The Influence of the General Allocation Fund, a Fund for the Results

and Fiscal Independence Against GDP Government Regency/City in

South Sumatera 2011-2016 Year

Nurul Aini, Taufiq and Rosmiyati Chodijah

Faculty of Economics, University of Sriwijaya, Indonesia

Keywords: General Allocation Fund, funds for Results, Fiscal Independe, GDP.

Abstract: This research aims to know the influence of the General Allocation Fund (DAU), funds for results (DBH) and

Fiscal Independence (KF) against GDP Government district/city in South Sumatra Province year 2011-2016.

The scope of this study discusses the condition of the General Allocation Fund (DAU), funds for results

(DBH), Fiscal Independence (KF) and GDP. This research is focused on the regency/city Governments in

South Sumatera 2011-2016 Year. The population of this research is the entire Government regency/city in

South Sumatra Province. The sample of this research is a local government regency/city in South Sumatra

Province from the years 2010-2016. Selection criteria samples in this research is a regency/city in South

Sumatra Province which have entered the national realization of report data at the site of the Directorate

General of Financial Equalization of local Government on a regular basis from the year 2011-2016. The

methods used to collect data in this research is a method of documentation, i.e. by way of collecting, recording,

and secondary data review Report in the form of realization of a grant obtained from the website of the

Directorate General of Financial Equalization The Local Government. From the report it budget-realization

obtained data on the number of General Allocation Fund, a Fund for the results. Gross Regional Domestic

Product data (GDP) Per Capita is obtained from the Central Bureau of statistics (BPS) South Sumatra

provinces from the year 2011-2016 as for the fiscal independence of the data obtained from the ratio of the

total admissions area taking action against PAD. The data analysis techniques in the study of linear multiple

regression analysis with SPSS uses panel data. The research found that DAU does not affect GDP, DBH did

not have an effect on GDP and GDP effect on KF.

1 INTRODUCTION

Regional autonomy is empowering regions in

decision making areas related to management of

resources owned in accordance with the interests,

priorities, and potential of the area. With the granting

of regional autonomous counties and cities, financial

management fully in the hands of local governments.

Therefore, the financial management system needed

a good area in order to manage decentralized funds in

a transparent, economical, efficient, effective and

accountable. The enactment of this act provides an

opportunity for the region to explore the local

potential and improve their financial performance in

order to realize the independence of the region.

The goal of autonomous region to boost economic

growth regions. According to Boediono (1992) in the

research of Maryati (2011) one of the size of the

region's economic growth is the gross Regional

domestic Income (GDP). Gross Domestic income

(GDP) an area can indicate how big the activity of an

economy as a whole. The concept of Gross Domestic

Income (GDP) is a measure that is most often used as

an indicator of domestic economic growth but is not

the only indicator of domestic economic growth.

Economic growth is a process, not an economic

picture at a certain period, there are developments or

changes and use of time.

Regional autonomy is the rights and obligations

of the authorities of the autonomous regions to set up

and take care of her own affairs of Government and

the interests of the local community in the system of

unitary State of the Republic of Indonesia. Regional

autonomy in Indonesia is based on law No. 32 Year

2004 revised into law No. 23-year 2014. In Act No.

23 of the year 2014 explained that local governments

separate executive function with legislative functions.

Based on its functions, the regional government (the

Executive) and the regional people's representative

208

Aini, N., Taufiq, . and Chodijah, R.

The Influence of the General Allocation Fund, a Fund for the Results and Fiscal Independence Against GDP Government Regency/City in South Sumatera 2011-2016 Year.

DOI: 10.5220/0008438602080217

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 208-217

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

Council (legislative) agency relationship occurs

(Ardhani, 2011).

The regional budget is a financial plan that is the

basis in the implementation of the public service. In

the area of budget documents called Indonesia's

budget revenue and Expenditure area (BUDGETS),

both for provincial as well as city and County. The

process of drafting the budget post Act No. 32 Year

2004 and Act No. 23-year 2014 involves two parties:

the Executive and legislative branches, each through

a team or Budget Committee. As for the Executive

Managing operationalization region as obligated to

make draft/draft BUDGETS, which can only be

implemented if it is endorsed by the PARLIAMENT

in the process of ratification.

Shopping areas include direct and indirect

expenditures (permendagri No. 25 Year 2009), is the

allocation to be done effectively and efficiently,

where shopping areas can become a benchmark of the

success of the autonomy of the region. Local

authorities allocate funds in the form of a budget

capital expenditure in the budget to add fixed assets.

Capital spending is spending that benefits tend to

exceed one year and will add assets or wealth, the

government will further add to the regular budget for

operating costs and maintenance costs. Thus, local

governments should be able to allocate budget

expenditures well because capital expenditures is one

step for the local Government to improve public

services in order to face the fiscal decentralization.

Capital spending has an important role because it has

long term benefits for providing service to the public.

Allocation of capital expenditure is based on the

needs of the regional facilities and infrastructure, will

be good for the smooth execution of the tasks of

Government and public facilities. Capital

expenditures intended to get fixed assets local

governments, namely, equipment, buildings,

infrastructure and other fixed property.

The shopping area is an estimate of the burden of

the expenditure areas allocated in a fair and equitable

so that the relative can be enjoyed by all groups of

society without discrimination, in particular in the

granting of public service. However, the fact that

local governments in allocating income areas tend to

be used for the purposes of routine spending on

capital expenditures. It can be seen from the reports

on the realization of the budget (LRA) regency/city

Government of South Sumatra Province year 2011-

2016. Shopping (spending) of local government

revenue and Expenditures in the budget area (grant)

is a regular activity of the accounts payable area to

finance operating activities in Government. To

finance the expenditure required the acceptance of

sources from the region in the framework of the

implementation of regional autonomy (Nuarisa,

2013).

Economic growth is one of the indicators

commonly used in determining the success of

development. Used as a measure of economic growth

over the development or progress of the economy of

a country or region because it is closely related to the

economic activities of the community especially in

terms of the increase in the production of goods and

services. The increase is then expected to provide a

trickle down effect, therefore, already come with the

increased economic growth to become one of the

targets of development both at the national and

regional levels. To measure the present national

economic growth in use the gross domestic product

(GDP) real terms, while for level areas using gross

Regional domestic product (GDP) real.

Related policies are contained in Act No. 22 of

year 1999 about the financial equalization between

the Center and regions imposed effective January

2001 (Per this Act in its development is updated with

the promulgation of Act No. 32 Year 2004 and Act

No. 33 of the year 2004. According to Act No. 33

Year 2004 source of acceptance which is used for

local government funding in fiscal decentralization is

an implementation of PAD, DAU, DAK, for the

results of the tax (BHP), the regional lender and other

legitimate acceptance.

Act No. 32 year 2004 mentioned that the transfer

of the Government in the form of DAU, DAK Funds

and for the results of implementation of the local

government authority to use. Funds for fiscal

stabilization role as Results between the Center with

an area of tax that has been shared. DAU serves as

fiscal equalization between regions (fiscal

equalization) in Indonesia, while not acting as a

funding policy that is based on the emergency.

Details, outside of the function's third use of the Fund

handed over entirely to the regency/city Governments

are concerned. Therefore, the Government

regency/city is expected to be able to use these funds

effectively and efficiently for the improvement of

services in the community for the use of

accountability with those funds.

DAU (General Allocation Fund) an area

determined upon her little slit large fiscal (fiscal gap)

an area, which is the difference between the needs of

the region (fiscal need) and the potential of the region.

DAU more prioritized for areas with low fiscal

capabilities. In his research, Nopiani et al (2016)

describes the General Allocation Fund (DAU) a

positive effect against economic growth. This is

because the role of the DAU is very significant,

The Influence of the General Allocation Fund, a Fund for the Results and Fiscal Independence Against GDP Government Regency/City in

South Sumatera 2011-2016 Year

209

because the shopping area more dominated than the

number of DAU. This is not much different from the

role of the PAD that is as capital in financing

infrastructure development and infrastructure by

local governments that will have an impact on

economic growth.

DBH (funds for the result) is funding the balance

sourced from state budget comprising DBH DBH

taxes and not taxes (natural resources). DBH

assignment as one of the sources of financing of local

governments in improving the infrastructure in the

form of facilities and infrastructure will support

economic activity in the production of goods and

services by investors from both the local community

or from outside the area in question. In a study by

Hendriwiyanto (2014) describes the positive results

for the influential funds towards economic growth.

This means the higher the funds received for the

results area will affect close to economic growth. This

is due to funding for the results that are flexible in

terms of the operations cause more freely in planning

the allocation of a budget to development activities in

accordance with its economic agenda.

Adi and Mumtaz Anwar (2015) says the fiscal

decentralization to function as an important technique

for curing increases the efficiency of the economy,

health, public services and better infrastructure. In

addition the role local governments can also be done

by means of an increase in extensification and

intensification of tax, as well as the presence of

regional retribution in increasing acceptance of the

area, although in receipt there should be an increase

in the facility of an infrastructure development and

public services provided by the local government.

To date, fiscal decentralization and regional

autonomy is an issue that is still interesting to discuss

because of the various studies ever done indeed there

is the ambiguity of the relationship between fiscal

decentralization with economic growth. In the context

of fiscal decentralization and economic growth in

Indonesia, some of the research done to see the

impact of fiscal decentralization towards economic

growth, in particular by using model analysis

Econometrics, as well as produces a summary. On

one hand, the results of the study show that fiscal

decentralization will effect positive towards

economic growth, as well as research results Wibowo

(2008), and Waluyo (2007). While research results

Swasno (2007) concludes otherwise, that fiscal

decentralization is precisely the negative effect

against the growth of the economy.

2 LITERATURE REVIEW AND

HYPOTHESIS

General Allocation Fund

The General Allocation Fund (DAU) is one of the

Government's transfer of funds to local governments

that are sourced from the state budget, income that is

allocated with the goal of equitable distribution

between regional financial capability to fund the

needs of the region in order the implementation of

decentralization. DAU is block grant which means

that its use is left up to the regions in accordance with

the priorities and needs of the region for the

improvement of service to the community in the

framework of the implementation of regional

autonomy (Yovita, 2011). Finance equalization

policies bring impact on the greater gap between

capability areas, particularly as each region has

different areas of financial capability. In other words,

the areas that have the potential of the United Nations

and a huge nature resources will get a great reception,

the small potential certainly will get a small income

as well.

The General Allocation Fund (DAU) is directed

to reduce that gap, which means the area has a

relatively large financial capability will have a

relatively small DAU so otherwise. DAU is allocated

to provinces and regency/city. A quantity defined at

least 26% DAU of Domestic Revenue (PDN) the net

specified in the state budget. Proportion of provinces

and regions to DAU for the district/city set in

accordance with the balance of authority between the

province and regency/city (Yovita, 2011).

Stages of the Calculation of the DAU

1. Academic Stages

The concept of the beginning of policy

formulation over the implementation of the formula

DAU conducted by independent teams from various

universities in order to obtain the appropriate DAU

counting policy with the provisions of the ACT and

the characteristics of the autonomous region in

Indonesia.

2. The Stages of Administrative

At this stage of the Monetary Department DJPK

do coordination with relevant agencies for the

preparation of the data base of the counting of the

DAU including consolidation and data verification

activities to get the validity and recent data that will

be used.

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

210

3. The Technical Stages

It is the stage of manufacture of the simulation

calculations DAU which will be consulted to

PARLIAMENT and Government are conducted

based on a formula of DAU as mandated ACT by

using available data as well as paying attention to the

results of the parties ' recommendations

academically.

4. The Stages of Political

Is the final stage, the discussion of the calculation

and allocation between Governments with DAU

Panja shopping districts Budget Committee

representatives for consultation and approval of the

results of calculating DAU (Yovita, 2011).

Funds for the Results

Results sourced from funds for taxes and natural

resources. The funds were sourced from taxation

consists of Earth and Building Tax (PBB), the Bea

Acquisition of land and buildings (BPHTB) and

income tax (PPh). The research of Zulkifli (2013)

many countries using the system for the results of the

tax by distributing a fixed percentage of certain

national taxes, such as income tax or value added tax

to local government. Add income areas in the

framework of the financing of the implementation of

the functions being performed with authority patterns

for the results of tax revenue and not the tax (SDA)

between the Center and regions. While the funds for

results sourced from natural resources derived from

forestry, mining, fisheries, mining General

petroleum, mining, natural gas and geothermal

mining.

Fiscal Independence

The local government authority in the exercise of its

discretion as autonomous regions was strongly

influenced by the area's capabilities in the area of

revenue generation. The larger the area that received

the original income, then the greater the local

government authority also in the exercise of policy

autonomy. The implementation of regional autonomy

aims to improve public services and promote the

economy of the region. One way to improve public

service by doing the shopping for the benefit of the

investment realized through capital expenditures.

Fiscal independence is none other than Original

Income ratio region (PAD) to the total acceptance of

the area where the original region, revenue was the

acceptance of the area from the local tax levy, sector

areas, the results of the company-owned areas, results

wealth management area which is separated and other

legitimate areas of original income (Zulkifli, 2013),

meaning the larger PAD area, the better his

independence anyway. Capital expenditure is an

expenditure budget for the acquisition of fixed assets

and other assets that benefit more than one accounting

period. Capital expenditures include, among others,

capital expenditures for the acquisition of land,

building and building, equipment and intangible

assets.

This is in accordance with regulation No. 58 Year

2005 which States that the grant is structured

according to the needs of the Organization of the

Government and regional capabilities in generating

revenue. Each drafting budget, allocation of capital

expenditure should be adjusted to the needs of the

region by considering the PAD that is received. So if

the government wants to increase capital

expenditures for public services and social welfare,

then the government will have to dig into the PAD

that much.

Economic Growth

Research Putro (2010) stated that economic growth is

defined as the development of activities in the

economy that caused the goods and services produced

in the community increased and prosperity of

communities increased. So economic growth

measures the achievement of the development of an

economy from a period to another period. The ability

of a country to produce goods and services will

increase. Capabilities that increase is due to the added

factors of production both in quantity and quality. The

investment will add to capital goods and technology

used is also growing. In addition, the workforce was

increased as a result of the development of the

population with increasing their education and skills.

Each economy can set aside a certain proportion of

the national income if only to replace capital items

(buildings, equipment and materials) are broken. But

for growing the economy needed new investments in

addition to the stock of capital. If there is an

economical relationship considered directly between

the magnitude of a stock of capital (K) and the total

output (Y), then each additional net against capital

stock would result in the increase of total output in

accordance with the capital output ratio (Putro, 2010).

Economic growth according to the theory of the

growth of the Solow-Swan growth depends on

increasing the provision of factors of production

(labour and capital accumulation) and the level of

technological advancement. This view is based on

classical analysis, that the economy will still be

experiencing full employment rates (full

The Influence of the General Allocation Fund, a Fund for the Results and Fiscal Independence Against GDP Government Regency/City in

South Sumatera 2011-2016 Year

211

employment) and a capacity of capital equipment will

still be fully used. The theory stated that Rostow

Growth changes from backwardness towards

economic progress can be described in a series of

stages that must be undertaken by all countries.

Developed countries entirely has surpassed the stage

of takeoff toward sustainable economic growth

(economic progress they've already established so

that such economic wheel can spin themselves to

drive the economy and bring the entire population to

a standard of living adequate all-round better), while

countries that are developing or underdeveloped

countries, in General were still in the stage of the

community's traditional or stages of drafting the

framework of take off. One of the many strategies or

tactics development staple for take-off is the

deployment or the mobilization of savings funds

(denominated in domestic and foreign currency) in

order to create a provision for adequate investment in

favor of accelerating the pace of economic growth

(Putro, 2010).

General Allocation Fund Relations

(DAU) Against GDP

DAU is derived from the STATE BUDGET funds

allocated with the goal of financial equalization

between regions to finance its expenditure needs in

the framework of decentralization. According to

Rumanti (2009) planning a shopping assignment

elicits weak inefficient performance of Government,

so there is a work unit that excess financing, there is

also a unit of work that lack of financing. This will

have an impact on the economy of the region in

General and financial area in particular. Research

results Sihite (2009) concluded that positive and

influential DAU significantly to economic growth.

However such research in contrast to Isa research

results (2010) concluded that significant positive

defenseacquisition university has no effect against

economic growth. Based on the framework of thought

that has been outlined, then compiled the following

hypothesis:

The General Allocation Fund (DAU) effect on

GDP the Government regency/city in South Sumatra

2011-2016 Year.

Relations Funds for Results (DBH)

Against GDP

DBH is one part of the Equalization Fund in addition

to the General and special allocation funds, which

transfers from the Central Government to the regions

with the aim of maximized local development in

accordance with the goal of autonomous region

(Nehen, 2012). The higher the DBH then regional

development level expectations are getting higher, so

that DBH influential positive on economic growth.

This opinion also supported by study Pujiati (2008),

Santosa (2013).

The relationship between DBH with assumed

economic growth with the higher level of

expectations then DBH regional development the

higher (Pujiati, 2008; Santosa, 2013). Further

realization of direct expenditures assumed positive

effect against economic growth (Bose and Osborn,

2007; Chude and Chude, 2013). This shows that the

productivity level of goods and services through

economic growth requires the realization of direct

shopping is great, then the large direct expenditures

are funded from the allocation of the acceptance of

the region which is the DBH. Based on the framework

of thought that has been outlined, then compiled the

following hypothesis:

Funds for the results (DBH) effect on GDP the

Government regency/city in South Sumatra 2011-

2016 Year.

The Fiscal Independence of the

Relationship (KF) Against GDP

Research conducted by Apriana (2010) concluded

that the independence of the region has no effect and

does not significantly to economic growth, as the

Government has yet to maximize the potential of the

local one with ease the investment process.

According to the research of Hamza (2008) also

concluded that the independence of the influential

ratio significantly to economic growth. This is

because the larger the PAD obtained as well as the

smaller loans and assistance from the Center, the

more self-sufficient the area. With increasingly

independent regions, economic growth in the area can

experience increased. Based on the framework of

thought that has been outlined, then compiled the

following hypothesis:

Fiscal independence (KF) effect on GDP the

Government district/town in South Sumatra 2011-

2016 Year.

3 RESEARCH METHODOLOGY

This research uses descriptive quantitative research

methods that aim to explain empirical phenomena

accompanied by statistical data, characteristics and

patterns of relationships between variables. The data

analyzed in this writing is secondary data, sourced

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

212

from the document reports on the realization of a

GRANT obtained from the website of the Directorate

General of Financial Equalization of local

government through the internet. From the report it

BUDGETS-realization obtained data about the

allocation of Public Funds, funds for results and

Fiscal Independence. Gross Regional Domestic

Product data (GDP) Per Capita is obtained from the

Central Bureau of statistics (BPS) of South Sumatra

Province from the years 2011-2016.

Research and Operational Definition of

the Variables

The Dependent Variable

The dependent variable is a variable which is a

variable that is affected or become due, because of the

free variables. The dependent variable in this study is

the GDP. Economic growth is a process of rising per

capita output that continuously in the long term and is

one indicator of the success of development,

increasing economic growth usually also higher the

welfare of society. An economic growth proxiedwith

the gross Regional domestic product (GDP) per

capita. Gross Regional domestic product (GDP) is the

amount of value added goods and services resulting

from the activity of the economy in an area.

Calculating GDP using two kinds of pricing i.e. price

and constant price. GDP on the price applicable is the

added value of goods and services are calculated

using prices prevailing at the year in question, while

the GDP on the basis of constant prices are calculated

by using prices in a given year as a base year. The

growth rate of the economy of an area proxied with

GDP on the basis of constant prices. GDP on the basis

of constant prices using rates in a given year as the

base year to eliminate price increase factors

(Adiwiyana, 2011). Economic growth variables for

each regency/city in South Sumatra BPS data can be

seen from South Sumatra Province based on constant

prices.

Independent Variable

The independent variable in this study consists of the

General Allocation Fund, a special allocation of

Funds, income funds for the region, the Original

results and Fiscal Independence.

1. General Allocation Fund

The General Allocation Fund (DAU) is one of

the Government's transfer of funds to local

governments that are sourced from the STATE

BUDGET, income that is allocated with the goal

of equitable distribution between regional

financial capability to fund the needs of the region

in order the implementation of decentralization.

DAU indicators are as follows:

a. index Of regional needs, consists of: expenses

or shopping districts, on average, the

population index, a broad index of the region,

building price index, an index of relative

poverty.

b. from the reception area, consists of: reception

areas, industry index, an index of nature

resources, human resources index (Yovita,

2011).

In this study the number of postal funds taken

from DAU equalization grant budget

realization in the report.

2. Funds for the results

DBH is money sourced from the state budget

revenue is allocated to regions based on numeric

percentage to fund the needs of the region in the

framework of the implementation of

decentralization (Law No. 33 of the year 2004,

about the Financial Equalization between the

Government The Central and local governments).

DBH are transferred to the Central Government to

local governments consist of 2 types: DBH DBH

taxes and not taxes (natural resources). DBH is a

source of potential income sufficient area and is

one of the Government's authorized capital region

in getting development funds and meet the

shopping area which is not derived from a PAD in

addition to DAU and DAK (Wandira, 2013).

Theoretically the local Government will be able to

set a higher capital expenditure if the budget gets

larger DBH anyway, as otherwise the smaller

capital expenditures that will be set if the DBH

budget is getting smaller. Funds for the results of

a positive effect towards capital expenditures. The

variable Funds measureable Results For with

funds for tax proceeds and not taxes.

3. Fiscal Independence

Fiscal independence is none other than original

income ratio region (PAD) to the total acceptance

of the area which means the larger PAD area, the

better his independence anyway. According to

Zulkifli (2013) this variable is calculated by the

formula:

Fiscal independence = Native Revenue

(PAD)/Total acceptance region (TPD)

Populations and Samples

Priyatno (2010) suggests that the population of the

region is a generalization of the object/subject that

The Influence of the General Allocation Fund, a Fund for the Results and Fiscal Independence Against GDP Government Regency/City in

South Sumatera 2011-2016 Year

213

has certain characteristics and quantity specified by

researchers to study and then drawn the conclusion.

The population of this research is the entire

Government regency/city in South Sumatra Province.

The sample is part of a number and its owned by

the population (Priyatno, 2010). As for the technique

used is a Non Probability Sampling with a Purposive

Sampling approach, namely the determination of the

sample with a particular consideration in accordance

with the object of research. The sample of this

research is a local government district/city in South

Sumatra Province from the years 2010-2016.

Selection criteria samples in this research is a

regency/city in South Sumatra Province which have

entered the national realization of report data at the

site of the Directorate General of Financial

Equalization of local Government on a regular basis

from the year 2011-2016.

Types and Sources of Data

Type of this research is quantitative descriptive

research that aims to explain empirical phenomena

accompanied by statistical data, characteristics and

patterns of relationships between variables. The data

analyzed in this writing is secondary data, sourced

from the document reports on the realization of a

grant obtained from the website of the Directorate

General of Financial Equalization of local

government through the internet. From the report it

budget realization obtained data about the allocation

of Public Funds, funds for results and Fiscal

Independence. Gross Regional Domestic Product

data (GDP) Per Capita is obtained from the Central

Bureau of statistics (BPS) of South Sumatra Province

from the years 2011-2016.

Methods of Analysis

This study will use multiple regression analysis

techniques with the help of SPSS program using data

that has been previously tested and meets classical

assumptions. As for the regression equation model

used in this study are formulated as follows:

GDP = a + b1DAU + b2DBH + b3KF + e

Description:

GDP = Economic Growth

a = Constant

b1 = the coefficient of regression to the variable x 1

b2 = coefficient of regression to the variable x 2

b3 = coefficient of regression to the variable x 3

Allocation of Public Funds = DAU

DBH = Funding For Results

KF = Fiscal Independence

Analysis

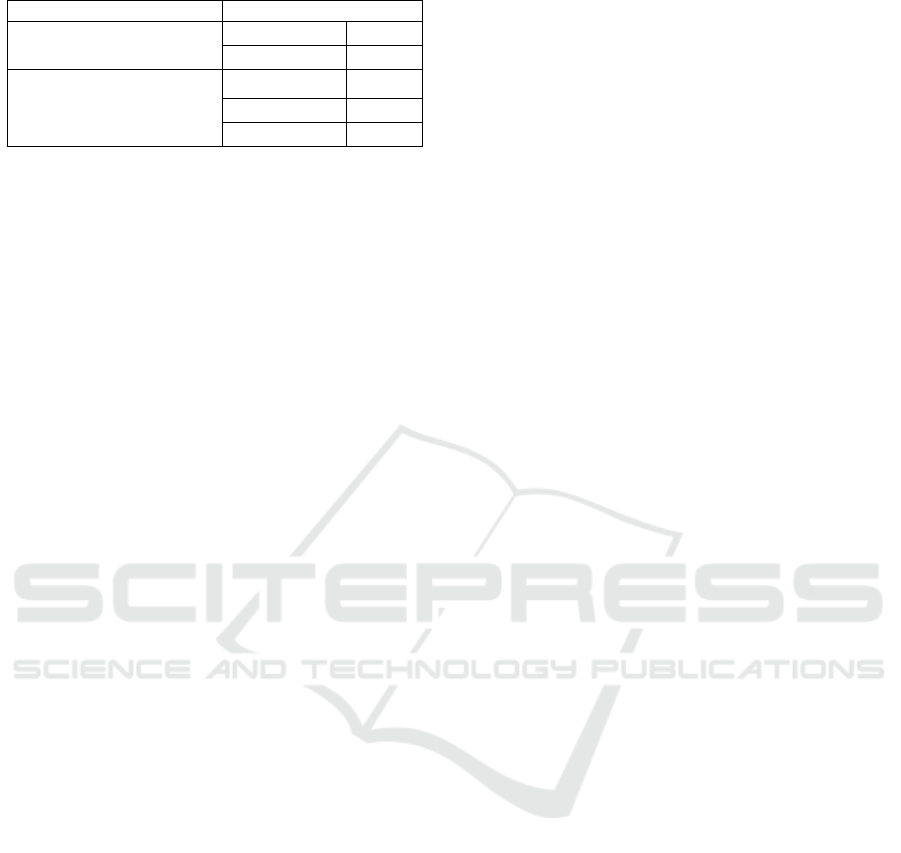

Table 1: Assumption Classic.

Kolmogorov-Smirnov (UjiNormalitas)

Asymp.Sig

0,348

Multiplier Lagrange Test (UjiLinearitas)

R Square

0,018

Tolerancedan VIF (UjiMultikollinearitas)

Model

Tolerance

VIF

DAU

DBH

KF

0,998

0,995

0,993

1,012

1,005

1,007

Durbin-Watson (UjiAuto Korelasi)

DW

1,188

Uji White(UjiHeteroskedastisitas)

R Square

0,114

Source: The Data Processed

Based on table 1 of the second value obtained and

Asymp 0.934. SIG. of 0.348 0.05 larger than normal

Gaussian data can be inferred.

Results display output shows a value of R square

of 0.018 to the amount of n observations of 90, then

the magnitude of the value of the chi square count =

0.018 x 90 = 1.62. This value is compared with the

chisquare table with df = (n-k) = 90-4 = 86 and the

level of significance of 0.05 obtained the value of chi

square table 108.648. Because the value of the chi

square count is smaller than the table chi square, then

it can be inferred that the correct model is a linear

model.

Based on table 1 above, note that the tolerance

value of all independent variables > 0.10. VIF value

of all independent variables < 10.00. Based on the

criteria in decision making can be concluded that this

research does not happen multicollinearity.

Based on Table 1 it is known that the DW value is

1,419. Based on the decision making criteria that the

DW value is between -2 to +2 so it can be concluded

there is no autocorrelation.

Results display output shows a value of R square

of 0.114 to the amount of n observations of 90, then

the magnitude of the value of the chi square count =

0.114 x 90 = 10.26. This value is compared with the

c2 table with df = (n-k) = 90-82 = 86 and the level of

significance of 0.05 obtained the value of chi square

table 104.139. Because the value of the chi square

count is smaller than the table chi square, then it can

be concluded that there is no Heteroskedastistity.

Analysis of Regression

PDRB= a +b

1

DAU+b

2

DBH+ b

3

KF+e

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

214

Tabel 2: The result of hypotheses test.

Adjusted R Square

0,141

F Test

F

5,860

Sig

0,001

t test

Sig.DAU

0,333

Sig.DBH

0,965

Sig.KF

0,000

Source: the Data processed

Based on table 2 the magnitude of the influence of

the General Allocation Fund (DAU), funds for results

(DBH) and Fiscal Independence (KF) against GDP

simultaneously was 14.1%. F test results in table 2 in

F value can count of 5.860 with Sig. 0.001, since the

value of the probability of significance is much

smaller than 0.05 indicates that the regression model

are appropriate and correct.

Based on the results of the statistical tests t 2 in

the table, the fiscal independence of variables (KF) is

significant because it has a value under 0.05

significance i.e. 0.000. So it can be concluded from

three independent variables in the regression model,

there is one independent variables i.e. fiscal

Independence effect on the dependent variable i.e.

GDP.

4 DISCUSSION

The Influence of the DAU against GDP

General Allocation Fund is one form of acceptance

that comes from the balance of the funds with the

purpose of financial equalization between regions to

finance its spending needs. General Allocation funds

given to the regions adapted to the conditions and the

potential of the area so as not happening misalokasi.

The determination of the allocation of public funds is

made to pay attention to the needs of an area. This is

indicated in case of improvement of the General

Allocation funds then the independence of a region

will be even lower. The results showed that DAU had

no effect against the GDP, meaning high or low DAU

will not affect GDP. This indicates that the general

allocation fund absorption is still not significant,

therefore the Government should prioritise allocation

of funds allocation of public expenditures on those

areas which are directly in contact with the public

interest, such as infrastructure or facilities that may

encourage growth of economic results of the research

it supports Sulistyawati (2011) which explains that

the Fund General allocations does not have an effect

on economic growth, but this research contrary to the

research conducted by Endrawati (2010) that shows

different results that the general allocation fund a

positive effect against economic growth.

The Influence of DBH against GDP

The results showed that DBH does not affect GDP,

meaning high or low DBH will not affect GDP. The

fact or condition of the court case, indicating if the

allocated funds for realization of the results is not

Tax/less natural resources contribute to maximum for

government spending in the County Town of South

Sumatra Province, such as the construction of means

of public facilities (fields, irrigation infrastructure,

technical training, research and so on) that directly

touched or enjoyed a short period of time in the

community. In addition, the magnitude of the quantity

of funds for realization of the results is not

Tax/natural resources for the reception Area in the

County Town of South Sumatra Province in 10 years

it does not respond thoroughly (accumulation)

towards economic growth, where the multiplier effect

in the real process on the human resources of the

regency and city of South Sumatra Province engaged

in various sectors of the gross Regional domestic

product (GDP). In other words, influence or

relationship Results Not funds for Tax/natural

resources towards economic growth in the County

Town of South Sumatra Province did not respond to

production activities, either input or output portion of

the community that work sector-a sector of the

economy. In addition, disconnections in the

allocation of funds for quality and Results instead of

Taxes/natural resources at the Expense of the City

District Government of South Sumatra Province with

various policy through development programs for the

public sector the true expected to directly get in touch

with the community, in particular the human

resources that exist in the County Town of South

Sumatra Province as a production factor for the

activity of the economy. The results of this study

support the Aziz (2016) that explains that the funds

for the results does not affect GDP.

The Influence of KF against GDP

The results showed that KF effect on GDP, meaning

high or low KF will affect GDP. This research fits

with research Yuana (2014). Fiscal independence is

the main indicator in measuring the ability of local

governments to finance their own activities of local

governance that is executed, without depending on

ammunition from the outside, including from the

Central Government. According to Halim (2001), the

main characteristic of a region capable of carrying out

The Influence of the General Allocation Fund, a Fund for the Results and Fiscal Independence Against GDP Government Regency/City in

South Sumatera 2011-2016 Year

215

decentralized fiscal autonomy is the ability of the

financial area, meaning the area have the ability and

authority to digging out to finances resources,

manage and use own its treasury to finance the

organization of the government. The more self-

sufficient a region will be more generous in doing

economic development.

5 CONCLUSIONS

The positive effect of fiscal independence and

significantly to the economic growth of the region. So

it is expected that constantly improved the ability of

the area in an effort to improve the fiscal in the

autonomous areas, so that it can continue to improve

the regional investment and boost the economic

growth of the region. Meanwhile, the income of the

DAU and DBH have no effect significantly to

economic growth. DAU and DBH to mean that

increases haven't been able to boost economic

growth. For it is need for policy areas that can

increase per capita income, by encouraging

communities to undertake a productive economic

activities, so as to be able to provide more job

opportunities so that the growth the economy can be

improved and the Government also expected to

prioritize the allocation of DAU and DBH in fields

which directly come into contact with the public

interest, such as infrastructure or facilities that could

encourage economic growth

This study has several limitations, including: a)

there is still some contention between the results of

this research with previous research. So researchers

hope to researchers next back review about factors

that affect economic growth, b) research results

cannot be generalized to the case other than the object

of research, c) the object of the research is still limited

city and regency in South Sumatra Province, d) period

of research conducted in this study only 6 years old,

is expected to further research could use a longer

period in order to make research a higher degree of

accuracy.

REFERENCES

Adi, Shahid & Mumtaz Anwar. 2015. “Impact of Fiscal

Decentralization on Economic Growth: The Case of

Pakistan”. Pakistan Journal of Social Sciences (PJSS),

Vol. 35, No. 1: 91-107

Adiwiyana, P., & Januarti, I. 2011. “Pengaruh

Pertumbuhan Ekonomi, Pendapatan Asli Daerah, dan

Dana Alokasi Umum Terhadap Pengalokasian

Anggaran Belanja Modal”. (Doctoral dissertation,

Universitas Diponegoro).

Apriana, Dina danSuryanto, Rudi., 2010, "Analisis

Hubungan Antara Belanja Modal, PendapatanAsli

Daerah, Kemandirian Daerah dan Pertumbuhan

Ekonomi Daerah (Studi pada Kabupaten dan Kota se

Jawa-Bali)", Jurnal Akuntansidan lnvestasi, Vol.XI

No. 1, Januari

Ardhani, P., &Ardiyanto, M. D. 2011. “Pengaruh

Pertumbuhanekonomi, PendapatanAsli Daerah, Dana

Alokasi Umum, dan Dana Alokasi Khususterhadap

Pengalokasian Anggaran Belanja Modal (Studipada

Pemerintah Kabupaten/Kota di Jawa Tengah)”.

(Doctoral dissertation, Universitas Diponegoro).

Azis, M. (2016). “Pengaruh Dana Bagi Hasilbukan Pajak/

Sumber Daya Alam Dana Alokasi Umum (DAU) dan

Pendapatan Asli Daerah (PAD) terhadap Pertumbuhan

Ekonomi di Kabupaten Malinau”. INOVASI, 12(1), 49-

63.

Bose, N., Haque, M. E. and Osborn, D. R., 2007. “Public

Expenditure and Economic Growth: a Disaggregated

Analysis for Developing Countries”. The Manchester

School, 75(5), pp.533-556.

Chude, N. P. and Chude, D. I., 2013. “Impact of

Government Expenditure on Economic Growth in

Nigeria”. International journal of business and

management review, 1(4), pp.64-71.

Endrawati, U. M. (2010). “Pengaruh Pendapatan Asli

Daerah (PAD), Dana Alokasi Umum (DAU), dan Dana

Alokasi Khusus (DAK) Terhadap Pertumbuhan

Ekonomi: Studi Kasus Sumatera Barat”. Jurnal

Akuntansidan Manajemen 5 (2), 68-84.

Halim, A. 2001. “Manajemen Keuangan Daerah”.

Yogyakarta: UPP YKPN.

Hamzah, Ardi. 2008. “Analisis Kinerja Keuangan

Terhadap Pertumbuhan Ekonomi, Pengangguran, dan

Kemiskinan: Pendekatan Analisis Jalur (Studi Pada 29

Kabupatendan 9 Kota Di Provinsi Jawa Timur Periode

2001-2006)”. Simposium Nasional Akuntansi XI.

Hendriwiyanto, Guntur danKholis, Nur. 2014.

“PengaruhPendapatan Daerah

TerhadapPertumbuhanEkonomiDenganBelanja Modal

SebagaiVariabelMediasi”. JurnalIlmiahMahasiswa

FEB, Vol.3, No. 1.

Isa, FilzahMar'i., 2010, "Pengaruh Dana Aiokasi Umum

(DAU), Dana Alokasi Khusus (DAK) dan Belanja

Modal Terhadap Tingkat Pertumbuhan Ekonomi

Kabupatendan Kota di Provinsi Sumatera Utara",

Doctoral dissertation, Medan: FE Universitas Sumatera

Utara.

Maryati, Ulfidan Endrawati. 2010. “Pengaruh Pendapatan

Asli Daerah (PAD), Dana Alokasi Umum (DAU), dan

Dana Alokasi Khusus (DAK) terhadap Pertumbuhan

Ekonomi (StudiKasus Sumatera Barat)”, Jurnal

Akuntansidan Manajemen Vol 5 No.2 ISSN 1858-3687

hal 68-84.

Nehen, I.K. and Widiatedja, I.P., 2012. “Perekonomian

Indonesia”. Udayana University Press.

Nopiani, Ni Made, Wayan Cipta, & Fridayana

Yudiaatmaja. 2016. “Pengaruh Pendapatan Asli

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

216

Daerah, Dana Alokasi Umum, Dan Belanja Modal

Terhadap Pertumbuhan Ekonomi”. e-Journal Bisma

Universitas Pendidikan Ganesha, Vol 4.

Nuarisa, Sheila Ardhian. 2013. “Pengaruh PAD, DAU, dan

DAK Terhadap Pengalokasian Belanja Modal”.

Accounting Analysis Journal. Universitas Negeri

Semarang.

Permendagri No. 25 Tahun 2009 tentang Pelayanan

Publikadalahkegiatanataurangkaiankegiatandalamrang

kapemenuhankebutuhanpelayanansesuaidenganperatur

anperundang-

undanganbagisetiapwarganegaradanpendudukatasbara

ng, jasa, dan/ataupelayananadministratif yang

disediakanolehpenyelenggarapelayananpublik.

Priyatno, Duwi, 2010. “Teknik Mudahdan Cepat

Melakukan Analisis Data Penelitiandengan SPSS dan

Tanya Jawab Ujian Pendadaran”. Gaya Media,

Yogyakarta.

Pujiati, A., 2008. “Analisis Pertumbuhan Ekonomi di

Karesidenan Semarang Era Desentralisasi Fiskal”.

Economic Journal of Emerging Markets, 13(2).

Putro, NugrohoSuratno. 2010. “Pengaruh Pertumbuhan

Ekonomi, PendapatanAsli Daerah dan Dana Alokasi

Umum Terhadap Pengalokasian Anggaran Belanja

Modal (Studi Kasus Pada Kabupaten/Kota Di Provinsi

Jawa Tengah)”. Doctoral dissertation. Semarang:

Universitas Diponegoro.

Rumanti, Indah Ari., 2009, "Pengaruh Pendapatan Asli

Daerah (PAD) dan Dana Aiokasi Umum (DAU)

Terhadap Pertumbuhan Ekonomidengan

Pengalokasian Belanja Modal sebagai Variabel

Intervening pada Kabupaten/Kota Se Provinsi

Jawadan Bali", Doctoral dissertation,Yogyakarta:

FakultasEkonomi UMY.

Santosa, Agus Budi. 2013. “Pengaruh Pendapatan Asli

Daerah, Dana Alokasi Umum, Dana Alokasi Khusus

Terhadap Belanja Modal (Studi Kasus di Provinsi Jawa

Barat, Jawa Tengah dan Jawa Timur Periode Tahun

2007-2010)”. Jurnal Bisnisdan Ekonomi. Volume 20

N0. 2. Hal: 184-198.

Sihite, Friska., 2009, "Pengaruh Pendapatan Asli Daerah,

Dana Aiokasi Umum, Dana Aiokasi Khususdan Belanja

Modal terhadap Pertumbuhan Ekonomi Daerah di

Kabupaten/Kota Provinsi Sumatera Utara", Doctoral

dissertation, Medan: FE Universitas Sumatera Utara.

Swasno, Fauziah. (2007). “Fiscal Decentralization and

Economic Growth: Evidence from Indonesia”.

Economics and Finance in Indonesia, Vol.55 (2).

Undang-Undang No 17 Tahun 2003 tentangKeuangan

Negara.

Undang-Undang No 32 Tahun 2004 tentangPemerintahan

Daerah

Undang-Undang No.33 tahun 2004 tentangPendapatanasli

Daerah

Undang-Undang No.28 Tahun 2009 tentangPajak Daerah

danretribusi Daerah

Undang-Undang No 23 Tahun 2014 tentangPemerintahan

Daerah

Wandira, ArbieGugus. 2013.”Pengaruh PAD, DAU, DAK,

dan DBH terhadap Pengalokasian Belanja Modal”.

Doctoral dissertation. Semarang: Universitas Negeri

Semarang.

Waluyo, Joko. (2007). “Dampak Desentralisasi Fiskal

Terhadap Pertumbuhandan Aplikasi Untuk

Ekonomidan Bisnis”. Yogyakarta: Penerbit Ekonisia.

Waluyo, J., 2007. “Dampa kDesentralisasi Fiskalterhadap

Pertumbuhan Ekonomidan Ketimpangan

Pendapatanantardaerah di Indonesia”. Makalahpada

Lokakarya Fiscal Decentralization. Wisma Makara,

Kampus UI, Depok, Jakarta.

Wibowo, Puji. (2008). “Mencermati Dampak

Desentralisasi Fiskal Terhadap Pertumbuhan Ekonomi

Daerah”. Journal Keuangan Publik, Vol. 5, No. 1,

Oktober 2008.

Yovita, Farah Marta. 2011. “Pengaruh Pertumbuhan

Ekonomi, Pendapatan Asli Daerah dan Dana Alokasi

Umum Terhadap Pengalokasian Anggaran Belanja

Modal (Studi Empirispada Pemerintah Provinsi Se

Indonesia Periode 2008 – 2010)”. Diponegoro Jurnal

Of Accounting. Semarang: Universitas Diponegoro.

Yuana, Alfionita Putri. 2014. “Analisis Kinerja Keuangan

Daerah terhadap Pertumbuhan Ekonomidan

Ketimpangan Regional di Era Desentralisasi Fiskal

(Studi Kabupaten/Kota di Provinsi Jawa Timur Periode

2008-2012)”. Jurnal Ilmiah Fakultas Ekonomidan

Bisnis Universitas Brawijaya.

Zulkifli, M. 2013. “Analisis Faktor yang Berpengaruh

Terhadap Alokasi Belanja Modal Pemerintah

Kabupaten/Kota di Provinsi Sulawesi Selatan”. Jurnal

Publikasi. Fakultas Ekonomidan Bisnis Universitas

Hasanuddin. Makasar.

The Influence of the General Allocation Fund, a Fund for the Results and Fiscal Independence Against GDP Government Regency/City in

South Sumatera 2011-2016 Year

217