Effect of Capital Expenditure, Investments and Human Development

Index to Gross Regional Domestic Product Provinces in Sumatera-

Indonesia

Didik Susetyo, Zunaidah, Anna Yulianita and Wulan Lestari

Department of Economics Faculty, Sriwijaya University

Keywords: Capital Expenditure, Investments, Human Development Index, GRDP.

Abstract: The purpose of this study is to analyze the effect of capital expenditure, investment (domestic and foreign)

and the human development index to GDP provinces in Sumatra Island. This study uses data 2007-2016

period were sourced from the official website of each relevant institutions namely the Directorate General of

Fiscal Balance, the Central Bureau of Statistics and the Investment Coordinating Board. The analytical

method used is the panel data regression and statistical tests. Based on panel data regression test results, it is

known that the effect of capital spending, investment, and human development index to GDP province is

simultaneous positive and significant effect. While the individual test result showed that capital spending is

positive but not significant effect; the Investment is significant and positive effect; and the human

development index is positive and significant impact.

1 INTRODUCTION

1.1 Background

Among the five bigest islands in Indonesia, one

of which is the island of Sumatra. Through policies

and programs of the government, every province in

Sumatra Island continue development ranging from

repair of roads, construction of bridges, construction

of school buildings and other public facilities.

Construction of this growing encouraging increased

government spending while also attracting investors

to make investment. If the construction is already

well underway, the human development index

numbers will also increase along with the welfare of

society has also increased so that it will encourage

economic growth.

Economic growth is defined as a long-term

increase in the ability of a country to provide more

and more kinds of economic goods to its citizens,

this ability to grow in accordance with the

advancement of technology, institutional and

ideological adjustments are needed (Jhingan, 2007:

57).

The relationship between economic growth and

government spending, or more generally the size of

the public sector, is government spending can boost

economic growth in the long term (Sodik, 2007: 27).

Budget areas listed in the Regional Budget

(APBD) portrait reflect local governments to

determine priorities related to programs and

activities that will be implemented in a budget year

(DJPK, 2015).

402

Susetyo, D., Zunaidah, ., Yulianita, A. and Lestari, W.

Effect of Capital Expenditure, Investments and Human Development Index to Gross Regional Domestic Product Provinces in Sumatra-Indonesia.

DOI: 10.5220/0008440704020412

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 402-412

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

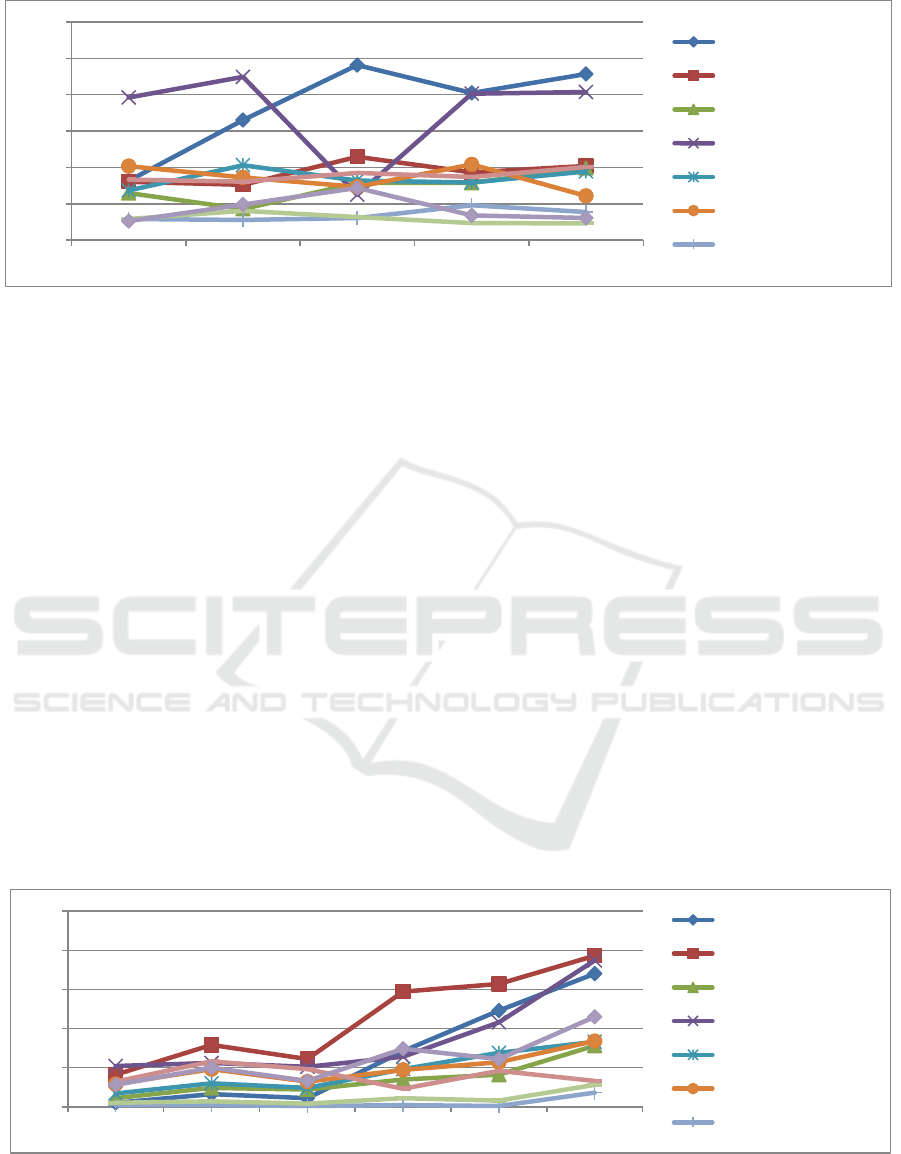

Source: Directorate General of Taxation and Finance, 2017

Figure 1: Actual Capital Expenditures by Province in Sumatra (billion rupiah) Year 2012-2016

Figure 1 illustrates the realization of capital

spending by province in Sumatra Island. The

highest capital expenditures made by Riau Province

in 2012 amounted to 1961.67 billion rupiah and the

lowest capital expenditure undertaken by the Riau

Islands province of 262.34 billion rupiah. From the

picture above we can see that capital expenditures

fluctuates.

These data relevant to result study of local

government district-city in Sumatra of (Susetyo et

al., 2017) that the influence of regional spending to

gross regional domestic product districts-cities is

positive and significant. The bigger local spending

will increase the gross regional domestic product

regencies-cities. Local spending is one form of

government investment to stimulate the local

economic growth.

According Sodik (2007: 8) the portion of capital

expenditures in the budget is a very important

component of expenditures for capital expenditures

will have a multiplier effect in moving the economy

of the area. Therefore, the higher the number the

better the ratio is expected to impact on economic

growth. Conversely, the lower the number, the less

the impact on economic growth.

In macroeconomic theory, in terms of

expenditure, gross regional income is the sum of

many variables including the investment. There are

some things that actually affect in terms of this

investment. Investment itself affected by foreign

and domestic investment. Investments are

happening in the area consists of public investment

and private investment. Investment from the private

sector can come from domestic and overseas

(foreign). The government investment is done in

order to provide public goods. The amount of

government investment can be calculated from the

difference between total government budget by

shopping routine. While private investment consists

of the Domestic Investment (DCI) and Foreign

Direct Investment (FDI), which helps speed

development.

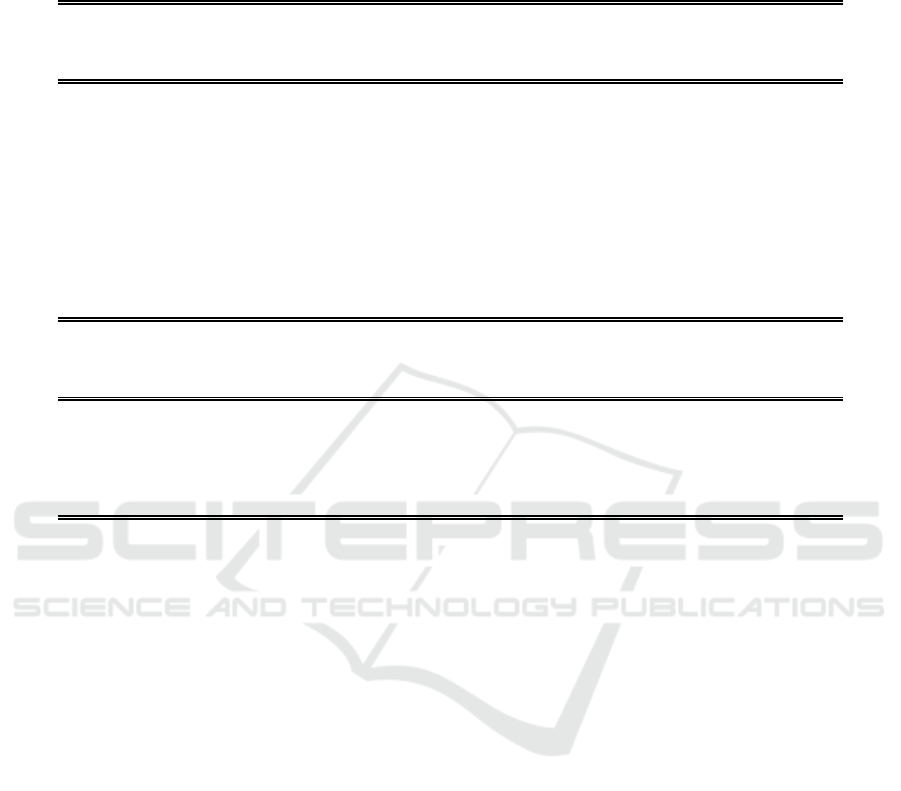

Source: Central Institution of Statistics, 2017.

Figure 2: Realization of Private Domestic Investment Projects by Province in Sumatra (units) Year 2010-2015

0

500

1000

1500

2000

2500

3000

2012 2013 2014 2015 2016

Aceh

Sumatera Utara

Sumatera Barat

Riau

Jambi

Sumatera Selatan

Bengkulu

0

50

100

150

200

250

2010 2011 2012 2013 2014 2015

Aceh

Sumatera Utara

Sumatera Barat

Riau

Jambi

Sumatera Selatan

Bengkulu

Effect of Capital Expenditure, Investments and Human Development Index to Gross Regional Domestic Product Provinces in

Sumatra-Indonesia

403

Figure 2 illustrates the condition of private

investment by the Province in Sumatra fluctuation.

The realization of domestic investment projects

(Domestic Investment) were highest in 2015 owned

by the Province of North Sumatra with a total

project cost of 193 units valued at 4.28 trillion

rupiah and the second largest is owned by Riau

Province for 187 projects worth 9.94 trillion rupiah.

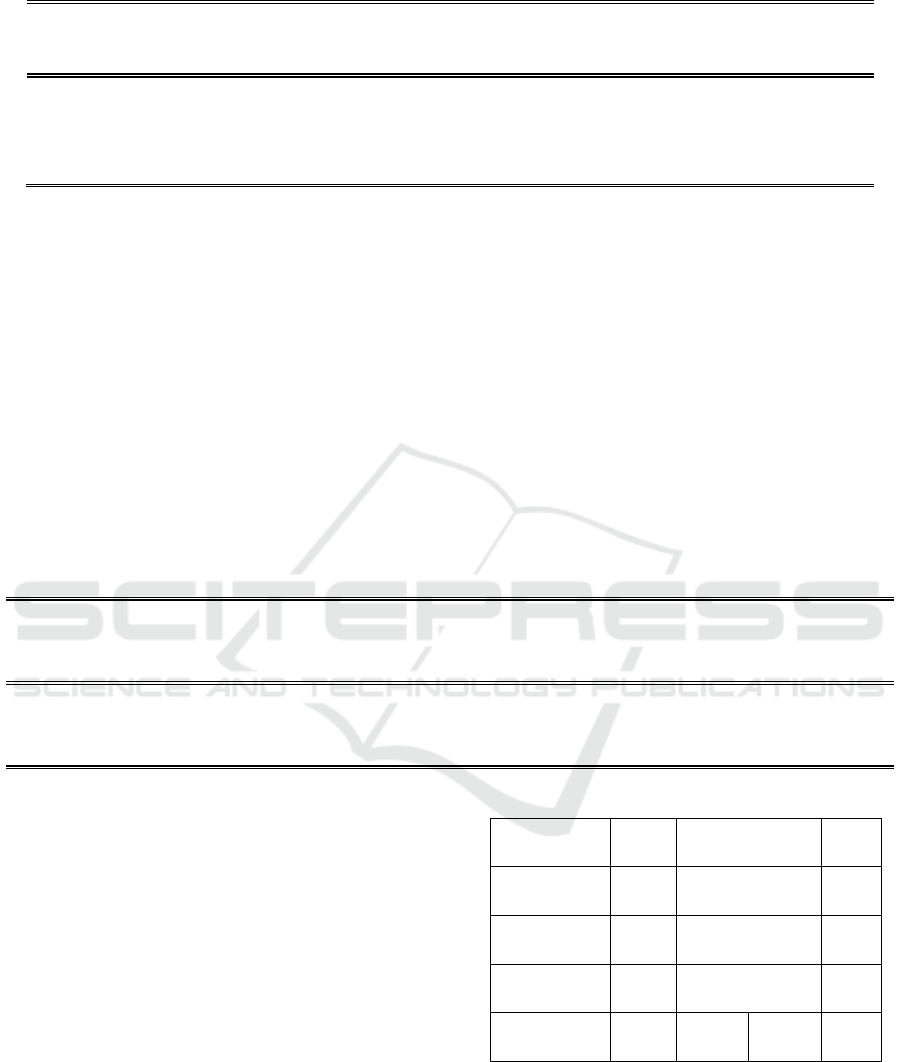

Source: Central Institution of Statistics, BPS, 2017

Figure 3: Realization of Private Investment Project PMA by Province in Sumatra(units) Year 2010-2015

Projectrealizationforeigninvestment (PMA) were

highest in 2015, isownedbythe Riau

Islandsprovinceunits as many as 594 projectsworth

640 million US thedollarlater in

thesecondpositionheldbyNorth Sumatra

provinceunits as many as 438 projectsworth 124.6

million US dollars.

Development is one way to improve the quality

of life for the creation of prosperous societies. The

government continues to development in all aspects,

aspects of education, health and a decent life. To

measure the success of the development, one of the

indicators that can be used is the Human

Development Index (Melliana and Zain, 2013: 23).

Table 1: Human Development Index by Province in Sumatra 2011-2015 Year

Provinsi

Tahun

2011

2012

2013

2014

2015

Aceh

72.16

72.51

73.05

73.16

74.28

Sumatera Utara

74.65

75.13

75.55

76.28

76.75

Sumatera Barat

74.28

74.70

75.01

75.25

76.15

Riau

76.53

76.90

77.25

77.56

78.65

Jambi

73.30

73.78

74.35

74.75

75.13

Sumatera Selatan

73.42

73.99

74.36

74.56

75.25

Bengkulu

73.40

73.93

74.41

74.25

75.16

Lampung

71.94

72.45

72.87

73.35

73.13

Kep. Bangka Belitung

73.37

73.78

74.29

74.85

75.35

Kep. Riau

75.78

76.20

76.56

77.24

77.65

Source: CentralInstitution of Statistics (BPS), 2017.

Human Development Index is one measure that

can be used to assess the quality of human

development, both in terms of its impact on the

physical condition of the human being (health and

welfare) as well as non-physical (education) ,

Because in the calculation of life expectancy index,

education index, and the index of decent living

standards involving components of economic and

non-economic quality of education, health and

population, the HDI deemed relevant to be the

benchmark in determining the success of

development (Melliana and Zain, 2013: 237).

1.2 Research Problem

Based on the background description can be

formulated research problem as the following

issues:How does the effect of capital expenditure,

investment (domestic and foreign), and the human

development index to GDP provinces in Sumatra

Island?

0

200

400

600

800

2010 2011 2012 2013 2014 2015

Aceh

Sumatera Utara

Sumatera Barat

Riau

Jambi

Sumatera Selatan

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

404

The purpose of this study is to analyze the effect

of capital expenditures, investment (domestic and

foreign) and the human development index to GDP

provinces in Sumatra Island.

1.3 Benefits Research

This study is expected to provide of theoretical

and practical benefits as follows:

a. Theoretical Benefits: These results are expected

to enrich the research and can be used as a

benchmark for future studies both in the way of

analysis and the results of its analysis. As well

as for other students who may be learning and

assessment process by using disciplines have

been studied which can be used as a source of

data, information, as well as writing and

literature for further research activities.

b. Practical benefits of this research to provide

feedback or information materials for relevant

agencies for consideration or to contribute to

studies related to the effect of capital

expenditure, investment and human

development index on economic growth.

1.4 Theoretical Framework

Economic growth explain or measure the

achievement of economic development of

something. In economic activities, in fact, economic

growth means development of the physical

production of goods and services existing in the

country, such as increasing and the amount of

production of industrial goods, development of

infrastructure, increase the number of schools, the

increase of the production of the service sector and

an increase of the production of capital goods

(Sukirno, 2010: 423).

To explain the requirements that must be met for

a perokonomian can achieve steadfast growth or

steady growth in the long term, the analysis of the

Harrod-Domar use the analogy-analogy follows: (i)

capital goods has reached full capacity, (ii) savings

is proportional to the national income, (iii) capital-

output ratio(capital-outputratio)value, and (iv) the

economy consists of two sectors.

Harrod-Domar theory did not notice

requirements to reach full capacity when the

economy consists of three sectors or four sectors.

However it is based on the theory above can easily

be concluded things that need to apply if the

aggregate expenditure includes more components,

which include government spending and exports. In

such circumstances, capital goods that increase can

be fully used if the AE

1

= C + I

1

+ G

1

+ (XM)

1

where

I

1

+ G

1

+ (XM)

1

isequal to (I+∆I). Through analysis

of the Harrod-Domar can be seen that (i) the long-

term growth of aggregate expenditure prolonged

need to be accomplished to achieve economic

growth, and (ii) economic growth firm would only

be possible if I + G + (XM) continuously increases

with the level of encouraging (Sukirno, 2010: 435).

Wagner put forward a theory about the

development of greater government spending in the

percentage of the GNP which is also based on the

observation well in European countries, the USA

and Japan in the 19th century. Where is Wagner is

the development of government spending in relative

terms, the law of Wagner is in an economy, when

per capita income increases, in relative terms in

government spending will increase

(Mangkoesoebroto, 2001: 171).

Another thing with the theory of Peacock and

Wiseman, the theory is based on an analysis of

government expenditure reception. The government

always tries to enlarge its expenditure by relying

increase tax revenue, but people do not like paying

taxes to finance government expenditures are

growing. Increased tax revenues caused government

spending also increased. Under normal

circumstances the increase in GNP led to greater

government revenues, as well as government

spending becomes larger (Mangkoesoebroto, 2001:

173).

Government spending is one component of

expenditure, then the higher government spending

will result in planned expenditures were higher for

all income levels. If the government spending rises,

the planned expenditure curve shifts upward. The

increase in government spending to encourage the

increase in revenue is greater. Fiscal policy has a

multiplier effectagainst earnings due according to

the consumption function C = C (Y - T), the higher

incomes lead to higher consumption. When the

increase in public spending increase revenues, it also

increases consumption, which in turn increases

income, and increase consumption, and so on.

Therefore, the increase in government spending lead

to a larger income (Mankiw, 2006: 277).

Empirical study has been done of capital

expenditure district-city in Sumatra by Susetyoet al.,

(2018) that the influence of local public utility of

capital expenditures toward GRDP districts-cities is

positive and significant. The greater the capital

expenditures for local public utilities will increase

the GRDP districts-cities in Sumatra. Capital

expenditure for public utility districts and cities into

Effect of Capital Expenditure, Investments and Human Development Index to Gross Regional Domestic Product Provinces in

Sumatra-Indonesia

405

one form of government investment can stimulate

local economic growth.

Human Development Index (HDI) is a measure

for the impact of development performance area that

has a very large dimensions, because it shows the

quality of the population of a region in terms of life

expectancy, education and decent living standards.

HDI is a composite index calculated as the average

of the three indices that describe the basic human

capacity to expand the choices, the life expectancy

index, education index, and a decent standard of

living index (CBS, 2008).

Education and health are fundamental

development objectives; health education and each

also has an important meaning. Health is very

important for well-being, and education are essential

for a satisfying and rewarding life; both are

fundamental in relation to the broader notion of the

improvement of human capability as the core

meaning of the actual construction. At the same

time, education plays an important role to improve

the ability of developing countries to absorb modern

technology and develop the capacity for the

realization of sustainable growth and development.

Moreover, health is a prerequisite for increasing

productivity, and educational success is also

dependent on adequate health. Thus, health and

education can also be seen as a component of a vital

growth and developmentas an input for the

aggregate production function. Their dual role as

input and output at the same time make the health

and education is very important in economic

development (Todaro, 2009: 445).

2 RESEARCH METHODS

The scope of this study to discuss the effect of

capital expenditure, investment (domestic and

foreign) and the human development index to GDP

provinces in Sumatra Island. The study covers ten

provinces, such asNangroAceh Darussalam, North

Sumatra, West Sumatra, Riau, Kepulauan Riau,

Jambi, Bengkulu, South Sumatra, Bangka Belitung,

and Lampung. The data used in this research is panel

data which istime series and a cross-section 2007 to

2016 period.

2.1 Types and Sources of Data

The data used in this research is quantitative data

by category of secondary data.The panel data are

combined between time series and cross- section

dataof the years 2007-2016. The sources of

secondary data were obtained fromwebsite of the

officialthe Statistic Central Institution, the

Directorate General of Taxation and Finance, and

Investment Coordinating Board of Indonesia.

2.2 Method of Analysis

Regression analysis with panel data can be done

in several steps (Yamin, et.al,2011: 200): (a) Pooled

Least Squares Models; (b) Fixed Effects Model

(Least Squares Dummy Variables); )c) Random

Effects Model (REM).

Selection of modelestimationapproaches use the

data panel is determined by using two ways: (1)

Chow test, can be used to decide to use Pooled OLS

Model or Fixed Effects Model (FEM).If the p-value

cross section F <0.05, H

0

isrejected. (2) Hausman

test, can be used to decide using the Fixed Effects

Model (FEM) or Random Effects Model (REM).If

the p-value Chi-square cross section <0.05, H

0

isrejected.

Hypothesis testing is done to see the significance

of parameters by using: (1) F-test or simultaneously

test used to prove the hypothesis that the overall

coefficient simultaneously regression significant

influence in determining the value of the dependent

variable. If the entire value of the regression

parameter is equal to zero, it can be said that there is

no linear relationship between the dependent

variable and independent variables. (2) t-test or test

each partial variable. Testing using t-test aims to see

the level of significance of the effect of each

independent variable assuming the other

independent variables held constant. If the value of

the t statistic <t table, then the zero hipotetsis

accepted. This means between independent and

dependent variables did not affect significantly.

Conversely, if the value of the t statistic> t table,

then hipotetsis zero is rejected, in other words, the

alternative hypothesis is accepted, which means

significant independent variable on the dependent

variable.

3 RESULT AND DISCUSSION

There are three techniques fundamental approach

used in estimating the regression model with panel

data, namely: (a) Model Pooled Least Square;(b)

Fixed Effect Approach Model and (c) Random

Effect Approach Model.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

406

Estimation Results Regression with Method

Pooled Least Square

The calculation results using a panel data

regression modeling techniques Pooled Least Square

asthe following.

Table 2: Estimation Results Regression with Method Pooled Least Square

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

-1546084.

354489.5

-4.361439

0.0000

BM

39.37229

12.05299

3.266600

0.0015

I

8.755284

1.308530

6.690932

0.0000

IPM

21655.37

4828.812

4.484617

0.0000

R-squared

0.651486

Mean dependent var

138859.9

Prob(F-statistic)

0.000000

Based on estimates presented in Table 2 can be

seen that the Capital Expenditure (BM) has a

coefficient value of 39.37229 and the probability of

0.0015.It is claimed that there is positive and

significant, while Investment (I) have a coefficient

of 8.755284, which means positive and significant

impact with the probability 0.0000. From the

estimation can also be seen that the Human

Development Index (IPM) has a coefficient value of

21655.37 and probability of 0.0000, which means

positive and significant impact. With a coefficient

value of -1546084 which assumes that the value of

the intercept between individuals are considered

equal where this is the assumption that severely

limit, so themethods Pooled Regression can not

catch the real picture on the relationship between the

dependent variable with independent and too simple

to describe the phenomenon which exists. Therefore

thing to do is to process the data using Fixed Effect.

Estimation Results Regression with Method

Fixed Effect

Panel regression output results with Fixed Effect

methods can be seen in the Table.

Table 3: Estimation Results Regression with Method Fixed Effect

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

-2332434.

374835.0

-6.222562

0.0000

BM

19.28110

15.66544

1.230805

0.2217

I

3.773998

1.265323

2.982636

0.0037

IPM

32858.29

5157.132

6.371426

0.0000

Effects Specification

Effect of Capital Expenditure, Investments and Human Development Index to Gross Regional Domestic Product Provinces in

Sumatra-Indonesia

407

Cross-section fixed (dummy variables)

R-squared

0.837207

Mean dependent var

138859.9

Adjusted R-squared

0.814753

S.D. dependent var

128240.9

S.E. of regression

55195.33

Akaike info criterion

24.79588

Sum squared resid

2.65E+11

Schwarz criterion

25.13455

Log likelihood

-1226.794

Hannan-Quinn criter.

24.93295

F-statistic

37.28511

Durbin-Watson stat

1.000954

Prob(F-statistic)

0.000000

Coefficient Capital Expenditure (BM) of

19.28110 showsthatthereis a positivecorrelationtothe

GDP with a probabilityvalueCapital

expenditureamountedto 0.2217 where 0.2217

isgreaterthanalpha 5

percentsothattheindependentvariableis not

significanttothe GDP. Investment (I) is also a

positive influence on the GDP with acoefficient of

3.773998 and probability of 0.0037, which means

investing significantly affect the GDP due to the

probability value is greater than alpha 5 percent.

Similarly, the HDI has a coefficient of 32858.29,

meaning IPM positive effect on the GDP. HDI has a

probability of 0.0000. This indicates that the HDI

significantly affect the GDP.

R-squared value of 0.837207 indicates

thatthevariable Capitalexpenditure (BM), investment

(I) and HDI are abletoinfluencethe GDP amountedto

83.72 percentandtheremaining 16.28

percentisexplainedbyothervariables.

Results Regression Estimation Method with

Random Effect

Table 4: Estimation Results Regression with Method Random Effect

Variable

Coefficient

Std. Error

t-Statistic

Prob.

C

-2154363.

352822.1

-6.106089

0.0000

BM

27.53116

14.05931

1.958215

0.0531

I

4.691863

1.209599

3.878858

0.0002

IPM

30295.58

4835.968

6.264636

0.0000

Effects Specification

S.D.

Rho

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

408

Cross-section random

54301.61

0.4918

Idiosyncratic random

55195.33

0.5082

Weighted Statistics

R-squared

0.583770

Mean dependent var

42492.87

Adjusted R-squared

0.570763

S.D. dependent var

85657.94

S.E. of regression

56119.82

Sum squared resid

3.02E+11

F-statistic

44.88059

Durbin-Watson stat

0.932240

Prob(F-statistic)

0.000000

Unweighted Statistics

R-squared

0.605792

Mean dependent var

138859.9

Sum squared resid

6.42E+11

Durbin-Watson stat

0.523153

Based on estimates using Random Effectmethod

it is known that the R-squared value of

0.583770,meaning that 58.37 percent of the GDP

variable is affected bythevariable Capitalexpenditure

(BM), investment (I) and IPM andtheremaining

41.63 percentisinfluencedbyothervariables.

In the method of Random Effect, Capital

Expenditure (BM) has a coefficient of 27.53116,

means capital expenditure to GDP has a positive

relationship with probability equal to 0.0531. The

probability that results frommethod Random Effect

showed that the relationship between capital

expenditure in the GDP is not significant.

In contrast to the Investment (I) which has a

coefficient of 4.691863 and probability of 0.0002,

meaning that the investment has a positive and

significant relationship to GDP. Likewise with HDI,

the results of estimation usingmethod, Random

Effectresulting HDI coefficient of 30295.58,

meaning that there is a positive correlation to GDP

with a probability of 0.0000 which indicates that the

relationship is significant.

Chow Test (Common Effect vs. Fixed Effect)

Model selection with Common Effect or Fixed

Effect can be done by testing Likelihood Ratio Test

provided that if a significant probability value

generated by the α (alpha) then the decision could be

made by using a model FixedEffect. Selection of

panel data model using the Chow test, by comparing

the p-valueChi-square cross section of the

significance level of 0.05.Chow test in this study

carried out by meanstest Likelihood available on the

program

Table 5: Regression Results withChow Test

Redundant Fixed Effects Tests

Equation: ESTIMASI

Test cross-section Fixed Effects

Effect of Capital Expenditure, Investments and Human Development Index to Gross Regional Domestic Product Provinces in

Sumatra-Indonesia

409

Effects Test

Statistic

d.f.

Prob.

Cross-section F

11.028131

(9,87)

0.0000

Cross-section Chi-square

76.119880

9

0.0000

Based on test results known that the probability

of a Chi-square cross section of 0.0000 while

significant value α is 5 percent so that H

0

rejected

and H

1

accepted.

Hausman Test (Fixed Effects vs Random

Effect)

This test aims to compare methods Fixed Effect

and methods Random Effect. Hausman test is done

by comparing the p-value random cross section of

the significance level of 0.05. Hausman test on the

research carried out by means Hausman test

available. The test results can be seen in the

following table:

Table 6: Results of the Hausman TestRegression with

Correlated Random Effects - Hausman Test

Equation: ESTIMASI

Test cross-section Random Effects

Test Summary

Chi-Sq. Statistic

Chi-Sq. d.f.

Prob.

Cross-section random

6.242794

3

0.0104

From Hausman test known that probability

radom cross section of 0.0104 and less than the

significance level α which is 5 percent, so that the

decisions taken at this Hausman test is H

0

rejected

and H

1

accepted. Thus the election decision making

model estimation method used is the method Fixed

Effect.

The estimation result of the fixed effect model as

follow:

GDP = -2332434 + 19.28110 BM + 3.773998 I +

32858.29 IPM + e

(-6.222562) (1.230805) (2.982636)

(6.371426)

R-squared

0.83720

7

Mean dependent

var

138859

.9

Adjusted R-

squared

0.81475

3

S.D. dependent

var

128240

.9

S.E. of

regression

55195.3

3

Akaike info

criterion

24.795

88

F-statistic

37.2851

1

Durbin-Watson

stat

1.0009

54

Prob(F-statistic)

0.00000

0

Hypothesis Test

The F-test is a hypothesis test equipment to see if

together (simultaneously) the regression coefficient

of the independent variables affect the dependent

variable. F test can be seen by comparing the value

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

410

of the F-statistic with the F-table or by comparing

the F-statistic probability with a significance level (α

= 5%).

By the estimation results indicate that the

probability of an F-statistic showed a value of

0.000000, this means that the probability F-statistic

is less than 0.05 then H

0

is rejected. That is, it can be

concluded that the variable capital expenditure,

investment and human development index

significantly affect the GDP provinces in Sumatra

Island.

The student t-test a hypothesis test to see whether

partial regression coefficients of independent

variables affect the dependent variable. The t-test

can be seen by comparing the value of t-statistic

with t-table, or comparing the t-statistic probability

with a significance level (α = 5%).

By the estimation results indicate that the t-

statistic variable capital expenditure amounted to

1.230805,where the value of t-statistic is smaller

than t-table(1,230 805 <2.353), then H

0

is received,

which means that the variable capital expenditure

does not significantly influence the GDP provinces

in Sumatra Island. In addition, the probability of a t-

statistic on the t-test is at 0.2217,where the value is

greater than 0.05 (t-statistic 0.2217>0.05).

Investment variable has a value of t-statistic of

2.982636,where the value of t-statistic greater than t-

table (2.697663> 2.353), then H

0

is rejected, which

means that the investment variables significantly

influence the GDP provinces in Sumatra Island. In

addition, the probability of a t-statistic on the t-test is

at 0.0037,where the value is less than 0.05 (t-statistic

0.0037 <0.05).

From the estimation, it is known that the human

development index variable has a value of t-statistic

of 6.371426, where the value of t-statistic greater

than t-table (6.371426>2.353) then H

0

isrejected, it

means a significant effect on the human

development index to provinces in Sumatra Island. It

can also be seen from the t-statistic probability of

0.0000 which is smaller than the significance level

of 0.05.

The result of the study has some implications

related to the theory of regional growth. Based on

the estimated model which the effect of the capital

expenditure, investments, and human development

index has significant to gross domestic product

province in Sumatra. The coefficient determination

of fixed effect models about 83.72 percent. It means

all variable independent can explain significantly to

the dependent variable and the residual explained by

others variables about 16.28 percent such as

improving public facilities in infrastructure,

education, and health expenditure will improve

human quality.

Some of implications on the policy by

maintaining the stability of the economy, politics

and security in the country, improve the facilities

and infrastructure which support the projects, and

making simplify the rules in investing program. For

the purposes of further research is that the study

should be extended by using proxy of variables so

that the estimation model can be used to advance the

provinces in Sumatra.

4 CONCLUSIONS

ANDRECOMMENDATIONS

Based on the analysis and discussion above, it

can be taken some conclusions such as:

1. The effect of capital spending, investments,

and human development index to GDP

province is simultaneously positive and

significanteffect.

2. The partial estimation that capital expenditures

have a positive relationship to the GDP but

partially no effect significantly to

GDPprovince.Investment (domestic and

foreign) have a positive relationship to the

GDP provinces in Sumatra Island. Human

development index has a positive relationship

to the GDP provinces in Sumatra Island.

3. Coefficient of determination of fixed effect

method showed that capital spending,

investment, and human development index

explained significantly to the GDP province in

Sumatra. The residual explained by others

variables such as improving public

facilities,regionalinvestment climate,

education, and health expenditure will improve

human quality.

Based on the analysis, discussion, and

conclusions that have been presented, the

recommendation as follow:

1. The capital expenditure should be allocated

appropriately and proportionately to investment

projects whose benefits could be felt by the

people so that they can provide significant

impact on the growth of regional gross

domestic product.

2. The local government is expected to increase

investment Domestic Investment (DCI)

through a policy of maintaining the stability of

the economy, politics and security in the

country, improve the facilities and

Effect of Capital Expenditure, Investments and Human Development Index to Gross Regional Domestic Product Provinces in

Sumatra-Indonesia

411

infrastructure which support and simplify the

rules in investing so as to increase the GDP

provinces in Sumatra Island.

3. The local government is expected to attract

foreign investment by creating a climate

conducive to investment, simplification of the

licensing process, as well as improving the

quality of human resources so that the expected

value of Foreign Direct Investment (FDI) can

be increased and can push the GDP provinces

in Sumatra Island.

4. Government policies should be oriented

towards social welfare. By improving public

facilities in infrastructure, education and health

will improve human quality that the human

development index numbers will increase

which in turn will push the GDP provinces in

Sumatra Island.

REFERENCES

Jhingan, ML., 2007. Economic

DevelopmentandPlanning,King Grafindo Persada, Jakarta.

Mangkoesoebroto, Guritno, 2001. Public

Economics,Issue3, BPFE, Yogyakarta.

Mankiw, N. Gregory,. 2006. Makroekonomi,Edisi ke-6,

Penerbit Erlangga, Jakarta.

Melliana, A dan Zain, I. 2013. Analisis Statistika Faktor

yang Mempengaruhi Indeks Pembangunan Manusia di

Kabupaten/Kota Provinsi Jawa Timur dengan

Menggunakan Regresi Data Panel. Jurnal Sains dan

Seni Pomits Vol. 2, No.2, (2013) 2337-3520 (2301-

928X Print).

Sodik, Jamzani. 2007. Pengeluaran Pemerintah dan

Pertumbuhan Ekonomi Regional. Jurnal Ekonomi

Pembangunan Vol. 12 No. 1, April 2007 Hal: 27-36.

UPN Veteran, Yogyakarta.

Sukirno, Sadono. 2010. Makroekonomi: Teori Pengantar

Edisi Ke-3, Rajawali Pers, Jakarta.

Susetyo, Didik, Zunaidah, Siti Rohima, Devi Valeriani,

Abdul Bashir (2018). “Impactof Capital

ExpenditureandPublicUtilityCustomerstoEconomic

Development ofDistrict-City in Sumatra-Indonesia",

International JournalofEconomicsand Financial

Issues, 2018, 8(1), pp.126-135, ISSN: 2146-4138

availableat http: www.econjournals.com

Susetyo, Didik, Zunaidah, Siti Rohima, Anna Yulianita,

Devi Valeriani, M. Adam, 2017, “Expenditure

Analysis of Local Government and Regional

Economic Development District/City of Ten Province

in Sumatra Island Indonesia”, INTERNATIONAL JOURNAL

OF APPLIED BUSINESS AND ECONOMIC RESEARCH,ISSN:

0972-7302: SCOPUS Index Journal and JEL Index,

Vol.15, No.3, 2017, pp. 17-43.

Todaro, MP. dan Smith, SC, 2009. Pembangunan

Ekonomi,Edisi Kesebelas, Jilid 1, Penerbit Erlangga,

Jakarta.

Yamin, dkk,. 2011. Regresi dan Korelasi dalam

Genggaman Anda, Salemba Empat, Jakarta.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

412