The Effect of Macroeconomic Variables on Non Performing

Financing in Sharia Commercial Banks

Muslimah

Universitas Sriwijaya, Indonesia

Keywords: Gross Gross Domestic Product (GDP), Inflation, Exchange Rate (Exchange Rate), Money supply (M2), Non-

Performance Financing (NPF), time-series.

Abstract: The main object of this research aims to analyze the effect of macroeconomic variables on non-performing

financing. The population of this study is all Islamic banks in Indonesia. The data used are the overall level

of GDP, inflation, exchange rate / exchange rate, money supply (M2) and the level of non-performing

financing in Islamic commercial banks in Indonesia. Data starts from January 2005 to December 2014. This

study uses a quantitative approach, with secondary data usage based on time series data. Data is obtained from

reports on Islamic banking statistics published by Bank Indonesia (BI). The analysis technique used is

multiple linear regression to obtain a comprehensive picture of the relationship between one variable and

another. The results showed that GDP had a positive effect on NPF, inflation and the exchange rate had no

effect on NPF and M2 had a negative effect on NPF. The variable that most affects the NPF is GDP.

1 INTRODUCTION

The Bank is a financial institution that functions

as a financial intermediary that distributes funds from

parties with excess funds to those who lack funds.

Funds owned by banks are derived from bank funds

themselves, funds from the public and loan funds.

One of the bank's goals is to provide a safe place for

depositors (Mankiw, 2013).

The Bank also has a mission in the Indonesian

economy, which is to improve the lives of many

people by channeling funds to the public in the form

of credit so that the purchasing power or effort of the

community can increase, thereby increasing

Indonesia's economic development. That in a

country's economy it is impossible to grow quickly

without the role of banks in channeling credit.

Financing portfolio (Financing) is the largest part of

bank assets, because financing is the main activity of

the Islamic banking business. Thus the revenue-

sharing or profit-buying income which is a financing

instrument for Islamic banking is the dominant source

of income (Arifin, 2009). There is no risk-free term in

Islamic economics, so Islamic banks in carrying out

their main activities will also face risks, namely

financing risk or credit risk.

Credit risk is the risk due to the failure of the

customer or another party to fulfill the obligation to

the bank in accordance with the agreed agreement.

Credit or financing risk is reflected by the ratio of

Non-Performing Financing (NPF) to Islamic banks

and Non-Performing Loans (NPLs) in conventional

banks. Several previous studies cited by (Makri,

2013) tested the determinants of Non Performing

Loans (NPL) and non-performing loans, proving and

confirming that macroeconomic variables have a

strong influence on non-performing loans. The ability

and fluency in repaying loans is influenced by the

level of community income. The higher the level of

total community income reflected by GDP (Mankiw,

2013), then the possibility of problematic financing

will be small because the community is able to pay it

off (Faiz, 2010). So that GDP is included in this study.

Inflation in general is defined as the increase in the

price of goods and services as a result of the amount

of money (demand) which is more than the amount of

goods or services available (supply), as a result of

inflation is the fall in the value of money. The effect

of changes in inflation on the NPF is that high

inflation will cause a decline in real income so that

people's living standards also fall. Before inflation, a

debtor is still able to pay the installment, but after

inflation occurs, prices have increased quite high,

while the debtor's income has not increased, the

250

Muslimah, .

The Effect of Macroeconomic Variables on Non Performing Financing in Shariah Commercial Banks.

DOI: 10.5220/0008439002500257

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 250-257

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

debtor's ability to weaken because most or even all of

his income has been used to fulfill household needs

as a result of rising prices.

Foreign exchange rates are the domestic price of

foreign currency or foreign currency. (Hendry, 2011).

Foreign exchange rates against the Indonesian

currency represent economic stability in the country

of Indonesia. Strengthening the rupiah exchange rate,

the stronger the rupiah, the better the national

economy in this country. Changes in currency

exchange rates will also greatly affect the smooth

running of the customer's business. If the value of the

rupiah falls compared to foreign exchange and if the

business is carried out using imported materials, it

will hit the customer's business and can increase the

problematic financing ratio.

The relationship between money supply and credit

risk arises through the behavior of borrowers due to

changes in money supply in the economy. However,

if the central bank decides to follow an expansionary

monetary policy, reduce the required reserve level

and reduce the discount rate. Increased money supply,

which means increased productivity and profitability

which in turn stimulates investment and consumption.

As a result, income increases. In addition, increasing

the money supply will reduce interest rates and

increase the opportunity for people to have cheaper

funds. These conditions increase the ability of

borrowers to repay their obligations and contribute to

reducing banks "credit risk exposure (Ahmad and

Ariff 2007). Accelerating money supply growth can

act as an indicator of potential future growth (Berk

and Bikker, 1995). Impact of money supply on credit

risk examined by Ahmad (2003), he found a

significant and negative relationship between M2 asa

proxy for money supply and credit risk. Several

studies of external factors that include

macroeconomic conditions are: Gross Domestic

Product (GDP), Inflation, and Exchange Rate that

affect the level of the ratio of non-performing loans

(NPL) or non-performing financing (NPF) in Islamic

commercial banks, between Other: Rahmawulan

(2008), Setiawan (2013), Febrianti (2015), and

Shingjergji (2013) examine external factors that

affect non-performing loans (NPL / NPF). Their

results show that GDP has a significant positive effect

on non-performing loans (NPL / NPF). While

Khemraj (2005), Azeez (2015), Haniifa (2015),

Nursechafia and Abduh (2014), and Firmansyah

(2014) show that GDP results have a significant

negative effect on non-performing loans (NPL /

NPF). Meanwhile, the results are different from

Soebagia (2005), and Ihsan (2011) which shows that

GDP has no significant effect on non-performing

loans (NPF).

Nahar and Sarkev (2016), show that inflation has

a significant positive effect on non-performing loans

(NPL). Haniifah (2015) shows that inflation has a

non-significant positive impact on non-performing

loans (NPL). While Rajha (2016), Badar and Yamin

(2013), ahmad and Bashir (2013) show that inflation

has a significant negative impact on non-performing

loans (NPL). Febrianti (2015), stated that the

exchange rate had a significant positive effect on the

Indonesian Islamic banking NPF. Shingjergji (2013)

and Farhan, Sattar, Khalil and Chaudhry (2012)

stated that the exchange rate has a positive effect on

non-performing loans (NPLs) in contrast to Nahar

and Sarkev which stated that the exchange rate had no

effect on NPLs, and this research was supported by

Firmansari (2014) , Haniifa (2015), Badar and

Yasmin (2013) as well as Nursechafia and Abduh

(2014. Badar and Yasmin showed that M2 did not

affect non-performing loans (NPLs), whereas

Nursechafia and Abduh (2014) showed the opposite

result, namely that M2 had a significant positive

effect on NPF. Based on the phenomenon of gaps and

the diversity of research gaps, the results of existing

research regarding the external influence of banking

on NPL / NPF.

The Objectives of the Research

1. What is the influence of GDP, inflation rate,

exchange rate fluctuations, and money supply on

NPF (Non Performing Financing) at Islamic

Commercial Banks in 2005-2014?

2. Which variable plays the most dominant role on

the problematic financing level (NPF / Non-

Performing Financing) in Sharia Commercial

Banks in 2005-2014?

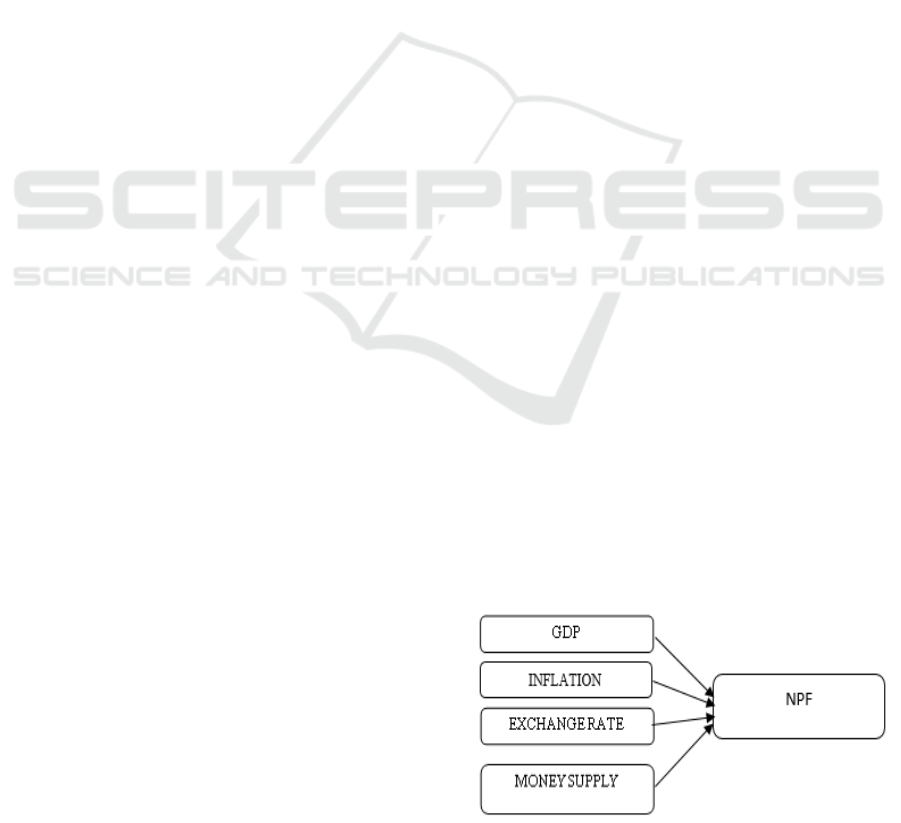

2 CONCEPTUAL FRAMEWORK

Based on background and problems of this

research, the researchers describe the research

framework as seen in Figure 1 below

The Effect of Macroeconomic Variables on Non Performing Financing in Shariah Commercial Banks

251

2.1 HYPOTHESIS

The hypothesis is a temporary answer to the

formulation of the research problem, (Sugiono, 2012:

93). Based on the formulation of the problem above,

the hypothesis proposed in this study are:

1. Gross Domestic Product has a negative effect

on NPF.

2. Inflation has a positive effect on NPF.

3. Exchange rates or exchange rates have a

positive effect on the level of the NPF.

4. Money supply has a negative effect on NPF

2.2 DATA AND METHODOLOGY

The population in this study are all Sharia

commercial banks registered at Bank Indonesia in the

observation period January 2005 to December 2014..

The data used as samples in this study are NPF data

for Islamic Commercial Banks, Real GDP, Inflation

and exchange rates (middle exchange rates). This data

is in the form of monthly data for each variable

starting from the period January 2005 to December

2014, except for the GDP variable which is only

available in quarterly form which is then interpolated

into monthly data through the quadratic match sum

method. The reason for choosing the year period used

is to get accurate results

The data analysis method used in this study is the

Ordinary Least Square Method (OLS) using multiple

linear regression techniques. In conducting multiple

linear regression analysis, this method requires to test

classic assumptions in order to get good regression

results. In analyzing multiple linear regression

models in order to produce a good estimator, that is

linear bias with the minimum variant (best linear

unbiased estimator = blue) is the fulfillment of the

assumptions of the basic assumption of regression,

namely by performing a series of classic assumption

tests as follows:

A. Classic assumption test

1. Normality Test

This normality test aims to test whether in the

dependent variable regression model, both

independent variables and both are normally

distributed or not.

2. Multicollinearity Test

Multicollinearity test aims to test whether the

regression model found correlation between

independent variables (Tanjung, 2013: 52

3. Autocorrelation Test

Autocorrelation is a phenomenon that arises

from incorrect specifications regarding the

relationship between endogenous variables and

explanatory variables.

E(𝒖

𝒊

𝒖

𝒋

) ≠ 0; i ≠ j

The autocorrelation test aims to test whether in a

linear regression model there is a correlation between

the interfering errors in period t with errors in the

period t-1 (before). Correlation test aims to find out

whether there is a correlation between members of a

series of observational data described according to

time (time series) or space (cross section).

4. Heterocytacity test

Heteroscedasticity test is used to determine

whether or not there is a deviation from the

classical heteroscedasticity assumption, namely

the existence of variance inequality of residuals

for all observations in the regression model. The

prerequisites that must be fulfilled in the

regression model so that there is no symptom of

heteroscedasticity is if the Prob value. F count is

greater than alpha level 0.10 (10%) does not

occur heteroscedasticity

B. Statistic test

Statistical analysis test used in the form of

regression analysis, namely analysis that can measure

the influence between a group of variables that are

interconnected. In this study, analysis uses multiple

linear regression method. Multiple linear regression

is defined as a model that has a minimum independent

variable of two or more. The regression equation in

this study is as follows:

NPF = 𝜷

𝟎

+ β𝑿

𝟏

+ β2𝑿

𝟐

+ β3𝑿

𝟑

+β4𝑿

𝟒

....+βn𝑿

𝒏

𝑋

1

= variable GDP

𝑋

2

= Inflation variable

𝑋

3

= exchange rate variable

𝑋

4

= variabel Money Supply

C. Hypothesis test

Hypothesis test s used to test the effect of the

independent variable either partially or

simultaneously to the dependent variable.

1. Simultaneous Significance Test (Test F Statistics)

Simultaneous significance test (F test statistic)

aimed to show whether all the independent variables

used simultaneously influence on the dependent

variable or not.

2. Parsial Significance Test (Test t Statistics)

The purpose of partial significance test (t test

statistic) is to determine whether each independent

variable (GDP,Inflation,exchange rate and M2)

affect the dependent variable (NPF) is significant or

not.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

252

3 RESULTS AND DISCUSSIONS

The influence of GDP on NPF

The first hypothesis proposed states that GDP has

a significant negative effect on NPF. This is in

accordance with the general theory when the GDP

growth rate increases, it will increase economic

activity (Samuelson, 2001), so that when economic

activity increases, people's income will rise which in

turn also increase the capacity for borrowers or

debtors to repay their loans. When the loan or credit

repayment capacity of the debtor increases, in other

words, the loan repayment will be timely and the

interest, so the probability of the possibility of non-

performing loans will decrease. In addition, the

decline in real GDP is also a common characteristic

of recession (Samuelson, 2001), the recession will

cause economic sluggishness that affects the debtor's

business cycle and ultimately affect business

profitability.

The results of testing the Gross Domestic Product

(GDP) variable on the level of the Sharia bank NPF

ratio, it is known that GDP has a significant positive

effect on the level of the ratio of Islamic banks' NPF.

So the higher the real GDP growth, the higher the

level of problematic financing in Islamic commercial

banks, but the effect is not large because a 1% GDP

increase only raises the NPF level by 0.0095%. This

is because when GDP conditions increase, the

macroeconomic income of the community also

increases, but this does not reduce the level of

problematic financing, because this indicates the

tendency of the Indonesian people who are

considered highly consumptive, so that most of their

income is prioritized for their consumption needs

rather than repayment of loans to banks. It is proven

that Indonesia is currently ranked second as the most

consumptive country in theworld

afterSingapore.(Tranggono,2012)

These findings support the results of research

conducted by Soebagio (2005), Imaduddin (2006),

Edwin (2007), Rahmawulan (2008) and (Mutmainah

and Chasanah, 2012). in their research GDP has a

significant positive effect on Problem Financing.

Influence of Inflation on NPF

The second hypothesis states that Inflation has a

positive and significant effect on NPF is not

acceptable. The results of this study inflation rate has

no effect on NPF.

According to Chapra (2001), inflation implies that

money cannot function as a fair and correct

accounting unit. Inflation causes people to behave

unfairly to others, by undermining the purchasing

power of monetary assets unknown. This damages the

efficiency of the monetary system and raises the costs

of welfare for the community. Inflation tends to

damage values, reward speculative efforts by

inflicting losses on productive activities and

exacerbating income inequality. Thus inflation is a

symptom of disequilibrium that is not in accordance

with the emphasis of Islam on equilibrium. In pure

Islamic theory, actually inflation will not occur

because of the characteristic Islamic financial

characteristics. When the money used is full bodied

money or fully backed money, there will be no

inflation. This is because the type of money does not

cause the creation of circulating money with

Seignorage. Based on the above theory, inflation has

no effect on the level of NPF.

Sharia Commercial Banks also have stronger

durability compared to Conventional Banks. Islamic

banks use several types of contracts in financing that

aim to diversify credit risk. The most dominant

financing used is financing with a murabahah

agreement that is equal to 61% based on Sharia

Banking Statistics 2015. In murabahah applications

installments are fixed from the beginning to the end,

so that when there is an increase in inflation in the

long term, this does not affect the amount of

installments paid by the customer. Because customers

can plan cash flow arrangements needed to pay off

murabahah financing (Mutamimah and Chasanah,

2012).

Thus, the impact of inflation can be reduced and

has no effect on NPF. The results of this study support

the results of the study by Popita (2013) and Firdaus

(2015) which concluded that the inflation variable

had no significant effect on NPF Syariah Bank.

Febrianti (2015) states that the cause of inflation is

not significant affects the NPF because the value of

financing and non-performing loans in Islamic banks

is relatively small in nominal terms when compared

to conventional banks so that the impact of inflation

is not significant on NPF. In addition, inflation that

occurred during the observation period was not as

severe as the inflation that occurred during the

1997/1998 crisis which reached hyper inflation so

that it could make it difficult for debtors. These

findings support the results of research conducted by

Nursechafiah and Abduh (2014), and Bhattarai

(2014), in their research the inflation variable did not

have a significant effect on Problem Financing.

The Effect of Macroeconomic Variables on Non Performing Financing in Shariah Commercial Banks

253

Influence of Exchange Rate on NPF

The third hypothesis proposed states that the

Exchange has a positive and significant effect on

NPF. variables From the results of the study obtained

the value of the Statistics for the variable exchange

rate of 0.6115 with a significance value of 0.54 where

this value is greater at a significance level of 0.10.

Thus the third hypothesis states that the Exchange

variable which has a positive and significant effect on

NPF is rejected. Based on the results of data analysis

it can be concluded that the exchange rate does not

negatively affect NPF. The absence of influence

between the two variables because the NPF is not

directly affected by the economic conditions seen

from the exchange rate. Changes in exchange rates

require a long period of time to influence the

condition of the bank's NPF level. Fluctuating

exchange rates have no effect on margin fluctuations,

such as in Conventional Banks. Because financing

products at Islamic Banks make borrowers who use

the services of Islamic Commercial Banks obtain

fixed and unchanged margins, as is the case with

loans in Conventional Banks. So that it will make the

borrower community will be better able to regulate

their financial flow or cash flow.

The results of this study strengthen the research of

Febriyanti (2015), which concludes that in the long

run the exchange rate has no significant effect on

financing risk (NPF) of Islamic Commercial Banks

(BUS). This is due to the average amount of financing

in foreign currency in Sharia Banking in the range of

5% of the total financing disbursed, based on the 2015

Indonesian Banking Statistics. So that changes in

exchange rates do not have enough impact and even

have almost no impact on NPF Syariah Banks. In

addition, financing exposure at Islamic Commercial

Banks is more directed at the real sector activities of

the domestic economy so that it does not have a high

level of integration with the global financial system.

The results of the study support the research of

Mutamimah and Chasanah (2012) and Firdaus (2015)

which show that the exchange rate does not affect the

occurrence of changes in the level of problematic

financing The results of this study also support the.

results of Popita's (2013) and Firdaus (2015) study

which concluded that the inflation variable had no

significant effect on NPF Syariah Bank.

Influence of M2 on NPF

Effect of the amount of money in circulation (M2)

on NPF The fourth hypothesis proposed states that

M2 has a negative and significant effect on NPF.

Variables from the results of the study obtained t-

statistics value for the exchange rate variable of -

1.892 with a significance value of 0.061 where this

value is significant at a significance level of 0.10.

Thus the fourth hypothesis states that the M2 variable

has a negative and significant effect on NPF received.

The amount of money in circulation is one of the

macro policies used by the government to stabilize

economic conditions. Therefore changes in the

amount of money in circulation will affect banking

conditions. When the amount of money circulates

increases, one of the instruments used by the

government is to raise interest rates. It is expected that

with the increase in interest rates, it will stimulate the

public to invest their funds in the bank. When people

invest their funds in banks, Islamic banks as part of

the banking industry will collect these funds. The

amount of funds that has been collected will increase

the ability of Islamic banks to channel funds through

financing. In the end the amount of financing will

increase. This condition also increases the ability of

borrowers to repay their obligations and contribute to

reducing banks "credit risk exposures (Ahmad and

Ariff 2007). These findings support the results of

research conducted by Nursechafia and Abduh

(2014), Iriani and Yuliadi (2015) who in their

research Money Supply variables negatively affect

the Term Financing

4 CONCLUSION

GDP has a significant positive effect on the ratio

of Islamic banks' general bank NPF. So the higher the

real GDP growth, the higher the level of non-

performing financing in Islamic banks. This is

because when GDP conditions increase, the

macroeconomic income of the community also

increases, but this does not reduce the level of

problematic financing, because this indicates the

tendency of the Indonesian people who are

considered highly consumptive, so that most of their

income is prioritized for their consumption needs

rather than repayment of loans to banks. The debtor's

failure to repay the loan can be caused by internal

factors from the debtor such as the cessation of

income received by the debtor to repay his loan or

other factors affecting the debtor in repaying his debt.

And the performance factor of the bank also

influences the increase in high financing.

The inflation rate has no effect on the NPF,

because the value of financing and non-performing

loans in Islamic banks in nominal terms is still

relatively small when compared to conventional

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

254

banks so that the impact of inflation is not significant

on the NPF.

The exchange rate or exchange rate does not affect

non-current financing. This is due to the fact that the

financing in foreign currency in Islamic banks is at an

average of around 5% of the total financing disbursed

(Bank Indonesia, 2013), so that changes in exchange

rates do not have enough impact and almost no impact

on the Islamic bank NPF. The money supply has a

positive and significant effect. Islamic banks as part

of the banking industry will collect funds from the

community. The amount of funds that has been

collected will increase the ability of Islamic banks to

channel funds through financing. In the end the

amount of financing will increase. With the increase

in financing, there will be an increase in NPF if the

increase in the amount of money in circulation is not

accompanied by an increase in output of production

goods.

The money supply has a positive and significant

effect. Islamic banks as part of the banking industry

will collect funds from the community. The amount

of funds that has been collected will increase the

ability of Islamic banks to channel funds through

financing. In the end the amount of financing will

increase. With the increase in financing, there will be

an increase in NPF if the increase in the amount of

money in circulation is not accompanied by an

increase in output of production

5 SUGGESTION

The results of this study can be useful for

evaluating the development of the Islamic

Commercial Bank system and steps for taking related

policies such as:

a. Policies related to Gross Domestic Product

Sharia Commercial Banks should be cautious in

channeling credit to the public, the link between

GDP and non-performing loans, in recession

conditions where there is a decline in sales and

corporate income, it will affect the company's

ability to repay its loans. This will cause an

increase in non-current credit outstanding.

b. The government suppresses the amount of

money in circulation by providing financing

options that are clear, easy and safe for the

community so that the funds can develop and

manage the community itself

c. For further research researchers can use

customer characteristics as additional veriabel

so that banks can reduce the level of their NPF.

REFERENCES

Ahmad.FawadandBashir.Taqadus.2013.”Explanatory

Power ofMacroecoomic Variables as Determinant of

Non Performing Loans: Evidence from

Pakistan”.World Applied Sciences Journal 22. Pp.243-

255

Alsadek H. Gait, Andrew C. Worthington .2006, “An

Empirical Survey of Individual Consumer, Busness

Firm and Financial Institution Attitudes towards Islam

Methods”, School of Accounting & Finance University

of Wollongong, Wollongong NSW 2522 Australia, JEL

Classification: D12; G20; Z12.

Arifin, Zainul.2009. Dasar-dasar Manajemen Bank

Syariah. Jakarta: Azkia Publisher

cet. 7, ed. Revisi.p.15

Babouček, I. - Jančar, M. 2005, “A VAR analysis of the

effects of macroeconomic shocks to the quality of the

aggregate loan portfolio of the Czech banking sector”,

Prague, the Czech National Bank, working paper series

no. 1.

Badar.M.and Yasmin.Atiya.2013 ”Impact of

Macroeconomic Forces of Non Performing Loans: An

Empirical Study of Commercial Banks in

Pakistan”.WSEAS Transaction on Business.Vol.10.

Bank Indonesia. 2005. www.bi.go.id.

Bank Indonesia. 2008. www.bi.go.id.

Bank Indonesia. 2011. www.bi.go.id

Bank Indonesia. 2013. www.bi.go.id.

Bofondi, M. and T. Ropele . 2011. "Macroeconomic

determinants of bad loans: evidence from Italian

banks." Bank of Italy Occasional Paper(89).

Chapra, M.U. (2001), “Why has Islam prohibited interest:

rationale behind the prohibition of interest”, Review of

Islamic Economics, Vol. 9, pp. 5 -20..

EkanayakeandAA.Azeez.2015.”Determinant of Non

Performing Loans in Licensed Commerciak Bank :

Evidence from Srilanka”.Asian Economic and Finance

review.Pp. 868-882

Fahmi. Irham . 2014.Manajemen Perkreditan (bandung:

Alfabeta 2014).

Faiz, Ihda A. 2010. Ketahanan Kredit Perbankan Syariah

Terhadap Krisis Keuangan Global. Volume IV, No. 2,

Desember 2010. Jurnal Ekonomi Islam: La_Riba.

Farhan.Muhammad,Sattar.Ammara,Chaudhry,dan

Khalil.2012.” Economic Determinant of Non

Performing Loan: Perception of Pakistani Bankers”.

European journal Business and Management. Vol.4

No.19.2012

Fawad, Ahmad & Taqadus Bashir, 2013, “Explanatory of

Macroeconomics Variables as Determinant of Non-

Performing Loans: Evidence from Pakistan”.World

Applied Sciences Journal 22. Pp.243-255.

Febriyanti.Silvia Eka.2015."Analisis Pengaruh

Pertumbuhan GDP ,Inflasi,BI Rate dan Nilai Tukar

tehadap Kredir bermasalah pada Bank Konvensional

dan Bank Syariah”.Malang.Universitas Brawijaya.

Festic, M. dan Beko, J. 2008. The Banking Sector and

Macroeconomic Performance in Central European

The Effect of Macroeconomic Variables on Non Performing Financing in Shariah Commercial Banks

255

Economies. Czech Jornal of Economics and Finance.

No. 58, Vol. 3-4, pp. 131-151.

Firmansyah,Irman.2014.” Determinant of Non Performing

Loan : The Case of Islamic Bank in Indonesia”. No.

02,Vol.17,oktober 2014. Buletin Ekonomi Moneter dan

Perbankan.

Firmansari.2015. “Pengaruh Variabel makroekonomi dan

Variabel Spesifik bang terhadap Non Performing

Financing pada Bank Umum Syariah dan Unit Syariah

di Indonesia periode 2003-2014”. Jurnal Ekonomi

Syariah,Teori dan Terapan. Vol.2 No.6

Gunsel, N. 2008. "Micro and Macro determinants of bank

fragility in North Cyprus economy." International

Research Journal of Finance and Economics ISSN

1450-2887(22).

Haniifah.Nanteza. 2015. ” Determinant of Non Performing

Loans (NPLs) in Uganda Commercial Banks”. A

Contemporary business journal. Vol.5.Pp. 137-153

Hendrie Anto (2003), Pengantar Ekonomi Mikro Islami.

Yogyakarta: Penerbit Ekonosia.

Imaduddin, Muhammad. 2006, “Determinant of Banking

Kredit Default In Indonesia: A Comparateive

Analysis”.

Iriani,Dian ,Latifah dan Yuliadi,Imamudin.2015. The effect

of macroeconomic variables on non performance

financing of Islamic Banks in Indonesia.Economic

Journal of Emeging Markets.Pp.120-134

Islamoglu.Mehmet.2015.”The Effect of Macroeconomic

Variables on Non Performing Loan of Publicly traded

Bank in Turkey”.The Journal of International Sociel

Research.Vol.8.Issue 39 August 2015

Karim, Adiwarman A.2008. Ekonomi Mikro Islami.

Jakarta: Raja Grafindo Persada, ed. 3.p.34

Karim, Adiwarman. 2010. Bank Islam: Analisis Fiqih dan

Keuangan. Jakarta: Raja Grafindo Persada, ed. 4, cet.

7.p.102-103

Kuncoro, Mudrajad dan Suhardjono. 2002. Manajemen

Perbankan; Teori dan Aplikasi. Yogyakarta: BPFE-

Yogyakarta, ed. 1, cet. 1,p.583

Machmud, Amir dan Rukmana.2010. Bank Syariah: Teori,

Kebijakan, dan Studi Empiris di Indonesia. Jakarta:

Erlangga, 2010.p.24-25

Majah, Ibnu.2001. Sunan Ibnu Majah. Beirut: Daar Ihya al-

Turatsi al-Arabiy, Bab. Buyu’, Hadis 2184.p.299

Mankiw, N. Gregory, et al. 2013. Pengantar Ekonomi

Makro, Principles Of Economics An Asian Edition-

Volume 2. Jakarta: Penerbit Salemba Empat.

Mokhtar, M., Smith, P & Wolf, S. 2005. “Measurement and

Management of Non-performing Loans in Malaysian

Islamic Banks: an Analysis”. Islamic Financial

Architecture, Risk Management and Financial Stability

by Islamic Research and Training Institute.

Proccedings. No. 46.

Muhammad.2002. Kebijakan Fiskal dan Moneter dalam

Ekonomi Islam. Jakarta: Salemba Empat.

Muhammad. 2004. Manajemen Dana Bank Syari’ah. Edisi

Pertama. Yogyakarta: Ekonisia. Kampus Fakultas

Ekonomi UII.

Muthohharoh, M .2010. The impact of

MacroeconomicShocks on Stability of Dual Banking

System in Indonesia. Faculty of Economics and

Management. Bogor Agricultural University, Bogor.

Nahar.S dan Sarkev.N.(2016).”Are Macroeconomics

Factors substantially influential for Islamic Bank

Financing ?Cross Country Evidence”.University of

Science and Technology.P.R. China.

Nasution E, Mustafa dan Wiliasih, 2007, “Profit Sharing

dan Moral Hazard Dalam Penyaluran Dana Pihak

Ketiga Bank Umum Syariah di Indonesia”. Jurnal

Ekonomi dan Pembangunan Indonesia, Vol VIII,

No.02 105-129

Nursechafiah and Abduh.M.2014.”The Susceptibiliti of

Islamic Banks Credit Risk Toward Macroeconomic

variables”. Journal of Islamic Finance. Vol.3 No

1.Institute of Islamic Banking and Finance

Peraturan Bank Indonesia No. 5/7/PBI/2003 Tahun 2003

Tentang Kualitas Aktiva Produktif Bagi Bank Syariah.

Rahmawulan, Yunis.2007. “Perbandingan Faktor Penyebab

Timbulnya NPL dan NPF pada Bank Konvensional dan

Bank Syariah di Indonesia”. Tesis,Program

Pascasarjana Universitas Indonesia, ,p.94.

Rajha,Subhi,Khaleed. 2016.”Determinant of Non

Performing Loans: Evidence from The Jordanian

Banking Sector”. Journal of Finance and Bank

Management.Vol.4 Pp.125-136

Setiawan.Chandra dan Putri.Monita.2013.”Non

Performing Financing and Bank Efficiency of Islamic

Bank in Indonesia”. Journal of Islamic Finance and

Business Research.Vol. 2 Pp.58-76

Setyowati, Desti. 2010. Indikasi Moral Hazard dalam

Pembiayaan: Perbandingan antara Bank Syariah dan

Bank

Siamat, Dahlan, 2001, Manajemen Lembaga Keuangan,

Edisi ketiga, Lembaga Penerbit Fakultas Ekonomi

Univer-sitas Indonesia, Jakarta.

Shingjergji.Ali.2013.”The Impact of Macroekonomic

Variables on The Non Performing Loans in The

Albanians Banking System during 2004-

2012”.Academic Journal of Interdisiplinary Studies

No.9.MCSER Publishing Rome-Italy

Sisherdianti, Danastri. 2008. “Faktor-faktor Variabel

Ekonomi Makro yang Mempengaruhi Kekuatan Bank

Syariah; Studi Kasus Bank Muamalat Indonesia”.

Tesis, Program Pascasarjana Universitas

Indonesia.p.93

Soebagio Hermawan. 2005. “Analisis Faktor-Faktor yang

Mempengaruhi Terjadinya Non Performing Loan

(NPL) pada Bank Umum Komersial (Studi Empiris

pada Sektor Perbankan di Indonesia), Tesis, Program

Magister Managemen, Universitas Diponegoro.

Sugiono.2012. Metode Penelitian Bisnis .Bandung:

Alfabeta. h. 88.

Supriyanto. Trisiliadi,2014. Konsep Rate Of Profit

Perspektif Ekonomi Islam (Desertasi, UIN Syarif

Hidayatullah, 2014), h. 12.

Tanjung,Hendri . 2013. Metodologi Penelitian Ekonomi

Islam .Bekasi: Gramata Publising,, h. 141.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

256

Undang-undang Republik Indonesia Nomor 21 Tahun 2008

Tentang perbankan Syariah Pasal 1 ayat 12.

Van Deer Heidjen (1996) dalam Achsien, Iggi H. (2000),

Investasi Syariah di Pasar Modal : Menggagas Konsep

dan Praktek Manajemen Portofolio Syariah. Jakarta:

Gramedia

The Effect of Macroeconomic Variables on Non Performing Financing in Shariah Commercial Banks

257