Co-movement in Asset Market: Does Global Financial Cycle Works?

Empirical Evidence in Indonesia

Sri Andaiyani and Saadah Yuliana

Faculty of Economics, Universitas Sriwijaya, Palembang, Indonesia

Keywords: global financial cycle, risk aversion, asset, stock

Abstract: The movement of global financial risk is more volatile and procyclical during US unconventional monetary

policy. Indonesia, as one of the important EMEs in the world, also received higher capital inflows. Asset

markets of home country is more vulnerable to global risk aversion movement. T herefore, this study

attempts to analyze the impact of global financial cycle on asset markets in Indonesia using Vector

Autoregressive model (VAR). The empirical findings of this study are twofold. First, Global financial cycle

has a significant effect on stock and exchange rate markets. This result is consistent with Indonesia as an

open capital account country that remain vulnerable to the global financial cycle. Second, robustness check

reveals strong evidence that co-movement in Indonesian’s asset markets is affected by global financial cycle

as proxy the VIX index.

1 INTRODUCTION

After financial crisis 2008, the central bank of

the United States, known as the Federal Reserve or

the Fed, injected the unprecedented amount of

liquidity through large-scale asset purchases

(LSAPs). Fluctuations in global financial condition

related to unconventional monetary policy in the

United States also made investors switched to other

investment assets in the emerging market economies

(EMEs) such as bond markets and stock markets. In

EMEs, Stock price and bond price have increased

during the economic recovery in advanced

economies. The ability of financial institutions to

keep the effects of risk in global markets determine

the performance of the financial institution. If the

financial institution in a country can control the

global risk arising from the developed countries, the

financial market conditions in developing countries

will be better. The financial market risks consist of

movements in interest rates, stock price index,

commodity price index, or the exchange rate. This is

supported by a statement from Fratzscher et al

(2013) that the global externality effects of monetary

policy decisions in developed countries do affect the

developing countries.

Figure 1: Global financial cycle (VIX Index)

Source: CBOE VIX index, Datastream

Movement of global financial risk is more

volatile and procyclical (figure 1). Asset markets of

home countries are more vulnerable to sudden rise in

global risk aversion. According to Rey (2015), there

is two global factor that drives the movements in

capital flows and asset prices across EMEs. The first

is the global financial cycle that reflects both

aggregate volatility of asset markets and degree of

risk aversion of markets. The second set of global

0,00

10,00

20,00

30,00

40,00

50,00

60,00

70,00

80,00

90,00

652

Andaiyani, S. and Yuliana, S.

Co-movement in Asset Market: Does Global Financial Cycle Works? Empirical Evidence in Indonesia.

DOI: 10.5220/0008443606520658

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 652-658

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

factors is US monetary policy that has a significant

effect on cross-border credit flows. A tightening of

US monetary policy leads to increase global risk

aversion, a fall in cross-border lending and a fall in

asset prices at the global level (Miranda-Agrippino

and Rey, 2015).

Indonesia, as one of the important EMEs in the

world, has received higher capital flows since the

global financial crisis. Capital inflows could have a

significant effect on asset prices, including property

prices (Falianty, 2016). Nevertheless, there are no

empirical studies of the spillover effect from the

global financial cycle to Indonesian’s asset markets.

Therefore, this research attempts to analyze the

effect of the global financial cycle on asset markets

in Indonesia. In this study, the Indonesian asset

markets financial markets, comprising the exchange

rate market, the stock market, and the bond market

are considered.

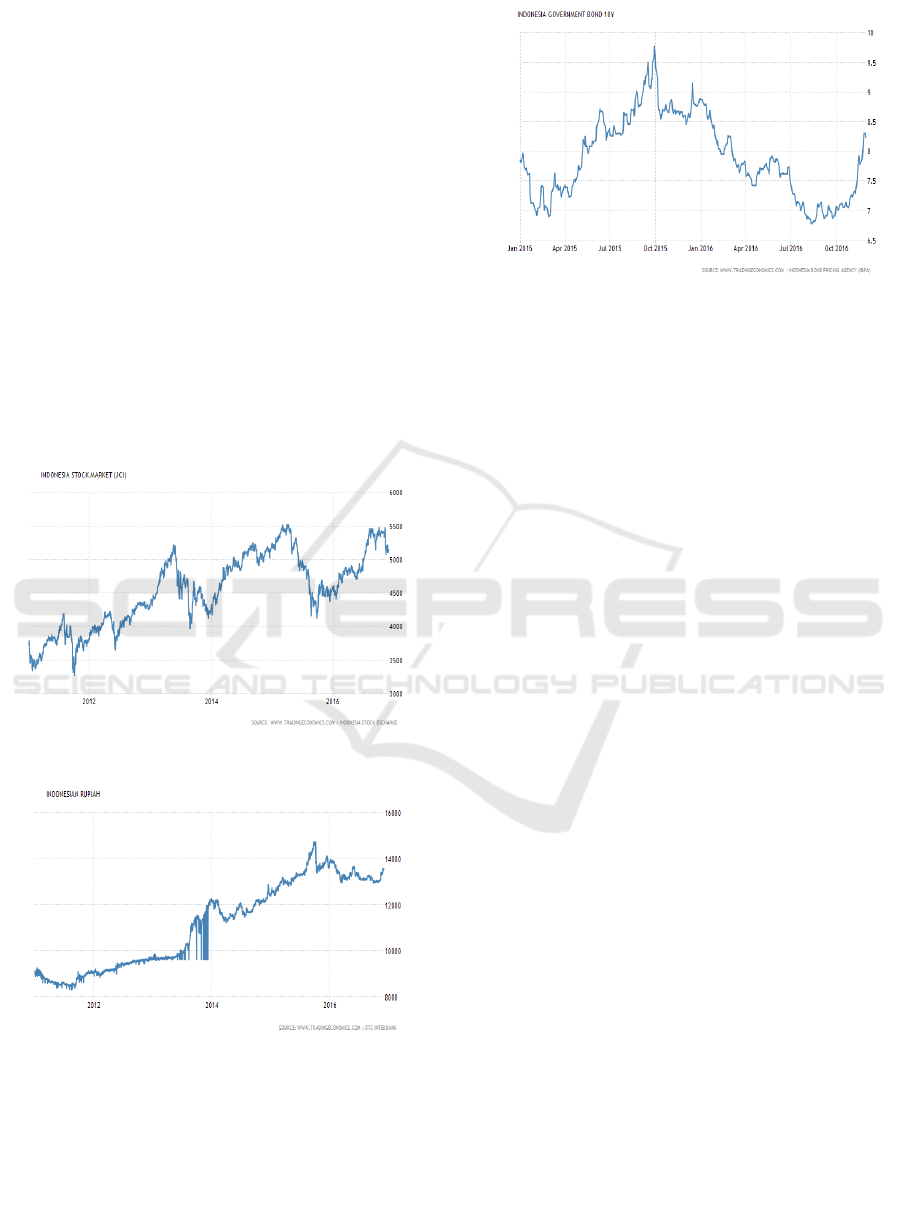

Figure 2: Asset Markets in Indonesia

Source: Datastream

Recent studies on global financial cycle argued

that global financial risk may have the impact on

asset markets. Miranda-Agrippino and Rey (2015),

Banerje, Devereux and Lambardo (2016) and Rey

(2015) argued that global financial factor explains

the important role of the variance of a large cross-

section of returns of risky asset price around the

world. Other studies that global risk sentiment has a

significant effect on fragile five asset markets. When

market sentiment deteriorates, equity prices fall and

local currencies depreciate, while LC government

bond yields and sovereign CDS prices increase

(Yildirim, 2016).

One of the contributions of this study is to give

more information about the transmission of the

global financial cycle to Indonesian’s asset markets.

The transmission of global financial cycle provides

an overview of investor’s sentiment in asset markets.

Besides, I employ data frequency using weekly and

monthly data to see whether the global financial

cycle has a deferent impact or not on asset markets.

An important question in this study is whether this

increased co-movement of global financial risk

provides evidence of contagion. Defining contagion

as a significant increase in cross-country co-

movement of asset returns (Dungey and Gajurel,

2014).

2 LITERATURE REVIEW

Blanchard et al. (2010) explain that an increase

in global financial risk was an important channel

through which the crisis was propagated to emerging

economies. The empirical studies from Longstaff et

al. (2011) suggest that global factors explain a large

fraction of the variation in the international interest

Co-movement in Asset Market: Does Global Financial Cycle Works? Empirical Evidence in Indonesia

653

rate. The recent study by Yildirim (2016) also shows

that global financial risk factors have hit the asset

markets in the emerging fragile five countries.

Global financial risk aversion has sharply increased,

the exchange rate of local currencies depreciated,

government bond yield and country risk premium

also increased significantly, but stock prices

decreased.

Recent studies have investigated the effects of

the global financial cycle to asset markets and

macroeconomic conditions. Using two analytical

approaches – turning-point analysis and frequency-

based filters, Drehmann, Borio and Tsatsaronis

(2012) find that global financial cycles are best

captured by combinations of credit and property

prices, while equity prices do not fit the picture well.

The theory that explains the transmission of the

global financial cycle to asset market in EMEs

country is international investor risk appetite due to

market imperfections or the behavior of international

investors. Information asymmetries make investors

more uncertain about the actual economic

fundamentals of a country (Dungey and Gajurel,

2014). Falianty (2016) discuss the impact of capital

flows on the property market and the impact of

macroprudential policies represented by Loan to

Value (LTV) regulation on the property market in

Indonesia. She finds the significance of GDP to

Property Price Index (PPI). Capital flows (CF) and

LTV regulation have not significantly affected the

property price index, even for CF have the

marginally significant effect to PPI.

Yildirim (2016) provides theoretical framework

between global financial risk, capital inflows, and

EMEs asset prices. The result finds that global

financial risks depend on the strength of a country’s

macroeconomic conditions. In other words, these

impacts vary across asset classes and countries.

Some researchers focus on the risk-taking channel of

monetary policy to explain these links. In this case,

Bruno and Shin (2015) build the model by focusing

on the functioning of this channel via the banking

sector. The model suggests that movement in US

unconventional monetary policy are transmitted

internationally via shifts in global risk aversion,

which drive the asset prices in EMEs by affecting

leverage of financial intermediaries, bank lending,

and thereby, portfolio inflows into their economies.

Other studies from Lizarazo (2013) develops a

model for small open economies taking into account

risk-averse international investors with decreasing

absolute risk-aversion preferences, which is

consistent with the typical features of investors in

EM financial markets. The model provides a

possible mechanism to explain the links between

investors' characteristics (risk aversion and wealth),

capital inflows to EMs, and EM asset prices, notably

sovereign risk premiums and bond prices. Based on

the mechanism, as international investors become

more risk-averse, sovereign CDS prices move higher

while capital inflows to EMs and their bond prices

decrease (Yuldirim, 2016).

3 THEORETICAL FRAMEWORK

Since financial crisis, asset markets in the world

have become increasingly integrated with large

portfolio flows. But Global banks, namely asset

managers, have an important role in the process of

internationalization. This study follows theoretical

model from Miranda-Agrippino and Rey (2015).

They explain a theoretical framework in

international asset pricing where the risk premium

depends on the wealth distribution between

leveraged global banks and asset managers that have

more fund. It can help to interpret the data in the

best way.

Miranda-Agrippino and Rey (2015) assume that

there are two types of investors: global banks and

asset managers. Global banks are affected entities

that fund themselves in dollars because they operate

in the global capital markets. They can borrow at a

rate of US risk-free rate and a lever to buy risky

assets in dollars. Investors are risk neutral with

constraints Value-at-Risk (VaR) and will then be

imposed the rules. Risk neutrality is an extreme

assumption that might justify the fact that investors

benefit from a guarantee, either because they are a

universal bank that is part of the guarantee scheme,

or because the risk of failure is greater.

Asset managers hold a portfolio of regional

assets which are non-tradable assets in the financial

markets. It can occur due to asymmetric information.

Miranda-Agrippino and Rey (2015) stated that any

global bank will maximize expected yields to be

obtained from a portfolio of risky assets held by the

constraints Value-at-Risk. Risk values define the

upper limit predicted the number of banks suffered

losses in the portfolio. Another research from Adrian

and Shin (2014) shows the value of risk is taken out

of proportion to the standard deviation of the bank's

portfolio risk. Global banks choose portfolio as

follows;

)

s.t V a

≤

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

654

states vector of excess return of all risky

assets traded in the world. Risky assets are all

tradable securities such as equities and corporate

bonds. Portfolio securities of global bank portfolios

expressed

and

is the equity of the bank.

V a

= α

By following Lagrangian optimization problems

of literature Miranda-Agrippino and Rey (2015)

sought its First Order Conditions of the obtained

solution to asset demand is

. (1)

Equation (1) shows the average portfolio

allocation of the investor.

is a Lagrange multiplier

symbol. VaR constraint has the same role as risk-

averse. Furthermore, asset managers are average

standard variance of investor. They have the same

access to the assets traded by global banks. The

owners of assets are also invested in local assets

(regional) that were not traded. Asset managers

chooses their portfolio of risky assets by

maximizing:

indicate the vector of portfolio weights of the

asset managers in tradable risky assets. While

as a

fraction of their wealth that is invested by asset

managers in their regional assets. Vector of excess

returns on investments that are not traded expressed

by

, and

I is an equity of asset manager.

Therefore, the selection of optimal portfolio in risky

securities that can be traded at risk for asset

managers, namely:

(

. (2)

4 METHODOLOGY AND

DATASET

4.1 Empirical Method

Some literatures employ a Vector Autoregressive

(VAR) model to test the effects of global financial

cycle on asset markets in EMEs. Yildirim (2016)

employs VAR model especially Structural VAR

(SVAR) to analyze the impact of global financial

shock on fragile five asset markets. On the other

hand, VAR model can capture the dynamic

interaction between monetary policy, risk aversion

and uncertainty, leverage and credit flows (Rey,

2015; Akinci, 2013).

Following previous empirical model, this study

also employs VAR model to analyze the effects of

global financial cycle on Indonesia’s asset market

using daily data. This estimation techniques

preceded by several standard measures such as

stationary test or stationary stochastic process (Ajija

et.al, 2011) and determination of the optimal lag

with lag order selection criteria. Sims (1980) states

that if there is a simultaneous relationship between

variables observed, the variables should be treated

equally, no more endogenous and exogenous

variables. The VAR is used to prove an economic

theory or to find theoretical foundations from a

shock (Bilmeier and Bonatot, 2002).

VAR Model

The specification of the VAR model in reduced

form is,

Where

is a vector with all variables;

is a

contemporaneous relation among variables; A (L) is

a finite-order matrix polynomial with the lag

operator L;

is a vector of structural disturbance;

and B is a non-zero diagonal matrix. Basically, there

are several ways to place restrictions on the VAR

model, such as long run restriction, impact, and sign

restriction. This restriction helps to identify the

models and to insert the basic theory into the model.

4.2 Dataset

To investigate the response of Indonesian’s asset

prices to global financial risk shocks, this study

focuses on daily data from January 2, 2006 to

October 30, 2016. Using daily data can capture the

spillovers of external financial shocks on Indonesian

asset markets because high frequency daily data give

more information and more precise analysis.

However, lower data frequencies, like those of

weekly and monthly, are used in the literature as

follows Yilidrim (2016).

The data were obtained from Thomson Reuters

DataStream. The unit of measurement of the data

used is quite varied. Asset markets in this study are

divided to three markets. It includes exchange rate

Co-movement in Asset Market: Does Global Financial Cycle Works? Empirical Evidence in Indonesia

655

market, bond market and stock market. For

exchange rate market, I use Indonesian rupiah to US

dollar. Then, I use 10-year government bond yield to

capture the effect of global financial cycle to bond

market. For stock market, I employ Indonesian

Stock Exchange (IDX). Moreover, the VIX index is

used to proxy global financial cycle. All variables

are measured in logarithms except for the

government bond yields., which is expressed in

percentages.

5 EMPIRICAL RESULT

In this section, empirical result will be

discussed. The testing procedure conducted to test

the data stationarity is Augmented Dickey-Fuller test

(ADF). From stationary testing, the results obtained

indicate that all variables are stationary at first

difference except VIX index. Furthermore, the

estimated VAR model followed by determining

optimal lag length in model. Determination of the

optimal lag length is important in modeling the

VAR. If the optimal lag entered is too short, it could

not explain the dynamism of the whole model. The

test results of lag length in the VAR is 2.

Table 1: Unit Root Test

Level

First Difference

VIX

-3.95401

***

-

JAKCOMP

-2.545979

-25.29732

***

GbYield

-1.626074

-20.51981

***

EXRATE

-0.268953

-31.47800

***

Note: The test critical value for 1%, 5%, and 10%

significance level are -3.478, -2.882, and -2.578

respectively. ***, **, * denote significance at 1%,

5%, 10%, respectively.

Further testing is cointegration test by Johansen

cointegration test (Johansen Test of Cointegration)

to test whether there is a long-term relationship in

the analysis that will use the VAR model. Testing is

done by comparing the value of the Max-eigen value

statistic with critical value at α = 5%. Based on the

value of the Max-eigen value statistic on Johansen

cointegration test (See Table. 2), it can be concluded

that there is no cointegration relationship among the

variables in the long term. Furthermore, I estimate

the data with VAR model. The analysis of the VAR

model in this study can focus on relationship of asset

markets variable with VIX index.

Table 2: Unrestricted Cointegration Rank Test (Maximum Eigenvalue)

Hypothesized

Max-Eigen

0.05

No. of CE(s)

Eigenvalue

Statistic

Critical Value

Prob.**

None

0.170125

28.15859

30.81507

0.1021

At most 1

0.121005

19.47533

24.25202

0.1891

At most 2

0.094104

14.92338

17.14769

0.1024

At most 3

0.003401

0.514492

3.841466

0.4732

Trace test indicates 1 cointegrating eqn(s) at the 0.05 level

* denotes rejection of the hypothesis at the 0.05 level

**MacKinnon-Haug-Michelis (1999) p-values

By estimating VAR on daily data, this study

indicates that asset markets in Indonesia are affected

by global financial cycle. These markets are more

vulnerable with capital inflows that related to global

financial cycle. A sharp increase in global financial

risk during this period decreased stock price and

depreciated Indonesian currency. However, global

risk aversion does not have effect on government

bond yield. Consequently, Indonesia must offer high

coupon rates on government bonds to attract investor

appetite. As the result, global financial cycle shock

has a significant impact on Indonesian’s asset

markets. Global financial cycle has a positive and

significant effect on exchange rate market. It is

relevant with flexible exchange rate regime which is

applied in Indonesia. As in countries with more

flexible regime in exchange rate, the effect of global

financial cycle on exchange rate volatility can be

quite large (Ananchotikul and Zhang, 2014). The

VAR estimation results may not provide a

comprehensive analysis because the evidences that

examine a significant relationship among the

variables are very limited.

Hence, this study employs the Impulse Response

Function (IRF) to examine the impact of shock of

innovation variable to other variables. The

estimation using the assumptions that each of

innovation variables do not correlate with one

another, so that a shock effect may be direct.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

656

Besides, being able to determine the effect and

duration of the shock, the IRF approach can also be

used to determine how long the shock effect will

end. Figure of impulse response will show a

response of a variable due to shock from other

variables until some period after the shock. If figure

of impulse response shows the movement that

getting closer to the point of equilibrium

(convergence) or return to the previous equilibrium,

it means that the response of variable of a shock will

disappear, so that the shock does not leave a

permanent effect on these variables. Figure 2

presents the response global financial cycle shock on

asset prices in Indonesia. It shows the response

Indonesian’s asset markets variables to a 1-standard

deviation increase in global risk aversion (i.e., a1-

standard deviation increased in the VIX). due to

more simpler and the result of estimation relatively

similar with least square regression model.

Global financial cycle does not have any effect

on 10-year government bond yield. Investors are not

interested to Indonesian government bond yet. To

attract investors' appetite, Indonesia had to offer

expensive coupons for its sovereign bonds

through Finance Ministry Regulation No.

91/PMK.010/2016 in May 2016. Moreover, high

coupon rates on government bonds also influence

Indonesia's corporate bond yields as investors are

not interested in corporate bonds that carry a

significantly lower coupon rate compared to the

government bonds (corporate bonds tend to use the

government bond yield as reference).

1.3

1.4

1.5

1.6

1.7

1.8

1.9

2.0

1 2 3 4 5 6 7 8 9 10

Response of CBOEVIX to CBOEVIX

-5

0

5

10

15

20

1 2 3 4 5 6 7 8 9 10

Response of D(EXRATE) to CBOEVIX

-.01

.00

.01

.02

.03

.04

1 2 3 4 5 6 7 8 9 10

Response of D(GBYIELD) to CBOEVIX

-16

-12

-8

-4

0

4

1 2 3 4 5 6 7 8 9 10

Response of D(JAKCOMP) to CBOEVIX

Response to Cholesky One S.D. Innovations ± 2 S.E.

Figure 3: Impulse response function

By contrast, the global financial shock has a

positive and significant impact on LC government

bond yields in five fragile emerging economies-

Brazil, India, Indonesia, South Africa, and Turkey

(Yildirim, 2016; Ananchotikul and Zhang, 2014).

Historically, the Indonesia Government Bond 10Y

reached an all times high of 20.76 in October of

2008 and a record low of 4.99 in February of 2012.

The other empirical evidence shows that Indonesian

stock markets are affected by the global financial

cycle. This finding is consistent with Yldirim

(2016), Ananchotikul and Zhang (2014), Chudik and

Fratszcher (2011) that global financial risk caused a

decline in stock prices. Particularly, the effect of the

global factor on stock market volatility is correlated

with the financial openness of the country, as

measured by total financial liabilities as a percent of

GDP. The more exposed a country is to external

fund flows, the greater is the volatility spillover

deriving from higher global risk aversion to the

domestic equity market.

This study clearly appears that an increase in

global financial risk is acknowledged by investor

sentiment in EMEs especially in Indonesia. This

result is consistent with Indonesia as an open capital

account country that remains vulnerable to the

global financial cycle. In addition, the VIX index as

a representative of the global financial cycle tends to

boost a tightening monetary policy (Miranda-

Agrippino and Rey, 2015).

Robustness checks

In this part, to have the strong analysis of these

findings, I employ the robustness check using the

same model but different data frequencies including

weekly and monthly data. Yildirim (2016) argued

that there is an emerging consensus that data

frequency matters in examining the link between

financial variables. Therefore, I check whether the

difference of data frequency has a similar impact to

the empirical result of recent literature.

This study estimates the VAR model with

weekly and monthly data to check whether these

findings depend on the data frequency or not. The

empirical results are similar to the previous result

with daily data in this study. These results confirm

that the global financial cycle has a significant

impact on Indonesian’s asset markets. Furthermore,

the Indonesian currency has depreciated when the

global financial cycle sharply increased.

6 CONCLUSION

This empirical results in this study support some

literature about the impact of the global financial

cycle on co-movement asset markets in EMEs.

By estimating VAR on daily data, this study

indicates that asset markets in Indonesia are affected

by global financial cycle. These markets are more

vulnerable with capital inflows that related to global

Co-movement in Asset Market: Does Global Financial Cycle Works? Empirical Evidence in Indonesia

657

financial cycle. A sharp increase in global financial

risk during this period decreased stock price and

depreciated Indonesian currency. But global risk

aversion does not have an effect on government

bond yield. Consequently, Indonesia must offer high

coupon rates on government bonds to attract investor

appetite. In addition, robustness checks in this study

are consistent with empirical findings on daily data.

This conclusion is consistent with the fact that

the Indonesian financial market is still strongly

affected by foreign financial markets, so if there is a

shock in the global financial market, that will easily

cause panic among domestic investors. Bank

Indonesia, as policymakers, send clear signals to

stand ready to supply the foreign exchange and at

the same time buy the bonds that foreign investors

wish to unwind, and thus avoiding herding behavior

and contagion of escalating capital reversals.

Moreover, the intervention is a way to bring about

the objective of monetary stability to be consistent

with maintaining financial system stability. By

stabilizing the foreign exchange market and

government bond market, the intervention helps in

stabilizing the overall financial markets.

Further research may extend this analysis by

giving more information about stance domestic

monetary policy that relates to global financial risk

aversion. To get more specific description associated

with the problem, the analysis of the data can also be

directed to the semi-quantitative method (a blend of

quantitative and qualitative methods), so that the

statistical facts can be synchronized with the

behavioral aspects.

REFERENCES

Ajija et al. 2011. “Cara Cerdas Menguasai Eviews”.

Salemba Empat

Bilmeier and Bonatot. 2002. Exchange Rate Pass-Through

and Monetary Policy in Croatia. IMF Working Paper

WP/02/109.

Ananchotikul, N., Zhang, L., 2014. Portfolio flows, global

risk aversion, and asset prices in emerging markets.

IMF Working Paper WP/14/156 (August).

Akinci, Ö., 2013. Global financial conditions, country

spreads, and macroeconomic fluctuations in emerging

countries. J. Int. Econ. 91 (2), 358–371.

Banerjee, R, Michael B. Devereux dan Giovanni

Lombardo. 2016. Self-oriented monetary policy,

global financial markets and excess volatility of

international capital flows. Journal of International

Money and Finance 68 (2016) 275–297

Blanchard, O.J., Das, M., Faruqee, H., 2010. The initial

impact of the crisis on emerging market countries.

Brookings Papers on Economic Activity 41 (1), 263–

323.

Bowman, D., Londono, J.M., Sapriza, H., 2015. US

unconventional monetary policy and transmission to

emerging market economies. J. Int. Money Finance.

55, 27–59.

Dungey, Mardi, & Gajurel. 2015. Contagion and banking

crisis – International evidence for 2007–2009. Journal

of Banking & Finance. Vol. 60 (C) Pages 271-283.

Chudik, A., Fratszcher,M, 2011. Identifying the global

transmission of the 2007–09 financial crisis in a

GVAR model. Eur. Econ. Rev. 55, 325–339.

Drehmann, M, C Borio and K Tsatsaronis.2012.

Characterizing the financial cycle: don’t lose sight of

the medium term, BIS Working Papers No 380.

Ebeke, C., Kyobe, A., 2015. Global financial spillovers to

emerging market sovereign bond markets. IMF

Working Paper WP/15/141.

Falianty, Telisa. 2016. Capital Flows, Macro Prudential

Policy, and Property Sector, IJABER, Vol. 14, No. 10

(2016): 6935-6958.

Fratzscher, M., Lo Duca, M., Straub, R., 2013. On the

international spillovers of US quantitativeeasing. ECB

Working Paper No. 1557.

Longstaff, F.A., Pan, J., Pedersen, L.H., Singleton, K.J.,

2011. How sovereign is sovereign credit risk?

American Economic Journal: Macroeconomics 3 (2),

75–103.

Lizarazo, S.V., 2013. Default risk and risk averse

international investors. J. Int. Econ. 89 (2), 317–330.

http://dx.doi.org/10.1016/j.jinteco.2012.08.006.

Miranda-Agrippino, Silvia dan Rey H. 2015. World Asset

Markets and The Global Financial Cycle. NBER

working paper series.

Narayan, P.K., Ahmed, H.A., Narayan, S., 2015. Do

momentum-based trading strategies work in the

commodity futures markets? J. Futur. Mark. 35, 868–

891.

Rey, Hélène. 2015. Dilemma not Trilemma: The global

Financial Cycle and Monetary Policy Independence.

NBER Working Paper No. 21162

Setiawan, Budi. 2018. LASSO Technique Application in

Stock Market Modelling: An Empirical Evidence in

Indonesia. https://doi.org/10.29259/sijdeb.v2i1.%25p

Yildirim, Zekeriya.2016. Global financial conditions and

asset markets: Evidence from fragile emerging

economies. Economic Modelling 57 (2016) 208–22

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

658