,

according to certain traits and to be given to a

particular class. The order of taking zakat from the

wealthy people's wealth can be seen in the Qur'an:

“Take alms of their wealth, wherewith thou mayst

purify

3

them and mayst make them grow

4

, and pray

for them. Lo! thy prayer is an assuagement for them.

Allah is Hearer, Knower.” (QS At-Taubah 103)

Islam places zakat as the third pillar after prayer. In

the Qur'an, the mention of the theme of zakat is

always adjacent to the theme of prayer. This indicates

that both have the same meaning as important and

there is a close relationship in growing the quality of

life of the people. Salat is the most important form of

worship, while the zakat is the most treasured treasure

(maaliyah). The harmony between the two is

absolutely manifest in order to build a good social

order, based on the balance of religious and socio-

economic values.

Zakat functions as a means of self-purification, so

with zakat will cleanse the culprit (muzakki): a)

cleanse the souls of people who have excess wealth

from the stinginess, b) cleanse the poor fakir from

envy, c) clean the community from the seeds of

disintegration occur the gap between rich and poor, d)

freeing up the part which belongs to another person

inherent in every treasure; and so forth. Zakat in the

sense of growing and developing, the impact of its

implementation will develop a harmonious image of

life: a) to develop the personality of the person who

has the wealth possessions of his moral existence, b)

to develop a poor personality whose heart is

comforted thanks to the closeness of the affluent, c)

and multiply the value of wealth as Allâh promises,

d) become a social security method in Islam, e)

reduce the occurrence of social inequality.

ICRI 2018 - International Conference Recent Innovation

802

2.2 Infaq

Lactically (etymologically) infaq comes from the root

n-f-q meaning to spend the treasure. In the

terminology of fiqh, infaq is issuing or spending a

good treasure for the case of worship or other

permitted matters. Whereas according to the

terminology of Shari'a, infaq means removing some

of the property or income / income for a commanded

interest, His believing servants. (QS At-Taubah 34)

We find the information of the Prophet (s) when Allâh

SWT gave to the sons of Adam to infaq as the hadith

narrated by Imam Bukhari and Imam Muslim

(mutttafaq 'alaihi) which means: Implement the infaq

O children of Adam. This context is consistent with

the sound of His verse in the Qur'an surah Al- Isra '17:

100 which means: "Say, if you had mastered the

treasures of the mercy of my Lord, you would hold the

treasury for fear of spending it." Allâh threatened His

neglectful servant from committing to spend the

treasure on this Allâh road, that is to those who like

to keep possessions and are reluctant to share for the

benefit of others (QS At-Taubah 35).

Then Allâh SWT also ordered that all human beings

like to spend (treasure) his possessions in his way as

a good and righteous loan (shadaqah) as embodied in

his word (meaningful): "Who is willing to lend to

Allâh , a good loan (spend his fortune in Allâh's path)

then Allâh will double payment to him with multiple

folds. Allâh narrows and elaborates (sustenance) and

to Him you are returned." (QS Al- Baqarah: 245)

Allâh commands a man to spend his own wealth (QS

At-Taghabun: 16) and to provide for wives and

families according to ability (QS Ath-Thalaq: 7). In

spending the treasure it should be spent that is a good

treasure, and not a bad property (QS Al-Baqarah:

267).

In the tradition of society we have become the

prevalence of the theme of providing a livelihood

(nafakah) of a father / husband to the child-wife and

family as an obligation that can not be refuted. Under

certain conditions a similar thing can also happen

from a wife / mother to spend his family, for example

in a state as a single parent or can also when the

husband is not having a job / income.

2.3 Shadaqah

Etymologically shadaqah is derived from Arabic

taken (musytaq) from the root s-d-q (meaning

true). Because shadaqah be a sign of truth based on

the attitude of the faith of the perpetrators. In

terminology Shari'ah shadaqah its original meaning is

tahqiqu syai'in bisyai'i or set/apply something to

something.

Shadaqah is any form of virtue which is not bound

by amount, time, and not limited to mere matter but

can also be a nonmaterial virtue. In addition,

shadaqah is as a form of expression of honesty

(shiddiq) of a Muslim's sense of faith because he does

something nuanced truth (shadaqa). (See: QS Al-

Baqarah 171)

In his hadith narrated by Imam Bukhari,

Rasulullâh states, which means: every good thing is

shadaqah. Shadaqah also has a more straightforward

and broader sense as the hadith of the Prophet

narrated by Imam Abu Daud which means: strive for

jihad with treasure, physical, and oral.

The one who bershadaqah is the true person of his or

her faith. Shadaqah is voluntary and not tied to certain

conditions in the implementation of either amount,

time, or measure. Volunteering done by a person to

others, especially to the poor, is always open at every

opportunity that is not specified in number, type or

time. Shadaqah is also not limited to material giving

but also useful services to others.

The point of this third term, that understanding

infaq wider and more common than with zakat. If in

the context of zakat determined the type, number, and

measure then in infaq not determined the type,

amount, and time when a wealth or property must be

donated. Allâh gives freedom to the owner of the

wealth to determine the type of, how much should be

shared with others. That way, infaq is issuing a

treasure that includes zakat and nonzakat.

Shadaqah has a broader meaning compared to

infaq. In sharia, shadaqah means worshiping Allah by

way of spending some of his property which is

outside the Shari'ah obligation. Although it is

understood that the term shadaqah, in Arabic,

sometimes means 'compulsory charity'. Meanwhile,

some fiqh scholars also say otherwise that shadaqah

shall be called zakat --- whereas shadaqah sunnah is

called infaq. Some others say infaq must be called

zakat --- while infaq sunnah is called shadaqah.

For the use of cross-term terminology among the

three ZIS terms we note the comparison in the

implementation below.

Zakat is compulsory and obligatory

shadaqah; or in other sense shadaqah and

infaq which is mandatory then referred to as

zakat.

In the general sense infaq and shadaqah are

equally sunnah. Infaq referred to as

shadaqah sunnah; Shadaqah is called infaq

Review of Zakat, Infaq, and Shadaqah as a Similar Terminology

803

sunnah.

All three are the same that gives something

to the other party.

If Infaq and Shadaqah have no restrictions,

it is not determined how much the value

should / will be issued, and freely given to

whomever wishes; in the case of Zakat in its

implementation has limits on how to be

issued and to whom will be given as the

target recipients have been determined.

Zakat has a provision of haul (time) and

nishab (number of counts) in the calculation

of possessions and the obligation to issue

them; while Infaq and Shadaqah are not

dependent on haul and nishab.

Zakat is required for the capable Muslims

(aghniya'), while Infaq and Shadaqah are

recommended and highly appreciated for all

Muslims, whether rich or poor in accordance

with their sincerity and ability.

Zakat, infaq and shadaqah is the proving of our faith

to Allah and to fellow Muslims who need it. If we see

from the use of the Qur'anic verses of the term

shadaqah, zakat and infaq actually refer to an

understanding of "something that is issued and given

to others" especially kinsfolk. In Islam, zakat, infaq

and shadaqah have similarities in their role to

contribute significantly in the foundation of Islamic

economic building.

Ibn Jarir in his recommentary explained about the

hadith from Ibn Mas'ud that Rasulullah SAW said,

"Shadaqah is in the hands of Allah before in the hands

of the needy." Therefore worship and worship it is

sincerity of charity completely because Allâh. Imam

Kasani, a follower of the Hanafi madhhab called the

chief of the clerics, said: "The zakat pillar is to give a

portion of the treasures of Allah to Allâh SWT and

leave it to Him."

Paying zakat, issuing shadaqah, and sharing

treasures in Allâh's way is a logical consequence of

the faithful attitude of the servants of God, who

realize that the sustenance earned is truly sourced

from Allâh SWT. For it is Allâh who provides for the

sustenance of all His creatures; "There is not a

creeping thing on earth but it is Allâh who gives

sustenance." (QS Huud: 6)

So what do the servants do by fulfilling the

zealous appeals and commands, infaq, and shadaqah

is nothing but the manifestation of the sense of trust

and the truth of the attitude of faith (QS Al-Baqarah:

265). They have the conviction that what is given

from the share of the property to the rightful to receive

(mustahiq) with his sincerity to spend in the way of

Allah will not make him bankrupt or deficient, even

by the way of 'purification of wealth' that his

sustenance will also increase as a reflection of mercy

and the gift and the presence of the pleasure of Allah

SWT.

3 DISCUSSION

3.1 Three the Same Things

So far it has been commonly woke up understanding

in Muslim society about the terms zakat, infaq, and

shadaqah. Zakat, infaq, and shadaqah are understood

as a form of proof of a Muslim's faith in Allâh to carry

out his commands. Judging from the use of the

Qur'anic verses the term shadaqah, zakat, and infaq

itself refers to a common sense that is something that

is issued or given --- from one person to another.

Zakat, infaq and shadaqah have similarities in their

role to contribute significantly to the balance of life

and avoid the gap between the rich (aghniya') and the

papa (dhu'afa), which can lead to social gaps or

vulnerabilities.

Then there is the difference between the three

when it is attached to the context of its

implementation, which is typically regulated in the

formulation of fiqh (law) of Islam. Zakat is

mandatory while infaq and shadaqah are sunnah. Or

in another sense, zakat is intended as something that

must be issued, while infaq and shadaqah is a term

used for something that is not mandatory, but it is

recommended. Thus, infaq and shadaqah are terms

for spending or sharing something that is voluntary.

The differences can also be observed, among

others, namely;

Zakat: its nature is obligatory and has

stipulation / limit of amount of property to

be zakat and anyone who can accept it.

Infaq: voluntary contributions (material)

with the granting of the according to

sincerity.

Shadaqah: broader than infaq, because the

given not limited to the material only.

Zakat has been set limits and infaq and shadaqah have

no limit, Zakat is determined who is entitled to

receive --- that is to eight asnaf / class of not able /

poor people --- while infaq and shadaqah may be

given to anyone, regardless of the eighth the group set

forth as the provisions laid down by God. Thus, the

definition of shadaqah is the same as infaq, including

the law and its provisions.

From the above understanding that zakat is an

obligation to issue something (some property

ICRI 2018 - International Conference Recent Innovation

804

possession) that is limited to those who have the

ability, the rich; while infaq as a form provides some

ownership (material) to all Muslims even to non-

Muslims; and shadaqah as a much broader (material

and non-material) form of gifting done by anyone and

without limitation --- which is not bound by the

number and time limitations. Anytime can be done.

From these descriptions and discussions can be drawn

a link to place these three interconnected terms.

Clearly these three terms --- zakat-infaq-shadaqah ---

are not synonyms, because they are not the same, each

has a different meaning, albeit for an almost identical

purpose.

3.2 Infaq

Infaq is understood as a term always associated with

a kind of donation. The word infaq is meaningful to

spend, fund, the general nature of covering any

'shopping' includes the matter of treasure. In essence,

berinfaq it is to pay with funds, give and spend the

wealth. The goal can be for goodness, donation, or

something for yourself, or for fulfilling consumptive

needs.

Thus, the infaq is not only limited to doing good

in the way of Allâh, but also for social affairs or

donations, even whatever form of expenditure and

expenditure of property is called infaq, with the scope

as follows; Giving a portion of wealth (QS Al-Anfal:

63), Spending a living such as a husband financing

the spending (providing for) his wife and family (QS

An-Nisaa ': 34), and Issuing Zakat (to issue zakat

property on work or harvest crops) (QS Al-Baqarah:

267)

What is meant by good infaq and for the way of

goodness, Al-Quran does not simply call it by the

term infaq alone but always accompanied by the

word: fi sabilillah ( ):

"And spend (your treasures) in the way of Allah, and

do not throw yourself into perdition, and do good,

for Allah loves those who do good." (QS Al-

Baqarah: 195)

3.3 Shadaqah

The term shadaqah has a similar meaning to the term

infaq but more specifically. The difference between

infaq and shadaqah lies in intention and purpose.

Shadaqah is typical that the treasure is issued in the

framework of worship or closer to Allâh. While infaq,

there is a nature of worship (closer to Allâh) and also

includes non-worship. Shadaqah can not be used for

things that are not good. Because shadaqah only for

the sake of getting closer to Allâh. Shadaqah as the

activity spend the treasure in Allâh's path, there is a

mandatory law and there is a law

recommended/sunnah.

Shadaqah dimension broad, which is not only limited

to the affairs of the expenditure of property alone but

all things that connotes goodness - though not

necessarily with financial property - belong to the

category shadaqah. Prophet Muhammad SAW once

said that the smile is shadaqah

9

. Giving commands of

good and preventing evil is a shadaqah. Freeing the

way from an obstacle so that passers-by do not harm

is also a shadaqah.

3.4 Zakat

Zakat is a treasure service that includes the

obligations of Islam. Zakat becomes the foundation

which belongs to one of the pillars of Islam. As the

most important part of the shadaqah treasure which is

the worship in the way of Allâh, Zakat certainly only

intended for its use in the path of Allâh SWT alone.

The form of ownership of such property may be

in the form of cash, crops, agricultural produce, or

stored gold silver. Ownership of someone's property

that must be issued that has reached nishab 85 gram

in the period of one year / haul

10

. Excluded from this,

namely zakat agriculture and fruits. Because the zakat

agriculture and fruits are taken in the harvest time.

Similarly zakat treasure findings (rikaz) taken

instantly when found / obtained.

Sheikh Muhyiddin an-Nawawi said: "The

obligation of zakat is the teachings of Allâh's religion

which are known clearly and surely. Therefore,

whoever denies this duty, he indeed denied Allah and

denied the Messenger of Allaah 'alahi wasallam, so

he was condemned to kafir."

11

When a person pays

zakat on the part of his possessions, in fact he is

spending his wealth in the path of Allâh (infaq), and

what he does in giving part of the property to those

who are entitled to receive it is a shadaqah, as a right

or justified action. Someone who berinfaq is spend his

wealth in the way of Allâh he was doing the process

of shadaqah and what he issued it will undoubtedly

grow and develop as well as zakat because it is issued

in the channel of good and right (QS Al-Baqarah

261).

In certain verses Allâh SWT even mention the context

of zakat by using the word shadaqah. This is also the

basis for the implementation of zakat as it is known

so far. The Word of Allâh:

Review of Zakat, Infaq, and Shadaqah as a Similar Terminology

805

“The alms are only for the poor and the needy, and

those who collect them, and those whose hearts are to

be reconciled, and to free the captives and the

debtors, and for the cause of Allah, and (for) the

wayfarer; a duty imposed by Allah. Allah is Knower,

Wise.” (QS At-Taubah 60)

In the above verse explicitly Allâh SWT mentions the

phrase "shadaqatu" (shadaqah) for the mention of the

obligation of zakat and to anyone who is zakat /

shadaqah is actually handed over, that is to the eight

asnaf / group entitled to receive it. Mawardi in the

book Ahkam As-Sulthaniyah in the

In the verse which commands the 'taking' of zakah

from the group of capable persons (aghnia'), the two

terms (zakat and shadaqah) are used together, of

course with the same meaning:

"Take shadaqah from some of their possessions, by

charity you cleanse and purify them and pray for

them ...." (QS At-Taubah 103)

Qadhi Abu Bakr bin Arabi has a very valuable

opinion about why zakat is called shadaqah. "The

word shadaqah comes from the word shidq, true in

relation to the deeds of deeds and utterances and

beliefs."

The word shadaqah is mentioned in the Qur'an 12

times, all of which are verses that descend on

Makkah. The word zakat in the form of definition is

called 30 times in the Qur'an, which is 27 times

mentioned in one verse along with the prayer/salat.

Of the 30 verses about the zakat are eight verses that

descend with the verses that descend on Mecca, the

rest are verses that descend on Medina.

Yusuf Qardhawi criticized the opinion of some

experts who stated that the word zakat is always

associated with praying in 82 places. "This amount is

exaggerated, so it is not in accordance with the

calculations we mentioned. But if what they mean is

also other words that mean the same as zakat like al-

Infaq, 'gifts', al-ma'un, 'necessities', and tha'am, al-

poor, 'feeding the poor' and others, so we do not know

the exact number but will range from 32 to 82 places."

In the Qur'an and the hadith of the Prophet, often the

term zakat is referred to as shadaqah only. This

mention must have relevance because basically zakat

is also part of shadaqah. It's just in the context of its

application must be careful to distinguish what the

real shadaqah with the meaning of zakat and which is

shadaqah outside zakat. As for the obligatory

Shadaqah not only zakat, there are other shadaqah

who fall for the mandatory, for example shadaqah

become nadzar and various penalties as sanction

(kafarat) which must be paid or fulfilled. Shadaqah is

referred to as "lend a good loan to Allâh".

Allâh SWT affirms the importance of God's servants

giving good loans as proof of the faith: "Verily those

who are justified (Allâh and His Messenger) both

male and female and lend to Allâh a good loan will

undoubtedly multiply the payment to them; and for

them a great reward." (QS Al-Hadid: 18)

4 CONCLUSION

Looking at the three models of Allâh SWT's

command in the context of sharing obligations to each

other, this author tries to conclude that the three

things that Allâh and His Messenger are obliged to

His servants are equal and equal. This is how Allâh

'Azza wa Jalla leads His servant in the matter of

possessions. The premise is that zakat, infaq, and

shadaqah are the same words or phrases in their

intents and purposes, which are differentiated in their

implementation or practical practice. Zakat in one

side is called infaq, and on the other side is also called

shadaqah. Likewise, infaq is zakat and shadaqah;

shadaqah it is zakat and infaq.

In conclusion, the author considers that the three

terms in this series zakat-infaq-shadaqah are in fact a

unity as a medium for believers to empathize

themselves with others who specifically share with

others. This is the way Allâh SWT is exemplified by

His Apostle by providing the opportunity for the

servants to share by remembering those around him.

For those who have the wealth to get used to

internalization of the surrounding environment there

are groups of socially disadvantaged people with

various backgrounds, putting them in the position of

the poor (fuqara). It is the duty of the rich to uplift

and defend them not to always feel worse and be

brought close to the bridge of affection through:

zakat, infaq, and shadaqah according to their

respective proportions and abilities.

Zakat, infaq, and shadaqah are three things in

common. For when a man performs his charity he is

in the act of spending his wealth in the way of Allâh

(infaq) and what he does is a righteous deed

(shadaqah). When someone berinfaq (spendafter in

the way of Allâh) he is actually carrying out the

shadaqah, and the treasures he lives will grow and

develop as the basic meaning of zakat. Likewise when

one practices the shadaqah in the form of true treasure

ICRI 2018 - International Conference Recent Innovation

806

he is doing the right thing by spending his wealth in

the way of Allâh, which from what he issued it is also

a manifestation of zakat.

Zakat is the name of certain property which has

attained certain conditions required by Allâh to be

issued and given to those who are entitled to receive

it with certain conditions also, in order for the treasure

to be holy, clean, good, blessing, to grow and expand.

Infaq is removing a portion of the treasure or income

for an interest ordered by the teachings of Islam. If

zakat should be given to certain mustahiq (eight

asnaf), then infaq may be given to anyone. (QS Al-

Baqarah: 215). Infaq issued by everyone who

believes, both high and low income, whether while

being prosperous or mediocre. (QS Ali Imran: 134)

Shadaqah is the same as infaq, only if infaq is related

to matter, shadaqah has a broader meaning,

concerning things that are nonmaterial. Narrated by

Muslims from Abu Dharr, Rasulullah SAW states

that if one is unable to share with treasure then read

tasbih, read takbir, tahmid, tahlil, good relationship

husband and wife, and invite to do good and prevent

evil deeds (amar ma'ruf nahi munkar) is shadaqah.

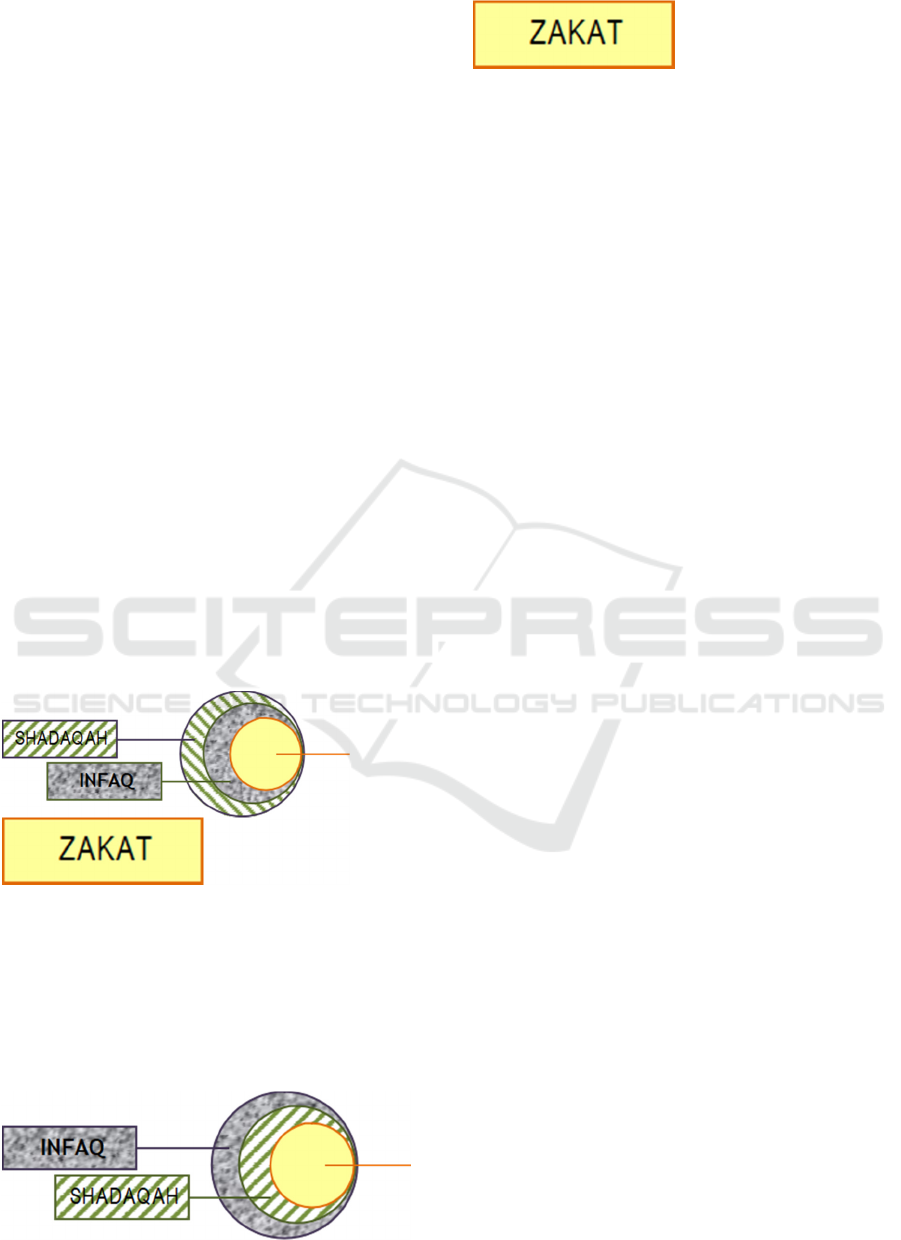

As a simple illustration:

Figure 1: Illustration of Shadaqah-Infaq-Zakat

In Figure 1 it shows that Shadaqah is covering the

infaq and zakat, which means that infaq and zakat is

a sadaqah which is performed either mandatory or

recommended.

Figure 2: Illustration of Infaq-Shadaqah-Zakat

In Figure 2 it shows that Infaq is covering the

implementation of Shadaqah and Zakat, which means

shadaqah and zakat it is an infaq which is

implemented either mandatory or recommended.

Equally important is the execution of worship which

focuses on spreading the good and the truth primarily

in the matter of sharing some of this treasure --- that

what is issued and submitted is essentially devoted to

Allâh SWT, although in practice as a designation for

fellow human beings. Strictly speaking, in this

context the actual zakat / infaq / shadaqah is for Allâh.

REFERENCES

Al-Ghazali, Rahasia Puasa dan Zakat, cet. 14, Bandung:

Karisma, 2003

Al-Kabisi, Muhammad Abid Abdullah, Hukum Wakaf,

Kajian Kntemporer Pertama dan Terlengkap tentang

Fungsi dan Pengelolaan Wakaf serta Penyelesaian atas

Sengketa Wakaf, Jakarta: Dompet Dhuafa dan Iiman,

2003.

Al-Zuhayly, Wahbah, Zakat Kajian Berbagai Mazhab, Cet.

6, Bandung: Remaja Rosdyakarya, 2005. An-Nawawi,

Imam, Terjemah Hadits Arba’in An-Nawawiyah,

Jakarta: Sholahuddin Press, 2004.

An-Nawawi, Muhyiddin, al-Majmu’ Syarh al-

Muhadzdzab, Mesir, al-Muniriyah, jilid V, cetakan.

Kedua, 2003

Ash-Shiddieqy, M. Hashbi, Pedoman Zakat, Semarang:

Pustaka Rizki Putra, 2002. El-Madani, Fiqh Zakat

Lengkap, Yogyakarta: Diva Press, 2013.

Hafidhuddin, Didin, Panduan Praktis tentang Zakat Infak

dan Sedekah, Jakarta: Gema Insani, 1998. Hafidhuddin,

Didin, Zakat Dalam Perekonomian Modern, Jakarta:

Gema Insani, 2002.

, Zakat Infaq Sedekah, Cet. 7, Jakarta: Gema Insani,

2008.

Hidayat, A, dan Hikmat Kurnia, Panduan Pintar Zakat,

Jakarta: Qultum Media, 2006

Mardani, Hukum Islam: Zakat, Infak, Sedekah dan Wakaf

(Konsep Islam Mengentaskan Kemiskinan dan

Menyejahterakan Umat), Jakarta: Citra Aditya Bakti,

2016.

Al Mawardi. Al Ahkam As Sulthaniyah (terj. Fadli Bahri),

Bekasi: Darul Falah, 2014.

Mas’udi, Masdar Farid, dkk., Reinterprestasi

Pendayagunaan ZIS Menuju Efektivitas Pemanfaatan

Zakat Infaq Sedekah, Jakarta: Piramedia, 2004.

Review of Zakat, Infaq, and Shadaqah as a Similar Terminology

807

Qardhawi, Yusuf, Hukum Zakat, Cet. V, Bogor: Pustaka

Litera AntarNusa, 2001. Qardhawi,Yusuf, Shadaqah

Cara Islam Mengentaskan Kemiskinan, Bandung:

Rosda Karya, 2010.

Raya, Ahmad Thib, Rasionalitas Bahsa Al-Qur'an Upaya

Menafsirkan Al-Qur'an dengan Pendekatan

Kebahasaan, Jakarta: Fikra, 2006.

Sari, Elsi Kartika, Pengantar Zakat dan Wakaf, Jakarta:

Grasindo, 2007.

Taimiyah Al Hurani, Syaikhul Islam Taqiyyudin Ahmad

bin, Kumpulan Fatwa Ibnu Taimiyah, (penerjemah,

Lukmanul Hakim, Lc. Fatihunnada Lc. Muhammad Al

Fath), Jakarta : Pustaka Azzam, 2010.

Yusuf Wibisono, Mengelola Zakat Indonesia, Yogyakarta:

Prenada Media Grup, 2015.

https://muslim.or.id/367-syarat-wajib-dan-cara-

mengeluarkan-zakat-mal.html

http://pena-mylife.blogspot.com/2012/06/biografi-sheikh-

al-azhar-mahmud-syaltut

ICRI 2018 - International Conference Recent Innovation

808