The Effect of Firm Size, Sales, Age of Receivables on Financial

Performance at Automotive Companies Listed at the Indonesian

Stock Exchange

Thomas Sumarsan Goh

1

and Melanthon Rumapea

1

1

Accounting Department, Economics Faculty, Universitas Methodist Indonesia, Medan - Indonesia

Keywords: Firm Size, Sales, Age Of Receivables, Financial Performance

Abstract: The global financial crisis that lasted until early 2010 and the trade war between China and United Stated of

America have brought the effect to the slow down of Indonesian economic. The research aims at studying

the effect of firm size, sales, age of accounts receivables on financial performance at the automotive

companies that have been listing at the Indonesian stock exchange, partially and simultaneously. This study

has used descriptive method. The study has used time series data of the period of 2014-2017 which is

expressed in yearly data. The analysis tool of the study is Multiple Regression Analysis. The results showed

that simultaneously and partially, firm size, sales, age of accounts receivables have significantly effected the

financial performance of the automotive companies. The result of the coefficient of determination was 98,8

percent. The remaining 1.2% has been effected by other factors that have not been included in this study.

1 INTRODUCTION

The objective of the firm is to make profit and to

increase the wealth of the shareholders. The

managers try to optimize the use of the resources of

the company by planning, implementing and

controlling the operation of the company. The task

of the managers in finance is to manage the assets of

the company, to select the best funding option for

the company and to invest the asset of the company.

The company can improve the performance through

the good management in the accounts receivables.

One of the tools to manage the accounts receivables

is to generate the ageing of receivables schedule.

The ageing of receivables can give the information

about the long overdue debt, so that the company

can make an intensive collection from the

companies. If the companies can reduce the bad debt

collection, then the companies can increase the

financial performance.

The second factor to increase the financial

performance in this research is the sales. If the

companies can increase the sales of the company,

while the expenses are stable, therefore the

companies can increase their performance generally,

and their financial performance specifically.

However, on the other circumstances, the increase in

sales, can decrease the profit of the company. This

can happen if the company’s sales are in credit, and

the bad debt is increase too. Today, the world has

been facing with the trade war between China and

United States. The trade war between these super

power countries have brought impact to other

countries in terms of currency fluctuation, sales,

interest rates, competition and other factors. Sales of

the companies have also been influenced by the

global recession due to the property sector in the

United States then the recession have spread to other

countries, such as Greek, Argentina and Turkey.

The financial performance is assumed to be

influenced by the size of the companies. The bigger

the company therefore the better of the company’s

financial performance will be. However, if the big

companies do not manage their resources well, then

the companies can not compete and at the end, the

companies will be smaller and smaller and go

bankrupt.

Based on the above background, therefore the

title of this study is The Effect of Firm Size, Sales,

Age of Receivables on Financial Performance at

Automotive Companies Listed at The Indonesian

Stock Exchange.

Goh, T. and Rumapea, M.

The Effect of Firm Size, Sales, Age of Receivables on Financial Performance at Automotive Companies Listed at the Indonesian Stock Exchange.

DOI: 10.5220/0009507111491153

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1149-1153

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1149

This research has been limited to the firm size,

sales, age of receivables, financial performance at

the automotive companies listed at the Indonesian

Stock Exchange at the period of 2014 until 2017.

Based on the background and the limitation of the

research, therefore, the researcher determines the

problem formulation as the following: have the firm

size, sales and age of receivables effected the

financial performance simultaneously and partially

at the automotive companies listed at the Indonesian

Stock Exchange?

The objective of this study is to know the effect

of firm size, sales, and age of receivables on

financial performance at the automotive companies

listed at the Indonesian Stock Exchange at the period

of 2014 until 2017.

2 THEORICAL FRAMEWORK

Financial statement is made up of the statement of

financial position, comprehensive income statement,

statement of changes in equity, cash flow statement

and notes to financial statement (Sumarsan, 2018).

The users of financial statement are the internal of

the companies and the external of the companies.

The internal users consist of the management and

the employees, whereby the external users consist of

the customers, the suppliers, the creditors, the

investors, the governments and other external

parties.

A good financial system is one that efficiently

takes money from savers and gets it to the

individuals who can best put that money to use

(Keown, 2014).

According to Keown (2014) an income statement

or profit and loss statement indicates the amount of

profits generated by a firm over a given time period,

such as 1 year. Profit equals to sales minus expenses.

The income statement starts with sales then substract

the cost of goods sold to get gross profits (Kieso,

2008). Then, gross profits deduct the operating

expenses to determine the operating profit or earning

before interest and taxes (EBIT). After that, the

EBIT substract the interest and taxes to get net

income or earning after tax (EAT). The figure of

EAT represents the earning available for the

shareholders, which means the profit that may be

reinvested in the company or distributed to its

owners, if the net cash is available. The distribution

of profit to the shareholders are known as dividend.

Income statement gererally starts with sales

(Brigham, 2015). The company tries to increase its

sales in many ways. A sales strategy is designed to

execute an organization’s marketing strategy for

individual accounts (Ingram, 2006). A firm’s sales

strategy is important for two basic reasons. First, it

has a major impact on a firm’s sales and profit

performance (Ingram, 2006). Second, it influences

many other sales management decisions. The new

sales person should focus on understanding how the

sales process works in the company so that they can

better balance the time across different sales efforts.

According to Suwito and Herawaty (2005),

public companies listed on the Indonesian Stock

Exchange can be categorized into 3 (three) large

groups, namely large companies, medium companies

and small companies. Determination of the size of

the company is based on total assets of the company

or the sales of the company or the stock market

value.

The size of a company is the size of the

company's capacity which is valued from the assets

it has. The greater the assets of a company, it can be

said that the larger the size of the company

(Sutrisno, 2003).

The size of the company in this study is

projected by the average of the total assets. The

greater the total assets owned by the company, the

larger the size of the company.

Receivables are amounts owed to the entity and

can take two basic forms, which are accounts

receivable and notes receivable (Griffin, 2009).

Receivables are usually a significant portion of the

total current assets (Warren, 2014). In order to

increase the sales of the company, therefore the

company will offer installment sales, credit sales and

leasing. The accounts receivable arises from the

credit sales of goods or services. The company

should do the evaluation of 5Cs for its customers.

The five Cs consist of character, capacity, collateral,

capital of the customer and the economic condition.

The collateral of the customer can be the bank

guarantee, of which the amounts is based on the

company’s request. The company tries to minimize

the bad debt. One of the tools to reduce the bad debt

of the company is preparing an age of accounts

receivable reports. Company can use the schedule of

the ageing of receivables to confirm the number of

the customers’ receivables and to make plan to

collect the companies’ debt faster. The receivables

collection period is the average length of time

required to convert a firm’s receivables into cash. It

is calculated by dividing accounts receivable by

sales per day (Brigham, 2016).

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1150

3 RESEARCH METHOD

This study has used descriptive method. The

population of this study are the automotive

companies that have been listed at the Indonesian

Stock Exchange and have submitted their audited

financial statements for the period of 2014 until

2017 to the Indonesian Stock Exchange. This

research has used a non probability sampling, using

purposive sampling technique. The purposive

sampling method have the following criteria: the

automotive companies are listing at the Indonesian

Stock Exchange for the period of 2014 until 2017,

the companies have published their audited financial

statements; and the denominators of the statements

are in Indonesian Rupiah (IDR).

Based on the above criteria, therefore there are

12 automotive companies for the sample. The

samples are PT. Astra Internasional Tbk, PT. Astra

Otoparts Tbk, PT. Indo Kordsa Tbk, PT. Good Year

Indonesia Tbk, PT. Indomobil Sukses Internasional

Tbk, PT. Indospring Tbk, PT. Multi Prima Sejahtera

Tbk, PT. Multistrada Arah Sarana Tbk, PT. Nipress

Tbk, PT. Prima Alloy Steel Universal Tbk dan PT.

Selamat Sempurna Tbk.

Data collection method is documentary method

by gathering literatures, journals, and audited

financial statements.

Data analysis method in this study is multiple

regression analysis (Lindstrom, 2015). The analysis

has used SPSS.

The independent variable is the explanatory

variable and the dependent variable is the explained

variable (Gujarati, 2009). The independent variables

in this study are firm size, sales and age of accounts

receivables. The firm size has been used the average

of total assets. The dependent variable is financial

performance, which is the profit..

4 ANALYSIS

The data has been processed with SPSS.

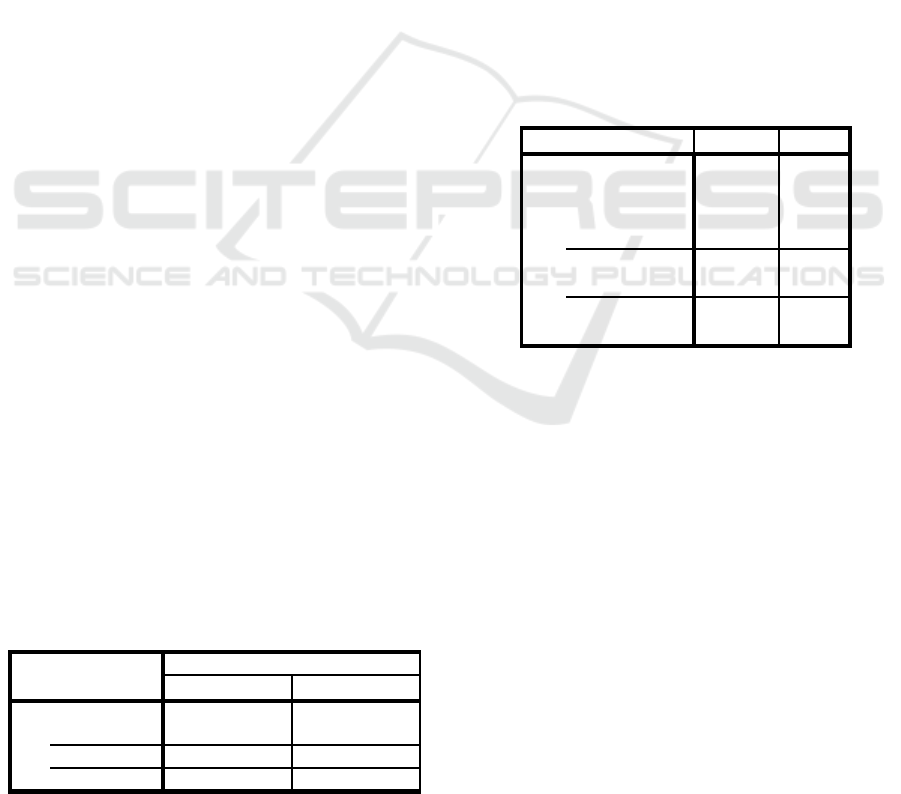

Table 1: The Analysis Result of Coefficient of

Multiple Linear Regression

Model

Unstandardized Coefficients

B Std. Error

1 (Constant) -595694 187354

TotAsset -,077 ,009

Sales ,167 ,012

Age_Rec 6737 2678

Source: Data Processed, 2018

Based on table 1, the regression model is as the

following:

Profit = -595694 – 0,077 TotAssets + 0,167

Sales

+ 6737 Age_Rec

The above regression model has shown that:

a. The constant value of -595694 shows that if the

independent variables are constant, therefore the

profit will decrease as much as 595694 unit.

b. The coefficient of firm size is -0.077. The

negative sign shows that if the firm size

increased by 1% then the profit will decrease

0.077 (0.77%).

c. The coefficient of sales is 0.167. The positive

sign shows that if the sales increased by 1%

then the profit will increase 0.167 (16.7%).

d. The coefficient of age of receivables is 6737.

The positive sign shows that if the age of

receivables increased by 1% then the profit will

increase 6737.

Table 2: Coefficient of Partially Test

Model t Sig.

1 (Constant) -

3,180

,00

3

TotAsset -

8,666

,00

0

Sales 14,4

96

,00

0

Age_Rec 2,51

5

,01

6

Source: Data Processed, 2018

Based on table 2, the tcount of firm size is -8.666

with the significant error of 0.000. The ttable of firm

size is 2.01537. So, it can be concluded that

partially, firm size has effected the financial

performance negatively and significantly. This has

indicated that the larger the size of the company then

the lower the profitability of the firm. The manager

of the company should manage the total assets of the

company efficiently and effectively. The manager

should use the total assets of the company optimally,

and he should decide whether the assets to use for

the operation of the company, or to invest the assets

to generate income from them. Finance manager can

invest the idle assets in terms of buying share of

other companies in order to get dividends and capital

gain or buying government bonds in order to

generate interest income.

The tcount of sales is 14.496 with the significant

error of 0.000. The ttable of sales is 2.01537. So, it

The Effect of Firm Size, Sales, Age of Receivables on Financial Performance at Automotive Companies Listed at the Indonesian Stock

Exchange

1151

can be concluded that partially, sales has effected the

financial performance positively and significantly.

This has indicated that the bigger the sales of the

company then the higher the profitability of the firm

is. The management of the companies should

manage to increase the sales because the growth of

sales can increase the profit of the firm.

The tcount of age of accounts receivable is 2.515

with the significant error of 0.016. The ttable of age

of accounts receivable is 2.01537. So, it can be

concluded that partially, age of accounts receivable

has effected the financial performance positively and

significantly. This has indicated that the

improvement in the age of the accounts receivable of

the company then the higher the profitability of the

firm will be. The company tries to shorter the age of

accounts receivable, which means the bad debt

becomes smaller or there is no bad debt in the

company, and the result is the profit of the firm

becomes higher.

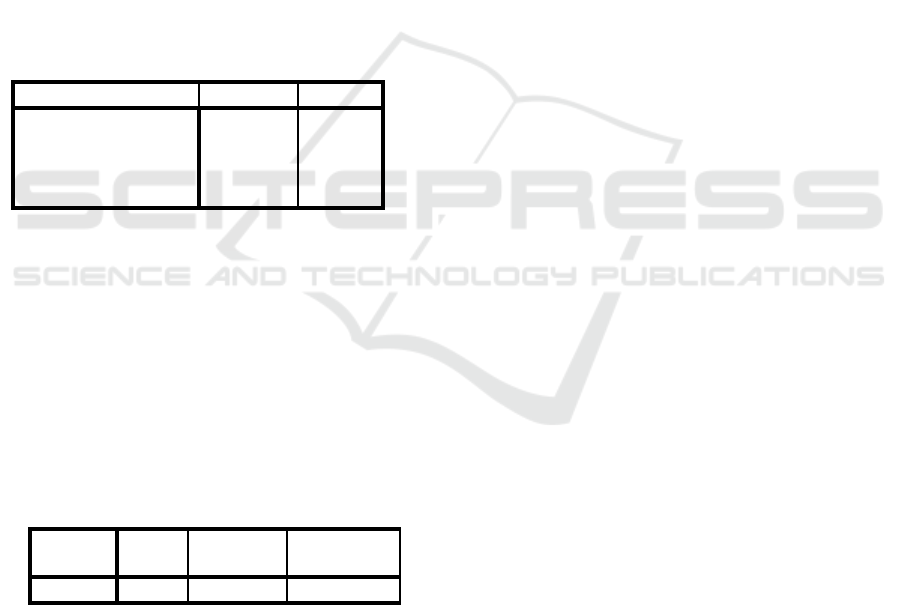

Table 3: The Simultaneous Test, ANOVA

Model F Sig.

1 Regression 1219,8

7

,000

b

Residual

Total

a. Dependent Variable: Profit

b. Predictors: (Constant), TotAsset, Sales, Age_Rec

Based on table 3, the Fcount of the model is 1219.87

with the significant error of 0.000. The Ftable is

2.61. So, it can be concluded that simultaneously,

firm size, sales and age of accounts receivable have

effected the financial performance positively and

significantly. This has indicated that the total assets,

sales and the age of accounts receivables of the

company have influenced the profitability of the

firm.

Table 4: The Determination Coefficient

Model R R Square

Adjusted

R Square

1 ,994

a

,988 ,987

Source: Data processed, 2018

Based on table 4, the coefficient of determination

has shown that the R Square is 0.988 or 98.8%. This

has been indicated that the firm size, sales and age of

accounts receivables had effected the profit of the

firm as much as 98.8%, the remaing 1.2% has been

effected by other factors that have not been included

in this study. The other factor such as liquidity,

dividend payout ratio, net working capital and other

factors.

5 RESULTS

The results of the study are

a. Firm size has effected the firm’s profit

negatively and significantly. This has indicated

that the larger the size of the company then the

lower the profitability of the firm. The result has

been supported by Isik (2017) that the size of

the company has effected the profitability of the

firm.

b. Sales has effected the financial performance

positively and significantly. The result has been

in accordance with the statement from Ingram

(2006) that there is a major impact on a firm’s

sales and profit performance.

c. The age of accounts receivable has effected the

financial performance positively and

significantly. This has shown that the company

has managed the accounts receivables well then

it will increase the financial performance of the

company, through higher profit.

d. The coefficient of determination has shown that

the R Square is 0.988 or 98.8%, which means

that the firm size, sales and age of accounts

receivables had effected the profit of the firm as

much as 98.8%, the remaing 1.2% has been

effected by other factors that have not been

included in this study.

6 CONCLUSIONS

Based on the above analysis and results, then it can

be concluded that simultaneously firm size, sales

and age of receivables have effected the financial

performance positively and significantly. Partially,

firm size has effected the firm’s profit negatively

and significantly. Partially, sales and age of accounts

receivable have effected the financial performance

positively and significantly. The coefficient of

determination has shown that the R Square is 0.988

or 98.8%. This has been indicated that the firm size,

sales and age of accounts receivables had effected

the profit of the firm as much as 98.8%, the remaing

1.2% has been effected by other factors that have not

been included in this study. The other factors are as

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1152

liquidity, dividend payout ratio, net working capital

and other factors.

ACKNOWLEDGEMENTS

The researchers would thank the Department of

Accounting of Economics Faculty of the Methodist

University of Indonesia, and colleagues who have

supported the works and shared the ideas.

REFERENCES

Brigham, Eugene F., and Phillip R. Daves (2016)

Intermediate Financial Management, 12th Edition.

United States of America: South Western, Cengage

Learning.

Griffin, Michael P. (2009) MBA Fundamentals:

Accounting and Finance. United States of America:

Kaplan Publishing.

Gujarati, Danador N., and Dawn C. Porter (2009) Basic

Econometrics, Fifth Edition. United States of

America: McGraw-Hill.

Ingram, Thomas N., Raymond W. Laforge, Charles H.

Schwepker, Jr., Michael R. Williams (2006) Sales

Management: Analysis and Decision Making, Sixth

Edition. United States of America: South-Western,

Thomson.

Isik, Ozcan, Esra Aydin Unal and Yenel Unal (2017) ‘The

Effect of Firm Size on Profitability: Evidence From

Turkish Manufacturing Sector’, Journal of Business,

Economics and Finance, 6 (4), 301-308. Available

at: DOI: 10.17261/Pressacademia.2017.762.

Keown, Arthur J, John D. Martin and J. William Petty

(2014) Foundation of Finance: The Logic and

Practice of Financial Management. Eighth Edition.

Upper Saddler. United States of America: Pearson

Education, Inc.

Kieso, E Donald, Jerry J. Weyganot, Terry D. Warfield

(2008) Akuntansi Intermediate. Edisi Keduabelas.

Jilid 2. Alih Bahasa: Emil Salim. Jakarta: Penerbit

Erlangga.

Lindstrom, Erik, Henrik Madsen, Jan Nygaard Nielson

(2015) Statistics for Finance. United States of

America: CRC Press.

Sumarsan, Thomas (2018) Akuntansi Dasar Dan Aplikasi

Dalam Bisnis Versi IFRS Jilid 1, Edisi 2. Jakarta:

Indeks.

Sumarsan, Thomas (2018) Akuntansi Dasar Dan Aplikasi

Dalam Bisnis Versi IFRS Jilid 2, Edisi 2. Jakarta:

Indeks.

Sutrisno (2003) Manajemen Keuangan: Teori, Konsep dan

Aplikasi, Edisi pertama, Yogjakarta: Ekonisia

Suwito, Edy dan Arleen Herawaty (2005) Analisis

Pengaruh Karakteristik Perusahaan Terhadap

Tindakan Perataan Laba Yang Dilakukan Oleh

Perusahaan Yang Terdaftar Di Bursa Efek Jakarta.

Simposium Nasional Akuntansi VIII. Solo, 15-16.

Warren, Carl S., James M. Reeve, Jonathan E. Duchac

(2014) Financial and Managerial Accounting, 12th

Edition. United States of America: South-Western

Cengage Learning.

The Effect of Firm Size, Sales, Age of Receivables on Financial Performance at Automotive Companies Listed at the Indonesian Stock

Exchange

1153