Assessing Mobile Content "Mobee" Business in Indonesia:

For Case Study Data 2007 - 2014

Ignatius Roni Setyawan

1

and Budi Frensidy

2

1

Department of Management, Faculty of Economy University of Tarumanagara, Jl,

Tanjung Duren Utara 1 Jakarta 11470, Indonesia

2

Department of Accounting, Faculty of Economy & Business, Universitas Indonesia, Depok 16424, Indonesia

Keywords: Assessing Mobile Content Business, Market Analysis, Financial Analysis, Mobee, Subscriber.

Abstract: In the disruption era, so many startups have to really pay attention to the problem of market and financial

analysis. The successful experience of Facebook, Alibaba, Gojek, and Grab teaches the importance of

market and financial analysis (Rene and Li (2016) and (Lee and Shin (2018)). In fact, before the disruption

era like today there was a business that had been highlighted in Indonesia and was expected to boom around

2007-2008.This business is a business mobile content called “Mobee”. The application has not been

launched in Android but its future is promising. To market Mobee's product successfully, it must first be

analyzed. The financial analysis is about the market situation. The market situation of Mobee products is

relatively new because the subscriber is still not familiar with the issue of browsing. However, that does not

diminish the potential of Mobee's business product. The subscribers (business content users) are no longer

overly concerned about the difficulty in browsing, but they are more concerned with the usefulness of

browsing for operational activities (business). Looking at the prospects for the future, Mobee deserves to go

public in 2011. In comparison, Mobee's business value is 459.6 - 599,6 billion rupiah which is three times

from the business value of Kopitime DotCom. Bids for new investors can be considered quite interesting

because with 20% of shares of Mobee, new investors will get a capitalization of shares of 45.96 - 59.96

billion rupiahs. The success of Mobee business will give more opportunity for the development of startups

in Indonesia.

1 INTRODUCTION

Mobee, like any other mobile content business in the

world, has 4 types of business models or products

such as microbrochure, micronewspaper,

micromagazine & microcatalog. By definition each

microbrochure i.e. subscriber can match the texture

of the goods you want to buy by downloading the

image on the phone. Micronewspaper can help the

subscriber to confirm whether the texture of the

news is being hot news by downloading the

alternative news format news on the phone. As for

micromagazine, is enables a subscriber to confirm

magazine titles by downloading miniature of

magazines on mobile phones. The last one is a

microcatalog that can help subscriber to identify the

texture of goods that they search in a store quickly

by downloading the goods on the phone.

At that time the owner requested the business to

undergo an in-depth analysis in terms of the market

and finance to assess the feasibility of IPO related

companies in 2011 by releasing shares as much as

30% to the public. Specifically, investors are offered

US $ 1.5 million equivalent to Rp 13.5 billion (IDR

9000 per US $ exchange) with details of US $ 500

thousand prepaid to be distributed to existing

shareholders and US $ 1 million placed as working

capital company, repayable as needed for 1 year. If a

new investor agrees with this offer they will get 20%

of Mobee shares worth equivalent to 0.2 x Rp 300

Billion (conservative value) = Rp 60 Billion and

they can place 1 person as the Director of Finance

for Mobee and 1 person as a commissioner (Sembel,

2007).

In order to realize this company plan, we intend

to provide support in market and financial analysis.

For market analysis, we will use the STP

(Segmenting, Targeting & Positioning) method to

see where exactly the company is in a competitive

position. At that time, there were two potential

Setyawan, I. and Frensidy, B.

Assessing Mobile Content "Mobee" Business in Indonesia: For Case Study Data 2007 - 2014.

DOI: 10.5220/0008487400110018

In Proceedings of the 7th International Conference on Entrepreneurship and Business Management (ICEBM Untar 2018), pages 11-18

ISBN: 978-989-758-363-6

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

11

competitors namely Alatto and Yahoo Indonesia.

After conducting market analysis, we do product

analysis to see in detail the unique features of the

product or business model offered either

microbrochure, micronewspaper, micromagazine or

microcatalog. In addition to discussing the

uniqueness, the limitations of the product will also

be analyzed.

Our financial analysis is done using the stages of

the business valuation process. The approach we use

is DCF (Discounted Cash Flow) because the Mobee

business is a new running business running and it

has many offers and expectations for the investors in

the future. This financial analysis will be affected by

scenario for the range of subscribers’ counts

referring to three conditions, which are optimistic,

moderate and pessimistic. The final value of the

average of the subscribers will determine the value

of the valuation of Mobee business. As a

consideration for us is the valuation model of

Kopitime Dot.com company that has long been

listed on Indonesian Stock Exchange (IDX). The

company turned out to have been concerned about

the problem of investment cost component for a type

of internet based services company that is equipment

and software, technical cooperation and strategy,

advertising and promotion, as well as operational

costs.

Finally, based on the previous description, the

objective of this study is to assess Mobee's mobile

business content by looking at two critical aspects of

market analysis and financial analysis. The benefit

from the exposure of this study, in addition, is to

give an idea on what is the fair value of Mobee

mobile business content that will be utilized by

prospective new investors. It will also give a

recommendation for the company owner whether the

company is feasible to conduct IPO in 2011. The

success in this IPO will depend on how valid the

valuation results that are applied by the related

analysis.

2 MATERIALS & METHODS

2.1 Market Analysis

To conduct market analysis, according to previous

research Rene and Li (2016) and Lee and Shin

(2018), it will consist of: Segmentation (S),

Targeting (T), Positioning (P), Product Analysis,

Competitor Analysis, and Strategy Analysis.

In the next stage, we also conduct competitor

analysis using the Competitive Profile Matrix

(CPM) model that is oriented towards customer,

product and technical factors. Qualitative

determination of strengths and weaknesses of

players is measured by using criteria E (Excellent),

G (Good) and F (Fair). Using this CPM can

ultimately determine Porter's competing strategy and

related QSPM matrix from the company. In addition,

an operational business strategy will be determined.

2.2 Financial Analysis

While performing financial analysis, we refer to the

procedure from Bergvall-Kareborn and Howcroft

(2013), which was applied to Apple Business Model

in several countries, such as Sweden, UK, US and

China. This procedure has compatibility with the

overall business valuation process. This financial

analysis includes: 1) Determine the potential market

by using the assumption of optimistic, moderate and

pessimistic conditions, 2) Determine the growth rate

of the company with supernormal growth approach,

3) Determine the nominal revenue of the company

from the subscriber, 4) Determine the subscription

fee of the company, 5) Determine the operating

expense, 6) Determine the discount rate, (7)

Determine the tax rate, 8) Determine the perpetual

rate, and 9) Determine its valuation with the

spreadsheet.

3 RESULT

3.1 Market Analysis

Why should Mobee do market analysis? Mobile

technology business is known for being "bullish".

Many business transaction and telecommunication

activities are already using sophisticated information

technology medium. The sophistication of

information technology is not an obstacle for

subscriber because information technology that has a

high selling value is user-friendly information

technology. Even if there is an internet that allows

subscribers to access information as needed, content

and features are sometimes still not satisfactory. In

addition, the high cost of internet browsing makes

business content from mobile phones to be one of

the best alternatives. If so, considering the market

situation, Mobee's product as a content business

player has the best chance of scooping a huge

potential market. This will be successful if Mobee is

able to make the STP process according to Kotler

and Keller (2016) as well as possible.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

12

3.1.1 Segmentation (S)

This means determining the part of the potential

market that should be entered. The potential market

is all the information technology about subscriber

community in Indonesia. Potential market shares

from Mobee can be grouped demographically and

psychographically. Demographically, subscribers

can be grouped into Media and Non-Media. The

ideal comparison is 3: 2.

Media has a larger portion because it has the

same line of business with Mobee that is equally in

the field of mass communication. The benefit of

media groups is the possibility of a significant

increase in the number of potential markets when

compared to running alone. The details of media

groups include the National General Media, Local

Media, Business, and Entertainment.

The next group is non-media with a portion that

is not as dominant as the media group. The benefit is

the Mobee content business can be used as a vehicle

for dissemination of non-media group profile

information to potential target market. Details of

non-media groups consist of Financial Institutions

such as Mobile Banking & Financial Portal. In

addition, there is also Education which consists of

School, University & Course. Then, the latter is the

others namely MLM Company, Job Market,

Classified Ads, Professional Associations, Hobby

Community, m-Government & Political Parties. For

psychographic segmentation, the company (Mobee

Indonesia) can group its subscribers into business

and non-business types.

Business type means the type of subscriber that

utilizes Mobee as a vehicle for business activities

such as searching for new potential markets or

venues for promotion or a venue for finding new

business partners. Meanwhile, the non-business type

is more directed to the type of subscriber who only

uses Mobee as a means of entertainment or

entertainment. Both of these types have typical

behavior. The non-business types are more

concerned with the format or feature of the content,

while the non-business type prioritizes the content of

the content itself.

3.1.2 Targeting (T)

It is the process of specifically determining which

part of the potential market should be entered. The

closer term is the "niche" or niche market. The

reason for determining the market niche is because

not all segments will be easily accessed by the

company given the tight competition.

For Mobee, for example, its market niche is

assumed to be a subscriber community of media

groups. The logical consideration is that media

groups are seen to be making a larger contribution as

they will be able to effectively run banners to new

prospects in the Mobee market area. Meanwhile, the

non-media groups tend to still optimize the internet

content business. Thus, their contribution will not be

as big as the media group.

3.1.3 Positioning (P)

It is uniquely determined by what the company will

serve a "niche" or niche market. The reason for

determining positioning is that all niche markets

have unique demands because they are supported

with high purchasing power, so Mobee needs to

position its core product competencies as best as

possible. For example, Mobee can focus on core

competencies: easiness and highly interactive power.

The definition of convenience is that the

subscriber will easily access information at any time

without having to be haunted by anxiety caused by

delays in the process of browsing as well as on

getting internet access. The highly interactive power

can be demonstrated by how much the content and

format attentiveness of Mobee can keep the

subscriber tune-in until the process of memorizing a

product brand can take place continuously. Other

than that, the subscriber can do more enjoyable

blogging activities and chatting. Blogging is an

activity to revise the personal web appearance on a

regular basis. Chatting is a conversation activity via

text between subscribers.

3.1.4 Product Analysis

The uniqueness of the content business has a

distinctive feature or has a degree of that is higher

than the other media features.

1. The advantages of a more cost-effective content

business are faster, more reliable, more various,

and easier.

2. The limitations namely 1) the existence of a

dependence with the operator of the phone card

makes the existence of content business will be

influenced by the business dynamics of the

mobile phone card operators. 2) The phone's

monitor screen is not as wide as the PC monitor

screen; then there are some subscribers who

cannot enjoy the content and format.

All three of the above factors should be discussed by

Mobee product category consisting of micropage;

Assessing Mobile Content "Mobee" Business in Indonesia: For Case Study Data 2007 - 2014

13

microreader; content development tool & mobeelink

(see appendix 1-2 for the details of Mobee product).

3.1.5 Competitor Analysis

If the player’s data has been available completely

then some stages of making a competitive profile

matrix can be done as recommended by David and

David (2016) as follows:

1. Determine critical success factors both internally

and externally.

2. Give weight to critical success factors based on

brainstorming among marketing and operational

executive teams.

3. Determine the rating of critical success factors

based on the results of the subscriber survey.

4. Determine the scores on critical success factors

that reflect the competitiveness position of

Mobee products when compared to potential

competitors.

However, if player data is not available given the

market may be new, it needs to be adjusted. This

adjustment is related to the determination of the

weight and rating of critical success factors. As a

replacement, we can directly assess the critical

success factors in qualitative judgment. Kotler

(2006) suggests four levels of judgment: excellent

(E); good (G); fair (F) and poor (P).

In the detail in table 1 judgmental judgment of

there are three content business players that can be

identified namely: Alatto, Yahoo-Indonesia and

Mobee. These three players have special

characteristics in the content business market. Alatto

and Mobee probably have something in common

because of using the same media that is mobile

phone, while Yahoo-Indonesia relies more on

Internet media for its core activities.

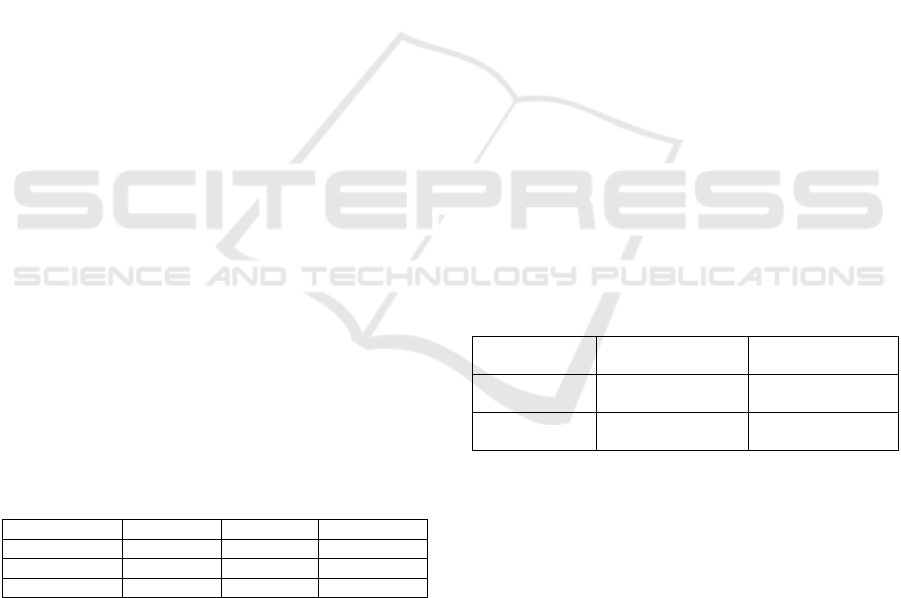

Table 1: Competitive Profile Matrix Analysis For

Business Content Players.

Players Customer Product Techniques

Alatto F G G

Mobee E E F

Yahoo Indo. E G G

Source: Result data analysis (2007)

Based on table 1, Mobee is no less dominant

compared with Alatto and Yahoo-Indonesia. Alatto

is not so dominant in terms of customer awareness;

product availability and selling ability due to the

assumption of making competitive profile matrix is

using Indonesian market. If we look at the gait of

Alatto in Europe it will probably be different

judgments. Alatto is quite dominant in two countries

namely Portugal with Optimus project and in the

Netherlands with Telfort project (see appendix 3 for

details). So Mobee and Alatto are unlikely to

compete frontally because of the market

geographical differences.

Precisely, here that would be suggested is Mobee

can benchmark to Alatto in terms of technical

assistance. This is important considering Mobee

could be involved in a tight competition with

Yahoo-Indonesia considering that Indonesian

subscribers have high purchasing power to access

maximum information. If the weak side of Mobee

can be overcome, it is not impossible that Yahoo-

Indonesia subscriber will be able to "switch" to

Mobee, because its product is relatively the same in

terms of usage.

3.1.6 Strategy Analysis

Determination of generic strategy is done by using

generic strategy concept from Michael E. Porter

consisting of low cost and differentiation. Low cost

relates to cost efficiency on the use of a product,

while differentiation is related to the unique charm

that a product offers. The essence of Porter's generic

strategy is to build a competitive advantage of a

product when compared to a competitor's product. It

can be seen in detail in the matrix diagram in table 2.

Based on observations on internal information; then

Mobee can use Different-Focused Strategy.

Table 2: Generic Porter Strategy Type Analysis for

Mobee.

Low Competition

Advantage

High Competition

Advantage

Broad Target Low Cost Strategy

Differentiation

Strategy

Narrow Target

Cost Focused

Strategy

Differentiation

Focused Strategy

Source: David and David (2016)

3.1.7 Why Should Mobee Use a

Differentiation-focused Strategy?

The reason Mobee does need to build the uniqueness

so that the potential subscriber of conventional

content business such as Yahoo-Indonesia, Astaga

and Detik can also be achieved overdraft. Some of

the uniqueness that needs to be built, such as content

that is more varied both in terms of text, images,

video and sound. Then, also the speed of access to

information (download) in accordance with the

wishes and the ultimate cost advantage of 6x sms

from the old technology need to be build.

However; Mobee is unlikely to take a large

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

14

market share (broad target). This is not just Mobee is

a new player in the content business, but more

importantly, Mobee needs to build the image first

among the subscriber. As understood, the subscriber

today is still not familiar with mobile business

content as well as internet business content that

already existed. Mobee needs to focus on the market

segment of the media group while the non-media

group market education process is effective.

Another alternative determination of a grand

strategy is to use the Quantitative Strategic Planning

Matrix (QSPM) model derived from IFE (Internal

Factors Evaluation) and EFE (External Factors

Evaluation) matrix in the SWOT analysis process.

The main content of QSPM is the various types of

grand strategy that can be used by the company. In

the first quadrant is generally the type of market

penetration & market development strategy.

Quadrants II and IV each have a strategy type

product development & horizontal integration and

concentric & conglomerate diversification.

Meanwhile Quadrant III only has type of strategy of

retrenchment & divesture.

For the Mobee case, based on the information

obtained we can qualify entry in quadrant I. The

core position in quadrant I is the more dominant

factor of the factor compared with the factor of

threats and strengths factor is also more dominant

than the weaknesses factor.

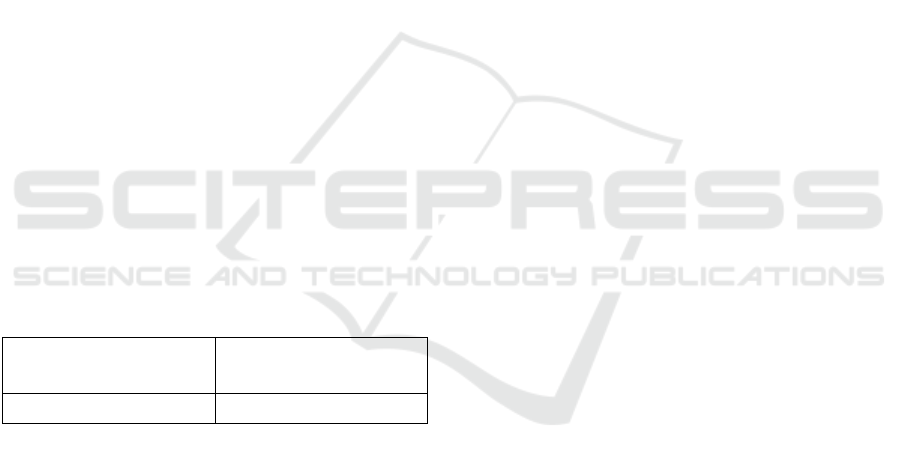

Table 3: Quantitative Strategic Planning Matrix Analysis

of Mobee.

Rapid Market Growth

Second Quadrant

Weak Competitive Positiobn

First Quadrant

Strong Competitive Position

Third Quadrant Fourth Quadrant

Slow Market Growth

3.1.8 Why Is Mobee Included in Quadrant

I?

There are two main reasons. First, Mobee exists

when the number of mobile phone users in Indonesia

has increased drastically. The main requirement to

be a Mobee subscriber is to have a mobile phone.

Secondly, Mobee tries to offer multimedia services

that are content business in the latest form. So far,

the Indonesian subscriber is new to the content

business format via the internet.

By looking at the results of the mapping in

quadrant I, the most relevant strategy is market

penetration. The operational definition is to build

community among subscriber like yahoo.group.

Lupiyoadi and Hamdani (2006) states generally the

subscriber has a repeat order character that means

once they trust (trust) then forever they will not

switch to other types of portals. Thus, the

development of community will accelerate the

creation of trust among subscriber. Functionally the

development of subscriber community is optimized

with Mobee's web-design program, which should

appear on the mobile screen. The Mobee web-design

needs to be up-dating at all times so that the

innovation power of Mobee will still appear to be

maximum and the subscriber's loyalty is maintained.

3.2 Financial Analysis

For Mobee valuation, we will use one of the most

popular methods of DCF or discounted cash flow

application. The steps of this DCF method are as

follows:

1. Determine the potential market for the last 6

months in 2007 with 3 scenarios that are

optimistic scenario, most likely, and pessimistic

that involves about 100 thousand to 600

thousand people. These figures are based on

benchmarks from Compass that can reach 500

thousand people per day. The optimistic, most

probable, and pessimistic conditions are 20%,

60%, and 20% based on the weighting used in

PERT (project evaluation and review technique)

i.e. 1/6, 4/6 and 1/6 (Taylor, 2015). Optimistic

conditions are all Mobee content received by the

users and some users are the subscriber groups of

the top media such as Kompas and SWA. The

most likely condition is most of Mobee's content

is accepted by users and most of them are

subscriber of "second tier" media groups. The

pessimistic condition is that only a small

percentage of content is received and some users

are subscribers of non-media groups.

2. Determine growth from 2007-2008 and 2008-

2011 (supernormal growth period) and 2011 and

beyond (normal growth period). Each for an

optimistic scenario is 20%; 50% and 10%. Then

for the most likely scenario, the growth rate is

10%, 20% and 5%. And the last pessimistic

scenario has a growth rate of 5%, 10% and 0%.

3. Determine the nominal revenue that Mobee can

earn from advertising and other sources of 10%

and 5%. Especially, ads will have a downward

trend from 2007-2014 of 1% per year due to

regulatory factors (limitation of advertising via

SMS) and market saturation (in the future, there

will be more copy-paint businesses that have

similar content to Mobee).

4. Determine Mobee subscription fees reasonable

Assessing Mobile Content "Mobee" Business in Indonesia: For Case Study Data 2007 - 2014

15

and interesting enough to get enough subscribers

that is Rp. 10,000, - per month.

5. Determine operating expenses as a percentage of

gross income. The amount of operating costs is

determined by an revenue-based basis with a

25% scenario in 2007-2008; 20% in 2009-2011

and 15% for 2012-2014.

6. Determine the relevant discount rate for the

present value calculation of the company's cash

flow of 25% with details of 50% debt and 50%

equity. Debt has a 20% interest cost and equity

has a cost of 30%. Discount rate is certainly

already considering the business risk factors

from Mobee.

7. Determine the tax rate of 30%.

8. Determining perpetual growth for the period

after 2014, based on the growth of the last two

years (2012-2014). Perpetual growth is required

to calculate the Mobee terminal value in 2014.

9. Obtain the valuation value of Mobee by utilizing

spreadsheet program in Excel (Alaistair, 2012)

By changing one of the above assumptions, the

value of the Mobee valuation will change

automatically. We do not use Monte-Carlo

simulations because the Mobee business has not

been fully operated, so it will be difficult to

determine the equivalent value for each random

number.

To get the best results, we do what-if analysis or

scenario analysis with the main focus on changes in

the number of subscribers to be obtained. This factor

is considered the most crucial writer because it

covers about 85% revenue from Mobee. Subscriber

factor will be the most vulnerable to business

competition risk.

Based on the results of scenario analysis, we get

the range of Mobee values between 459.6 - 599.1

billion rupiahs. The details can be seen in Table 4-6.

Scenario A with the number of subscriber counts of

50, 250, and 550 thousand of people for pessimistic

conditions, most likely, and optimistic. Scenario B

has a subscriber count of 100, 300, and 600 thousand

people. Scenario C has 150, 350, and 650 thousand

subscribers.

We select a range of subscriber, with counts of

+/- 50 persons in each scenario per 3 conditions,

with the following considerations: a) Business

content is still relatively new so the accuracy of

determining the subscriber’s number interval should

not be too long, and b) Determination of short

intervals will make Mobee’s management work

more rationally because there is a firm target.

The following is a description of the scenario

table from Mobee's assessment. The emphasis of the

discussion per scenario is the number of subscribers

and cash flow which will be the determining factor

of the company's value i.e. 459.6 - 599,6 billion

rupiahs.

Table 4: (Scenario A): Number of subscriber (000).

Year Optimist Moderate Pessimist Average

2007 550 250 50 270

2008 1320 550 105 615

2009 1980 660 115 815

2010 2970 792 127. 1094.

2011 4455 950 139 1489

2012 4900 997 139. 1606

2013 5390 1047 139 1734.

2014 5929 1100 139 1873

Cash flow (Rp. 000000)

Year Cash Flow PV Growth

Value =

459608

2007 9780 9780 13.61%

2008 44169 35335 13.61%

2009 61895 39613 13.61%

2010 82384 42180 13.61%

2011 111081 45499 13.61%

2012 126198 41352 6.98%

2013 135008 35391 7.04%

2014 144507 30305 7.00%

Table 5: (Scenario B): Number of subscriber (000).

Year Optimist Moderate Pessimist Average

2007 600 300 100 320

2008 1440 660 210 726

2009 2160 792 231 953

2010 3240 950 254. 1269

2011 4860 1140 279 1712

2012 5346 1197. 279 1843

2013 5880 1257 279 1986

2014 6468 1320 279 2141

Cash flow (Rp. 000000)

Year Cash Flow PV Growth

Value =

529356

2007 11592 11592 13.37%

2008 52141 41713 13.37%

2009 72397 46334 13.37%

2010 95514 48903 13.37%

2011 127715 52312 13.37%

2012 144796 47446 6.77%

2013 154597 40526 6.83%

2014 165157 34635 7.00%

Referring to the go-public experience of

Kopitime, an internet service company in Jakarta

Stock Exchange (now IDX) overall, then we can

identify some important components of investment

capital for Mobee. Such components include

equipment & software, technical cooperation &

strategy, advertising & promotion as well as

operational costs.

The dominant cost component is equipment &

software, and technical & strategy cooperation.

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

16

Considering that Mobee's business is highly

uncertain, we assume the Mobee business is merely

a lessee in the lease contract with some of the

business content-related technology providers.

Table 6: (Scenario C): Number of subscriber (000).

Year Optimist Moderate Pessimist Average

2007 650 350 150 370

2008 1560 770 315 837

2009 2340 924 346 1091

2010 3510 1108. 381 1443

2011 5265 1330 419 1935

2012 5791 1397 419 2080

2013 6370 1466 419 2238

2014 7007 1540 419 2409

Cash flow (Rp. 000000)

Year Cash Flow PV Growth

Value =

599104

2007 13403 13403 13.19%

2008 60113 46090 13.19%

2009 82899 53055 13.19%

2010 108644 55625 13.19%

2011 144349 59125 13.19%

2012 163395 53541 6.60%

2013 174186 45661 6.67%

2014 185806 38966 7.00%

4 CONCLUSIONS

Looking at the prospects for the future, Mobee

deserved to go public in 2011. In comparison,

Mobee's business value is 459.6 – 599.6 billion

rupiahs which is 3 times from the business value of

Kopitime DotCom. In addition, based on market

aspect, the company is located in quadrant I which

berate has the strengths and opportunities above the

industry's competitors namely Tools and yahoo

Indonesia. The strategy that can be run is market

penetration that builds community among

subscribers like yahoo.group and later social media

like Facebook, Twitter, etc.

Meanwhile, an offer for new investors can be

considered quite interesting. With 20% of shares of

Mobee, new investors can get a capitalization of

shares of 45.96 - 59.96 billion rupiahs. The

calculations are 0.2 X 459.6 billion rupiahs X 0.5

and 0.2 X 599.6 billion rupiahs X 0.5. Figures 0.5 is

an internal or equity financing factor which is

nothing but debt and equity if it refers to the concept

of financial management.

5 LIMITATION &

IMPLICATIONS

Although Mobee's mobile business case occurred in

the era before Android (before the current era), we

still think that all four of Mobee's business models

are still within the scope of e-commerce and will

inspire the growth of many more sophisticated

business models i.e. startup companies or start ups

that become trending topic in the world.

In our opinion, pioneering companies do need to

properly understand the market and financial

analysis to determine the accuracy of reasonable

business value in order to wait for large funds from

crowd funders (see Gojek case in Indonesia).

REFERENCES

Alastair, D. (2012), Mastering Financial Mathematics

with Excel: A Practical Guide for Business

Calculations, Prentice-Hall Chapter 14.

Bergvall-Kareborn, B. & D. Howcroft (2013), The Apple

Business Model: Crowdsourcing Mobile Application,

Accounting Forum 37, pp. 280-289.

David, F. R. & F.R. David (2016), Strategic Management:

Concepts & Cases, 16th ed, McGraw-Hill Chapter 5-

6.

Kotler, P. & K.L. Keller (2016), Marketing Management,

15th ed, Prentice Hall Chapter 6-8.

Lupiyoadi, R. & A. Hamdani (2006), Services Marketing

Management, 3rd edition, Lembaga Penerbit FE UI,

Chapter 18.

Appraisal & Consultants Reports from PT Kharisma

Triaya (2007), Business Valuation of PT Kopitime Dot

Com.

Lee, I & Y.J.Shin (2018), Fintech: Ecosystem, Business

Model, Investment Decisions & Challenges, Business

Horizons, 61, pp 35 -46.

Renee, S. & Y. Li (2016), Fintech: Disrupting or

Constructing?: A Study of the Fintech Digital Banking

Start-ups on the Incumbent Retail Bank, Working

Paper from School of Management, Erasmus

University, pp. 1-31

Sembel, R. (2007), Mobile Content Broadcaster

Technology: Case Study of Firm Valuation, Lecturer

Notes from Doctoral Program Faculty of Business &

Economy Universitas Indonesia.

Taylor, B. W. (2015), Introduction to Management

Science, 12th ed, Prentice-Hall Chapter 8.

Assessing Mobile Content "Mobee" Business in Indonesia: For Case Study Data 2007 - 2014

17

APPENDIX

Figure 1: Microbrochure.

Figure 2: Micronewspaper.

Figure 3: Micromagazine.

Figure 4: Microcatalog.

Figure 5: ZONE portal & Discover.

Optimus Portugal.

Optimus extends their ZONE content offering to

customers by providing links to relevant mobile

content on the Internet.

Telfort (KPN) Netherlands

Telfort (KPN) Netherlands, 1.7 million

subscribers

Branded ‘ZapIt!’

Mix of off-portal and on-portal content

with age verification controls

Results

• Increase size of portal

• Increase content sales

• Higher data traffic

Alatto Technologies neil.flanagan@alatto.com

www.alatto.com

ICEBM Untar 2018 - International Conference on Entrepreneurship and Business Management (ICEBM) Untar

18