The Effects of Financial Attitude, Locus of Control, and

Income on Financial Behavior

Agus Zainul Arifin, Irene Anastasia, Halim Putera Siswanto

and Henny

Faculty of Economics, Tarumanagara University, Jakarta, Indonesia

Keywords: Financial Attitude, Locus of Control, Income, Financial Behavior.

Abstract: This study aims to examine whether having sufficient opportunity and knowledge on how to manage the

income, the workforce will have good financial behavior. This research is based on Theory of Reasoned

Action (TRA), and then developed into Theory of Planned Behavior (TPB). The dependent variables in this

study are locus of control, financial attitude, and income of the workforce who have been working and

living in Jakarta – Indonesia. The samples consisted of 395 respondents, which were taken through

purposive sampling technique, and then the data was processed by using SmartPLS version 3.0. Eventually,

this study found that financial attitude, locus of control, and income positively affected financial behavior.

1 INTRODUCTION

The theory of behavioral finance is based on the

Theory of Reasoned Action (TRA) that was firstly

exposed by Ajzen in 1980 (Jogiyanto, 2007), and

then developed into the Theory of Planned

Behaviour (TPB). TRA is based on the assumption

that human beings behave consciously by

considering all acquired information. TRA stated that

when an individual decides to do or not to do a

certain action, he or she is influenced by intention.

The intention is influenced by belief that forms

behavior (Ajzen, 1991). Intention influences an

individual’s will to set the behavior, which is

determined by three factors, which are attitude

toward behavior, subjective norm, and perceived

behavioral control (Ajzen, 2005).

Shefrin (2000) and Nofsinger (2001) mentioned

that behavioral finance learns about how human

psychology affects financial decision. The concept

of behavioral finance states that the community

thinks and makes decision by considering more on

non-economic aspects, especially the psychological

aspect (irrationality). Suryawijaya (2003) expressed

that in real life, an individual often acts based on

judgement, which is on contrary to the theories

holding the assumption that human beings act

rationally.

There are several variables affecting financial

behavior, which are sociology, economics,

accounting behavior, and investments. Financial

behavior is also affected by other variables, such as

financial attitude, income, and locus of control.

Locus of control is the characteristic of human

psychology. This concept was initially put forward

by Rotter in 1966. Locus of control is one among the

variables of personality defined as an individual’s

belief on the capability in self-controlling, or as an

individual’s mindset controlling the power

determining success or failure in life (Sardogan et

al., 2006). Therefore, it can affect an individual’s

financial behavior. Locus of control of an

individual’s consumptive behaviour is related to the

individual’s desire to consume products which are

actually not abundantly needed in order to achieve

maximum satisfaction. An individual’s desire to

consume a product materially is limited by his/her

own income. There is a possibility that an individual

with higher income will show more responsible

financial behavior. Therefore, income can affect an

individual’s financial behavior (Aizcorbe et al.,

2003). Locus of control is divided into two parts,

which are internal locus of control (more self-relying

on hope) and external locus of control (more relying

on hope to others) ((Tambunan, 2001) and

(Moningka, 2006)).

Financial attitude according to Pankow (2003, in

Ningsih and Rita: 2010) and Klontz et al., (2011) is

a measure of state of mind, opinion, and judgement

about finance. Financial attitude has an important

role in determining an individual’s financial success

or failure. Jodi and Phyllis (1998, in Rajna et al.,

Arifin, A., Anastasia, I., Siswanto, H. and Henny, .

The Effects of Financial Attitude, Locus of Control, and Income on Financial Behavior.

DOI: 10.5220/0008488200590066

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 59-66

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

59

2011) mentioned that financial attitude can be

perceived as a psychological tendency expressed

when evaluating recommended practice of financial

management. Financial attitude is the applied

financial principles in order to create and maintain

value through proper decision making and resource

management (Rajna, 2011). The higher an

individual’s financial attitude, the higher his/her

awareness to save the income, thus will affect

financial behavior.

Locus of control has shown different phenomena

in many studies. Grable et al., (2009) and Ida and

Dwinta (2010) mentioned that locus of control does

not affect financial behavior. According to Kholila

and Iramani (2013), locus of control positively

affects financial behavior. Meanwhile, Perry and

Morris (2005) stated that locus of control affects

consumer financial behavior.

Income also shows different results in various

studies. Perry and Morris (2005) stated that income

does affect consumer financial behavior, meanwhile

Grable et al., (2009), Ida and Dwinta (2010), and

Kholila and Iramani (2013) expressed the opposite

result.

From various studies that have been conducted,

there is an evidence that financial attitude positively

affects financial behavior (Budiono, 2014). Another

study also stated that financial attitude has a strong

effect on financial behavior, as that conducted by

Parrotta and Johnson (1998, in Rajna et al., 2011).

Another survey conducted by Manulife

Indonesia (2016) among Indonesian investors

concludes that Indonesian people are commonly

incapable in managing expenses effectively and tend

to think impulsively. This survey result stated that

70% respondents did not have savings fund, 53%

respondents spent 70% of their monthly income,

10% respondents spent more than 90% of their

monthly income, and 66% respondents did not have

investment plan. This result indicates that

Indonesian people do not have good financial

behavior when spending their income to fulfil their

individual and family needs.

This study intends to reassess how locus of

control, financial attitude, and income affect

financial behavior. This study is the replication of

the one conducted by Perry and Morris (2005). In

Indonesia, a similar study was conducted by

Kholilah and Iramani (2013) with respondents living

in Surabaya, as well as that conducted by Ida and

Dwinta (2010) with students in Indonesia as the

respondents. The difference between this study and

the previous ones is related to the research subject.

This study involves employees in Jakarta due to this

city is viewed as the capital city of Indonesia, which

becomes the benchmark of economic achievements

in this country. Besides, the employees in Jakarta

also have bigger opportunity to conduct various

activities to manage their income to be allocated in

many media investment due to having more

complete information. Moreover, the study

regarding financial behavior in more specific way

among employees in Jakarta has not been conducted

previously.

2 THEORETICAL REVIEW AND

HYPOTHESIS

According to Ajzen (2005), based on the Theory of

Planned Behavior, the intention affecting an

individual’s will to set a behavior consists of three

determinants, which are attitude toward behavior,

subjective norms, and perceived behavioral control.

Pompian (2006) explains human behavior in

financial aspect psychologically is divided into two

parts. The first is Behavioral Finance Micro (BFMI)

which is related to behavior or bias from individual

investor. This kind of behavior describes an

individual as a rational being. This aspect is viewed

from individual’s cognitive and emotional aspects.

The second is Behavioral Finance Macro (BFMA)

which detects and describes the anomaly in Efficient

Market Hypothesis (EMH) explained in behavioral

model. The theory of traditional finance assumes

that investors tend to behave rationally (Statman,

2008).

In practice, financial decision is divided into

three kinds, which are decision to consume, decision

to save, and decision to invest. Consuming is a kind

of activity conducted by individuals in spending

their incomes in order to fulfil their necessities

(Mankiw, 2003). According to Maslow,

consumption is influenced by an individual’s

motivation. Human necessities are arranged from the

most urgent to the least urgent (additional

necessities). When the most urgent necessities have

been fulfilled, it stops being a motivator, and then

the individual will attempt to fulfil the next

necessities (Kotler et al., 2003). Saving is the

residual of income that has been spent to fulfil the

consumption necessities, and the excess of fund is

saved for a certain period (Case, 2007). Investment

is an individual’s activity in allocating present fund

in order to gain profit in the future (Henry, 2009).

Thaler (1999) assumed that an individual’s

financial behavior could not only be explained by

the theory of finance and the law of economics, but

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

60

can also be explained with the theory of psychology.

Ricciardi and Simon (2000) stated that financial

behavior consisted of three aspects, which were

psychology, sociology, and finance. These aspects

would strengthen financial behavior of an individual.

Suryawijaya (2003) mentioned that investors often

showed irrational behavior by managing the

knowledge possessed in order to make conclusion

far from the assumption of rationality. Olsen (1998)

explained that financial behavior focused on the

principles of economics and psychology which

determined the financial decision making. Perry and

Morris (2005) expressed that an individual tended to

make decision which deviated from the reality,

because the individual tended to think in short-term

and conducted it due to the decision. It was

considered more beneficial.

Locus of control was initially expressed by

Rotter (1966) which was one among personality

variables defined as an individual’s belief on his/her

own capability to control the destiny. Sardogan et. al

(2006) defined locus of control as the mind

controlling the power in positive or negative

situations that occurred in individual’s life. Robbins

and Judge (2008) defined locus of control as the

extent of which an individual felt certain that he/she

was the determinator of his/her own destiny.

Robbins and Judge (2008) also stated that locus

of control (LOC) was divided into two kinds, which

were internal and external LOC. Internal LOC was

an individual’s belief that what happened in life was

under his/her own control. By working hard, an

individual would succeed. They also believe that

those who fail are due to the lack of motivation to

themselves. An individual who has internal locus of

control is identified to rely hopes more to

him/herself and also to be fond of their own

expertise. The result achieved in internal locus of

control is assumed to be originated from self-

activities. An individual who has internal locus of

control will view the world as something that can be

predicted and individual’s behavior also has certain

roles within (Kreitner and Kinicki, 2003). Among

the explanations on LOC, it can be concluded that

the higher the internal locus of control possessed, the

more responsible the individual in his/her financial

behavior. This is because the individual is viewed

more capable in controlling him/herself, managing

financial matters, not easily being influenced by

other people, being more motivated, and being more

capable in accomplishing difficult tasks than anyone

who has lower locus of control.

External locus of control is the perspective of

individuals who believe that the powers are out of

their control, but they do affect their life, such as

fate, opportunity, luck, or other people (Moorhead

and Griffin, 2013). An individual having external

locus of control will view the world as something

that cannot be predicted, thus the individual will

have no roles within. An individual who is having a

higher external locus of control will rely more on

hopes to other people, as well as seeking and

choosing advantageous situations. Someone with

high external locus of control tends to show

irresponsible financial behavior (Kreitner and

Kinichi, 2003).

Financial attitudes has an important role in

determining the success or failure of an individual’s

financial behavior. Pankow (2003, in Ningsih and

Rita: 2010) and Klontz, et al., (2011) explains the

financial attitude as the way of thinking, arguing,

and assessing on finance. Eagly and Chaiken (1993)

defines financial attitude as a psychological

tendency which is the easiest to be exploited, in

showing something that is liked or disliked. Robbins

and Judge (2008: 92) defines financial attitude as a

kind of behavior in certain aspects, in form of

preferable situation to object, individual, and

occasion.

Income can be meant as the revenue acquired by

an individual comprising salary, gain, or other

compensations. An individual with higher source of

income shows more responsible financial behavior.

Hilgert et al., (2003) explains that an individual with

higher income has the capability to pay the bills on-

time compared to one with lower income. Aizcorbe

et al., (2003) reveals that a family with lower income

has small possibility to show saving behavior. Arifin

et al., (2017) also reveals an evidence that income

does not affect an individual’s financial behavior.

Ida and Dwinta (2010) conducted a study about

the effect of locus of control, financial knowledge,

and income on financial behavior, with university

students as their research subjects in Bandung. The

result of this study shows that locus of control and

income does not affect financial behavior. Grable, et

al., (2009) also conducted a study on locus of

control, income, and financial knowledge. Their

research subject was the community of America and

South Korea living impermanently in United States.

This study reveals that there is no direct effect of

locus of control and income on financial

management behavior generally. Kholila and

Iramani (2013) in their study about the effect of

locus of control, income, and financial knowledge

on financial behavior, concludes that locus of

control positively influences financial behavior,

whereas income does not. Perry and Morris (2005)

The Effects of Financial Attitude, Locus of Control, and Income on Financial Behavior

61

were conducting a study by using the variable of

locus of control, income, and financial knowledge.

They conclude that locus of control and income do

affect consumer financial behavior.

Budiono (2014) also conducted a study by using

the variables of financial attitude, financial behavior,

and financial knowledge, with university students in

Yogyakarta as research subject. The result shows

that financial attitude has a positive influence on

financial behavior, but external locus of control

shows the opposite effect on financial behavior.

Mien and Thao (2015) conducted a study in

Vietnam which reveals that there is a positive

relationship between financial attitude and financial

behavior.

Based on the literature study and relevant

research conducted in the past, the hypotheses in this

study can be proposed as follows:

H

1

: Locus of Control affects Financial Behavior

H

2

: Financial Attitude affects Financial Behavior

H

3

: Income affects Financial Behavior

3 RESEARCH METHODOLOGY

The subject of this research is the employees who

are being included in the workforce-age, having

fixed income every month, and living in Jakarta. The

objects of this research are locus of control, financial

attitude, and income (as independent variables), and

financial behavior (as dependant variable). The data

were collected by distributing questionnaires to

employees in Jakarta. These questionnaires were

distributed to individuals by using the WhatsApp

application, and e-mail gradually. The collected data

were then analyzed by using SmartPLS (Arifin,

2017)

Financial behavior has four dimensions

(Kholilah and Iramani, 2013) and then were

developed into 10 indicators, which are controlling

personal finance, paying the bills on-time, planning

personal finance, fulfilling family necessities,

allocating money for saving, feeling happy to save

the money, allocating money for pension and

insurance, allocating money for urgent purposes,

arranging periodical budget, and paying all related

bills.

Financial attitude was measured by using 11

indicators (Rajna et al., 2011; Mien and Thao,

2015), comprising the aspects of saving, financial

objective, budget, financial prosperity, monthly

income, financial planning, pension fund, insurance,

and the period to achieve financial success.

Locus of control has seven indicators, which are

the combination among internal and external locus

of control adopted from Rotter (1966) and Mien and

Thao (2015), which include the way to solve the

problems, the pressures from surrounding

environment, the capability to do anything that exist

in mind, the capability to change something

important in life, the capability to do something that

can affect the future, the capability to solve the

problems in life, and the capability to control any

occasions in life.

Income is all revenues acquired by an individual

every month. This categorization of respondents

based on monthly acquired income uses nominal

scale with dummy variable (D). Dummy = 1 is for

those having income higher than five millions

(rupiah), and Dummy = 0 is for those with income

lower than five millions.

The scale used in measuring financial attitude,

locus of control, and financial behavior is the likert

scale, applying five categories ranging from

“Strongly Disagree” to “Strongly Agree”, which

requires the respondents to determine the degree of

agreement or disagreement to the statements

provided (Malhotra, 2009).

3.1 Statistical Analysis

The outer-model test was used to analyze the

validity and reliability of this research model. The

validity test uses Partial Least Square (PLS). The

inner-model test was used to test the relationship

among latent variables. Then, the bootstrapping

process will be conducted to acquire the result of t-

statistic test and original sample. The Normed Fit

Index (NFI) was used to test the Goodness-of-Fit

(GoF).

3.2 Data Analysis

Collected data was then analyzed by using Partial

Least Square (PLS), which becomes an alternative

analysis method of Structural Equation Modelling

(SEM) based on variance. According to Ghozali

(2014), data analysis by using SEM based on PLS

can be applied to assess a model comprising the

analysis of outer-model and inner-model.

In order to pass the convergent validity test, the

loading factor has to be greater than 0.70. However,

according to Ghozali (2014), for initial phase of

research from the development of measurement

scale, the loading factor between 0.5 and 0.6 is

already sufficient. In this study, the loading factor

limit is 0.5. The assessment of composite test and

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

62

Cronbach’s

must have greater value than 0.7.

3.2.1 Outer-model Test

a. Validity Test.

An indicator is considered valid when having a

loading factor above 0.5 to its latent variable. The

result of convergent validity test is displayed in

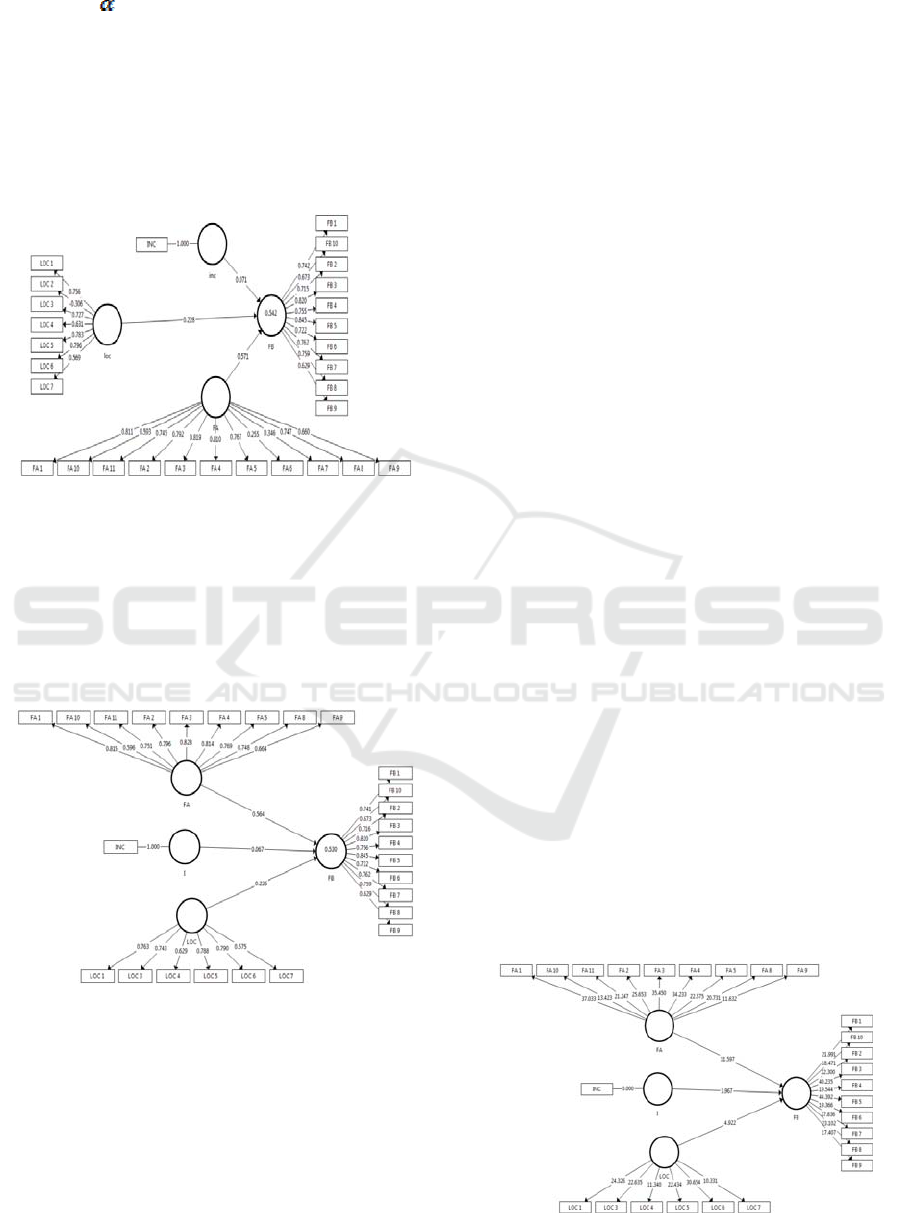

Exhibit 1 as follows.

Exhibit 1: Loading Factor from the-First Convergent

Validity Test.

In Exhibit 1, indicators that do not meet the

minimum requirement are indicator FA6, FA7, and

LOC2. Consequently, they are omitted. After that,

the test was reconducted to gain the result of

convergent validity, of which can be seen in Exhibit

2 as follows.

Exhibit 2: Loading Factor from the-Second Convergent

Validity Test.

Exhibit 2 shows that all indicators have loading

factor greater than 0.5. Therefore, the convergent

validity test has been passed, and all indicators are

already valid. Table 2 shows that the value of cross-

loading factor among the indicators of FA (FA 1 –

FA 11) in construct FA has the greatest value

compared to those of the other constructs (FB, I, and

LOC). Such result reflects that the latent construct

has better value to the indicators located in the same

construct, compared to the indicators in the others.

The same phenomenon also happens to the

indicators of the other constructs. Based on the

cross-loading factor, all indicators of constructs in

this study are already valid.

A variable is considered reliable when the

composite reliability and Cronbach’s Alpha has

greater value than 0.7. In this study, the result of

reliability test is as follows: FA = 0.923, FB = 0.925,

I = 1.000, and LOC = 0.864. The composite

reliability for all variables are greater than 0.7.

Therefore, all variables examined have met the

requirement of discriminant validity. The lowest

composite reliability is 0.864 for LOC, and the

highest is 1.000 for income.

3.2.2 Inner-model Test

After the model in this study has met the outer-

model criteria, then the inner-model test can be

conducted. This test is applied to measure the

Coefficient of Determination (CD) in form of R-

Square. The result is R-Square = 0.530, which

means that 53% of the change in variable Financial

Behavior (FB) can be explained by the independent

variables, and the remaining 47% is explained by

other variables are not examined in this study. The

test of Goodness of Fit (GOF) is conducted by using

NFI ranging from 0 to 1. The NFI is closer to 1,

which means that the model built is better or fitter.

The NFI in this study is 0.809 (close to 1.000), thus

this model is considered fit.

3.2.3 The Contribution of Each Indicator to

Variable

In order to measure the contribution of each

indicator to its related variable, another test is

conducted by using bootstrapping simulation

method. The result can be seen in Exhibit 3 as

follows.

Exhibit 3: Bootstrapping.

The Effects of Financial Attitude, Locus of Control, and Income on Financial Behavior

63

For Financial Attitude (FA) variable, the

indicator FA1 has the highest contribution, with the

value of 37.033. For Locus of Control (LOC)

variable, the indicator LOC6 has the highest

contribution compared to other LOC indicators, with

the value of 30.654. Lastly, for Financial Behavior

(FB) variable, the indicator FB3 has the highest

contribution compared to other FB indicators, which

is 40.235.

In Exhibit 3, the value of t-test about the effect of

FA on FB is 11.597. The effect of LOC on FB is

positive, which is 4.922. The effect of income on FB

is also positive, which is 1.967. All values are

greater than 1.96, so that all independent variables

have positive and significant influence on FB. Thus,

all hypotheses in this study are accepted.

4 CONCLUSIONS

4.1 The Effect of Financial Attitude on

Financial Behavior

Data analysis shows that Financial Attitude (FA) has

a positive effect on Financial Behavior (FB). The

better the financial attitude of an individual, the

better financial plan arranged for short-term

(consumption) and long-term (investment). This

means that financial behavior of the individual will

also be better. This phenomenon is supported by the

characteristic of respondents, most of which (81%)

have bachelor-degree. This group of respondents (S-

1 level of education) has a more rational way of

thinking. The result of this study is consistent to

those conducted by Mien and Thao (2015) and

Budiono (2014).

4.2 The Effect of Locus of Control on

Financial Behavior

This study reveals that Locus of Control has a

positive effect on Financial Behavior. According to

Rotter (1966), Locus of Control is an individual’s

belief of his/her capability to control his/her own

life. Locus of Control shows an individual’s faith in

his/her own success. When an individual has higher

internal locus of control, then the financial behavior

becomes better, because the individual is perceived

to appreciate the revenue more deeply and is

attempted to conduct good financial management. In

contrast, when an individual has better external

locus of control, then the individual will have less

control in financial behavior, because the individual

believes that the success comes from external

factors. This result is consistent with two previous

studies conducted by Kholila and Iramani (2013),

Perry and Morris (2005), and Arifin (2017), but in

the opposite to those conducted by Ida and Dwinta

(2010), and Grable et al., (2009).

4.3 The Effect of Income on Financial

Behavior

This study shows that Income has a positive effect

on Financial Behavior. This result is consistent to

the existing theory mentioning that the higher the

income, the better an individual’s financial

management, such as the increase of saving and

investment. This result is supported by the

characteristic of respondents, which 81% of them

already have bachelor-degree. This group of

respondents also has higher level of awareness on

long-term financial planning, due to 68% of them

can generate income more than five million rupiahs

every month.

Therefore, it can be concluded that individuals

with higher income can arrange their finance better,

due to because they are more capable to save and

invest money than those with lower income. This

result is consistent to the study conducted by Perry

and Morris (2005), which states that income

significantly affects financial behavior. On the other

hand, the result do not support the studies conducted

by Kholilah and Iramani (2013), Grable et al.

(2009), as well as by Ida and Dwinta (2010).

4.4 Limitation and Suggestion

Based on the theoretical review and data analysis,

this study reveals that Financial Attitude, Locus of

Control, and Income positively affect Financial

Behavior.

In conducting this study, there were several

limitations, which were the amount of samples and

the variety of respondents. Thus, for further

research, those two factors should be enhanced with

the same variables examined. The amount of

questionnaires collected compared to the amount of

workforce in Jakarta Special Region might become a

problem for not reaching the minimum amount of

samples required. Respondents with 81% having

bachelor-degree causes the variation in educational

background becomes less normally-distributed,

because in fact, bachelor-degree workers are the

smallest part in population, compared to those

without the bachelor-degree among the available

workforce in labor market.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

64

REFERENCES

Aizcorbe, Ana M., Arthur, B. Kennickeell, and Kevin B.

Moore, 2003. “Recent Changes in U.S. Family

Finances: Evidence from the 1998 and 2001 Survey of

Consumer Finances”. Federal Reserve Bulletin, 89 (1),

pp. 1-32.

Ajzen, I., 1991. The theory of planned behavior.

“Organizational Behavior and Human Decision

Processes, 50, 179–211”.

Ajzen, Icek, 2005. Attitudes, Personality, and Behavior.

New York: Open University Press.

Arifin, Agus Z., Kevin, dan Halim Putera Siswanto, 2017.

The Influence of Financial Knowlwdge, Financial

Confidence, and Income on Financial Behavior among

the Workforce In Jakarta. MIX: Jurnal Ilmiah

Manajemen, Vol. VII (1), 37-47.

______________, 2017. The Influence of Financial

Knowledge, Control and Income on Individual

Financial Behavior. European Research Studies

Journal, Volume XX, Issue 3A, 2017: 635-648

Budiono, Tania, 2014. “Keterkaitan Financial Attitude,

Financial Behavior & Financial Knowledge Pada

Mahasiswa Strata 1 Universitas Atmajaya

Yogyakarta”. Source: http://e-

journal.uajy.ac.id/id/eprint/6696. (Accessed in October

2016).

Case, Karl E. and Ray C. Fair, 2007. Principles of

Economics, 8

th

Edition. New Jersey: Pearson

Education Inc.

Eagly, Alice Hendrickson, and Shelly Chaiken, 1993. The

Psychology of Attitudes. Florida: Harcourt Brace

Jovanovich College Publishers.

Ghozali, Imam, 2014. Partial Least Squares: Konsep,

Metode, dan Aplikasi Menggunakan Program Warp

PLS 4.0. Semarang: Badan Penerbit Universitas

Diponegoro.

Grable, John E, Joo Yung Park, and So Hyun Joo, 2009.

“Explaining financial management behavior for

Koreans living in the United States”, The Journal of

Consumer Affairs, 43 (1), 80-107.

Henry, Faizal Noor, 2009. Investasi, Pengelolaan

Keuangan Bisnis dan Pengembangan Ekonomi

Masyarakat. Jakarta: PT Indeks.

Hilgert, Marianne A., Jeanne M. Hogarth, and Sondra

Beverly, 2003. Household Financial Management: The

Connection between Knowledge and Behavior.

Federal Reserve Bulletin, 89 (7), 309–322.

Ida dan Chintia Yohana Dwinta, 2010. ”Pengaruh locus of

control, financial knowledge, dan income terhadap

financial management behavior”. Jurnal Bisnis dan

Akuntansi, 12(3), 131-144.

Jogiyanto, Hartono M., 2007. Teori Portofolio dan

Analisis Investasi. Edisi 5. Yogyakarta: BPFE.

Kholilah, Naila Al. dan Rr. Iramani, 2013. “Studi

Financial Management Behavior pada Masyarakat

Surabaya”. Journal of Business and Banking, 3(1), 69

– 80.

Klontz, B., Beitt, S. L., Mentzer, J. & Klontz, T., 2011

“Money Beliefs and Financial Behaviors:

Development of the Klontz Money Script Inventory”.

The Journal of Financial Therapy, 2 (1), 1-22.

Kotler, Philip, 2003. Manajemen Pemasaran. Edisi

Kesebelas (Terjemahan), Jakarta: PT. Indeks -

Kelompok Gramedia.

Kreitner, Robert dan Kinicki, Angelo, 2003. Perilaku

Organisasi (Terjemahan) Edisi Pertama. Jakarta:

Salemba Empat.

Malhotra, N.K., 2009. Riset Pemasaran, Edisi Keempat

(Terjemahan), Jilid 1. Jakarta: PT. Indeks.

Mankiw, N. G., 2003. Pengantar Ekonomi. Jakarta:

Erlangga.

Mien, Nguyen Thi Ngoc and Tran Phuong Thao, 2015.

Factors Affecting Personal Financial Management

Behaviors: Evidence from Vietnam. Proceedings of

the Second Asia-Pacific Conference on Global

Business, Economics, Finance, and Social Sciences

AP15, pp: 1-16.

Moningka, C., 2006. Konsumtif: Antara Gengsi dan

Kebutuhan. Source:

http://www.suarapembaruan.com/News/2006/12/13/ur

ban/urb02.htm. (Accessed in September 2016).

Moorhead, Gregory dan Ricky W. Griffin, 2013. Perilaku

Organisasi (Terjemahan). Jakarta: Salemba Empat.

Ningsih, Retno Utami dan Maria Rio Rita, 2010.

Financial Attitudes dan Komunikasi Keluarga tentang

Pengeluaran Uang Saku: Ditinjau dari Perbedaan

Gender. Informatics & Business Institute Darmajaya,

JMK 8(2), 206-219.

Nofsinger, J. R., 2001. Investment Madness: How

Psychology Affects Your Investing and What to Do

About It. New Jersey: Prentice Hall.

Olsen, Robert A., 1998. “Behavioral Finance and Its

Implications for Stock-Price Volatility”. Financial

Analysts Journal, 54(2), 10-18.

Perry, Vanessa G, and Marlene D Morris, 2005. “Who is

in control? The role of self perception, knowledge, and

income in explaining consumer financial behavior”.

The Journal of Consumer Affairs”, 39(2), 299-313.

Pompian, Michael M., 2006. “Behavioral Finance and

Wealth Management. How to Build Optimal Portfolios

that Account for Investor Biases”. First Edition. New

Jersey: John Wiley & Sons, Inc.

Rajna, A., Ezat, W.P.S., Junid, S.A., and Moshiri, H.,

2011. “Financial Management Attitude and Practice

among the Medical Practitioners in Public and Private

Medical Service in Malaysia”. International Journal

of Business and Management, 6 (8), 105-113.

Ricciardi, V. & Simon, H. K., 2000. “What is Behaviour

in Finance?” Business, Education and Technology

Journal, 2(2), 1-9.

Robbins, Stephen P., dan Timothy A. Judge, 2008.

Perilaku Organisasi. Edisi 12 (Terjemahan), Jilid 1,

Jakarta: Salemba Empat.

Rotter, J., 1966. “Generalized expectancies for internal

versus external control of reinforcement”.

Psychological Monographs: General and Applied,

80(1), 1-28.

Sardogan E. M., Kaygusuz, C. ve Karahan, T. F., 2006. A

Human Relations Skills Training Program, University

The Effects of Financial Attitude, Locus of Control, and Income on Financial Behavior

65

Students Locus of Control Levels, Mersin University.

Journal of the Faculty of Education, 2(2), 184-194.

Shefrin, Hersh, 2000. Beyond Greed and Fear:

Understanding Behavioral Finance and Psychology of

Investing. Brighton: Harvard Business School Press.

Statman, Meir, 2008. What is Behavioural Finance?

Handbook of Finance, Vol. 2, Chapter 9. New Jersey:

John Wiley & Sons Inc.

Suryawijaya, A. Marwan, 2003. Ketidakrasionalan

Investor di Pasar Modal. Pidato Pengukuhan Jabatan

Guru Besar pada Fakultas Ekonomi Universitas

Gadjah Mada, Yogyakarta.

Tambunan, R. 2001. Remaja dan Perilaku Konsumtif.

Jurnal Psikologi dan Masyarakat. Source:

http://www.e-psikologi.com/remaja/191101.htm.

(Accessed in September 2016)

Thaler, Richard H.. 1999. Mental Accounting Matters.

Journal of Behavioral Decision Making, 12(3), 183-

206.

www.manulife-indonesia.com (Accessed in October

2016).

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

66