Analysis of Poverty, Regional Tax and Economic Growth on HDI

District/City in North Sumatra

Evi Syuriani Harahap

1

, Indra Maipita

1

and M. Fitri Rahmadana

1

1

Faculty of Economics, Universitas Negeri Medan, Medan -Indonesia

Keywords: Poverty, Regional Taxes, Economic Growth, HDI

Abstract: This study aims to analyze Poverty, Regional Taxes and Economic Growth on HDI District/City In North

Sumatra. The analytical model used in this study is panel data analysis using time series data from 2013 to

2016 while the cross section data is 33 District/City in North Sumatra. From the estimation results show that

poverty has a negative influence on HDI, regional taxes have a positive influence on HDI and economic

growth has a positive influence on HDI. This means that an increase in poverty will comply with the HDI,

and an increase in regional taxes and economic growth will increase the HDI of District/City in North

Sumatra.

1 INTRODUCTION

The development paradigm that is currently

developing is economic growth as measured by

human development, seen by the level of quality of

human life in each country. One of the benchmarks

used in looking at the quality of human life is the

Human Development Index (HDI) which is

measured by the quality of education, health and

economic levels (purchasing power). Through the

improvement of these three indicators, it is expected

that there will be an increase in the quality of human

life. This is due to the existence of individual

heterogeneity, geographic disparity and the diverse

social conditions of the community, causing income

levels to no longer be the main benchmark in

calculating the success rate of development (Ananta,

2013).

Placing human development as the ultimate goal

of the development process is expected to create

opportunities that directly contribute to efforts to

expand and improve human capabilities and the

quality of their lives, among others, through

improving health services, basic education and

social security (Sen, 1999). The government as the

executor of development certainly requires quality

human capital as the basic capital of development.

To produce quality human beings, efforts are needed

to improve their human resources. The human

quality can be measured through the human

development index.

Regional tax is a financial source that comes

from the community in an area that will be used to

finance the needs of an area. The size of the tax paid

depends on the population and the potential of the

community in improving the economy. One way to

improve the economy is to improve the quality of

human resources as measured by the Human

Development Index (HDI). The higher the HDI in an

area, the more advanced the quality of human

resources which results in an increase in the

potential of the community in increasing their

economy which results in an increase in local taxes

as a result of economic activities. This is in line with

the research conducted by Fatmasari (2015) and

Saragih (2018) which states that regional taxes have

a significant effect on increasing the HDI value.

Economic growth is something that is often

associated with human development. The increase in

economic growth can enable increased output and

income in the future so that it will increase the HDI.

One of the most important development tasks is to

translate economic growth into an increase in human

development. Human development or the quality of

Human Resources (HR) is very important, efforts to

improve the quality of human resources in

development have become a necessity. Good quality

of human resources in a region has a role in

Harahap, E., Maipita, I. and Rahmadana, M.

Analysis of Poverty, Regional Tax and Economic Growth on HDI District/City in North Sumatra.

DOI: 10.5220/0009509506090615

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 609-615

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

609

determining the success of management

development in the region (Putra, 2015).

Poverty will prevent individuals from consuming

nutritious nutrition, get proper education and enjoy

the environment that supports healthy living. From

an economic point of view all of them will produce

less qualified human resources, or can be said to

have a low level of productivity. So that in

development this will affect the level of human

development in an area. This is consistent with the

research conducted by Mirza (2012) which states

that poverty has a negative effect on the Human

Development Index. This means that if the poverty

level rises, the HDI falls.

When viewed from the condition of North

Sumatra, the increase in Regional Taxes, GDRB was

followed by an increase in the Human Development

Index (HDI) but the poverty rate even increased in

2015. The following are GDRB data, poverty rates

and HDI in North Sumatra from 2013 - 2016.

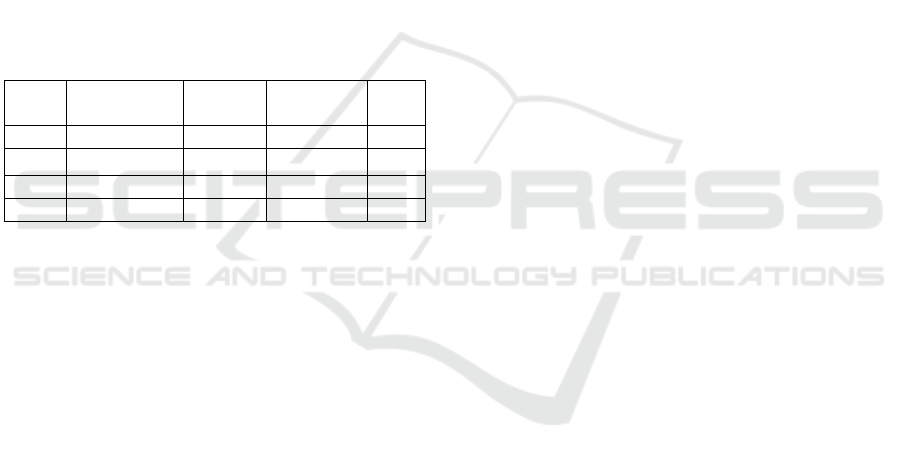

Table 1: Regional Tax Data, GDRB and Poverty in

North Sumatra

Source: Central Statistics Agency (CSA)

If seen from the table above, the increase in

regional taxes from 2013 - 2016 was followed by an

increase in GDRB and HDI. This was not followed

by a decrease in the number of poor people. In 2014

to 2015 the number of poor people increased from

1360610 to 1508140.

Based on the data and description above

regarding the human development index, economic

growth, poverty and local / regency / city tax in

North Sumatra, the authors are motivated to conduct

further research under the title Poverty Analysis,

Economic Growth and Regional Taxes on Regency /

City Economic Growth in North Sumatra ".

2 THEORICAL FRAMEWORK

Human Development Index (HDI)

The basic idea underlying this index is the

importance of paying attention to the quality of

human resources. HDI has played two key roles in

the field of economic development implemented: 1)

as a tool for popularizing human development as a

new understanding of welfare, and 2) as an

alternative to per capita GDP as a way to measure

the level of development for comparison between

countries and time (Elizabeth, 2007). To find out the

quality of life or welfare of the community, the

United Nations has determined the Human

Development Index (HDI) or Human Development

Index (HDI), which is a measure of human

development standards. This index is formed based

on four indicators namely: 1). life expectancy, 2).

literacy rates, 3). average school years and 4).

purchasing power. Life expectancy indicators

represent the dimensions of longevity and health

(health dimensions), while indicators of literacy and

school length reflect the output of the knowledge

dimension (education dimension). The indicators of

purchasing power ability (income) are used to

measure the dimensions of decent life (UNDP,

2004).

Poverty

Etymologically, "poverty" comes from the word

"poor" which means it is not material and is

inadequate. The Central Bureau of Statistics defines

as the inability of individuals to meet the minimum

basic needs for decent living (BPS, 2016) further

stated that poverty is a condition that is below the

standard line of minimum needs, both for food and

non-food called the poverty line or also called a limit

poverty. According to (World Bank, 2004) one of

the causes of poverty is due to lack of income and

assets to meet basic needs such as food, clothing,

housing, acceptable levels of health and education.

In addition, poverty is also related to limited

employment and usually those who are categorized

as poor do not have jobs (unemployment), and their

education and health levels are generally inadequate.

The measure of poverty is not only living in food

shortages and low income levels, but looking at the

level of health, education and fair treatment before

the law and so on (Adisasmita, 2005).

Economic Growth

In general, economic growth is defined as increasing

the ability of an economy to produce goods and

services. Economic growth shows the extent to

which economic activity will generate additional

income for the community in a given period.

Because basically economic activity is a process of

using production factors to produce output, then this

process will in turn result in a return of service to the

factors of production owned by the community.

With the economic growth, it is expected that

people's income as the owner of production factors

will also increase (Sukirno, 2006: 423). According

to Kuznets economic growth is a long-term increase

in the ability of a country to provide more and more

Years GDRB (Rp)

Proverty

(Person)

Regional

Tax (Rp)

HDI

(%)

2013 469464020000 1416400 1937261087 68.36

2014 521954950000 1360600 2050583195 68.87

2015 571722010000 1508140 2290986197 69.51

2016 628394160000 1452550 2407715357 70.00

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

610

types of economic goods to its population; this

ability grows according to technological progress,

and institutional and ideological adjustments that are

needed (Jhingan, 2010: 57).

Thus it can be concluded that developments in

economic activities are characterized by an increase

in the output of goods and services which impacts on

the increase in per capita income.

Economic growth is an increase in the output of

society caused by the increasing number of

production factors used in the production process,

without any change in "technology" production

itself, for example an increase in output caused by

the growth of capital stock or the addition of

production factors without changes in technology

long production (Arsyad, 2010).

The concept of calculating economic growth in

a period is:

𝐆

𝐭

𝐏𝐃𝐑𝐁

𝐭

𝐏𝐃𝐑𝐁

𝐭𝟏

𝐏𝐃𝐑𝐁

𝐭𝟏

Where:

Gt = period t economic growth (quarterly or

annual)

PDBRt = Real Gross Domestic Product period t

(based on constant prices)

PDBRt-1= PDBR one previous period

Local tax

Regional Regional Tax is a mandatory fee carried

out by an individual or regional head body without

balanced direct compensation, which can be forced

based on applicable laws and regulations and used to

finance the administration and regional development

(Prakosa, 2005). Measuring the success of regional

development in increasing the value of HDI, the

amount of PAB acquisition is one of the factors used

to see the successful implementation of regional

autonomy. PAD was chosen as one of the influential

factors, because this research was shown to look at

the financial performance of local governments in

supporting the implementation of regional

development. Regional taxes which act as regional

revenues will then determine the size of the PAB

acquisition and are used to support government

expenditures, one of which is shown to improve

social welfare. The effect of PAD on HDI will then

again affect the receipt of regional retribution. In

addition, the changes that occur in the GRDP value

will again affect the value of regional taxes, regional

levies and regional profits which act as sources of

regional revenue. From the explanation, it can be

concluded that there is a causal relationship between

regional revenue and the implementation of regional

development.

Effect of Poverty on the Human Development

Index (HDI)

The new growth theory emphasizes the importance

of the role of government, especially in improving

HDI and encouraging research and development to

improve human productivity. The reality can be seen

by investing in education will be able to improve the

quality of human resources as shown by the increase

in one's knowledge and skills. The higher the level

of education of a person, then the knowledge and

expertise will increase so that it will encourage an

increase in work productivity. Companies will get

more results by hiring workers with high

productivity, so the company will also provide

higher salaries to those concerned. In the informal

sector such as agriculture, increasing the skills and

expertise of the workforce will be able to increase

agricultural output, because skilled workers are able

to work more efficiently. In the end someone who

has high productivity will get better welfare, which

is shown through increased income and

consumption. The low productivity of the poor can

be caused by their low access to education (Rasidin

and Bonar, 2004).

The Effect of Economic Growth on the Human

Developmend Index (HDI)

The relationship between economic growth and

human development is influenced by 2 (two) main

lines, namely the path of household activities,

including households and various community

organizations, as well as shopping channels and

government policies. Household activities contribute

greatly to improving human development indicators

through household spending on food, clean water,

health care and schools (UNDP, 1996). The

tendency of household activities to spend a number

of factors that directly reduce human beings. Vice

versa, the relatively high level of income tends to

increase household spending to increase human

development (Ananta, 2013).

Economic growth provides direct benefits for

increasing human development through increasing

income. Increased income will increase the

allocation of household spending for more nutritious

food and education, especially for poor households

(Ranis, 2004).

Regional Tax Effects on the Human Development

Index

The decentralization policy is aimed at realizing

regional independence, autonomous regional

governments have the authority to regulate and

manage the interests of local communities according

to their own initiatives based on community

Analysis of Poverty, Regional Tax and Economic Growth on HDI District/City in North Sumatra

611

aspirations (Law No. 34/2004). The ability of

regions to provide funding originating from the

regions is highly dependent on the ability to realize

these economic potentials into forms of economic

activity that are capable of creating revolving funds

for sustainable regional development (Darwanto and

Yustikasari in Setyowati and Suparwati, 2012).

PAD is the most important source of financing in

supporting regional capacity in carrying out regional

autonomy. In this context, PAD as a measure of

regional own income is highly expected as a source

of funding for improving services to the community

(Abdullah and Solichin, in (Setyowati and

Suparwati, 2012).

3 RESEARCH METHOD

This study examines the analysis of poverty,

regional tax and economic growth in the Regency /

City Human Development Index in North Sumatra

during the period of 2013 to 2016. It always leads to

increased income. This is because the resources

generated by economic growth cannot be used to

promote the improvement of other indicators. In

addition, the structure and processes that occur in the

community cannot benefit the poor. For example,

various increases in yields only benefit landowners

and not laborers. However, the condition can

change. The poor can get multiple benefits from

income growth and increasing HDI if the

government wants to use the benefits of growth to

finance health services and access to education for

the poor. In addition, the structure and processes that

exist in the community are appropriate, so that the

benefits of economic growth are also enjoyed by the

poor. According to the World Development Report,

progress in both fields is mutually reinforcing each

other and one without the other is not enough

(Kanbur and Squire, 1999).

Types and Data Sources

The data in this study are secondary data obtained

from the North Sumatra Central Bureau of Statistics

which is panel data consisting of time series data

during the period 2013-2016 and cross section data

consisting of 33 regencies / cities in North Sumatra.

Analysis Method

In the model data panel model equation with a

combination of time series and cross section, the

model can be written with:

Y

it

= β

0

+ β

1

X

it

+ β

2

X

it

+ β

3

X

it

+ μ

it

Information:

Y = Human Development Index (HDI)

X1 ` = Poverty

X2 = Regional Tax

X3 = Economic Growth

β0 = intercept

β1, β0, β3 = independent variable regression

coefficient

μit = error component at time t

unit cross section i

i = 1, 2, 3, ...., 33 (district / city

cross section data in North Sumatra)

t = 1, 2, 3, 4 (time series data,

2013 - 2016)

There are three tests that can be used as a tool in

choosing a panel data regression model (Common

Effect Model, Fixed Effect Mode, and Random

Effect Model) based on the characteristics they have,

namely: F Test (Chow Test), Hausman Test and

Lagrange Multiplier Model .

a. F Test (Chow Test)

It is done to choose which model is the most

appropriate between the Common Effect Model

and the Fixed Effect Model. The basis of the

hypothesis is obtained by comparing the

probability values of Cross-Section Chi-Square.

If the Probability value < 0.05, Fixed Effect

Model is more appropriate to use than the

Common Effect Model. Whereas if the

Probability value > 0.05 then the Common

Effect Model is more appropriate to use than the

Fixed Effect Model.

b. Hausman Test

Is done to choose whether which model is the

most appropriate between Fixed Effect Model

or Random Effect Model. If the Probability of

Cross-Section Random < 0.05, Fixed Effect

Model is more appropriate than the Random

Effect Model. Whereas if the Probability value

> 0.05 then Random Effect Model is more

appropriate to use than the Fixe Effect Model.

c. Lagrange Multiplier Model

If the Chow Test model chosen is the Common

Effect Model while the Hausman Test model is

chosen by Random Effect Model, then to

determine which model is the most appropriate

between Common Effect Model or Random

Effect Model, the Lagrange Multiplier Model is

tested. The method used is Pagan Breusch. If

the P value is <0.05, the best estimation method

is the Random Effect Model. If the P value is >

0.05, the best estimation method is the Common

Effect Model.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

612

Testing of Classical Assumptions

a. Multicollinearity Test

The multicollinearity test aims to test whether

the panel regression model found a correlation

between independent variables. A good model

is a model that does not have a correlation

between the independent variables. To test the

problem of muticolinearity can be seen from the

correlation coefficient of more than 0.80, there

is multicollinearity (Gujarati, 2006).Uji

Heterokedastisitas

b. Uji heterokedasticity

Used to see whether the residuals of the model

formed have a constant variance or not. A good

model is a model that does not occur

heterocedasticity. The heterocedasticity test

used in this study used the Glejser Test. The

Glejser test regresses the independent variables

to absolute residuals. The Glejser test only

applies to the Fixed Effect Model. Glejser Test

Results can be seen from the Probability value.

If the P value is < 0.05, there is

heterocedasticity. Conversely, if P value> 0.05,

it is free from violations of the assumption of

heterocedasticity.

c. Normality test.

The normality test aims to test whether in the

regression model the panels are normally

distributed or not. A good regression model is to

have normal data distribution. This can be seen

by comparing the value of Probability Jarque -

Bera (JB). If P value JB> 0.05 then the data is

normally distributed. Conversely, if P value JB

<0.05, the data is not normally distributed.

Hypothesis test

a. T test

The t test is used to test the independent

variables on the dependent variable partially.

This can be known from the prob value t count.

If the prob value is <0.05, the hypothesis is

accepted. Conversely, if the Prob value is> 0.05,

the hypothesis is rejected.

b. F test

The F test is used to test the relationship of

independent variables to the dependent variable

simultaneously. This can be known from the

prob value F count. If the prob value is <0.05,

the hypothesis is accepted. Conversely, if the

Prob value is> 0.05, the hypothesis is rejected.

c. Coeficient Determinan (R

2

)

The coefficient of determination is used to see

how much influence the independent variables

have on the dependent variable. The coefficient

of determination is determined by the adjusted

R-Square value. Table 2

4 RESULT AND DISCUSSION

Table 2:Panel Data Result

Variable Coeffici ent Std. Error t-Statistic Prob.

C 3.687909 0.048541 75.97551 0.0000

Log(Prover ty) -0.097306 0.009664 -10.06939 0.0000

Log(GD RP) 0.073514 0.007612 9.658163 0.0000

Log(Regional

Tax) 0.013555 0.004713

2.876176 0.0047

R-squared 0.613785 Mean dependent va

r

4.217612

Adjusted R-

squared 0.604662 S.D. dependent va

r

0.073225

S.E. o

f

regression 0.046041 Akaike info criterion -3.288525

Sum squared

resid 0.269207 Schwarz criterion -3.200733

Log likelihoo

d

219.3984 Hannan-Quinn criter. -3.252851

F-statistic 67.27757 Durbin-Watson sta

t

0.088255

Prob(F-

statistic) 0.000000

From the table of estimation results, the

regression equation in this study is made as follows:

Y

it

= 3.687909 – 0.097306 X

it

+ 0.073514X

it

+

0.013555X

it

+ μ

it

From the above equation, it can be explained as

follows:

a. The constant value is 3.687909, meaning that if

Poverty, Economic Growth and Regional Taxes

increase, the HDI will increase by 3.69%. Nilai

β

1

= - 0.097306, meaning that if the Poverty

variable rises by 1% while the Economic

Growth and Regional Tax variables remain then

HDI decreases by 9.7306% Sign (-) shows there

is a contradictory relationship between Poverty

and HDI. If poverty increases, the HDI will

drop.

b. b. The value of β2 = 0.073514, meaning that if

the Economic Growth variable rises by 1%

while the Poverty and Regional Tax variables

remain then HDI increases by 7.3514% Signs

(+) indicate that there is a unidirectional

relationship between Economic Growth and

HDI. If Economic Growth rises, the HDI will

rise.

c. The value of β3 = 0.013555, meaning that if the

Regional Tax variable rises by 1% while the

Poverty and Economic Growth variables remain

then the HDI increases by 1.3555% Signs (+)

indicates that there is a unidirectional

Analysis of Poverty, Regional Tax and Economic Growth on HDI District/City in North Sumatra

613

relationship between Regional Taxes and HDI.

If the Regional Tax increases, the HDI will rise.

Test Panel Data Model

a. Chow Test

Table 3: Chow Test Result

Effects Test Statistic d.f. Prob.

Cross-section

F 583.158537 (32,95) 0.0000

Cross-section

Chi-square 692.386875 32 0.0000

From the table it can be seen that the probability

value of the Chi-Square cross-section is 0,000 <0,05,

so it is concluded that the Fixed Effect Model is

more appropriate to use than the Common Effect.

b. Hausman Test

Table 4: Hausman Test Result

Test

Summary

Chi-Sq.

Statistic

Chi-Sq.

d.f. Prob.

Cross-section

rando

m

209.276642 3 0.0000

From the table it can be seen that the probability

value of the cross-section random is 0,000 <0,05, so

it is concluded that Fixed Effect Model is more

appropriate to use than Random Effect.

Classic assumption test

a. Multicollinearity Test

Table 5: Multicolinearity Test Result

log(p

eko)

Log(paja

k

daerah)

log(kemiski

n

an)

log(GDRP) 1 0.4029

351

0.306 8735

log(Regio

nal Tax)

0.402

9351

1 0.5091601

log(Prover

t

y

)

0.306

8735

0.509160

1

1

If the value of the independent variable is <

0.80, there is no multicollinearity between

independent variables.

b. Heteroscedasticity Test

Table 6: Heteroscedasticity Test Result

Variable Coefficient

Std.

Error

t-Statistic Prob.

C 12.48428 8.378710 1.490001 0.1395

Log(GD

RP

)

-1.103073 1.025723 -1.075410 0.2849

Log(Regi

onal Tax

)

-0.043890 0.095112 -0.461459 0.6455

Log(Pro

verty) -1.009355 1.435608 -0.703085 0.4837

From the table above it can be seen, the

probability value of the independent variable> 0.05

is free from violations of the assumption of

heterocedasticity.

c. Normality test

0

4

8

12

16

2

0

2

4

-0.10 -0.05 0.00 0.05 0.10

Series: Standardized Residuals

Sample 2013 2016

Observations 131

Mean 1.01e-15

Median -0.007397

Maximum 0.127166

Minimum -0.090554

Std. Dev. 0.045506

Skewness 0.170942

Kurtosis 2.326530

Jarque-Bera 3.113683

Probability 0.210801

Figure 1: Normality Test Result

From the table it is known that the Jarque-Bera

Probability value is equal to 0.210801 where it is

greater than 0.05 so it is concluded that the data is

normally distributed.

Hypothesis testing

a. T test

From the results of testing the data obtained the

value of Prob (t-statistic) <α is equal to 0.0000 <0.05

for the poverty variable. Thus the poverty variable

has a negative and significant influence on the

District / City HDI in North Sumatra. So, the higher

the poverty, the lower the HDI Regency / City in

North Sumatra will be. The value of the Prob (t-

statistic) Economic Growth variable is 0.0000 <0.05.

With the value of the Prob (t-statistic) shows that the

variable economic growth has a positive and

significant effect on HDI. So, the higher the

economic growth, the higher the HDI district/city in

North Sumatra. The value of the Prob (t-statistic)

Regional Tax variable is equal to 0.0047 < 0.05.

With the Prob value (t-statistic) it shows that the

regional tax variable has a positive and significant

effect on HDI. So, the higher the regional tax, the

higher the HDI district / city in North Sumatra.

b. F test

The F test is used to test the relationship of

independent variables to the dependent variable

simultaneously. From the results of testing the data

obtained the value of Prob (F-Statistics) <α that is

equal to 0.000000 <0.05. Then the two independent

variables, namely poverty, economic growth and

local taxes jointly influence the HDI District / City

in North Sumatra.

c. Determinant Coefficient (R2)

The coefficient of determination is used to see how

much influence the independent variables have on

the dependent variable. The coefficient of

determination is determined by the adjusted R-

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

614

Square value. Based on the estimation results

obtained the value of R-Squared is equal to. This

shows that the variables of poverty, regional tax and

economic growth are able to explain the HDI

variable of 61.3785%. While the remaining

38.6215% is influenced by other variables not used

in this study.

5 CONCLUSIONS

Based on the results of the analysis and discussion

that has been conducted, the conclusions can be

taken as follows:

1. Partially, Poverty has a negative and significant

effect on HDI District / City in North Sumatra.

2. Partially, Economic Growth has a positive and

significant effect on District / City HDI in North

Sumatra.

3. Partially, Regional Taxes have a positive and

significant effect on District / City HDI in North

Sumatra.

4. Poverty, Economic Growth and Regional Tax

simultaneously have a positive and significant

effect on HDI District / City in North Sumatra

REFERENCES

Adisasmita, Rahadjo. (2005). Dasar-dasar Ekonomi

Wilayah. Yogyakarta: Graha Ilmu.

Ananta, Prayudha. (2013). Determinan Pembangunan

Manusia Provinsi Lampung. Tesis. FEB

Universitas Lampung.

Arsyad, Lincolin. (2010). Ekonomi Pembangunan.

Yogyakarta: STIM YKPN

Badan Pusat Statistik. Sumatera Utara (2016). Indeks

Pembangunan Manusia (IPM) Provinsi Sumatera

Utara. BPS Sumatera Utara. Diakses melalui

website: www.bps.go.id.

Elizabeth A. Stanton. (2007). The Human Development

Index: A History. Working Paper Series Number

127: Global Development and Environment

Institute Tufts University.

Fatmasari, Rahmi Budhy. (2015). Analisis Pengaruh Pajak

Daerah Terhadap Pelaksanaan Pembangunan

Daerah di Provinsi Jawa Tengah. Skripsi Fakultas

Ekonomi dan Manajemen Institu Pertanian Bogor.

Bogor.

Gujarati, D. (2004). Basic Econometrics. Fourth Editions.

New york: The McGraw Hill Companies.

Jhingan, M.L. (2010). Ekonomi Pembangunan dan

Perencanaan, Terjemahan. Penerbit Rajawali.

Jakarta.

Kanbur, Ravi dan Lyn Squire. (1999). The Evolution of

Thinking about Poverty: Exploring The

Interactions.

http://kanbur.dyson.cornell.edu/papers.htm.

Mirza, Denni Sulistio. (2012). Pengaruh Kemiskinan,

Pertumbuhan Ekonomi dan Belanja Modal

terhadap Indeks Pembangunan Manusia di Jawa

Tengah Tahun 2006 – 2009. Jurnal Ekonomi

Pembangunan.

Putra, Dwi. (2015). Pengaruh Dana Alokasi Umum, Dana

Bagi Hasil, Dana Alokasi Khusus dan Pendapatan

Asli Daerah Provinsi Bali. Jurnal Ekonomi

Pembangunan.

Prakosa, K. (2005). Pajak dan Retribusi Daerah.

Yogyakarta: UII Pr.

Ranis, Gustav. (2004). Human Development and

Economic Growth. Working Papers 887.

Economic Growth. New Haven: Yale Universi

Sen, Amartya. (1999). Development as Freedom. New

York: Anchor Books. Chicago

Saragih, Arfah Habib. (2018). Analisis Pengaruh

Penerimaan Pajak Daerah terhadap Indeks

Pembangunan Manusia. Jurnal Economia, Volume

14, Nomor 2, Oktober 2018.

Sukirno, Sadono. (2006). Pengantar Teori Makro Ekonomi

. Jakarta: Raja Grafindo Persada.

UNDP. (1996). Human Development Reports 1996. New

York: Oxford University Press.

UNDP. (2002). Arab Human Development Report 2002.

New York: United Nations Publications.

UNDP. (2004). Human Development Report. New York :

Oxford Univesity Press

World Bank. (2004). Definisi Kemiskinan. http:/ /www.

worldbank. Org (online). Diakses tanggal 2

Desember 2018

Analysis of Poverty, Regional Tax and Economic Growth on HDI District/City in North Sumatra

615