Fraud Disclosure: Determinants and Implication

Enggar Diah Puspa Arum

1

and Diza Armalia Wisdianti

1

1

Faculty of Economics and Business, Universitas Jambi, Jambi-Indonesia

Keywords: Audit Committee, Internal Audit, Managerial Ownership, Whistleblowing System, Fraud Disclosure, Market

Reaction

Abstract: The purpose of this research is to analyze factors affecting fraud disclosure and its implication on market

reaction. Audit committee, internal audit, managerial ownership, and internal control play important role to

reach good governance that can reduce fraud. Whistleblowing system is a part of internal control and expected

to strengthen good governance. Minimizing the possibility of fraud is expected to improve the company's

reputation as reflected in market reactions. This research was analyzed by using path analysis. Target

population is banking industries listed on the Indonesia Stock Exchange. Results showed that audit committee,

internal audit, and managerial ownership have a positive effect on whistleblowing system. Internal audit and

whistleblowing system have a negative effect on fraud disclosure. Audit committee and whistleblowing

system have a positive effect on market reaction, and fraud disclosure has a negative effect on market reaction.

This research provides empirical evidence that the better the governance structure the better the

whistleblowing system. The better implementation of the whistleblowing system, the less disclosure of fraud.

Furthermore, the less fraud disclosure the better the market reaction.

1 INTRODUCTION

Accounting fraud cases still occur until now,

including one of the big companies in the UK. At the

beginning of the second quarter of 2017, British

Telecom known to perform accounting fraud at one

of its business lines in Italy. Accounting fraud was

detected by a whistleblower. The modus operandi is

to perform an increase in the profits of the company

for several years through corruptive cooperation with

corporate clients and financial services. The practice

of accounting fraud has occurred since 2013 with the

motive of obtaining a bonus as a stimulus. The fraud

scandal caused losses to shareholders and investors

where British Telecom's share price plummeted when

it announced a correction of its 530 million earnings

in January 2017 (Priantara, 2017).

Accounting fraud scandals also occured on large

companies in Japan, namely Toshiba. In May 2015 it

was revealed that Toshiba did a lie through

accounting fraud, with a value of 1.22 billion US

dollars. Toshiba then was removed from the stock

index and a significant sales decline occured. (Sari,

2017).

Accounting fraud cases in Indonesia are

dominated by the banking industry. According to the

statement of the Chief Executive of the OJK Banking

Supervisor, Nelson Tampubolon, from January to the

end of the third quarter of 2016, the Financial

Services Authority (OJK) recorded 26 cases of

banking crime (OJK, 2016).

Indonesia still has a high risk of fraud and the

most detrimental fraud is fraudulent financial

reporting (ACFE, 2016). One of the most effective

ways to prevent fraud is through a whistleblowing

system mechanism where the effectiveness can be

seen from the number of frauds that have been

detected as well as the shorter time of action

compared to other methods. The Whistleblowing

System is a part of the internal control system in

preventing the practice of irregularities and fraud and

strengthening the application of good governance

practices (KNKG, Pedoman Sistem Pelaporan

Pelanggaran - SPP (Whistleblowing System - WBS),

2008) (KNKG, Pedoman Sistem Pelaporan

Pelanggaran - SPP (Whistleblowing System - WBS),

2008). An effective internal control system requires

the support of directors as the management of the

company, an audit committee that carries out overall

supervision, and an internal audit as part of its duties

and responsibilities (KNKG, Pedoman Umum Good

Corporate Governance Indonesia, 2006).

Arum, E. and Wisdianti, D.

Fraud Disclosure: Determinants and Implication.

DOI: 10.5220/0009500510011005

In Proceedings of the 1st Unimed International Conference on Economics Education and Social Science (UNICEES 2018), pages 1001-1005

ISBN: 978-989-758-432-9

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

1001

The market penalizes fraud firms significantly

when the prospective fraud news is released to the

public (Christensen, Paik, & Williams, 2010).

Investors perceive fraudulent reporting to be more

prevalent in the economy or rely more on financial

statement information relative to other sources of

information, they place greater importance on

conducting their own fraud risk assessments. In turn,

investors who deem fraud risk assessment to matter

in investment decision making make greater use of

fraud red flags to avoid potentially fraudulent

investments (Brazel, Jones, Thayer, & Warne, 2015).

This study is a replication of the research of

Cahyo & Sulhani (2017) which indicated that the

audit committee had a negative effect on

whistleblowing system while the internal audit had no

effect on the whistleblowing system. Furthermore,

the whistleblowing system did not affect fraud

disclosure and fraud disclosure had a significant

negative effect on the market reaction. This study

intends to reexamine the variables that have been

studied by adding managerial ownership variables as

one element of the governance structure.

2 THEORETICAL FRAMEWORK

2.1 Audit Committee and Whistleblowing

System

The audit committee must have members who are

experts in the financial sector to improve the

supervision of the company. Increasing oversight of

companies has an impact on improved internal

control and reduced fraud practices (KNKG,

Pedoman Umum Good Corporate Governance

Indonesia, 2006). The Audit Committee which has

expertise in finance reduces problems in internal

control. This means that Audit Committee members

who have expertise in finance can increase the

effectiveness of internal controls (Khrisnan, 2005).

According to Lee and Fargher (2018), higher-quality

audit committee is associated with the

implementation of a stronger internal whistleblowing

system, so the first hypothesis in this study is

formulated as follows:

H

1

: The audit committee has an effect on the

whistleblowing system.

2.2 Internal Audit and Whistleblowing System

The importance of appropriate whistleblowing

policies and procedures to the effective discharge of

an organization’s corporate governance is significant.

Corporate governance is fundamental to effective risk

and control within organisations, which means that

whistleblowing policies must be at the heart of

internal auditors’ responsibilities (Cowan, 2014). In

other words, internal audit is a party that plays an

important role in implementing the whistleblowing

system (Read & Rama, 2003).

Internal audit function effectiveness influenced by

internal auditor competency (Arum, 2015). Therefore

internal audit competencies that measured by

expertise in finance will improve the implementation

of a whistleblowing system, so the second hypothesis

in this study is as follows:

H

2

: The internal audit has an effect on the

whistleblowing system.

2.3 Managerial Ownership and

Whistleblowing System

Managerial ownership can help reduce opportunistic

actions to maximize personal interests, in addition

managers will also be more careful in making

decisions that are in accordance with the interests of

the company because it is related to their interests as

owners, so that disclosure of internal control

information will be more qualified (Wardani &

Sulhani, 2017). Therefore the third hypothesis in this

study is as follows:

H

3

: The managerial ownership has an effect on the

whistleblowing system

2.4 Whistleblowing System and Fraud

Disclosure

Whistleblowing system can detect the majority of

fraud in an organization. Whistleblowing system is a

device that can be used to warn management about

fraud within the company (KNKG, Pedoman Sistem

Pelaporan Pelanggaran - SPP (Whistleblowing

System - WBS), 2008). The disclosure of fraud has

become an early detection of company management

to prevent ongoing fraud (Khan, Anuar, & Mahzan,

2014). So that the fourth hypothesis in this study is as

follows:

H

4

: The whistleblowing system has an effect on

the fraud disclosure

2.5 Fraud Disclosure and Market Reaction

According to ACFE (2016), companies that are

indicated to have fraud can reduce their business

reputation so that it can cause losses to the company.

Disclosure of fraud and the use of financial statement

information have an effect on investor perceptions in

conducting investment risk assessments (Brazel,

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1002

Jones, Thayer, & Warne, 2015). Companies that

indicated fraud cases experienced a decline in the

stock market reaction (Christensen, Paik, & Williams,

2010). So the fourth hypothesis in this study is as

follows:

H

5

: The fraud disclosure has an effect on the market

reaction.

3 RESEARCH METHOD

The type of research is quantitative research that uses

secondary data in its analysis. According to Sekaran

& Bougie (2013), secondary data is the data or

information collected from available sources.

Secondary data for this study was obtained from

annual reports of research subject. The data can be

downloaded on the relevant company website pages

as well as on the Indonesia Stock Exchange website.

While the company's stock price data was obtained

from the Indonesia Stock Exchange website.

The target population in this study were banking

companies listed on the Indonesia Stock Exchange in

2017. All members of the target population were used

as samples in the study. Data analysis in this study

was tested by using path analysis with SPSS 22

Program.

The object of this research is the audit committee,

internal audit, managerial ownership, whistleblowing

system, fraud disclosure, and market reaction. The

audit committee variable was measured by the ratio

of the number of members who have accounting and

financial backgrounds to the total number of audit

committee members.The internal audit variable was

measured by dummy variable, if the head of the

division of internal auditors have a background in

finance experts then rated 1, and if otherwise then

rated 0. The managerial ownership variable was

measured by percentage of share ownership by the

companies manager. The fraud disclosure was

measured by the amount of fraud reported in that

period on the annual report, and the market reaction

was measured by stock returns.

Hypothesis testing is done to obtain empirical

evidence of the influence of the audit committee,

internal audit, and managerial ownership on the

whistleblowing system. Hypothesis testing is also

done to obtain evidence of the influence of the

whistleblowing system on fraud disclosure and its

implications for market reaction.

4 RESULTS AND DISCUSSION

4.1 The Effect of Audit Committee on

Whistleblowing System

Based on statistical testing, it is empirically proven

that the audit committee has a positive effect on the

whistleblowing system. This can be seen from the

direction of the regression coefficient and the

significance level of 0.045 which is smaller than 0.05

(table 1). Thus Hypothesis 1 in this study was

accepted.

The background of the financial expertise of the

audit committee has a role in improving internal

control in the implementation of the whistleblowing

system. The results of this study indicate that the audit

committee has carried out overall supervision

including internal control and the Whistleblowing

system..

4.2 The Effect of Internal Audit on

Whistleblowing System

The result of statistical test showed that internal audit

has a positive effect on the whistleblowing system.

This is indicated by the direction of the regression

coefficient showing a positive number and a

significance level of 0.027 which is smaller than 0.05

(table 1). Thus hypothesis 2 in this study was

accepted.

The head of the internal audit division with an

accounting and financial education background is

proven to be able to improve internal control in a

whistleblowing system. The internal audit division

has a large responsibility in overseeing and ensuring

that the internal control function has been running

effectively.

4.3 The Effect of Managerial Ownership on

Whistleblowing System

The result of statistical test showed that managerial

ownership has a positive effect on the whistleblowing

system. This is indicated by the direction of the

positive coefficient and the significance level

obtained is 0.036 which is smaller than 0.05 (table 1).

Managerial ownership is indicated by the number of

shares owned by the board of commissioners,

directors, and management in a company. The results

of the observations in this study indicate the

percentage and number of share ownership by

management is still few. But managerial ownership

proved to have a positive effect on the whistleblowing

system.

Fraud Disclosure: Determinants and Implication

1003

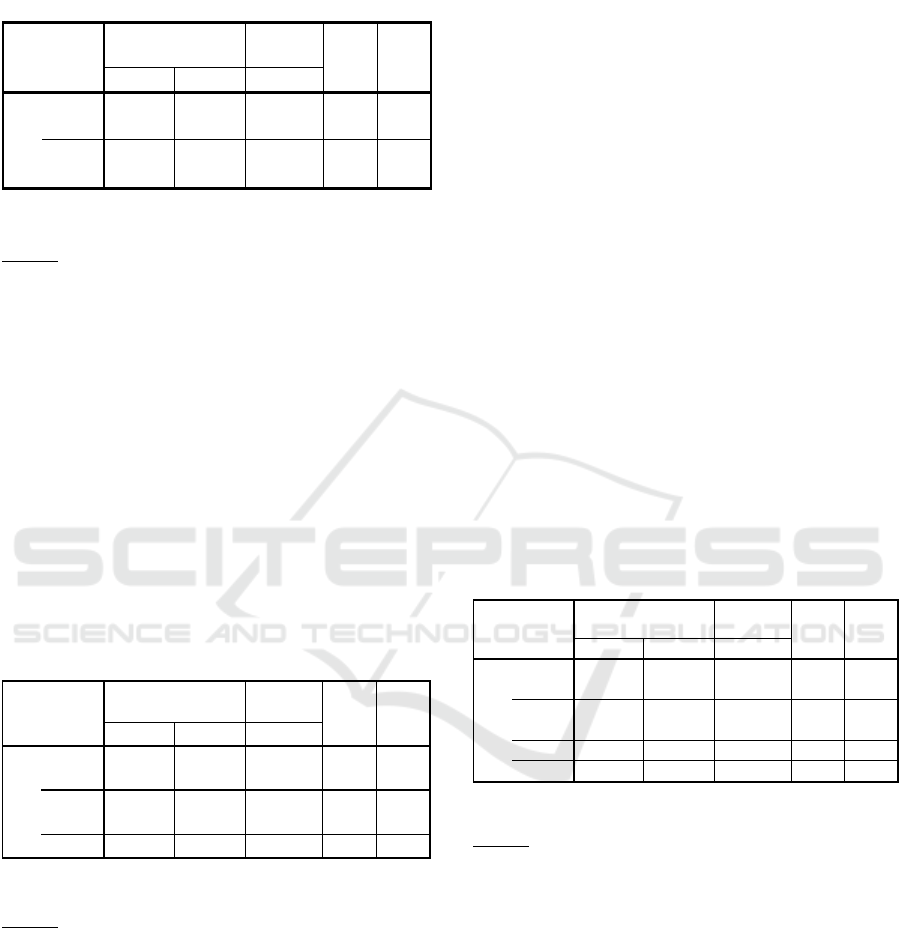

Table 1: Test Results of the Effect of Audit

Committee, Internal Audit, and Managerial

Ownership on Whistleblowing System

Source: SPSS 22 output based on research data

4.4 The Effect of Whistleblowing System on

Fraud Disclosure

Based on the results of statistical testing using SPSS,

the whistleblowing system has a negative effect on

fraud disclosure. This can be seen in the direction of

the negative regression coefficient and the level of

significance smaller than 0.05 (table 2). Thus it can

be said that hypothesis 4 in this study was accepted.

The existence of a whistleblowing system is to

prevent and reduce fraud. Based on the results of this

study it can be said that the whistleblowing system is

proven to reduce fraud disclosure.

Table 2: Test Results of the Effect of Whistleblowing

System on Fraud Disclosure

Source: SPSS 22 output based on research data

The direct effect of the audit committee on fraud

disclosure is 0.236 while the indirect effect is -0.084,

so the total effect is 0.152. The direct effect of the

internal audit on the fraud disclosure was -0.139

while the indirect effect was -0.252, so the total effect

was -0.391. Furthermore, the direct effect of

managerial ownership on fraud disclosure is 0.094

while the indirect effect is -0.081, so the total effect

is 0.013.

4.5 The Effect of Fraud Disclosure on Market

Reaction.

Based on the result of the study, fraud disclosure has

a negative effect on market reaction as measured by

stock returns. This can be seen from the direction of

the negative regression coefficient and the

significance level of 0.002 which is smaller than 0.05

(table 3). Thus it can be said that Hypothesis 5 in this

study was accepted.

Based on the research result showed that the lower

the level of fraud disclosure, the higher the stock

return, and conversely the higher the level of fraud

disclosure, the lower the stock return.

The direct effect of the audit committee on the

market reaction is 0.363 while the indirect effect is -

0.138, so the total effect is 0.225. The direct effect of

the internal audit on market raction is -0.159 while the

indirect effect is 0.081, so the total effect is -0.078.

The direct effect of managerial ownership on the

market reaction is -0.141 while the indirect effect is -

0.055, so the total effect is -0.196. Furthermore, the

direct effect of WBS on the market reaction is 0.052

while the indirect effect is 0.409, so the total effect is

0.461.

Table 3: Test Results of the Effect of Fraud

Disclosure on Market Reaction

Source: SPSS 22 output based on research data

5 CONCLUSIONS

This research examined the effect of audit committee,

internal audit, managerial ownership, and

whistleblowing system on fraud disclosure and their

implication on market reaction. The results indicated

that the better the audit committee, the better the

whistleblowing system. The better the internal audit,

the better the whistleblowing system. The better the

managerial ownership, the better the whistleblowing

system. Whistleblowing system has a negative effect

Coefficients

a

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig. B Std. Error Beta

1 (Constant) .299 .053

5.642 .000

AC .074 .096 .120 .764 .045

IA .147 .064 .360 2.295 .027

MO .141 .179 .115 .787 .036

a. Dependent Variable: WBS

Coefficients

a

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig. B Std. Error Beta

1 (Constant) 1.077 .179

6.005 .000

AC .483 .245 .236 1.973 .056

IA -.189 .172 -.139 -1.100 .027

MO .384 .454 .094 .845 .040

WBS -2.333 .399 -.701 -5.848 .000

a. Dependent Variable: FD

Coefficients

a

Model

Unstandardized Coefficients

Standardized

Coefficients

t Sig. B Std. Error Beta

1 (Constant) -.027 .024

-1.137 .263

AC .066 .025 .363 2.675 .011

IA -.019 .017 -.159 -1.147 .259

MO -.051 .044 -.141 -1.162 .253

WBS .015 .053 .052 .293 .071

FD -.052 .015 -.583 -3.374 .002

a. Dependent Variable: MR

UNICEES 2018 - Unimed International Conference on Economics Education and Social Science

1004

on fraud disclosure and fraud disclosure has a

negative effect on market reaction.

This research is only conducted on banking

companies listed on the Indonesia Stock Exchange in

2017, therefore the further research is expected to

expand observations on other type companies. This

study also only used stock returns to measure market

reaction, therefore further research is expected to use

other indicators to measure market reaction, such as

abnormal returns and cumulative abnormal returns.

Further research is also expected to examine other

variables that related to good governance to explain

their effect on fraud disclosure and market reaction.

REFERENCES

ACFE. (2016). Survai Fraud Indonesia. Jakarta: ACFE

Indonesia Chapter.

Arum, E. D. P. (2015). Determinants of Internal Audit

Function Effectiveness and Its Implication on Financial

Reporting Quality. International Journal of Economic

Research, 12(5), 1989-2000.

Brazel, J. F., Jones, K. L., Thayer, J., & Warne, R. C.

(2015). Understanding Investor Perceptions of

Financial Statement Fraud and their Use of Red Flags:

Evidence from the Field. Review of Accounting

Studies, 20(4), 1373–1406.

Cahyo, M. N., & Sulhani. (2017). Analisis Empiris

Pengaruh Karakteristik Komite Audit, Karakteristik

Internal Audit, Whistleblowing System, Pengungkapan

Kecurangan Terhadap Reaksi Pasar. Jurnal Dinamika

Akuntansi dan Bisnis, 4(2), 249-270.

Christensen, T. E., Paik, D. G., & Williams, C. (2010).

Market Efficiency and Investor Reactions to SEC Fraud

Investigations. Journal of Forensic & Investigative

Accounting, 2(3), 1-30.

Cowan, M. (2014). Whistle-blowing: Not Childs Play for

Internal Auditors. New Mexico: Thomson Reuters.

Khan, M., Anuar, B., & Mahzan, N. (2014). The

intervening effects of whistleblowing in reducing the

risk of asset misappropriation. Journal of Business and

Economics, 5(10), 1929-1939.

Khrisnan, J. (2005). Audit Committee Quality and Internal

Control: An Empirical Analysis. The Accounting

Review, 80(2), 649-675.

KNKG. (2006). Pedoman Umum Good Corporate

Governance Indonesia. Jakarta: Komite Nasional

Kebijakan Governance.

KNKG. (2008). Pedoman Sistem Pelaporan Pelanggaran-

SPP (Whistleblowing System-WBS). Jakarta: Komite

Nasional Kebijakan Governance.

Lee, G., & Fargher, N. L. (2018). The Role of Audit the

Committee in Their Oversight of Whistle-blowing.

AUDITING: A Journal of Practice & Theory, 37(1),

167-189.

OJK. (2016, November 14). Siaran Pers Otoritas Jasa

Keuangan. Retrieved from ojk.go.id: https://www.ojk.

go.id/id/berita-dan-kegiatan/siaran-pers/Documents/

Pages/Siaran-Pers-Tekan-Kasus-Tindak-Pidana-

Perbankan,-OJK-Luncurkan-Buku-Pahami-dan-

Hindari/SIARAN%20PERS%20SOSIALISASI%20TI

PIBANK.pdf

Priantara, D. (2017, June 22). Warta Ekonomi. Retrieved

from wartaekonomi.co.id: https://www.wartaekonomi.

co.id/read145257/ketika-skandal-fraud-akuntansi-

menerpa-british-telecom-dan-pwc.html

Read, W. J., & Rama, D. V. (2003). Whistle-blowing to

Internal Auditors. Managerial Auditing Journal, 18(5),

354-362.

Sari, K. (2017, September 14). Integrity. Retrieved from

integrity-indonesia.com: https://integrity-

indonesia.com/id/blog/2017/09/14/skandal-keuangan-

perusahaan-toshiba/

Sekaran, U., & Bougie, R. (2013). Research Methods for

Business: A Skill Building Approach. UK: John Wiley

& Sons.

Fraud Disclosure: Determinants and Implication

1005