The Impact of IS Investment on Bank’s Performance based on

MCDM Techniques

Ansar Daghouri, Khalifa Mansouri and Mohammed Qbadou

Laboratory: Signals, Distributed Systems and Artificial Intelligence (SSDIA)

ENSET of Mohammedia, University HASSAN II Casablanca

Keywords: Banks, information system, investment, multi-criteria, performance.

Abstract: While banks are investing heavily in information system (IS), the results of studies of the relation between

those investments and superior performance of the firm are mixed. Many studies have analysed the impact

of IS investment on firm performance, without taking into account the non-financial firm’s performance,

This paper proposes a framework to evaluate the non-financial bank’s performance based on an approach

combining two most used MCDM methods and the impact of IS investment on this performance. The

results of this study that dealt with fifty banks show that IS investment does not insure superior

performance.

1 INTRODUCTION

The relationship between information system (IS)

and firm performance is among the topics that are

worrying researchers as well as leaders who invest

heavily in IS, and want to discover if those

investments are rewarded by the improved firm

performance.

However, results from research that have study

this relation are contradictory; some authors have

confirmed the positive impact of IS investment on

firm performance (Barua et al., 1995) (Rai et al.,

1997) (Dedrick et al., 2003) (Ada et al., 2012) (Lim

& Trim, n.d.). While other found no significatif

impact of IS investment on firm performance

(Koski, 1999) (Strassman, 1990) (Ho et al., 2011).

The mixed results can be explained by firm’s

sector, work methodology and the choice of research

model’s variables (Kleis, 2012) (Liao et al., 2015)

(Saunders & Brynjolfsson, 2016).

The majority of literature’s studies deal with

financial firm’s performance forgetting the non-

financial aspect of the performance.

This paper investigates the impact of IS

investment on non-financial performance of banks

using actual data from fifty banks. Besides, this

study proposes a combined approach of mutli

criteria decision-making methods (MCDM) to

evaluate the non-financial bank’s performance.

The structure of this paper is as follows: section

2 and 3 present respectively an overview of works

related with non-financial performance, IS

investment and its impact on firm performance and

the most used MCDM methods. Next section

exposes work methodology and main results. At the

end, we present concluding remarks.

2 LITERATURE REVIEW

2.1 Non-financial Performance

The evaluation of firm’s performance has long been

based on financial results through financial

indicators (Gijsel, 2012), but this purely financial

vision has been strongly criticized, in this way we do

not assess the true and global firm’s performance.

The overall performance sought at the firm level

need to be assessed on the basis of financial and

non-financial indicators (Bogieevie et al., 2016).

Performance measurement system is a group of

techniques implemented by leaders to evaluate the

performance of firm’s activities (Neely et al., 2000).

Authors have fixed the examples of the most popular

techniques for proposing a set of performance

measures such as: balanced scorecard (Kaplan &

Norton, 2005)and performance hierarchies (Lynch &

Cross, 1991).

86

Daghouri, A., Mansouri, K. and Qbadou, M.

The Impact of IS Investment on Bank’s Performance based on MCDM Techniques.

DOI: 10.5220/0009773900860093

In Proceedings of the 1st International Conference of Computer Science and Renewable Energies (ICCSRE 2018), pages 86-93

ISBN: 978-989-758-431-2

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Nevertheless, the choice of appropriate

indicators to evaluate performance is one of the most

critical projects due to the multidimensional aspect

of performance and yet the indicators are not an

independent process that can be applied to all types

of firms.

The performance measures based on non-

financial indicators have been widely applied by

researchers (Drury & Tayles, 1995) (Gomes et al.,

2004) (Imsail & King, 2007) (Ibrahim & Lloyd,

2011).

With the multitude of non-financial performance

indicators, in this work, we choose to use the most

used indicators (Milan & Aluç, 2017) (Zhelyuk &

Popa, 2009) (Strandberg, 2014) such as: customer

satisfaction, market share, employee feedback, and

human resource…

2.2 IS Investment and Firm

Performance

Since 1980, the authors began to study the impact of

investment in information system on firm

performance (Solow, 1987). The finding of previous

studies can be grouping to three possibilities. Studies

confirming the positive impact of IS investment on

firm performance (Kwon, 2007), in 2005, the results

of study (Lee & Kim, 2006) has showed that IS

investments cause economic performance, other

studies have confirmed the positive impact between

the IS investment and performance but taking in

each time specific variables to the study and based

on different theories. According to studies based on

the IT productivity paradox and RBV theory (Jung,

2009) (Anderson et al., 2003) (Huang et al., 2006)

(Otim et al., 2012), they confirm the negative impact

of IS investment on firm’s performance. Finally,

some studies (Ho et al., 2011) (Motiwalla et al.,

2005) showed that IS investment does not impact

firm performance.

3 MCDM METHODS

3.1 Analytical Hierarchy Process

The analytical hierarchy process (AHP) is a

powerful tool that can be used to analyse decision

(Saaty, 1970).

It can be used when multiple or conflicting

criteria are present also when the process of making

decision is based on both qualitative and quantitative

decisions.

The AHP method takes into account a set of

evaluation criteria and alternatives to choose later

the best decision among others based on the criteria

of the study. The AHP implementation consists of

three main steps (Saaty & Penivati, 2008).

An AHP analysis uses pairwise matrix A {m*n}

to measure the item’s impact on one level of the

AHP hierarchy on the next higher level.

Each entry a

ij

of A represents the importance of

criterion i relative to criterion j (with; a

ij

a

ji

=1):

If aij > 1: i is more important than j;

If aij < 1: i is less important than j;

If aij =1: same importance.

The normalized decision matrix A

norm

is derived

by A using Eq (1):

C

ij

=a

ij

/

∑

/ i, j= 1,2…n

(1)

Finally, the weighted normalized decision matrix is

built using Eq (2) under the form (3):

W

i

=

∑

/ n= 1,2…n

(2)

W=

⋯

(3)

3.2 Topsis Method

TOPSIS (Technique for Order Preference by

Similarity to Ideal Solution) method developed in

1981 (Hwang & Yoon, 1981)is one of the most used

MCDM methods that depend on distance to positive

ideal solution and negative ideal solution.

The positive ideal solution (Wang & Wu, 2012)

is composed of all the good values of criteria, wile

the negative ideal solution include all worst values

of criteria.

TOPSIS method procedure steps (Roszkowska,

2011) as follows:

Construction of normalized decision matrix:

r

ij

=

∑

/ j= 1,2…J; i=1,2…n

(4)

Where x

ij

and r

ij

are original and normalized score of

decision matrix.

Construction of weighted normalized decision

matrix:

∗

/ j= 1,2…J; i=1,2…n

(5)

The Impact of IS Investment on Bank’s Performance based on MCDM Techniques

87

Determination of positive ideal solution and

negative ideal solution:

=

|

,

|

,

,

…

(6)

=

|

,

|

,

,

…

(7)

J and J’ represent respectively maximization and

minimization values.

Calculation the separation measures of each

alternative from positive ideal solution and

negative ideal solution:

∗

(8)

(9)

Calculation the relative closeness coefficient

to the ideal solution:

∗

∗

Where 0

∗

1

(10)

Closeness of the alternatives to the ideal

solution is ranked according to the value C

i

*

the best alternative is that having the highest

value.

4 IMPLEMENTATION

4.1 Work Methodology

Existing works on firm’s performance and IS

investment has looked at this subject from only the

financial aspect of performance and all most the

studies use only data collection and meta-analysis.

This study is focus on two main axes; it offers a

framework to evaluate the non-financial bank’s

performance based on two famous MCDM methods

namely AHP and TOPSIS, thereafter, it investigates

the impact of IS investments on banks performance.

This work uses actual data providing from fifty

banks, the choice of banking sector was made on the

basis of its large consumption and investments on

information systems.

To obtain our results, we implement a work

methodology by following the steps shown in Figure

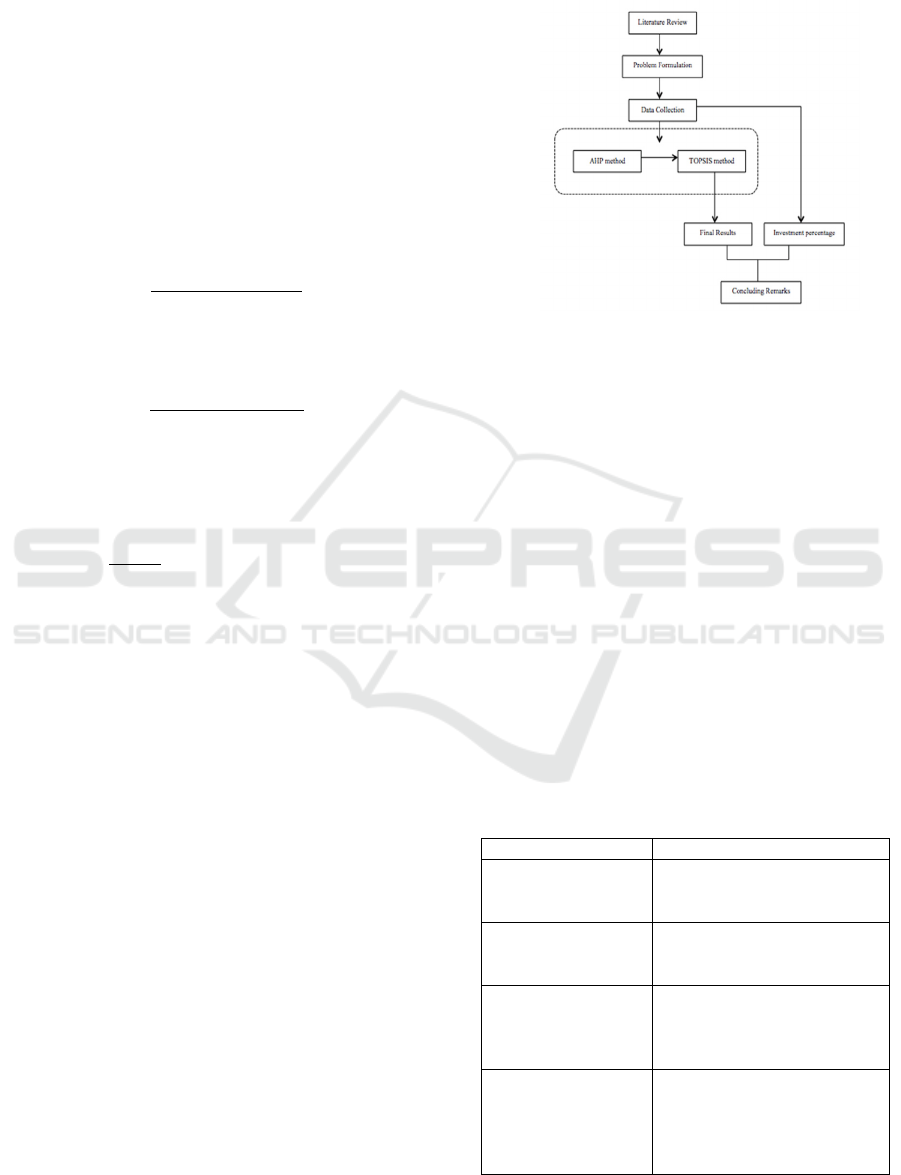

1.

Figure 1: Research Procedure

The study begins with a literature review to get

an overview of works related with non-financial

performance and the impact of IS investments on

this performance. Then, we formulate the work’s

problem to identify the inputs and outputs, in our

case, we work on the bank’s data to analyse the

impact of IS investment on bank’s performance;

that’s why we passed to data collection. In the step

of data analysis, we used AHP method to calculate

the weights of criteria and sub-criteria (Table 1)

used to evaluate the non-financial performance;

those criteria were taken from previous works. The

weight’s criteria are used next by TOPSIS method to

evaluate bank’s performance and to rank the

different alternatives. In the step of data collection,

we collect also data in relation with the percentage

of IS investment to analyse afterwards the impact

and to conclude with remarks.

Table 1: Hierarchical Representation of Criteria.

Main Criteria Sub Criteria

Customer (C

1

)

CustomerNumber (C

11

),

CustomerSatisfaction (C

12

)

and ComplaintsNumber (C

13

)

Expansion and

Market Share (C

2

)

BrancheNumber (C

21

),

NewProducts (C

22

) and

NewService (C

23

)

Employees (C

3

)

Headcount (C

31

),

AverageAge (C

32

),

Satisfaction (C

33

) and

TrainingInvestment (C

34

)

Service Quality (C

4

)

OnTimeDelivery (C

41

),

CommunicationCapability

(C

42

), RateDelay (C

43

),

Availability (C

44

) and Access

(C

45

)

ICCSRE 2018 - International Conference of Computer Science and Renewable Energies

88

Environment (C

5

)

TotalPaperConsumption

(C

51

) and EnergyUse (C

52

)

Security (C

6

)

RiskRate (C

61

) and

Breakdown (C

62

)

5 ANALYSIS RESULTS

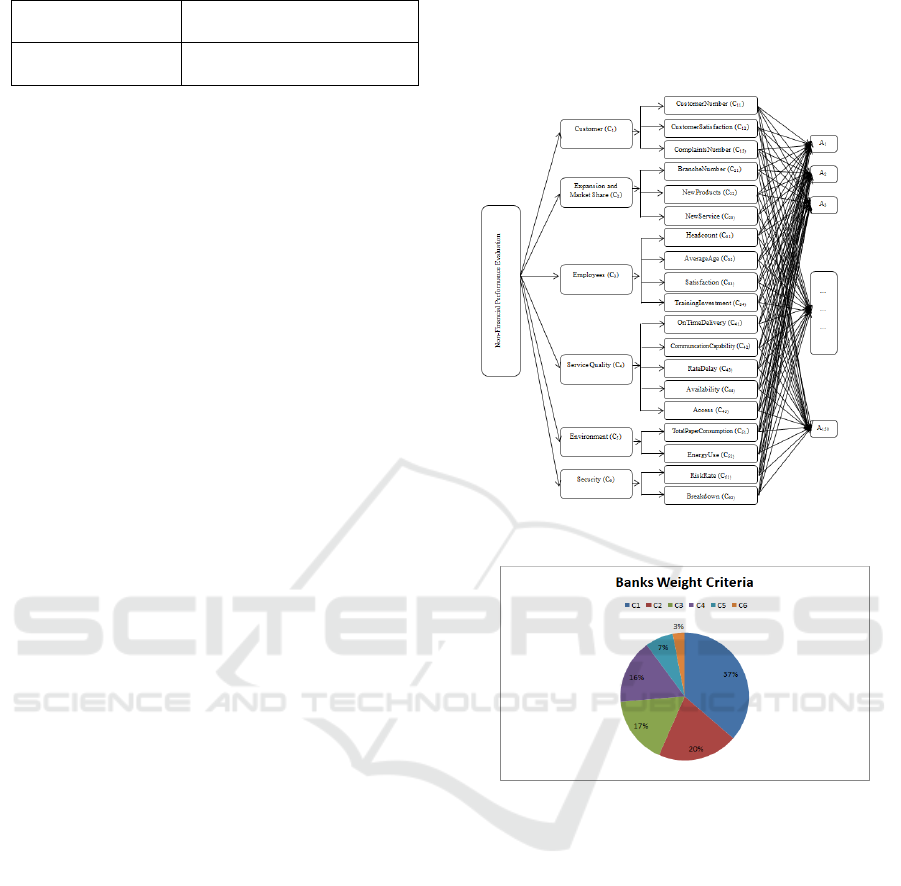

In the previous section, we have presented the

conceptual model adopted to evaluate the bank’s

non-financial performance. Figure 2 is a

visualization of Table 1 representing six main

criteria chosen to evaluate bank’s performance

(customer, expansion and market share, employees,

service quality, environment and security) and sub-

criteria (three sub-criteria to evaluate customer, three

sub-criteria to evaluate expansion and market share,

four sub-criteria to evaluate employees, five sub-

criteria to evaluate service quality, two sub-criteria

to evaluate environment and two sub-criteria to

evaluate security).

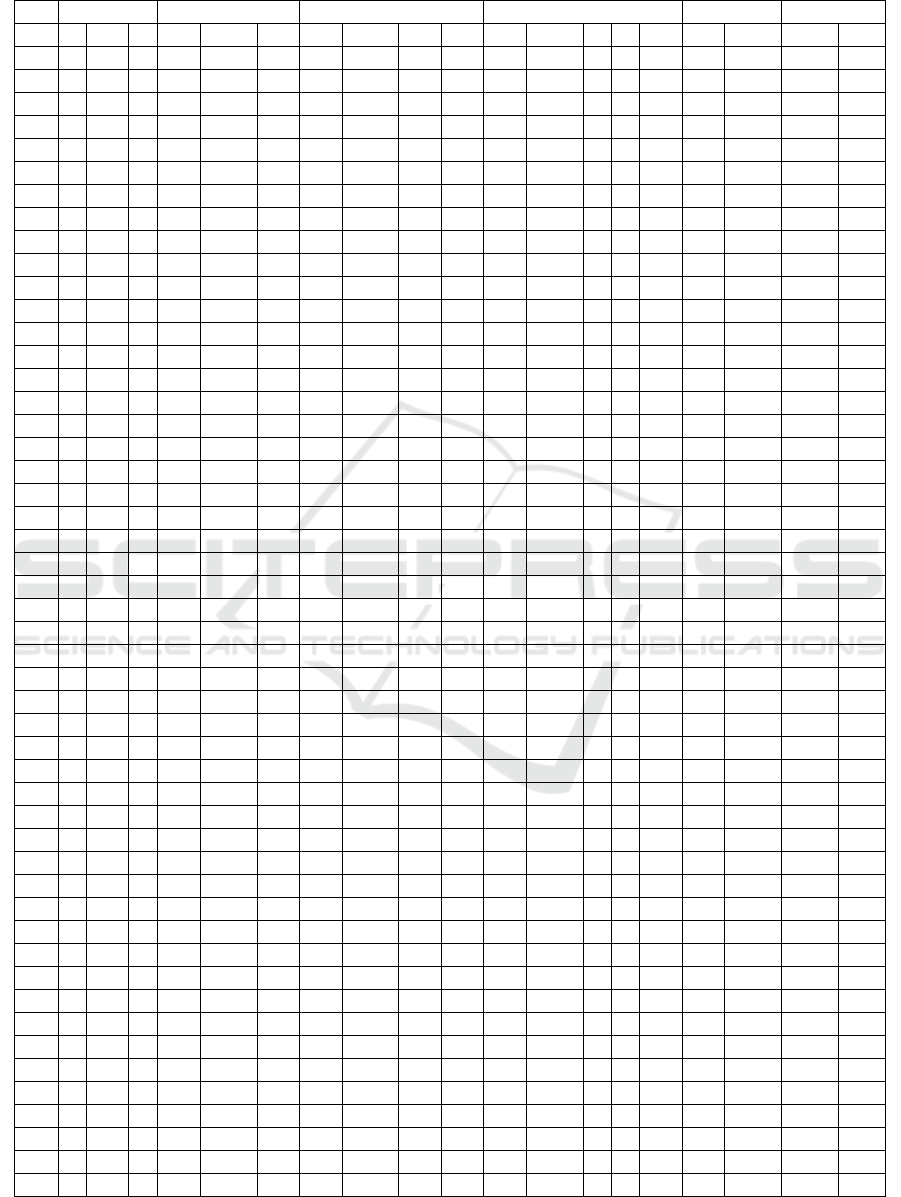

To calculate the weights of criteria and sub-

criteria, we implemented Eq (1)-(2)-(3). As can be

seen from Figure 3, customer (w

1

=0,36) is the most

important non-financial criterion followed by

expansion and market share (w

2

=0,20), employees

(w

3

=0,17), service quality (w

4

=0,16), environment

(w

5

=0,07) and security (w

6

=0,03) is the least

important non-financial criterion.

We can conclude that customer is the most

influent criterion (Bolton, 1998) (Bolton et al., 2004)

on firm’s non-financial performance which is a

logical result given the importance of the customers

who are the mark of a good firm’s image and who

insure the others criteria especially market share and

service quality.

Based on these results, we have implemented

TOPSIS method to rank the fifty banks on terms of

non-financial performance as shown in Table 2. In

the stage of data collection, we worked by the

value's conversion to facilitate data entry.

Figure 2: Hierarchical Structure

Figure 3: Banks Weight Criteria

The Impact of IS Investment on Bank’s Performance based on MCDM Techniques

89

Table 2: Decision Matrix of 50 Banks

C

1

C

2

C

3

C

4

C

5

C

6

N 1

2 3 1

2

3

1

2 3 4 1 2 3 4 5 1

2

1

2

1 A AB D A AA D B AA E G C AC D I L B AA GA HB

2 A AC D A AA D B AB F G D AB D I L B AB GA HB

3 B AC D B AB D A AA F G D AB D I L B AB FA HB

4 C AC D C AB D B AA E G D AB D I J B AB GA HB

5 B AC E B AB E C AA E G D AC D H L A AB EA IB

6 A AC D C AA D A AB E H D AB D I K B AA GA HB

7 B AC D B AA E A AB E G D AB D I L B AA GA HB

8 A AB E B AA D B AB E G D AB D I J B AA FA HB

9 A AB E B AA E A AB E G D AC D H L C AA FA HB

10 D AB E C AC F C AB F G D AC E I L C AC FA IB

11 B AC D B AC F B AB F G C AB D I J B AA GA HB

12 B AC D B AA E B AB F G C AB D I L A AA GA HB

13 C AB D A AA D A AB F H C AB D H K B AB GA IB

14 C AB E C AB D A AB F G D AC D H K B AB EA HB

15 C AB E C AB D A AB E G D AA D I L B AB GA JB

16 A AB E C AB D C AB F G D AB E I J C AB GA HB

17 C AB E B AB E B AB E G D AB D I L C AA GA IB

18 B AB D B AA E B AB E G D AC D H L C AA GA HB

19 C AC D B AB E C AB F H C AC D H K C AA GA HB

20 C AB F C AC E B AB F G C AC D H K B AA GA HB

21 C AB D A AA E B AB E G C AC D I K B AB GA HB

22 C AC E B AA D B AB F G D AC E I L B AB FA IB

23 B AB D C AB D A AB E G D AB D I L C AB FA HB

24 B AC D B AA F B AB F G D AB D H J B AB GA HB

25 A AB E A AC D A AB F G D AB D H L B AB GA HB

26 A AB E B AB E C AB E H C AB D I K A AA GA IB

27 A AB E C AB D B AB E G C AA D I K C AA GA HB

28 A AB E B AB D B AB E G C AB D I L C AC GA HB

29 B AC E B AA D B AB F G C AB E I J C AA EA JB

30 C AC D C AB E B AB E G D AC D H L B AB GA HB

31 A AC D A AA E B AB E H C AC D H L B AB GA HB

32 B AC D B AC E C AB E G D AC D I K A AB GA HB

33 B AC D C AA D B AB E G C AC D I K B AB GA IB

34 B AB F B AA D B AB E G D AC E H K C AA GA HB

35 C AB D B AB F A AB E G C AC D H L B AA GA HB

36 C AC E C AB D A AB F G D AC D H L B AB EA HB

37 A AB F A AB E A AB E G C AB D H L A AB GA HB

38 A AC E A AC E A AB E H D AB D I L B AB FA HB

39 A AB E B AB F B AB F G D AB E I L C AA GA IB

40 A AC E C AB D C AB E G D AB D I J B AB GA HB

41 B AB E B AB E B AB F G C AC D I L B AB GA HB

42 B AC E B AB E B AB E G C AC D I L A AB EA HB

43 C AC F B AA F A AB E G C AC E H L B AA GA JB

44 C AC F C AA D B AB F G C AC D H L C AB GA HB

45 A AB D C AC D B AB E H C AC D H L B AA FA HB

46 A AB E B AB E C AB F G D AB D I K B AB FA IB

47 B AB E A AB F B AB F G C AB E I K B AA FA HB

48 B AC E B AC D B AB E G C AC D I K B AA GA HB

49 A AB D C AA E B AB E G D AC D I L B AB GA HB

50 A AB D B AA D B AB E G D AC D I L C AA GA HB

ICCSRE 2018 - International Conference of Computer Science and Renewable Energies

90

Figure 4: Sub-Criteria Weight

In this section, we evaluate the non-financial

bank’s performance based on the decision matrix

(Table 2) and the weight’s sub-criteria (Figure 4)

using in order Eq (4) (5) (6) (7) (8) (9)(10) to obtain

the rank of each alternative (bank).

Subsequently, we studied the correlation between

the two variables (IS investment and non-financial

performance). In general way, firms invest on IS to

achieve better competitive advantages through

reducing costs. Given the number of alternative, ten

banks were selected based on the results of the non-

financial performance evaluation (the first three, the

four averages and the last three).

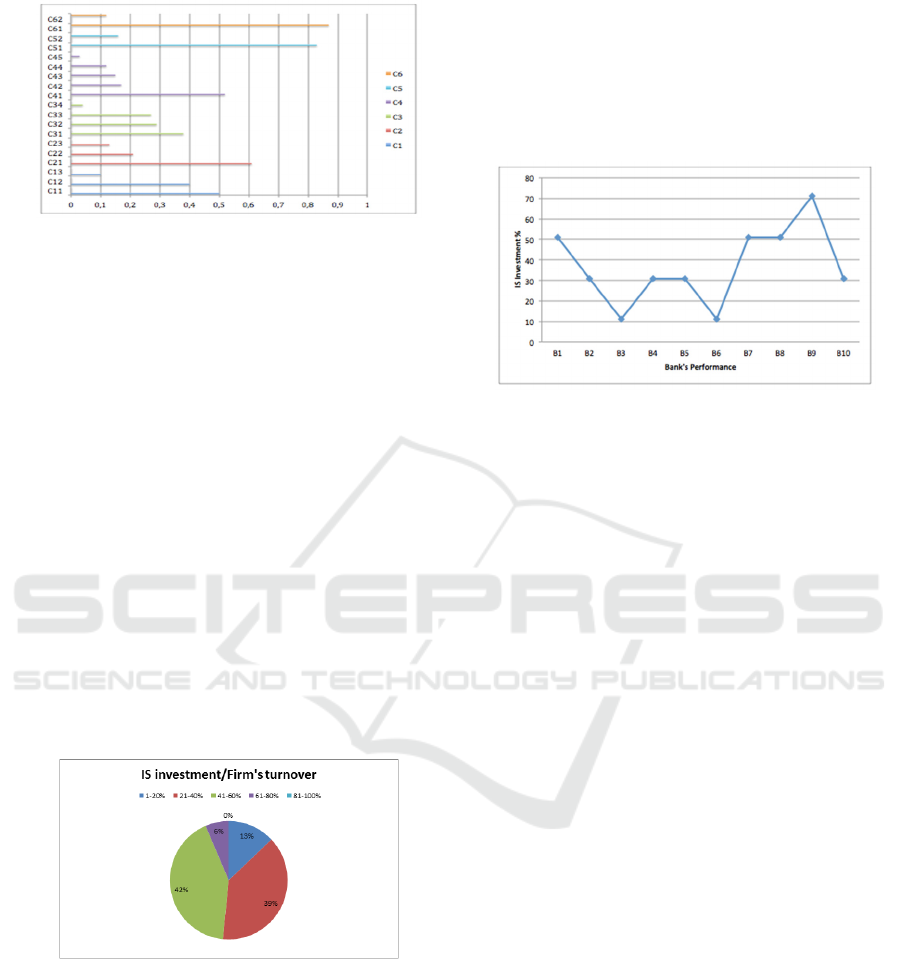

The financial sector is considered as the biggest

investor in the IS. The figure below (Figure 5)

shows the results of the IS investment percentage

compared to the bank’s turnover. It can be

concluded that more than 80% of financial firms

invest between 21 and 60% of their turnover in

information systems; which is a huge investment

given the large turnover of banks.

Figure 5: Bank's Investment Percentage

The curve shows the ranking of the bank's non-

financial performance according to the IS

investment (Figure 6), we find that the impact of IS

investment does not always ensure the performance

of the company, as shown concretely the example of

the B

3

bank which is ranked third performance

rating but in return invests only a percentage

between 1-20%. Unlike the B

9

bank which invests

61-80% of its turnover but is ranked among the last

three banks in terms of performance. These two

contradictory examples lead us to believe that there

are other factors that influence the relationship

between IS investment and non-financial bank

performance.

Figure 6: Impact of IS investment on Banks Performance

6 CONCLUSIONS

Evaluating the non-financial bank performance is

crucial for the competitors and managers. Customer,

expansion and market share, employee service

quality, environment and security affect this type of

performance. The use of several criteria and sub-

criteria for bank evaluation makes the process of

evaluating and ranking bank more difficult. In this

study, we present a framework using the analytic

hierarchy process (AHP) with TOPSIS method for

evaluating the non-financial banking performance

and supporting bank selection decision. The weights

of different criteria and sub-criteria are calculated

using the AHP method, and for ranking banks, one

of the most popular MCDM namely TOPSIS has

been used. Furthermore, this paper investigates the

correlation between IS investment and non-financial

bank’s performance; more than 80% of bank’s invest

between 21 and 60% of their turnover in information

system which is a huge investment unfortunately

those investments are not rewarded by the improved

bank performance, since we have bank who invest

heavily in IS and are ranked at last among the others

on term of non-financial performance. In the future,

we will work in other sector to discover the way to

evaluating their performance and ranking companies

of the studied sector.

The Impact of IS Investment on Bank’s Performance based on MCDM Techniques

91

REFERENCES

Barua, A., Kriebel, C.H. & Mulhopadhyay, T. (1995)

Information Technologies and Business Value: An

Analytical and Empirical Investigation. Informatil

Systems Research, 6(1), pp.3-23.

Rai, A., Patnayakuni, R. & Patnayakuni, N. (1997)

Technology investment and Business Performance.

Communications of the ACM, 40(7), pp.89-97.

Dedrick, J., Gurbaxani, V. & kraemer, K.L. (2003)

Information technology and economic performance: a

critical review of the empirical evidence. ACM

computing surveys, 35(1).

Ada, S., Sharman, R. & Balkundi, P. (2012) Impact of

meta-analytic decisions on the conclusions drawn on

the business value of information technology.

Decision Support Systems, 54, pp.521-33.

Lim, S. & Trim, S. (n.d.) Impact of information

technology infrastructure flexibility on the competitive

advantage of small and medium sized-enterprises.

Journal of business & Management, 3(1), pp.1-12.

Koski, H. (1999) The Implications of Network Use,

Production Network Externalities and Public

Networking Programmers for Firm’s Productivity.

Research Policy, 28(4), pp.423-39.

Strassman, P.A. (1990) The Business Value of Computers.

New Cannan, CT:Information Economics Press.

Ho, J., Wu, A. & Xu, S.X. (2011) Corporate governance

and returns on information technology investment:

evidence form an emerging market. Strategic

Management Journal, 32(6), pp.595-623.

Kleis, L. (2012) Information technology and intangible

output: The impact of IT investment on innovation

productivity. Information Systems Research, 23(1),

pp.42-59.

Liao, Y.W., Wang, Y.M., Wang, Y.S. & Tu, Y.M. (2015)

Understanding the dynamics between organizational

IT investment strategy and market performance: A

system dynamics approach. Comput Ind, 171, pp.46-

57.

Saunders, A. & Brynjolfsson, E. (2016) valuing

information technology related intangible assets. MIS

Q, 40(1), pp.83-110.

Gijsel, P.V., 2012. The importance of non-financial

performance measures during the economics crisis.

School of Economics and Management.

Bogieevie, J., Domanovie, V. & Krstie, B. (2016) The role

of financial and non-financial performance indicators

in enterprise sustainability evaluation. Economika,

62(3).

Neely, A. et al. (2000) Performance measurement system

design: developing and testing a process-based

approach. Int. J. Oper. Product Manage, 20(10),

pp.1119-45.

Kaplan, R.S. & Norton, D.P. (2005) The balanced

scorecard: Measures that drive performance. Harvard

Business Review, 83(7), pp.172-80.

Lynch, R.L. & Cross, K.F. (1991) Measure up – The

Essential Guide to Measuring Business Performance.

In Mandarin, London., 1991.

Drury, C. & Tayles, M. (1995) Issues arising from surveys

of management accounting practice. Management

Accounting Research, 6, pp.267-80.

Gomes, C.F., Yasin, M.M. & Lisoba, J.V. (2004) An

examination of manufacturing organizations’

performance evaluation; Analysis, implications and a

framework for future research. International Journal of

Operations & Production Management, 24(5), pp.488-

513.

Imsail, N.A. & King, M. (2007) Factors influencing the

alignment of accounting information systems in small

and medium sized Malaysian manufacturing firms.

Journal of Information Systems and Small Business,

1(2), pp.1-20.

Ibrahim, S. & Lloyd, C. (2011) The association between

non-financial performance measures in executive

compensation contracts and earnings management.

Journal of accounting and public policy, 30, pp.256-

74.

Milan, S. & Aluç, R. (2017) Performance success factors

of non-financial performance measurement, a

literature review. Bachelor thesis accounting, auditing

and control.

Zhelyuk, T. & Popa, C.L. (2009) Non-financial

measurements in banking industries of Sweden,

Romania and Ukraine.

Strandberg, C. (2014) Non-financial metrics in the

financial sector. In National credit union social

responsibility forum., 2014.

Solow, R., 1987. We'd better watch out. New york book

review.

Kwon, S.O., 2007. Impact of IT investment on firm

performance: Focusing on four moderators. Master's

thesis.

Lee, S. & Kim, S.H. (2006) A lag effect of IT investment

on firm performance. Inf. Resour. Manage. J, 19(1),

pp.43-69.

Jung, J., 2009. IT investment decision and performance of

online brokerage firm under heterogeneity of IT

service dimensions. Master’s thesis.

Anderson, M., Banker, R. & Ravindran, S. (2003) The

new productivity paradox. Commun ACM, 46, pp.91-

94.

Huang, S.M., Ou, C.S., Chen, C.M. & Lin, B. (2006) An

empirical study of relationship between IT investment

and firm performance: A resource-based perspective.

Eur J Oper Res, 173, pp.984-99.

Otim, S., Dow, K.E., Grover, V. & Wong, J.A. (2012) The

impact of information technology investments on

downside risk of the firm: Alternative measurement of

the business value of IT. J Manag Inf Sys, 29(1),

pp.159-93.

Motiwalla, L., Khan, M.R. & Xu, S. (2005) An intra- and

inter-industry analysis of e-business effectiveness. Inf

Manag, 2, pp.651-67.

ICCSRE 2018 - International Conference of Computer Science and Renewable Energies

92

Saaty, T.L. (1970) How to make a decision: the analytical

hierarchy process. European Journal of Operational

Research, pp.9-26.

Saaty, T.L. & Penivati, K. (2008) Group decision making:

Drawing out and reconciling Differences. RWS

Publications, Pittsburgh, USA.

Hwang, C.L. & Yoon, K. (1981) Multiple attributes

decision making methods and applications. Berlin:

Springer.

Wang, H.W. & Wu, M.C. (2012) Business type, industry

value chain, and R & D performance: Evidence from

high-tech firms in an emerging market. Technological

Forecasting and Social Change, 79(2), pp.326-40.

Roszkowska, E., 2011. Multi-criteria decision making

models by applying the TOPSIS method to crisp and

interval data. University of Economics in Katowice,

pp.200-30.

Bolton, R.N., 1998. A dynamic model of the duration of

the customer's relationship with a continuous service

provider: The role of satisfaction. Marketing Science,

pp.45-65.

Bolton, R.N., Lemon, K.N. & Verhoef, P.C. (2004) The

theoretical underpinnings of customer asset

management: A framework and propositions for future

research. Journal of the Academy of Marketing

Science, 32(3), pp.271-92.

The Impact of IS Investment on Bank’s Performance based on MCDM Techniques

93