Optimization of Autoregressive Integrated Moving Average

(ARIMA) for Forecasting Indonesia Sharia Stock of Index (ISSI)

using Kalman Filter

Luluk Wulandari

1

, Yuniar Farida

1

, Aris Fanani

1

And Mat Syai’in

2

1

Departement of Mathematics, UIN Sunan Ampel Surabaya, Jl A.Yani 117, Surabaya

2

Departement of Electrical Engineering, Politeknik Perkapalan Negeri Surabaya, Jl Campus ITS Keputih Sukolilo,

Surabaya

Keywords: Indonesia Sharia Stock of Index, Autoregressive Integrated Moving Average, Artificial Neural Network,

Kalman Filter

Abstract: Forecasting stock price index is an important thing, because it can describe the state of stock price index going

forward. It can be a consideration for a company's investors to determine the decision in selling, buying, or

holding its stock. This research aims to find out an optimal model that can be used to forecast ISSI using

ANN and ARIMA model. The optimal model was analyzed from the smallest RMSE and MAE results. The

results of this research show that ANN (12,12,1) is more optimal than ARIMA (2, 1, 2) with values of MAE

= 0.59143 and RMSE = 0.58705. Then, ARIMA model will be improved using Kalman filter method, showing

that the residual value is very small with the RMSE value of 3.8693e-08. The RMSE value from the

forecasting results using ARIMA – Kalman Filter is much smaller than the RMSE of ANN. Thus, it can be

concluded that the ARIMA Kalman Filter method is more optimal than ANN in forecasting ISSI.

1 INTRODUCTION

Stock are securities traded in the capital market

indicating a capital ownership of an enterprise. In this

era, stock investment has become one of choices to

develop finance, because it will provide a big

advantage for investors. Ownership of stocks of a

company indicates that the owner of the stocks are

entitled to get advantages from developing business

by the company, and risked to endure a loss if a

company go bankrupt, increase and decrease of stock

price index into consideration for a company's

investors. Forecasting stock prices index in the stock

market is important to do. Because forecasting stock

price index can describe the stock price index in the

future. Indonesia Sharia Stock of Index (ISSI) is

stocks traded in the capital market of sharia. Capital

market sharia is part of the Indonesian capital

market.Generally, all activities in the capital market

sharia are similar to those in the Indonesian capital

market. However, the characteristics of capital

market sharia is product and transaction process

which does not not contradict with sharia principles

in the capital market (OJK, 2016). ISSI is rice set

from all sharia stock in Indonesia Stock Exchange.

Recently, there are 331 Sharia Stocks (Respati, 2017).

Stock price index as time series data are non-

stationary, non-linear, highly noisy and contains

uncertainty. This is because the stock market is

affected by many factors, such as traders’

expectations, general economic conditions and

political events. So, forecasting stock requires the

right approach.

There have been several studies related to stock

forecasting in the capital market, among others are

Rio Bayu Afriyanto who forecasted stock price using

the Neural Network method (Afrianto, Tjandrasa, &

Arieshanti, 2013). In this study, it is known that the

forecast are good, indicated by the accuracy level up

to 62.18%. Imam Halimi and Wahyu Andhyka

forecasted stock price index using a Neural Network

algorithm (Halimi & Kusuma, 2018). Amin Hedayati

Moghaddama and his partner forecasted stock price

index using Neural Network algorithm

(Moghaddama, Moghaddamb, & Esfandyari, 2016).

This research obtained a value of

of 0.9408.

Mohammed M Mustofa, forecasted stock price

movements using the Neural Network method

Wulandari, L., Farida, Y., Fanani, A. and Syai’in, M.

Optimization of Autoregressive Integrated Moving Average (ARIMA) for Forecasting Indonesia Sharia Stock of Index (ISSI) using Kalman Filter.

DOI: 10.5220/0008906900002481

In Proceedings of the Built Environment, Science and Technology International Conference (BEST ICON 2018), pages 295-303

ISBN: 978-989-758-414-5

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reser ved

295

(Mustofa, 2010). Muzakir forecasted the magnitude

of earthquake using Neural Networks in time series

data (Sultan, 2014). Jordan Grestandhi et.al analyzed

the OLS-ARCH and ARIMA method to predict the

stock price index (Jordan Grestandhi et al, 2011).

Bayu Ariestya Ramadhan analyzed the comparison of

ARIMA and GARCH methods to forecast stock

prices (Ramadhan, 2015). Ahmad Sadeq forecasted

stock index using ARIMA method (Sadeq, 2008).

The results of this forecasting are accurate with

MAPE 4.14%. Chintya Kusumadewi forecasted the

Indonesia stock market price index using the ARIMA

and Genetic Programming (Kusumadewi, 2014). In

this research, the MAPE value is smaller compared to

using the ARIMA method only, which is

1.181192667%. Ping-Feng Pai and Chih-Sheng Lin

combined ARIMA and Support Vector Mechine

(SVM) methods to forecast stock price (Ping-Feng

Pai and Chih-Sheng Lin, 2005). Nurissaidah

Ulinnuha and Yuniar Farida forecasted the weather

using ARIMA – Kalman Filter (Ulinnuha & Farida,

2018). In this research, it is known that the ARIMA

kalman filter method is optimal for forecasting, with

MAPE value of 0.000389.

From several studies above, most of the ANN

methods are proven to be more optimal when

compared to statistical methods such as ARIMA. This

is because ARIMA models cannot identify nonlinear

patterns of data (Shukur, 2015). So, the results of

forecasting by ARIMA model must be increased

using other methods, such as Kalman Filter. The

Kalman Filter approah is used as an optimal solution

for many data tracking and predictions, because the

Kalman filter reduces noise and obtains correct data

(Hairong Wang et al, 2017). So, in this research, the

results of ARIMA forecasting were improved by

using Kalman Filter to obtain a more optimal

forecasting result and compare it with the ANN

method.

2. THEORITICAL FRAMEWORK

2.1 Indonesia Sharia Stock of Index (ISSI)

ISSI is index of stock that covers all sharia stock in

Indonesia and registered in Indonesia Stock

Exchange. The difference between ISSI and stock in

general is that the implementation of ISSI does not

violate religion. Stocks of Sharia have some criteria.

They are:

1. Activities carried do not violate Islamic religious

law. They are :

a) Everything that belongs to gambling

b) Trade is prohibited sharia

c) Based financial services of usury (riba)

d) Traded risks contain uncertain elements or

gambling

e) Producing, distributing, trading and providing

illicit goods or services that defined by DSN-

MUI

f) Transactions carried contain elements of

bribery

2. Confirm of financial ratios. They are :

a) Total money based on interest compared to

total assets not exceeding 45%

b) Total interest income and other haram income

compared to total business income and other

income not exceeding 10%

2.2 Time Series Analysis

Time series data are some data from a specific

variable successive in each period, for example daily,

weekly, monthly, yearly and etc. Time series data are

important to predict next occurrences. because it is

known that multiple data patterns of the past will be

repeated in the future. Any observations made can be

expressed in random variables

which is obtained

on a certain time index

, with

. so, from time series, data can be

written with

2.3 Stationary Test of Time Series Data

Stationary data is when the data pattern is at

equilibrium around the constant mean and the

variance around average which is is constant for some

time (S. Makridakis, S. C. Wheelwright, and V. E.

McGee, 1999). The data that are not stationary

against variance, it must be transformed by the Box-

Cox transformation method (G. E. P. Box, G. M.

Jenkins, and G. C. Reinsel, 2013). The formulation is

as follows:

with λ is transformation parameter,

is

transformation data,

is Observation at time t

If the data are not stationary on mean, it is

necessary to do differencing. Backward shift operator

is very appropriate to describe the differencing

process (S. Makridakis, S. C. Wheelwright, and V. E.

McGee, 1999). The use of backshift is as follows :

(2)

BEST ICON 2018 - Built Environment, Science and Technology International Conference 2018

296

with

is observation value at t;

is observation

value at t-1; B is Backshift.

If there is differencing until the the

equation becomes:

(3)

2.4 Autocorrelation Coefficient Function

(ACF)

The autocorrelation coefficient is a determinant of

data basic pattern identification (L. Arsyad, 1995).

The stationary process of a time series (

) is

obtained from

and

which are constant and covariance

Based on the autocorrelation

coefficient between

and

for lags k as follows:

(4)

The autocovariance function between

and

for

lag k is as follow :

) (5)

is autocovariance function, for stationary state

. So, the equation (4)

and (5) become :

(6)

(7)

2.5 Partial Autocorrelation Coefficient

Function (PACF)

Partial autocorrelation is used to determine the

correlation between

and

, if the effect of

time is considered separate.

The formulstion is as follows :

(8)

2.6 Autoregressive Integrated Moving

Average (ARIMA) Model

The ARIMA model is a model used for forecasting

time series data that tend to be stationary. ARIMA

model is a combination of AR (p) and MA (q) models

with differencing data (d).

Formulation AR (p) model is:

(9)

Equation (9) using operator B (backshift):

(10)

with :

Formulation of MA (q) model is:

(11)

Equation (11) using operator B (backshift):

(12)

with :

Formulation of (ARMA) model is :

(13)

Equation (9) using operator B (backshift):

(14)

ARIMA Model is a combination of ARMA (p, q)

and differencing (d) models. Formulation of ARIMA

(p,d,q) model is :

(15)

with :

with

is AR factor (p);

is MA factor (q);

is order differencing.

2.7 Artificial Neural Network (ANN)

ANN is a method formed from the awareness of a

complex learning system in the brain which consists

of several sets of neurons that are closely related.

ANN have 3 main types, namely multilayer

perceptron, radial basic function and kohonen

network (J Hair & R.Anderson, 1998). The layers of

the ANN compiler are divided into 3 parts, namely

Optimization of Autoregressive Integrated Moving Average (ARIMA) for Forecasting Indonesia Sharia Stock of Index (ISSI) using Kalman

Filter

297

input layer, hidden layer and output layer (Sutojo T,

et al, 2010). ANN applies the activation function to

limit the output of the neuron to match output value

specified. There are 4 kinds activation functions,

namely:

a) Linear activation function, the formulation is :

(16)

b) Bipolar activation function, the formulation is :

(17)

c) Sigmoid Binner activation function, the

formulation is :

(18)

d) Sigmoid Bipolar activation function, the

formulation is :

(19)

2.8 Backpropagation

The Backpropagation algorithm uses an error output

to change the weight value in the backward (J. J.

Siang, 2005). Suppose given n different data inputs

that are connected to the output

data

( = 1,2, ..., ), the interpolation of ANN is:

(20)

with

is variable input ,

is output layer value,

is index of input,

is weight of the neuron in the

input layer leading to the hidden layer,

is bias

from the neuron at hidden layer,

is activation

function of the neuron in the hidden layer,

is

weight of the neuron j in the hidden layer that leads

to output layer,

is bias on the output layer, and

is activation function in the hidden layer.

The steps of the training algorithm for the ANN

are as follows:

a) Initialize of weights

b) Repeat steps until the iteration conditions

are appropriate.

c) For each pair of training data, do steps

Feedforward Algorithm :

d) Input unit

receives an input

signal

and the signal is forwarded to the next

section units.

e) Calculate all outputs in the hidden layer

(21)

Calculate activation function

hidden layer

(22)

f) Calculate all outputs at the output layer

(23)

Calculate the activation function

at the output

layer :

(24)

Backpropagation Algorithm :

g) Each output layer

accept the

target pattern (

) according to the input pattern

and calculate the error value (

)

(

(25)

The usual activation function is sigmoid then

, The formula is :

(

=

(26)

Equation (25) is substituted to equation (26)

obtained :

(27)

h) Calculate the change of weight

with the

learning .

i) Calculate the factor δ based on errors in each

hidden layer

(28)

(29)

Change of weight

use learning α.

BEST ICON 2018 - Built Environment, Science and Technology International Conference 2018

298

j) Output layer

is updated.

After deriving the Gradient Descent algorithm,

two equations are used to update the weights of

Updating the weights and bias on the Output Layer:

(30)

=

(31)

Updating the weights and bias on the Hidden Layer:

(32)

=

(33)

2.9 Kalman Filter

Kalman filter is one of the very optimal estimation

methods. Transition and measurement equations are

the basic components of applying the Kalman filter

method. Improved estimation results are based on

measurement data.

Estimate polynomial coefficients

and

with

the following model equation:

(34)

This estimate will take the value n = 2. So,

equation (34) changes to :

(35)

With :

and

,

is matrix system, is input value of iterasi, is

covariance matrix, is covariance matrix R;

is

initial value of input

;

is initial value of input

.

Find for values from noise with random ones

normal distribution.

System Model :

(36)

(37)

Measurement model :

(38)

(39)

Estimastion value :

(40)

Covariance value :

(41)

Correction Step :

Kalman gain value :

(42)

With and to get correction value from

and

using the formulation as follow :

=

(43)

Forecasting value :

(44)

3. RESEARCH METHOD

3.1 Data and Research Variable

The data used in this research are ISSI data sourced

from the Indonesian Stock Exchange. The data used

are daily close index data for the period of July 2017

to May 2018 amounting to 340 time series data, in

which 310 data are used as trainning data and 30 other

data as testing data.

3.2 Analysis Method

Forecasting was conducted using ARIMA method

with the following step :

a) Data stationary test

b) Identification of the model that is considered most

appropriate by calculating and testing the ACF

and PACF of correlogram.

c) The model estimation step of the parameters in the

model.

d) Calculates the values of RMSE and MAPE

e) Analysis of model compatibility with p-value

f) Use of models for further forecasting.

Optimization of Autoregressive Integrated Moving Average (ARIMA) for Forecasting Indonesia Sharia Stock of Index (ISSI) using Kalman

Filter

299

Forecasting using ANN method with the following

step :

a) Determine the number of parameters tested

which affect the output value

b) Determine the number of hidden layers

c) Determine the activation function

d) Evaluate the selection of the optimal model

using RMSE and MAE

e) Use models for further forecasting

Determination of the optimal model of both models

by selecting the value of MAE and RMSE smaller

value.

4 RESULT AND DISCUSSION

Before forecasting using ARIMA and ANN, it is

necessary to know descriptive statistics from the data

used in the research, shown in table 1.

Table 1 : Descriptive Statistic Data of Research

N

310

Minimum

173,247

Maximum

199,614

Mean

18,658,976

Std Deviation

4,738,130

4.1 Forecasting ISSI using ARIMA

First step in ARIMA method is Stationary test. In fact,

ISSI data are not stationary. Figure 1 is a graph of the

stationary data test results.

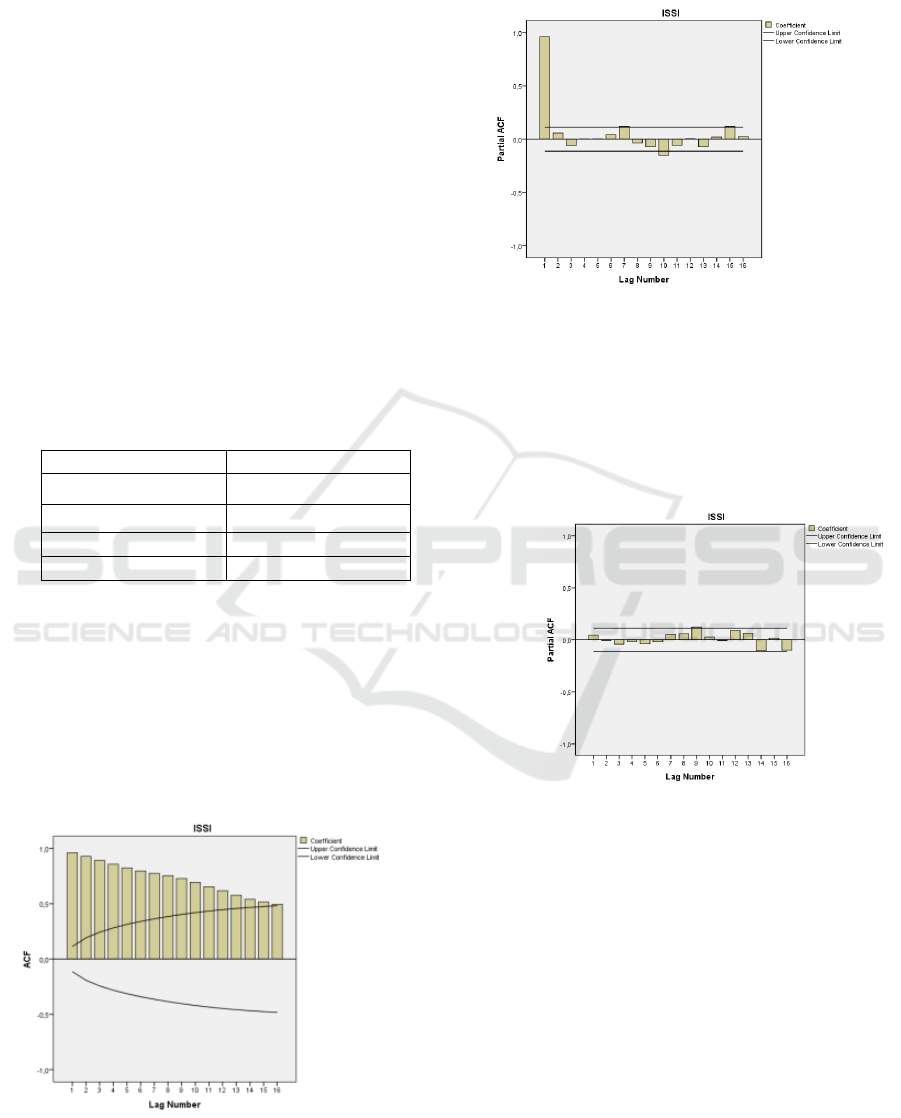

Figure 1: Graph of ACF non-stationary data

Based on the ACF graph, it appears that the ACF

graph decreases slowly to zero. This means that the

data are not stationary towards the mean.

Figure 2: Graph of PACF non-stationary data

Based on the partial graph ACF (PACF), it appears

that after lag 1, the graph is not significantly different

from zero. From the graph analysis of ACF and

PACF, it is found that the data are still not stationary

towards the mean. So, the data should be transformed

using differencing. The result of differencing data on

figure 3 indicates that the data are stationary.

Figure 3: Stationary PACF graph

After the data pattern test process, it was found

that with differencing 1, the data were stationary. The

next step is estimation of the model for forecasting

ISSI. The model used is ARIMA (p, d, q), where p is

the order of AR model, d is differencing data, q is

order of MA. In this research some ARIMA models

will be formed with orders (1,1,1), (2,1,1), (2,1,2),

(1,1,2), (1,1,3), (2,1,3).

The model of ARIMA (1,1,1) is :

The model of ARIMA (2,1,1) is :

BEST ICON 2018 - Built Environment, Science and Technology International Conference 2018

300

The model of ARIMA (2,1,2) is:

The model of ARIMA (1,1,2) is :

The model of ARIMA (1,1,3) is:

The model of ARIMA (2,1,3) is:

From the some model of ARIMA above, P-Value,

RMSE, MAPE and MAE were found to determine the

results of the model accuracy. It shows that ARIMA

with orders (2,1,2) is the most optimal model

compared to other models. Table 3 shows the P-

Value, RMSE, and MAE of ARIMA (2, 1,2).

Table 3: P-Value, RMSE and MAE of ARIMA (2,1,2)

Model

P-Value

RMSE

MAE

(2,1,2)

Constanta

0,751

1,080

0,700

AR(1)

0,000

AR(2)

0,000

D

1

MA(1)

0,031

MA(2)

0,0279

4.2 Forecasting ISSI using ANN

Forecasting ISSI using ANN consists of 4 activation

functions types namely semi linear, Bipolar Sigmoid,

Sigmoid and Hyperbolic Tangent which are used in

processing data from input to the hidden layer. From

several inputting neuron values from input layer,

hidden layer, and output layer by using 4 activation

functions, the optimal model will be obtained from

RMSE and MAE. In this research some ANN models

will be formed. Those are (4,4,1), (12,12,1), (8,10,1),

(4,8,1) . The best model of ANN is input layer = 12,

hidden layer = 12 and output layer = 1 and using

bipolar sigmoid of activation function. The MAE and

RMSE results of ANN are presented in table 2.

Table 2 : The results of MAE and RMSE of ANN

Neuron

Activation

Function

MAE

RMSE

12/12/2001

Linear

44,672

371,445

Sigmoid Binner

0,7958

118,747

Bipolar

Sigmoid

0,5914

0,58705

Hyperbolic

Tangent

0,7803

0,92354

4.3 The Comparison of Forecasting using

ARIMA and ANN

From the results of forecasting using these two

methods, it is known that the best model uses ARIMA

(2,1,2) and ANN (12,12,1). The best model of

forecasting ISSI is by comparing RMSE and MAE

from the two models. Table 4 presents the results of

the comparison.

Table 4 : Comparison of RMSE and MAE of

ARIMA(2,1,2) and ANN (12,12,1)

Model

RMSE

MAE

ARIMA (2,1,2

1,08000

0,70000

ANN (12,12,1)

0,58705

0,59143

From table 4 above, it is known that the best model is

forecasting using ANN method with input layer 12,

hidden layer 12 and layer 1 output. It is proved by the

RMSE and MAE values that are smaller than the

ARIMA model (2,1,2).

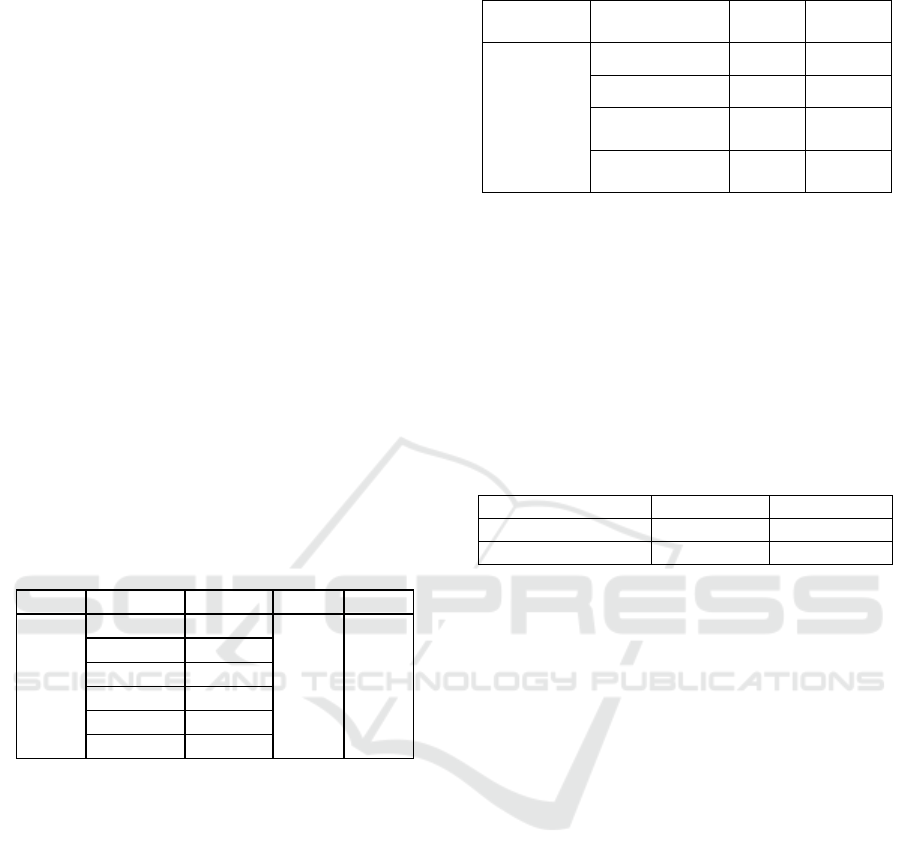

4.4 Improvement of ARIMA Method

Using Kalman Filter

From the results of forecasting, ISSI using ARIMA

method has a high residual value. So, it must be

improved using the Kalman filter method.

Comparison of Actual Data, ARIMA and ARIMA –

Kalman Filter is shown in figure 4.

Based on fig.4, it is known that the residual

value is very small with RMSE value of 3.8693e-08.

The RMSE value from the forecasting results using

ARIMA – Kalman Filter is much smaller than the

RMSE value of ANN. Thus, it can be concluded that

the ARIMA Kalman Filter method is more optimal

for forecasting ISSI.

Optimization of Autoregressive Integrated Moving Average (ARIMA) for Forecasting Indonesia Sharia Stock of Index (ISSI) using Kalman

Filter

301

Figure 4: Plot data comparison of Actual Data, ARIMA

and ARIMA-Kalman Filter

Comparison of actual data, forecasting results using

the ARIMA-Kalman Filter and ANN for one week

are presented in Table 5.

Table 5: Comparison of actual data, forecasting results

using the ARIMA-Kalman Filter and Neutral Network

Date

Actual

ARIMA –

KF

ANN

09 Mei 2018

175.873

175.873

173.8703

10 Mei 2018

175.873

175.873

173.0156

11 Mei 2018

177.602

177.602

173.386

12 Mei 2018

177.602

177.602

175.1289

13 Mei 2018

177.602

177.602

173.9586

14 Mei 2018

176.942

176.942

174.9494

15 Mei 2018

173.912

173.912

174.6113

Comparison of Actual Data, ARIMA-Kalman filter

and ANN is shown by plot data in figure 5.

Figure 5 :Plot data comparison of Actual Data, ARIMA-

Kalman filter and ANN

5. CONCLUSION

The best ARIMA model used forecasting ISSI is

ARIMA (2,1,2) with RMSE value of= 1,08000 and

MAE = 0,70000. Then, the best ANN model is ANN

(12,12,1) with RMSE = 0,58705 and MAE = 0,59143.

Comparison forcasting ISSI result using ARIMA

and ANN indicates that ANN model is more optimal

than ARIMA. So, the forecasting result of ARIMA is

improved using Kalman – Filter and forecasting

results that are very close to the actual data with the

RMSE = 3.8693e-08 were obtained. This RMSE

value is much smaller than ANN. Thus, ARIMA –

Kalman Filter is more optimal than ANN in

forecasting ISSI.

REFERENCES

Afrianto, R. B., Tjandrasa, H., & Arieshanti, I.

(2013). Prediksi Pergerakan Harga Saham

Menggunakan Metode Backpropagation

Neural Network.Jurnal Simantec ISSN

2088-2130.

G. E. P. Box, G. M. Jenkins, and G. C. Reinsel.

(2013). Time series analysis: forecasting

and control. John Wiley & Sons.

Hairong Wang et al. (2017). An adaptive Kalman

filter estimating process noise covariance.

Neurocomputing, 12-17.

Halimi, I., & Kusuma, W. A. (2018). Prediksi Indeks

Harga Saham Gabungan (IHSG)

Menggunakan Algoritma Neural Network.

Jurnal Edukasi dan Penelitian Informatika

ISSN(e): 2548-9364 / ISSN(p) : 2460-0741.

J Hair & R.Anderson. (1998). Multivariate Data

Analysis. New York: Prentice Hall.

J. J. Siang. (2005). Jaringan syaraf tiruan dan

pemrogramannya menggunakan matlab.

Yogyakarta: Andi.

Jordan Grestandhi et al. (2011). Analisis

Perbandingan Metode Peramalan Indeks

Harga Saham Gabungan (IHSG) Dengan

Metode Ols-Arch/Garch Dan ARIMA .

ISBN : 978 – 979 – 16353 – 6 – 3 .

Kusumadewi, C. (2014). Prediksi Harga Saham di

Bursa Efek Menggunakan Metode

Campuran Autogressive Integrated Moving

Average dan Genetic Programming.

Bandung: Universitas Telkom.

L. Arsyad. ( 1995). Peramalan Bisnis. Jakarta:

Indones.

Moghaddama, A. H., Moghaddamb, M. H., &

Esfandyari, M. (2016). Stock market index

BEST ICON 2018 - Built Environment, Science and Technology International Conference 2018

302

prediction using artificial Neural Network.

Journal of Economics, Finance and

Administrative Science, 89-93.

Mustofa, M. M. (2010). Forecasting stock exchange

movements using Neural Networks:

Empirical evidence from Kuwait. Expert

Systems with Applications.

OJK. (2016). Mengenal Pasar Modal Syariah.

Ping-Feng Pai and Chih-Sheng Lin. (2005). A

hybridARIMA and support vector machines

model in stock price forecasting. Science

Direct, 497 – 505.

Ramadhan, B. A. (2015). Analisis Perbandingan

Metode ARIMA dan GARCH untuk

Memprediksi Harga Saham. e-Proceeding

of Management ISSN : 2355-9357,(hal. 61).

Respati, Y. (2017). Apa itu indeks saham syariah

indonesia ? Diambil kembali dari Berita

ekonomi dan keuangan:

http://keuangansyariah.mysharing.co/apa-

itu-indeks-saham-syariah-indonesia/

S. Makridakis, S. C. Wheelwright, and V. E. McGee.

(1999). Metode dan aplikasi peramalan.

Jakarta: Bin.Aksara.

Sadeq, A. (2008). Analisis Prediksi Indeks Harga

Saham Gabungan Dengan Metode ARIMA.

Semarang: Universitas Diponegoro.

Shukur, O. B. (2015). Artificial Neural Network And

Kalman Filter Approaches Based On

ARIMA For Daily Wind Speed Forecasting.

Universiti Teknologi Malaysia .

Sultan, M. H. (2014). Optimasi Parameter Neural

Network Pada Data Time Series Untuk

Memprediksi Rata-rata Kekuatan Gempa

Per Periode. Volume 3(ISSN: 2086-0382).

Sutojo T, et al. (2010). Kecerdasan Buatan.

Yogyakarta: Andi Ofset.

Ulinnuha, N., & Farida, Y. (2018). Prediksi Cuaca

Kota Surabaya Menggunakan ARIMA-

Kalman Filter. Jurnal Matematika ISSN:

2527-3159.

Optimization of Autoregressive Integrated Moving Average (ARIMA) for Forecasting Indonesia Sharia Stock of Index (ISSI) using Kalman

Filter

303