Contribution of Zakat for Regional Economic Development

Agus Purnomo, Galuh Nashrulloh Kartika Majangsari Rofan, Atike Zahra Maulida

Universitas Islam Kalimantan MAB Banjarmasin, Adhyaksa Street, Number 2, Kayu Tangi, Banjarmasin City, ZIP Code

70122, Indonesia.

Keywords: Zakat; Development; Regional Economy

Abstract: Islamic economic development shows a significant increase in Indonesia. State revenue comes from tax

payments and zakat payments, therefore these two items can sustain the development of the economic

development of the community. Tax and zakat funds if collected and distributed in accordance with sharia

principles can help economic growth and the development of infrastructure facilities needed by the

Indonesian people. This study discusses the contribution of zakat to regional development in 2015 to 2017.

This research is a qualitative research using descriptive analysis. Primary data in this study are data obtained

from BAZNAS of South Kalimantan Province in Banjarmasin, while secondary data is obtained from

reports on zakat fund collection in 2015-2017, books on zakat, scientific journals, articles and others. Data

collection in this study uses interview, observation, literature study and documentation techniques. The

results of this study conclude that zakat funds are distributed in the economic, education and health sectors

as follows: 1) in 2015 zakat funds amounted to Rp. 665,332,320, the funds were empowered by the

community by 44% for economic activities with a nominal amount of Rp. 294,300,000. This activity is in

the form of additional business capital. 2) The distribution of education funds has increased from 2015 by

0.45% and in 2016 the contribution of education funds increased by 32.3%. In 2017 economic activity

experienced an increase of 8.43% from the previous year.

1 INTRODUCTION

Zakat is an instrument of state income as

exemplified in the time of the prophet Muhammad

SAW. Income from zakat can be used as state

income, so it is useful for financing and economic

development needs both locally and nationally (Ali

Sakti, 2017). In zakat there is a system of obligations

that are given to people who need it, with the

following benefits:

1. Meeting the needs of the poor

2. Reducing economic inequality

3. Suppress the number of social problems, such as

crime, prostitution, homelessness, beggars and

others.

4. Maintain the balance of people's purchasing

power, so that the business sector can run well.

5. Encouraging people to invest long-term (in the

form of reward by fulfilling the obligation of

zakat), does not accumulate wealth.

In the Indonesia’s economic system, state

revenue generated by several sectors, among others,

taxes, SBN (Certificate of State Value), zakat and

others that have been regulated in the law. Clarity

becomes a necessity so that the purpose of making

the law can be achieved. The National Zakat Agency

(Baznas) is an official body formed by the

government based on the Republic of Indonesia's

presidential decree No. 8 of 2001 and confirmed by

Law No.23 of 2011 concerning the Management of

Zakat. Baznaz as an institution authorized to carry

out zakat management nationally, which has the

duty and function of collecting and distributing

Zakat, Infaq and Sedekah (ZIS) at the national level

(Kaaf, 2002) .

Zakat is collected from several types, compiled

by the provincial/city BAZNAS, Rumah Zakat and

LAZIS with the same purpose, namely to prosper 8

groups as written in the Qur'an. It is compulsory for

every Muslim to issue 2.5% of zakat if he has

sufficient Nisab. So far, state revenues have come

from tax payments (Soemitro, 1988) and zakat

payments, therefore these two items can support the

development of the community's economic

development.

The collected zakat will be managed by

BAZNAS/LAZIS/Rumah Zakat and then distributed

Purnomo, A., Rofan, G. and Maulida, A.

Contribution of Zakat for Regional Economic Development.

DOI: 10.5220/0009022400002297

In Proceedings of the Borneo International Conference on Education and Social Sciences (BICESS 2018), pages 441-447

ISBN: 978-989-758-470-1

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

441

to the poor who need it with the aim of community

welfare. Zakat is required for those who have excess

property. The advantages of these assets are marked

by the attainment of zakat which is equivalent to 85

grams of gold. If someone has assets worth 85 grams

of gold or more, then he must issue zakat (Nawawi,

2010). Distribution of zakat funds is carried out in

various sectors, such as economics, health and

education.

The study of zakat as a system of state revenue

contributes a large portion of the Islamic economic

system. So important is that zakat is placed as the

third pillar of Islam, after prayer, preceding the

obligation of fasting and pilgrimage. The

contribution of zakat in Indonesia's economic

growth to finance Indonesia's economic

development in the form of education, health,

facilities and infrastructure, and the economy. State

revenues obtained from zakat payments are

empowered to finance various state expenditure

items. Based on this, the optimization of zakat is a

strategic potential to support Indonesia's economic

development in realizing real prosperity, namely

physically and mentally (Hafidhuddin, 2002).

The role of zakat is very important in the effort

to empower the economic potential of the people. So

that the implementation can be effective so that in

the end if zakat can actually run as expected, namely

the achievement of social safety nets and the rotation

of the economy, encouraging the use of idle funds,

encouraging innovation and the use of science and

technology and harmonizing the relationship

between the rich and the poor. In the end the ideal

life of the people will naturally come true. Based on

the explanation above, the writer is interested in

conducting research on "Contribution of zakat funds

in regional economic development." This research

was conducted in Baznaz, South Kalimantan

province.

2 THEORETICAL REVIEW

2.1 Definition of Zakat

Zakat according to language comes from the word

zakaa, which means holy, clean, good, increasing,

developing and blessing. As the Arabic phrase zakaa

al-jar’u, it means that the tree grows and develops.

Whereas zakat according to is certain taking from

certain assets, according to certain characteristics to

be given to certain groups (Dahlan, 1999). The

relationship between the meaning of zakat in terms

of language and terms is very real and very close,

namely that the assets issued by zakat will be a

blessing, increasing, developing and increasing, holy

and clean (good). In the Qur'an and as-Sunnah there

are several words that are often used for zakat,

namely Sadaqah (true), infaq (issuing something

good besides zakat) and rights (zakat is the right of

the mustahik or recipients) (Hafidhuddin, 2002).

In the zakat management guide book (Zakat,

2017), fiqh experts agree that zakat is obliged to

people who are independent, Muslim, baligh and

intelligent, knowing that zakat is obligatory, male or

female. In line with the provisions of Islamic

teachings which always set common standards on

every obligation imposed on the people, then in

determining the property to be the source or object

of compulsory zakat must also fulfill some of the

following conditions:

1. Full property (al-milku at-tam)

2. Develop (name).

3. Simply ratio.

4. More than basic needs.

5. Free of debt.

6. It's been owned one year.

7. Kinds of Zakat

2.2 Purpose of using Zakat Funds

According to Sharia

The purpose of the zakat funds is to finance various

state expenditure items, which are indeed required of

them (the Muslims), when the conditions of Baitul

Mall are empty or insufficient. So there is a binding

goal of being allowed to collect zakat, which is the

expenditure that is already the duty of the Muslims,

and there is a state of vacancies in the state treasury.

Zakat funds must be used for the purpose of benefit

(Malik, 2001). Expenditures in question are

expenditures needed for the development of a

modern economy in the view of Islamic financial

economics. The primary needs of the people as a

whole are security, health, education, and

infrastructure facilities to support Indonesia's

economic growth. While the needs of Muslims for

the education, health, and facilities of the

infrastructure are (Zallum, 2002):

1. Financing jihad related to the formation and

training of troops, procurement of weapons, and

so on.

2. Financing for the procurement and development

of military industries and supporting industries.

3. Development to meet the basic needs of the

needy, the poor, and Ibnu Sabil.

4. Financing for salaries of soldiers, judges,

teachers, and all state employees to carry out the

BICESS 2018 - Borneo International Conference On Education And Social

442

arrangement and maintenance of various benefits

of the people.

5. Financing for the provision of welfare or public

facilities such as the construction of facilities and

infrastructure for the development of the modern

economy.

6. Financing disaster management and events that

afflict the ummah/people, while property at

Baitul Mall is missing or lacking.

7. Health financing for people who cannot afford

such as: fakir, miskin, yatim, piatu, ibnu sabil,

convert.

Zakat is the amanah of the people, which must be

spent honestly and efficiently to realize the goal of

zakat in the development of economic growth.

2.3 Contribution of Zakat in Regional

Economic Development

At the time of the Prophet Muhammad SAW, the

APBN revenue side consisted of kharaj (a type of

land tax), zakat, Khums (tax 1/5), jizyah (a kind of

tax on non-Muslim bodies), and other receipts. Zakat

is very necessary to support regional economic

development. Zakat is an obligation that must be

completed by a Muslim. The purpose of zakat is to

eliminate the economic gap between rich people and

economically disadvantaged people. The target of

the distribution of zakat is clear as stated in the Al-

Qur'an of the At-Taubah verse 60 below:

In this verse, one of the recipients of zakat is the

fakir and the miskin. Zakat is not just an aid at any

time to poor people to ease the economic burden, but

also aims to overcome poverty, so that poor people

are helped in improving their standard of living

towards a prosperous life forever (Al-Qardawi,

2012).

The process of distributing zakat makes it easy for

the recipient of zakat to fulfill their daily needs. If

zakat is distributed in the form of productive goods,

the economic needs of the recipient community of

zakat will be fulfilled independently with the help of

the productive goods received (Al-Qardawi, 2012).

Productive zakat is distributed to people who are

believed to have the expertise to operate these

productive goods, so that the aim of giving zakat as

a means to improve people's living standards is

achieved. Meanwhile for people who do not have

expertise, zakat is given in the form of goods that

can be directly consumed. Zakat that has been

distributed both in the form of productive goods and

consumer goods has directly increased the income of

the per capita community. In the short term, zakat in

the form of consumer goods can meet basic needs.

Whereas in the long run, zakat can create new

economic resources, along with the increase of

people who have the ability to entrepreneurship.

Zakat that has been distributed provides a micro

effect in the form of increasing income per capita

and increasing the purchasing power of the people.

Furthermore, the existence of this micro effect will

have a significant impact on the macro economy

(Sartika, 2008).

Taxes can provide macro benefits as a success of the

government in the implementation of economic

development, especially in terms of providing public

facilities. With the increase in the quality and

quantity of public facilities, the macro society is

prosperous. Unlike zakat, in this case zakat tends to

provide benefits in a micro way. The recipient group

of zakat has been determined in the Qur'an (8

ashnaf), so the distribution of zakat is aimed directly

at individuals who are entitled to receive it.

Therefore, the synergy of the welfare of the micro

and macro will facilitate the government in building

a strong economy and able to compete in the global

economic arena (Michael, 2000).

In economic development, the flow of wealth

distribution will certainly continue to flow.

Economic development will continue to create zakat

that must be collected from the community along

with improving the quality and quantity of public

facilities. In addition, the existence of economic

development in the quantity of underprivileged

people will decrease, so that the flow of zakat from

the providers of zakat will be even greater with the

increase in the assets that must be paid zakat after

entering the nishab and haul.

Zakat in Indonesia's economic development is very

important, because zakat has complementary

benefits. With the synergy of zakat in the economic

system, the economic development that is formed is

a strong economy and can compete in the midst of

an economic crisis. This is the impact of

strengthening the micro sector supported by zakat.

Productive zakat has given long-term effects to

create a strong micro sector. By empowering

productive zakat for the micro sector, it will have the

potential to create zakat which will increase state

revenue from the zakat sector. With the increase in

government revenue from the zakat sector, the

government will obtain sufficient fiscal space to

develop the economy that can improve the welfare

of society both macro and micro.

Contribution of Zakat for Regional Economic Development

443

3 RESEARCH METHODS

3.1 Types of Research

This research is a qualitative research using

descriptive analysis. This study describes the

contribution / role of zakat in the development of a

modern economy in the perspective of Islamic

finance. There is a contribution of zakat to find out

the income of zakat payments, so that it knows the

financing of the country's economy in terms of

education, health, and economic activities.

3.2 Research Sites

This research will be conducted at BAZNAS

(National Zakat Agency) of South Kalimantan

Province.

3.3 Types and Data Sources

The type of data used in this study consists of

primary data and secondary data. Primary data in

this study are data obtained from BAZNAS of South

Kalimantan Province in Banjarmasin and the

Regional Revenue Service of South Kalimantan

Province regarding tax contributions. Primary data

taken directly from the field through interviews on

zakat income in 2015-2017 for regional economic

growth in South Kalimantan Province regarding

policies in the use of funds for the growth of

regional economic growth and direct observation, as

well as tracking the contribution of zakat funds in

regional economic growth in terms of Islamic

finance. Secondary data is obtained from reports on

zakat fund collection in 2015-2017 books, scientific

journals, articles and others.

3.4 Data Collection Technique

The data in this study are primary data and

secondary data, the data is obtained by:

a) Interview, the first interview was carried out on

the leadership/staff of the Regional Revenue

Service of South Kalimantan Province regarding

the contribution of taxes and the second was an

interview with the leadership / staff of the

Baznas of South Kalimantan Province regarding

the regional economic growth.

b) Observation, which is done by observing the

object of research in collecting funds for the

contribution of zakat in the economic growth of

the South Kalimantan Region.

c) Literature and documentation studies, namely by

studying some reading material and material of

scientific works, journals, documents in the form

of statistical data on data collection reports on

Zakat fund report data for 2015-2017 regarding

contributions to economic development in the

province of South Kalimantan in education,

health and economic, as well as reports on tax

and zakat contributions.

3.5 Data Analysis

The data obtained from the field are summarized so

as to form a clear concept map. Further

interpretation and qualitative descriptive analysis

were carried out with interactive analysis techniques.

4 RESULTS AND DISCUSSION

4.1 Contribution of Zakat, Infaq and

Sedekah Funds

Zakat, Infaq, and Sedekah (ZIS) is one of the state

revenue instruments obtained from the community

and then channeled to 8 asnaf. Collection of ZIS

funds through Zakat Institutions/Baznas, Zakat

Houses, or amil zakat, infaq and sedekah (LAZIS)

institutions. Every month Baznas conducts

socialization on zakat, infaq and sedekah to the

community, government institutions or private

institutions, companies, and CVs with the aim to

remind the public of the obligation to pay zakat

2.5% of the assets that have reached their Nisab.

The role of ZIS (Zakat, Infaq, and Sedekah Sedekah)

fundraising is aimed at building the economic and

social welfare of the South Kalimantan Province.

According to Mr. Adi as the staff of the Baznas of

South Kalimantan Province, it was stated that the

Zakat, Infaq and Sedekah Funds collected by

BAZNAS came from public funds that had arrived

at Nisab, so the funds were managed and distributed

to 8 Asnaf (Adi, 2018). In collecting zakat funds in

2015 to 2016 experienced an increase as described

in the table below:

BICESS 2018 - Borneo International Conference On Education And Social

444

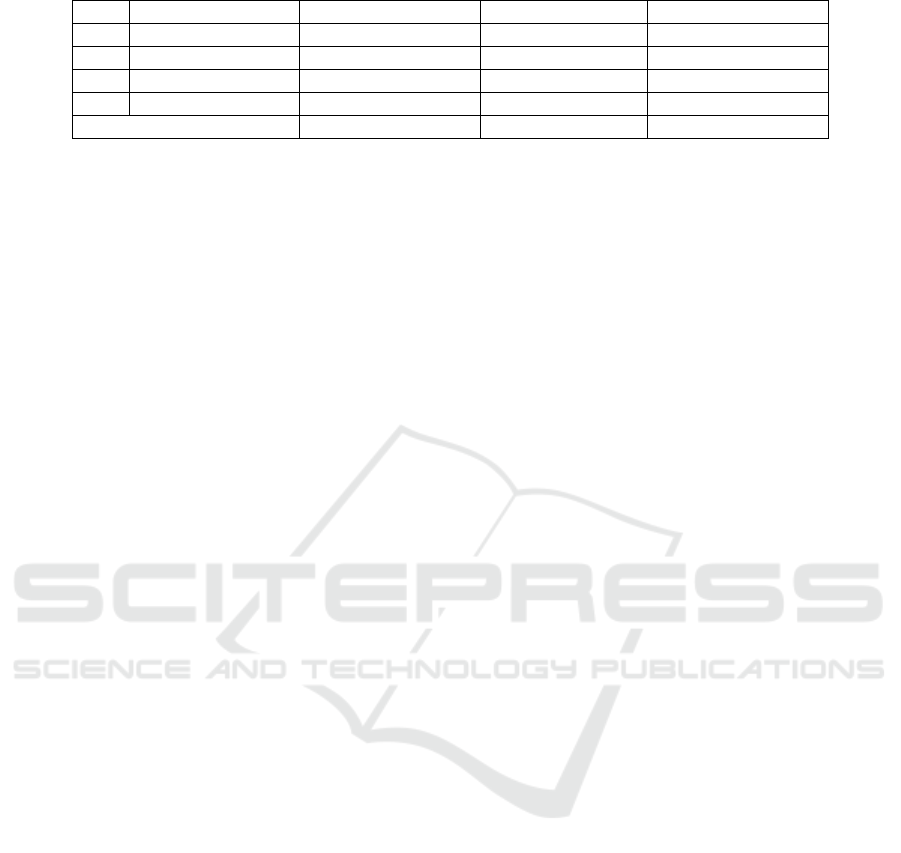

Table 1. Withdrawal of zakat, infaq and sedekah funds

N

o T

y

pe of Funds 2015 2016 2017

1 Zaka

t

Rp 665.332.320,- Rp 901.599.200,- Rp 1.640.885.874,-

2 Infak/Sedekah Rp 117.995.619,- Rp 217.433.724,- Rp 836.537.989,-

3 Amil funds Rp 383.166.540,- Rp 366.790.697,- Rp 793.368.332,-

4 Grant funds Rp 300.000.000,- Rp 0,- Rp 400.000.000,-

Total Rp 1.466.494.479,- Rp 1.485.823.621 Rp 3.670.792.195

Data Sources: 2015-2017 Baznas Collection Report

The types of funds collected by the Baznas of South

Kalimantan Province are as follows: 1) Zakat Funds,

2) Infaq and Sedekah Funds, 3) Amil Funds, 4)

Grants. The funds collected by BAZNAS of South

Kalimantan Province from 2015 to 2016 increased

by 22% from ZIS fundraising in 2015, while the

collection of ZIS (Zakat, Infak and Sedekah) funds

in 2016 to 2017 experienced an increase in

fundraising zakat, infaq / sedekah, and amil, and

grants amounting to 40% of fundraising in 2016.

Zakat, infaq and sedekah (ZIS) funds that are

widely accepted from the community have increased

from year to year, both from private institutions and

city or provincial governments, from private or state

higher education institutions at the level of South

Kalimantan Province continue to increase due to the

role of the Provincial BAZNAS in conducting the

socialization of the liabilities obtained if it is

sufficient Nisab of 85 grams of gold within a period

of 1 year, a portion of its assets must be issued and

channeled through the amil zakat institution at the

city and provincial level (Adi, 2018).

Baznas is one of the institutions of the national

charity charity that collects and manages funds

received from the community to be channeled to the

community in education, economic and health

activities. The existence of amil zakat institution

aims to prosper and alleviate poverty in the 8th

group of Asnaf, so the existence of the Amil Zakat

body plays a role to remind the obligation of

property ownership of a person who has reached his

Nisab which is equivalent to 85 grams of gold so

that his zakat is 2.5% of the property equivalent to

85 grams of gold and has been held for 1 year. Mrs.

Dina as the staff of the distribution of zakat funds

said that the more days the more zakat, infaq, and

sedekah funds were obtained from the community

over the ownership of the assets they owned. If you

have arrived at Nisab, a person's assets must be

issued as much as 2.5% of the amount owned,

because the thing that needs to be remembered is

some of the assets owned by someone if they have

reached the Nisab, then there is a right for others

(Dina, 2018).

4.2 Distribution of Zakat Funds in

Regional Economic Development

Funds that have been collected by the National

Zakat Agency (BAZNAS) are distributed to people

who need to meet economic needs. In the

distribution of Zakat funds made by BAZNAS

Kalimantan Province for economic activities,

Education and Health. Zakat funds, infaq and

sedekah collected from the community will be

distributed to 8 organizations in the form of

economic activities, education and health (Dina,

2018).

Zakat, Infaq and Sedekah (ZIS) funds in the

2015 BAZNAS amounted to Rp. 665,332,320 and

the funds were absorbed by the public by 44% for

economic activities, which amounted to Rp.

294,300,000,- to be channeled in financing

economic activities such as additional business

capital in the form of services, culinary, and others.

In the distribution of zakat funds for economic

activities in the form of providing venture capital,

assistance for welfare welfare for the poor, poor,

gharim, converts, physical, and for Ibn Sabil carried

out every year (Dian, 2018).

Economic activities carried out by the provincial

Baznas are in the form of additional working capital

for people who are less able to entrepreneurship.

According to Mr. Eko as staff of ZIS (Zakat, Infaq

and Sedekah) fund distribution "in distributing zakat

funds in the form of economic activities, prospective

participants who will be given additional business

capital, propose business capital financing to the

provincial baznas then the Provincial Baznas

conducts a study survey the feasibility of the

prospective customer is eligible for business capital

from Baznas with the criteria determined by Baznas,

he is a capable or not, and must be honest "The

collection of Zakat funds for economic activities,

Education and Health are as follows:

Contribution of Zakat for Regional Economic Development

445

Table 2. Distribution of zakat funds in economic development

N

o Yea

r

Education Econo

m

y

Health Total Amoun

t

1. 2015 Rp 3.000.000 Rp 587.025.000 Rp 2.800.502 Rp 592.825.502

2. 2016 Rp 291.329.000 Rp 307.455.000 Rp 1.000.000 Rp 599.784.000

3. 2017 Rp 270.779.534 Rp 1.510.360.000 Rp 8.735.000 Rp 1.789.874.534

Source of Financial Report Data Distribution of 2015-2017 Zakat funds

The results of the distribution of Zakat funds

from the 2015 to 2017 period have increased in

education, economic and health activities. Judging

from the data table of the distribution of zakat funds

above that in 2015 the activities of the contribution

of zakat funds for education in the form of

scholarships from the level of junior high school to

university level, showed that the distribution of

education funds increased from 2015 by 0.45% and

in 2016 contributions education funds increased by

32.3%. In 2017 economic activities experienced an

increase of 8.43% from the previous year because

more and more people who were less able or lack of

capital wanted entrepreneurship, in the process of

entrepreneurship submission here the interested

people submitted proposals for additional capital to

the BAZNAS, then the provincial Baznas did survey

the place, type of business, and reasons for

proposing the business.

ZIS (Zakat, Infaq and Sedekah Sedekah) funds that

have been channeled in economic activities will be

supervised and monitored by the business actors and

every entrepreneur is advised to be trained every

month to set aside a portion of the business results to

be saved for the purpose that the savings can be used

as capital additional (Dian, 2018). In ZIS funds

distributed to the public in the form of business will

be accompanied and supervised by the Provincial

Baznas every month with the aim of knowing the

development of the business and each of the

business people.

The contribution of zakat funds in the form of

education can help communities improve education

welfare. Every year the results of the collection of

Zakat, Infaq and Sedekah funds are always

increasing due to the role of socialization from the

Provincial National Zakat Agency to state and

private institutions/institutions, public/private

schools, and private universities or state universities

with the aim to remind the public that some the

wealth we get is partly from the rights of others who

need it if the wealth we get for one year has reached

85 gold nisab, then it must be issued 2.5% of the

income of every human being (Adi, 2018).

In 2016 BAZNAS distributed 49% of Zakat funds to

the public in educational activities, 51% in economic

activities, and 0.2% in health activities. For

educational activities at the provincial BAZNAS,

they channel zakat funds in the form of junior high

school education scholarships to university level for

poor or drop out students. Furthermore, the

Provincial Baznas assist and supervise the academic

achievements of students, or students so that the

recipients of Baznas scholarships are able to

compete in the academic field. In distributing

education funds to underprivileged people, here is

supervised and accompanied by the Provincial

Baznas with the aim that young generation children

can get the knowledge and ideals they want later

(Dian, 2018). The purpose of an education program

is to improve the intelligence and skills of the

nation's children to reach the desired goals.

In 2016 the distribution of zakat funds to health

activities amounted to 0.17% that the data shows

that public awareness and awareness of the

importance of health is still lacking. The purpose of

the distribution of zakat funds for health activities is

to provide services to the underprivileged in the

form of provision of clean water, posyandu activities

for toddlers, treatment of cataract eyes, provision of

bathrooms and small and large water disposal sites,

medical treatment in villages.

In 2017 funds for health activities that have been

absorbed by 0.49% of health funds in 2016, resulting

in an increase in health funds used for free treatment

for underprivileged people..

5 CONCLUSIONS

Based on the discussion that has been written above,

the writer can conclude several things:

1. Zakat, Infaq and Sedekah Funds are funds

collected by Baznas which have a very important

contribution in regional economic development

through several types of Economic, Education

and Health activities. The purpose of these

activities is to build a regional economic system

and alleviate poverty. The goal is realized

through the distribution of zakat which leads to

the people in need for regional economic

development.

BICESS 2018 - Borneo International Conference On Education And Social

446

2. The distribution of zakat funds for economic,

education and health activities is as follows: 1) in

2015 zakat funds amounted to Rp 665,332,320

then the funds were absorbed by the public by

44% for economic activities with a nominal

amount of Rp. 294,300,000. The funds are used

for activities in the form of additional business

capital so that the program is able to boost

economic growth in the community. 2) the

distribution of education funds has increased

from 2015 by 0.45% and in 2016 the

contribution of education funds increased by

32.3%. In 2017 economic activity experienced an

increase of 8.43% from the previous year. 3) In

2016 the distribution of zakat funds to health

activities amounted to 0.17% that the data above

shows that public awareness of the importance of

health is still lacking awareness. The purpose of

the distribution of zakat funds in health activities

to provide health to the underprivileged in the

form of clean water supply, posyandu activities

for toddlers, treatment of cataract eyes, provision

of bathrooms and small and large water disposal

sites, medical treatment in villages. In 2017

funds for health activities that have been

absorbed by 0.49% of health funds in 2016,

resulting in an increase in health funds used for

free treatment for underprivileged people.

REFERENCES

M Al Quran & terjemahannya oleh Departemen Agama RI

terbitan PT Syaamil Bandung, (2014).

Adi. (2018, Maret 2). Distribusi Dana Zakat. (A. Purnomo,

Interviewer)

Ali Sakti, d. (2017). Perbankan Syariah Di Indonesia.

Jakarta: Rajawali Press.

Al-Qardawi, Y. (2012). Fiqhuz Zakat. Jakarta: Litera

Antar Nusa.

Dahlan, A. A. (1999). Ensiklopedi Hukum Islam. Jakarta:

Ichtiar Baru van Hoeve.

Dian. (2018, Maret 3). ZIS pada Baznas Kalsel. (A.

Purnomo, Interviewer)

Dina. (2018, Maret 2). Distribusi Zakat Pada Baznas

Provinsi Kalimantan Selatan. (A. Purnomo,

Interviewer)

Hafidhuddin, D. (2002). Zakat Dalam Perekonomian

Modern. (Jakarta: Gema Insani 2002). Jakarta: Gema

Insani .

Kaaf, A. Z. (2002). Ekonomi Dalam Perspektif Islam.

Bandung: Pustaka Setia.

Malik, A. A. (2001). Politik Ekonomi Islam, Terj.oleh

Ibnu Sholah Al Izzah. Bangil.

Michael, P. (2000). Pembangunan Ekonomi di Dunia

Ketiga (terjemahan). Jakarta: Erlangga.

Nawawi, I. (2010). Pengelola Dana Zakat. Jurnal Al

Iqtisahadiyah, 7(6).

Contribution of Zakat for Regional Economic Development

447