Stability Analysis of Cycle Business Investment Saving-Liquidity

Money (IS-LM) Model using Runge-Kutta Fifth Order and Extended

Runge-Kutta Method

Ulia Maulidah Musyaffafi

1

, Mohammad Hafiyusholeh

1

, Yuniar Farida

1

, Aris Fanani

1

and Ahmad Zaenal Arifin

2

1

Sunan Ampel Islamic State University, Street Ahmad Yani 117, Surabaya, East Java, Indonesia

2

Universitas PGRI Ronggolawe, Tuban, East Java, Indonesia

Department of Mathematics, Science and Technology

az_arifin@unirow.ac.id

Keywords: Routh-Hurwitz Criteria, Runge-Kutta Fifth Order, Extended Runge-Kutta.

Abstract: Forecasting the future conditions of economic stability can be illustrated in business cycle model. The IS-LM

business cycle model is a business cycle model which is represented in a differential equation involving

investment function (I), saving function (S), and money demand function (L). In this research, stability

analysis on the IS-LM business cycle model was performed. Stability analysis was performed by Routh-

Hourwitz criteria. After that, numerical simulation would be performed by comparing the Runge-Kutta

method of fifth order and Extended Runge-Kutta to determine the stability speed of the model. This research

resulted fixed point IS-LM model that is

∗

,

∗

,

∗

0.0979,0.0097,0.0351. Through data

simulations, it was obtained numerical solution with the Extended Runge-Kutta method that has faster stable

result, with25, compared with the Runge-Kutta Fifth Order method that is stable when 36.

1 INTRODUCTION

Indonesia is one of the countries that has experienced

economic crisis since the 1990s. Until now, the state

of the economy has been fluctuating and tends to be

unstable. One example of economic growth in

Indonesia in 2018 was overshadowed by a slowdown

compared to previous year. As for information, in

2017 Indonesia economic growth reached 5.07% or

lower than the growth of neighboring countries, such

as Malaysia which has 5.8% growth (Angriani, 2018).

This situation requires Indonesia to develop

economic forecasting in order to know the future

condition of the economy.

Forecasting future economic conditions can be

illustrated in the business cycle models, one of which

is the IS-LM (Investment Saving-Liquidity Money)

business cycle model. The IS-LM business cycle

model is a system of differential equations involving

the investment function (I), the saving function (S),

and the money demand function (L) (Dwiningtias &

Abadi, 2014).

The IS-LM business cycle model is a business

cycle model that is represented in the form of a system

of differential equations (Dwiningtias & Abadi,

2014). The method used in solving differential

equation can be obtained by analytical or numerical

method. However, the weakness of the analytical

method is that not all mathematical equations can be

solved to produce the exact value and the method

takes a very long time in the process of work

(Alfaruqi, 2010). Therefore, numerical methods are

needed as alternative to analytical methods. The

numerical methods in question include Taylor series

method, Euler method, Runge-Kutta method, and

Heun method. Meanwhile, methods that include

many steps are Adam-Bashforth-Moulton method,

Milne-Simpson method, and Hamming method.

Among these methods, researchers are more

interested in using the fifth order Runge-Kutta

method and the Extended Runge-Kutta Method to

look at the behavior of dependent variables that affect

the business cycle model. The advantage of the

Runge-Kutta method is that it does not use derivatives

in its process (Muhammad, 2015). In addition, the

240

Musyaffafi, U., Hafiyusholeh, M., Farida, Y., Fanani, A. and Arifin, A.

Stability Analysis of Cycle Business Investment Saving-Liquidity Money (IS-LM) Model using Runge-Kutta Fifth Order and Extended Runge-Kutta Method.

DOI: 10.5220/0008905400002481

In Proceedings of the Built Environment, Science and Technology International Conference (BEST ICON 2018), pages 240-246

ISBN: 978-989-758-414-5

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

higher the order is used, the greater the level of

accuracy produced.

This research is interesting because the IS-LM

cycle model will be stability analysis of the model and

model simulation is performed to show the behavior

of variables affecting IS-LM business cycle model in

graphic form. In addition, a comparison of the fifth

order Runge-Kutta method and the Extended Runge-

Kutta Method will be used to simulate the model that

has been obtained with the stability speed of the

model.

This research will be stability analysis of IS-LM

business cycle model with variable of income rate,

rate of interest, and capital stock rate. This model is a

modified model of the business cycle model of

Gabisch and Lorenz (1987) by substituting

investment, saving, and money demand functions.

Model stability analysis was performed by

determining fixed point which then performed fixed

point stability analysis with Routh-Hurwitz criteria

followed by determining stability time through

Runge-Kutta method of order five and Extended

Runge-Kutta.

2 THEORITICAL FRAMEWORK

2.1 Business Cycle Model

The IS-LM model is one of the models in the field of

macroeconomics. The IS-LM business cycle model

involves investment (saving) function, saving

function on goods market and Liquidity preference,

and Money supply in money market (Rosmely, et al.,

2016).

The business cycle model was first introduced by

Kalecki (1935) and Kaldor (1940) in the form of a

system of differential equations, ie.:

,

,

,

(1)

with

is the rate of income,

is the rate of capital

stock,

,

is an investment function that

relies on income and capital stock,

,

is a

saving function that depends on income and capital

stock, and 0 is the acceleration due to the excess

or lack of investment.

In 1977, Torre changed the model (1) by

replacing the capital stock (K) variable with the

interest rate variable (R). The business cycle is

modelled as follows:

,

,

,

(2)

with

is the interest rate,

,

is a money

demand function that depends on income and interest

rates, 0 is the acceleration caused by the lack or

excess demand for money, and 0 is the constant

supply of money.

Then in 1987, Gabisch and Lorenz added capital

stock variables (K) into the business cycle model (2),

so that it becomes a business cycle model

,

,

,

,

(3)

,

,

with 0 is the capital depreciation constant.

2.2 Function I,S, and L

In 2005, Cai provided assumptions on the investment

function (I),saving function (S) and money demand

functions (L). The amount of investment (I) islinearly

dependent on the difference between income (Y)

subtracted by capital stock (K) and interest rate (R).

Meanwhile, the saving function (S) depends on the

sum of income (Y) with interest rate (R). Money

demand functions (L) depends on the difference

between income (Y) and interest rate (R). All three

functions can be denoted as follows:

,,

,

(4)

,

Annotation,

growth rate of investment to income,

the rate of decline in investment on capital stock,

growth rate of savings to income,

the growth rate of money demand for income,

the rate of decline in investment on interest

rates,

the growth rate of savings on interest rates,

the rate of decline in demand for money against

interest rates,

where ,

,

,

,

,

,

are positive constants in

the interval

0,1

.

2.3 Matrix Jacobi

In searching for stability analysis, it is necessary to

have a characteristic equation on differential

equations constructed from a Jacobi matrix.

Stability Analysis of Cycle Business Investment Saving-Liquidity Money (IS-LM) Model using Runge-Kutta Fifth Order and Extended

Runge-Kutta Method

241

Given functionality

,

,

,…,

in

system with

∈,1,2,…,.

⋯

⋮⋱⋮

⋯

6

Matrix above is called the Jacobian matrix of at

point (Hale & Kocak, 1991).

2.4 Eigen Value

If is a matrix x , then a nonzero vector in

called the eigenvector of

if is a scalar multiple

of

, i.e.

(7)

For any scalar

, scalar is called the eigenvalue

of

, and is called the eigenvector of which is

related

(Rosmely, Nugrahani, & Sianturi, 2016).

To obtain the eigenvalues of a matrix

,

equation (7) can be rewritten as

or equivalent to

0 (8)

So can be an eigenvalue. There must be a non

zero solution of the equation (8). Equation (8) has a

non zero solution if and only if

0 (9)

Equation (9) is called characteristic equation of

matrix . Scalars keeping the equation (9) are

eigenvalues

(Anton, 2008).

2.5 Routh-Hurwitz Criteria

One of the methods that can be used in determining

fixed point stability is the Routh-Hurwitz stability

criterion, which is a criterion for showing stability by

not seeing the real sign of the eigen value directly but

by looking at the coefficients of the characteristic

equation. The Routh-Hurwitz Stability Criteria is

expressed in Theorem 1 below:

Theorem 1. Example

,

,…,

real numbers

0 if . All values of the characteristic

equation

⋯

0

And Hurwitz matrix as follows:

1

…0

…0

0

01

…0

…0

⋮⋮⋮

⋮⋱⋮

…

Then the eigenvalue of the equation

(9) will have

a negative real part if and only if the determinant of

the matrix

is positive:

0 for all 1,2,…,

According to Routh-Hurwitz criteria, the above

theorem for value 2,3,4, , the fixed point will be

stable if and only if:

2;

0,

0

3;

0,

0,

,

4;

0,

0,

0,

2.6 Runge-Kutta Method of the Fifth

Order

The Runge-Kutta method is a development of the

Euler method with the completion calculation

performed step by step (Alfaruqi, 2010). This method

is an alternative to the Taylor series method that does

not require derivative calculations (Iffatul, 2016).

However, not all functions can be easily counted. The

higher the order in the Taylor series is, the higher the

derivative should be calculated and it makes the

Taylor series rarely used in the solution of ordinary

high-order differential problems (Alfaruqi, 2010).

The fifth order Runge-Kutta method can be written as

follows:

4

(10)

with:

,

1

3

,

1

3

1

3

,

1

6

1

6

1

2

,

1

8

3

8

,

1

2

3

2

2

2.7 Extended Runge-Kutta Method

The Extended Runge-Kutta method is an extension of

the Runge-Kutta method on the main function and its

evaluation function (Muhammad, 2015). In general,

the Extended Runge-Kutta equation model can be

written as follows:

∑

(11)

with,

,

′

,

BEST ICON 2018 - Built Environment, Science and Technology International Conference 2018

242

Equation (11) is a major function of the general

equation of Extended Runge-Kutta model. So that

equation of Extended Runge-Kutta fourth order is can

be obtained as follows:

(12)

with,

,

,

,

,

′

,

′

,

′

,

′

,

3 METHODOLOGY

3.1 Type of Research

This research is a quantitative research because this

research used quantitative data so that data analysis

used quantitative analysis.

3.2 Variable of Research

In this research, variables consist of independent

variables and dependent variables. The independent

variables used are the acceleration due to

excess/shortage of investment stock, the constant of

money supply, the acceleration due to

excess/shortage of money demand, the constant of

capital depreciation, the rate of investment growth on

capital stock, the level of investment to income, the

growth rate of savings to income, money to earnings,

decreased demand for money on interest rates,

reduced rates of investment on interest rates, and

growth rates on savings on interest rates.

Meanwhile, the dependent variables used are the

national income rate, the rate of interest rate, and the

rate of capital stock. The variables used in this

research are secondary data obtained from Bank

Indonesia in 2016.

3.3 Method of Research Analyze

The process of analysis in this research is divided into

two, namely:

a. Analysis of fixed point stability of IS-LM model

The algorithm for performing fixed point

stability analysis of IS-LM model as follows:

1. Determining the IS-LM model used by

substituting the Gabisch-Lorenz IS-LM

model into the investment, saving, and

money demand functions of Cai. (Equation

(4)).

2. Determining the fixed point of the IS-LM

model using the method of elimination and

substitution to obtain the point

∗

,

∗

, and

∗

.

3. Determining Jacobi's matrix in Equation (6).

4. Determining characteristic equation that

fullfills det

0.

5. Determining the stability of fixed points

through Routh-Hurwitz criteria

b. Numerical simulation of the IS-LM model

1. Variable declarations used in the IS-LM

business cycle model

(,

,

,

,

,

,

).

2. Determining a numerical solution using

the fifth-order Runge-Kutta method

3. Determining the stability time of each

method

4. Determining the best method of both

methods according to the fixed point

stability time velocity.

4 ANALYSIS AND DISUSSION

4.1 Model Stability Analysis

The business cycle model used in this research was a

model introduced by Gabisch and Lorenz (1987) by

substituting the investment, saving, and capital stock

functions of equation (4) into equation (3) with the

parameters given by Cai ( 2005), namely:

(13)

with ,

,

,

,

,

,

are positive constants in

the interval

0,1

.

The fixed point in the equation (13) can be

obtained if it fulfills

0.

so it obtains

0 (14)

0 (15)

0 (16)

Next is to find fixed point

∗

,

∗

,

∗

by using

elimination and substitution on each equation.

Stability Analysis of Cycle Business Investment Saving-Liquidity Money (IS-LM) Model using Runge-Kutta Fifth Order and Extended

Runge-Kutta Method

243

Thus, fixed point model, that is

∗

,

∗

,

∗

,

was obtained where:

∗

∗

(17)

∗

The stability of the fixed point is obtained by

looking at the eigenvalues of the characteristic

equations derived from the model by searching

(0, so we can get the characteristic

equation

0 (18)

when

Because the eigenvalues of the equations (18) was

difficult to determine, the stability of the fixed point

can be investigated using the Routh-Hurwitz

criterion. According to Routh-Hurwitz criteria, the

eigenvalues of the equation (18) will make a fixed

point

∗

,

∗

,

∗

(4.12) stable if and only if

0,0,and 0.

4.2 Numerical Simulation using

Runge-Kutta Method of the Fifth

Order

In this section, a numerical simulation of the IS-LM

business cycle model will be conducted to find the

stability time of the model using the Runge-Kutta

method of order five.

The initial value used in the simulation was data

from Bank Indonesia in 2016 in the form of income

rate 5, rate of interest 9.18, and

capital stock rate 4.47 [9]. The parameters

used in the simulation of this business cycle model

are presented in Table 1.

Based on these parameters and by taking into

account the data in Table 1, it was obtained a fixed

point

∗

,

∗

,

∗

0.0979,0.0097,0.0351.

Before performing numerical simulations, a fixed

point stability simulation was performed by

substituting the parameters in Table 1 into equations

(18). It will be shown that the parameter meets Routh-

Hurwitz criteria such that the point remains stable.

Table 1: Value of business cycle parameters.

Symbol Parameter Definition Value

The growth rate of investment to

income

0.5

The rate of decline in investment on

capital stock

0.7

Constant depreciation of capital

0.5

Saving growth rate against income

0.1

The growth rate of money demand fo

r

income

0.6

The rate of decline in investment on

interest rates

0.7

The rate of saving growth against

interest rates

0.8

The rate of decline in money demand

on interest rates

0.9

Constant money supply

0.05

Acceleration due to the excess or lac

k

of investment

1

Acceleration due to the excess or lac

k

of money demand

4

According to Routh-Hurwitz criteria, the point

remains stable if and only if 0,0, and

0. The simulation results based on these criteria

can be seen in Table 2.

Table 2: Eigen Value of Characteristic Equations.

4.4000

6.3500

2.6760

25.2640

Based on the table above, it can be seen that the

eigenvalue of the characteristic equation in equation (18)

satisfied the Routh-Hurwitz criterion 4.4000

0,2.67600, and 25.26400 so

the fixed point of the model was stable.

The next was to develop numerical simulation

with the Runge-Kutta method of order five with the

help of MATLAB R2013 software by substituting the

parameters in Table 1 into Eq. (13) to obtain the graph

in Figure.1.

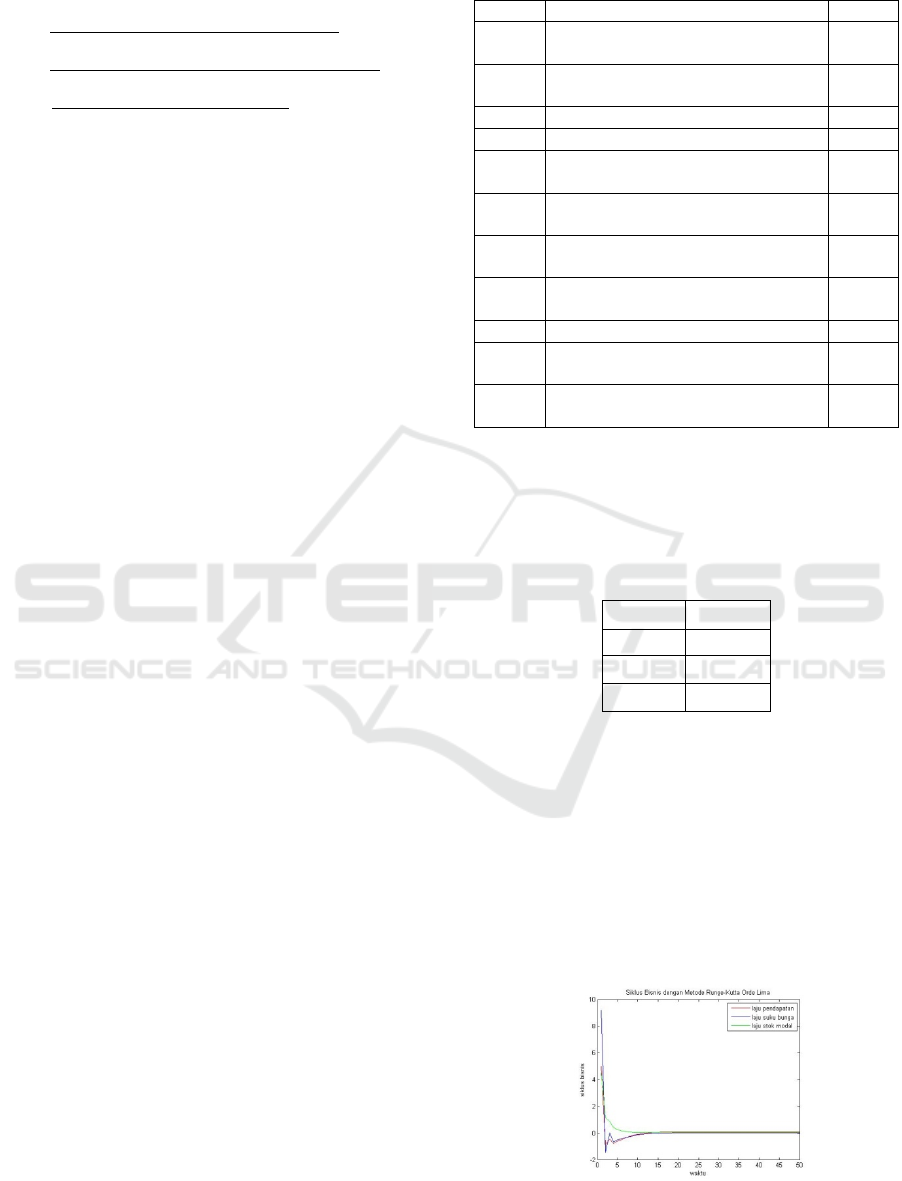

Figure 1: Numerical simulation by Runge-Kutta method of

the fifth order.

BEST ICON 2018 - Built Environment, Science and Technology International Conference 2018

244

The business cycle will experience different

fluctuations and then move constantly to a fixed point

so as to obtain a stable point. Figure 1 shows business

cycle stability around the point. Figure 1 shows

business cycle stability around the point 36 with

value 0.0979,0.0097, and 0.0351.

Therefore, according to Routh-Hurwitz criteria, this

business cycle is stable.

4.3 Numerical Simulation with

Extended Runge-Kutta Method

The initial value used in this simulation was the same

as the previous simulation of the income rate

5, rate of interest 9.18, and capital stock rate

4.47. The resulting numerical simulation is

as follows.

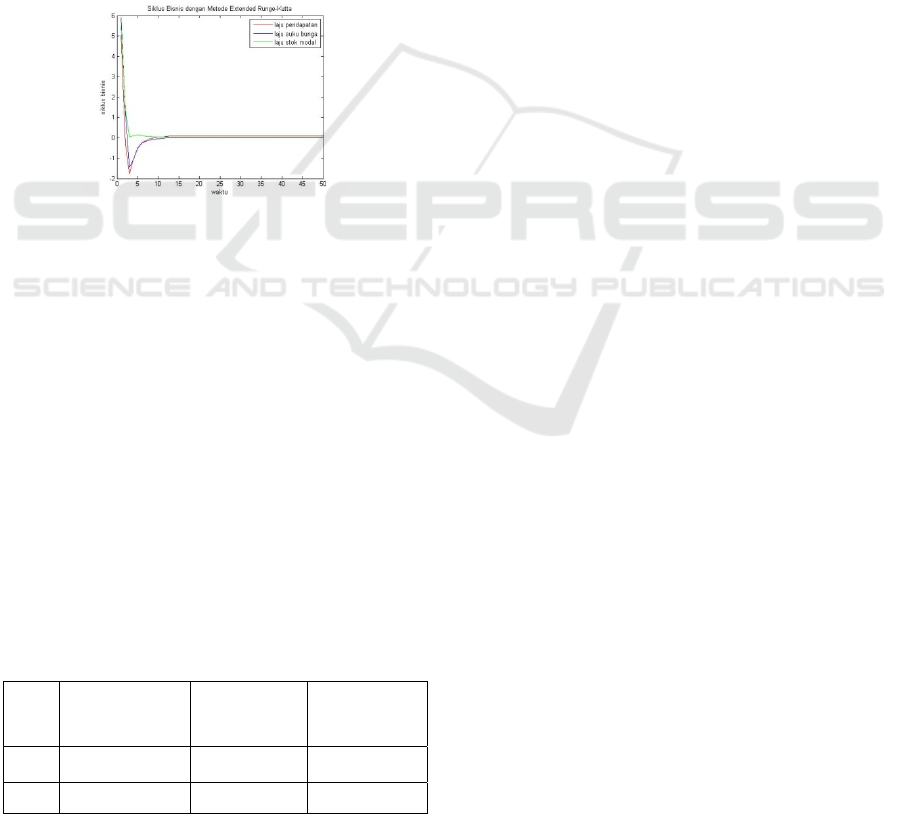

Figure 2: Numerical simulation with Extended Runge-

Kutta method.

Based on Figure 2,. the business cycle model with

the Extended Runge-Kutta method has similar pattern

and behavior that decrease (recess) and then move

constantly to a stable point. In Figure 2, the business

cycle has stability around the point 25 with value

0.0979,0.0097, and 0.0351.

Therefore, according to Routh-Hurwitz criteria, this

business cycle is stable.

4.4 Comparison Method

In this research, the comparison of the two methods

was developed by comparing the stability time of

each method and computation time to obtain a stable

point.

Table 3: Comparison Method.

Income Rate

(0.0979)

Rate of

Interest (

0.0097)

Capital Stock

Rate (

0.0351)

RK5

36 35 32

ERK

25 25 24

Based on Table 3, we can shows the stability time

of each method. The stability time resulting from the

Runge-Kutta method of order five was the rate of

income that was stable at 36, rate of interest that

had stable moment 35, and the capital stock rate

that was stable at the moment 32. Meanwhile, the

stability time generated by the Extended Runge-Kutta

method was the income rate that was stable at the

moment 25, rate of interest that was stable at the

moment 25, and the capital stock rate that was

stable at the moment 24.

Based on the Runge-Kutta method, the fifth order

business cycle model will experience stability in the

next 36 years, or in 2052, and with the Extended

Runge-Kutta method, stability of the next 25 years

will be in the year 2041. Both will be stable at the

point

∗

,

∗

,

∗

0.0979,0.0097,0.0351

.

Therefore, the Extended Runge-Kutta method has

a faster stability time than the Runge-Kutta method.

This is because the main function of the Extended

Runge-Kutta is added with the derivative function.

So, the results obtained by the Extended Runge-Kutta

method are faster to be stable than the fifth order

Runge-Kutta method.

5 CONCLUSIONS

Based on the formulation of the problem and the

results of the discussion, the following conclusions

can be obtained:

1. In the IS-LM business cycle model, we get a

stability model of equilibrium point

∗

,

∗

,

∗

0.0979,0.0097,0.0351. Model

of business cycle stability can be shown by the

value of the equation of characteristics obtained

from the model, that is

0

with

By substituting the parameter values, it was

obtained 4.40000,2.67600, and

25.26400 which meets the Routh-

Stability Analysis of Cycle Business Investment Saving-Liquidity Money (IS-LM) Model using Runge-Kutta Fifth Order and Extended

Runge-Kutta Method

245

Hurwitz criteria so that the IS-LM business cycle

model is stable.

2. The numerical solution using the Runge-Kutta

method of order five obtained the time stability of

the IS-LM business cycle model by substituting

the parameters when 36.

3. Numerical solution using Extended Runge-Kutta

method obtained the time stability of the IS-LM

business cycle model by substituting the

parameters when 25.

4. In determining the stability of the IS-LM model,

the Extended Runge-Kutta method has a faster

stability time with 36 than the current fifth

order Runge-Kutta method with 25. This

happens because the Extended Runge-Kutta

method adds the derivation function to the main

function so that the stability point gets faster.

REFERENCES

Alfaruqi, 2010. Penyelesaian Persamaan Diferensial Biasa.

Pens Its, Pp. 65-75.

Angriani, D., 2018. metroTVnews.com. [Online] Available

at: http://ekonomi.metrotvnews.com [Accessed 1 2

2018].

Anonim, n.d. https://kbbi.kata.web.id/pertumbuhan-

ekonomi/. [Online] [Accessed 28 03 2018].

Anton, H., 2008. Aljabar Linier Elementer. Jakarta:

Erlangga.

Cai, J., 2005. Hopf bifurcation in the IS-LM business cycle

model with time delay.. Electronic Journal of

Differential Equations., pp. 1-6.

Chapra & Canale, 1990. Numerical methods for engineers.

New York: McGraw-Hill Book Co..

Dernburg, T. F. & Muchtar, K., 1987. Makroekonomi edisi

ketujuh. Jakarta: Erlangga.

Dornbusch, Rudiger & Fisher, 2016. Ekonomi makro.

s.l.:s.n.

Dwiningtias & Abadi, 2014. Model siklus bisnis dengan

waktu tundaan. MATHunesa.

Gabisch, G. & Lorenz, H.-W., 1989. Business Cycle

Theory A Survey of Methods and Concepts. Springer.

Hale, J. K. & Kocak, H., 1991. Dynamic and Bifurcation.

Springer-verlag.

Iffatul, 2016. gunadarma.ac.id. [Online] Available at:

iffatul.staff.gunadarma.ac.id/.../BAb-

+08+Solusi+Persamaan+Diferensial+Biasa.pdf

[Accessed 21 Januari 2018].

Indonesia, B., 2017. Laporan Perekonomian Indonesia.

Jogiyanto, H., 2006. Metodologi Penelitian Bisnis. BPFE

UGM.

Kaddar, A. & Alaoui, H. T., 2008. Fluctuation in a Mixed

IS-LM Business Cycle Model. Electronic Journal of

Differential Equations, pp. 1-9.

Kaldor, N., 1940. A Model of the Trade Cycle. JSTOR, pp.

78-92.

Kalecki, M., 1935. A Macrodynamic Theory of Business

Cycles. JSTOR, pp. 327-344.

Lestari, E. P., 2011. Intensitas Perdagangan dan

Keselarasan Siklus Bisnis di ASEAN-4 dan UNI-

EROPA. Jurnal Ekonomi Pembangunan, pp. 163-186.

Luenberger, D., 1979. Introduction to Dynamic Systems.

New York: Wiley.

Mankiw, G., Quah, E. & Wilson, P., 2012. Pengantar

ekonomi makro. Jakarta: Salemba Empat.

Mardiana, A., 2014. Uang dalam ekonomi islam. Al-

Buhuts, Volume 10, p. 91.

Muhammad, S. T., 2015. Pengkajian metode extended

runge kutta dan penerapannya pada persamaan

diferensial biasa. JURNAL SAINS DAN SENI ITS, pp.

Vol. 4, No.2, (2015) 2337-3520.

MZI, 2015. Telkom University. [Online] Available at:

http://cdndata.telkomuniversity.ac.id [Accessed 2 Mei

2018].

Pasaribu, R. B. F., 2009. Fluktuasi Ekonomi Dan Siklus

Ekonomi. Universitas Gunadarma, pp. 1-61.

Reksoprayitno, S., 2012. Pengantar Ekonomi Makro.

Yogyakarta: BPFE-Yogyakarta.

RI, K., 2015. Qur'an Kemenag, Jakarta: Kementrian

Agama.

Rosmely, Nugrahani, E. H. & Sianturi, P., 2016. Analisis

Bifurkasi Pada Model Siklus Bisnis Is-Lm (Investment

Saving-Liquidity Money). IPB Repository.

Samuelson, P. A. & Nordhaus, W. D., 1997.

Makroekonomi. Jakarta: Erlangga.

Sugianti, D., 2017. Analisis Model Matematika Order

Fraksional Makroekonomi Investment Saving-Liuidity

Money (IS-LM) di Indonesia. Airlangga.

Suparmoko, 2000. Keuangan Negara. BPFE.

Supriyono & Miyoshi, T., 2014. Perbandingan algoritma

metode MECD dan metode runge-kutta untuk

menyelesaikan persamaan diferensial berderajat dua

yang bersistem besar. pp. 149-158.

Torre, V., 1977. Existence of limit cycles and control in

complete Keynesian. JSTOR, pp. 1457-1466.

Umar, M., 2009. Analisis Dampak Kebijakan Fiskal dan

Moneter dalam Perekonomian Indonesia: Aplikasi

Model Mundell-Fleming. Diponegoro.

BEST ICON 2018 - Built Environment, Science and Technology International Conference 2018

246