Analysis of the Effect of Gross Domestic Product and Price of Food

Commodities on Inflation in Indonesia

Kurnia Novianty Putri

1

, Fitrawaty

2

and Sri Fajar Ayu

3

1

Department of Economy Post Graduate School, State University of Medan, North Sumatera

2

Department of Economy, State University of Medan, North Sumatera

3

Department of Economy, State University of North Sumatera, North Sumatera

Keywords: Gross Domestic Product, Price of Food Commodities, Inflation, Error Correction Model

Abstract: The purpose of this study was to find out how the effect of gross domestic product, the price of rice, the

price of bulk cooking oil, the price of sugar, the price of curly red chili, and the price of chicken meat on

inflation in Indonesia. The research method used was the regression technique with Error Correction Model

data analysis. Data was processed using E-views 7.0. At unit root test, it is known that all observation

variables were stationary. In determining the optimal lag length shows the criteria of Akaike Information

Criterion (AIC), Schwarz Criterion (SC) and Human Quinn Criterion (HQ) and the smallest value was

chosen between the optimal lag value of Schwarz Criterion (SC) at lag 1. The cointegration test results

indicate that the variable was in a long-term equilibrium condition, so the regression results were

cointegrated regression. Result of the classic assumption test were, data was normally distributed, free from

autocorrelation, liberaly from the symptoms of multicollinearity, and free from the heteroscedasticity. The

results obtained were the effect of gross domestic product variables, price of medium quality rice, price of

bulk cooking oil prices in the short term positif and significant on inflation in Indonesia. Price of curly red

chilli in the short term positif and not significant on inflation in Indonesia. Price of sugar and price of

chicken meat in the short term negatif and not significant on inflation oi Indonesia. Also found that the

effect of gross domestic product variables in the long term positif and significant on inflation in Indonesia,

price of medium quality rice and price of curly red chilli in the long term positif and not signifikan on

inflation in Indonesia. Price of bulk cooking oil prices, price of sugar, and price of chicken meat in the long

term all not significant on inflation of Indonesia.

1 INTRODUCTION

Inflation is an increase in the prices of goods

continuously in a certain period. The high inflation

rate would reduce economic growth. The term of

economic growth was used to describe the progress

of economic development in a country. A country is

said to experience growth, if the product of its goods

and services increased or in other words there is a

development of a country's potential Gross Domestic

Product (GDP).

The increase in GDP have a good and bad effect

on Indonesia's economic condition. One of them is

the increase in GDP which is the cause of demand-

side inflation, the consumptive behavior of the

Indonesian people causes demand to increase so that

prices can increase. In 2008 the value of GDP was

only Rp. 1,524,123,000,000,000.00. Then in 2015 it

grew to Rp. 2,272,929,000,000,000.00 despite the

increase in GDP value good for Indonesia's

economic growth, but could cause inflation. In

Nugroho's research (2012) states that GDP has a

positive impact on inflation.

In essence, community welfare will be achieved

well if the basic needs of the community can be

realized. One of the basic human needs is food.

Therefore, the fulfillment of a country's food needs

is an absolute matter. Based on the Food Price Index

of the Food and Agriculture Organization (FAO),

world food commodity prices have continued to

increase since 2000. The world food crisis that

occurred between 2007-2008 was marked by the

price of food commodities which rose sharply and

then reached its highest point in 2011-2012. Food

Price Index data showed that the level of world food

prices in 2011 was the latest record for the past ten

years (published by the World Bank). The

economies of countries in the world, especially

developing countries with the largest expenditure of

Putri, K., Fitrawaty, . and Ayu, S.

Analysis of the Effect of Gross Domestic Product and Price of Food Commodities on Inflation in Indonesia.

DOI: 10.5220/0009502404730480

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 473-480

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

473

households, are food expenditure that has an impact

and influence on the economy of the country.

The results of empirical research showed that

food commodity prices is one of the biggest factors

affecting the high inflation rate in developing

countries such as China, India and Indonesia (Lee &

Park, 2013). Data from FAO showed that the

average inflation of Indonesian food commodities in

the past ten years was 10.36%, while Thailand was

around 5.57%, followed by Malaysia and the

Philippines around 2.8%. Empirical studies show

that the poor at both the national and regional levels

are very sensitive and vulnerable to being affected

by rising food inflation in recent years (Pratikto &

Ikhsan, 2015). Food inflation is a significant

contributor to inflation in Indonesia. Fluctuations in

food commodity prices had become an important

problem in controlling inflation in Indonesia. High

inflation will cause people's real income to decline

so that people's purchasing power decreases. Furlog

in Astari (2015) stated that fluctuations in food

commodity prices can be used as an inflation

indicator because it has the ability to respond

quickly to various economic shocks that occur, such

as increasing supply and demand shocks.

Figure 1: Food Commodity Price Development from

2008 up to 2017 (In Rupiah)

Based on the description previously stated, it is

considered important to conduct research on how

much effect the fluctuations in food commodity

prices and gross domestic product have on inflation

in Indonesia.

2 RESEARCH METHOD

The scope of the observations made in this study are;

inflation data, Gross Domestic Product (GDP), and

food commodity price data, namely medium quality

rice price data, bulk cooking oil prices, local sugar

prices, curly red chili prices, chicken meat prices in

Indonesia using time series data in the period of

2008: Q1 - 2017: Q4. This research was limited by

time series secondary data in the form of annual

reports that have been compiled and have been

published by related parties namely Bank Indonesia

(BI), Central Statistics Agency (BPS), Logistics

Agency (Bulog), and Development Planning Agency

(BAPPENAS). Data is also obtained from books and

other research results related to the research

conducted.The increase in GDP have a good and bad

effect on Indonesia's economic condition. One of

them is the increase in GDP which is the cause of

demand-side inflation, the consumptive behavior of

the Indonesian people causes demand to increase so

that prices can increase. In 2008 the value of GDP

was only Rp. 1,524,123,000,000,000.00. Then in

2015 it grew to Rp. 2,272,929,000,000,000.00

despite the increase in GDP value good for

Indonesia's economic growth, but could cause

inflation. In Nugroho's research (2012) states that

GDP has a positive impact on inflation.

Data analysis used Error Correction Model,

which is a form of model used to determine the

effect of short-term and long-term independent

variables on the dependent variable. In addition to

knowing the effect of economic models in the short

and long term, the ECM model can also overcome

data that is not stationary characterized by the

presence of high R2 but has a low Durbin Watson

value (Shocrul, 20011: 137). Data analysis in this

study utilized Microsoft Excel 2007 software and

then processed by E-Views 7.0. The model used in

this study show below.

IINF

t

= f (PDB

t

, BER

t

, MGC

t

, GUL

t

, CMK

t

, DAY

t

)

………………..…… (1)

IINF

t

= β

0

+β

1

PDB

t

+ β

2

BER

t

+ β

3

MGC

t

+ β

4

GUL

t

+

β

5

CMK

t

+ β

6

DAY

t

+εi

Where :

INF = rate of Inflation (%)

PDB = Produk Domestik Bruto (Milyar Rupiah)

BER = Medium quality rice prices (Rupiah)

MGC = Bulk cooking oil prices (Rupiah)

GUL = Local sugar prices (Rupiah)

CMK = Curly red chili prices (Rupiah)

DAY = Chicken meat prices (Rupiah)

β

0

= Constant

0

5000

10000

15000

20000

25000

30000

35000

40000

INF BER GUL MGC CMK DAY

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

474

β

1

: β

2

: β

3

: β

4

: β

5

= Coefficient of Regression

εi = Disturbance error

3 RESULTS AND DISCUSSION

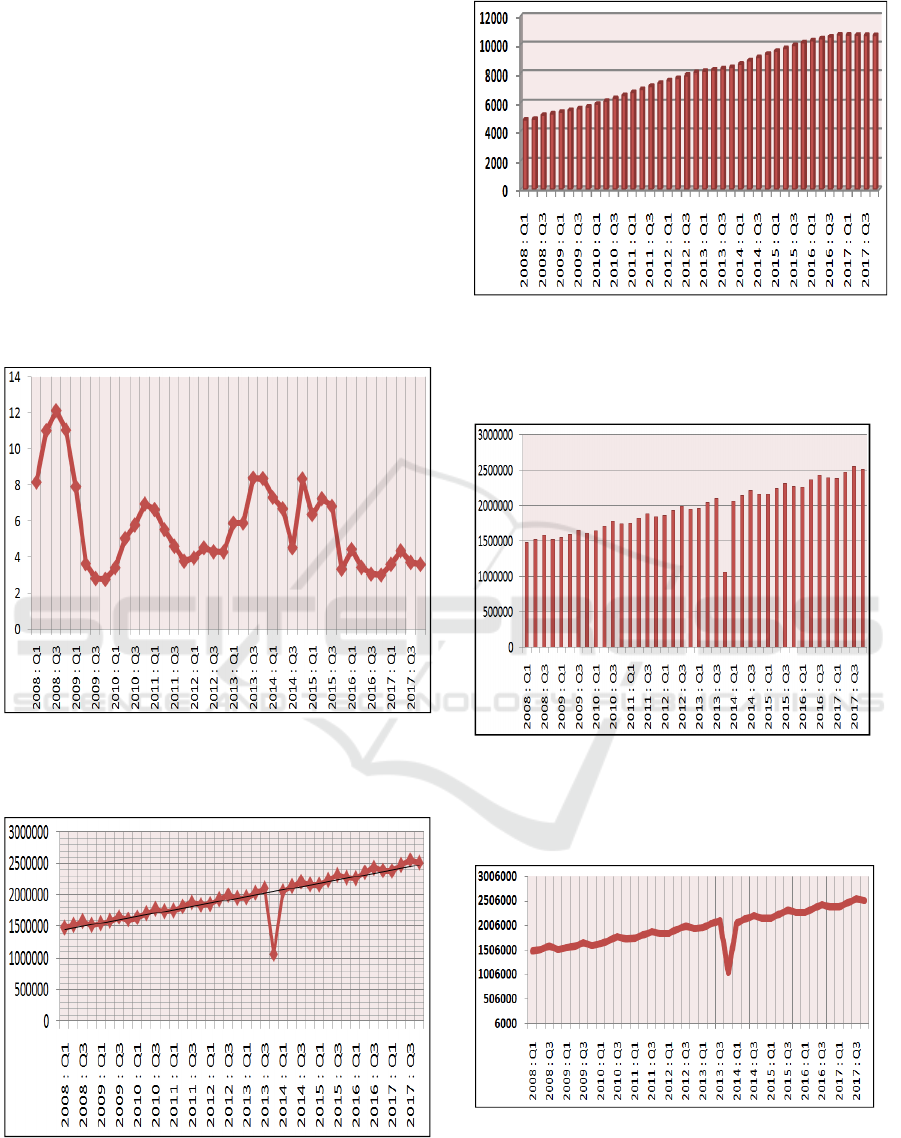

Data of inflation rates in Indonesia from 2008 to

2017, data of Indonesia's Gross Domestic Product

(GDP) growth, data of changes in medium quality

rice prices in Indonesia, data of changes in bulk

cooking oil prices in Indonesia, data of changes in

sugar prices in Indonesia, data of changes Curly red

chili prices in Indonesia, and data of changes in

prices of chicken meat in Indonesia are presented

respectively in Figure 2, Figure 3, Figure 4, Figure

5, Figure 6, Figure 7, and Figure 8.

Source : processed form Cenral Statistic Agency

Figure 2: Presentation of Graphs of Inflation Rate in

Indonesia from 2008:1 to 2017:4

Source : processed form Cenral Statistic Agency

Figure 3: Graph of Gross Domestic Product Growth

in Indonesia Years from 2008: 1 to 2017: 4

Source : processed form Cenral Statistic Agency

Figure 4: Graph of change of Medium Quality Rice

Prices in Indonesia from 2008: 1 to 2017: 4 (In

Rupiah Currency)

Source : processed form Cenral Statistic Agency

Figure 5: Graph of Changes in Bulk Cooking Oil

Prices in Indonesia from 2008: 1 to 2017: 4 (In

Rupiah currency)

Source : processed form Cenral Statistic Agency

Figure 6: Graph of Changes in Local Sand Sugar

Prices in Indonesia from 2008: 1 to 2017: 4 (In

Rupiah currency)

Analysis of the Effect of Gross Domestic Product and Price of Food Commodities on Inflation in Indonesia

475

Source : processed form Cenral Statistic Agency

Figure 7: Graph of Changes in Curly Red Chilli

Prices in Indonesia from 2008: 1 to 2017: 4 (In

Rupiah currency)

Figure 8: Chart of Chicken Meat Prices in Indonesia

from 2008: 1 to 2017: 4 (In Rupiah currency)

Stationarity Test (Unit Root Test)

Stationary data is data that shows the mean, variance

and autovariance (in lag variations) remain the same

at any time when the data is formed or used,

meaning that with stationary data the time series

model can be said to be more stable. The data

stationarity test used in this study is the Phillips

Perron Test (PP test) with no trend constants is a test

developed by Philips and Perron which aims to

determine data stationarity at the level. If the results

of the unit data root tests are obtained partially or all

data is not stationary, it is necessary to proceed to

the degree of integration test. Variables used in this

study were none stationary with a probability level

of α = 5% at the level of the level. Therefore it is

necessary to carry out further tests by using an

integration degree test (different) to find out at what

degree the data will be stationary. Based on the

calculation results obtained values at the first

different level are also not all stationary data. Then

stationary test observations were carried out again at

the second different level. Based on the calculation

results obtained the calculated value for all

stationary variables at the level of second different.

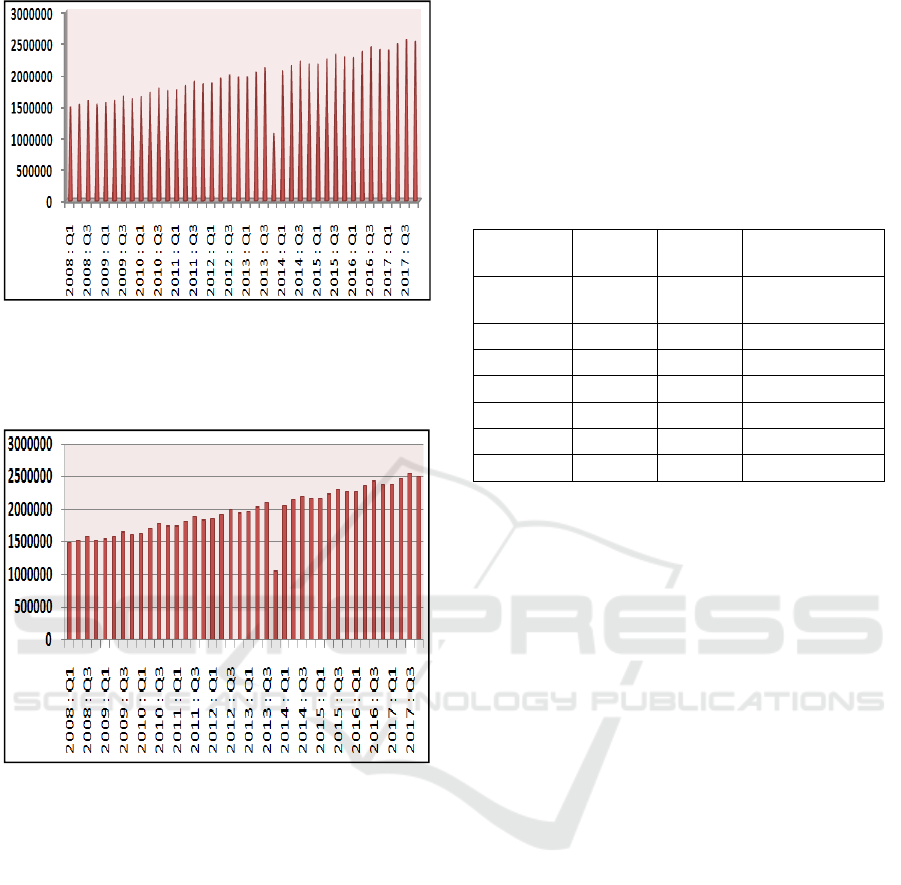

Tabel 1: Unit Root Test Results with the ADF

Method in Second Different

Variables Value of

Statistic

Proba

bility

Interprettatio

n

LNINF -

6.0669

0.0000 Stationer

LNPDB -6.2819 0.0000

Statione

r

LNBER -14.828 0.0000

Statione

r

LNMGC -5.9389 0.0000

Statione

r

LNGUL -4.4753 0.0013

Statione

r

LNCMK -6.5923 0.0000

Statione

r

LNDAY -6.1009 0.0000

Statione

r

From Table 1 it was found that all calculated

ADF values showed that all stationary observation

variables were in second different after being

reduced twice. After it is believed that all

observation variables have the same degree of

integration, cointegration tests can be performed on

the observation variables

Determination of Optimal Lag Length

Lag Length Test (Determination of Optimal Lag)

Optimal lag is the number of lags that have a

significant influence or response. Determination of

Lag According to Alfian (2011) besides influencing

himself, a variable can also influence other

variables. The lag testing used in this study uses the

Akaike Information Criterion (AIC) approach,

Schwarz Information Criterion (SC) and Hannan

Quinn (HQ). The results show the Akaike

Information Criterion (AIC), Schwarz Criterion (SC)

and Human Quinn Criterion (HQ) criteria and the

smallest value is chosen between the optimal lag

Schwarz Criterion (SC) value in lag 1.

Cointegration Test.

Cointegration tests can be expressed as a test of the

balance relationship or long-term relationship

between economic variables as desired in the theory

of econometrics (Insukindro, 1999). The method

used for the cointegration test in this study is the

Engle-Granger Cointegration Test method. The

Agumented Dickey Fuller (ADF) test results can be

seen in Table 2.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

476

Tabel 2: Results of Cointegration Test

V

ariable critical value of

ADF

ADF

Prob

abi-

lity

ECT

1% 5% 10%

-3.6329 -2.9484 -2.6128 -4.922 0.000

3

Table 2 shows the ADF test value> Critical

Value which is -4,922, then indicates cointegration

between regression variables between gross

domestic product value, medium quality rice price,

bulk cooking oil price, local sugar price, curly red

chili price, price of chicken meat to inflation. This

indicates that the variable is said to be in a long-term

equilibrium condition, so the regression results are

cointegrated regression.

Error Correction Domowitz-El Badawi Model

The ECM model developed by Domowitz and El

Badawi is based on the fact that the economy is in a

state of imbalance. According to this model, the

ECM model is valid if the error correction

coefficient sign is positive and statistically

significant. This error correction coefficient value is

located 0 <g <1 (Widarjono, 2009: 336). Following

the approach developed by Domowitz and El

Badawi, the raw form of ECM was obtained as

follows:

To find out the specification of the model with

ECM is a valid model, it can be seen in the results of

statistical tests on the coefficient of ECT. To obtain

the magnitude of the standard deviation of the long-

term regression coefficient in the ECT model

estimation.

Error Correction Model can explain the behavior

of short-term and long-term influence on

independent variables on the dependent variable.

The processing estimation results are carried out

using the Eviews 7 program, with the ECM linear

regression model, the results of data processing are

shown at Table 3.

Tabel 3: Results of Regression Estimation with Error

Correction Domowitz-El Badawi model

V

ariabl

e

Coefisie

n

Statistic - t

P

robability

A

djust

ed R

2

C 8.5110 0.4982 0.6229

0.73

34

Short term

D

(LNPDB) 0.3198 2.6485 0.0381

D

(LNBER) 19.2491 2.6940 0.0127

D

(LNMGC) 12.67267 2.9262 0.0074

D

(LNGUL) -2.6495 -0.9734 0.3400

D

(LNCMK) 2.0487 0.9981 0.3282

D

(LNDAY) -14.9658 -2.0463 0.0518

Long term

L

NPDB(-1) 0.0300 2.806059 0.0309

L

NBER(-1) 1.4953 1.2781 0.2134

L

NMGC(-1) -1.5671 -1.2668 0.2174

L

NGUL(-1) -0.9443 -0.6893 0.4972

L

NCMK(-1) 0.8277 0.7575 0.4561

L

NDAY(-1) -0.4710 -0.2771 0.7841

E

CT 0.4943 5.8954 0.0000

The results of the Domowitz-El badawi error

correction model obtained a positive and significant

coefficient value (probability value < absolute price

of critical value for α = 5%). this indicates that the

ECM model used in this study is valid or

appropriate. in this study the value of ect (error

correction term) is 0.4943 with a t-statistic value of

5.8954 > t-table 5% df 40 = 1.6838 significant at α =

5%. the ECT coefficient value is positive and

statistically significant means that the Domowitz-El

Badawi ECM specification model used in this study

is valid (Widarjono, 2009).

Classical Assumption Test

Normality Test. The normality test is used to test

whether in the regression model, the independent

variable and the dependent variable are normally

distributed or not. This test was carried out with

Jarque Bera. The assumption of normality can be

fulfilled the value of the Sig value > 0.05%. Based

on data processing, the J-B statistical probability

value is 0.2693 > α = 5% (0.05). So, it can be

concluded that the data used in the ECM model is

normally distributed.

Autocorrelation Test. The result of autocorrelation is

that the estimated parameters are biased and the

variants are minimum, so they are not efficient

Analysis of the Effect of Gross Domestic Product and Price of Food Commodities on Inflation in Indonesia

477

(Damodar Gujarati, 2004). To test the presence or

absence of autocorrelation, one of them is known by

conducting the Breusch-Godfrey Test or the

Langrange Multiplier (LM) Test. From the results of

the LM test if the value of the Prob. F count is

greater than alpha level 0.05 (5%) stating that the

model is free from autocorrelation. Criteria for

rejection or acceptance can be made using the

Durbin-Watson Table. The criteria for acceptance or

rejection to be made with the values of dL and dU

are determined based on the number of independent

variables in the regression model (k) and the number

of samples (n). The values of dL and dU can be seen

in Table DW with a significance level (error) of 5%

(α = 0.05). Number of independent variables: k = 6.

Number of samples: n = 40. Table Durbin-Watson

shows that the value of dL = 1.1754 and the value of

dU = 1.8538 so that the criteria for whether or not

autocorrelation can be determined. Durbin-Watson

(DW) value is 2.0833, this value is greater than

1.8538 and smaller than 2.4922 so it can be

concluded that the ECM model is free from the

problem of autocorrelation.

Multicollinearity Test. Multicollinearity is the

condition of a linear relationship between

independent variables (Wing Wahyu, 2009). A good

regression model should not have a correlation

between independent variables. If the independent

variables correlate with each other, then these

variables are not orthogonal (Imam Ghozali, 2006).

Orthogonal variables are independent variables with

the value of correlation between each independent

variable equal to zero. Multicolinerity in this study

was tested using the partial correlation method

between independent variables. The rule of tumb

from this method is if the correlation coefficient is

high enough above 0.85, we expect there is

multicollinearity in the model (Widarjono, 2009:

106). The multicollinearity test results show that all

independent variables have a correlation coefficient

value below 0.85 so that it can be concluded that the

ECM model is free from the symptoms of

multicollinearity.

Heteroscedasticity Test. Heteroscedasticity aims to

test whether in the regression model there is an

inequality of variance from the residual one another

observation. A good regression model is

homoschedasticity or heteroscedasticity does not

occur. To test for the presence or absence of

heteroscedasticity Glejser Test can be used. If the

value is Prob. F count is greater than alpha level

0.05 (5%) then Ho is accepted which means there is

no heteroscedasticity. A good regression model is a

regression that does not occur heteroscedasticity. If

the significance value is > 0.05 then

homoskedasticity occurs and if the significance

value is <0.05, heteroscedasticity occurs.

Hypothesis Test

t-test. The t-statistical test is used to determine the

effect of each independent variable on the dependent

variable (Ghozali, 2013). Determine the acceptance

criteria or rejection of H0, namely by looking at

significant values. If p-value is < 0.05, then Ho is

rejected or Ha is accepted and if p-value is > 0.05

then Ho is accepted or Ha is rejected. The F-Statistic

Test is used to find out whether the independent

variables simultaneously or simultaneously affect

the dependent variable.

In the short term t-statistics and the probability of

each variable gross domestic product (GDP) t-

statistic = 2.6485 and the coefficient value = 0.0319

(prob = 0.0381) shows that the variable gross

domestic product (GDP) has a positive effect and

significantly influences inflation in Indonesia.

Medium quality rice price variable (BER) with t-

statistic value = 2.6940 and coefficient value =

19.249 (prob = 0.0127) shows that medium quality

rice (BER) variable has a positive influence and

significantly influences inflation in Indonesia. The

variable price of bulk cooking oil (MGC) with a

value of t-statistic = 2.9262 and the coefficient value

= 12.6726 (prob = 0.0074) shows that the variable

bulk cooking oil (MGC) has a positive and

significant effect on inflation in Indonesia. Variable

sugar (GUL) with t-statistic value = -0.9734 and

coefficient value = -2.6495 (prob = 0.3400) shows

that the variable price of sugar (GUL) has a negative

effect and does not significantly influence inflation

in Indonesia. Red curly chili variable (CMK) with t-

statistic value = 0.9981 and coefficient value 2.0487

(prob = 0.3282) shows that the red curly chili

variable (CMK) has a positive effect and does not

significantly influence inflation in Indonesia.

Chicken meat variable (DAY) with t-statistic value =

-2.0463 with coefficient value = -14.9658 (prob =

0.0518) shows that the variable price of chicken

meat has a negative effect and does not significantly

influence inflation in Indonesia.

In the long term the gross domestic product (GDP)

variable t-statistic = 2.8060 and the coefficient value

= 0.0300 (prob = 0.0309) shows that the variable

gross domestic product (GDP) is positively

influential and significantly influences inflation in

Indonesia. Medium quality rice price variable (BER)

with t-statistic value = 1.2781 and coefficient value

= 1.4953 (prob = 0.2134) shows that the medium

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

478

quality rice (BER) variable has a positive effect and

does not significantly affect inflation in Indonesia.

Variable price of bulk cooking oil (MGC) with t-

statistics value = -1.2668 and coefficient value = -

1.5671 (prob = 0.2174) shows that the variable bulk

cooking oil (MGC) has a negative effect and does

not significantly affect inflation in Indonesia.

Variable sugar (GUL) with t-statistic value = -.6893

and coefficient value = -0.9443 (prob = 0.4972)

shows that the variable price of sugar (GUL) has a

negative effect and does not significantly influence

inflation in Indonesia. Red curly chili variable

(CMK) with t-statistic value = 0.7575 and

coefficient value 0.8276 (prob = 0.4561) shows that

the curly red chili variable (CMK) has a positive

effect and does not significantly influence inflation

in Indonesia. Chicken meat variable (DAY) with t-

statistic value = -0.2771 with coefficient value = -

0.4710 (prob = 0.7841) shows that the variable price

of chicken meat has a negative effect and does not

significantly affect inflation in Indonesia.

F-Test. In the short and long term, the estimation

results can be seen that the F-statistic value is 5.0799

with a statistical probability of 0.0001 smaller than

α = 0.05 indicating that together all independent

variables are gross domestic product (GDP), price of

quality rice medium (BER), the price of bulk

cooking oil (MGC), the price of sugar (GUL), the

price of curly red chili (CMK), the price of chicken

(DAY) and the Error Correction Term (ECT) have a

significant effect on inflation in Indonesia.

Coefficient Determination Test. This means that if

R

2

= 0, it indicates that there is no influence between

the independent variables on the dependent variable.

The smaller R

2

approaches 0, it can be said that the

smaller the influence of the independent variable on

the dependent variable. Conversely, if R

2

approaches

1, it indicates the stronger influence of independent

variables on the dependent variables. Based on the

results of data processing with the Error Correction

Model method in the short and long term, the value

of R Squared is 0.7334 or 73.34%, so that in the

short and long term variables the gross domestic

product (GDP), medium quality rice (BER), price

bulk cooking oil (MGC), price of granulated sugar

(GUL), curly red chili price (CMK), chicken meat

prices (DAY) affect inflation in Indonesia with a

value of 73.34%. while the rest in the short and long

term is 26.66% explained by variables outside the

model (not examined).

4 CONCLUSIONS

Based on the estimation results that have been done

using the Domowitz-El Badawi Error Correction

Model model the following conclusions can be

drawn;

Of the several independent variables that were

tried to be estimated in the equation of the effect of

Gross Domestic Product variables, Medium Quality

Rice Prices and Bulk Cooking Oil Prices in the short

term these variables had a positive and significant

effect on inflation in Indonesia. While the variable

Curly Red Chilli Prices in the short term have a

positive and not significant effect on inflation in

Indonesia. As well as the variable sugar price and

variable price of chicken meat, each variable in the

short term does not affect inflation in Indonesia.

At long term, from several independent variables

that are tried to be estimated in the equation of the

variable effect of Gross Domestic Product has a

positive and significant influence on inflation in

Indonesia. Variable Price of Medium Quality Rice,

and Price of Curly Red Chili have a significant

positive effect on inflation in Indonesia in the long

run. Variable Prices of Bulk Cooking Oil, Variable

Prices of Sugar, and Variable Prices of Chicken

Meat have a negative and not significant effect on

inflation in Indonesia.

From the coefficient of determination (R

2

) with

the estimated model results obtained R-Squared

value of 0.7334 meaning that in the short and long

term variable Gross Domestic Product, Medium

Quality Rice Prices, Bulk Cooking Oil Prices, Local

Sugar Prices, Curly Red Chili Prices, and Chicken

Meat Prices affect Inflation in Indonesia with a

value of 73.34%. The rest is influenced by other

variables not discussed in this study.

Based on the conclusions stated above, there are

several suggestions that can be used as

recommendations as follows;

Because of at the short term all the independent

variables affect Inflation, it is recommended that the

government implement appropriate fiscal and

monetary policies. The policy objective is to

maintain the stability of food commodity prices

appropriately. This is due to the large contribution of

the effects of food commodity prices on the inflation

rate in Indonesia.

Because of the rate of economic growth will

have a negative effect if accompanied by a high

inflation rate. For this reason, there will be

continued cooperation between Bank Indonesia as

the monetary authority and the government as the

fiscal authority and related agencies and institutions

Analysis of the Effect of Gross Domestic Product and Price of Food Commodities on Inflation in Indonesia

479

to increase the effectiveness of inflation control

through strengthening the national inflation control

team.

The government is expected to collaborate

sustainably with local farmers as well as food

commodity traders. This is so that traders do not

make prices according to their own wishes and local

farmers get a comparable advantage from the price

of the commodity. Also to equalize the welfare of

the Indonesian people in each different region. So

that later inequality between regions can be

minimized.

REFERENCES

Astari. (2015). Fluktuasi Harga Komoditas Pangan

dan Dampaknya Terhadap Inflasi di Prov

Banten. Institut Pertanian Bogor. Bogor.

BAPPENAS RI.(2018).

http://bappenas.go.id/index.php?cID=8926.

Accesed March 11

th

2018

FAO. Global Food Price Monitor. (2018).

www.fao.org/giews/food-

prices/tool/public/#/home. Accesed April 27

th

2018

Ghozali, I. (2006) Aplikasi Analisis Multivariate

dengan Program SPSS. Badan Penerbit

Universitas Diponegoro. Semarang

Gujarati, D,N. (2004). Basic Econometrics.

McGraw-Hill Inc. Singapore, 4

th

edition

Lee, H., & Park, C. (2013). International

Transmission of Food Prices and Volatilities: A

Panel Analysis. Asian Development Bank

Economics Working Paper Series No.363.

Pratikto, R. & Ikhsan, M. (2015). Inflasi dan

Kemiskinan: Implikasi Terhadap Kebijakan

Moneter. Dipresentasikan pada Seminar

Akademik Pembangunan Ekonomi Indonesia

(SAPEI) 2015.

Widarjono, A. (2007). Ekonometrika Teori dan

Aplikasi. Ekonisia FE UII. Yogyakarta.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

480