Development of Banking Earnings Management Software

Nurika Restuningdiah

1

, Heny Kusdyanti

1

, Vega Wafaretta

1

and Mika Marsely

1

1

Universitas Negeri Malang, Jl. Semarang No. 5, Malang, Indonesia

Keywords: Earnings Management Software, Banking Sector, Learning Media

Abstract: Earnings management is the way taken by the management to affect the numbers in the financial statements.

Certain techniques are used to reduce earnings fluctuations by reducing or increasing the amount of profit

for specific motivation. Earnings management can occur in all business sectors, among services, trade, and

manufacturing. However, although earnings management taught in the subject of financial accounting

theory, college students in accounting major still seems unfamiliar with the calculation of earnings

management. Therefore, this study aims to develop earnings management software that can be used to

detect earnings management in the banking sector. This study focuses on earnings management in the

banking sector because of the different characteristics of banks. It is expected that this software becomes a

supplementary media in the learning process to increase students' understanding of earnings management.

The development process consists of the Analysis Stage, Design Stage, and Development Stage. Earnings

management software then was improved based on the validation by expert judgment and the commentary

by students as main users.

1 INTRODUCTION

Agency theory studies the contract design to

motivate agents to deal with the principal’s interest.

Agency problems are conflicts of interest between

agents (management) and principals (owners of

capital) often arise in various companies. Agency

theory studies the problem information asymmetry

of designing a contract to control moral hazard. The

most efficient contract does so with the lowest

possible agency cost. Company directors manage

earnings to satisfy bondholders and shareholders.

The need to influence the financial market

perception is one of the motivations for earnings

(Scott (2015), Neffati et al. (2011), Hu (2010)).

Earnings management is a management choice

for accounting policies or real action. There are

several patterns of earning management such as a.

Taking a bath (If a company must report a loss, then

management also reports a large loss. Taking a bath

usually occurs in periods of organizational stress or

organizational restructuring. An example of his

actions is the write off assets); b. Income

minimization; c. Income maximization; d. Income

smoothing (managers smooth reported earnings to

receive constant compensation) (Scott, 2015). One

example is the result of the research by

Restuningdiah and Wafaretta (2017) that when the

realization of profit exceeds expectations, the

manager will avoid the risk of accrual based

manipulation. Accrual earnings management can be

conducted and detected through many techniques as

to reduce the fluctuation of earnings.

Earnings management can be viewed from both a

financial reporting and a contracting perspective.

From a contracting perspective, earnings

management is used to protect companies from

unexpected events due to rigid and incomplete

contracts. Earnings management influences

managers' motivation to facilitate compensation they

receive from time to time. From a financial

reporting perspective, managers use earnings

management to avoid reporting losses so that the

company's reputation does not go down, which will

result in a decline in stock prices (Scott, 2015).

Company directors manage earnings to reach a

situation that satisfies bondholders and shareholders.

Indeed, one of the motivations for earnings

management is the desire to influence the financial

market perception associated with the firm risk,

namely the change in net income (overall risk), the

Restuningdiah, N., Kusdyanti, H., Wafaretta, V. and Marsely, M.

Development of Banking Earnings Management Software.

DOI: 10.5220/0009504110851089

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1085-1089

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1085

change in total sales (operational risk) and the debt-

to-equity ratio (financial risk) (Neffati et al. 2011).

As an effort to protect the interests of the owner

(investor), information is needed regarding the

practice of earnings management carried out by

management. But until now no tool can quickly

detect the existence of earnings management

practices in the company, so investors who are

unfamiliar with various income smoothing

calculation techniques have not been able to utilize

income smoothing information in their decision

making.

Not only investors but accounting students are

also not familiar with earnings management. Most

learning process still provides theoretical

information only and has not yet linked to the real

information of earnings in the capital market. It

encourages needs to build earnings management

software to ease the understanding of earnings

management for students. Based on the background,

the objectives of this study to develop earnings

management software in the banking sector as an

ICT-based learning media for accounting students,

Although earnings management can occur in all

business sectors, this study focuses on the banking

industry due to the different characteristics of other

industries. The banking industry has tighter

regulations compared to other industries, for

example, a bank must meet a minimum Capital

Adequacy Ratio (CAR) and provide financial

statements as one indicator of the healthy bank by

Bank Indonesia (Setiawati and Na'im, 2001 in

Nasution and Setiawan, 2007).

2 RESEARCH METHOD

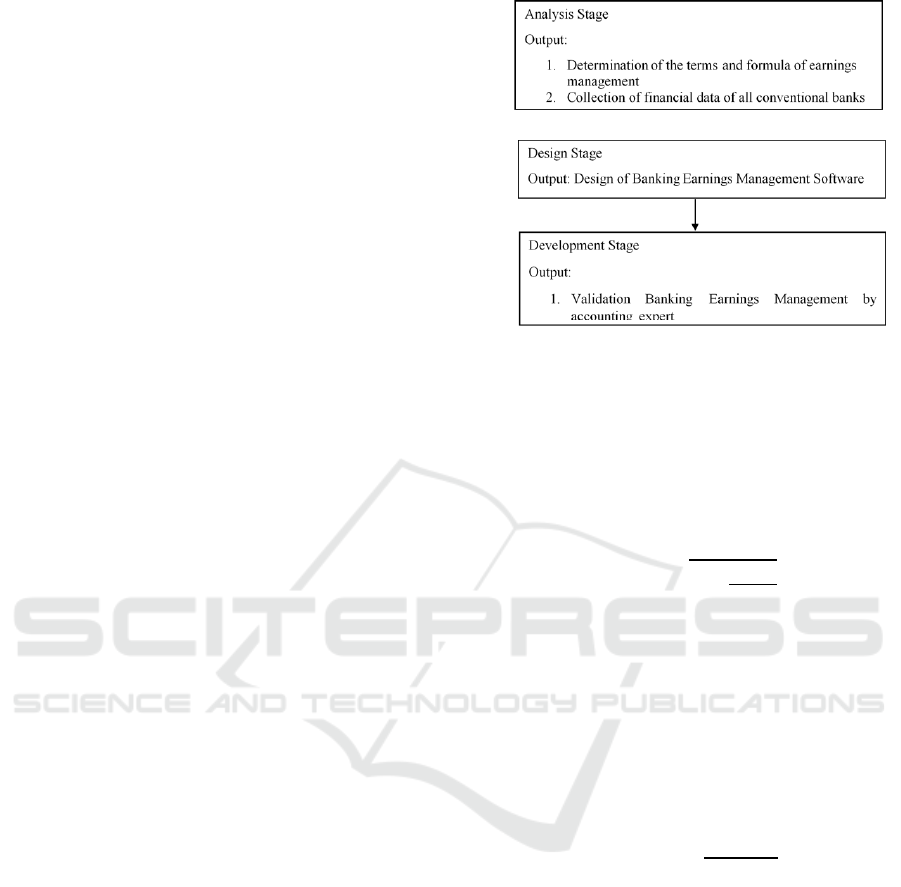

According to the purpose of research, the

development process took six (6) months for the

development of earnings management software,

obtaining the validation results of the expert of

material, and doing the trial test to the student. The

development process contains three (3) stages,

namely Analysis Stage, Design Stage, and

Development Stage, whereas each stage has an

output that supports the process of content

development of earnings management software as

illustrated in figure 1 below.

Figure 1: Development of Banking Earnings

Management Software

In design stage, the formula of earnings

management input in the software are model by

Healy (1985) and DeAngelo (1986) (Callao et al.,

2017). The formula are shown as follows.

Healy (1985):

1

∑

1

Notes:

TA

it

: Total Accruals in year t

A

it-1

: Total Assets in year t -1

n : number of years in the estimation

period

DeAngelo (1986):

1

2

Notes:

TA

it-1

: Total Accruals in year t -1

A

it-2

: Total Assets in year t -2

2.1 Validation by Experts

This study used primary data by questionnaire to

infer the validity of earnings management software.

The indicators validated are the suitability of the

material and the accuracy of the material. The

questionnaire uses a Likert scale of 4. Criteria for

each rating scale is score 4 for very clear, 3 for clear,

2 for unclear, and 1 for very unclear. The data

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1086

analysis used is by calculating the percentage,

according to the formula:

Σ

Σ1

100%

Notes:

P = percentage

∑

x

= Score of respondents’ answer in 1 item

∑

x1

= Maximum score in 1 item

Each item is validated by several criteria such as

valid, valid enough, less valid and not valid. The

score for each criterion can be seen in table 1.

Table 1: Validation Criteria

ANSWER CRITERIA

80 – 100 Valid

60 – 79 Quite Valid

40 – 59 Need Revision (Less Valid)

0 – 39 Need Revision (Not Valid)

Source: Sudjana (2005)

The questionnaire gave to an accounting lecturer

as a material expert in investment management

system and a practitioner as a media expert. The

questionnaire of earnings management software also

includes additional forms of comments, criticisms,

and suggestions from the validator related to the

software. Feedbacks from the material and media

expert judgments then are used as the basis for the

revision of the earnings management software.

2.2 Trial Test to the Students

After validation by an expert, the software tested to

accounting students who have been taking

investment management course. It was based on the

consideration that the investment management

course discusses how to evaluate the firms’

performance including earnings management

tendency as the basis for investing.

3 RESULTS

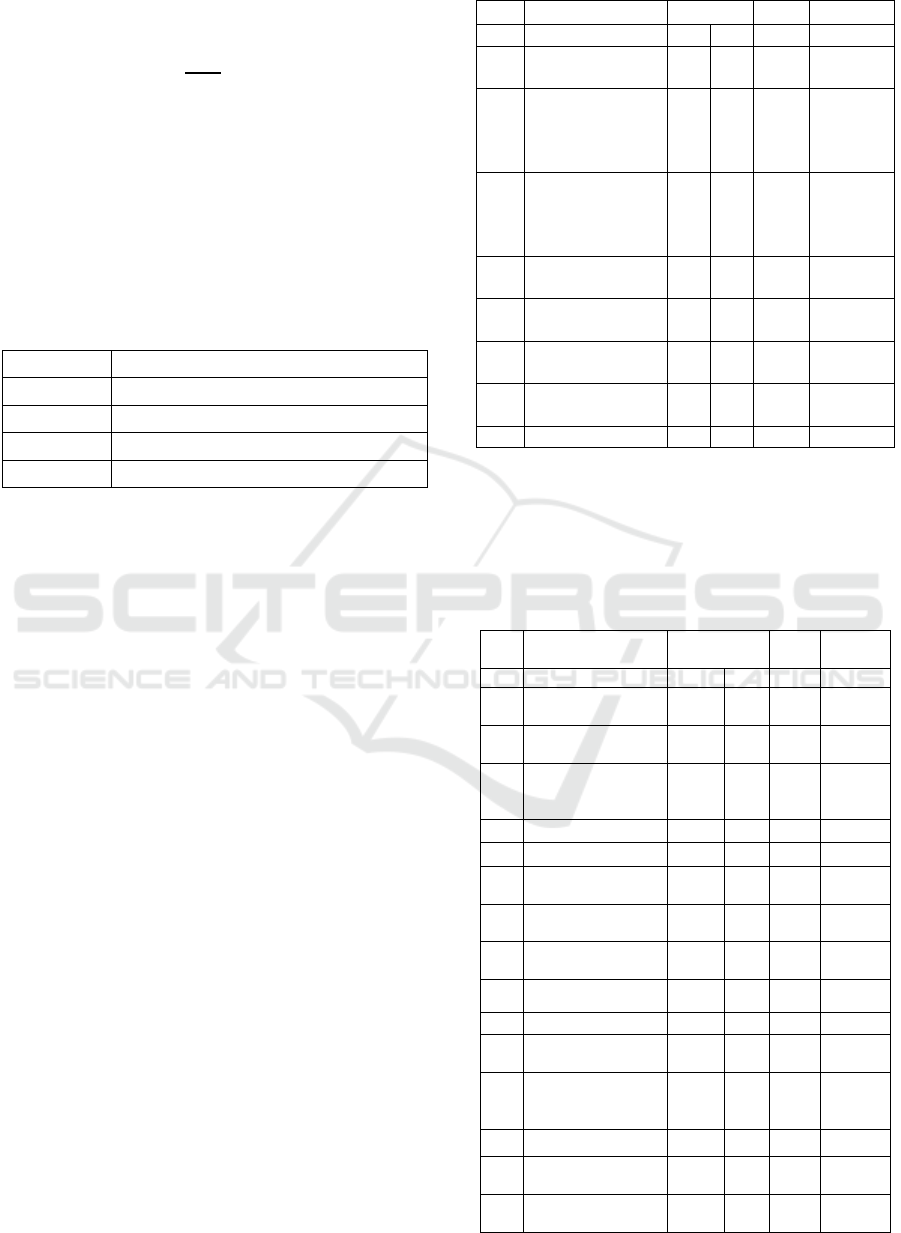

Table 2 shows the results of material expert

validation. The suitability of the material is 87,5 %

(valid), and the accuracy of the material is 100%

(valid). Based on this validation, earnings

management software for the banking sector was

declared valid and did not need revision.

Table 2: Material Expert Validation

No Explanation Score % Result

X Xi

1 The Suitability

of the Material

a. The material

presented is by

the prevailing

theory

4 4 100 Valid

b. The material

presented is by

the learning

outcome

3 4

75

Quite

Valid

Average

3,

5

4

87,5 Valid

2 The Accuracy

of the Material

a. The accuracy of

the definition

4 4 100 Valid

b. The accuracy of

the formula

4 4 100 Valid

Average

4 4

100 Valid

Table 3 shows the results of media expert

validation. The technical quality, the key function,

and the display quality of earnings management

software are 100% (valid), 100% (valid), and

93,75% (valid), respectively.

Table 3: Media Expert Validation

N

o

Explanation Score % Result

X Xi

1 Technical

Quality

a. The application is

easy to use

4 4 100 Valid

b. Entry and exit

process is easy to

use

4 4 100 Valid

Average

4 4 100

Valid

2

Key Function

a. Key functions are

easy to use

4 4

100 Valid

b. Accuration of key

functions

4 4

100 Valid

c. Speed reaction of

key functions

4 4

100 Valid

Average

4 4

100 Valid

3

Display quality

a. Compatibility of

color selection

4 4

100 Valid

b. The effectiveness

of the layout

screen

4 4

100 Valid

c.

Font size

4 4

100 Valid

d. Data

Completeness

3 4

75 Valid

Average

3,75 4 93,7

5

Valid

Development of Banking Earnings Management Software

1087

Revision of Banking Earnings Management

Software is related to data completeness. The media

expert suggested adding data for five years, such as

the annual report from 2012 until 2017. After

revision, the learning media is ready to be

implemented and evaluated (field test) by the

accounting students as the user in the learning

process. Field validation was carried out on thirty-

three (33) accounting students.

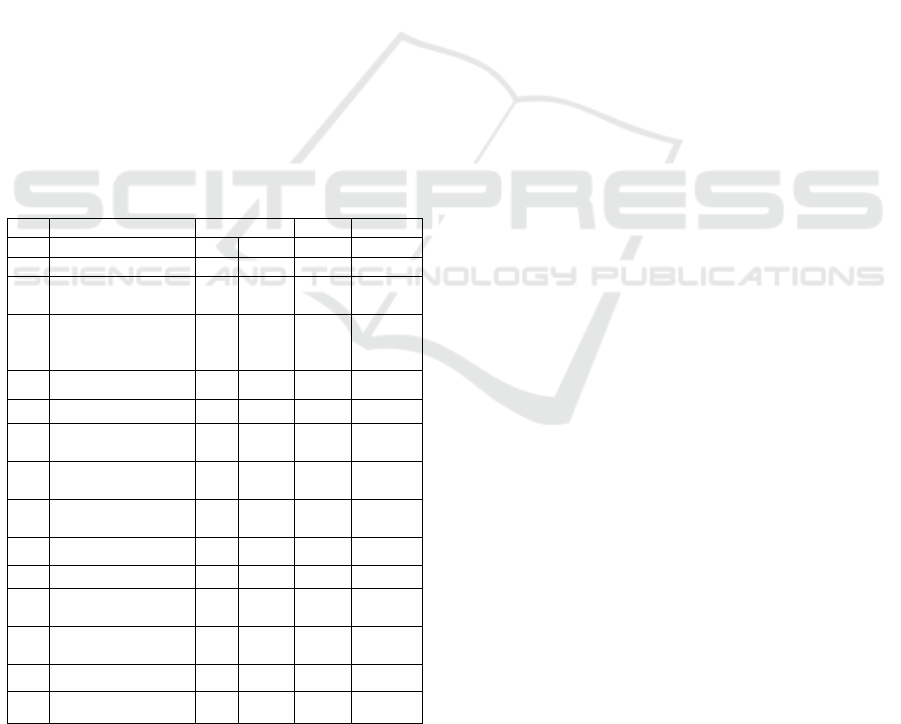

Table 4 shows the result of the field test. The

technical quality of media is 98,6 % (valid), the key

function of media is 95,8% (valid), and the display

quality of media is 81,9% (valid). The suggestions

from the respondents that The Banking Earnings

Management Software should be able to: a. Be used

in offline mode, b. Automatically update the data

(annual report), c.Analyze and support short-term

decision making from the quartal financial report, d.

Encompass not only the banking sector but all

industry sectors, d. Add the logo of Universitas

Negeri Malang (UM) or IDX, e. Append more

colors and pictures to make this software more

interesting, and f. Can be downloaded through play

store or app store in the future so that this software

can be more accessible as learning media.

Table 4: Field Test

No Explanation Score % Result

X Xi

1. Technical Quality

a. The application is

easy to use

141 144 97,9 Valid

b. Entry and exit

process is easy to

use

143 144 99,3 Valid

Average

142 144 98,6 Valid

2. Key Function

a. Key functions are

easy to use

138 144

100 Valid

b. Accuration of key

functions

141 144

97,9 Valid

c. Speed reaction of

key functions

129 144

89,6 Valid

Average

136 144

95,8 Valid

3.

Display quality

a. Compatibility of

color selection

110 144

76,4 Valid

b. The effectiveness

of the layout screen

119 144

82,6 Valid

c.

Font size

125 144

86,8 Valid

Average

118 144 81,9 Valid

4 DISCUSSION

Learning media helps to simplify the learning

process, by connecting learners, lecturers, and

teaching materials. The optimal use of media can

improve the effectiveness of the learning process. In

accounting learning in the classroom, many books

used are in English, and often many accounting

terms are rarely used, so it needs a tool or media that

can help students in studying accounting.

Besides that, in student-centered teaching, the

emphasis is on students as active learners. The

students find information and problem-solving

independently. Multimedia technology supports the

self-exploration and active participation by students

to solve a problem (Malik and Agarwal, 2012).

5 CONCLUSIONS

This study produced earnings management software

for the banking sector which has been validated by

an expert. The software was designed to enhance

students' ability in self-study and help the accounting

learning process.

This study limits designed earnings management

software for consolidated banks. Further projects

may take to expand the scope by adding more

comprehensive calculation as per entity; such as for

insurance companies, sharia banks, and sharia

insurance banks which are subsidiary companies of

the conventional bank as parent company;

conventional parent bank itself; and the consolidated

banks. Furthermore, the software may comprise all

industry sectors.

REFERENCES

Callao, S., Jarne, J. I., & Wróblewski, D. (2017).

Detecting earnings management investigation on

different models measuring earnings mnagement

for emerging eastern european countries.

International Journal of Research -

Granthaalayah, 5(11), 222–259.

Hu, L. (2010). Does Corporate Governance Matter,

Evidence from Earnings Management Practices

in Singapore. Dissertations and Theses

Collection (Open Access).

Malik, S. and Agarwal, A. (2012). Use of

multimedia as a new educational technology tool

– a study. International Journal of Information

and Education Technology, 2 (5).

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1088

Nasution, M. and Setiawan, D. (2007). Pengaruh

Corporate Governance Terhadap Manajemen

Laba di Industri Perbankan Indonesia.

Proceedings Simposium Nasional Akuntansi X

Makasar. Juli. Hal. 1-26.

Neffati A., Imène, F. B., and Christophe, S. (2011).

Earnings management, risk and corporate

governance in US companies. Corporate

Ownership & Control, 8 (2), Continued – 1.

Restuningdiah, N. and Wafaretta, V. (2017). Real

and Accrual-Based Earnings Management in

Islamic Banks in Indonesia. 6th Global

Conference on Business and Social Science.

Sudjana, N. (2005). Media Pengajaran

(Penggunaan dan Pembuatannya). Percetakan

Sinar Baru Algensindo Offset. Bandung.

Scott, W. R. (2015). Financial Accounting Theory

7th Edition. Pearson Canada Inc. Canada.

Development of Banking Earnings Management Software

1089