Possible Method for Monthly Natural Rubber Price Forecasting

Ketut Sukiyono

1*

, Nusril

1

, Eko Sumartono

1

, Indra Cahyadinata

1

, M. Zulkarnain Yuliarso

1

, Gita

Mulyasari

1

, Musriyadi Nabiu

1

, Febrina Nur Annisa

2

1

Department of Agricultural Socio-Economics, Faculty of Agriculture, University of Bengkulu

2

Study Program of Magister of Agribusiness Management Faculty of Agriculture, University of Bengkulu

Keywords : Rubber, Double Exponential Smoothing, Decomposition, ARIMA, forecasting.

Abstract : Future price information is crucial not only for producers but also for other agribusiness actors. Price is a

signal for them to make a decision regarding what to produce and when to sell including for natural rubber.

For this reason, forecasting and selecting the best model becomes important. This study is aimed to

analyze and select the possible forecasting methods for monthly natural rubber prices in Indonesia and

World Markets. The univariate model of Double Exponential Smoothing, Decomposition, and ARIMA

models are applied to forecast price data from 2012:1 – 2016:12. The selection of an accurate model is

based on the lowest value of MAPE, MSD, and MAD. ARIMA is the possible methods for world rubber

price forecasting while Double Exponential Smoothing should be applied for predicting domestic rubber

prices because it allows for better predictive performance.

1 INTRODUCTION

Price is often used as a signal for producers to

produce and or sell a commodity. Ribeiro, Sosnoski,

and Oliveira (2010) stated that decision making

requires information on how prices behave before

the harvest is done. In addition, price fluctuations

make agriculture a risky business as reported by

Grega (2002) and Fafchamps (2000). Price is also

often a determinant of the level of competitiveness

of a product. Therefore, price determination will be

able to assure the sustainability of farm business

including rubber farming. Price uncertainty also

causes difficulties in designing policies related to

improving the welfare of farmers. Price uncertainty

and price volatility also make farmers more

vulnerable (FAO et al., 2011 and Sukiyono, et al.,

2017) in the case of oil palm farmers). With these

environmental conditions, price information in the

future will be very important. Future pricing

information requires accurate price forecasting. Any

error in the prediction of price can cause a huge

amount of revenue loss. This implies the importance

of selecting the most probable forecasting model.

Several analytical methods for forecasting are able

to apply. Pandey and Upadhyay (2016) classify

these forecasting methods into two categories: time

series and simulation approach. Kirchgassner and

Wolters (2007) and Pandey and Upadhyay (2016)

state that a time series is defined as a set of

numerical observations arranged in sequenced order

or an even time interval. These data are historical

data from market prices and collected at an equally

spaced and discrete time interval. On the other hand,

the simulation approach requires and generates a

large amount of data and computationally intensive.

This current paper applies a time series approach

and is aimed at selecting a possible method for

forecasting rubber price at world and domestic

(Indonesia) markets.

Among time series forecasting models, three

models are commonly used, that is, exponential

smoothing, decomposition, and ARIMA.

Exponential Smoothing method is designed based on

a simple statistical model and does not use any

variable other than the variable being forecast.

Robert and Amir (2009) note that the exponential

smoothing model has advanced significantly in the

last few decades and established as one of the

forecasting methods. Sudha et al., (2013) and Rani

and Raza (2012) are among researchers using

exponential smoothing models to forecast

agricultural product and price. Another time series

forecasting model is a decomposition approach.

This approach involving additive and multiplicative

decomposition separates trend and seasonal

172

Sukiyono, K., Nusril, ., Sumartono, E., Cahyadinata, I., Yuliarso, M., Mulyasari, G., Nabiu, M. and Annisa, F.

Possible Method for Monthly Natural Rubber Price Forecasting.

DOI: 10.5220/0008785301720179

In Proceedings of the 2nd International Research Conference on Economics and Business (IRCEB 2018), pages 172-179

ISBN: 978-989-758-428-2

Copyright

c

2020 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

component from time series and computes the

prediction whether by multiplying or adding to

seasonal indices Saini, Saxena, and Surana (2017).

This model has applied for various agricultural

products, among others are Taru and Mshelia (2009)

and Bergmann, O’Connor and Thümmel (2015). A

comprehensive discussion on decomposition method

is given by Dogum (2010) and Prema and Rao

(2015). Finally, an Auto-Regressive Integrated

Moving Average (ARIMA) model, introduced by

Box and Jenkins (1976), is a technique for finding

the most suitable pattern from a group of time series

data, by utilizing past and present data to perform

accurate forecasting. Weiss (2000) defines that

ARIMA is a linear function of the previous actual

values and random shocks. This model is also

widely used in various agricultural products prices,

such as chicken, pork, cabbage and other major

agricultural prices (Hu Tao (2005) and Feng Liu et

al. (2009)).

Each forecasting method discussed above also

shows the advantages and disadvantages of each

method. The problem is what the most accurate

forecasting model for forecasting rubber prices in

both the world market and the domestic market is.

The selection of forecasting models so far has

tended to use subjectivity considerations. There is no

explanation from researchers regarding the selection

and application of certain forecasting models for

their research. Some researchers have tried to choose

the best forecasting model using several models,

including Sukiyono and Rosdiana (2018) on the

price of rice at the wholesale level. From some of

these studies, each different commodity and

observation period has the best different model. That

is, the forecasting model for commodities will not

necessarily be appropriate or accurate for other

commodities. Therefore, this study tries to determine

the best model by comparing the accuracy of

forecasting from the three models that are widely

used so far, namely double exponential smoothing,

decomposition, and ARIMA.

2 METHODS

This research used monthly data on rubber prices at

domestic and world markets from 2012:1 – 2016:12

or 72 observations. Three-time series forecasting

models are proposed namely, double exponential

smoothing, additive and multiplicative

decomposition, and ARIMA. These methods are

explained in brief as follows:

2.1 Double Exponential Smoothing

Exponential Smoothing Model is a continuous

improvement procedure for forecasting against the

latest observational objects to produce a smoothed

time series (Kumar and Gwada, (2015) and Jatra

(2013)). This model focuses on exponentially

decreasing weights as the observation get older. In

other words, recent observations are given relatively

more weight in forecasting than the previous

observations.

This study applies double exponential

smoothing, also known as trend adjusted exponential

smoothing. This model departs from improving a

single exponential smoothing model by introducing

the second equation with a second smoothing

constant or second weight (α

2

) and assuming

monthly rubber price is influenced by the trend

component. Kumar and Gwada, (2015) stated that

introduction and selection of (α

2

) having to consider

(α

1

). The double exponential model can be written

as follows:

1111

1

tttt

bSXS

(1) and

1212

1

tttt

bSSb

(2)

where,

t

S

= smoothened value at time period t;

1

t

S

= smoothened value at time period t – 1; α

1

=

level smoothing constant;

1

X

= actual price at time

period t;

t

b

= trend estimate of the time period

t;

1

t

b

= trend estimate of the period t-1; and α

2

=

trend smoothing constant.

2.2 Decomposition Method

Decomposition methods are based on an analysis of

the individual components of a time series, i.e.,

trend, seasonality, cycle, and error. In this

approach, each component strength is estimated

separately and then substituted into a model that

explains the behavior of the time series. There are

two decomposition methods: multiplicative and

additive (Peng and Chu, (2009) and (Rajchakit,

2017). An additive decomposition model takes the

following form:

ttttt

eS

C

TY

(3)

while a multiplicative decomposition model can be

written as:

ttttt

eS

C

TY

, (4)

where

t

Y

, the actual time series value at period t, is

a function of four components: seasonal (S),

Possible Method for Monthly Natural Rubber Price Forecasting

173

cyclical (C), the trend (T) and an error component

(e).

2.3 Arima

In applying an ARIMA model, this research follows

Box-Jenkins methodology which involves four

steps, namely identification, estimation, model

checking, and forecasting. Dieng (2008) explains

that the Box-Jenkins forecasting approach involves

an interactive process between the forecaster and the

data in terms of using diagnostic statistics to select

the appropriate models. This approach also requires

fewer data and has generally proved successful in

practice. In general, according to Ekananda (2014),

an ARIMA model is characterized by the notation

ARIMA (p, d, q), where p, d, and q denote orders of

Auto-Regression (AR), Integration (differencing)

and Moving Average (MA), respectively. ARIMA is

a parsimonious approach which can represent both

stationary and non-stationary processes. Box and

Jenkins (1976), an economic variable, Y, has a

generating function which belongs to ARIMA (p, d,

q) model is given by:

qtq1t1tptp1t11t1t

Y

Y

Y

Y

(5)

where t = 1, 2, 3 ... T

t

is an uncorrelated process

with mean zero,

i

and

i

are coefficients (to be

determined by fitting the model)

2.4 Forecasting Accuracy Measures

Three accuracy measures were calculated: Mean

Absolute Percentage Error (MAPE), Mean Absolute

Deviation (MAD), and Mean Squared Deviation

(MSD). MAPE is a percentage point error while

MAD and MSD are scale-dependent measures.

Karim, Awala and Akhter (2010) noted that the

smaller measurement values show more accurate

forecasts since it produces minimum forecasting

error. It should be noted that there was no shock

variable at the period of study. It means that there is

no unexpected change in a variable under analysis.

3 RESULTS AND DISCUSSION

3.1 Indonesian Rubber Profile

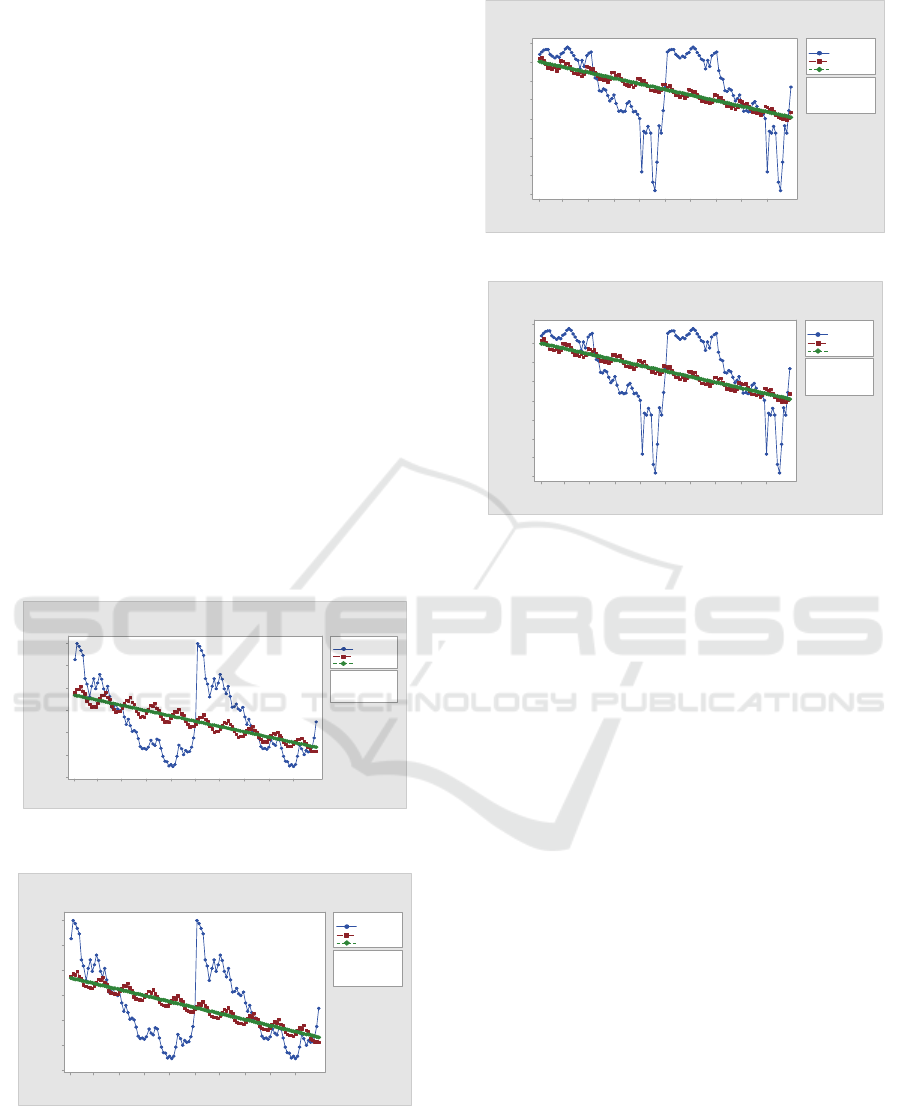

Figure 1: Domestic Rubber Price (Indonesia) and

World (Singapore).

Indonesian Rubber Production in 2015 amounted to

34,340 tons and is estimated continues to increase

until 2020 with a production of 40,449 tons (Karet

outlook 2016). In terms of consumption, rubber

consumption in 2020 is projected at 596 tons or

increase over the next five years with an average of

0.85% per year within the period 2016 - 2020. Karet

outlook (2016) also reported that for the next five

years Indonesia is expected to surplus Rubber. If in

2016 Indonesia's rubber surplus amounted to 35,575

tons, this surplus is projected to continue to increase

reaching 39,854 tons in 2020. The high production

of rubber in Indonesia places Indonesia as one of the

producers and exporters of rubber in the world.

Indonesia in 2010 only able to contribute to the

world rubber needs of 2.41 million tons of natural

rubber or second after Thailand which amounted to

3.25 million tons (Purba, 2011). In addition, based

on data from Perkebunan Perkebunan Nusantara, as

reported by (Kompas, 11/09/2017), rubber

production in Indonesia is currently recorded at 3.2

million tons per year. Of that amount, which can be

absorbed domestically only 18 percent and the rest

for export purposes. Indonesia's rubber exports are

mostly directed to Vietnam, the Netherlands, the

United States, and India.

Relation to the development of rubber prices,

domestic and world price data presented in Figure 1

show a reasonably fluctuating movement. Recorded

by Kompas, in 2011, the average price of rubber

reached 5.58 US dollars per kilogram (kg), whereas

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

174

in 2017 the average is only 1.2 US dollars per kg in

the world market.

Figure 1 is not intended to compare the price

level at two markets due to different unit price, but it

is rather than to show the behavior pattern or

tendency of rubber price. Figure 1 shows that world

rubber prices and domestic rubber prices have likely

similar patterns. The price of rubber in both markets

tends to fall from the beginning of 2012 to the end of

2015 and started to increase in 2016. However, the

downward rubber price trend in the Singapore

market is sharper than in the domestic market.

Statistical summary of rubber price in domestic

and world markets is presented in Table 1. Table 1

shows that rubber prices in the domestic market in

the period January 2012 - 2016 moved from Rp

4,594.00/kg to Rp 8,408.00/kg with an average price

of Rp 7,288.42/kg and Standard Deviation of

967.81. While in the world market, prices move

from the US $ 1,230.00/ton to the US $ 4,000.00/ton

with an average price of US $ 2,260.00/ton.

Table 1: Statistical summary of Domestic and World

Rubber Price.

Level Mean St.

Dev.

Max Min

Domestic

Price

(Rp./Kg)

7,288,42

967.81

8,408.00

4,594.00

World

Price

(US$/To

n)

2,260.00

773.40

4,000.00

1,230.00

3.2 Model Forecasting Estimation

As discussed above, this article uses three

forecasting models, namely exponential smoothing,

ARIMA, and decomposition. The choice of the best

model is used by three indicators of the accuracy of

MAPE, MAD, and MSD where the model that has

the lowest MAPE, MAD, and MSD values shows

the most accurate forecasting method

3.3 Double Exponential Smoothing

This double exponential smoothing method uses two

smoothing coefficients namely α

1

(smoothing

constant) and α

2

(smoothing trend). This smoothing

coefficient is determined by trial and error to

produce the smallest error value (Stevenson, 2009).

An indicator used to select the values of α and β is

the Root Mean Square Error (RMSE), the best

values of α and β are indicated by the smallest

RMSE values. The results of forecasting rubber

prices are presented in Figures 2 and 3, and Table 2.

For world rubber prices, the best values for α

1

and α

2

are 1.31913 and 0.02533 while for domestic

rubber prices, the best values are 1.07791 and

0.02571. Looking at these values, both show almost

the same value. This shows the similarity of data

patterns between the two markets (see Figure 2).

Table 2: Forecasting results using Double Exponential

Smoothing.

Prices

1

2

Accuracy Measure

MAPE MAD MSD

World Market 1.31913 0.02533 5.9 1.33 29,954.6

Domestic

Market

1.07791 0.02571 3.0 210.00 142,285.0

60544842363024181261

4500

4000

3500

3000

2500

2000

1500

1000

α (level) 1.31913

γ (trend) 0.02533

Smoothing Constants

MAPE 5.9

MAD 133.3

MSD 29954.6

Accuracy Measures

Index

World Price

Actual

Fits

Var iabl e

Smoothing Plot for World Price

Double Exponential Method

60544842363024181261

8000

7000

6000

5000

4000

α (level) 1.07791

γ (trend) 0.02571

Smoothing Constants

MAPE 3

MAD 210

MSD 142285

Accuracy Measures

Index

Domestic Price

Actual

Fits

Variable

Smoothing Plot for Domestic Price

Double Exponential Method

Figure 2: Smoothing Plots for World and Domestic

Price.

Possible Method for Monthly Natural Rubber Price Forecasting

175

3.4 Decomposition Model

The estimated forecasting models for world

rubber prices using decomposition approach are

presented in Figure 3 (a) and (b) for multiplicative

and additive respectively. Examining these figures,

additive and multiplicative methods are likely to

produce the same pattern and results. Both models

also have a similar trend, namely, a downward trend

with a comparable slope. By examining these

results, both methods can be used to estimate the

same level of accuracy. This conclusion is also

supported by identical MAPE and MAD values (see

Table 3). The MAPE values for both decomposition

forecasting models are 26%, and the MAD values

for both models are 540 and 539. This result

concludes that it is multiplicatively more accurate

than the additive in forecasting world rubber prices.

However, looking at the MSD value, multiplicative

has a smaller MSD value than additives. The MSD

value of the multiplicative decomposition model is

433,526 while the additive MSD value is 436,576.

This unconvincing result implies that forecasters can

use additives or multiplicative to forecast world

rubber prices.

10896847260483624121

4000

3500

3000

2500

2000

1500

1000

MAP E 26

MAD 540

MSD 433526

Accuracy Measures

Index

Wor l d Pr i ce

Actual

Fits

Trend

Variabl e

Time Series Decomposition Plot for World Price

Multiplicative Model

(a) Multiplicative Model

10896847260483624121

4000

3500

3000

2500

2000

1500

1000

MAPE 26

MAD 539

MSD 436576

Accuracy Measures

Index

World Price

Actual

Fits

Trend

Variabl e

Time Series Decomposition Plot for World Price

Additive Model

(b) Additive Model

10896847260483624121

8500

8000

7500

7000

6500

6000

5500

5000

4500

MAPE 10

MAD 675

MSD 725984

Accuracy Measures

Index

Domestic Price

Actual

Fits

Trend

Vari able

Time Series Decomposition Plot for Domestic Price

Multiplicative Model

(c) Multiplicative Model

10896847260483624121

8500

8000

7500

7000

6500

6000

5500

5000

4500

MAPE 10

MAD 676

MSD 725270

Accuracy Measures

Index

Domestic Price

Actual

Fits

Trend

Vari able

Time Series Decomposition Plot for Domestic Price

Additive Model

(d) Additive Model

Figure 3: Decomposition Model for domestic and World

Price

The unconvincing results are also indicated by

the multiplicative and additive decomposition

models for domestic rubber prices as presented in

Figure 3 (c) and (d) as well as Table 3. Figure 3(c)

and (d) also show that additive and multiplicative

likely have similar in pattern and accuracy.

Decomposition plots tend to have downward trends

and similar cyclical patterns. Both additive and

multiplicative decomposition seemingly have a

similar slope. These results imply that the two

forecasting models have the same level of

forecasting accuracy. This means that these two

decomposition models will produce nearly similar

results. This conclusion is more convincing when

viewed from the accuracy of measurement

forecasting, namely, MAPE and MAD (Table 3).

MAPE values for both additive and multiplicative

are the same, i.e., 10%. Looking at MAD,

multiplicative has the lower MSD value than

additive, i.e., 675 and 676 for multiplicative and

additive correspondingly. In addition, based on

MSD value, the multiplicative decomposition model

is less accurate than additive since multiplicative has

a higher value than additive. This means that

forecasters are better off applying an additive

decomposition model to estimate future Indonesian

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

176

rubber prices. By examining all accuracy measures

used in this research, forecasters can apply an

additive or multiplicative decomposition model for

predicting domestic rubber prices due to

inconclusive result.

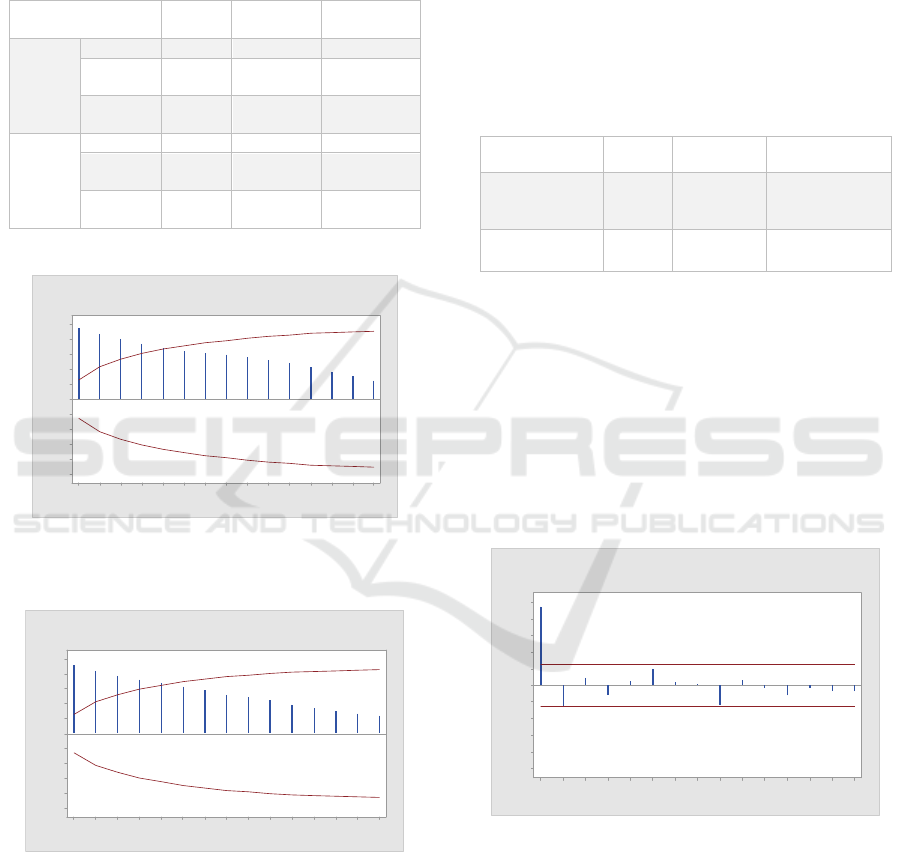

Table 3: Accuracy for Forecasting of World and Domestic

Rubber Prices using Decomposition Model

Decomposition

Type

MAPE

(%)

MAD MSD

World

Prices

Additive 26 539 436,576

Multi-

plicative

26 540 433,526

Conclu-

sion

Incon-

clusive

Additive Multipli-

cative

Domes

tic

Prices

Additive 10 676 725,270

Multi-

plicative

10 675 725,984

Conclu-

sion

Incon-

clusive

Multipli-

cative

Additive

151413121110987654321

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

Lag

Autocorrelation

Autocorrelation Function for World Price

(with 5% significance limits for the autocorrelations)

(a) World Market

151413121110987654321

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

Lag

Autocorrelation

Autocorrelation Function for Domestic Price

(with 5% significance limits for the autocorrelations)

(b) Domestic Markets

Figure 4: Autocorrelation Function (ACF) for World Price

and Domestic Price

3.5 ARIMA

Stationary test Autoregressive Integrated Moving

Average (ARIMA) is used to complete the monthly

price time series for 5 years. The use of time series

cannot be separated from the problems of

autocorrelation and partial autocorrelation

calculations as illustrated in Figures 4 and 5.

ACF and PACF in Figures 4 and 5 show that the

series is not stationary because the ACF chart does

not die down even though in the PACF there is 1 lag

that is cut off. So, the series needs to be

differentiated. This differentiation is performed with

the Augmented Dickey-Fuller (ADF)

Table 4: Unit Root test with Augmented Dickey-Fuller

(ADF)

Data t-statistic Probability Conclusion

W

orld Market

P

rice

1.648 0.45

2

N

ot Stationary *

)

D

omestic

M

arket Price

1.122 0.69

9

N

ot Stationary *

)

*) is corrected by differencing data accordingly.

Because both price data are not stationary, they

are converted to stationary data on the first

differencing. Then, the ARIMA model for domestic

rubber prices is estimated. After comparing all the fit

statistics, the best model is ARIMA (1,1,4) where all

the parameters are significant at their respective

significance levels (Table 5). Similar steps are also

made for world rubber prices and ARIMA (1,1,4) is

the best model.

151413121110987654321

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

Lag

Partial Autocorrelation

Partial Autocorrelation Function for World Price

(with 5% significance limits for the partial autocorrelations)

(a) World Market

Possible Method for Monthly Natural Rubber Price Forecasting

177

151413121110987654321

1.0

0.8

0.6

0.4

0.2

0.0

-0.2

-0.4

-0.6

-0.8

-1.0

Lag

Partial Autocorrelation

Partial Autocorrelation Function for Domestic Price

(with 5% significance limits for the partial autocorrelations)

(b) Domestic Market

Figure 5: Partial Autocorrelation Function (PACF) for

World Price and Domestic Price

Selecting the Possible method for Forecasting

Rubber Prices. Table 6 presents a summary of

accuracy measures for all forecasting models applied

in this research. Among the parametric model used

for world rubber prices, it is very difficult to decide

which is the best forecasting model. If based on

MAPE, ARIMA apparently is the best model with

the lowest value MAPE in which ARIMA generates

5.31 % forecasting error.

However, if based on MAD and MSD, a double

exponential model is the most accurate forecasting

model. This model has the lowest value of MAD

and MSD compared to other models. By following

closely Bowerman et al. (2004); and Hyndman and

Koehler (2006) to use MAPE for reasons of

simplicity, the possible forecasting model for world

rubber price is ARIMA.

Table 6: MAPE, MAD and MSD Value for each

Forecasting Technique

Forecasting

Model

MAPE

(%)

MAD MSD Best

Model

World Price of Rubber

Double

Exponential

Smoothing

5,90 1.33 29,954.6

ARIMA

ARIMA 5,31 14,51 50,630.0

Decompo-

sition

Additive 26 539 436,576.0

Multiplica-

tive

26 540 433,526.0

Domestic Price of Rubber

Double

Exponential

Smoothing

3.000 210 142,285

Double

Exponen-

tial

Smoothing

ARIMA 3.381 27.162 145,695

Decompo-

sition

Additive 10 676 725,270

Multiplica-

tive

10 675 725,984

For domestic rubber prices, the best forecasting

model is the Double Exponential Smoothing Model.

This conclusion is based on two accuracy measures

used in this paper, namely, MAPE and MSD.

Double Exponential Smoothing model has the

lowest MAPE and MSD value compared to other

models even though this model has a higher value of

MAD compared to ARIMA and Decomposition

models. In order words, forecasters are better to

apply double exponential smoothing model to

predict domestic rubber prices in the future.

4 CONCLUSION

The main purpose of this article is to select the right

model and forecasting model for predicting future

rubber prices, both in the domestic market and the

world market. Three types of forecasting methods

were used for this study, i.e., Double Exponential

Smoothing Method, Classical Decomposition

Method and ARIMA. Forecasting method will be

selected with minimum estimated error, that is

minimum value MAPE, MAD, and also MSD.

Although some decisions are not always unanimous,

it is found that ARIMA and Double Exponential

Smoothing models provide the most accurate

prediction of rubber prices with most accuracy

measures.

This finding also implies that depends only on

one forecasting method usually cannot produce a

reliable result. It is better to apply some

methodologies. The methods successfully used in

such commodities, like the regression analysis and

smoothing techniques, are difficult to apply for other

commodities. Such situations also give a great

opportunity for other methods in which the role of

human judgment and experience are higher. The

result of the forecast also depends on the quality of

the applied data.

REFERENCES

Bowerman, B. L., O’Connell, R. T., and Koehler, A. B.

(2004). Forecasting, time series, and regression: An

applied approach. Belmont, CA7 Thomson

Brooks/Cole.

Box, G. E. P., and Jenkins, G. M., (1976). Time Series

Analysis, revised edition, San Francisco: Holden-Day,

1976

Dennis Bergmann, Declan O’Connor, Andreas Thümmel,

(2015) Seasonal and cyclical behaviour of farm gate

IRCEB 2018 - 2nd INTERNATIONAL RESEARCH CONFERENCE ON ECONOMICS AND BUSINESS 2018

178

milk prices, British Food Journal, 117(12): pp.2899-

2913, https://doi.org/10.1108/BFJ-08-2014-0294

Dieng, Dr. Alioune. (2008). Alternative Forecasting

Techniques for Vegetable Prices in Senegal. Reveu

Senegalaise de Recherches agricoles et

agroclimentaires. 1(3): pp. 5 -10. Retrieved from

www.bameinfopol.info/IMG/pdf/Dieng_MP_1_.pdf

Ekananda, Mahyus. (2014). Analisis Data Time Series

Untuk Penelitian Ekonomi, Manajemen dan

Akuntansi. Edisi Pertama. Mitra Wacana Media.

Jakarta.

Fafchamps, M., (2000). Farmers and price fluctuation in

poor countries. Quat. J. Econ., 15: pp. 1–27.

FAO, IFAD, IMF, OECD, UNCTAD, WFP, the World

Bank, the WTO, IFPRI, the UN HLTF, (2011). Price

Volatility in Food and Agricultural Markets: Policy

Responses. Technical Report. FAO and OECD.

Retrieved from

http://www.oecd.org/agriculture/pricevolatilityinfooda

nd agricultural marketspolicyresponses.htm

Grega, C., (2002). Price stabilization as a factor of

competitiveness of agriculture. J. Agric. Econ., 48: pp.

281–284.

Hyndman, Rob J., and Anne B. Koehler. (2006). Another

look at measures of forecast accuracy. International

Journal of Forecasting. 22: pp.679 – 688.

Jatra, A.P., Darnah, A.N. and Syaripuddin. (2013).

Peramalan Index Harga Konsumen (IHK) Kota

Samarinda dengan Metode Double Exponential

Smoothing dan Brown. Jurnal Eksponential, (Online),

4 (1): pp. 39-46.

Karim, R.M., A. Awala and M. Akher. (2010).

Forecasting of Wheat production in Bangladesh.

Bangladesh J. Agric. Res. 35(1): pp. 17 – 28.

Kirchgassner, G. and Wolters, J. (2007) Introduction to

Modern Time Series Analysis. Springer, Berlin

Heidelberg. pp. 1 – 274.

Kumar, T. Vasanth and D.M. Gowda, (2015). Forecasting

of Price of Maize - by an Application of Exponential

Smoothing. International Journal of Current

Agricultural Research, 3(11): pp. 168-172. November

2015.

Pandey, Nivedita and Upadhyay. K.G., (2016). Different

Price Forecasting Techniques and their Application in

Deregulated Electricity Market: A Comprehensive

Study. Paper presented at International Conference on

Emerging Trends in Electrical, Electronics and

Sustainable Energy Systems (ICETEESES–16).

Peng, Wen-Yi and Ching-Wu Chu. 2009. A comparison

of univariate methods for forecasting container

throughout volumes. Mathematical and Computer

Modelling. 50 (2009): pp. 1045 – 1057.

https://doi.org/10.1016/j.mcm.2009.05.027 Retrieved

from

https://www.sciencedirect.com/science/article/pii/S08

95717709001794.

Purba, F. Hero. K. (2011). Komoditi Karet Indonesia

Dalam Pasar Internasional http: // pphp.deptan.go.

id/disp_informasi_/1/5/54/1185/potensi_dan_perkemb

anga _pasar_dunia.html. Accessed at 12 September

2017.

Rajchakit, Manlika. (2017). A New Method for

Forecasting via Feedback Control Theory.

Proceedings of the International MultiConference of

Engineers and Computer Scientists 2017 Vol I,

IMECS 2017, March 15 - 17, 2017, Hong Kong.

Rani, Saima and Irum Raza. (2012). Comparison of Trend

Analysis and Double Exponential Smoothing Methods

for Price Estimation of Major Pulses in Pakistan.

Pakistan J. Agric. Res. 25(3): pp. 234 – 239.

Ribeiro, Celma de Oliveira, Anna Andrea Kajdacsy Balla

Sosnoski and Sydnei Marssal de Oliveira. 2010. Um

modelo hierárquico para previsão de preços de

commodities agrícolas (A Hierarchical Model To

Agricultural Commodities Prices Forecast). Revista

Produção On-line, 10(4): pp. 719 – 733. Accessed:

July 21, 2018. doi:10.14488/1676-1901.v10i4.225.

Robert, R. A., and F.A. Amir, (2009). A New Bayesian

Formulation for Holt's Exponential Smoothing.

Journal of Forecasting, 28: pp. 218–234.

Saini, Deepak, Akash Saxena, and S.L.Surana. (2017).

Hybrid Approach of Additive and Multiplicative

Decomposition Method for Electricity Price

Forecasting. SKIT Research Journal. 7 (1): pp. 12 –

30.

Sudha, CH.K., Rao, V.S and Suresh, CH. (2013). Growth

trends of maize crop in Guntur district of Andhra

Pradesh. International Journal of Agricultural

Statistical Sciences. 9 (1): pp. 215-220.

Sukiyono Ketut, Indra Cahyadinata, Agus Purwoko, Septri

Widiono, Eko Sumartono, Nyayu Neti Asriani, and

Gita Mulyasari. (2017). Assessing Smallholder

Household Vulnerability to Price Volatility of Palm

Fresh Fruit Bunch in Bengkulu Province. International

Journal of Applied Business and Economic Research.

15(3): pp. 1 – 15.

Sukiyono, Ketut and Rosdiana (2018). Pendugaan Model

Peramalan Harga Beras Pada Tingkat Grosir. Jurnal

AGRISEP. 17(1): pp 23 – 30. Maret 2018. DOI:

10.31186/jagrisep.17.1.23-30

Taru, V.B., and M.S.I. Mshelia, (2009). Estimation of

seasonal price variation and price decomposition of

maize and guinea corn in Michika local government

area of Adamawa state. J. Agric. Soc. Sci., 5: pp. 1–6.

Possible Method for Monthly Natural Rubber Price Forecasting

179