The Analysis Factors of Micro Small and Medium Enterprises

Income in Indonesia

Inda Arfa Syera

1

, Muhammad Yusuf

2

and Fitrawaty

2

1

Post Graduate of Economics, Universitas Negeri Medan, Medan, Indonesia

2

Faculty of Economics, Universitas Negeri Medan, Medan, Indonesia

Keywords: Micro Small and Medium Enterprises Income, Bank Credit Distribution, Micro Small and Medium

Enterprises Labor, and Interest Rate

Abstract: This study aims to analyze the factors that effect Micro Small and Medium Enterprises income in Indonesia

by using the Ordinary Least Square (OLS) method. The source of data were Bank Indonesia and The

Cooperative Ministry in 2010:1 – 2017:4. The results of data analysis indicates that: (1) Bank credit

distribution has a positive and not significant effect on Micro Small and Medium Enterprises income in

Indonesia, (2) Micro Small and Medium Enterprises Labor has a positive and significant effect on Micro

Small and Medium Enterprises income in Indonesia, (3) Interest rate has a negative and significant effect on

on Micro Small and Medium Enterprises income in Indonesia.

1 INTRODUCTION

The era of reform, the economy was built on the

basis of a populist economic system. The main

components of the people's economic system are

human resources as consumers, as workers, and as

entrepreneurs. Thus a populist economic system is

an economic order that provides the widest

opportunity for employment and effort for the

community to achieve an even and equitable welfare

improvement. Concretely, efforts to improve the

community's economy must be carried out in various

programs, including the development of Micro,

Small and Medium Enterprises (MSMEs).

MSMEs are the key to economic growth because

they can help the recovery of the economy with

income earned (Brașoveanu and Bălu, 2014).

According to Law Number 20 of 2008 Definition of

Micro, Small and Medium Enterprises is a business

carried out by individuals or groups of people on a

small scale. The law also emphasizes that micro-

enterprises are one form of productive business

owned by individuals and / or individual business

entities that conform to the criteria of micro-

enterprises.

Furthermore, it is also explained about small

businesses, namely a form of independent business

that is carried out by people per group or group of

people or business entities that are not subsidiaries

or branches of companies owned, controlled or

become a part, either directly or indirectly from

medium-sized businesses or large businesses that

meet the criteria of small businesses. Whereas the

definition of a medium business is a productive

economic enterprise that is independent, carried out

by individuals or business entities that are not

subsidiaries or branches of the company owned,

controlled, or become the amount of net assets or

proceeds of sales as stipulated in Law Number 20 In

2008.

Based on data from the Ministry of Cooperatives

and Small and Medium Enterprises of the Republic

of Indonesia in 2011-2017, MSME revenue growth

has fluctuated from year to year. The highest income

growth occurred in 2016 amounting to 67.98% and

the lowest growth occurred in 2017 at 4.68%.

According to the 2016 World Business Activity

Survey conducted by Bank Indonesia, MSME's

rapid revenue growth in 2016 was due to the easier

access to bank loans supported by lower interest

rates, increased demand for goods and services, and

an increase in the number of workers in several

important sectors.

Syera, I., Yusuf, M. and Fitrawaty, .

The Analysis Factors of Micro Small and Medium Enterprises Income in Indonesia.

DOI: 10.5220/0009501704470454

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 447-454

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

447

Whereas in 2017, there was a decline in MSMEs

revenue growth in Indonesia due to a slowdown in

business activities mainly due to the decline in

business activities in the agriculture, plantation,

livestock, forestry and fisheries deposits due to

seasonal factors and unfavorable weather conditions,

decreased activity industrial sector business, and the

decline in the number of workers in the fourth

quarter of 2017.

Figure 1: MSME Income Growth in Indonesia in 2011-

2017

Based on the production theory, the factors that

influence the increase in production associated with

increased income are capital and labor (Sukirno,

2014). Since the 1970s, the Indonesian government

has facilitated the distribution of funds to the

MSMEs sector which began with two credit schemes

from Bank Indonesia, namely Permanent Working

Capital Credit (PWCC) and Small Investment Credit

(SIC).

In addition, Bank Indonesia has issued Bank

Indonesia Regulation (BIR) Number 3/2/PBI/20011

which requires banks to provide 20 percent of their

total loans to small businesses. The regulation was

issued to encourage banks to increase the

distribution of funds to the MSMEs sector which is

used as capital.

The following are data on bank credit

dictribution, MSMEs labor, interest rate and

MSMEs income in Indonesia in 2014: 1-2017: 4:

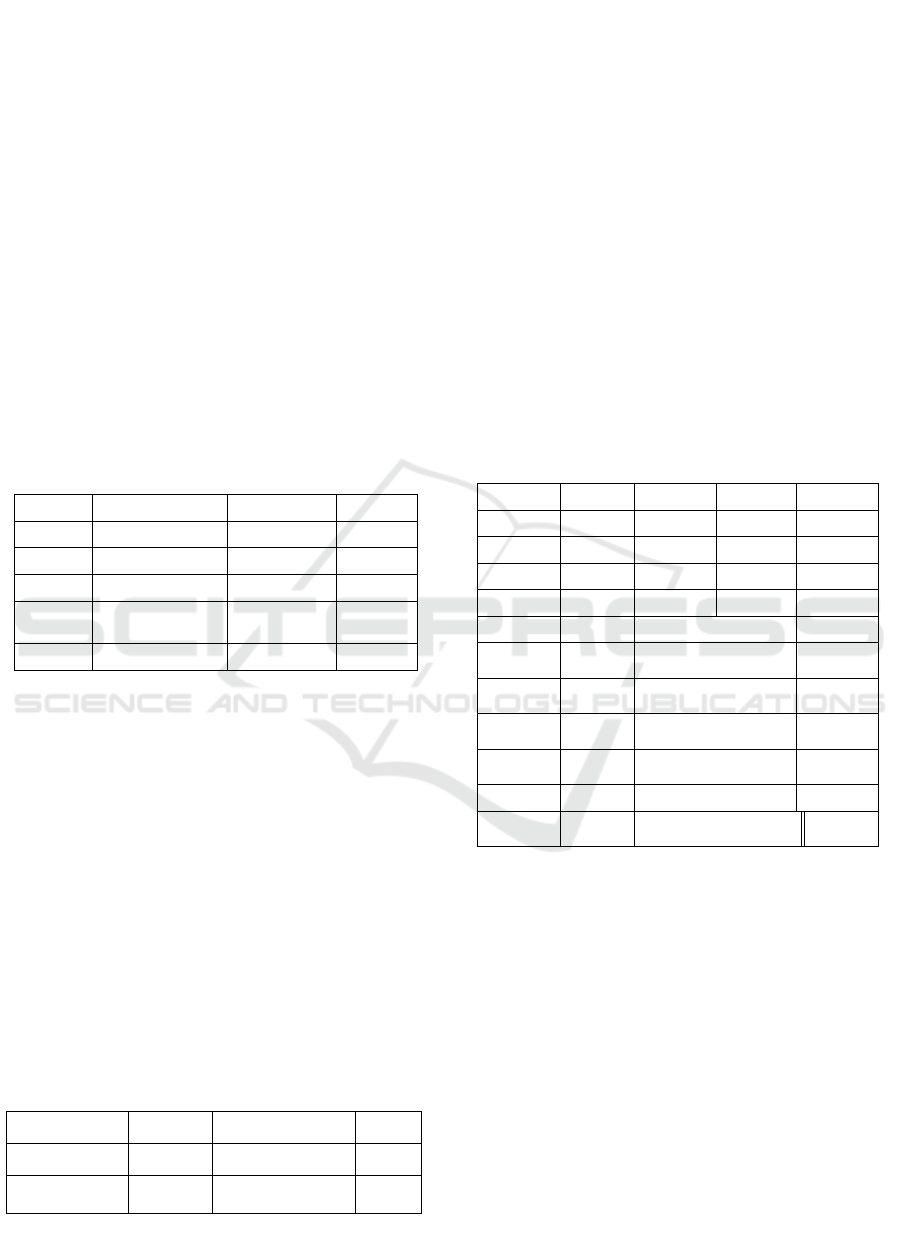

Table 1: Bank Credit Distribution, MSMEs Labor, Interest

Rate and MSMEs Income in Indonesia 2014:1-2017:4

Years

MSME

Income

(Billion)

Bank

Credit

Distributi

on

(Billion)

MSME

Labor

(Million)

Interest

Rate

(%)

2014-1 374.92 637.52

27.82

7.5

2014-2 380.78 669.28

28.27

7.5

2014-3 387.15 683.02

28.75

7.5

2014-4 394.04 694.97

29.28

7.67

2015-1 270.04 702.85

30.71

7.58

2015-2 330.53 735.37

30.98

7.5

2015-3 444.10 752.36

30.93

7.5

2015-4 610.74 797.84

30.59

7.5

2016-1 1,090.56 815.33

28.62

7

2016-2 1,259.33 851.98

28.19

6.67

2016-3 1,377.15 868.25

27.99

5.58

2016-4 1,444.00 898.04

28.01

4.75

2017-1 1,459.90 888.37

28.25

4.75

2017-2 1,424.84 992.47

28.71

4.75

2017-3 1,338.82 942.69

29.39

4.5

2017-4 1,201.84 976.40

30.30

4.25

Source: Bank Indonesia, Ministry of Cooperatives and Small and

Medium Enterprises of the Republic of Indonesia

Based on table 1 above, in 2014: 4, when interest

rates rose to 7.67%, bank lending also rose to 694.97

Billion and MSMEs income continued to increase.

In fact, when interest rates should rise, bank lending

falls which results in a decline in MSMEs income in

Indonesia.

In 2016: 1-2016: 3, when the number of workers

fell, MSMEs income continued to increase. In fact,

the decline in the number of workers affects the

production process. Then, in 2017: 1, when interest

rates fell to 4.5%, bank lending fell to 942.69 Billion

and MSMEs income continued to increase. In fact,

when interest rates have dropped, bank lending has

risen which has resulted in increased MSMEs

income in Indonesia.

Because of the phenomena that contradict the

theory, it is interesting to do further research on the

factors that influence the income of MSMEs in

Indonesia. The purpose of this study is to find out

what factors influence the income of MSMEs in

Indonesia in 2010: 1-2017: 4.

2 THEORETICAL FRAMEWORK

According to Sukirno (2014), production theory in

economics distinguishes its analysis from two

approaches, namely:

1. Production Theory with One Factor Changed

Production theory with one factor changes explains

the relationship between the level of production of

goods produced based on the amount of labor used.

In the analysis of production theory with one factor

5.45

6.33

5.655.56

7.15

67.98

4.68

0

100

2011

2012

2013

2014

2015

2016

2017

MicroSmalland

MediumEnterprises

Income Income

Micro

Smalland

Medium

Enterpri…

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

448

changes only the amount of labor can be changed in

number.

Then the production function can be expressed as

follows:

Q = f (L) (1)

Where:

L = The Amount of Labor;

Q = The Amount of Production Produced.

2. Production Theory with Two Factors Change

According to Pracoyo and Pracoyo (2006), the

theoretical concept of long-term production is if all

the production factors used in the production process

are variable. The concept of long-term production

theory uses 2 variable inputs. According to Akhmad

(2014), the production theory with two changing

factors is a combination of labor and capital change.

In this case, how changes in producer behavior

choose the combination of labor and capital to

produce the same output is explained by the isoquant

and isocost curves.

a. Isoquant

According to Akhmad (2014), isoquant is a curve

that describes various combinations of the use of

two types of variable inputs efficiently with a certain

level of technology to produce the same level of

production. So production analysis with two factors

(all factors) input is a variable, both capital and

labor.

Then the production function can be expressed as

follows:

Q = f (K, L) (2)

Where:

K = The Amount of Kapital;

L = The Amount of Labor;

Q = The Amount of Production Produced.

The isoquant curve can be described as follows:

Figure 2: The Isoquant Curve

Caption: Isokuan shows a combination of 2 inputs

namely capital and labor which can be used to

produce the same level of output. Each point on the

isoquant curve shows various combinations of the

same input which can produce the same output. The

farther from the origin (upwards), the more output

will be generated, because the use of input increases.

b. Isocost

In carrying out production activities, producers have

problems regarding limited funds to allocate a

number of inputs. The limitations of these funds are

shown in a curve called isocos. According to

Pracoyo and Pracoyo (2006), Isokos is a curve that

describes the combination of two inputs that require

the same cost.

If it is assumed that producers only use two

inputs in their production, namely labor and capital,

the production costs that must be spent are:

TC = rK + wL (3)

Dimana:

r = Rent;

K = The Amount of Kapital;

w = Wage;

L = The Amount of Labor.

The isocost curve can be described as follows:

Figure 3: The Isocost Curve

Caption: The isocos curve shows various

combinations of 2 inputs, namely capital and labor

used to produce output at the same cost. If the

producers' funds change, while the price of the two

inputs is fixed, the isocos will shift parallel to the

previous one, because it has the same slope. If the

price of one or both inputs changes, while the funds

held are fixed, the slope of the isocos will change.

In this study, the amount of production is

considered as income earned by MSMEs from

capital (bank credit), labor and interest rates that

have been empirically proven by other researchers.

According to Kasmir (2014), the more loans

channeled, the better, especially in terms of

increasing income. Thus, it can be said that credit

distribution has a positive effect on income.

According to Sindani's (2018) research on the

effect of trade accounts receivable financing on the

growth of SMEs in Kakamega District, Kenya with

OLS estimation (Ordinary Least Square), the result

is trade receivables financing positively and

significantly affects SME growth in Kakamega

The Analysis Factors of Micro Small and Medium Enterprises Income in Indonesia

449

District, Kenya individually without include other

factors.

Whereas according to research conducted by

Nwosa and Oseni (2013) about the impact of bank

loans on SMEs in the manufacturing sector in

Nigeria with estimation of ECM (Error Correction

Mode), the result is bank loans have no significant

effect both in the short and long term for SMEs in

the manufacturing sector in Nigeria.

In addition to lending, labor is an important

factor in production, because labor is the driving

force of other input factors, without the presence of

labor, other production factors will not stop.

According to Todaro (2000) labor force growth is

traditionally regarded as one of the positive factors

that spur economic growth, a greater number of

labor means that it will increase the level of

production.

According to Maryati (2014) about the role of

Sharia Community Financing Banks in the

development of MSMEs and rural agribusiness in

West Sumatra, the result is large productive

financing and business assets that have a significant

and positive effect on the value of business

production, while labor has a significant and

negative effect on business production.

Meanwhile, according to research conducted by

Ulrich and Cyrille (2016), we examine the effect of

commercial bank credit on SME income in

Cameroon: Empirical evidence from 1980-2014 with

OLS (Ordinary Least Square) estimates. The result

is that the stock of capital and labor has a positive

impact on the income of SMEs in Cameroon. Also

revealed that commercial bank loans and real

interest rates have a negative and significant impact

on the income of SMEs in Cameroon.

According to Mishkin (2008) the stability of

interest rates is highly expected, because the stability

of interest rates also encourages financial market

stability so that the ability of financial markets to

channel funds from people who have the opportunity

to produce investment can run smoothly and

economic activity also remains stable. When interest

rates are low, the more funds flow, resulting in

increased economic growth and vice versa (Sundjaja

and Berlian, 2003).

3 RESEARCH METHOD

This type of research is quantitative research using

secondary data from 2010: 1-2017: 4. Data on bank

creding distribution in billion rupiah units is

obtained from Bank Indonesia and interest rates in

percent units are obtained from Bank Indoensia. The

MSMEs labor in units of millions per person was

obtained from the Ministry of Cooperatives and

Small and Medium Enterprises of the Republic of

Indonesia and MSMEs income in billion units was

obtained from the Ministry of Cooperatives and

Small and Medium Enterprises of the Republic of

Indonesia

The analytical method used in this study is

Multiple Regression Analysis where regression

analysis is known as Ordinary Least Square (OLS)

analysis with classic assumption tests, namely

normality test, mutlikollinearitas test and

heteroscedasticity test. The hypothesis test

conducted is t test, F test and R

2

test.

The following is a multiple linear regression

equation:

Y = β

0

+ β

l

X

1

+ β

2

X

2

+ β

3

X

3

+ e

i

(4)

Where:

Y = MSMEs Income;

X

1

= Bank Credit Distribution;

X

2

= Labor;

X

3

= Interest Rate;

β

0

= Parameter Constants;

β

1

= Bank Credit Distribution Regression

Coefficient;

β2 = Labor Regression Coefficient;

Β3 = Interest Rate Regression Coefficient;

ei = Disturbance Error.

4 ANALYSIS

4.1 Classic Asumption Test

4.1.1 Normality Test

The normality test is used to test whether in the

regression model, the independent variable and the

dependent variable are normally distributed or not.

A good regression model is if the data distribution is

normal or near normal. Tests are carried out using

the Jarque Bera Test or J-B Test. The following are

the results of the normality test:

Data is processed with eviews 9

Figure 4: Result of Normality Test

0

1

2

3

4

5

6

7

8

-0.6 -0.4 -0.2 0.0 0.2 0.4 0.6 0.8 1.0

Series: Residuals

Sample 2010Q1 2017Q4

Observations 32

Mean 2.21e-15

Median 0.018619

Maximum 0.907312

Minimum -0.591216

Std. Dev. 0.351064

Skewness 0.727603

Kurtosis 3.577200

Jarque-Bera 3.267716

Probability 0.195175

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

450

Based on the data above, Jarque-Bara value is

3.267716 with p value of 0.195175 > 0.05, it can be

concluded that the data used is normally distributed.

4.1.2 Uji Multikolinearitas

Multicollinearity is the condition of a linear

relationship between independent variables.

Multicollinearity testing uses a variance inflation

factor (VIF). If the VIF value of a variable is not

more than 10, then the variable does not multiply

with other variables in the model (Gujarati, 2003).

The following are the results of the

multicollinearity test:

Table 2: Result of Multicollinearity Test

Variance Inflation Factors

Date: 12/03/18 Time: 01:49

Sample: 2010Q1 2017Q4

Included observations: 32

Coefficient Uncentered Centered

Variable Variance VIF VIF

C 203.6926 47769.19 NA

LNBCD 0.006453 274.5416 1.201890

L

NSMEs_

L 0.737744 50684.12 1.206438

IR 0.004360 42.48433 1.015031

Data is processed with eviews 9

Based on the data above, it shows that the VIF

values of all variables are less than 10. This means

that all variables in this study are not

multicolinearity with other variables in the model.

4.1.3 Heteroscedasticity Test

Heteroscedasticity aims to test whether in the

regression model there is an inequality of variance

from the residual one another observation. A good

regression model is homoschedasticity or

heteroscedasticity does not occur.

Table 3: Result of Heteroscedasticity Test

Heteroskedasticity Test: Breusch-Pagan-Godfrey

F-statistic 0.805684 Prob. F(3,28) 0.5013

Obs* R-squared 2.542840

P

rob. Chi-Square(3) 0.4676

S

caled explained

SS 2.508726

P

rob. Chi-Square(3) 0.4737

Data is processed with eviews 9

Based on the data processing above, where the

value of p value is indicated by the value of the

Prob. chi square (3) in Obs * R-Squared which is

equal to 0.4676. Because the p value is 0.4676>

0.05, it can be concluded that there is no problem of

heteroscedasticity.

4.2 Ordinary Least Square (OLS) Test

This study uses multiple linear regression with an

estimation model of Ordinary Least Square (OLS).

The following are the results of Ordinary Least

Square (OLS) calculations:

Table 4: Result of Ordinary Least Square (OLS) Test

Dependent Variable: LNSMEs_Income

Method: Least Squares

Date: 12/03/18 Time: 01:35

Sample: 2010Q1 2017Q4

Included observations: 32

Variable Coefficient Std. Error t-Statistic Prob.

C -49.50241 14.27209 -3.468477 0.0017

LNBCD 0.053353 0.080329 0.664183 0.5120

LNSMEs_L 3.759710 0.858920 4.377251 0.0002

IR -0.387454 0.066027 -5.868097 0.0000

R-squared 0.660139 Mean dependent var 13.09665

Adjusted R-

squared

0.623725 S.D. dependent var 0.602193

S.E. of

regression

0.369393 Akaike info criterion 0.962557

Sum squared

resid

3.820632 Schwarz criterion 1.145774

Log

likelihood

-11.40091 Hannan-Quinn criter. 1.023288

F-statistic 18.12885 Durbin-Watson stat 0.443552

Prob(F-

statistic)

0.000001

Based on the data in table 2 above, the Ordinary

Least Square (OLS) equation is obtained:

Y = β

0

+β

1

X

1t

+β

2

X

2t

+β

3

X

3t

+e

t

Y = -49.50241 + 0.053353 X

1

+ 3.759710 X

2

–

0.387454 X

3

This means that bank lending has a positive

effect on MSME income in Indonesia, labor has a

positive effect on MSME income in Indonesia and

interest rates have a negative effect on MSME

income in Indonesia.

The Analysis Factors of Micro Small and Medium Enterprises Income in Indonesia

451

4.3 Hypothesis Test

4.3.1 F-Test

This test aims to see whether there is a significant

influence between independent variables on the

dependent variable simultaneously or together. In

the context of this study, this simultaneous testing

wanted to see whether the variables of Banking

Credit Distribution, MSMEs Labor and Interest Rate

had an effect on MSMEs Income or not. To see

whether or not the influence of the independent

variables on the dependent variable is seen from the

significance value. If the significance value is <

alpha, then there is a significant effect between the

independent variables on the dependent variable.

And vice versa, if the value of sig. > alpha, then

there is no significant effect between the

independent variables on the dependent variable.

After testing, it can be seen from Table 4. above,

the results of the significance value are 0.000001

<0.05, which means that independent variables

(Bank Credit Distribution, MSMEs Labor and

Interest Rate) have a significant effect on MSMEs

Income or jointly influence revenue MSMEs, so that

changes in MSMEs income can be explained by the

independent variables tested.

4.3.2 t-Test

The t test statistic shows how far the influence of

one free varaibel individually in explaining the

variation of the dependent variable. To do the t test

by Quick Look, is if the prob value < alpha then

there is a significant effect between the independent

variables on the dependent variable, and vice versa.

a. The Bank Credit Distribution

After testing using the eviews 9.0 application, it can

be seen from Table 4. above, that the probability

value for the bank lending variable is 0.5120 > 0.05.

This shows that the variable of bank credit

distribution does not have a significant effect on

MSMEs income in Indonesia. The direction of the

regression coefficient for the bank credit distribution

variable is positive, the positive value has the

meaning that the higher bank credit distribution will

be followed by an increase in MSMEs income in

Indonesia.

The coefficient value of 0.053353 means that the

value that will be obtained if bank credit distribution

rises by 1 billion, it will be followed by an increase

in MSMEs income of 0.053353 billion. Likewise, on

the contrary, if there is a decrease in bank credit

distribution of 1 billion, it will be followed by a

decrease in MSMEs income of the same value,

namely 0.053353 billion, cateris paribus.

b. The MSMEs Labor

Based on the results of the study, it shows that the

probability value for the labor variable is 0.0002 <

0.05. This shows that labor variables have a

significant effect on MSMEs income in Indonesia.

The direction of the regression coefficient for the

labor variable is positive, the positive value has the

meaning that the higher the number of workers it

will be followed by an increase in MSMEs income

in Indonesia.

The coefficient value of 3.759710 means that the

value that will be obtained if the amount of labor

increases by 1 million people will be followed by an

increase in MSMEs income of 3.759710 billion.

Likewise, on the contrary, if there is a decrease in

the amount of labor of 1 million people, it will be

followed by a decrease in MSMEs income of the

same value, namely 3.759710 billion, cateris

paribus.

c. The Interest Rate

Based on the results of the study, it shows that the

probability value for the interest rate variable is

0.0000 < 0.05. This shows that the interest rate

variable has a significant effect on MSMEs income

in Indonesia. The direction of the regression

coefficient for the interest rate variable is negative,

the negative value means that the higher the interest

rate will be followed by a decrease in MSMEs

income in Indonesia.

The coefficient value of -0.387454 means that

the value to be obtained if the interest rate rises by 1

percent will be followed by a decrease in MSMEs

income of 0.387454 billion. Likewise with the

opposite, if there is a decrease in the interest rate of

1 percent, it will be followed by an increase in

MSMEs income of the same value, which is

0.387454 billion, cateris paribus.

4.3.3 Determination Test (R

2

)

Based on Table 4. above, it is known that the results

of the data show that the value of R² obtained from

the estimation results is 0.660139. This means that

66.01 percent of the variation in MSME income is

explained by the variable bank lending, MSME

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

452

labor and interest rates. While 33.99 percent is

explained by other variables outside the model.

5 RESULTS

5.1 Effect of Bank Credit Distribution

on MSMEs Income in Indonesia

Based on the results of the study, it was shown that

positive credit distribution for MSMEs income in

Indonesia, but not significant. The effect of

insignificant credit disbursement on MSMEs income

in Indonesia with research conducted by Nwosa and

Oseni (2013) on the effect of bank loans on SMEs in

the manufacturing sector in Nigeria with estimation

of ECM (Error Correction Mode), which is not

significant bank loans in the long run short and long

for the SME sector in Nigeria.

5.2 Effect of Labor on MSMEs Income

in Indonesia

Based on the results of the study showed that labor

has a positive and significant effect on MSMEs

income in Indonesia. This is in accordance with the

production theory which states that labor is a factor

that affects production. If the number of workers

increases, it will affect the amount of production that

increases the income of MSMEs in Indonesia.

5.3 Effect of Interest Rate on MSMEs

Income di Indonesia

Based on the results of the study indicate that

interest rates have a negative and significant effect

on MSMEs income in Indonesia. This is in line with

the statement of Sundjaja and Berlian (2003) when

interest rates are low, so more funds flow so that

economic growth also increases and vice versa.

Thus, Bank Indonesia must maintain the stability of

interest rates, because it encourages financial market

stability so that the ability of financial markets to

channel funds from people who have the opportunity

to produce investment can run smoothly and

economic activity also remains stable.

6 CONCLUSIONS

MSMEs are the key to economic growth that can

help the Indonesian economy from income earned

by MSMEs. Based on the production theory, the

main factor that helps increase income is capital and

labor. The business capital obtained by MSMEs

comes from bank lending.

Based on the research that has been done, the

results obtained are that bank lending has a positive

and not significant effect on MSMEs income in

Indonesia. MSMEs labor has a positive and

significant effect on MSMEs income in Indonesia

and interest rates have a negative and significant

effect on MSME income in Indonesia.

REFERENCES

Akhmad. (2014). Ekonomi Mikro Teori dan Aplikasi

di Dunia Usaha.Yogyakarta: ANDI.

Brașoveanu, Iulian Viorel dan Bălu, Petronela –

Evelina. (2014). The Influence of the

Business Environment on Small and Medium

Enterprises. Journal of Knowledge

Management, Economics and Information

Technology. Vol. IV, Issue 2. Pp 1-13.

Gujarati, Damodar, (2003), Ekonometri Dasar.

Terjemahan: Sumarno Zain, Jakarta:

Erlangga.

Kasmir. (2014). Dasar-Dasar Perbankan Edisi

Revisi. Jakarta: PT Raja Grafindo Persada.

Maryati, Sri. (2014). Peran Bank Pembiayaan

Rakyat

Syariah dalam Pengembangan UMKM dan

Agribisnis Pedesaan di Sumatera Barat.

Journal of Economic Education. Vol 3. No. 1.

Pp 1 17.

Nwosa, Philip Ifeakachukwu and Oseni, Isiaq

Olasunkanmi. (2013). The Impact of Banks

Loan to SMEs on Manufacturing Output in

Nigeria. Journal of Social and Development

Sciences. Vol. 4, No. 5. Pp 212-217.

Pracoyo, Tri Kunawangsih dan Pracoyo, Antyo.

(2006). Aspek Dasar Ekonomi Mikro.

PTGramedia Widiasarana Indonesia: Jakarta

Sindani, Mary Nelima Lyani. (2018). Effects of

Accounts Receivable FinancingPractices

onGrowth of SMEs in Kakamega County,

Kenya.Expert Journal of Finance. Vol. 6. Pp

1-11.

Sukirno, Sadono. (2014). Mikroekonomi Teori

Pengantar. Edisi Ketiga. Jakarta: PTRaja

Grafindo Persada.

Sundjaja, Ridwan S dan Inge Berlian.

(2003).Manajemen Keuangan 2. Edisi

Keempat. Yogyakarta: Literata Lintas Media.

Todaro, Michael P. 2000. Pembangunan Ekonomi di

Dunia Ketiga. Erlangga. Jakarta

The Analysis Factors of Micro Small and Medium Enterprises Income in Indonesia

453

Ulrich, D’Pola Kamdem dan Cyrille, Tour Moise

Alexis. (2016). The Effect of Commercial

Bank Credit on The Output of Small and

Medium Enterprises in Cameroon: Empirical

Evidence From 1980-2014. Maghreb

Review of Economic and Management. Vol,

03, No. 02. Pp 43-53.

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

454