The Effectiveness of Government Internal Audit and the Influencing

Factors: Empirical Evidence from Aceh-Indonesia

Nadirsyah

1

, Muslim A. Djalil

1

, Rulfah M. Daud

1

and Mirna Indriani

1

1

Faculty of Economics and Bussiness, Universitas Syiah Kuala, Aceh-Indonesia

Keywords: Effectiveness of Internal Audit, Auditee Perceptions, Independence, Audit Staff Competency, Public Sector,

Government

Abstract: It continues to be questioned about the issues in the effectiveness of government internal audit in recent

years. It is due to many reports of corruption cases which generally come from outside the government, and

none of which comes from internal audit agencies as government internal control apparatus. This study is to

examine and analyze the effectiveness of government internal audits and what factors that influence the

effectiveness of internal audit. This study identifies the factors as management support, auditee perceptions

on internal audit function, organizational independence, and the competency of internal audit staff. This

study is conducted in Aceh Province by taking a sample of 15 inspectorates in Aceh Province with the

respondents of 332 government internal auditors who work in it. Primary data is collected through

questionnaires that are sent directly to internal auditors. Data are analyzed by a mean test and multiple linear

regressions. The study results show that government internal auditors in Aceh still carry out their duties

effectively. This disputes the issues that say internal audit is not effective. The factors that influence the

effectiveness of internal audit are the existence of high management support, positive auditee perceptions on

internal audit function and audit staff competency, while organizational independence is the factor that does

not influence the effectiveness of internal audit.

1 INTRODUCTION

The effectiveness of government internal audit in the

past few years has been questioned as many

corruption cases that have involved regional officials

both at the levels of district and province (Anggoro,

2015; Gintings and Budi, 2017). Throughout 2004-

2018 there were 781 corruption cases that are

handled by Corruption Eradication Commission

(KPK). Of the cases, there are 358 cases or 45.84%

involves regional government administrators (KPK,

2018). Internal audits seem ineffective in preventing

such irregularities. Government internal audits

should be an early detection tool in preventing state

financial irregularities though.

The effectiveness of government internal audits

is an important requirement along with the

increasing demands of the community for the

implementation of good regional government

financial management. Internal audit has become a

control tool that must be used by both the private

and the public sectors (Cohen and Sayag, 2010; M.

Badara and Saidin, 2013). Therefore is time for

management to seriously provide an effective role

for internal audits in the organization (Sumritsakun

and Ussahawanitchakit, 2009), especially in

regional governments in order to contribute to the

improvement of organizations (S. Badara and

Saidin, 2013) and important parts of government

organizational structures (Coram, Ferguson and

Moroney, 2008). In the broader context of

organization management and control, governance

and risk management processes are inherent in

internal audit function (Asare, 2009; Prawitt, Smith

and Wood, 2009).

There has not been done much about the study

that observes whether internal audit is still effective.

This study examines the effectiveness of

government internal audits so that it can provide an

overview of whether the government internal audit is

still effective or not in carrying out its duties. In

addition, this study also examines what factors that

influence the effectiveness of government internal

audits.

2 LITERATUR REVIEW

The Effectiveness of Internal Audit

Internal audit plays an important role in an

organization both private and public sectors in this

Nadirsyah, ., Djalil, M., Daud, R. and Indrian, M.

The Effectiveness of Government Internal Audit and the Influencing Factors: Empirical Evidence from Aceh-Indonesia.

DOI: 10.5220/0009503510611071

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1061-1071

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1061

case the regional government. Internal audit

functions as a reviewer in the process of preparing

financial statements both business and non-profit

(Reynolds, 2000). Internal auditors play a key role in

monitoring risk and identifying potential areas of

increased risk (Goodwin-Stewait and Kent, 2006).

The purpose of internal audit is to improve the

efficiency and effectiveness of the organization

through constructive criticism.

The Institute of Internal Auditors (IIA) defines

internal audit: as an independent and objective form

of confidence and consultation which is designed to

add value and improve organizational operations.

Internal audit helps organizations achieve their goals

by introducing a systematic and disciplined

approach to evaluating and increasing the

effectiveness of the risk management, control and

management processes (Mihret and Yismaw, 2007).

This definition shows that internal audits have a

paradigm shift from emphasizing past accountability

to improve future outcomes to help the auditee

operates more effectively and efficiently (Stern,

1994; Cenker and Nagy, 2002; Goodwin, 2004;

Mihret and Yismaw, 2007).

The role of internal audit is increasingly

important in management and supervision (Prawitt,

Smith and Wood, 2009), and its effectiveness in

carrying out its responsibilities must have a higher

frequency (Alzeban and Sawan, 2013). Effectiveness

in carrying out its functions will have an impact on

the quality of financial information which is

presented by management. The word "effectiveness"

has been defined differently by researchers. For

example, Arena and Azzone (2009) define

effectiveness as the ability to get results that are

consistent with the target goals. Meanwhile,

Dittenhofer (2001) views effectiveness as the ability

to achieve goals and objectives. In the same context,

a program can be seen as effective if the results are

in line with its objectives (H. N. Ahmad et al., 2009;

Mihret, James and Joseph, 2010). In terms of the

effectiveness of internal audits, it means the ability

of internal auditors to achieve the goals which are

set out in regional government (S. Badara and

Saidin, 2013). This is in line that the purpose of

internal audit for each organization depends on the

objectives which are set by the management of the

organization (Pungas, 2003) thus the purpose of

internal audits in regional government must also go

according to the targets which are set by the regional

government. Based on the description, the research

hypothesis is:

H1: Government internal audit is still effective in

Aceh Province.

The Factors Influencing the Effectiveness of

Government Internal Audit

The effectiveness of internal audit can be

influenced by several factors, such as auditor

professional expertise (Al-Twaijry, Brierley and

Gwilliam, 2003; Mihret and Yismaw, 2007; Arena

and Azzone, 2009; Anto, Sutaryo and Payamta,

2016). Other factors are auditor competency,

independence and objectivity of internal auditors

and management support (Mihret and Yismaw,

2007; Cohen and Sayag, 2010; Baharuddin, Alagan

and Mohd, 2014), internal audit quality (Mihret and

Yismaw, 2007; Cohen and Sayag, 2010). The

independence factor is a widely studied factor,

namely (Al-Twaijry, Brierley and Gwilliam, 2003;

Cohen and Sayag, 2010; Mihret, James and Joseph,

2010; D’Onza et al., 2015).

Arena and Azzone (2009) suggest that the

characteristics of the audit team, audit processes and

activities, and organizational relationships are what

affect the effectiveness of internal audit. Mihret and

Yismaw (2007) have identified organizational

characteristics in increasing or decreasing the

effectiveness of internal audits. They find that

internal audit quality influence the effectiveness of

internal audits.

Furthermore, Alzeban and Gwilliam (2014)

suggest the factors that influence the effectiveness of

the internal audit at the public sectors in Saudi

Arabia are the competency of internal audit

department staff, the relationship between internal

and external auditors, management support for

internal audits and internal audit independence.

Whereas MacRae and Gils (2014) identify nine

elements for the effectiveness of external audits in

the public sector, they are (1) organizational

independence, (2) a formal mandate, (3) unrestricted

access, (4) sufficient funding, (5) competent

leadership, (6) objective staff, (7) competent staff,

(8) stakeholder support, and (9) professional audit

standards.

Based on several previous studies, this study

identifies four factors that influence the

effectiveness of government internal audits in Aceh

Province, and they are management support, auditee

perceptions of internal audit function, organizational

independence, and the competency of internal audit

staff. These factors are very appropriate to see the

relation with the effectiveness of government

internal audit whose research subject is the

inspectorate auditor as the government internal

supervisor apparatus. The factor of management

support according to Cohen and Sayag (2010) is in

the form of support for programs of internal audit

activities and ensures that internal audits have

adequate resources that are needed to carry out all

audit work. Management support means the support

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1062

from the leadership of an internal audit entity, in any

form that can be used for the smooth implementation

of internal audit duties and responsibilities. AAIPI

(2014) have stipulated that the head of an internal

audit entity must communicate and request approval

of the annual internal audit activity plan to the

leadership of the ministry/institution/regional

government. This is the first step in providing

support to internal audit entity. There are existence

of a well-planned activity plan, and followed by the

provision of support in the form of human resources,

finance, as well as facilities and infrastructure for the

smooth implementation of their duties and

responsibilities.

The factor of auditee perception is a process that

someone uses to manage and to interpret their

sensory impressions in order to give meaning to

their environment (Robbins, 2006). The auditee

perceptions of internal audit function will be able to

increase the effectiveness of internal audits if the

auditee perceives positive internal audits.

Conversely, if the auditee perception is negative

about internal audit, the internal audit activities

become ineffective.

The factor of independence in an audit is

interpreted as a situation in which the auditor is in a

free position, he is not bound by any party, and there

is not intervention from any party in carrying out his

work. Auditors must be sufficiently independent of

auditing and ensure that they can do their work

without intervention or interference (Cohen and

Sayag, 2010). This is certainly not easy, as it is

expressed by Mihret, James and Joseph (2010), that

there will be difficulties for internal auditors to

maintain independence because internal auditors are

basically part of the organization as employees. The

same thing is also stated by Salsabila and

Prayudiawan (2011) that internal auditors would

have problems when they had to report findings that

did not benefit management or auditing with their

position as workers within the organization that they

are audited.

The factor of competency of internal audit staff

is the expertise from auditor personnel who will

contribute in running the audit task. Personnel

expertise will be a guarantee for the organization

that the assigned tasks will be completed properly.

The same applies to internal audit entities. An

auditor performance will be carried out by using

technical competencies, including education,

experience, and ongoing training (Awaluddin,

2013). According to the internal audit standard

(AAIPI, 2014), the effective role of APIP can be

realized if it is supported by professional and

competent auditors, such as education, knowledge,

expertise and skills, experience, and other

competencies which are needed to carry out their

duties and responsibilities.

Based on the description above, the hypothesis

of this study are:

H2: Management support influences on the

effectiveness of internal audit.

H3: Auditee perception influences on the

effectiveness of internal audit.

H4: Organizational independence influences on the

effectiveness of internal audit.

H5: Audit staff competency influences on the

effectiveness of internal audit.

3 RESEARCH METHOD

This study is conducted by survey method, which is

by taking 15 from 23 districts/cities in Aceh

Province. The choice of location is based on (1)

representation of city and district areas, and (2)

representation of financial performance that is

measured from obtained opinions on examination of

regional government financial statements. The unit

of analysis is 332 government internal auditors who

work in the district/city inspectorate.

Primary data is collected directly from the field

using a questionnaire. Secondary data is obtained

through the inspectorate offices of each district/city.

Data analysis is carried out using descriptive

statistics, average test and multiple linear

regressions.

4 RESULT AND DISCUSSION

The Characteristics of Respondents

The characteristics of respondents in this study are

the characteristics or the circumstances of

respondents. The respondents who are the subjects

in this study are 332 internal auditors who work at

the district/city Inspectorate. The characteristics of

respondents in this study included gender, age, level

of education, and working period. The data

regarding the characteristics of respondents from

this study can be seen fully in the following Table 1.

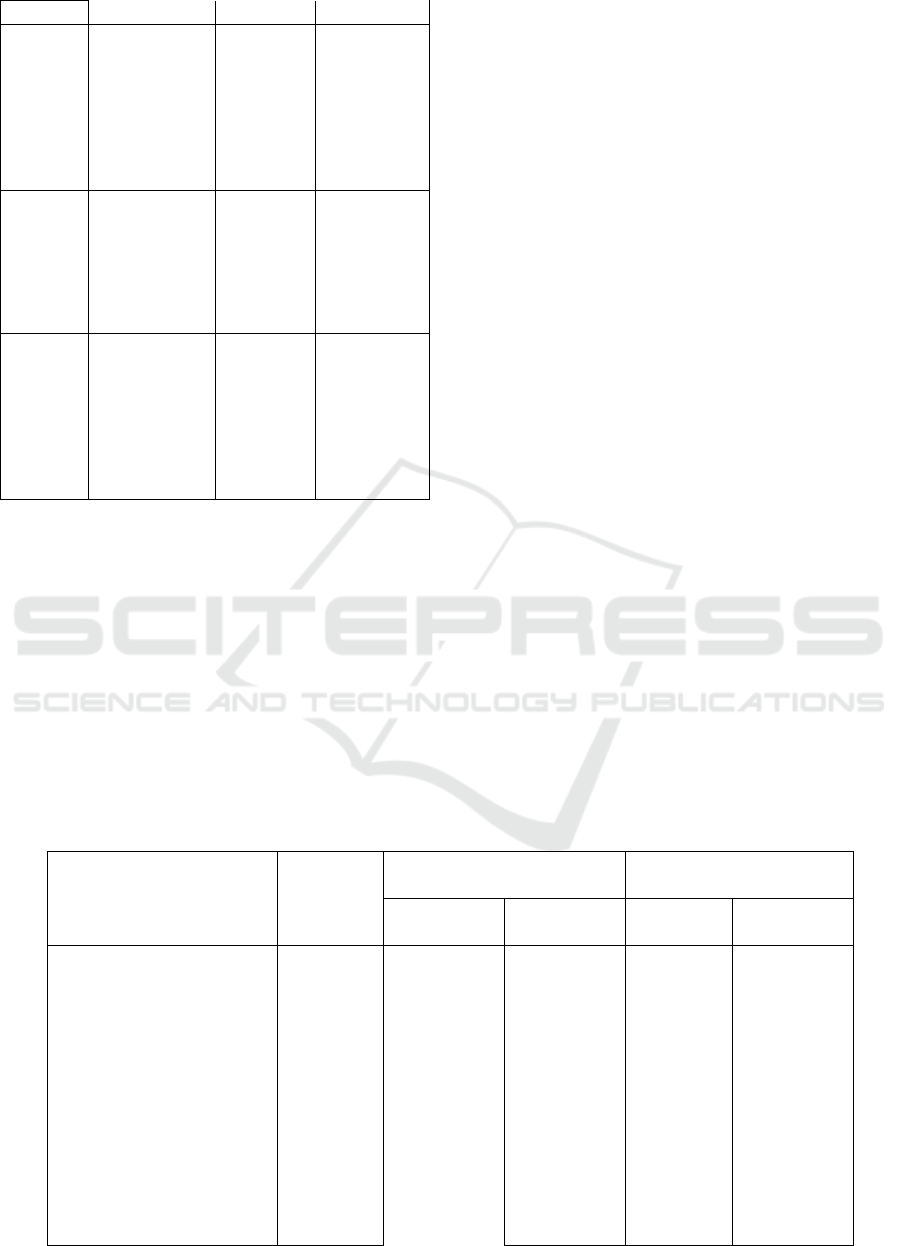

Table 1: The Characteristics of Respondents

The Characteristics of

Respondents

Amount Percentage

Gender

Male 168 50.6

Female

No response

156

8

47.0

2.4

The Effectiveness of Government Internal Audit and the Influencing Factors: Empirical Evidence from Aceh-Indonesia

1063

Total 332 100

Age

21 to 30 years 26 7.8

31 to 40 years 144 43.4

41 to 50 years 115 34.6

Above 50

years

No response

41

6

12.4

1.8

Total 332 100

Education

Diploma 24 7.2

Bachelor 223 67.2

Master 61 18.4

Doctor

No response

4

20

1.2

6.0

Total 332 100

Years Of

Service

Below 1 year 11 3.3

1 to 3 years 27 8.1

4 to 5 years 18 5.4

Above 5

years

No response

259

17

78.0

5.2

Total 332 100

Source: processed data (2018)

The above Table 1 shows the male

respondents in the sample are 168 people or 50.6%

of the total sample and female respondents are 156

people or 47%, while the remaining 8 people or

2.4% are respondents who did not response on the

gender column. Age of respondents is more

dominant between 31 to 40 years old or 43.4% of the

total sample and those who did not response on the

age column are 6 people or 1.8%.

The majority of respondents who have

Bachelor degree in level of education (S1) are 223

respondents or 67.2% of the total sample. The

majority of respondents who have a working period

of more than 5 years are 259 people or 78% of the

number of samples while those that do not response

on the work period column are 17 people or 5.2%.

The Results of Instrument Testing

The instrument testing of measuring tool is done to

test whether it is used to meet the requirements as a

good measuring tool in order to produce reliable

data. Therefore it is necessary to test validity and

reliability to assess the correlation between scores of

each item statement with a total score. The testing

the validity and reliability in this study uses the help

of SPSS software.

The coefficient correlation of r Pearson

correlation which is obtained must be compared with

the critical value of the Pearson product moment

correlation. Each item statement will be declared

valid if the value of r count > r table at a significance

level of 5%. The critical value of Pearson product

moment correlation or r table value is 0.228.

Reliability test is a measurement to determine

how far to which the measurement is without bias

(error free), so that it shows accuracy, consistency,

and determination of its measurements (Sekaran and

Bougie, 2013). Measurement of reliability on the

research instrument uses the Cronbach Alpha

technique (a). Sekaran and Bougie (2013) state that

an instrument can be said to be reliable if it has a

reliability coefficient value or Cronbach Alpha value

above 0.60. The results of the validity test and

reliability test can be seen in the following Table 2.

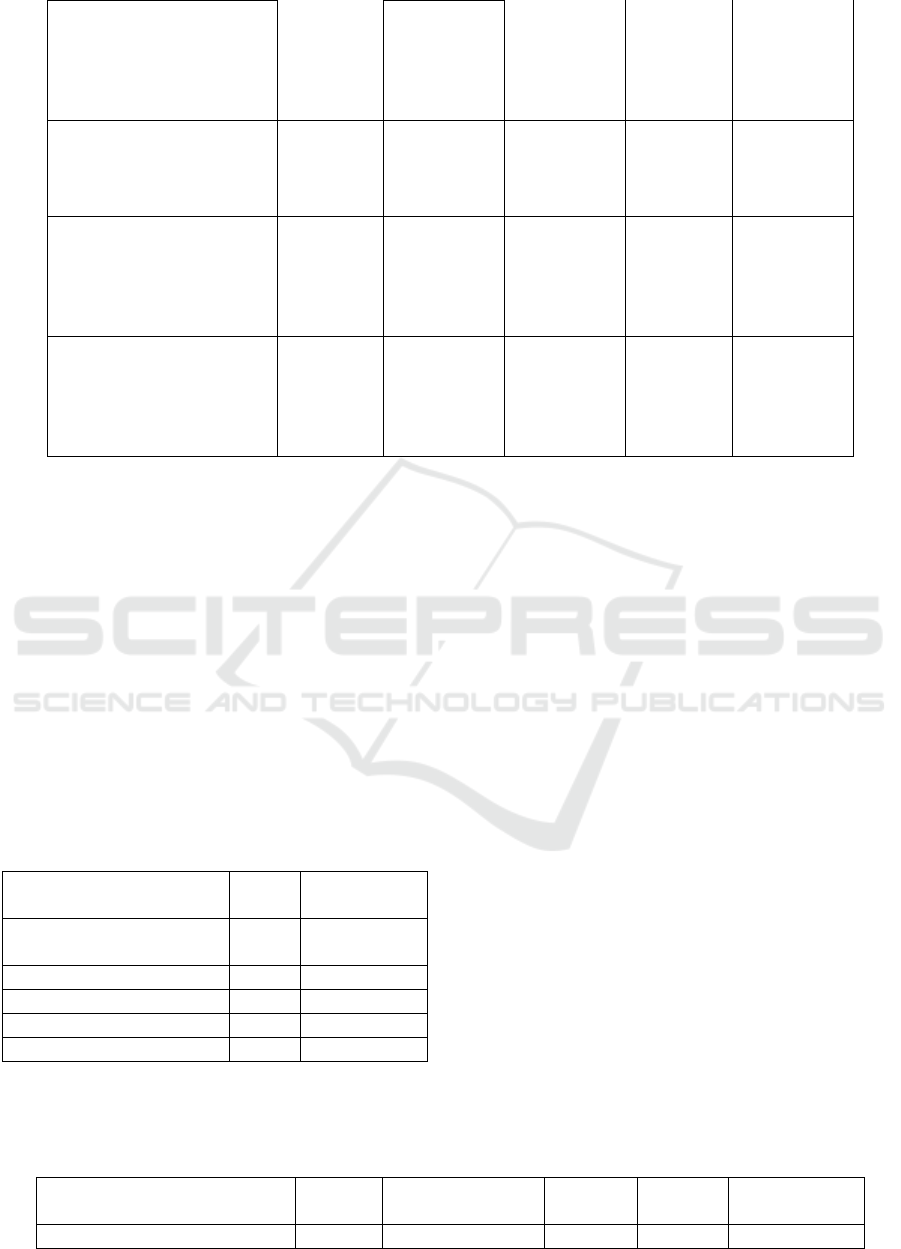

Table 2: The Results of Validity and Reliability Tests

Variable

Item of

Questions

Validity* Reliability*

Correlation

Coefficient

Description

Cronbach

Alpha

Description

Effectiveness

E1 0.627 Valid

0.913

Reliable

E2 0.579 Valid

E3 0.595 Valid

E4 0.677 Valid

E5 0.738 Valid

E6 0.716 Valid

E7 0.745 Valid

E8 0.651 Valid

E9 0.728 Valid

E10 0.718 Valid

E11 0.738 Valid

E12 0.669 Valid

E14 0.732 Valid

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1064

Management Support

DM1 0.769 Valid

0.871 Reliable

DM2 0.823 Valid

DM3 0.842 Valid

DM4 0.847 Valid

DM5 0.779 Valid

Auditee Perception on

Internal Audit Function

PA1 0.868 Valid

0.915 Reliable

PA2 0.920 Valid

PA3 0.897 Valid

PA4 0.888 Valid

Independence

IK1 0.810 Valid

0.825 Reliable

IK2 0.752 Valid

IK3 0.762 Valid

IK4 0.752 Valid

IK5 0.766 Valid

Competency of Internal

Audit Staff

KK1 0.850 Valid

0.898 Reliable

KK2 0.818 Valid

KK3 0.874 Valid

KK4 0.887 Valid

KK5 0.799 Valid

*Valid : If the value of correlation coefficient > the critical value of r correlation = 0.228

*Reliable : If the value of cronbach alpha > 0.60

Table 2 shows the results of validity and

reliability tests for each variable item. All variables

in this study show the correlation coefficient of

critical values (r) 0.228 which means that all

indicators of variables in this study have good

validity levels. The level of instrument reliability in

each variable in this study shows a good and

acceptable level of reliability because all variables

have alpha cronbach value > 0.60.

The Results of Descriptive Statistics

The results of descriptive statistics for each variable

can be shown in Table 3 below.

Table 3: Descriptive Statistics

Variable Mean

Standard

Deviation

Effectiveness of Internal

Audit

4.17 0.51

Management Support 3.91 0.67

Auditee Perception 3.81 0.69

Independence 3.91 0.97

Audit Staff Competency 3.55 0.72

Table 2 shows the average value of each variable

using the 5-point Likert scale. The average value of

the effectiveness of internal audit variable is 4.17

which almost close to the maximum value of 5. This

means that respondents consider that government

internal audit is still effective. The average value of

management support variable gets a result by 3.91.

This shows that respondents understand them in

carrying out their duties to get full support from the

leadership. The respondents also considered that the

auditee perception on the internal audit function is

very positive. This is indicated by the results of an

average value by 3.81. Respondents also viewed

them as still working independently with an average

score by 3.91. While the average value of

competency by 0.72 means that the auditor

inspectorate has competent staff.

The Results of Hypothesis Testing

Hypothesis testing is done, firstly to test whether

government internal audits are still effective.

Secondly, to examine whether there is an influence

of management support, auditee perceptions,

independence and competence of audit staff on the

effectiveness of government internal audits. The

testing results can be seen in Table 4 below.

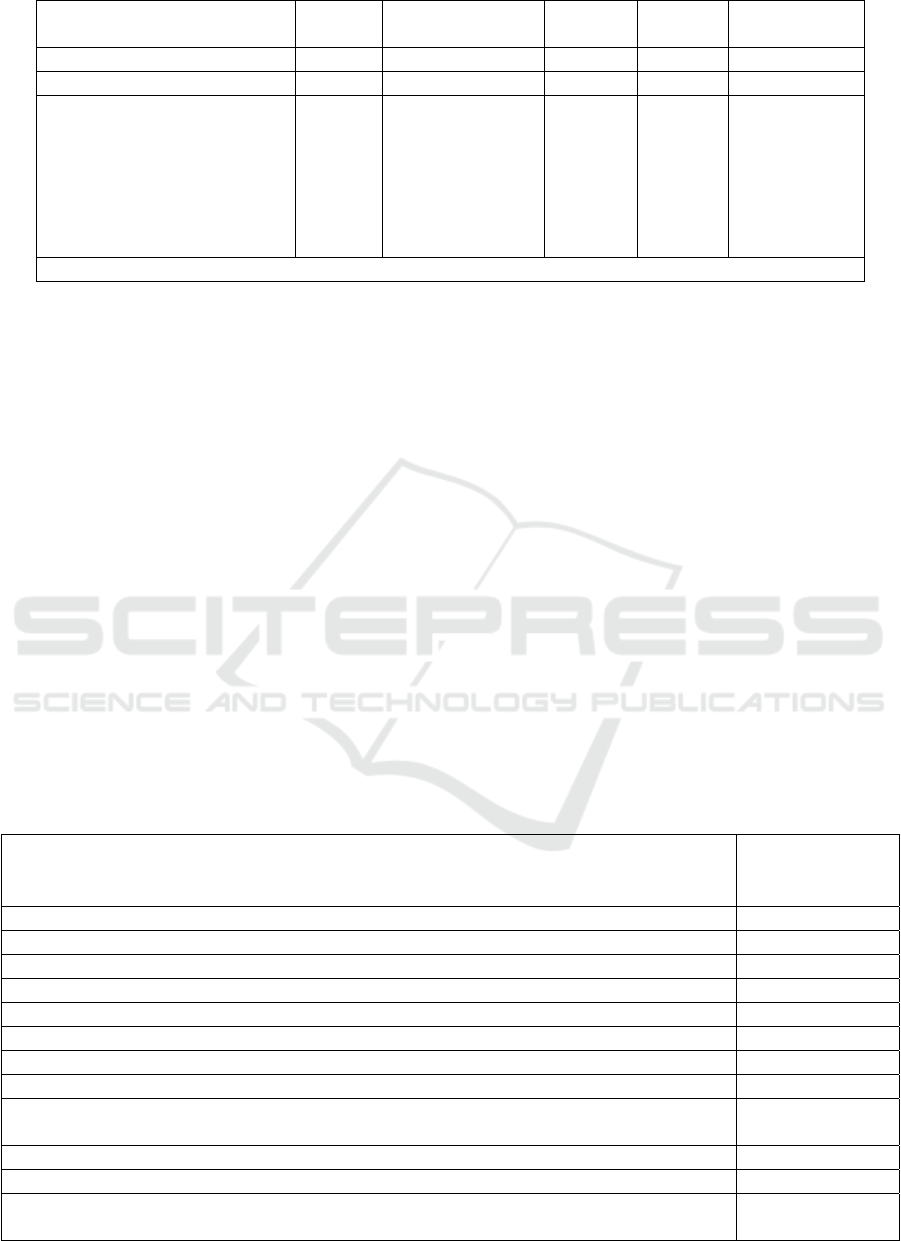

Table 4: The Results of Hypothesis Testing

Mean Mean

Difference

t-value p-value Conclusion

The Effectiveness of Government Internal Audit and the Influencing Factors: Empirical Evidence from Aceh-Indonesia

1065

Hypothesis I

58.378 -3.621 -10.378 0.000 H

1

: Accepted

Coefficient t-value p-value Conclusion

Hypothesis II, III, IV, V

Constant

Management Support

Auditee Perception

Organizational Independence

Audit Staff Competency

36.242

0.323

0.811

0.220

0.856

2.584

6.672

1.467

6.545

0.010

0.000

0.143

0.000

H

2

: Accepted

H

3

: Accepted

H

3

: Accepted

H

5

: Accepted

N= 332; R= 0.564; R

2

= 0.318; F= 31.304; Sig= 0.000;

The first hypothesis states that government internal

audits are effective. The results of hypothesis testing

can be seen in Table 4 which shows the results of t-

value = 10.378 with p-value = 0.000 is smaller than

the significant level α = 0.05. So it can be concluded

that government internal audits are still effective in

Aceh Province.

The results indicate that government internal

audits in several districts/cities of Aceh Province are

still working effectively. This means that internal

audit has an increasingly strategic role going

forward and the more effective the internal audit, the

better the performance of the government. With the

effectiveness of the auditors carrying out their

duties, they are expected to become agents of change

who can create added value to the products or

services of government agency (AAIPI, 2014).

Furthermore, the existence of an effective internal

audit will greatly help the management of the

government in order to realize good governance that

leads to clean government.

The study results also indicate that internal

audits still work consistently to review financial

reports, compliance with laws and regulations and to

evaluate internal control systems. If this is done

continuously, it will result in good and clean

governance. The results indicate that government

internal audit has been able to work in achieving the

goals and objectives. This is consistent with

(Dittenhofer, 2001) statement that effectiveness is

the ability to achieve goals and objectives.

Government internal audit has been effective, if the

results are in line with its objectives (N. H. Ahmad

et al., 2009; Mihret, James and Joseph, 2010). The

effectiveness of internal audit means that the ability

to achieve the stated objectives has been achieved

(M. Badara and Saidin, 2013).

Table 5 below shows the effectiveness of

government internal audit indicators in Aceh

Province.

Table 5: Effectiveness of Internal Audit Indicator

Effectiveness Indicator

Average Score

Scale of 1 to 5

Ensuring audit results are consistent with the objectives 4.35

Reviewing compliance with laws and regulations 4.31

Reviewing compliance with policies and procedures 4.17

Evaluating government internal control systems 4.29

Preparing an annual audit plan 4.06

Evaluating the effectiveness of risk management 4.16

Recommending the improvement of the operational control system in the organization 4.15

Increasing the productivity of government organizations 4.00

Determining the feasibility and effectiveness of organizational system related to internal

financial records and work supervision

4.12

Reviewing the reliability level of financial statements 4.17

Improving organizational performance 4.05

Ensuring the recommendations that are given are followed up by the leadership of the

organization

4.12

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1066

Reviewing compliance on the regulatory in organization 4.13

Reviewing the suitability of program implementation with program planning 4.23

Total Score 4.17

Table 5 shows that the average results are close

to the maximum value of 5. This means that

government internal audit in Aceh Province is still

effective. The testing results of the second, third,

fourth and fifth hypotheses imply that there are

several factors that influence the effectiveness of

internal audit. These factors are management

support, auditee perception, organizational

independence, and audit staff competency. The

results of the hypothesis testing can be seen in Table

4. Based on these results, the multiple linear

regression equations can be obtained as follows:

Y = 36.242+ 0.323X1 + 0.811X2 + 0.220X3 + 0.856 X4 + e

Description: Y = Effectiveness of internal audit;

X1 = Management support;

X2 =.Auditee perception;

X3 =.Organizational independence;

X4 =.Audit staff competency;

e = error.

It can be explained from the regression equation

that the constant value is 36.242, which means if the

factors of management support (X1), the perception

of the auditee (X2), organizational independence

(X3) and audit staff competency (X4) are considered

constant, then the value of internal audit

effectiveness is 36.242. The regression coefficient of

management support (X1) is 0.323X1.

This means that there is an increase by one unit

of management support will relatively increase the

effectiveness of internal audit by 32.3%. Thus, the

higher the management support, the more effective

the internal audit, which in the end will motivate the

auditors to work more so as to produce good

performance.

The regression coefficient of auditee perception

(X2) is 0.811. This means that there is an increase

by one unit of auditee perception will relatively

increase the effectiveness of internal audit by 81.1%.

Thus, the better the auditee perception on internal

audit, the more internal audit will be effective so that

the results that are achieved will be good.

The results from the regression coefficient of

organizational independence (X3) are 0.220. This

means that, every increase by one unit of

organizational independence then it will relatively

increase the effectiveness of internal audit by 22%.

Thus the more independent the internal audit

institution, the more effective the internal auditor.

The results of audit staff competency coefficient

(X4) are 0.856. This means that, each increase by

one unit of audit staff competency will relatively

increase the effectiveness of internal audit by 85.6%.

Thus the higher the level of competency of the audit

staff, the more effective the internal audit will be in

producing audit reports.

Based on Table 4, it is obtained the coefficient of

determination value (R2 = 0.318) or 31.8%. This

value indicates that management supports, auditee

perceptions, organizational independence, and audit

staff competency altogether have an influence on the

effectiveness of government internal audits by

31.8%, while 68.2% are influenced by other factors

that are not included in this study. It is obtained

correlation coefficient (R) results by 0.564, it

indicates that the degree of relation (correlation)

between the dependent variable and the independent

variable is 56.4% which means management

supports, auditee perception, organizational

independence, and audit staff competency have a

positive relation with the effectiveness of

government internal audits.

The testing result of the second hypothesis (H2)

is shown in Table 4 which shows the results of

accepting the alternative hypothesis (H2). This

means that management support has a significant

positive influence on the effectiveness of

government internal audits. The results are

consistent with previous studies such as Cohen and

Sayag (2010); Mihret and Yismaw (2007); Anto,

Sutaryo and Payamta (2016); and Baharuddin,

Alagan and Mohd (2014) state that management

support contributes significantly in increasing the

effectiveness of internal audits.

Management support is an important aspect of

carrying out work. Cohen and Sayag (2010) state

that management support provides support for all

programs that are implemented by internal audits or

ensures that internal audits have sufficient resources

to carry out all work related to the audit. Forms of

management support vary, for example, providing

facilities, training and education and so on. Like

what is stated by Mihret, James and Joseph (2010)

forms of support can be in the form of adequate

allocation in human resources and equipment for

internal audits, as well as a form of coordination

with auditors in order to be able to work together

The Effectiveness of Government Internal Audit and the Influencing Factors: Empirical Evidence from Aceh-Indonesia

1067

with the internal audit during the execution of their

duties.

The testing result of the third hypothesis (H3) is

shown in Table 4 which shows the results of

accepting the alternative hypothesis (H3). This

means that the auditee perception on internal audit

function has a significant positive influence on the

effectiveness of government internal audit. The

results indicate that auditee still believes in internal

audit function. According to Mulyadi (2002)

internal audit function is to investigate and to assess

internal control and the efficiency from the

implementation of functions in various

organizational units. Thus the internal audit function

is a form of control whose function is to measure

and assess effectiveness of other internal control

elements.

The purpose of internal audit itself is to provide

added value and to make improvements to the

organization operations. Furthermore, this goal can

be done by helping organizations achieve their goals

through a systematic approach, discipline to evaluate

and to make improvements on the effectiveness of

risk management, control processes that are honest,

clean and good (Akmal, 2006). Positive auditee

perceptions will have an impact on internal audits

that function effectively.

The testing result of the fourth hypothesis (H4) is

shown in Table 4 which shows the results of

rejecting the alternative hypothesis (H4). This means

that the organizational independence does not

significantly influence the effectiveness of

government internal audits in Aceh Province. The

results are not consistent with the results of previous

studies such as Anto, Sutaryo and Payamta (2016);

Baharuddin, Alagan and Mohd (2014); Cohen and

Sayag (2010); and D’Onza et al. (2015) who state

that organizational independence influences the

effectiveness of government internal audits.

According to (Walther and Skousen, 2009), there

are three kinds of threats of independence between

internal audit and management, they are if internal

audit career still depends on auditing, budget

approval is still in the hands of auditing, and there is

involvement from management (audited) in

developing internal audit plans. Relating to internal

audit career, the current career level system of which

internal audit is one step to occupy managerial

positions can be a threat to internal audit

independence (Goodwin and Yeo, 2001). The same

thing is also stated by Stewart and Zain,

Subramaniam and Stewart (2006) who state that the

placement pattern of internal auditors into

managerial positions allows the reluctant when they

are auditing the audited, and they know they will

occupy it in the future.

Independent threats are also caused by the

confusion from the role of internal auditors between

the trustees and as the consultants (Cooper, Leung

and Wong, 2006), despite the experimental results of

Zain, Subramaniam and Stewart (2006), internal

auditors do not become biased when conducting

activities as consultants. Independence threat

actually arises when internal auditors are involved in

the risk management process in audited

organizations (Zain, Subramaniam and Stewart,

2006). This is different from Arena and Azzone

(2009), that by monitoring internal control systems

and risk management, internal audit can help

managers achieve their goals by giving advice on the

effectiveness of these controls.

However, the independence of internal auditors

must continue to be endeavored so that in each

assignment, internal auditor does not feel that he has

a disturbance, either fear or intervention that can

influence his judgment. Internal auditors are not

allowed to side with anyone, because their technical

expertise is perfect. In the absence of independence,

they will not be able to maintain their freedom of

opinion (Singgih and Bawono, 2010). If the auditor

has been independent, the auditor can maintain

objectivity, so that the results are more valid and

accountable. In general perception, internal auditors

cannot carry out their audit activities effectively

without independence and objectivity, because both

of these are fundamental attributes for internal

auditors to maintain their credibility (D’Onza et al.,

2015). AAIPI (2014) regulate the independence of

internal audits in the form of coordination from the

leadership of internal audit with the leadership of

ministries/institutions/regional governments that are

realized by signing the audit charter between internal

audit and government/regional government. This is a

form of commitment that government/regional

government will not interfere in the performance of

internal audits so that the responsibility for carrying

out audits can be fulfilled.

The testing result of the fifth hypothesis (H5) is

shown in Table 4 which shows the results of

accepting the alternative hypothesis (H5). This

means that the competence of internal audit staff has

a significant positive influence on the effectiveness

of internal audit in Aceh Province. The results are

consistent with the results of previous studies such

as Baharuddin, Alagan and Mohd (2014) and (N. H.

Ahmad et al., 2009) who states the competence of

audit staff contributes to the effectiveness of internal

audit.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1068

To achieve the stated goals, an organization must

have reliable personnel. It is the personnel who are

professional and proficient in carrying out their

duties. Personnel expertise will be a guarantee for

the organization that the assigned tasks will be

completed properly. The same applies to internal

audit entities. An auditor performance will be

carried out by using technical competencies,

including education, experience, and ongoing

training (Awaluddin, 2013). In the government

internal audit standards, the role of APIP as an

effective internal auditor can be realized if it is

supported by professional and competent auditors,

such as education, knowledge, expertise and skills,

experience, and other competencies that are needed

to carry out their duties and responsibilities (AAIPI,

2014).

As time goes by, auditors must always maintain

and renew their expertise, so that they can always

carry out their duties and responsibilities optimally,

through the means of Continuing Professional

Education in order to ensure their competencies

which are in accordance with APIP needs and

environmental development supervision. Awaluddin

(2013) mentions professional expertise as a technical

competency, it is the competency that must be

possessed by an auditor either in the fields of

auditing, accounting, government administration, or

communication science. The technical competency

of internal auditors must be continuously improved

in order to provide efficient and effective and high-

quality services to interested parties (Mihret and

Yismaw, 2007; Mihret, James and Joseph, 2010).

6 CONCLUSIONS

Based on the results of discussion in the previous

chapter, then the conclusions are as follows.

1. Government internal audits at several

districts/cities in Aceh Province are still

effective.

2. Altogether the variables of management

support, auditee perceptions, organizational

independence, and audit staff competency have

an influence on the effectiveness of government

internal audits at several districts/cities in Aceh

Province.

3. Each variable of management support, auditee

perception and audit staff competency partially

have a significant influence on the effectiveness

of internal audit. While the organizational

independence variable does not influence the

effectiveness of internal audit.

REFERENCES

AAIPI (2014) Standar Audit Intern Pemerintah

Indonesia. Indonesia.

Ahmad, H. N. et al. (2009) ‘The effectiveness of

internal audit in Malaysian public sector’,

5(9), p. 6583.

Ahmad, N. H. et al. (2009) ‘The effectiveness of

internal audit in Malaysian public sector’,

Journal of Modern Accounting and Auditing,

5(9), pp. 53–62. doi:

http://ssrn.com/abstract=2162236.

Akmal (2006) Pemeriksaan Intern (Internal Audit).

Jakarta: Indeks.

Al-Twaijry, A. A. M., Brierley, J. A. and Gwilliam,

D. R. (2003) ‘The development of internal

audit in Saudi Arabia: An institutional theory

perspective’, Critical Perspectives on

Accounting, 14(5), pp. 507–531. doi:

10.1016/S1045-2354(02)00158-2.

Alzeban, A. and Gwilliam, D. (2014) ‘Factors

affecting the internal audit effectiveness: A

survey of the Saudi public sector’, Journal of

International Accounting, Auditing and

Taxation, 23(2), pp. 74–86. doi:

10.1016/j.intaccaudtax.2014.06.001.

Alzeban, A. and Sawan, N. (2013) ‘The role of

internal audit function in the public sector

context in Saudi Arabia’, 7(235), pp. 443–

454. doi: 10.5897/AJBM12.1430.

Anggoro, A. P. (2015) ‘Inspektorat Belum Paripurna

Cegah Korupsi - Kompas.com’,

Nasional.Kompas.Com. Available at:

https://nasional.kompas.com/read/2015/03/26

/15000041/Inspektorat.Belum.Paripurna.Cega

h.Korupsi.

Anto, A., Sutaryo and Payamta (2016) ‘Determinan

efektivitas audit internal pemerintah di

Indonesia’, in Simposium Nasional Akuntansi

XIX. Lampung: IAI.

Arena, M. and Azzone, G. (2009) ‘Identifying

Organizational Drivers of Internal Audit

Effectiveness’, International Journal of

Auditing Int. J. Audit, 13, pp. 43–60.

Asare, T. (2009) ‘Internal Auditing in the public

Sector: Promoting good governance and

performance improvement’, International

Journal on Governmental Financial

Management, 9(1), pp. 15–28.

The Effectiveness of Government Internal Audit and the Influencing Factors: Empirical Evidence from Aceh-Indonesia

1069

Awaluddin, M. (2013) ‘Effect of auditor

independence and competence on job

satisfaction and performance inspection

auditor Makassar’, Journal of Managerial,

1(1), pp. 13–23.

Badara, M. and Saidin, S. (2013) ‘Impact of the

effective internal control system on the

internal audit effectiveness at local

government level’, Journal of Social and

Development Sciences, 4(1), pp. 16–23. doi:

10.5923/j.ijfa.20130202.05.

Badara, S. and Saidin, S. Z. (2013) ‘Antecedents of

Internal Audit Effectiveness : A Moderating

Effect of Effective Audit Committee at Local

Government Level in Nigeria’, 2(2), pp. 82–

88. doi: 10.5923/j.ijfa.20130202.05.

Baharuddin, Z., Alagan, S. and Mohd, S. I. (2014)

‘Factors that contribute to the effectiveness of

internal audit in public sector’, in

International Proceedings of Economics

Development and Research.

Cenker, W. J. and Nagy, A. L. (2002) ‘An

assessment of the newly defined internal

audit function’, Managerial Auditing

Journal. Emerald, 17(3), pp. 130–137. doi:

10.1108/02686900210419912.

Cohen, A. and Sayag, G. (2010) ‘The effectiveness

of internal auditing: An empirical

examination of its determinants in Israeli

organisations’, Australian Accounting

Review, 20(3), pp. 241–255. doi:

10.1111/j.1835-2561.2010.00097.x.

Cooper, B. J., Leung, P. and Wong, G. (2006) ‘The

Asia Pacific literature review on internal

auditing’, Managerial Auditing Journal,

21(8), pp. 822–834. doi:

http://dx.doi.org/10.1108/0268690061070376

9.

Coram, P., Ferguson, C. and Moroney, R. (2008)

‘Internal audit, alternative internal audit

structures and the level of misappropriation

of assets fraud’, Accounting and Finance,

48(4), pp. 543–559. doi: 10.1111/j.1467-

629X.2007.00247.x.

D’Onza, G. et al. (2015) ‘A Study on internal

auditor perceptions of the function ability to

add value’, International Journal of Auditing,

19(3), pp. 182–194. doi: 10.1111/ijau.12048.

Dittenhofer, M. (2001) ‘Internal auditing

effectiveness: an expansion of present

methods’, Managerial Auditing Journal.

Emerald, 16(8), pp. 443–450. doi:

10.1108/EUM0000000006064.

Gintings, A. A. and Budi, R. (2017) Tak ada

laporan korupsi, fungsi Inspektorat

dipertanyakan, Tempo.co. Available at:

https://nasional.tempo.co/read/878933/tak-

ada-laporan-korupsi-fungsi-inspektorat-

dipertanyakan/full&view=ok (Accessed: 10

July 2017).

Goodwin-Stewait, J. and Kent, P. (2006) ‘Relation

between external audit fees, audit committee

characteristics and internal audit’, Accounting

and Finance, 46(3), pp. 387–404. doi:

10.1111/j.1467-629X.2006.00174.x.

Goodwin, J. (2004) ‘A comparison of internal audit

in the private and public sectors’, Managerial

Auditing Journal. Emerald, 19(5), pp. 640–

650. doi: 10.1108/02686900410537766.

Goodwin, J. and Yeo, T. Y. (2001) ‘Two factors

affecting internal audit independence and

objectivity: Evidence from Singapore’,

International Journal of Auditing, 5(2), pp.

107–125. doi: 10.1111/j.1099-

1123.2001.00329.x.

MacRae, E. and Gils, D. van (2014) Nine elements

required for internal audit efectiveness in

public sector. Florida: The Institute of

Internal Auditors Research Foundation

(IIARF).

Mihret, D. G., James, K. and Joseph, M. M. (2010)

‘Antecedents and organizational performance

implications of internal audit effectiveness:

Some propositions and research agenda’,

Pacific Accounting Review, 22(3), pp. 224–

252.

Mihret, D. G. and Yismaw, A. W. (2007) ‘Internal

audit effectiveness: An Ethiopian public

sector case study’, Managerial Auditing

Journal, 22(5), pp. 470–484. doi:

10.1108/02686900710750757.

Mulyadi (2002) Auditing. 6th edn. Jakarta: Salemba

Empat.

Prawitt, D. F., Smith, J. L. and Wood, D. A. (2009)

‘Internal Audit Quality and Earnings

Management’, The Accounting Review, 84(4),

pp. 1255–1280. doi: 10.2308.

Pungas, K. (2003) ‘Risk assessment as part of

internal auditing in the government

institutions of the Estonian Republic’, EBS

Review summer, 3, p. 42–46.

Reynolds, M. A. (2000) ‘Professionalism, Ethical

Codes and the Internal Auditor: A Moral

Argument’, Journal of Business Ethics.

Springer, 24(2), pp. 115–124. Available at:

http://www.jstor.org/stable/25074272.

Robbins, S. P. (2006) Perilaku organisasi. Jakarta:

PT Indeks Kelompok Gramedia.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1070

Salsabila, A. and Prayudiawan, H. (2011) ‘Pengaruh

Akuntabilitas, pengetahuan auditr dan gender

terhadap kualitas hasil kerja auditor internal

(Studi empiris pada Inspektorat wilayah

provinsi DKI Jakarta)’, Jurnal Telaah &

Riset Akuntansi, 4(1), pp. 155–175. doi:

10.1080/01402390.2011.569130.

Sekaran, U. and Bougie, R. (2013) Research

Methods for Business: A Skill-Building

Approach. 6th edn. New York: Wiley.

Available at:

https://books.google.co.id/books?id=mp6VM

gEACAAJ.

Singgih, E. M. and Bawono, I. R. (2010) ‘Pengaruh

independensi, pengalaman, due professional

care, dan akuntabilitas terhadap kualitas audit

(Studi pada Auditor di KAP “Big Four” di

Indonesia)’, in Simposium Nasional

Akuntansi XIII. Purwokerto: IAI.

Stern, G. M. (1994) ‘15 ways internal auditing

departments are adding value’, Internal

Auditor, 51(2), pp. 30–33.

Sumritsakun, C. and Ussahawanitchakit, P. (2009)

‘Internal audit innovation and firm stability

of Thai Listed Company: How Do Implement

in An Organization?’, Journal of Academy of

Business and Economics, 9(4), pp. 1–23.

Walther, L. M. and Skousen, C. J. (2009) The

Accounting Cycle, Ventus Publishing ApS.

doi: 10.1038/ncomms5819.

Zain, M. M., Subramaniam, N. and Stewart, J.

(2006) ‘Internal Auditors’ Assessment of

their Contribution to Financial Statement

Audits: The Relation with Audit Committee

and Internal Audit Function Characteristics’,

International Journal of Auditing, 10(1), pp.

1–18. doi: 10.1111/j.1099-

1123.2006.00306.x.

The Effectiveness of Government Internal Audit and the Influencing Factors: Empirical Evidence from Aceh-Indonesia

1071