Effects of Population, Consumption and Exports on

Economic Growth in Indonesia Period of 2005-2017

Ali Sandy Hasibuan

1

1

Student of Post Graduated Program, Universitas Negeri Medan, Medan -Indonesia

Keywords: Population, Consumption, Exports, Economic Growth

Abstract: The aim of this paper is to analyse the effect of population, consumption and exports on economic growth in

Indonesia. This study uses time series data in the period 2005-2017 obtained from the Badan Pusat Statistik

(BPS) and Bank Indonesia (BI). This study uses multiple linear regression analysis using Eviews 10. The

simultaneous test results show that population, consumption and exports have a significant influence on

economic growth in Indonesia. The partial test results show that the population variable has a significant

influence on economic growth in Indonesia, the consumption variable also has a significant influence on

economic growth in Indonesia and the export variable also has a significant influence on economic growth in

Indonesia.

1 INTRODUCTION

Economic development is a series of businesses and

policies carried out by the government of a country or

region to improve people's welfare. From the point of

view of economics, development is defined as an

effort to increase the growth of income per capita

faster than the rate of population growth (Todaro,

2011).

Economic development is a multidimensional

process which means that economic development has

interrelated relationships and influences among the

factors that produce economic growth. Development

and economic growth have interrelated relations

where development will encourage economic growth

and economic growth can facilitate the economic

development process itself.

Gross Domestic Product (GDP) is a benchmark

for the success of a country's development. from GDP

data, the value of a country's economic growth can be

determined, and economic growth is defined as the

rate of increase in income per capita (Sukirno, 1981).

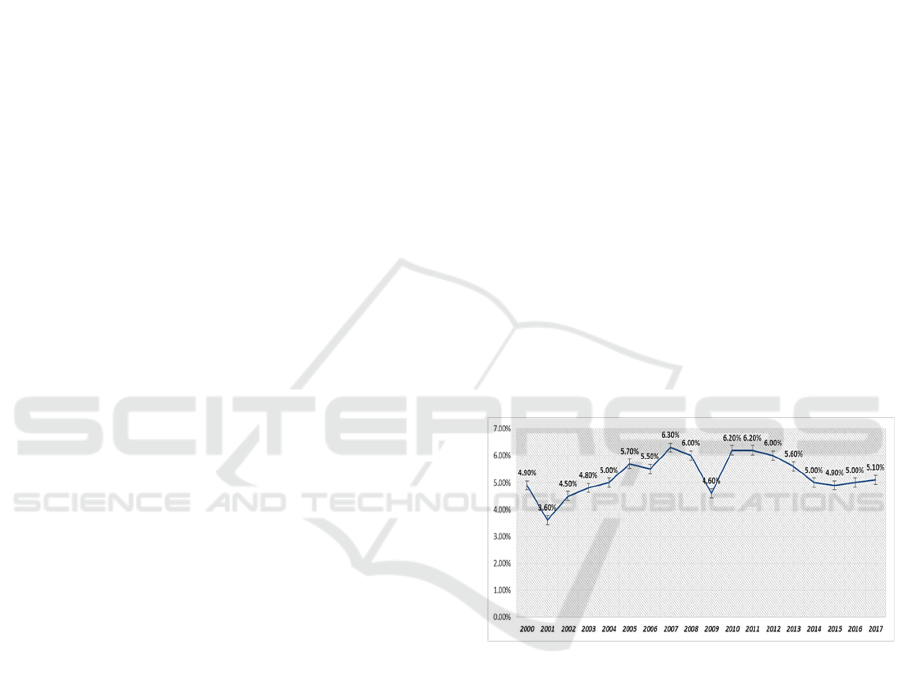

Figure 1: Economic Growth in Indonesia

(source : bps)

Figure 1. describes the graph of economic growth in

Indonesia in the period 2000 to 2017. Based on the

picture, it can be seen that the condition of economic

growth has fluctuated from year to year. The lowest

growth conditions existed in 2001 around 3.60% and

the highest condition of Indonesia's economic growth

was in 2007 at 6.30%.

In recent years, the percentage of Indonesia's

economic growth has decreased. Then experienced a

slight increase in 2017 where in the previous year

Indonesia's economic growth of 5.00% rose to 5.10%.

This change in economic growth is certainly

influenced by variable variables supporting economic

growth.

594

Hasibuan, A.

Effects of Population, Consumption and Exports on Economic Growth in Indonesia Period of 2005-2017.

DOI: 10.5220/0009508705940601

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 594-601

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Theoretical economic growth is influenced by

population (human resources), natural resources,

physical capital, and human capital (Mankiw, 2009).

As one of the factors that influence economic growth,

the main role of the population is in terms of

providing labor. Moreover, the population with

superior quality of human capital will be a more

productive workforce. Indonesia as a country with a

large population is expected to be able to take

advantage of the abundance of the population as a

driving force for economic growth.

Conceptually, the population affects the output of

the economy. High economic output can be obtained

from the production of goods and services carried out

by residents. The more population, a country will be

able to produce more goods and services, which

means it can consume more goods and services. This

will further encourage economic growth (Thuku et al,

2013).

Output is usually measured by Gross Domestic

Product (GDP). Gross Domestic Product shows the

total value of final goods and services produced by all

economic units. Economic growth occurs when an

economy is able to increase GDP from the previous

period.

On the other hand, Keynesian theory states that

national income growth is determined by the amount

of consumption expenditure, government

expenditure, investment and net exports. To increase

economic growth as measured by increasing national

income, an increase in consumption demand, demand

for government expenditure, investment demand, and

demand is needed. export and import. The

implementation of both concepts and theories

(Classical and Keynesian) can be used to calculate

economic growth both on a national scale and at the

scale of regional macroeconomics.

According to Salvator (1990), it implies that

exports are one of the engines of economic growth in

its study showing that exports are one of the main

factors for developing countries to increase their

economic growth. Increased exports by developing

countries can drive output and economic growth.

The impact of population, consumption and

exports in their influence on economic growth in

Indonesia still has to be studied. Thus, the process of

improving the country's economy on a macro level

can be achieved and felt by all communities in

particular. From the description above, the author is

interested in conducting research with the title "

Effects of Population, Consumption and Exports on

Economic Growth in Indonesia Period of 2005-2017"

2 THEORICAL FRAMEWORK

2.1 Population

According to the Badan Pusat Statistik (BPS),

population are all people who are domiciled in the

geographical area of Indonesia for 6 months or more

and / or those who live less than 6 months but aim to

settle. According to Maltus (in Lincolin Arsyad,

2010) that the general tendency of the population of a

country to grow according to a series of

measurements is to double every 30-40 years.

Meanwhile, at the same time, due to the decreasing

yield of the land production factor, the food supply

only grows according to the arithmetical series.

Because the growth of the food supply cannot keep

pace with the very fast and high population growth,

per capita income (in the farming community is

defined as per capita food production) will tend to fall

to very low, which causes the population to never

stabilize, or only slightly above the subsiten level

Population growth is a dynamic balance between

two forces that increase or decrease the population.

The development of the population will be influenced

by the number of babies born but simultaneously will

also be reduced by the number of deaths that can

occur in all age groups. In the spatial context of

population mobility also affects changes in

population, where immigration will increase the

population and emigration will reduce the population

in a region.

In the theory of growth according to Kuznet prior

to the era of growth, the economic activities of the

population were concentrated from the extractive

primary sectors, namely agriculture, fisheries and

mining. The process of economic growth has since

been characterized by a diversification of sectoral

activities with the growth of various types and types

of industries (Djojohadikusumo, 2004).

2.2 National Consumption

Household consumption expenditure is one of the

macroeconomic variables. A person's consumption

expenditure is part of the income spent. If the

consumption expenditure of all people in a country is

added up, then the result is the consumption

expenditure of the country concerned.

In macro terms, public consumption expenditure

is directly proportional to national income. The

greater the income, the greater the consumption

expenditure. The comparison of the size of the

additional consumption expenditure to income is

called Marginal Propensity to Consume: MPC. In

societies whose economic life is relatively unstable,

their MPC numbers are relatively large, while their

MPS numbers are relatively small, meaning that if

they get additional income, most of the additional

Effects of Population, Consumption and Exports on Economic Growth in Indonesia Period of 2005-2017

595

income will be allocated for consumption. This is the

opposite to the people whose economic life is

relatively more established. According to Rahardja

(2001: 45), consumption expenditure consists of

government consumption and public consumption.

Some of the reasons underlying the level of

consumption of the community or household are:

a. Household consumption expenditure has the

largest position in total aggregate expenditure.

b. Household consumption is endogenous in the

sense that the amount of household consumption

is related to other factors that are considered to

influence it. Therefore we can compile economic

models and theories that produce an

understanding of the relationship between the

level of consumption and other factors that

influence it. The theory and model is known as the

consumption model theory which has proven to be

beneficial for macroeconomic managers.

c. The rapid development of society has resulted in

the behavior of consumption behavior also

changing rapidly. This is another reason that

contains a study of household consumption

remains relevant

2.3 Export

According to Curry (2001), exports are goods and

services sold to foreign countries to be exchanged for

other goods (products, money). The export process is

an action taken to issue goods or commodities from

within the country to enter them into other countries.

The development of exports from a country is not

only determined by the factors of comparative

advantage but also by factors of competitive

advantage. The essence of the competitive advantage

paradigm is the superiority of a country in global

competition in addition to being determined by

comparative advantage (classical theories and H-O) it

has and also because of protection or assistance from

government facilities, also determined by its

competitive advantage. Competitive advantage is not

only owned by a country, but also owned by

companies in that country individually or in groups.

17 Another difference with comparative advantage is

that competitive advantage is more dynamic with

changes, such as technology and human resources

(Tambunan, 2001).

2.4 Economic Growth

In general, economic growth is defined as increasing

the ability of an economy to produce goods and

services. Economic growth shows the extent to which

economic activity will generate additional income for

the community in a given period. Because basically

economic activity is a process of using production

factors to produce output, then this process will in

turn result in a return of service to the factors of

production owned by the community. With the

economic growth, it is expected that people's income

as the owner of production factors will also increase

(Sukirno, 2006: 423).

According to Kuznets economic growth is a long-

term increase in the ability of a country to provide

more and more types of economic goods to its

population; this ability grows according to

technological progress, and institutional and

ideological adjustments that are needed (Jingan,

2010: 57).

Thus it can be concluded that economic growth is

a development in economic activity characterized by

an increase in the output of goods and services which

impacts on the increase in per capita income.

Economic growth is an increase in the output of

society caused by the increasing number of

production factors used in the production process,

without any change in "technology" production itself,

for example output increases caused by the growth of

capital stock or the addition of production factors

without changes in production technology the old one

(Arsyad, 2010: 96).

2.5 Effect of Population on Economic Growth

The economic growth rate can be attributed to the rate

of population growth because in principle economic

growth must be enjoyed by the population. The

number of residents needs to be considered because

besides being a subject, the population is also an

object of development. Changes that have been made

in the aspect of population will affect the

development process and the objectives to be

achieved.

In the view of classical economists there are four

factors that influence economic growth, namely the

number of people, the amount of stock of capital

goods, the area of land and natural wealth, and the

level of technology used even though realizing that

economic growth depends to many factors. But

classical economists focus on the influence of

population growth on economic growth. In their

growth theory, it is assumed that the area of land and

natural wealth are fixed in number and the level of

technology has not changed. Based on this example,

it is further analyzed how the influence of population

growth on the level of national production and

income (Sukirno, 2010: 433).

According to classical economics, the law of

additional yields that are increasingly scarce will

affect economic growth. This means that economic

growth will not continue. At the beginning, if the

population is small and natural wealth is relatively

excessive, the rate of return on capital from the

investment made is high. Then entrepreneurs will get

a big profit. This will get new investment and

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

596

economic growth materialized. Such circumstances

will not continue. If the population is too much, the

first thing will decrease the level of economic activity

because the productivity of each population has

become negative (Sukirno, 2010: 433).

2.6 Effect of National Consumption on

Economic Growth

Household consumption expenditure is the value of

expenditures made by households to buy various

types of needs in a given year. The income received

by households will be used to buy food, clothing,

transportation services, pay for children's education,

pay rent for houses and buy vehicles. These items are

purchased by households to meet their needs.

(Sukirno, 2010).

Household consumption decisions are influenced

by overall long-term and short-term behavior. Long-

term household consumption decisions are important

because of their role in economic growth. As for

short-term analysis, the role is important in

determining aggregate demand. Consumption is two-

thirds of GDP.

Keynes had an absolute consumption theory

called the Keynesian Theory (Absolute Income

Hypothesis). Keynes argues that the amount of

household consumption depends on the income

generated. The comparison between the amount of

consumption and income is called Keynes as

Marginal Propensity to Consume (MPC). This MPC

is used to measure that the greater the income owned,

then the level of household consumption is also high,

and vice versa.

2.7 Effect of Exports on Economic Growth

Export is an international trade process that aims to

gain profits so that each country will benefit from the

occurrence of international trade, this occurs because

the specialization of each country is different so that

international trade will occur so that efficiency and

specialization will occur in each country. In other

words, cost comparative emphasizes that comparative

advantage will be achieved if a country produces an

item that requires fewer hours of labor than other

countries so that production efficiency occurs.

The important function of the export component

of foreign trade is that the state gains and gains

national income, which in turn increases the amount

of output and the rate of economic growth. With a

higher level of output the vicious circle of poverty can

be broken and economic development can be

improved (Jhingan, 2000). Exports play an important

role in the economic activities of a country. Exports

will generate foreign exchange which will be used to

finance the import of raw materials and capital goods

needed in the production process which will form

added value. According to Salvator (1990), it implies

that exports are one of the engines of economic

growth in its study showing that exports are one of the

main factors for developing countries to increase their

economic growth. Increased exports by developing

countries can drive output and economic growth.

2.8 Previous Research

The results of the research by Darma Rika

Swaramarinda entitled (2011) "The Effects of

Consumption Expenditures and Government

Investment on Economic Growth in Indonesia". The

results of the study show that government

consumption expenditure and investment expenditure

have a positive effect on economic growth, there is a

positive relationship between the expenditure of

government consumption and economic growth in the

study period.

The research results of Dian Purnamasari entitled

(2015) "Population and Economic Growth: A New

Empirical Explanation". The results of the research

show that the Estimated Results indicate that

population density has a negative effect on the

accumulation of human capital and the accumulation

of human capital has a positive effect on output. This

study concludes that a large population will have a

positive effect on economic output if the population

has superior quality of human capital. This means that

the positive influence of population density on output

occurs when high population densities encourage the

accumulation of human resources.

The research results of Christiawan Eka Arianto,

et al, entitled (2015) "Influence of Population and

Unemployment Rate on Economic Growth of Jember

Regency". The results of the study show that from the

results of the analysis carried out, conclusions can be

drawn on the partial test (t test), it is known that the

number of residents has a positive and significant

influence on economic growth. While unemployment

has a positive but not significant influence on

economic growth in Jember Regency.

The research results of Dian Fristia Alfiyanto

entitled (2014) "analysis of the influence of

population, labor, education level and government

expenditure on economic growth in grobogan district

in 1990-2012". The results showed that population,

labor, government expenditure had a significant

effect on gross regional domestic product (RGDP)

while the education level did not have a significant

effect on gross regional domestic product (RGDP).

The results of Ismadiyanti Purwaning Astuti's

research, Fitri Juniwati Ayuningtyas entitled (2018)

"the influence of exports and imports on economic

growth in Indonesia from 2000-2016". The results

showed that exports had a positive influence on

economic growth..

Effects of Population, Consumption and Exports on Economic Growth in Indonesia Period of 2005-2017

597

Ari Muliyanta Ginting's research results entitled

(2017) "analysis of the effect of exports on

Indonesia's economic growth 2001-2015". The

results showed that exports had a positive and

statistically significant influence on economic growth

in Indonesia..

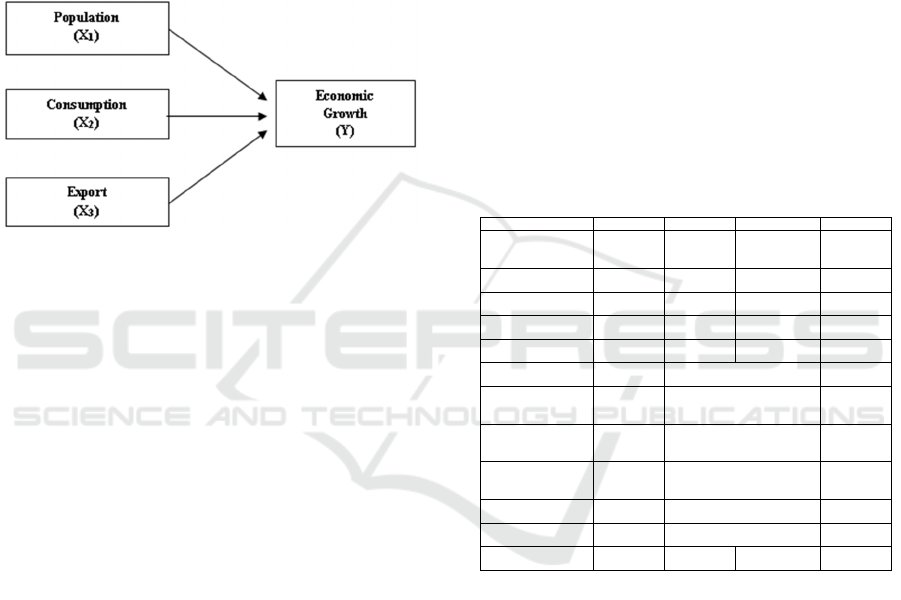

2.9 Framework of Thinking

Based on the explanation of the theory and previous

research, the framework of this research can be

described as follows:

Figure 2: Framework of thinking

3 RESEARCH METHOD

This research was conducted in North Sumatra

Province. The data used in this study are secondary

data based on periodic data series (time series) from

2005 - 2017 obtained from the Central Statistics

Agency. The analysis technique used in this study is

quantitative analysis techniques.

In this study the independent variables were

Population (X1), Consumption (X2) and Export (X3)

in Indonesia in 2005 - 2017. Whereas the dependent

variable was Indonesian Economic Growth in 2005 -

2017. The analysis tools used were analysis multiple

linear. The regression equation is as follows:

Y = β

0

+ β1 LogX1 + β

2

LogX

2

+ β3 LogX3+ μi

Description:

Y = Economic Growth

X1 = Population

X2 = Consumption

X2 = Export

β0 = Constanta

β1, β2, β3 = Regression coefficient

μi = Error term

This analysis aims to determine the Effect of

Population, Consumption and Exports on Economic

Growth in Indonesia from 2005 - 2017. In this

analysis using the program Eviews 10 assistance

which aims to see the effect of independent variables

on the dependent variable.

4 RESULT AND DISCUSSION

4.1 Estimation Results

Multiple regression analysis is a method used to

determine the possible forms of relationships between

variables, namely the independent variable and the

dependent variable together with the help of the

program Eviews 10, the following results are

obtained:

Table 1: Results of Multiple Regression Estimates

Dependent Variable: LOG_PDBG

Method: Least Squares

Sample: 2005 2017

Included observations: 13

Variable

Coefficien

t

Std. Erro

r

t

-Statistic Prob.

C -25.35258 1.680960 -15.08220 0.0000

LOG_POP 4.463171 0.212204 21.03250 0.0000

LOG_CONS 0.038451 0.025361 1.516129 0.0163

LOG_EX 0.043944 0.017869 2.459256 0.0362

R-squared 0.999823 Mean dependent va

r

12.33389

Adjusted R-

squared 0.999764 S.D. dependent va

r

0.092011

S.E. of

regression 0.001414 Akaike info criterion -10.03659

Sum squared

resid 1.80E-05 Schwarz criterion -9.862760

Log likelihoo

d

69.23784 Hannan-Quinn criter. -10.07232

F-statistic 16925.10 Durbin-Watson sta

t

1.497590

Prob(F-statistic) 0.000000

Source : Eviews output

From the table of estimation results, the regression

equation in this study is made as follows:

Log_PDBG = -25.3525 + 4.4631*Log_POP +

0.0384*Log_CONS + 0.0439*Log_EX

From the above equation, the results that can be

explained are as follows:

1. Constant value of –25,352, meaning that if the

value of the Population, consumption and export

value is 0, then the economic growth decreases by

25,352%.

2. Value of β1 = 4,463, meaning that if the variable

Total Population increases by 1% while the

Consumption and Export variables remain then

economic growth has increased by 4,463% Signs

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

598

(+) indicate there is a unidirectional relationship

between population and economic growth. If the

population increases, economic growth will rise.

3. Value of β2 = 0.038, meaning if the Consumption

variable is 1% while the variable Total Population

and Exports is fixed then economic growth

increases by 0.038%. The sign (+) shows that

there is a direct relationship between consumption

and economic growth. If consumption rises,

economic growth will rise.

4. Value of β3 = 0.044, meaning that if the Export

variable is 1% while the variable Population and

Consumption is fixed then economic growth

increases by 0.044%. The (+) sign indicates a

unidirectional relationship between exports and

economic growth. If exports rise, economic

growth will rise.

4.2 Classic Assumption Test

Multicollinearity

Aim to find out whether there is a significant

correlation between fellow independent variables.

Table 2: Multicollinearity test

LOG_POP LOG_CONS LOG_EX

LOG_POP 1.00000 0.79570 0.74349

LOG_CONS 0.79570 1.00000 0.75509

LOG_EX 0.74349 0.75509 1.00000

Source : Eviews output

From the table above it can be seen that there are

no variables that have a greater value (>) 0.8. so it can

be concluded that there is no multicollinearity in the

regression model.

Serial Correlation (Autocorrelation)

To detect the presence or absence of serial correlation

in the research model. This study uses the Lagrange

Multiplier test (LM Test) to detect the presence or

absence of autocorrelation. From the results of testing

the data obtained the results of the Prob -obs * R-

square value of 0.3580> 0.05. so that it can be said

that there is no autocorrelation in the regression

model

Table 3: Autocorrelation test (LM Test)

Breusch-Godfrey Serial Correlation LM

Test:

F-statistic 0.656926 Prob. F(2,7) 0.5477

Obs*R-square

d

2.054411

Prob. Chi-

Square(2) 0.3580

Source : Eviews output

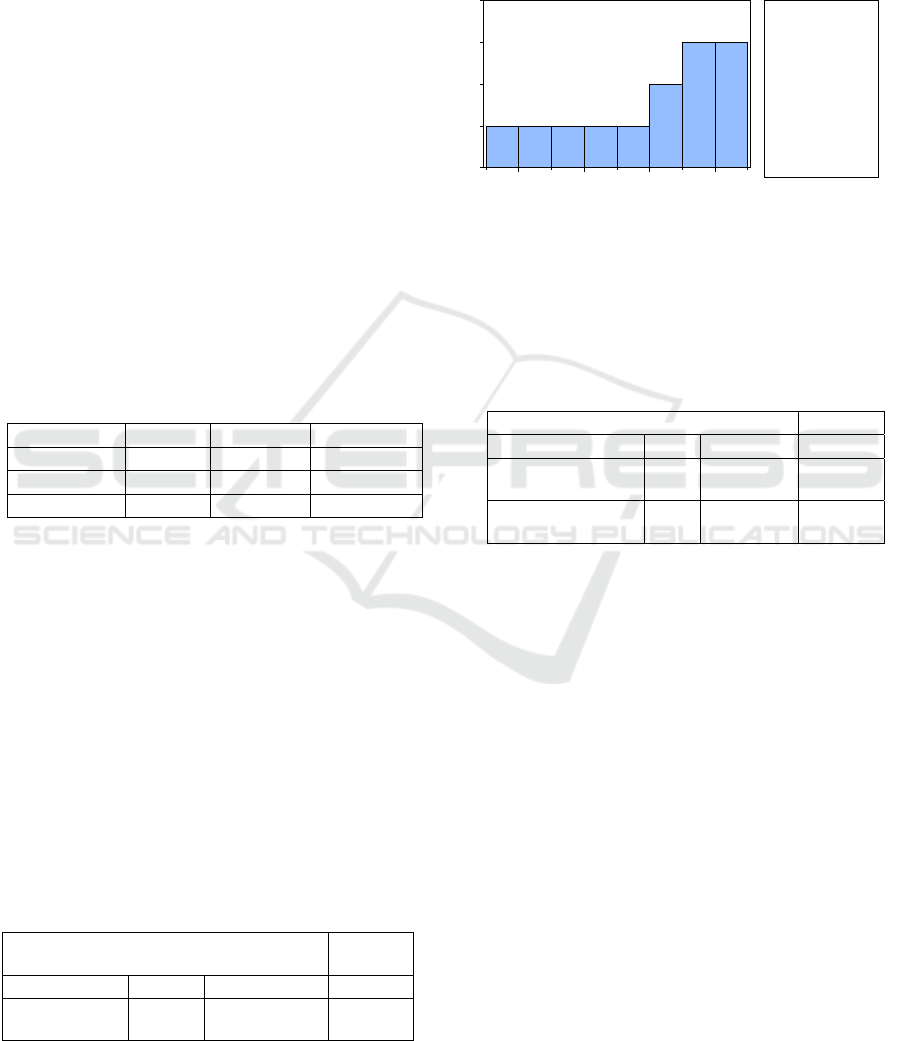

Normality

From the results of testing the above data obtained

results with a Probability value> α or 0.502220> 0.05.

so it can be concluded that the data used in this study

has a normal distribution and passes the normality

test.

0

1

2

3

4

-0.002 -0.001 0.000 0.001

Series: Residuals

Sample 2005 2017

Observations 13

Mean 2.39e-15

Median 0.000130

Maximum 0.001358

Minimum -0.002088

Std. Dev. 0.001225

Skewness -0.580251

Kurtosis 1.906295

Jarque-Bera 1.377436

Probability

0.502220

Figure 3: Normality test

Heteroscedasticity

To see the presence or absence of heteroscedasticity

can be done by the White Heteroscedasticity test on

Eviews by looking at the value of Prob Value –obs *

R-square contained in the output table.

Tabel 4. Heteroskedasticity test

Heteroskedasticity Test: White

F-statistic 3.3511 Prob. F(5,7) 0.0731

Obs*R-s

q

uare

d

9.1693

Prob. Chi-

S

q

uare

(

5

)

0.1025

Scaled ex

p

lained SS 1.9914

Prob. Chi-

S

q

uare

(

5

)

0.8503

Source : Eviews output

From the table above, it can be seen the value of

Prob Value –obs * R-square of 0.1025> 0.05. it can

be said that there is no heteroscedasticity in the

regression equation model.

4.3 Hypothesis Testing

t Test

The t test is used to test the independent variables on

the dependent variable partially. From the results of

testing the data obtained the value of Prob (t-statistic)

<α that is equal to 0.0000 <0.05 for the variable

Population. Thus the variable population has a

positive and significant influence on economic

growth in Indonesia. So, the higher the population,

the higher the economic growth in Indonesia.

The value of the Prob (t-statistic) consumption

variable is 0.0163 <0.05. With the Prob value (t-

statistic) it shows that the consumption variable has a

positive and significant influence on economic

growth. So, the higher the consumption of the

Effects of Population, Consumption and Exports on Economic Growth in Indonesia Period of 2005-2017

599

community, the higher the economic growth in

Indonesia.

The value of the Prob (t-statistic) export variable

is 0.0362 <0.05. With the Prob value (t-statistic) it

shows that the export variable has a positive and

significant influence on economic growth. So, the

higher the export of the community, the higher the

economic growth in Indonesia.

F Test

The F test is used to test the relationship of

independent variables to the dependent variable

simultaneously. From the results of testing the data

obtained the value of Prob (F-Statistics) <α is equal

to 0.000000 <0.05. Then the three independent

variables, namely the population, consumption and

export together influence economic growth in

Indonesia.

Coefficient of Determination (R2)

The coefficient of determination is used to see how

much influence the independent variables have on the

dependent variable. The coefficient of determination

is determined by the value of adjusted R-Square.

Based on the estimation results obtained the value of

R-Squared is 0.999823. This shows that the variable

population, consumption and export are able to

explain the variable of economic growth of 99.98%.

While the remaining 0.02% is influenced by other

variables not used in this study.

5 CONCLUSIONS

5.1 Conclusions

Based on the results of the analysis and discussion

that has been conducted, the conclusions can be taken

as follows:

1. The population has a positive and significant

effect on economic growth in Indonesia

2. Consumption has a positive and significant effect

on economic growth in Indonesia

3. Exports have a positive and significant effect on

economic growth in Indonesia

4. Population, national consumption and export

simultaneously have a positive and significant

effect on economic growth in Indonesia

5.2 Suggest

Based on the results of the discussion and

conclusions, the suggestions that the author needs to

describe are as follows:

1. Population, export consumption is able to explain

the variable Economic Growth of 99.98% So that

in taking government policy it is necessary to pay

attention to other variables not examined.

2. For researchers interested in conducting studies in

the same field, they should add a time span of

research and other variables not used in the study.

REFERENCES

Alfiyanto, Dian Fristia (2014) ‘Analisis Pengaruh Jumlah

Penduduk, Tenaga Kerja, Tingkat Pendidikan dan

Pengeluaran Pemerintah Terhadap Pertumbuhan

Ekonomi Di Kabupaten Grobogan Tahun 1990-

2012’, Electronic Theses and Dissertation

Universitas Muhammadiyah Surakarta. Available at:

http://eprints.ums.ac.id/30661/

Arianto, Christiawan Eka (2015) ‘Pengaruh Jumlah

Penduduk Dan Angka Pengangguran Terhadap

Pertumbuhan Ekonomi Kabupaten Jember’,

Universitas Jember Digital Repository. Available at:

http://repository.unej.ac.id/handle/123456789/63990

Arsyad, Lincolin (2010) Pengantar Perencanaan

Pembangunan. Media Widya Mandala: Yogyakarta

Djojohadikusumo, Sumitro. (1994) Perkembangan

Pemikiran Ekonomi: Dasar Teori Ekonomi

Pertumbuhan Dan Ekonomi Pembangunan. Pt

Pustaka Lp3es Indonesia: Jakarta.

Jhingan, M.L (2010) Ekonomi Pembangunan Dan

Perencanaan. PT. Rajagrafindo Persada: Jakarta.

Mankiw, N. Gregory (2006) Makroekonomi. Erlangga:

Jakarta.

Purnamasari, Dian (2015) ‘Penduduk Dan Pertumbuhan

Ekonomi: Sebuah Penjelasan Empiris Baru’,

Dipenegoro University Institutional Repository.

Available at: http://eprints.undip.ac.id/45748/

Astuti, Ismadiyanti Purwaning dan Fitri Juniwati

Ayuningtyas (2018) ‘Pengaruh Ekspor Dan Impor

Terhadap Pertumbuhan Ekonomi Di Indonesia’,

Jurnal Ekonomi dan Studi Pembangunan, 19(1), pp.

1-10. Available at: http://dx.doi.org/10.18196/jesp.

0.0.3836

Rahardja, Pratama (2008) Pengantar Ilmu Ekonomi

(Mikroekonomi Dan Makroekonomi), Edisi Ketiga.

Fakultas Ekonomi. Universitas Indonesia

Swaramarinda, Darma Rika (2011) ‘Pengaruh Pengeluran

Konsumsi Dan Investasi Pemerintah Terhadap

Pertumbuhan Ekonomi Di Indonesia’, Jurnal Ilmiah

Ekonosains, 9(2), pp. 95-105. Availlable at:

https://doi.org/10.21009/econosains.0092.01

Sukirno (2006) Makroekonomi: Teori Pengantar. Penerbit

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

600

Pt. Raja Grafindo Persada: Jakarta..

Todaro, Michael (2011) Pembangunan Ekonomi Dunia

Ketiga Erlangga: Jakarta.

Effects of Population, Consumption and Exports on Economic Growth in Indonesia Period of 2005-2017

601