Financial Performance Changes in the Digital Economy

of Indonesian Retail Companies

Yuliani

1

, Husnah

2

, Ima Andriyani

3

1

Departement of Management, Universitas Sriwijaya, Palembang, Indonesia

2

Department of Management, Universitas Tadulako, Palu, Indonesia

3

Department of Management, Universitas Tridinanti, Palembang, Indonesia

Keywords: Digital Economy, Financial Performance, Retail Company

Abtract: Digital economy could cause the change of financial performance nowadays. The objective of this research

is to measure financial performance by comparing the performance before and after digital economy. This

study uses financial ratio to measure financial performance, such as, liquidity, activities, solvency and

profitability. The unit of analysis is retail firm with purposive sampling method of 15 firms and the study

period was 2013-2017. The data analysis method used nonparametric Wilcoxon signed rank test. The findings

show that activities ratio and profitability ratio are significantly after digital economy meanwhile liquidity

and solvency are found to be insignificant after digital economy. Therefore, financial performance is

decreasing after digital economy. This result imply that retail company in Indonesia have to change business

strategy, especially classic pattern sales to be based on digital technology.

1 INTRODUCTION

Digital economy has become a disruptive factor

that has swept the whole world and expanded in all

business sectors such as transportation, medical,

commerce, tourism, education, health and so on. The

digital economy topic discussed in all events in the

form of conferences, discussions and government

policies. The discussion is better known as disruption

revolution, namely from industry 1.0 to cyber-based

4.0 industry (Tandelilin, 2018). The term disruption

can be seen as a term that can be positive or negative

(Experd, 2017). Negative impression if it is

destructive and positive impression if it is an

innovation, fresh perspective, inspiration for creative

millennial times.

Digital economy is a situation where business

activities are dynamic and based on the internet.

According from (Carlsson, 2004) interprets that

digital economy is a dynamic new economy in which

business activity leads to high productivity with a

markedly high use of the internet and heterogeneous

forms of connection resulting in a very broad new

combination. According to (Ayres & Williams, 2004)

digital economics produces an innovation and adopts

Information and Communications Technologies

(ICTs). This innovation is related continuously on

many levels, namely basic science, engineering,

industry, system integration and new applications.

Previous research on digital economics related to

topics in financial management is still relatively

small. The disruptive era makes companies in

business activities will change strategies, especially

sales strategies. Many giant retail sector companies

were decided to close several outlets. For example, 7

Eleven officially closed all outlets at the end of June

2017 cause the company lost Rp.447.9 billion in the

first quarter of 2017, PT Matahari Department Store

closed two outlets in Pasaraya Blok M and Manggarai

at the end of September 2017, retail company Disc

Tarra Prior to close its outlets by the end of 2015,

Lotus retail stores closed outlets in October 2017 and

Debenhams retail store outlets in 2017 (Tandelilin,

2018). The transportation sector has sprung up GoJek,

Grab, Uber. The production sector with zero

inventory appears Alibaba, Bukalapak, Lazada,

Shopee. These new companies are established or

called start-up companies.

The results of research in the field of financial

management related to digital economy are the

emergence of digital finance and financial inclusion

in research conducted (Ozili, 2018). The results show

that digital finance through financial technology has

Yuliani, ., Husnah, . and Andriyani, I.

Financial Performance Changes in the Digital Economy of Indonesian Retail Companies.

DOI: 10.5220/0008436200050013

In Proceedings of the 4th Sriwijaya Economics, Accounting, and Business Conference (SEABC 2018), pages 5-13

ISBN: 978-989-758-387-2

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

5

a positive impact on financial inclusion for

developing countries and developed countries

because digital economy provides individual comfort.

The field of marketing was carried out by researchers

(Lu & Chang, 2013) about consumer perceptions of

online retailers towards e-loyalty intention in 949

respondents indicating that the higher consumers of

online retailers, the more likely consumers are to

make online purchase.

The main objective of this research is to provide

empirical evidence about financial performance as

measured by financial ratios as a consequence of the

impact of the digital economy on retail companies on

the Indonesia Stock Exchange in 2013-2017. The

remaining of this paper is organized as follows.

Section 2 provides the literature on the variables used

for this study, where as section 3 describes the

methodology. The results would then be covered in

Section 4 and finally section 5 the result of this paper.

2 LITERATURE REVIEW

2.1 Liquidity Ratio

Liquidity is related to the company's ability to

repay short-term debt or long-term debt that is due

soon. Companies that do not experience problems in

paying off short-term debt are called liquid

companies. Conversely, companies that are not able

to pay off short-term debt or debt that is due soon are

called illiquid companies. The company's liquidity

measurement includes the current ratio, quick ratio,

cash ratio, net working capital to asset ratio and

measure interval (Ross et al., 2005).

The liquidity ratio in this study uses the current

ratio. Current ratio is the most often used as a

reflection of liquid or not a company. A Small

Current ratio reflects low short-term liquidity. A high

current ratio shows current assets, but has an

unfavorable influence on the profitability of the

company. Current assets generally result in lower

returns or profit levels than fixed assets so there is a

trade-off between risk and return in this condition

(Barclay & Smith, 1995; Hoshi et al., 1991). Current

ratio formula is:

2.2 Activities Ratio

Activities ratio are used to measure the ability of

companies to use their assets efficiently (Hanafi,

2016). This ratio reflects how much funds are

embedded in company assets. if the funds embedded

in certain assets were large enough, while the funds

should be able to be used to invest in other assets that

are more productive, the profitability of the company

should not be and should be. The activity ratio

consists of the average age of accounts receivable,

inventory turnover, fixed asset turnover and total

asset turnover (Hanafi, 2016).

This study measures the ratio of activity to two

ratios, namely inventory turnover (IT) and total asset

turnover (TATO). Inventory turnover measures how

much inventory will spin in a year. The greater the

inventory turnover, the more effective the company

will be in managing its inventory. Conversely, if the

greater the average number of inventory life, the

worse the company's performance will be because the

greater the funds embedded in inventory assets

(Dehning et al., 2007; Kaynak, 2003). The inventory

turnover formula is:

Total asset turnover shows the extent to which the

company's ability to generate sales is based on fixed

assets owned by the company. For companies with a

large proportion of total fixed assets, this ratio

becomes important to note (Hanafi, 2016). However,

for the service industry the fixed asset turnover ratio

is not so important to note. The ratio formula is:

2.3 Solvency Ratio

The solvency ratio measures the company's ability

to pay off its long-term obligations (Hanafi, 2016).

Companies that are able to pay off their long-term

liabilities are called solvable companies, which is

companies are categorized as insolvable if their long-

term liabilities are greater than the total assets owned.

The solvency ratio is more focused on the right side

of the company's balance sheet. Solvency ratio

consists of debt to total asset ratios, times interest

earned ratios and fixed charge coverage ratios

(Hanafi, 2005; Ross et al., 2005).

The ratio's used as a measurement of the solvency

ratio in this study are debt to asset ratio (DAR) and

debt to equity ratio (DER). DAR ratio by comparing

between total debt and total assets. Companies that

have a high DAR ratio mean that the company uses

high financial leverage (Utami, 2017). The proportion

of existing fixed assets should have the ability to pay

off existing debt. The DAR formula is:

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

6

The ratio of the total debt ratio to the amount of

capital available shows the DER ratio. The use of

high debt will increase profitability, besides that high

debt will have an impact on risk (Barth & Miller,

2018; Utami, 2017). For certain conditions, the

company may have high debt, for example a booming

or normal macroeconomic condition, but if the

economic conditions of recession, the use of high debt

will also cause a high risk. If high sales companies

will not experience difficulties in paying installments

because the interest charged tends to be fixed. It is not

good if sales go down, the company's ability to pay

installments is slow. The DER ratio is used by the

formula:

2.4 Profitability Ratio

Profitability is used to measure a company's

ability to obtain profits at the level of sales, certain

assets and capital in a period (Hanafi, 2016). This

ratio can be interpreted as the company's ability to be

efficient for a certain period. The ratios contained in

profitability are profit margins, return on assets

(ROA), return on equity (ROE).

This study measures profitability with two ratios,

namely ROA and ROE. ROA measures the ability of

a company to generate net income based on certain

assets. According to (Muritala, 2012) that a high

ROA ratio reflects that companies in manage their

assets are getting better or called more efficient and

effective.

ROE measurement is used to determine the

company's ability to obtain profits from internal

funding sources. This measure is a measure of

profitability seen in the perspective of shareholders.

According to (Hanafi, 2016) this ratio does not take

into account dividends and capital gains for

shareholders, because this ratio does not include a

measure of the return received by the actual

shareholders. High ROE indicates that the level of

corporate profitability is high (Utami, 2017). The

ROE measurement formula is as follows:

3 RESEARCH METHODS

The population of the research are 23 companies

in the retail sector in the Indonesia Stock Exchange

(IDX). The research period is 2013-2017. The

selection of the period was based on 2015 that used

as the basic year of the digital economy phenomenon.

A purposive technique in selecting samples with

several criteria, namely 1) Retail companies that have

not been delisted during the 2013-2017 period; 2)

Retail companies that have financial information

December 31, 2013 up to a minimum of September

2017, this is due to the lack of retail companies that

have published complete financial reports until

December 31, 2017. Based on the selected criteria,

there are 15 retail companies as research samples. The

source of research data is the financial statements of

retail companies so that the data used is secondary

data.

Measurement of financial performance of this

study uses four ratios, namely liquidity, activity,

solvency and profitability. Data analysis techniques

descriptively that is to determine the mean by adding

up the calculation results of the ratio and divided by

the number of years of research and calculating the

difference between the average after and the average

before. The research hypothesis was inferentially

tested using a non-parametric Wilcoxon signed-rank

test method.

4 RESULT

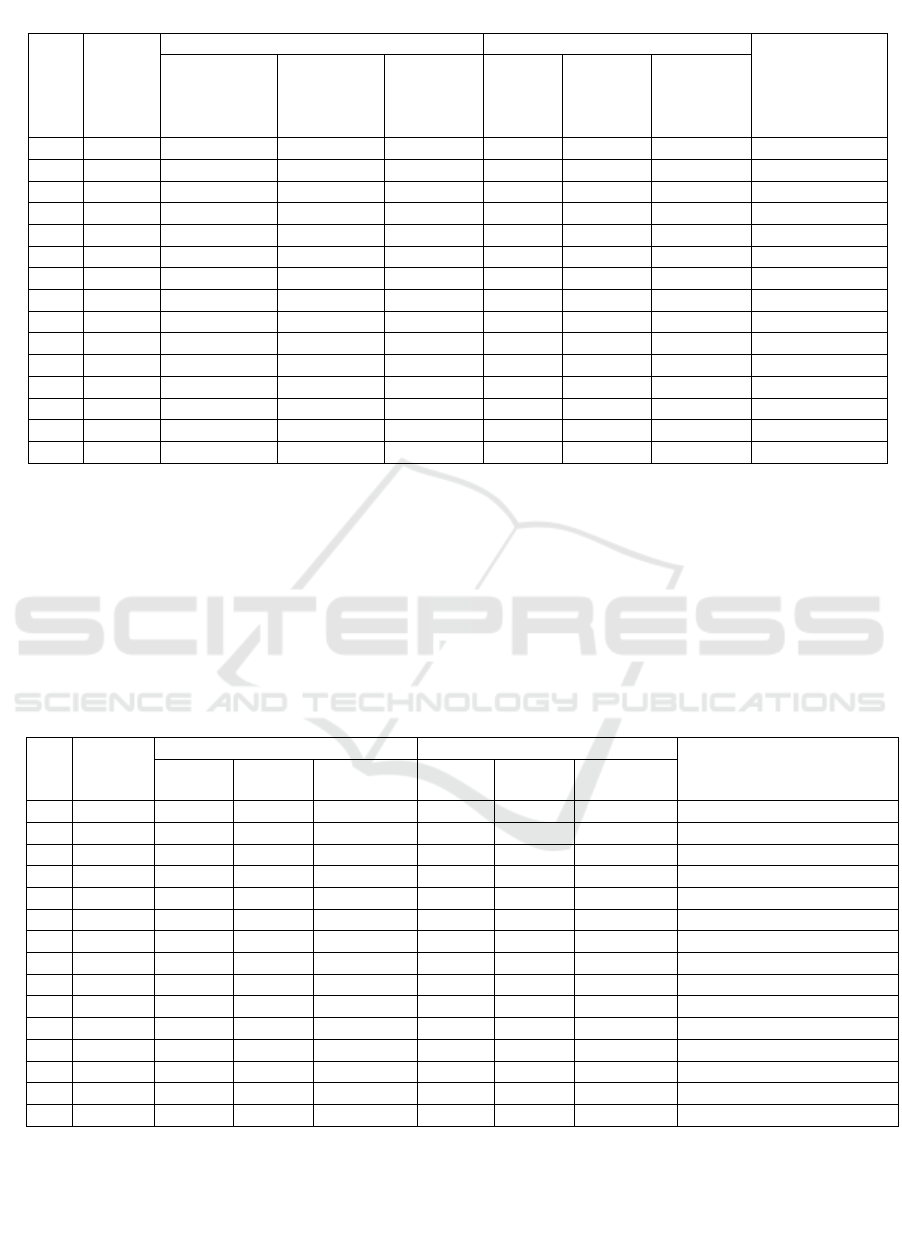

The change of financial ratios based on the

average value between after and before is explained

in detail as follows: Changes in the development of

liquidity ratios are measured by the current ratio

(CR), namely the comparison between current assets

and current debt for the period of two years before

and two years after the digital economy occurs is

shown in Table 1. The average CR ratio development

in Table 1 is 66.67% the impact of digital economy

does not occur in the decline of CR. Based on Table

1, the impact after the digital economy for retail

companies as a whole still shows an improvement in

the liquidity ratio, which is proxy by CR, although

there are some companies that experienced a sharp

decline.

Financial Performance Changes in the Digital Economy of Indonesian Retail Companies

7

Table 1: Change of Current Ratio (%)

No

Code

Before

After

Average

difference

(after

deducting

before)

(t-2)

(t-1)

Average

(t+1)

(t+2)

Average

1

ACES

397,74

508,89

453,32

726,12

634,68

680,40

227,09

2

AMRT

82,07

91,46

86,77

89,60

88,34

88,97

2,21

3

CENT

162,66

53,57

108,12

143,82

165,81

154,82

46,72

4

CSAP

107,35

112,87

110,11

125,75

118,31

122,03

11,92

5

ERAA

171,84

148,22

160,03

131,33

147,62

139,48

(20,56)

6

GOLD

580,72

903,61

742,17

71,41

93,34

82,38

(659,79)

7

HERO

162,88

117,76

140,32

142,94

135,16

139,05

(1,27)

8

KOIN

133,85

121,21

127,53

116,03

114,24

115,14

(12,40)

9

LPPF

90,10

84,08

87,09

114,90

113,90

114,40

27,31

10

MAPI

111,74

134,36

123,05

158,23

153,52

155,88

32,83

11

MIDI

87,00

82,49

84,75

76,62

64,74

70,68

(14,07)

12

RALS

246,49

278,53

262,51

280,56

362,81

321,69

59,18

13

RANC

159,37

131,30

145,34

159,39

173,83

166,61

21,28

14

RIMO

173,00

127,00

150,00

119,00

339,47

229,24

79,24

15

TELE

140,33

180,11

160,22

598,91

170,80

384,86

224,64

Source: Processed from financial statement, 2013-2017

The activity ratio proxy by Inventory Turnover

(IT) is shown in Table 2. IT ratios reflect the

effectiveness of the company's operating activities

related to inventory management. This ratio

measurement is comparing the cost of goods sold and

ending inventory. The higher this ratio reflects the

more effective inventory turnover means that the

company is efficient in controlling inventory.

Efficiency reflects that the company does not need to

incur additional costs such as maintenance costs. As

many as 67% of retail companies experienced a

decline in IT after the digital economy occurred in

2013-2017. This condition reflects that the impact of

digital economy is able to reduce the IT performance

of retail companies after two years of digital

economy.

Table 2: Change of Inventory Turnover (x)

No

Code

Before

After

Average difference

(after deducting before)

(t-2)

(t-1)

Average

(t+1)

(t+2)

Average

1

ACES

1,15

1,13

1,14

1,63

1,19

1,41

0,27

2

AMRT

1,61

1,35

1,48

7,47

5,64

6,56

5,08

3

CENT

0,63

0,78

0,71

4,53

15,11

9,82

9,12

4

CSAP

0,06

0,55

0,31

4,07

3,30

3,69

3,38

5

ERAA

6,28

6,58

6,43

8,51

5,54

7,03

0,60

6

GOLD

7,77

8,99

8,38

3,33

2,39

2,86

(5,52)

7

HERO

4,95

4,29

4,62

5,15

3,73

4,44

(0,18)

8

KOIN

11,76

7,57

9,67

4,79

3,96

4,38

(5,29)

9

LPPF

0,81

0,84

0,83

0,76

0,69

0,73

(0,10)

10

MAPI

1,66

1,98

1,82

0,68

0,54

0,61

(1,21)

11

MIDI

1,81

1,54

1,68

1,48

1,14

1,31

(0,37)

12

RALS

4,43

4,72

4,58

0,79

0,60

0,70

(3,88)

13

RANC

4,21

6,61

5,41

2,16

1,65

1,91

(3,51)

14

RIMO

14,25

10,90

12,58

0,04

0,14

0,09

(12,49)

15

TELE

14,90

14,52

14,71

3,31

2,19

2,66

(12,05)

Source: Processed from financial statement, 2013-2017

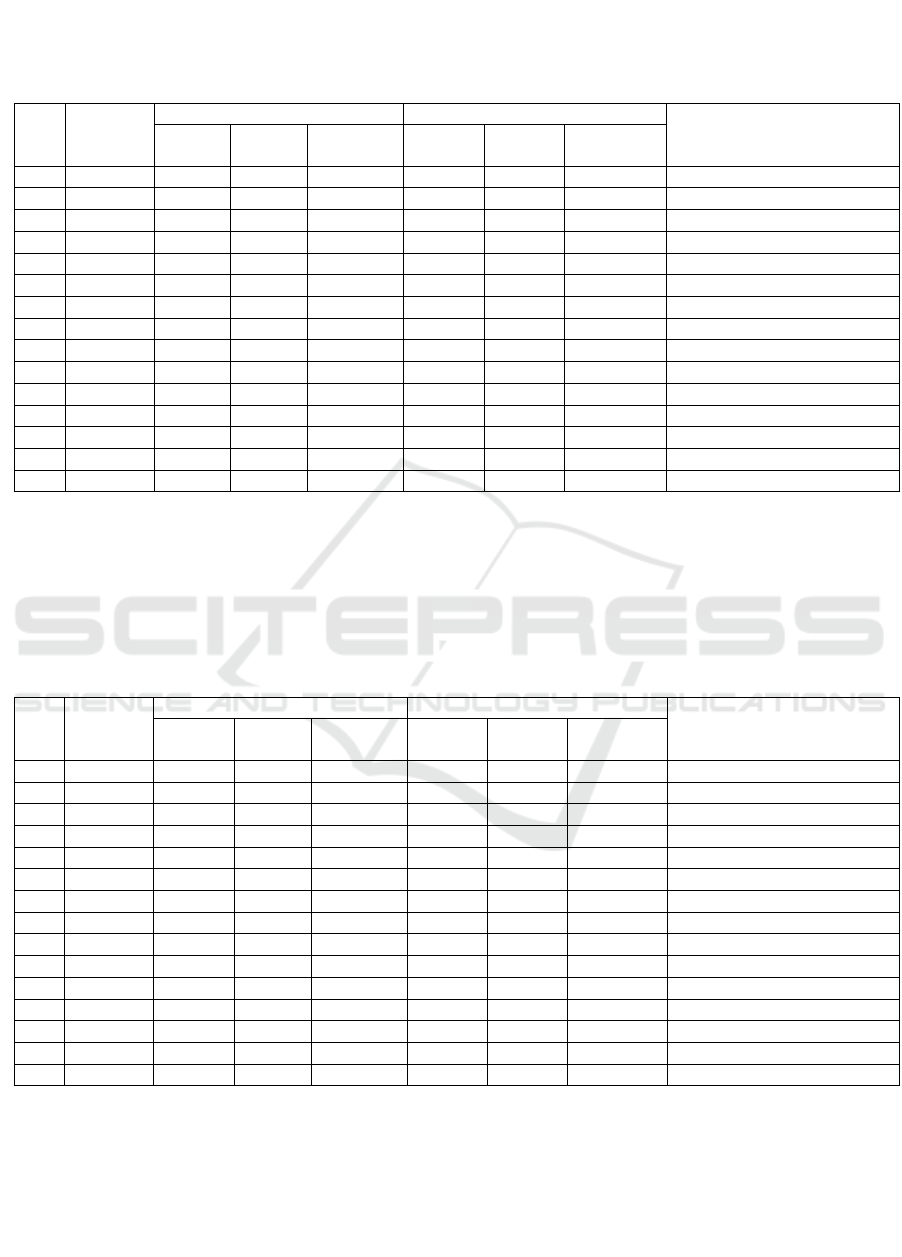

Activity ratio can be measured by Total Asset

Turnover (TATO). TATO compares the net sales

value to total assets in a certain period. The higher the

TATO reflects the better retail companies in

managing assets, resulting in high net sales. Table 3

shows the average development of TATO before and

after the digital economy occurs. The impact after two

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

8

years of digital economy showed retail companies

experienced a decline in TATO.

Table 3: Change of Total Asset Turnover (x)

No

Code

Before

After

Average difference

(after deducting before)

(t-2)

(t-1)

Average

(t+1)

(t+2)

Average

1

ACES

1,57

1,54

1,56

0,69

1,03

0,86

(0,70)

2

AMRT

3,18

2,97

3,08

2,88

2,12

2,50

(0,58)

3

CENT

0,04

0,08

0,06

0,11

0,12

0,12

0,06

4

CSAP

2,07

2,12

2,10

1,57

1,20

1,30

(0,71)

5

ERAA

2,55

2,36

2,46

2,53

2,09

2,31

(0,15)

6

GOLD

0,51

0,48

0,50

0,06

0,12

0,09

(0,41)

7

HERO

1,53

1,54

1,54

1,83

1,28

1,58

0,02

8

KOIN

3,30

2,25

2,78

2,05

1,59

1,82

(0,96)

9

LPPF

2,30

2,32

2,31

2,04

1,85

1,05

(0,37)

10

MAPI

1,25

1,36

1,31

1,32

1,05

1,19

(0,12)

11

MIDI

2,36

2,31

2,34

1,99

1,51

1,75

(0,59)

12

RALS

1,37

1,28

1,33

1,26

0,98

1,12

(0,21)

13

RANC

1,83

2,10

1,97

1,86

2,19

2,53

0,56

14

RIMO

0,06

0,02

0,04

0,00

0,04

0,02

(0,02)

15

TELE

3,03

2,91

2,97

3,32

2,32

2,82

(0,15)

Source: Processed from financial statement, 2013-2017

Table 4.Shows Debt to Asset Ratio (DAR) for

retail companies in the study sample. It appears that

all retail companies fund total assets sourced from

debt. The higher the DAR reflects the greater

corporate debt which in turn can lead to the

company's dependence on external funds. The impact

of the development after the digital economy occurs

for retail companies is quite diverse based on the

average difference in DAR.

Table 4: Change of Debt to Asset Ratio (%)

No

Code

Before

After

Average difference

(after deducting before)

(t-2)

(t-1)

Average

(t+1)

(t+2)

Average

1

ACES

0,23

0,20

0,22

0,18

0,20

0,19

(0,03)

2

AMRT

0,76

0,79

0,78

0,73

0,76

0,75

(0,03)

3

CENT

0,12

0,26

0,19

0,21

0,26

0,24

0,05

4

CSAP

0,77

0,75

0,76

0,67

0,70

0,69

(0,08)

5

ERAA

0,45

0,51

0,48

0,54

0,51

0,53

0,05

6

GOLD

0,20

0,15

0,18

0,44

0,49

0,47

0,29

7

HERO

0,31

0,34

0,33

0,27

0,29

0,28

(0,05)

8

KOIN

0,74

0,78

0,76

0,83

0,85

0,84

0,08

9

LPPF

1,27

0,95

1,11

0,62

0,57

0,60

(0,52)

10

MAPI

0,69

0,70

0,70

0,70

0,62

0,66

(0,04)

11

MIDI

0,76

0,76

0,76

0,79

0,81

0,80

0,04

12

RALS

0,27

0,26

0,27

0,28

0,23

0,26

(0,01)

13

RANC

0,44

0,48

0,46

0,40

0,39

0,40

(0,06)

14

RIMO

11,84

9,55

10,70

2,96

0,11

1,54

(9,16)

15

TELE

0,60

0,50

0,55

0,61

0,61

0,61

0,06

Source: Processed from financial statement, 2013-2017

The solvency ratio with the Debt to Equity Ratio

(DER) proxy shows a comparison between debt and

total capital. The higher the DER shows the fewer

internal funding sources from shareholders' own

capital. Table 5 shows the development of DER

before and after the digital economy occurs. The

impact after digital economy has occurred, almost all

companies in funding reduce external funding means

that they are more likely to use additional capital from

internal, namely their own capital from retained

earnings and shareholders.

Financial Performance Changes in the Digital Economy of Indonesian Retail Companies

9

Table 5: Change of Debt to Equity Ratio (%)

No

Code

Before

After

Average difference

(after deducting

before)

(t-2)

(t-1)

Average

(t+1)

(t+2)

Average

1

ACES

0,29

0,25

0,27

0,22

0,25

0,24

(0,04)

2

AMRT

3,21

3,65

3,43

2,68

3,16

2,92

(0,51)

3

CENT

0,14

0,35

0,25

0,20

0,27

0,24

(0,01)

4

CSAP

3,34

3,04

3,19

2,00

2,29

2,15

(1,05)

5

ERAA

0,82

1,03

0,93

1,18

1,02

1,10

0,18

6

GOLD

0,24

0,18

0,21

0,79

0,95

0,87

0,66

7

HERO

0,45

0,52

0,49

0,37

0,41

0,39

(0,10)

8

KOIN

2,83

3,60

3,22

4,84

5,69

5,27

2,05

9

LPPF

(4,76)

18,19

6,72

1,62

1,33

1,48

(5,24)

10

MAPI

2,22

2,33

2,28

2,33

1,65

1,99

(0,29)

11

MIDI

3,21

5,37

4,29

3,76

4,38

4,07

(0,22)

12

RALS

0,36

0,36

0,36

0,39

0,30

0,35

(0,02)

13

RANC

0,79

0,92

0,86

0,67

0,64

0,66

(0,20)

14

RIMO

(1,09)

(1,12)

(1,11)

(1,51)

0,13

(0,69)

0,42

15

TELE

1,49

1,01

1,25

1,56

1,59

1,58

0,33

Source: Processed from financial statement, 2013-2017

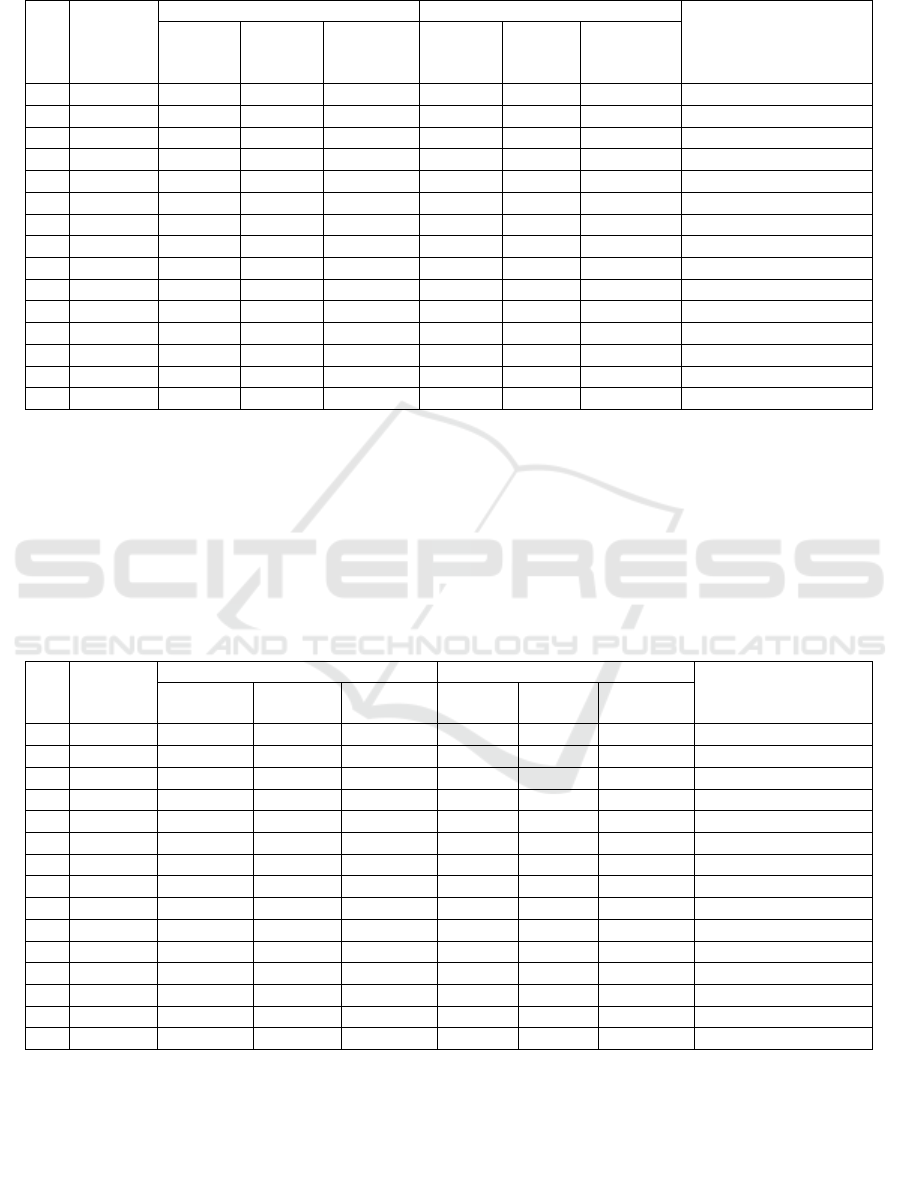

Profitability ratios measure a company's ability to

earn profits in a given period. The ratio used as a

measure of asset effectiveness in generating net

income is the Return on Assets (ROA) approach. The

impact of digital economy after two years on average

shows the development of a decline of almost 99% of

retail companies in Indonesia. ROA decreases due to

changes in net income as a measure of the level of

success of the company's operational efficiency.

Referring to Table 6, it can be explained that the

digital economy impact causes a decrease in net

income decline of almost all retail companies in

Indonesia.

.

Table 6. Change of Return on Asset (%)

No

Code

Before

After

Average difference

(after deducting

before

(t-2)

(t-1)

Average

(t+1)

(t+2)

Average

1

ACES

20,29

18,62

19,46

18,93

12,82

15,88

(3,58)

2

AMRT

5,19

4,09

4,64

2,84

0,22

1,53

(3,11)

3

CENT

(3,77)

(4,71)

(4,24)

(2,27)

(1,92)

(2,10)

(2,15)

4

CSAP

2,44

3,47

2,96

1,76

1,36

1,56

(1,40)

5

ERAA

6,97

3,50

5,24

3,53

3,19

3,36

(1,88)

6

GOLD

6,84

3,17

5,01

(0,86)

0,17

(0,35)

(5,35)

7

HERO

8,65

0,53

4,59

1,61

0,90

1,26

(3,34)

8

KOIN

10,90

5,04

7,97

0,00

(1,53)

(0,77)

(8,74)

9

LPPF

39,16

41,64

40,40

41,57

35,14

38,36

(2,04)

10

MAPI

4,20

0,84

2,52

1,95

2,30

2,13

(0,40)

11

MIDI

3,19

5,37

4,28

4,60

0,95

2,78

1,51

12

RALS

8,92

7,80

8,36

8,79

8,15

8,47

(0,11)

13

RANC

4,67

1,21

2,94

5,48

3,63

4,56

(1,62)

14

RIMO

(111,74)

(68,10)

(89,92)

(9,06)

2,11

(3,48)

(86,45)

15

TELE

8,53

6,07

7,30

5,71

3,13

4,42

(2,88)

Source: Processed from financial statement, 2013-2017

Table 7 shows the development of Return On

Equity (ROE) of retail companies in Indonesia. ROE

measures the rate of return on capital in generating

net income. The higher ROE reflects the better

operational efficiency of the company. Negative ROE

reflects that the return on capital in operational

efficiency is not effective. It appears in Table 7 in the

two years before digital economy happens that almost

all companies have positive ROE as well as digital

economy, but if calculated with the average

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

10

development of the difference, the ROE of retail

companies has d ecreased.

Table 7: Change of Return on Equity (%)

No

Code

Before

After

Average difference

(after deducting

before

(t-2)

(t-1)

Average

(t+1)

(t+2)

Average

1

ACES

26,26

23,24

24,75

23,16

15,99

19,58

(5,18)

2

AMRT

21,85

19,04

20,45

10,46

0,92

5,69

(14,76)

3

CENT

(4,29)

(6,34)

(5,32)

(2,87)

(2,59)

(2,73)

(2,59)

4

CSAP

10,58

14,01

12,30

5,29

4,49

4,89

(7,41)

5

ERAA

12,66

7,11

9,89

7,68

6,45

7,07

(2,82)

6

GOLD

8,51

3,73

6,12

(1,54)

0,33

(0,61)

(6,73)

7

HERO

12,53

0,80

6,67

2,21

1,28

1,75

(4,92)

8

KOIN

41,75

23,16

32,46

(0,01)

(10,25)

(5,13)

(37,59)

9

LPPF

-147,20

799,10

325,95

108,86

81,92

95,39

(230,56)

10

MAPI

13,50

2,81

8,16

6,51

6,10

6,31

(1,85)

11

MIDI

13,44

22,39

19,92

21,90

5,11

13,51

(6,41)

12

RALS

12,14

10,57

11,36

12,24

10,61

11,43

0,07

13

RANC

8,38

2,32

5,35

9,17

5,97

7,57

2,22

14

RIMO

10,30

7,96

9,13

4,63

2,38

3,51

(5,62)

15

TELE

21,27

12,19

16,73

14,63

8,10

11,37

(5,37)

Source: Processed from financial statement, 2013-2017

Based on Table 8 below it appears that the

financial performance of retail companies has four

significant variables as the impact of the digital

economy. The significant variable is the ratio of

activities proxy by IT and TATO. In addition,

profitability ratios show significant results which are

proxy by ROA and ROE.

Table 8: Hypothesis Testing Results

Variables

Before average

After average

Average difference

(before-after)

Statistical Test Z

Wilcoxon

Liquidity:

CR (%)

16,6

14,7

(1,9)

0,229

Activity:

IT (x)

49,6

32,1

(17,5)

0,082**

TATO (x)

17,6

14,0

(3,6)

0,001*

Solvency:

DAR (%)

12,2

59,1

46,9

0,420

DER (%)

17,8

15,1

(2,7)

0,948

Profitability:

ROA (%)

68,3

52,2

(16,1)

0,069**

ROE (%)

33,6

11,9

(21.7)

0,005*

Source: Processed from secondary data, 2018

Level of significant *5% **10%

5 DISCUSSIONS

The overall financial performance after digital

economy shows a decrease based on the average

difference between two years after and two years

before. The liquidity ratio is proxy by CR showing a

decline of 1.9%, which means that the ability of retail

companies to pay short-term liabilities tends to

decrease. However, if you pay attention to the

average before and after the impact of the digital

economy, there is no difficulty because it is still

above the normal limit of 2: 1. The change in CR after

the above before in the statistical findings is not

significant. This means that the impact of the two-

year digital economy of retail companies still has a

positive CR value.

The overall financial performance after digital

economy shows a difference between two years after

and two years before. The liquidity ratio is proxy by

CR showing a decline of 1.9%, which means that the

Financial Performance Changes in the Digital Economy of Indonesian Retail Companies

11

ability of retail companies to pay short term liabilities

tends to decrease. However, if you pay attention to

the average before and after impact of the digital

economy, there is no difficulty because it is still

above the normal limit of 2: 1. The change in CR after

the above before in the statistical findings is not

significant. It means that the impact of the two-year

digital economy of retail companies still has a

positive CR value.

The leverage ratio proxy by DAR and DER has a

different development. The DAR increase of 46.9%

as a result of digital economy indicates that retail

companies add a higher external funding source,

namely 46.9%. Table 8 shows that the average two

years before the DAR digital economy is 12.2%. The

impact of digital economy causes a high increase in

debt, namely 46,% to 59.1%. Based on the statistical

test Z Wilcoxon found results that statistically the

solvency ratio after the digital economy occurs is

insignificant. This means that the average value after

and before the digital economy does not give a real

influence that retail companies change funding

decisions. These findings are consistent with the

findings of the study (Widjajanti, 2010) that the

occurrence of privatization does not contribute

significantly to the leverage ratio. These findings not

consistent with (Kaniel & Parham, 2016) about

causality between media attention and consumer

investment behavior, independent of the conveyed

information.

The calculation of profitability ratios proxy by

ROA and ROE shows a change in decline. This

means that the impact of digital economy has

evidence empirical, retail companies experience a

decline in net income. The decrease in the average

difference is quite high on the ROE variable of

21.7%, which mean that the retail company's net

profit target is not achieved as a result the capital used

for sales activities is relatively ineffective in

generating an increase in net income. The Wilxocon

statistical test found significant results, meaning that

the change in the decrease in ROE after the digital

economy occurred was empirically proven. The

results has same as (Edeling & Himme, 2018) but

different from (Widjajanti, 2010) where results are

found to be insignificant as a result of privatization.

6 CONCLUSION, LIMITATION

AND SUGGESTION

The financial ratio that is significantly after the

digital economy occurs is the activity ratio and

profitability ratio. The activity ratio is proxy by

inventory turnover and total asset turnover while the

profitability ratio is proxy by return on assets and

return on equity. On average, all financial ratios have

decreased performance. The decrease in the highest

average difference is return on equity and the lowest

current ratio. Profitability ratios that experience a

decline can be interpreted as a retail company

experiencing a decline in sales. This condition can be

seen that the level of inventory turnover is decreasing

is a reflection of the inventory that accumulates in the

warehouse is high enough so that the sales cycle has

decreased.

The topic of this study is very interesting and

relevance is in accordance with the real conditions

facing Indonesia today. The impact of industry 4.0 on

various business sectors not only in the trade sector

for retail companies but also disruptive all fields of

business such as transportation, medical, commerce,

tourism, education, health and so on. The conclusion

of this study only applies to retail companies, whereas

other business sectors allow changes in financial

performance. Further research is recommended to

conduct empirical testing for other business sectors so

that conclusions will be obtained more

comprehensively.

Another limitation of this study only examines the

impact of digital economics using variable financial

ratios such as liquidity, solvency, activity on

profitability so this finding only limited to the

company's fundamentals even though market

performance will be very important, especially for

investors. Subsequent research can add market ratio

variables so that it will complement this study and be

useful for investors in financial investment decision

making.

REFERENCES

Ayres, R. U., & Williams, E. (2004). The digital economy :

Where do we stand ? Technological Forecasting &

Social Change, 71, 315–339.

https://doi.org/10.1016/j.techfore.2003.11.001

Barclay, M. J., & Smith, C. W. (1995). The Maturity

Structure of Corporate Debt. The Journal of Finance,

L(2), 609–631.

Barth, A. J. R., & Miller, S. M. (2018). Benefits and Costs

of a Higher Bank “Leverage Ratio.” Journal of

Financial Stability.

https://doi.org/10.1016/j.jfs.2018.07.001

Carlsson, B. (2004). The Digital Economy : what is new

and what is not ? Structural Change and Economic

Dynamic, 15, 245–264.

https://doi.org/10.1016/j.strueco.2004.02.001

SEABC 2018 - 4th Sriwijaya Economics, Accounting, and Business Conference

12

Dehning, B., Richardson, V. J., & Zmud, R. W. (2007). The

Financial Performance Effects of IT-based Supply

Chain Management Systems in Manufacturing Firms.

Journal of Operation Management, 25, 806–824.

https://doi.org/10.1016/j.jom.2006.09.001

Edeling, A., & Himme, A. (2018). When Does Market

Share Matter? New Empirical Generalizations from a

Meta-Analysis of the Market Share-Performance

Relationship. Journal of Marketing, 82(3), 1–24.

Experd, C. (2017). Be Desruptive. Kompas.

Hanafi, M. (2016). Manajemen Keuangan (2nd ed.).

Yogyakarta: BPFE.

Hoshi, T., Kashyap, A., & Scharfstein, D. (1991).

Corporate Structure, Liquidity, and Investment:

Evidence from Japanese Industrial Groups. The

Quarterly Journal of Economics, 106(1), 33–60.

https://doi.org/https://doi.org/10.2307/2937905

Kaniel, R., & Parham, R. (2016). The Impact of Media

Attention on Consumer and Mutual Fund Investment

Decisions. Journal of Financial Economics, 123(2),

337–356. https://doi.org/10.1016/j.jfineco.2016.11.003

Kaynak, H. (2003). The Relationship Between Total

Quality Management Practices and their Effects on

Firm Performance. Journal of Operations

Management, 21, 405–435.

https://doi.org/10.1016/S0272-6963(03)00004-4

Lu, L., & Chang, H. (2013). Online Shoppers ’ Perceptions

of E-retailers ’ Ethics , Cultural Orientation , and

Loyalty An exploratory study in Taiwan. Internet

Research, 23(1), 47–68.

https://doi.org/10.1108/10662241311295773

Muritala, T. A. (2012). An Empirical Analysis of Capital

Structure on Firms ’ Performance in Nigeria.

International Journal of Advances in Management and

Economics, 1(5), 116–124.

Ozili, P. K. (2018). Impact of Digital Finance on Financial

Inclusion and Stability. Borsa Istanbul Review, xx, 1–

12. https://doi.org/10.1016/j.bir.2017.12.003

Ross, S. A., Westerfield, R. W., & Jaffe, J. (2005).

Corporate Finance (7th ed). New York: McGraw-Hill.

Tandelilin, E. (2018). Bagaimana Pendidikan Bisnis

Menyiapkan Mahasiswa untuk Bersaing di Era

Disruptif? Annualy APPMI.

Utami, W. B. (2017). Analysis of Current Ratio Changes

Effect , Asset Ratio Debt , Total Asset Turnover ,

Return On Asset , And Price Earning Ratio In

Predictinggrowth Income By Considering Corporate

Size In The Company Joined In Lq45 Index Year 2013

-2016. International Journal of Economics, Business

and Accounting Researcah (IJEBAR), 1(1), 25–37.

Widjajanti, K. (2010). Perubahan Kinerja Keuangan

Privatisasi BUMN. Jurnal Keuangan Dan Perbankan,

14(Edisi Khusus Oktober 2010), 621–632.

Financial Performance Changes in the Digital Economy of Indonesian Retail Companies

13