The Effect of Tax Avoidance, Real and Accrual Earnings

Management on Cost of Equity

Silvia Dewiyanti

1

and Andi Ulil Amri Burhan

2

1

Department of Accounting, Bina Nusantara University, Jakarta

2

Department of Accounting, ABFI Perbanas, Jakarta

Keywords: Tax Avoidance, Accrual Earnings Management, Real Earnings Management, Cost of Equity

Abstract:

This research aims to examine the effect of tax avoidance, accrual earnings management, and real

earnings management on the cost of equity. The independent variables used in this study are tax

avoidance measured by abnormal book-tax differences (ABTD), earnings accrual management as

measured by performance-adjusted current discretionary accruals (PACDA), and real earnings

management measured by abnormal discretionary expense and abnormal production cost.

Meanwhile, the dependent variable used is the cost of equity as measured by the equity cost

formula. The equity cost formula is obtained by summing the book value per share in period t

plus the earnings per share in the period t+1 then subtracted from the stock price in period t

which is divided by the share price in period t. The population in this study were manufacturing

companies listed on the Indonesia Stock Exchange from 2012 to 2016. Samples were taken using

the purposive sampling method. This study uses panel data regression analysis techniques. The

results showed that tax avoidance had a significantly positive effect on the cost of equity while

accrual earnings management and real earnings management had no effect on the cost of equity.

1 INTRODUCTION

All funding decisions contain risks which are cost

for the company. If funding comes from debt, the

company will bear the cost of debt. Meanwhile, if

funding comes from equity by issuing shares, the

company will bear the cost of equity. Risk

assessment becomes important to determine the cost

of equity, especially for investors. Investors consider

risk to be a cost that must be borne and affect the

expected rate of return on investment in a company.

Investors can see these risks from disclosures or

information contained in financial statements. The

disclosure and quality of information affects the cost

of equity (Botosan, 2006; Botosan & Plumlee, 2002;

Francis et al., 2004; Lambert et al., 2007).

One of the management actions that can

influence the quality of information in financial

statement, which can ultimately affect the cost of

equity, is tax avoidance. Tax avoidance is carried

out in order to reduce the tax or cash burden that the

company must pay to the tax authority. With tax

avoidance, companies will obtain greater cash

availability that can be used in production or

investment activities, thus will increase company

future cash flow. This expected future cash flow will

affect the cost of equity (Lambert et al., 2007).

Hutchens and Rego (2015) shows that tax

avoidance is positively correlated with cost of

equity. Investors regards tax avoidance as a risky

management action that increase uncertainty over

their investment which means increasing the cost of

equity. Meanwhile, Cook et al. (2017) shows that

investors respond differently too the level of tax

avoidance. For companies with low level tax

avoidance, an increase in tax avoidance will reduce

the cost of equity. And for companies with high

level tax avoidance, an increase in tax avoidance

will increase the cost of equity.

Other management actions that can affect the

cost of equity are earnings management. The

management discretion in preparing financial

statements make management freely choose the

accounting method used in financial reporting that

can increase or support the performance of

management. Francis et al. (2004) show that accrual

earnings management had positive impact to cost of

equity. On the other hand, Febrininta and Siregar

1134

Dewiyanti, S. and Burhan, A.

The Effect of Tax Avoidance, Real and Accrual Earnings Management on Cost of Equity.

DOI: 10.5220/0009506111341140

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1134-1140

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

(2014) show different result that accrual earnings

management does not affect the cost of equity.

Another form of earnings management is real

earnings management. Lambert et al. (2007) shows

that real earnings management can be intended to

cover the actual profits or performance of the

company, so will be distorts the equality of earning,

which are indicators of future cash flow. In line with

this, Kim and Sohn (2013) shows that real earning

management is positively related to the cost of

equity because it increases noises and reduces

investor expectations of future cash flows. Different

results are shown in Meini and Siregar (2014) and

Febrininta and Siregar (2014).

The inconsistency of previous research are the

motivation of this research. This research examine

the effect of tax avoidance, real and accrual earnings

management on cost of equity in Indonesia

manufacturing sector companies. Using data from

2012 until 2016, the result showed that tax

avoidance had a significantly positive effect on the

cost of equity while accrual and real earnings

management had no effect on the cost of equity.

2 HEORICAL FRAMEWORK

2.1 The Relation between Tax Avoidance and

Cost of Equity

Frank et al. (2009) revealed that tax avoidance is

related to the aggressiveness of financial reporting,

while Balakrishnan et al. (2018) revealed that tax

avoidance increases the obscurity of the company’s

information environment. Tax avoidance can reduce

the quality of financial statement information.

Lambert et al. (2007) shows that when the quality of

information is low, information held by investor to

assess future cash flow is less accurate. As a result,

investor assume there is uncertainty about the

company’s future cash flows. Future cash flows are

indicators of investment returns in the form of

dividends so that the uncertainty of future cash flow

will increase uncertainty in return on investment or

increase the cost of equity. This is confirmed by

Cook et al. (2017) and Hutchens and Rego (2015)

that for companies with high levels of tax avoidance,

an increase in tax avoidance will increase the cost of

equity. Based on previous research, the first

hypothesis in this research is:

H1 : Tax avoidance has a positive effect on the

cost of equity.

2.2 The Relation between Accrual Earnings

Management and Cost of Equity

Low accrual earnings quality can be caused by

accrual quality in financial reporting (Geraldina,

2013). Aggressive accrual earning management

contains discretional accrual elements such as

discretion in the selection of accounting method and

estimates in determining the useful life on an asset

loaded with uncertainty. This will have an impact on

the quality of accruals in financial reporting so that

the quality of earnings reported in financial

statement is doubtful. Profits reported in financial

statements do not reflect actual company profits. As

a result, investors do not have accurate information

in predicting the company’s future cash flow.

Francis et al. (2004) shows that accrual quality

has a positive effect on cost of equity. This is

confirmed by the research of Kim and Sohn (2013)

and Meini and Siregar (2014) which provide

empirical evidence that accrual earnings

management has a positive effect on the cost of

equity.

Investors consider there are risks or uncertainties

in the company’s future cash flow. Thus, investors

consider accrual earnings management to be risky so

that the information presented in financial

statements also contains risks. As a results, investors

want a higher rate of return in the presence of these

risks or in other words, the cost of equity increases.

Based on previous research, the second hypothesis

in this research is

H2 : Accrual earnings management has a

positive effect on the cost of equity.

2.3 The Relation between Real Earnings

Management and Cost of Equity

Real earnings management is an action that aims to

change reported earnings in a certain direction

achieved by changing the time or structure of

operations, investments, or funding that have

suboptimal business consequences (Zang, 2011).

According to Kim and Sohn (2013), manager are

more likely to do real earnings management than

accrual earnings management. In real earnings

management, management can change the time and

scale of real activities such as production, sales,

investment, and funding throughout the accounting

period. These real earnings management actions

include sales manipulation, reduce discretionary, and

excessive production (Roychowdhury, 2006).

Real earnings management can generate

abnormal profits, so they do not reflect actual profits

or real company performance. Real earnings

management can distort the quality of reported

The Effect of Tax Avoidance, Real and Accrual Earnings Management on Cost of Equity

1135

earnings which is an indicator of future cash flow.

Investors want a higher rate of return for companies

whose income is susceptible to interference (noisier)

and lower than expected levels of future cash flow

(Lambert et al., 2007).

In line with this, real earnings management is

positively related to the cost of equity because it

increases noise to company profits and reduces

investor expectations of future cash flow which are

indicators of investment returns. Kim and Sohn

(2013) shows empirical evidence that real earnings

management is positively correlated with the cost of

equity. Thus, investors demand a higher risk

premium for this activity by increasing the cost of

equity. Based on previous research, the third

hypothesis in this study is

H3 : Real earnings management has a positive

effect on cost of equity

3 RESEARCH METHOD

This research uses descriptive quantitative methods.

Thus, it carried out by processing data and

conducting analysis to obtain a conclusion on

existing data. This conclusion is in the form of

relationship between the independent variable and

the dependent variable.

This research using all manufacturing

companies, covering the basic industrial sector and

chemicals, various industries, and consumer goods

industries, listed on the Indonesia Stock Exchange

for period of 2012-2016. To get the desired sample,

this research using purposive sampling method, with

the following criteria :

1. Manufacturing sector company

2. Listed on Indonesia Stock Exchange before 1

Januari 2012

3. Use the rupiah currency in financial reporting

4. Has complete financial reports elements for the

period 2011 – 2015

The operationalization of this research variable

consists of one dependent variable, three

independent variables, and three control variables

which will be explained as follows:

1. Cost of equity

The measurement of the cost of equity in this

research used the modified Ohlson Model Approach.

The cost of equity is calculated based on the

discount rate used by investors to evaluate the future

cash flow (Dechow & Dichev, 2002).

r = (B

t

+ X

t+1

– P

t

) /P

t

where,

r : cost of equity

B

t

: Book value per share period t

P

t

: Stock price period t

X

t+1

: Earnings per share

1. Tax Avoidance

The measurement of tax avoidance in this

research using Tang and Firth (2011) approach

for measuring book tax differences (BTD).

BTDit = β0 + β1ΔINVit + β2ΔREVit +

β3NOLit + β4TLUit + εit

where,

BTD

it

: pretax income – current tax

expense/tax

rate

ΔINV

it

: investment changes in gross PPE and

intangible assets

ΔREV

it

: changes of revenue

NOL

it

: Net Operating Loses

TLU

it

: Total compensation for Loss

ε

it

: company residual value

All the above variables are scaled with total

assets in year t

2. Accrual Earnings Management

Jaggi et al. (2009) use performance-adjusted

discretionary accruals (PACDA) to measure

accrual earnings management, because it can

better capture accrual earnings management

and management usually has the most

discretion in current accrual activities.

PACDA is calculated by the following steps :

a. Calculating the total current accrual

estimated every year

TCA

it

/ A

it-1

= α0 (1/ A

it-1

) + α1 (ΔREV

it

/ A

it-

1

) + α2 (ROA

it-1

) + ε

it

b. Using the coefficients generated from

previous calculations to predict current

accruals (expected current accrual/ECA)

ECA

it

/ A

t-1

= α0 (1/ A

it-1

) + α1 {(ΔREV

it

-

ΔAR

it

) /A

t-1

)} + α2 (ROA

it-1

)

c. Determine PACDA

PACDA = (TCA

it

/ A

it-1

) – (ECA

it

/ A

t-1

)

Where,

TCA : total current accruals, from net income

before extraordinary items and terminated

operations plus depreciation and amortization

minus cash flows from operating activities

ΔREV : changes in net revenue

ΔAR : changes in account receivables

ROA : Returnof Assets

ECA : Expected current accrual

A : Net assets

ε

it

: residual value

3. Real Earnings Management

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1136

This research using the model from Cohen and

Zarowin (2010) to measure real earning

management

REM = (- R_DISX) + R_PROD

From these equation, Cohen and Zarowin (2010)

multiply R_DISX with negative 1 to make the

relationship unidirectional. Meanwhile, R_PROD is

not multiplied by negative 1 because the higher

production cost indicate that overproduction reduces

the COGS. Thus, the greater REM, the greater

manipulation of discretionary expense and

production cost to increase company profits.

4. Control Variables

This research using Size, Book-to-Market Ratio

(BM), and Leverage as control variable

5. Real Earnings Management

This research using the model from Cohen and

Zarowin (2010) to measure real earning

management

REM = (- R_DISX) + R_PROD

From these equation, Cohen and Zarowin (2010)

multiply R_DISX with negative 1 to make the

relationship unidirectional. Meanwhile, R_PROD is

not multiplied by negative 1 because the higher

production cost indicate that overproduction reduces

the COGS. Thus, the greater REM, the greater

manipulation of discretionary expense and

production cost to increase company profits.

6. Control Variables

This research using Size, Book-to-Market Ratio

(BM), and Leverage as control variable.

4 NALYSIS AND RESULTS

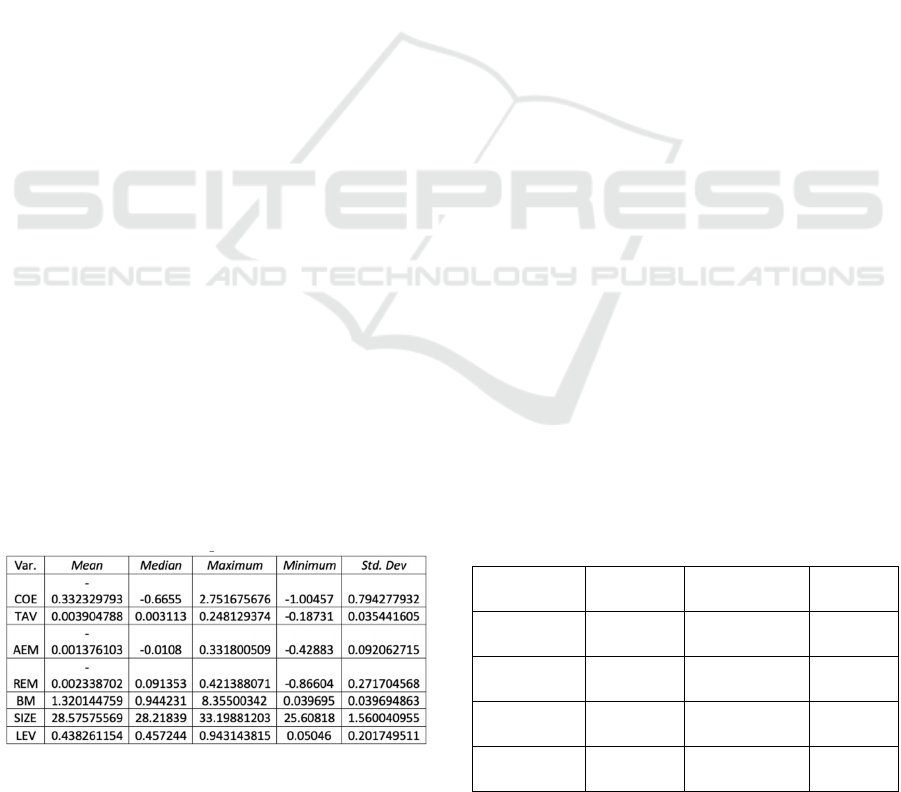

4.1 Descriptive Statistics

Table1: Descriptive Statistics

Cost of equity are the minimum rate of return

that an investor expects for his investment in a

company. The higher the value of the cost of equity,

the higher the minimum rate of return expected by

investors on their investment in the company’s

shares, and vice versa. The negative number on the

average cost of equity in the table 1 shows that the

average investor loses their investment during period

of 2012 – 2016. Meanwhile, the highest of the cost

of equity indicates investors get a profit on their

investment in the company’s shares.

The negative value of tax avoidance shows that

the average accounting profit before corporate tax is

smaller than the company’s taxable income.

However, the negative average value does not mean

that the average tax avoidance is negative at every

year. This is interesting to observe especially for the

tax authorities in assessing corporate tax avoidance,

especially in the period when tax avoidance is

positive. However, it does not rule out the possibility

of companies making tax evasion in the period when

tax evasion in the period when tax avoidance is

negative.

Accrual earnings management is an intervention

in financial reporting so that it can increase or

decrease accounting profit, by changing the

accounting method or estimation used when

presenting transaction in financial statements. The

negative average accrual earnings management

indicates, in average, management does not conduct

earnings management, or in other words,

management does not increase accounting profit

through accrual activity.

Real earnings management is an act of changing

accounting profits through real activities with sales

manipulation, decreasing discretionary expenses,

and excessive production. The negative average

value of real earnings management indicates that, in

average, management does not carry out real

earnings management through decreasing expenses

and not overproducing.

4.2 Hypothesis Result

Tabel 2: Determination coefficient result

R-squared 0,427938

Mean

dependent var -0,0579

Adjusted R-

squared 0,416971

S.D.

dependent var 0,27696

S.E. of

regression 0,211477

Sum squared

resid 13,99811

F-statistic 39,02384

Durbin-

Watson stat 1,575138

Prob(F-

statistic) 0,003

The Effect of Tax Avoidance, Real and Accrual Earnings Management on Cost of Equity

1137

Adjusted R-squared value of 0.4169, shows that

the variation in the value of cost of equity can be

explained by the independent variable and the

control variable in the regression model of 41.40%.

The remaining 58.30% is explained by other factors

outside the research model.

The probability value of F statistic is below the

0.05 significance level, meaning that the

independent variables affect the dependent variable.

Tabel 3: T test result

Variable Coefficient

Std.

Error

t-

Statistic Prob.

TAV 0,468314 0,1890 2,47740 0,0138*

AEM -0,13334 0,1102

-

1,20955 0,2274

REM 0,079118 0,1084 0,72925 0,4664

BM 0,271431 0,0305 8,87609 0,0000

SIZE -0,15928 0,0135 -11,746 0,0000

LEV 0,385968 0,2456 1,57103 0,1172

C 3,689984 0,3024 12,1989 0,0000

The effect of Tax Avoidance on Cost of Equity

The results in table 3 showed that tax avoidance had

a positive and significant effect (below the 0.05

significance value) on the cost of equity. Thus, it can

be concluded that the first hypothesis (H1) which

states "tax avoidance has a positive effect on the cost

of equity" can be accepted.

This positive relationship means that the greater

the tax avoidance by the company, the more the cost

of equity that must be borne by the investor. The

results of this study are in line with the results of the

Hutchens and Rego (2015) who also revealed in his

research that corporate risk (tax avoidance proxy)

has a positive effect on the cost of equity. This is

confirmed by Cook et al. (2017) that for companies

with high levels of tax avoidance, an increase in tax

avoidance will increase the cost of equity.

The effect of Accrual Earnings Management on

Cost of Equity

The results in table 3 showed that accrual earnings

management did not affect the cost of equity. Thus,

H2 which states "accrual earnings management has a

positive effect on the cost of equity unacceptable.

This negative relationship means that the greater the

accrual earnings management carried out by the

company, the smaller the cost of equity. The results

of this study are in line with the results of Reizky

Ifonie (2012) who conducted research on the effect

of information asymmetry and earnings management

on the cost of equity capital. The results of his

research show that earnings management has no

significant effect on the cost of equity. Reizky Ifonie

(2012) said the results were due to investors

evaluating at this time, while issuers or companies

issued new ordinary shares to cover their operational

and investment debts so the company was less

attractive to investors. In addition, investors consider

other things in investing in a company.

The results of this study prove that the greater

the profit management performed by the company,

the smaller the cost of equity. Accrual earnings

management actions do not affect investors.

Investors consider accrual earnings management

actions to be non-risky so that the information

presented in financial statements is in accordance

with reality. Another guess is the type of mutual

fund investor as one of the biggest types of investors

who invest in bonds. In mutual fund products, total

risk can be minimized and spread so that these

investors become less concerned with accrual

earnings management by the company. In addition,

it is suspected that the inability of creditors or bond

investors to detect the existence of management

profit actions made by the company because the

method of detecting both types of earnings

management (accruals and real) is fairly

sophisticated.

The Effect of Real Earnings Management on Cost

of Equity

The results of the study show that real earnings

management does not affect the cost of equity. Thus,

the third hypothesis (H3) which states that "real

earnings management has a positive effect on the

cost of equity" cannot be accepted. This negative

relationship means that the greater the real earnings

management by the company, the lower the cost of

equity. The results of this study indicate that

management does not carry out real earnings

management through manipulation of discretionary

expenses and excessive production.

The probability level that is above 0.05 is in line

with the average real earnings management which is

negative, which means that the average

manufacturing company in Indonesia in the study

period did not carry out real earnings management.

Manipulation of discretionary burden is carried out

by reducing the burden of research and

development, advertising, sales, administration and

general. This reduction will increase profit for the

year. This occurs when these expenses do not

directly lead to profits and income. This decrease

will also increase the cash flow for the period if the

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1138

company issues the burden in the form of cash.

However, this risks lower cash flows in the coming

period. Decreasing the burden of discretion causes

abnormal discretionary expenses. Managers also

carry out real earnings management through

manipulation of production by increasing production

more than is needed to increase revenue. When a

company produces more units, the fixed cost per unit

will be lower. This strategy can reduce cost of goods

sold and increase operating profit margins.

Excessive production will produce abnormal

production costs (abnormal production cost). The

combination of abnormal discretionary costs and

abnormal production costs will cover actual profits

or company performance.

5 CONCLUSIONS

Tax is one of the significant components of

corporate profits. In Indonesia, the tax rate that

applies to companies is 25% or a quarter of company

profits. This large tax burden has made the company

make efforts to reduce the tax burden that must be

paid to the tax authorities by tax evasion which

clearly violates the law and with tax avoidance. Tax

avoidance is still in the realm of the legal framework

of tax law by utilizing loopholes in tax law carried

out in order to reduce the tax burden that must be

paid to the tax authorities.

The company's actions to increase company

value are in line with what investors expect. With

the value of the company increasing, company

management hopes to get compensation for the

achievements they have achieved. However, tax

avoidance measures carry risks, which means that

there are additional risks that must be borne by

investors which can harm investors. tax avoidance

can reduce the quality of financial statements. As a

result, investors assume there is uncertainty about

the company's future cash flows. Disrupted future

cash flows will increase the cost of equity. This is in

accordance with the results of the study.

Earnings management is an opportunistic act of

management to increase or decrease accounting

profits with the intention of gaining personal gain.

Earnings management is done to cover actual

earnings or company performance so that it distorts

the quality of earnings reported in the financial

statements. The management discretion in preparing

financial statements makes management freely

choose the accounting method used in financial

reporting that can increase or support the

performance of management. Accrual earnings

management is achieved by changing the accounting

method or estimation used when presenting

transactions in financial statements. Aggressive

accrual earnings management contains discretional

accrual elements such as discretion in the selection

of accounting methods and estimates that are loaded

with uncertainties that will impact accrual quality in

financial reporting.

The results of this study prove that accrual

earnings management actions do not affect investors.

Investors consider accrual earnings management

actions to be non-risky so that the information

presented in financial statements is in accordance

with reality.

Management opportunistic behavior in earnings

management is not only done through the selection

of estimates and accounting methods (accrual

earnings management), but also with the real

activities of companies by changing the structure of

operations, investments, or funding that have

suboptimal business consequences (real earnings

management). The results of the study show that real

earnings management does not affect the cost of

equity. Technological advances and the ease with

which investors can capture information on the

market make management rethink the management

of earnings

REFERENCES

Balakrishnan, K., Blouin, J., & Guay, W. (2018). Tax

Aggressiveness and Corporate Transparency. The

Accounting Review.

Botosan, C. A. (2006). Disclosure and the cost of capital:

what do we know? Accounting and Business

Research, 36(sup1), 31-40.

Botosan, C. A., & Plumlee, M. A. (2002). A re‐

examination of disclosure level and the expected cost

of equity capital. Journal of accounting research,

40(1), 21-40.

Cohen, D. A., & Zarowin, P. (2010). Accrual-based and

real earnings management activities around seasoned

equity offerings. Journal of Accounting and

Economics, 50(1), 2-19.

Cook, K. A., Moser, W. J., & Omer, T. C. (2017). Tax

avoidance and ex ante cost of capital. Journal of

Business Finance & Accounting, 44(7-8), 1109-1136.

Dechow, P. M., & Dichev, I. D. (2002). The quality of

accruals and earnings: The role of accrual estimation

errors. The Accounting Review, 77(s-1), 35-59.

Febrininta, C. N., & Siregar, S. V. (2014). Manajemen

Laba Akrual, Manajemen Laba Riil, dan Biaya Modal.

Jurnal Akuntansi Multiparadigma, 5(1), 365-379.

The Effect of Tax Avoidance, Real and Accrual Earnings Management on Cost of Equity

1139

Francis, J., LaFond, R., Olsson, P. M., & Schipper, K.

(2004). Costs of equity and earnings attributes. The

Accounting Review, 79(4), 967-1010.

Frank, M. M., Lynch, L. J., & Rego, S. O. (2009). Tax

reporting aggressiveness and its relation to aggressive

financial reporting. The Accounting Review, 84(2),

467-496.

Geraldina, I. (2013). Preferensi Manajemen Laba Akrual

Atau Manajemen Laba Riil Dalam Aktivitas Tax

Shelter. Jurnal Akuntansi Dan Keuangan Indonesia,

10(2), 206-224.

Hutchens, M., & Rego, S. (2015). Does greater tax risk

lead to increased firm risk?

Jaggi, B., Leung, S., & Gul, F. (2009). Family control,

board independence and earnings management:

Evidence based on Hong Kong firms. Journal of

Accounting and Public Policy, 28(4), 281-300.

Kim, J.-B., & Sohn, B. C. (2013). Real earnings

management and cost of capital. Journal of

Accounting and Public Policy, 32(6), 518-543.

Lambert, R., Leuz, C., & Verrecchia, R. E. (2007).

Accounting information, disclosure, and the cost of

capital. Journal of accounting research, 45(2), 385-

420.

Meini, Z., & Siregar, S. V. (2014). The effect of accrual

earnings management and real earnings management

on earnings persistence and cost of equity. Journal of

Economics, Business & Accountancy Ventura, 17(2),

269-280.

Reizky Ifonie, R. (2012). Pengaruh Asimetri Informasi

Dan Manajemen Laba Terhadap Cost of Equity

Capital Padaperusahaan Real Estate Yang Terdaftar Di

Bursa Efek Indonesia. Jurnal Ilmiah Mahasiswa

Akuntansi, 1(1), 103-107.

Roychowdhury, S. (2006). Earnings management through

real activities manipulation. Journal of Accounting and

Economics, 42(3), 335-370.

Tang, T., & Firth, M. (2011). Can book–tax differences

capture earnings management and tax management?

Empirical evidence from China. The International

Journal of Accounting, 46(2), 175-204.

Zang, A. Y. (2011). Evidence on the trade-off between

real activities manipulation and accrual-based earnings

management. The Accounting Review, 87(2), 675-

703.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1140