Factors That Influence the Level of Development Inequality in

Districts / Cities Sumatera Utara Province

Patryano Gusti Anggara

1

, Muhammad Fitri Rahmadana

1

and Indra Maipita

1

1

Department of Economics, Faculty of Economics, Universitas Negeri Medan, Medan, North Sumatra, 20219, Indonesia

Keywords: Williamson Index, GRDP Per Capita, HDI, The Government Expenditures Budget

Abstract: Inequality Development in North Sumatra Province during the period of 2012 to 2016 shows an increasing

condition. The purpose of this study is to analyze the factors that influence development inequality in the

Regency / City in North Sumatra Province using panel data. With the independent variable GRDP Per

Capita, HDI, Government Expenditures Budget while the dependent variable is the Wiliamson index in

districts / cities in North Sumatra province. Data obtained by the Central Sumatra Provincial Statistics

Agency (BPS) during 2012-2016. The method used is Square Least Panel (PLS) with Fixed Effect Model

(FEM). The results showed that GRDP Per Capita had a negative effect on the Wiliamson Index of 35.52%

and significant, HDI had a negative effect on the Williamson Index of 18.26% and significant, the

Government Expenditures Budget had a negative effect on the Wiliamson Index of 32.9% in North Sumatra.

1 INTRODUCTION

Development inequality in principle is an economic

imbalance that implies poverty and inequality. In

order for inequality and development between an

area and other regions not to create a widening gap,

the implications of policy towards the development

cycle of development must be precisely formulated

(Suryana, 2000).

The most common inequality discussed is

economic inequality. Economic inequality is often

used as an indicator of differences in average per

capita income, between income level groups,

between employment groups, and / or between

regions. The average per capita income of a region

can be simplified into Gross Regional Domestic

Product divided by the population. Another way that

can be used is to base on personal income which is

approached by the consumption approach (Widiarto,

2001). To measure the inequality of regional

economic development, the Williamson Index is

used.

Regional disparity arises due to the lack of equity

in economic development. This can be seen from the

existence of advanced regions with underdeveloped

regions, or less developed regions. This inequality in

development is due to differences in development

between regions.

During 2012-2016 there were still inequality in

the provinces in Indonesia, using the relative per

capita GRDP approach. Williamson Index results for

development inequality nationally show that

development inequality is still very high or inter-

provincial development is uneven with the

Williamson Index from 2012-2016 on average> 1.

And one of the provinces in Indonesia that has

increased development inequality from 2012 -2016

is North Sumatra Province. One of the prominent

problems of inequality in North Sumatra Province is

the disparity between regions as a consequence of

the concentrated economic activities in the area

adjacent to the Provincial Capital. (Alisjahbana,

2005).

Inequality causes economic inefficiencies,

because inequality is high, overall savings rates in

the economy tend to be low, because high savings

rates are usually found in the middle class. Although

rich people can save in larger amounts, they usually

save in a smaller share of their income, and of

course save with a smaller share of their marginal

Anggara, P., Rahmadana, M. and Maipita, I.

Factors That Influence the Level of Development Inequality in Districts / Cities Sumatera Utara Province.

DOI: 10.5220/0009504605170523

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 517-523

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

517

income (Todaro, 2006). This negative impact causes

high inequality to be one of the problems in

development in creating prosperity in a region.

Economic growth is one indicator of public

welfare. Where when an area has high growth, the

area can be said to be a prosperous region. One

indicator of the level of welfare of the population of

a region is the per capita GRDP figure. GRDP is the

net value of final goods and services produced by

various economic activities in an area in a period

(Hadi Sasana, 2001), While GDP per capita is often

used as an indicator of development. The higher the

per capita GRDP of an area, the greater the potential

source of income for the region due to the greater

income of the people of the area (Thamrin, 2001).

This also means that the higher the per capita GRDP

the more prosperous the population of a region. In

other words, if income is high and evenly distributed

between regions, income inequality decreases.

Income inequality between regencies / cities in

North Sumatra. During 2013 to 2016, the highest

and ever increasing per capita income was in the city

of Medan. Then it was followed by Toba Samosir

Regency which although in 2013 the income per

capita was still below Asahan Regency, but in 2013

to 2016 the income per capita of Toba Samosir

Regency was more than that of Asahan Regency.

The next highest per capita income is Karo Regency,

although in 2013 it was still lower than Asahan

Regency.

The lowest per capita income in 2013 until 2016

was Pakpak Barat Regency, then, the second lowest

per capita income was Nias Regency, although in

2013 and 2014 Nias Regency per capita income was

still higher compared to Pakpak Bharat District, but

on average from 2013 to 2016 Nias Regency was

still lower compared to Pakpak Bharat Regency. The

next lowest per capita income is Pakpak Barat

Regency.

For North Sumatra Province during 2013 until

2016 per capita income continued to increase. In

2013, North Sumatra's per capita income was only

Rp. 25,391,986.04, - but in 2016 the income per

capita of North Sumatra Province reached Rp.

36,371,825.67, -. Still not evenly distributed and the

development gap in North Sumatra Province can be

minimized by utilizing the maximum potential of

each region to advance the regional economy

concerned in order to reduce inequality that occurs.

Economic development in an area can be said to

be successful if a region / region can increase

economic growth and improve people's living

standards equally or better known as the Human

Development Index (HDI). The problem that occurs

is the HDI in each region is different, this makes the

HDI value to be one of the factors that influence

income inequality between regions / regions.

Lisnawati (2007) states that "In the context of

regional development, the Human Development

Index (HDI) is set as one of the main measures

included in the Basic Pattern of Regional

Development." This indicates that HDI occupies an

important position in regional development

management. The function of HDI and other human

development indicators will be key to the

implementation of targeted planning and

development.

In 2016, North Sumatra Province had an HDI

value of 70. This value was still lower than the

national HDI value of 70.18. Although the province

of North Sumatra is ranked 8th out of 37 provinces

in Indonesia, but with the increasing value of

inequality every year, it has indicated that HDI in

North Sumatra Province needs special attention from

the provincial government so that its function is a

measure of the success of development in North

Sumatra province can be achieved.

Based on BPS data from North Sumatra Province

in 2016 the highest HDI value in North Sumatra was

Medan City at 79.4. Then the cities of Pematang

Siantar and the city of Binjai were 76.9 and 74.11

respectively. The lowest HDI value is West Nias

City at 59.03. Then followed by South Nias City and

Nias City at 59.14 and 59.75 respectively.

The rate of HDI in North Sumatra Province from

2014 to 2016 has increased. Although all regions in

North Sumatra province experienced an increase in

HDI values, there were several regions in the North

Sumatra province which still had low HDI values

and were far below the other regions. Therefore, this

is where the role of the North Sumatra provincial

government is needed in resolving regional

development inequality so that regional equity in the

North Sumatra province can increase. This is

because the low or high HDI will have an impact on

the level of productivity of the population, the lower

the HDI, the level of productivity of the population

will be low then low productivity can affect the low

income, and vice versa if the higher the HDI the

higher the productivity of the population push the

level of income to be higher (Hidayat 2014).

Government expenditure is one of the tools of

government intervention in the economy which is

considered the most effective. The expenditure is the

consumption of goods and services carried out by

the government as well as financing by the

government for the purposes of government

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

518

administration and development activities in the area

(Sukirno, 2002).

Heshmati (2014) states that many countries in

Asia will always pursue high economic growth

because for them if economic growth is prioritized,

then equity will be successful.

Regional financial capacity is shown in the form

of the Regional Budget (APBD). According to Law

No. 32 and 33 of 2004 the Regional Budget is an

annual financial plan. Regional governments are

discussed and agreed upon jointly by the Regional

Government and the Regional People's

Representative Council (DPRD), and are stipulated

by regional regulations. APBD contains details of all

regional revenues on one side and all regional

expenditures on the other side. Before 2003 the

APBD from the expenditure side consisted of

routine expenditure and development expenditure,

(Suyana Utama 2009).

The biggest expenditure from the local

government is prioritized for basic, secondary and

vocational education. Local governments administer

primary and secondary education reflecting the

benefits of regional budgets. With an educated

workforce it will increase the productivity of an

economy.

The allocation of government expenditure for

North Sumatra and Regency / City Provinces in

North Sumatra province is very fluctuating for each

year and tends to increase. But the increase was also

accompanied by the level of inequality in North

Sumatra province which also tended to increase

resulting in less optimal government spending to

alleviate inequality in the province of North

Sumatra.

The expenditure budget of the Regency / City

Government in North Sumatra Province differs

significantly between existing Districts / Cities. The

highest Regency / City Government expenditure

budget is Rp. 5,380,363,861 in Medan City followed

by successively Deli Serdang Regency of Rp.

3,529,117,634, and Langkat District Rp.

1,826,780,689. If we analyze the district with the

lowest expenditure budget, which is a newly

established regency or a district that has been

created, this should be a serious concern for both the

Central Government and the Provincial Government

in the division of regions that are deemed irrelevant

to be re-divided.

If these conditions are allowed, in the future the

level of inequality will be wider because per capita,

HDI, and government expenditure are interrelated.

Because of this, action needs to be taken so that

income inequality in North Sumatra Province can be

minimized.

2 THEORETICAL FRAMEWORK

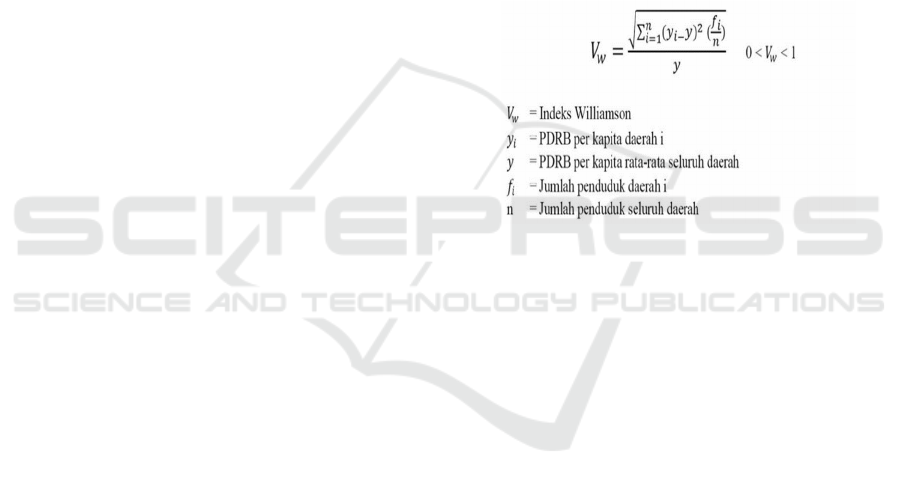

The Williamson Index is an analytical tool used to

measure inequality between regions. This index is

used to measure the coefficient of a region's

weighted variation and income disparity in the

development process. The Williamson index also

measures the spread of per capita income levels

between regions relative to the center where each

region's deviation is weighted by its contribution to

the population of the region as a whole.

Williamson index formula:

The advantages of Williamson's Index are easy

and practical in seeing disparities. While the

disadvantage is the Williamson Index is aggregate so

that it is not known which areas contribute to

disparity (Achjar, 2004). Williamson index (IW),

with the magnitude of the value between 0 and 1.

The greater the IW, the greater the gap, on the

contrary if IW gets smaller (close to 0), the more

evenly distributed IW value <0.3 means that the

income disparity is relatively low, IW between 0.3 -

0.5 is in the moderate category, then it is said to be

high if IW> 0.5 (Kuncoro, 2004).

The relationship between per capita income of a

country and the inequality of income distribution

among its inhabitants is explained by a hypothesis

proposed by Simon Kuznets (Arsyad, 1999). Using

data between countries and data from a number of

surveys or observations in each country with time

series data, Kuznets found a relation between

income inequality and the inverted U-level income

per capita. Kuznets stated that in the early stages of

economic growth, income distribution tended to

deteriorate (rising inequality), but at a later stage

income distribution would improve (downward

inequality) (Kuznet, 1971).

The inverse U hypothesis proposed by Kuznets is

based on Lewis's theoretical argument about

Factors That Influence the Level of Development Inequality in Districts / Cities Sumatera Utara Province

519

population movements from rural (agricultural

sector) to urban (industrial sector). Rural areas that

are very densely populated cause the wage rate in

the agricultural sector to be very low (whereas in

urban areas the wage rate is relatively high because

the population or labor is relatively small) and

makes the supply of labor from that sector to the

industrial sector unlimited (Sri Isnowati, 2007).

The Human Development Index (HDI) / Human

Development Index (HDI) is a comparative

measurement of life expectancy, illiteracy, education

and living standards for all countries worldwide

(BPS, BAPPENAS, UNDP, 2001). The HDI also

reveals that a country can do much better at a low

income level, and that a large increase in income can

play a relatively smaller role in human development

(Todaro and Smith, 2004). Inequality that occurs in

a region will affect the level of community welfare

in the region.

The human development index and income

inequality have interrelated relationships. According

to Becker (in Agus Iman Solihin, 1995), states that

HDI has a negative effect on inequality, Becker

examines more deeply the role of formal education

in supporting economic growth stating that the

higher the formal education obtained, the higher the

productivity of labor. This is in accordance with

human capital theory, namely that education has an

influence on economic growth and will reduce

income disparities because education plays a role in

increasing labor productivity.

According to Guritno (1999), government

expenditure reflects government policy. If the

government has established a policy to buy goods

and services, government expenditure reflects the

costs that must be spent by the government to

implement the policy. The theory about the

development of government expenditure was also

stated by economists, namely the development

model of the development of government spending,

and regarding the development of government

activities.

Musgrave and Rostow stated that the

development of state expenditure is in line with the

stage of economic development of a country.

According to Musgrave (1980) that in a

development process, private investment in the

percentage of GDP is greater and the percentage of

government investment in GDP will be smaller. In

the early stages of economic development, large

government expenditure is needed for government

investment, mainly to provide infrastructure such as

road facilities, health, education and other public

facilities. At the middle stage of economic

development, investment is still needed for

economic growth, but it is expected that private

sector investment has begun to develop. In the later

stages of economic development, government

spending is still needed, mainly to improve people's

welfare.

According to Sukirno (2004), economic growth

is the development of activities in the economy

which causes the goods and services produced in

society to increase and the prosperity of the

community increases. This is in accordance with the

theory of development of Harrod-Domar which

explains that the formation of capital / investment is

an important factor that determines economic

growth. In his theory, Harror-Domar argues that

investment has an effect on economic growth in a

longer-term perspective.

3 RESEARCH METHOD

This study uses secondary data with time series data

types during the period 2013-2016. With the data

used sourced from the Central Statistics Agency.

The data needed includes GDP per capita in rupiah

units, HDI value with an index value of 0 to 100,

government spending in rupiah units, and Wiliamson

index with an index value of 0 to 1 in North Sumatra

Province.

The data analysis method used in this study is

quantitative with a panel data analysis model or data

collection. Panel data is a combination of time series

data and time data (cross section). To overcome the

intercorrelations between independent variables

which can eventually lead to inappropriate

regression estimates, the panel data method is more

appropriate to use. The data used in this study are

time series data from 2013 to 2016 and cross

sections consisting of 25 districts and 8 cities in

North Sumatra Province. The function model of the

equations in this study area:

IW = β₀+ β1GRDPPC + β2HDI + β3GEB +εit

4 ANALYSIS

4.1. Selection of Models in Data Processing

In panel data processing, it is necessary to select the

most appropriate model between Common Effect

estimation models, Fixed Effect estimation models

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

520

and Random Effect estimation models. To choose

between the three estimation models there are

several tests that can be done, including :

4.1.1 Chow Test (F-statistical test)

This test is used to determine the most appropriate

model to be used between the Common Effect

estimation model or the Fixed Effect estimation

model, with the hypothesis:

H0 : choose to use the Common

Effect estimation model.

H1 : choose to use the fixed

effect estimation model.

This hypothesis test can be done by comparing

F-statistics with F-tables. If F-statistics > F-table

then H0 is rejected which means the most

appropriate model to use is the Fixed Effect Model

and can also be done by considering the probability

value (Prob.) For F-statistics. If the value of the

Prob. F-statistic < 0.05 (determined at the beginning

as the level of significance or alpha) then the chosen

model is Fixed Effect Model, but if > 0.05 then the

chosen model is the Common Effect Model

(Ekananda, 2016).

Table 1: Chow Test Results

From Table 1, the F-statistic value is 7.458908

with the F-table value at df (32.129) α = 5% is

1.0000000 so that the F-statistic value> F-table with

a probability of 0.0000 (<0.05), so H1 statistics are

accepted and reject H0, according to the results of

this estimation the right model used is the estimation

model Fixed Effect Model.

4.1.2 Hausman Test

This Hausman test is used to select the model that

will be used between the Fixed Effect estimation

model or the Random Effect estimation model, with

the following hypothesis test:

H0 : choose to use the Random

Effect estimation model.

H1 : choose to use the Fixed

Effect estimation model.

The Hausman test can be done by comparing

Chi-Square statistics with Chi-Square tables. If Chi-

Square statistics > Chi-Square table then H0 is

rejected which means the most appropriate model to

use is the Fixed Effect Model and can also be done

by considering the probability value (Prob.) For Chi-

Square statistics. If the value of the Prob. Chi-

Square statistic < 0.05 (determined at the beginning

as a significance level or alpha), the chosen model is

Fixed Effect Model, but if > 0.05 then the selected

model is Random Effect Model (Ekananda, 2016).

Table 2 :Hausman Test Results

Correlated Random Effects - Hausman Test

E

q

uation: REM

Test cross-section random effects

Test Summar

y

Chi-Sq.

Statistic

Chi-Sq.

d.f. Prob.

Cross-section

rando

m

7.694560 3 0.0528

From Table 2, the statistical Chi-Square value is

7.694560 with the Chi-Square table on df (3) α = 5%

is 7.815 so the Chi-Square value is statistics> Chi-

Square table with a probability of 0.05 (<0, 05) H1

is accepted and H0 is rejected so the panel data

model used is the Fixed Effect Model.

4.2 Hypotesis Result

4.2.1 T-Test (Partial Test)

The t-statistic test aims to determine the effect of the

independent variable GDP per capita, HDI,

Government Expenditures in the Regency / City of

North Sumatra Province.

Table 3: The Results of The T-Test

Variable Coefficient Std. Error t-Statistic Prob.

C -7.642758 2.979274 -2.565309 0.0115

PDRB -0.150958 0.042496 -3.552254 0.0005

IPM -1.608587 0.880617 -1.826660 0.0401

PP -0.106689 0.032423 -3.290567 0.0013

Table 3 is the result of testing the independent

variables namely Per capita GRDP, HDI, and

Government Expenditures partially on Development

Inequality in North Sumatra Province in 2013 -

2016. This study uses α = 5% or α = 0.05.

If written in an equation, the result is :

IW

it

= -7.642758 - 0.150958GRDPPC

it

-

1.608587HDI

it

- 0.106689GEP

it

+ ɛ

it

From this equation it can be concluded as

follows:

Redundant Fixed Effects Tests

Equation: FEM

Test cross-section fixed effects

Effects Tes

t

Statistic d.f. Prob.

Cross-section F 7.458908 (32,129) 0.0000

Cross-section Chi-

square 172.823370 32 0.0000

Factors That Influence the Level of Development Inequality in Districts / Cities Sumatera Utara Province

521

1. The constant is - 7.642758 which means that if

the variable per capita GRDP, HDI, and

Government Spending is zero, it means that the

effect of the three variables on the value of

development inequality in North Sumatra

Province is - 7.642758 percent.

2. Perkapita GRDP variable has a t-statistic of -

0,150958 and the probability shows a value of

0,0005 which is smaller than the confidence level

α = 5% (0,0005 <0,05) so that this can prove that

the Perkapita variable has a significant negative

effect towards development inequality in North

Sumatra Province which means H1 is accepted

and H0 is rejected. The percentage percentage of

the Percapita variable coefficient is -0.150958,

which means that each increase in Percentage

Percentage of 1 percent will reduce development

inequality by 0.15 percent assuming the HDI

variable, Government Expenditures are

considered zero, meaning there is no increase or

decrease. This is in line with the results of the

study of Nita Tri Hartini (2015) who concluded

that an increase in GDP per capita would also

reduce the Development Gap.

3. The HDI variable has a t-statistic of -1.61 and

probability shows a value of 0.041 which is

smaller than the confidence level α = 5% (0.0401

<0.05), so this can prove that the HDI variable

has a significant negative effect on development

inequality in North Sumatra Province which

means H1 is accepted and H0 is rejected. The

HDI variable coefficient is -1.61, which means

that every increase in the HDI value is 1 percent,

it will increase the development imbalance by

1.61 percent assuming the GDP per capita

variable, and Government Expenditures

expenditure is considered to be zero, meaning

there is no increase or decrease . These results

are in accordance with the study of Nita Tri

Hartini (2017) who concluded that the human

development index has a negative and significant

effect on income inequality in the province of

DIY.

4. The Government expenditure expenditure

variable has a t-statistic of - 0.106689 and

probability shows a value of 0.0013 which is

smaller than the confidence level α = 5% (0.0013

<0.05) so this can prove that the Government

expenditure expenditure variable has a negative

and significant effect on development inequality

in the district / city of North Sumatra Province

which means H1 is accepted and H0 is rejected.

The variable expenditure expenditure

government coefficient is - 0.106689, which

means that every increase in Government

expenditure is 1 percent, it will reduce

development inequality by 0.106689 percent

with the per capita GRDP variable assumption,

HDI is considered to be zero, meaning there is no

increase or decrease.

4.2.2 F-Test

To test whether the independent variables have a

simultaneous effect on the dependent variable, the F-

test is used by looking at probability and F-statistics.

The hypothesis is as follows :

H0 : Per Capita GRDP, HDI, and Government

Expenditure together have a significant

influence on Development Inequality in

North Sumatra Province for the period 2013-

2016.

H1 : Per capita GRDP, HDI, and Government

Expenditures have no effect on Development

Inequality in North Sumatra Province for the

period 2013-2016.

From the regression results, the F-statistic value

is 12.45468 with a probability of 0.0000 which

means it is smaller than α = 5%. The probability

value of F-Statistics in Table 4.11 is smaller than α =

5%, then H1 is accepted and H0 is rejected so it can

be concluded that together the variable per capita,

HDI, and Government Expenditures have a

significant effect of 12.45468 on Inequality

Development in North Sumatra Province for the

period 2013-2016.

4.2.3 Determination Coefficient Test Results (R²)

According to Gujarati and Porter (2012), the

coefficient of determination (R2) is used to measure

the goodness of fit of a regression line. This value

shows how much influence the independent

variables together can provide an explanation of the

dependent variable, where the coefficient of

determination (R2) is between 0 to 1 (0 ≤R2 ≤1).

The smaller R2 approaches 0, meaning that the

smaller the influence of the independent variable on

the dependent variable. Conversely, if R2

approaches 1, it indicates the stronger influence of

independent variables on the dependent variable.

Based on the results of panel data regression

analysis, the determination coefficient was 0.77.

This means 77 percent of inequality. Development

in 33 (thirtythree) regencies / cities in the Province

of North Sumatra in the period 2013-2016 can be

explained by the variable per capita, HDI, and

Government Expenditures. While the remaining 23

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

522

percent is explained by other variables not examined

in this study.

4.2.4 Interpretation of Analysis Results

Based on the statistical calculations that have been

done, it can be concluded that the resulting

regression is good enough to explain the factors that

influence development inequality in the Province of

North Sumatra for the period 2013-2016. But of all

the variables studied all variables did not have a

positive effect.

5 RESULT

Based on the results of the analysis that has been

carried out regarding the factors that influence

development inequality in North Sumatra province,

the following conclusions are obtained :

a. From the coefficient of determination in the

estimation results, the variables of development

inequality in North Sumatra Province can be

explained by the variables of GDP per capita,

ipm and government expenditure can be

explained by the model used.

b. The variables used explain the development

inequality variables showing the direction of

influence in accordance with the hypothesis. Per

capita GRDP has a negative and significant

effect, IPM has a negative and significant effect,

and government expenditure also has a negative

and significant effect.

c. The magnitude of the coefficient value of the

variables that explain the variables of

development inequality, the largest is the

variable government expenditure, followed by

successive variables per capita GRDP and HDI

variables.

6 CONCLUSIONS

Based on the results of testing and discussion, the

following are some suggestions related to the results

of the study:

a. Development inequality in North Sumatra

Province is still in the category of low inequality.

However, the Government of North Sumatra

Province is expected to continue to provide the

greatest access to the community, especially the

creation of new jobs so that the employment

opportunities of the population are increasingly

high. Thus it will increase per capita income

which in turn will reduce the income disparity

itself.

b. Besides increasing the per capita income of the

population, the government should also make

budget allocations that better accommodate the

interests of the community, especially for vital

accesses that can improve the quality of human

resources.

c. Government expenditure is also an obstacle if it

is not managed wisely which in turn will trigger

development inequality. For this reason,

management of government expenditure must

prioritize aspects that require attention such as

education, health, poverty alleviation and so on.

REFERENCES

Arsyad, Lincolin. (2002). Ekonomi Pembangunan.

Edisi Kedua. BPFE. Yogyakarta. Arsyad,

Lincolin. 2010. Pengantar Perencanaan

Pembangunan Ekonomi Daerah. Edisi Kelima.

BPFE. Yogyakarta.

Bappenas. (2010). Panduan Revitalisasi

Pengembangan Ekonomi Lokal. Direktorat

Perkotaan dan Perdesaan. Badan Perencanaan

Pembangunan Nasional. Jakarta.

BPS Provinsi Sumatera Utara. 2010-2017. Provinsi

Sumatera Dalam Angka. PD Aneka Industri

dan Jasa Provinsi Sumatera Utara.

BPS Provinsi Sumatera Utara. (2017). Produk

Domestik Regional Bruto Kabupaten/Kota di

Provinsi Sumatera Utara. 2010-2016.

BPS Provinsi Sumatera Utara. (2016) Produk

Domestik Regional Bruto di Provinsi Sumatera

Utara Menurut Kabupaten/Kotamadya 2010-

2017.

Kuncoro. Mundrajad. (2004). Otonomi dan

Pembangunan Daerah. Reformasi,

Perencanaan, Strategi dan Peluang. Penerbit

Erlangga. Jakarta.

Sukirno, Sukirno. 2002. Pengantar Teori

Mikroekonomi, Edisi ketiga. PT. Rajawali

Grasindo Persada.Jakarta.

Sukirno, Sukirno. (2004). Pengantar Teori

Makroekonomi, Edisi ketiga. PT. Rajawali

Grasindo Persada.Jakarta.

Todaro, M. P dan S. C. Smith. (2006). Pembangunan

Ekonomi di Dunia Ketiga. Edisi Kesembilan.

Jilid 1. Erlangga : Jakarta.

Factors That Influence the Level of Development Inequality in Districts / Cities Sumatera Utara Province

523