Analysis of Influence of Population, Investment and Inflation on

Regional Taxes with Gross Regional Domestic Products as an

Intervening Variable: Case Study Districts and Cities in North

Sumatra Province

Zulaili

1

, Indra Maipita

1

and Muhammad Fitri Rahmadana

1

1

Faculty of Economics, Universitas Negeri Medan, Medan-Indonesia

Keywords: Regional Tax, GRDP, Population, Investment, Inflation.

Abstract: Regional tax is one source for increasing regional income, in 2016 the regional tax in North Sumatra

regencies and cities if averaged contribution of 6.14% to regional income means that the districts and cities

in North Sumatra are very dependent on the central government through funds balance to manage his own

household. This study aims to test and analyze simultaneously and partially the influence of population,

investment, and inflation on gross regional domestic products and the influence of population, investment,

and inflation on regional taxes with gross regional domestic products as intervening variables in districts

and cities in the province North Sumatra. This type of research is quantitative research using secondary

data. The research data used is panel data, with a population of 33 districts and cities in North Sumatra in

2013-2016. The method used is multiple regression and path analysis by adding intervening / mediating

variables with SPSS and AMOS program analysis tools. The results of simultaneous analysis that

population, investment, and inflation have a significant effect on Gross Regional Domestic Product and

population, investment and inflation have a significant effect on regional taxes through Gross Regional

Domestic Product in districts and cities in North Sumatra Province. Based on partial research that

population and inflation have a significant effect on Gross Regional Domestic Product and investment does

not affect the Gross Regional Domestic Product. Then the Gross Regional Domestic Product can mediate

the relationship between the population and inflation with regional taxes, while the Gross Regional

Domestic Product cannot mediate the investment relationship with regional taxes.

1 INTRODUCTION

Legislation No. 32 of 2003 which has been replaced

by law Number 23 of 2014 jo. Number 9 of 2015

concerning regional government and law Number 33

of 2004 concerning financial balance between the

central and regional governments, with the issuance

of the law, the regional government has been given

the authority to regulate its own regional household.

Each region certainly strives to fill the coffers of its

budget which has been set in the Regional Budget

(APBD), including from Regional Original Revenue

(PAD), which is one of the sources of the PAD in

the form of regional taxes.

In accordance with the government system that

applies in our country, taxes are managed by the

central government and regional governments.

Taxes managed by the central government are a

source of state revenues contained in the State

Revenue and Expenditure Budget (APBN), while

taxes managed by regional governments are a source

of regional revenue contained in the APBD. Based

on law Number 28 of 2009 concerning regional tax

and regional retribution, each for the type of tax has

been clearly stipulated regarding the subject of tax

and object tax and the tax rate that applies according

to the existing rules.

Law Number 33 of 2004 Fiscal Balance between

the Central and Regional Governments stipulates

that among regional financial receipts comes from

PAD which consists of several components of

income, namely tax returns, regional levies, regional

company yields, and regional wealth management

results after being separated from legal component

of taxes, levies and other regional income.

In an effort to finance increased expenditure, the

government can increase taxes and / or loans. Higher

586

Zulaili, ., Maipita, I. and Rahmadana, M.

Analysis of Influence of Population, Investment and Inflation on Regional Taxes with Gross Regional Domestic Products as an Intervening Variable: Case Study Districts and Cities in North

Sumatra Province.

DOI: 10.5220/0009508005860593

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 586-593

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

taxes will increase production costs and can reduce

private sector investment. The government

sometimes increases spending and investment in

unproductive projects or the government sometimes

mis-allocates resources and impedes economic

growth (Olulu et al, 2014). The following are data

regarding Regional Taxes in the Districts and Cities

throughout the North Sumatra region.

The overall contribution of regional tax to PAD

in 2016 can be seen as an average of 54.90%, down

0.66% from 2015, which is 55.56%, while we can

see the contribution of regional tax to income of

6.14%. This proves that the districts and cities in

North Sumatra are very dependent on the Balancing

Fund allocated from the central government to the

regional government. Of the entire regencies and

cities in North Sumatra province, only two regencies

and cities have contributed to regional income,

namely Deli Serdang district (10.70%) and Medan

city (26.99%), the rest of the value of local tax

contribution to regional income far below the

average, where the average distance of each region

should not be much different, even in North Nias

district only 0.42% of the influence of regional tax

on regional income can signify a low regional

capacity in terms of earning income from the sector

taxation to manage the household needs of the

region and only expect assistance from the central

government through a balance fund.

Then the following are submitted regional tax

ratios in the aggregate of provinces, districts and cities

throughout Indonesia, where data is sourced from the

Ministry of Finance (APBD processed 2016):

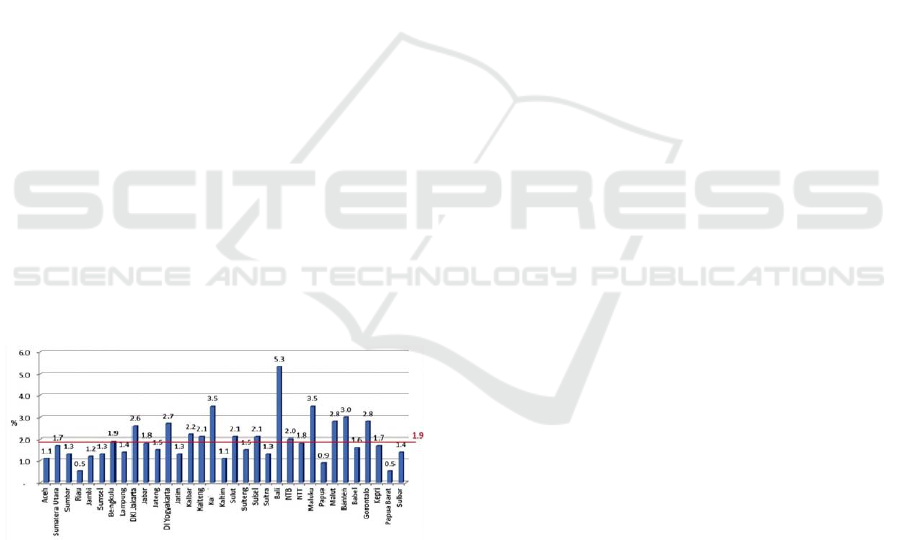

Figure 1: Aggregate Provincial, District and City Tax

Ratios.

Based on tax ratio data in all provinces, it can be

seen that the average national tax ratio is 1.9%.

Provinces that have a tax ratio above the national

average of 12 provinces as shown in the graph above.

While the average local tax ratio in North Sumatra

province is 1.7% below the national average of 0.2%.

We can conclude the low potential of resources that

can be extracted in North Sumatra. When compared

with the province of Bali, which is 5.3%, the province

of North Sumatra is very far behind while the tourism

potential in North Sumatra is no less great than the

province of Bali.

The total tax for districts and cities in North Sumatra

in 2013 amounted to Rp. 1,040,323,251,000 and for

2014 Rp. 1,545,439,089,000, this shows a significant

increase from 2013 to 2014, namely 67.3%. For 2015

the total regional tax for each district and city is Rp.

1,521,291,460,000 and in 2016 amounting to Rp.

1,920,935,230,000 an increase of 79.2%. While from

2014 to 2015 there was a decrease in the amount of

regional tax by 1.58%, this can be seen from the data

of districts and cities that experienced a decrease in

regional taxes from 2014 - 2015 namely South

Tapanuli, Labuhan Batu, Langkat, Tanjung Balai,

Binjai, and Padang Sidempuan.

The government is trying to increase PAD

through regional taxes. According to (Richard A.

Musgrave and Peggy B. Musgrave, 1993) the size of

the tax is largely determined by the GRDP, so the

GRDP has an effect on regional tax revenues. GRDP

values in districts and cities throughout North

Sumatra have increased from year to year, on the

other hand regional income cannot be separated

from national income in terms of concepts,

definitions, metology, scope and data sources. This

is intended to maintain the feasibility and

consistency of the results of calculations and

simplification in comparative studies and other

analyzes, so the 2000 base year used at the national

level has been simultaneously applied throughout

Indonesia from the provincial to the district level

which previously used the 1993 base year.

One of the factors that influence PAD is GDP

growth (Abdul Halim, 2001). According to Clark

and Lawson good GDP growth shows a good

condition of economic growth. Economic growth is

an increase in real per capita income that continues

to be sourced from within the region. By achieving

high economic growth and equal distribution of

income means that it can directly reduce poverty.

The higher the regional GDP directly the regional

tax increases, so that the revenue of PAD also

increases (Lintan Gupita Prasedyawati, 2013).

According to Robert Malthus, the consequence of

a continuous increase in population is the demand for

food is increasing (Adisasmita, 2005). Not only food

needs, a large population also requires greater

infrastructure and public infrastructure. North

Sumatra Province is ranked fourth in the province

which has the largest population in Indonesia. The

development of the population will affect government

spending, if the development of the population

increases, the bigger budget will be needed.

Analysis of Influence of Population, Investment and Inflation on Regional Taxes with Gross Regional Domestic Products as an Intervening

Variable: Case Study Districts and Cities in North Sumatra Province

587

With the increase in population and GDP per

capita, it causes an increase in people's purchasing

power. With the increase in people's purchasing

power, regional income from the Tax sector has also

increased. The economic development of a region is

determined by the ability of the region to finance all

program activities that it has planned. In order to

implement the program, the regions need sufficient

funding, which is one of the dominant contributors

to fulfilling regional funding through regional taxes.

Efforts to increase regional taxes are by

increasing the welfare of the people in their

respective regions, through increasing investment,

increasing GDP, and stabilizing the pace of inflation.

With the increase in people's welfare, it is expected

that the ability and awareness of the community to

pay taxes will be carried out well.

The relationship of population, investment and

inflation to local taxes has been widely investigated.

In the Helti K A (2010) study in the analysis of

factors that influence local taxation and the level of

efficiency and effectiveness of collection stated that

among the variables of inflation, population, and GDP

that most affected local tax revenues was the

population. Whereas according to Muchtolifah (2011)

in the effect of GDP, inflation, industrial investment

and labor on PAD stated that simultaneously and

partially the GDP variable, inflation, industry

investment and labor have an effect on PAD, the

dominant variable affecting is GRDP.

2 THEORETICAL FRAMEWORK

2.1 Local Tax

Regional Tax according is compulsory contributions

made by individuals or entities to the regions

without balanced direct compensation, which can be

imposed based on applicable laws and regulations,

which are used to finance regional government and

regional development. Regional taxes have a dual

role, namely as a source of regional income

(budgetary) and as a regulator (regulator).

Theories that support tax collection According to

Aristanti Widyaningsih (2011: 11-12) the tax

collection theory provides an explanation of the

state's right to collect taxes. These theories are

among others:

Pikul Power Theory, The tax burden must be

paid must be adjusted to the capacity of each person.

To measure load power two approaches can be used:

• Objective elements, seen from the amount of

income and wealth a person has.

• Subjective elements, taking into account the

magnitude of material needs that must be met.

Devotional Theory, The basis of the fairness of

taxation lies in the relations between the people and

their country. As dedicated citizens, the people must

always realize that paying taxes is an obligation.

Theory of Purchasing Power Principles, The basis of

justice lies in the tax collection. It means collecting

taxes means attracting purchasing power from

community households for state households.

Furthermore, the state will channel back to the

community in the form of maintaining community

welfare. Thus the interests of the whole community

are preferred.

2.2 Total Population

The population of Indonesia in 2016 reached 262

million with the assumption of a development of

1.49% (World Bank Data) of the population issued

by the 2016 Central Bureau of Statistics. Meanwhile

for the population according to BPS data for the

North Sumatra region it reached 4, 26 million, if the

population in North Sumatra is set at 5.6% of the

total population of Indonesia.

Adam Smith's Theory, Adam Smith argues that

supported by empirical evidence that high

population growth will be able to increase output

through increasing levels and expanding markets

both domestic and foreign markets. The addition of

high population accompanied by technological

changes will encourage savings and also use

economies of scale in production. Population

addition is one thing that is needed and is not a

problem, but as an important element that can spur

development and economic growth. The amount of

income can affect the population. If the population

increases, the income that can be withdrawn also

increases. The greater the number of residents will

lead to increased demand for consumer goods, then

will encourage the economy of scale in production,

so that it will reduce production costs, and ultimately

will affect Regional Original Income. With the

tendency of population growth in turn, it will

increase Regional Original Income (Sukirno, 2003).

Population is an important element in economic

activity and in an effort to build an economy.

Increasingly fast population growth has made the

proportion of the immature population to be higher

and the number of family members increases. With

the increasing population, it means that more goods

and services are needed to meet the needs of the

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

588

population who can increase the amount of

consumption, so that it can increase the per capita

income of the region.

2.3 Investments

Investment can be interpreted as spending or

expenditure on investors or companies to buy capital

goods and production equipment to increase the

ability to produce goods and services available in the

economy (Sukirno, 2006). Harrod-Domar Theory

Expressing that the model of economic growth is a

development of Keynesian theory. The theory

focuses on the role of savings and industry is very

decisive in regional economic growth (Arsyad,

1997). Some of the assumptions used in this theory

are that: The economy is in full employment and

capital goods in the community are fully utilized, In

the economy of two sectors (Households and

Companies) means the government sector and trade

do not exist, The amount of community savings is

proportional to the amount of national income,

meaning the savings function starts from the original

point (zero), The tendency to save (Marginal

Propensity to Save = MPS) is fixed, as well as the

ratio between capital and output (Capital Output

Ratio = COR) and capital-output ratio (Incremental

Capital Output), This theory has weaknesses,

namely saving trends and capital-output increase

ratios in reality are always changing in the long run.

Similarly, the proportion of labor and capital use is

not constant, prices are always changing and interest

rates can change and will affect investment. In the

endogenous growth model it is said that the

investment returns will be higher if the aggregate

production in a country gets bigger. It is assumed

that private and public investment in the field of

resources or human capital can create an external

economy (positive externalities) and spur

productivity that is able to compensate for the

scientific tendency to decrease the scale of yield.

An interesting implication of this theory is being

able to explain the potential benefits of

complementary investment in capital or human

resources, infrastructure facilities or research

activities. Given that complementary investments will

generate personal and social benefits, the government

has the opportunity to improve the efficiency of

domestic resource allocation by providing various

types of public goods (infrastructure facilities) or

actively encouraging private investment in

technology-intensive industries where human

resources are accumulated. Thus this model

encourages active government participation in

managing investment both directly and indirectly.

In Indonesia, investment or investment can be

classified into two parts, namely: Domestic

Investment (PMDN) and Foreign Investment (PMA).

2.4 Inflation

Increase the price of just one or two items not called

inflation, unless the increase extends to a large part

of the price of other items.

Keynesian Theory, Inflation occurs because a

society wants to live beyond the limits of its

economic capacity. The inflation process, according

to this view, is nothing but the process of seizing

part of sustenance among social groups who want a

greater share of what the community can provide.

The process of this struggle finally translates into a

situation where people's demand for goods always

exceeds the amount of goods available (the

inflationary gap). According to Irving Fisher in

Sadono Sukirno's book (2002: 25), the increase in

general prices or inflation (P) is caused by three

factors, namely the money supply (M), the velocity

of money circulation (V), and the amount of goods

traded (T). According to him inflation is the process

of raising prices of general goods that apply in the

economy. This does not mean that the prices of

various items rise by the same percentage. The

important thing is that there is a continuous increase

in the general prices of goods for a certain period.

The increase that occurs only once (although with a

large enough percentage) is not inflation.

Calculating Inflation Rate

GNP Deflator = (nominal GNP: real GNP) 100%

2.5 Gross Regional Domestic Product

(GRDP)

According to (Sadono Sukirno, 2004) GDP is the

value of all goods and services produced within one

year in a certain area without distinguishing

ownership of production factors, but more requires

the existence of production factors used in the

production process, GDP is one of reflection

economic progress of a region. The increase in GDP

will cause regional income from the tax and levy

sector to increase. This has an impact on increasing

PAD in the area.

2.6 Effect of Gross Regional Domestic

Product on PAD

Gross Regional Domestic Products can be

interpreted as the value of goods and services

Analysis of Influence of Population, Investment and Inflation on Regional Taxes with Gross Regional Domestic Products as an Intervening

Variable: Case Study Districts and Cities in North Sumatra Province

589

produced in that country in a given year. These

goods and services are produced not only by

companies belonging to the population of the

country but by residents of other countries who

reside in that country (Sukirno, 2003).

The higher a person's income, the higher the

ability of people to pay various levies set by the

government. In the macro concept, it can be

analogized that the greater the GRDP obtained, the

greater the potential for regional revenue.

3 RESEARCH METHOD

This study uses secondary data in the form of time

series during the years 2013-2016. The location of

this study is 33 (thirty three) regencies and cities in

North Sumatra Province The scope of this research

was carried out by focusing on the discussion of the

influence of population, investment, and inflation

and regional taxes on GRDP in districts and cities in

North Sumatra Province 2013-2016 .

Types and Data Sources of Research, This type of

research is quantitative research, which is research

that uses scientific methods that have criteria based on

facts, use principles of analysis, use hypotheses, use

objective measures, and use quantitative data. In

collecting data and information needed for research,

the data used is secondary data of City District in

North Sumatra province in 2013-2016.

Quantitative research tests the comparative

causal relationship of measured (parametric)

research variables. Comparative causal research is

research that compares causal relationships between

two or more variables in different time periods. This

study aims to analyze the direct and indirect effects

of independent variables on the dependent variable

through an intermediate variable with a path analysis

approach. This study uses statistics programs help

SPSS and AMOS.

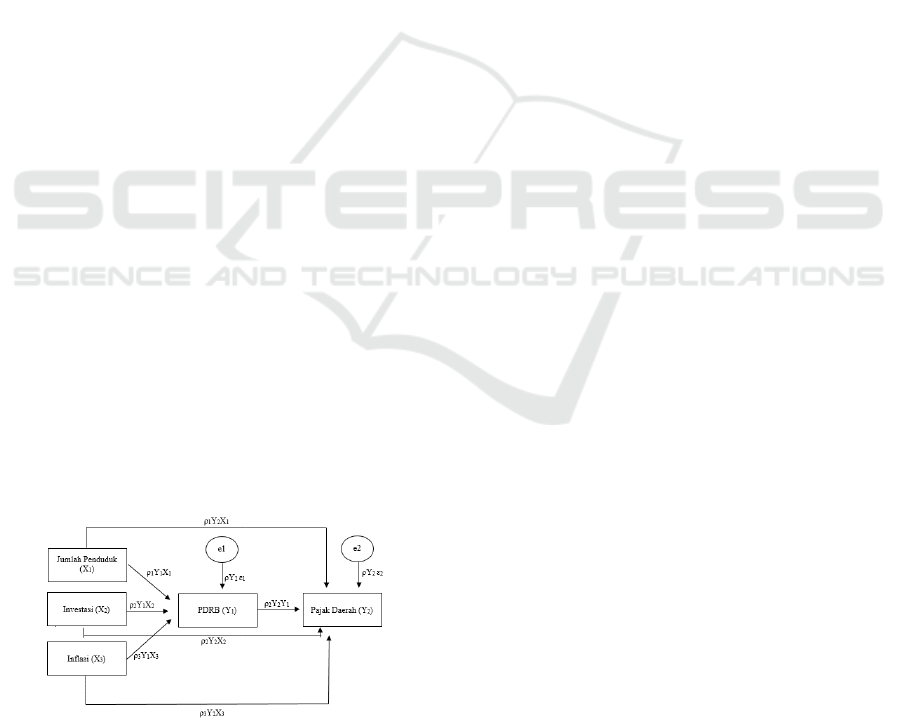

Figure 2: Path Analysis Approach.

4 ANALYSIS

Multiple linear regression models (multiple

regression analysis) can be called a good model if

the model meets the assumptions called classical

assumptions.

The first thing to do is to examine whether the

data is stationary or not. This Stasioneritas test needs

to be done because a regression analysis should not

be did when the data used is not stationary and

normally if it still done the resulting equations then

are a spurious regression.

4.1 The Results of the Analysis of the

Influence of Population,

Investment, Inflation on GRDP

Simultaneously and Partially

4.1.1 Simultaneous Statistical Test (F)

The probability value is 0,000. When compared with

the significance value of the test results against α =

0.05, then 0,000 < 0.05. That is, H0 is rejected

means, there is an influence of population,

investment, and inflation on GRDP simultaneously

at a confidence level of 95%.

4.1.2 Partial statistical test (t)

The t statistic test is done by comparing the

significance values smaller than α = 0.05. Can see

the results of testing the statistics t (partial test) on

the population, investment, inflation, against GRDP

described as follows. Variable number of population

has a coefficient number of 0.921 with a significance

value of 0.000 smaller than α = 0.05. This means

that partially the population variable has a

significant positive effect on the GRDP variable.

The investment variable has a coefficient number

of -0.023 with a significance value of 0.447 greater

than α = 0.05. That is, partially the investment

variable has a negative and not significant effect on

the GRDP variable. The inflation variable has a

coefficient number of 0.175 with a significance

value of 0.000 smaller than α = 0.05. That is,

partially the inflation variable has a significant

positive effect on the local tax variable.

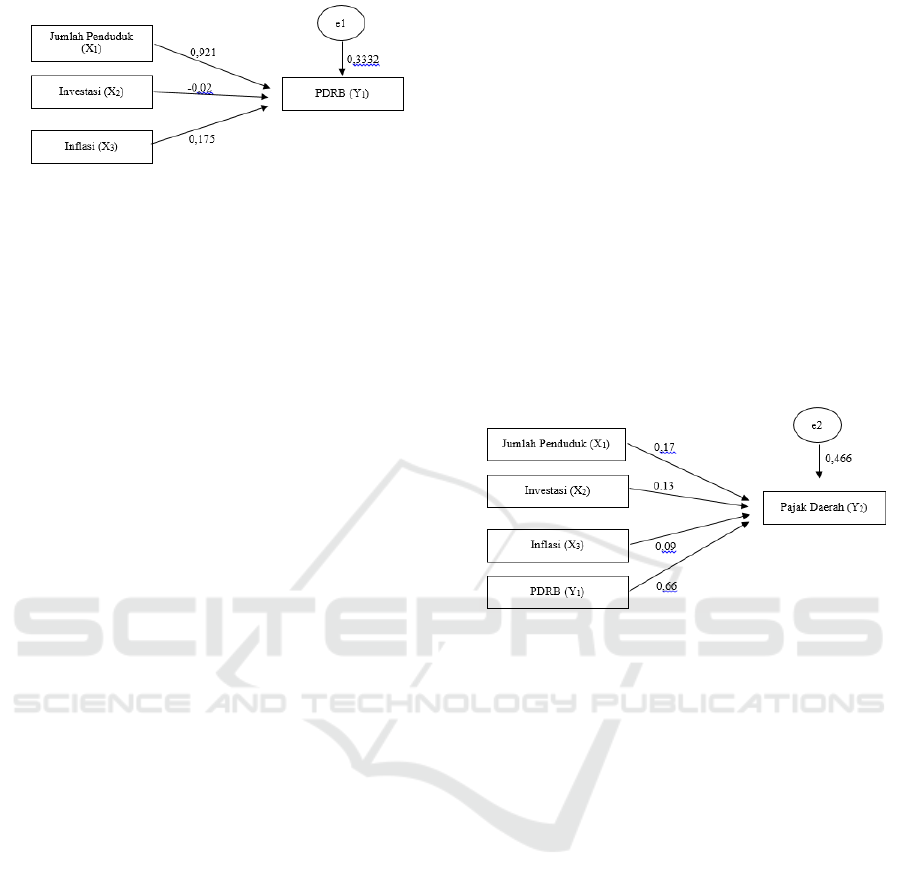

The path diagram is then made, then broken into

sub-sectors so that the structure of the path analysis

can be described as follows:

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

590

Figure 3: Analysis of Path Sub-sector 1.

Y1 = α1X1 + α2X2 + α3X3 + ε1

Y1 = 0.921X1 - 0.023X2 + 0.175X3 + 0.3332

Where :

ε1 = √ 1-R2 = √ 1 - 0.889 = √ 0.111 = 0.3332

R2 value of the hypothesis of the influence of

population, investment, inflation on GDP

simultaneously and partially in Table 4.9 is 0.889,

which means the coefficient of determination of the

contribution of independent variables to GDP in the

percentage of 88.9% (0.889 x 100%). This means

that 88.9% of the contribution of GRDP variables in

districts and cities in North Sumatra is explained by

population, investment, and inflation, while 11.1% is

explained by other variables.

4.2 The Results of the Analysis of the

Direct Effect of Population,

Investment, Inflation, and GDP on

Regional Taxes

The estimation of the effect of population,

investment, and inflation on local taxes with GDP is

an intervening variable.

4.2.1 Simultaneous statistical test (F)

That the probability value is 0,000. When compared

with the significance value of the test results against

α = 0.05, then 0,000 <0.05. That is, H0 is rejected,

meaning that there is an influence of population,

investment, and inflation on local taxes with GDP as

an intervening variable simultaneously at a 95%

confidence level.

4.2.2 Partial Statistical Test (t)

The t statistic test is done by comparing the

significance values smaller than α = 0.05. From the

results of table 4.13 above, we can see the results of

testing the statistics t (partial test) on the population,

investment, inflation, against GRDP described as

follows.

Variable number of population has a coefficient

number of 0.171 with a significance value of 0.165

greater than α = 0.05. That is, partially variable

population number has a positive and insignificant

effect on regional tax variables. The investment

variable has a coefficient number of 0.130 with a

significance value of 0.003 smaller than α = 0.05.

That is, partially the investment variable has a

significant positive effect on the local tax variable.

The inflation variable has a coefficient

number of 0.094 with a significance value of 0.048

smaller than α = 0.05. That is, partially the inflation

variable has a significant positive effect on the local

tax variable.

GRDP variable has a coefficient number of

0.663 with a significance value of 0.000 smaller than

α = 0.05. That is, partially the GRDP variable has a

significant positive effect on the regional tax

variable. This can be shown in sub-sector 2 below:

Figure 4: Analysis of Path Sub-sector 2.

From the picture of sub-sector 2 the path equation

can be made as follows:

Y2 = ߚ1X1 + ߚ2X2 + ߚ3X3 + ߚ4Y1 + ε2

Y2 = 0.171X1 + 0,130X2 + 0,094X3 + 0,663Y1 +

0,466

Where :

ε2 = √ 1-R2 = √ 1 - 0.783 = √ 0.217 = 0.466

The value of R2 of the second hypothesis of

0.783. That is, the coefficient of determination from

the contribution of independent variables to the

dependent variable is 78.3% (0.783 x 100%). That

is, 78.3% of local taxes are influenced by variables

of population, investment, inflation, and GDP, the

other 21.7% are influenced by other variables.

4.3 The Results of the Analysis of the

Influence of Population,

Investment, and Inflation on Local

Taxes with GDP as an Intervening

Variable

The testing of the hypothesis used is by conducting a

path analysis approach between the independent

Analysis of Influence of Population, Investment and Inflation on Regional Taxes with Gross Regional Domestic Products as an Intervening

Variable: Case Study Districts and Cities in North Sumatra Province

591

variables of population, investment, and inflation on

the dependent variable of regional tax with GDP as

an intervening variable. The applications used in this

path analysis are SPSS and AMOS.

Figure 5: Standardized Estimate Path Analysis.

5 RESULTS

The influence of one independent variable (X) on

the dependent variable (Y), both directly and

indirectly, is as follows:

5.1 Effect of Population, Investment

and Inflation on GDP

Simultaneously and Partially

The results of multiple regression analysis of

variable population, investment, and inflation on

GDP simultaneously are concluded that there is an

influence of population, investment, and inflation on

GDP in the districts and cities of North Sumatra as

evidenced by conducting simultaneous testing with a

significance value of 0,000 <0,05 and there is a

simultaneous influence of population, investment,

and inflation on local taxes with GDP as an

intervening variable with a significance value of

0,000 <0,05.

The results of testing the variable population

number on GDP shows a significance value of 0,000

<0,05, with a coefficient of 0.921, meaning that the

population has a significant positive effect on

GRDP. It can be concluded that population is one of

the factors to increase GRDP in regencies and cities

in North Sumatra Province, the increasing number of

population will also increase GDP. This is a reality

that if the population is managed properly, namely

by providing skills and improving education, the

number of residents will be a strength and will

contribute to the development process in this case

the GDP will increase.

Testing of investment variables against GRDP

with a significance value of 0.447> 0.05, with a

coefficient value of -0.762, meaning that investment

has a negative effect that is not significant or does

not affect GDP. The fact should be that with the

increase in investment, the GRDP will also increase,

because with the increase in investment,

employment and labor will increase, with increasing

employment, the income of each per capita will

increase, which will increase GRDP.

The test results of the inflation variable have a

significant positive effect on GDP, this is evidenced

by the significance value of 0.000 <0.05, with a

coefficient of 0.175. Inflation is one of the important

economic indicators that can provide information

about the development of prices of goods and

services paid by consumers. The annual GRDP

increases along with inflation fluctuations due to

economic growth, therefore with increasing inflation

it will also increase GDP in the districts and cities of

North Sumatra Province.

5.2 Effect of Population, Investment,

Inflation, and GDP on Regional

Taxes

The population based on the results of the study

shows that the significance value is 0.165> 0.05 with

direct coefficient of 0.17, meaning that the

population has a positive and insignificant effect on

local taxes in regencies and cities in North Sumatra

Province, whereas if you see the effect of the

population on taxes the area through GRDP has a

significance value of 0,000 <0,05, meaning that if

through GRDP, the total population has a significant

effect on local taxes, with the indirect coefficient

value of 0,607 and the total influence is positive

0,78.

Thus, if you look at the effect of population

numbers on local taxes, this study is contrary to Tax

is one of the important factors for investors in

determining the decision to invest in a country. In

theory, taxes affect investment decisions as long as

the tax imposition affects the amount of costs and

profits obtained by investors, so from this it can be

concluded that in the districts and cities in North

Sumatra Province the rate of regional tax imposition

on investors is still low so investors invest their

assets in the district and cities in North Sumatra

Province.

Analysis of the effect of inflation on district and

municipal taxes in North Sumatra concluded that

there was a significant positive effect of inflation on

local taxes with a significance value of 0.048 <0.05.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

592

Then if through GRDP, inflation has a significant

positive effect on district taxes and the city of North

Sumatra with a significance value of 0,000 <0,05,

with indirect values of 0,119 and total influence of

0,21.

The influence of GRDP on regional taxes in

aggregate has a significant positive effect because

the significance value is 0,000 <0,05 with a

coefficient of 0,663.

6 CONCLUSIONS

Population, investment, and inflation simultaneously

influence the GRDP of regencies and cities in North

Sumatra Province for the period of 2013 - 2016.

Partially the population and inflation have a

significant positive effect on GRDP, and investment

has a negative or insignificant effect or no effect on

GDP in regencies and cities in North Sumatra

Province for the period of 2013-2016.

The population, investment, inflation, and

GRDP have a positive direct effect on local taxes in

regencies and cities in North Sumatra Province for

the period of 2013-2016.

Variables for population, investment, and

inflation affect regional taxes with GRDP as an

intervening variable in districts and cities in the

North Sumatra Province for the period of 2013 -

2016. GRDP is not an intervening variable (unable

to mediate) on investment relations with local taxes.

GDP is an intervening variable (able to mediate) the

relationship between population, and inflation with

regional taxes.

REFERENCES

Abdul, Halim. (2001). Manajemen Keuangan Daerah.

Bunga Rampai, UPP-AMP YKPN. Yogyakarta.

Adisasmita, H.Rahardjo. (2005). Dasar- Dasar Ekonomi

Wilayah. Yogyakarta : Penerbit Graha Ilmu.

Aristanti Widyaningsih. (2011), Hukum Pajak Daerah

Perpajakan. Bandung.

Helti, K A. (2010). “Analisis Faktor-Faktor yang

Mempengaruhi Pajak Daerah serta Tingkat Efisiensi

dan Efektivitas Dalam Pemungutan” Fakultas

Ekonomi Universitas Sebelas Maret. Surakarta.

Jaka, Sriyana. (1999). Hubungan Keuangan Pusat -

Daerah. Jurnal Ekonomi Pembangunan. Vol. 4 No.1

Hal 312-323.

Kono, Paula A. (2011). “Hubungan Belanja Modal dan

Pendapatan Perkapita terhadap Pajak dan Retribusi

Daerah Kabupaten di Provinsi di Nusa Tenggara

Timur”. Electronic Thesis and Dissertation UGM.

Yogyakarta.

Lintan G, Prasedyawati, (2013). “Analisis Penerimaan

Pajak Reklame di Kota Semarang Tahun 1990 –

2011”. Fakultas Ekonomi dan Bisnis Universitas

Dipenogoro. Semarang.

Olulu, R. M., Erhieyovwe, E. K., & Andrew, U. (2014).

“Government Expenditures and Economic Growth:

The Nigerian Experience”. Mediterranean Journal of

Social Sciences, 5(10), 89–94.

Richard A, Musgrave, dan Peggy B. Musgrave. (1993).

Keuangan Negara Dalam Teori dan Praktek, Penerbit

Erlangga, Jakarta.

Analysis of Influence of Population, Investment and Inflation on Regional Taxes with Gross Regional Domestic Products as an Intervening

Variable: Case Study Districts and Cities in North Sumatra Province

593