Determinant of Saving in Islamic Bank: Case Study in Indonesia

Taufik Nugroho

1

, M Faishol Luthfi

1

and Sri Herianingrum

2

1

Master Study of Islamic Economics Program, Surabaya, Indonesia

2

Postgraduate Magister Islamic Economics Program, Surabaya, Indonesia

Keywords: Islamic Bank, Saving, VECM

Abstract: The development of the amount of saving in Sharia Banking in Indonesia during the 2011-

2017 periods experienced a relatively significant growth. However, in 2014-2015, the growth

of the amount of saving has decreased from the previous period. This decline is expected due to the impact

of the global financial crisis and high inflation. This research tries to analyse and compare the factors

influencing the growth of saving in Sharia Banking by using the VECM Method. The results of this study

indicate that in the short term there are two variables that affect the sharia savings significantly; that is the

variable of the amount of money in circulation (M2) and the variable of the currency exchange rate of

Rupiah to the US dollar (exchange rate). While the BI rate and inflation variables have no effect on sharia

savings. And in the long run, all macroeconomic variables are total money supply (M2), Rupiah exchange

rate to US dollar (exchange rate), BI rate and inflation signifies sharia savings significantly. In comparison,

the sharia saving is most influenced by sharia savings itself with 82% contribution. Then followed

by the inflation variable, which contributed 9.5%, and then Bi rate with a contribution of 6.2%, Rupiah

exchange rate to US dollar contributed 1.6% and the last variable, the amount of money in circulation (M2)

with a contribution of 0.37%.

1 INTRODUCTION

One of the most common problems facing emerging

countries like Indonesia is the lack of capital for

investments used to support the economic

development. Sources of state financing

development can come from within the country and

abroad. One of the alternatives to obtain domestic

financing funds is to source from public savings,

government savings, tax revenues and private

investment. Therefore, the existence of sharia

financial institutions is indispensable in financing

economic development.

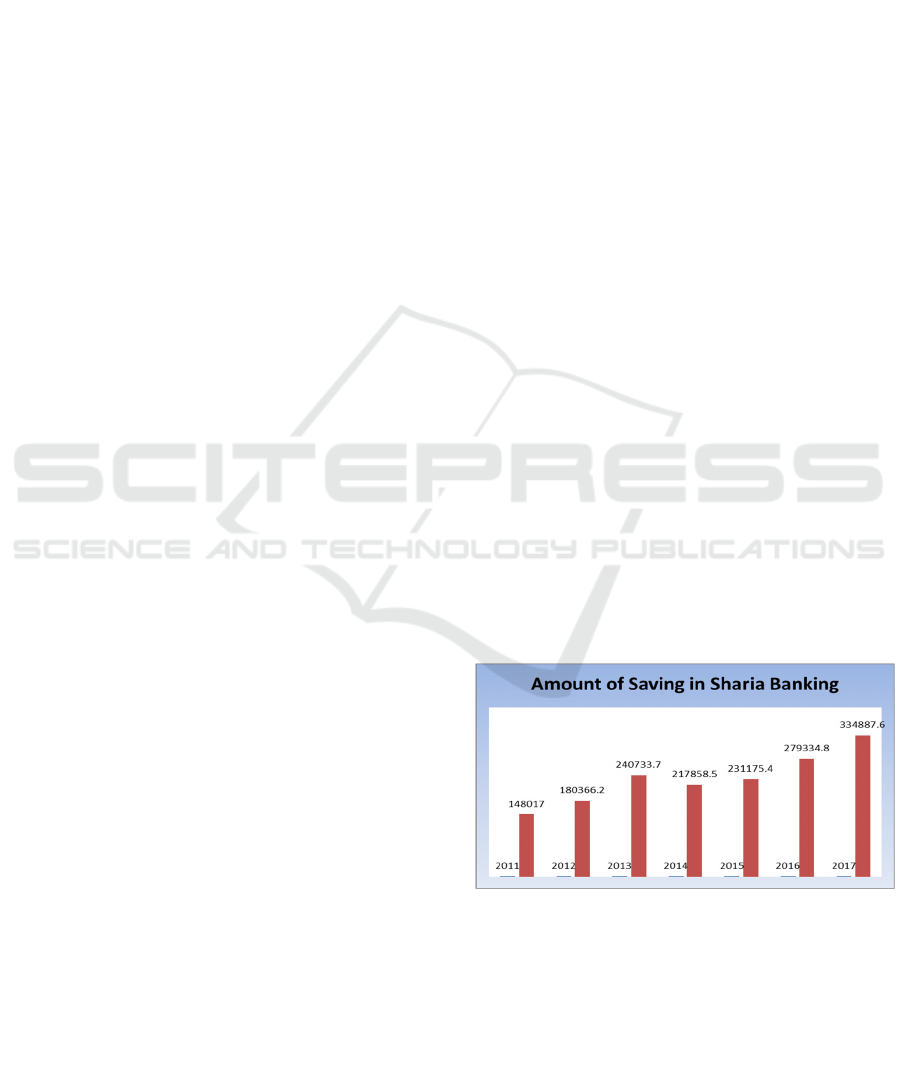

The growth of savings accounts in sharia

banking from 2011 and 2017 is relatively increasing

from year to year. However, in 2014-2015, the

growth of the level of saving decreased from

previous periods. Whereas in the previous five years

of 2009-2013 the growth of sharia bank assets

experienced an average growth of 43%; however, in

the period of 2014-2015 it experienced a decline

drastically. This retardation is not only seen from the

decline on assets itself but also financing provided

saving.

Source: Bank Indonesia

Figure 1.1 Amount of Saving in Sharia Banking

The decline was also seen in the liquidity and

profitability ratios. This is predicted because of the

impact of the global financial crisis and high

inflation. But the decline is not gradual. In 2016-

2017 the growth of sharia banking assets which is

shown by the amount of saving has increased

relatively highly.

Nugroho, T., Luthfi, M. and Herianingrum, S.

Determinant of Saving in Islamic Bank: Case Study in Indonesia.

DOI: 10.5220/0007538401050110

In Proceedings of the 2nd International Conference Postgraduate School (ICPS 2018), pages 105-110

ISBN: 978-989-758-348-3

Copyright

c

2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

105

The development of this IB-savings is influenced

by the inflation rate. In developing countries,

inflation may push down the savings rate because of

an expenditure boost for durable goods thereby

lowering the savings rate.

Encouraging people to replace their nominal

assets into real assets, interest rates also have a role

in the level of Islamic banking savings, because

interest rates are a factor that can affect the macro

economy. Although sharia banking does not use

interest rates, the interest rate is still a benchmark to

determine the ratio and profit sharing. In addition,

the money supply factor also has an important role

in increasing the number of Islamic banking savings,

because all economic and financial activities are

done using the money. Whereas the function of

money is no longer only used as a means of payment

it is also used as a tool to store wealth or for

precaution reasons. The Rupiah exchange rate

against the US dollar that becomes a global payment

instrument becomes an external factor that has an

effect on the amount of savings in sharia banking.

So that a crisis that occurs globally either directly or

indirectly will affect sharia financial institutions in

developing countries including Indonesia.

In response to savings growth experiencing

relatively fluctuating growth, it is necessary to

evaluate any factors that may affect the growth of

Third Party Funds. With this sharia banking can

make efforts in coping with the phenomenon of

growth retardation that will happen. For that reason,

this research aims to discover the factors that cause

the growth of third party funds based on macro-

economy.

Many studies have conducted research to

examine macro-economic impacts on savings. Most

researchers have focused on influence only, but

there are still few who examine the contribution to

macro-economic variables that contribute most to

savings growth, such as the research of Muhammad

(2011) and Friska. (2013). They found that "per

capita income, interest rates and inflation affect

short-term savings in Indonesia. Whereas in the long

run only the money supply has an effect on savings.

Then Haron, Sudin (2015) on Determinant of

Islamic and Conventional Deposits in the Malaysian

banking system and Loayza and Shankar (2000)

measured the relationship between savings in India

and factors of macro-economic variables.

Based on the explanation that has been put

forward, the formulation of the problem in this

research is (1) How the macro-economic variable is

influencing the amount of sharia bank savings (2)

How is the response of the amount of saving in

sharia banks due to macro-economic shock (3) How

big is the contribution of each variable to the saving

in sharia banking.

1.1 Macro-economic Internal

Indicators

1.1.1 Inflation

• Inflation Relationship Against Saving

A high and uncontrollable inflation may disrupt

banking efforts in mobilizing public funds due to

high inflation rates causing the real interest rate to

decline. Such facts will reduce the public's desire to

save money so that the growth of banking funds

sourced from the community will decline.

1.1.2 Amount of Money Supply

• Money Supply Relation (M2) Against Saving

The components that contribute to improved M2

are the increase of M1 and the quasi-cash increase.

Such increasing is credited by rising amounts of

credit or financing issued by sharia banking in both

Rupiah currency and foreign currency (Forex). Other

than that, the slowdown of the M2 growth that is

slow in money creation due to the nonoptimal

function of banking intermediation.

1.1.3 The Rupiah Exchange Rate Against

the US dollar (Exchange Rate)

• Relation of Rupiah Exchange Rate to Saving

The exchange rate is an external factor that also

has an influence on the amount of saving. The

weakening of the Rupiah against the US dollar will

reflect on the uncertain economic conditions,

thereby increasing the risk that will be responded to

by the business world. The exchange rate is expected

to have an influence on the development of sharia

banks saving.

1.1.4 Interest Rate

• Interest Rate Relationship to Savings

According to Pohan the development of unusual

interest rates can directly disrupt the development of

banking. Low interest rates will reduce the public

interest in saving so that the amount of banking

funds will decline. However, on the contrary if the

interest rates are high it will increase the desire of

people to save.

ICPS 2018 - 2nd International Conference Postgraduate School

106

2 METHODOLOGY

2.1 Data Analysis Method

The method of analysis used in this research is

Vector Auto-regression (VAR), which in case of

integration will be continued with the Vector Error

Correction Models (VECM) method. Model

selection is VAR/VECM in this study with minimal

consideration theoretical approach with the aim of

being able to capture the phenomenon economy well

(Widarjono, 2013).

The problems in this study will be analyzed

using Vector Auto-regression. If the data used is

stationary in the first difference then the VAR model

will be combined with error correction model

becoming Vector Error Correction Model (VECM).

Simply, VECM is used to analyze the existence of

long-term and short-term relationships between

independent variables and dependent variables in

time-series data and see the responses and

contributions of each variable.

This research uses five variables, so in Vector

Auto regression model (VAR) or Vector Error

Correction Model (VECM) there are five models of

equations that can be processed i.e. one model for

each variable studied. The following equation will

be obtained from the sharia bank saving equation:

2

……………

1

2

……………

2

2

……………

3

2

……………

4

2

2

……………

5

3 RESULT AND DISCUSSION

In the VECM estimation on the sharia savings

model, it is explained that in the short term there are

two variables that influence the sharia savings

significantly, namely the amount of money in

circulation (M2) and the Rupiah exchange rate

variable to the US dollar (exchange rate). While the

BI rate and inflation variables have no effect on

sharia savings. And in the long run, the macro-

economic variables are total money supply (M2),

Rupiah exchange rate to US dollar (exchange rate),

BI rate and inflation affect the sharia savings

significantly.

The amount of money in circulation is known to

have a negative and significant effect on the amount

of sharia savings in the short and long term. This is

in contrast to Panorama research (2016) which

explains that the money supply has a positive

influence on the amount of sharia savings. However,

the results of this study are consistent with research

conducted by Sukmana and Halim (2017) and Haron

and Azmi (2008) which explains that an increase in

the money supply will make the lending rate of

conventional banks decline, thus making the cost of

lending cheaper. This will make people borrow a lot

of money from banks to conduct economic activities

or consumption, thus making the amount of saving

decrease.

In addition, customers concerns over the impact

of the Greek crises that occurred in 2012 and

2015, which make people prefer to hold their money

in hand rather than save their money in the bank.

This is in accordance with one of the motive theories

of society's behavior in holding money is the motive

of vigilance, where to overcome the uncertainty and

uncontaminate matters, then we need to hold the

money. Assuming people will be more ready to face

things that cannot be expected before.

In the variable of the Rupiah exchange rate

to the US dollar it is known to have a positive and

significant influence on sharia savings either in short

or long term. This is in contrast to Muttaqien's

(2013) study which explains that sharia banking is

vulnerable to changes in the Rupiah exchange rate.

If the value of the rupiah weakens, Islamic banking

fund deposits will also decline. This is in line with

the theory where both individual customers and

corporate customers will tend to attract funds.

However, the results of this study are consistent with

the research by Rudiansyah (2014) which explains

that the exchange rate of rupiah against US dollar

affects positively savings due to in the sharia bank

there is a phenomenon of the terms emotional

Determinant of Saving in Islamic Bank: Case Study in Indonesia

107

-

.0125

-

.0100

-

.0075

-

.0050

-

.0025

.0000

.0025

.0050

10 20 30 40 50 60 70 80 90 100

LN_M2 LN_KURS

LN_BI INFLASI

Response of LN_TABUNGAN to Cholesky

One S.D. Innovations

customers (spiritual) and rational customers, where

the emotional customers are considered to have

loyalty to sharia banks higher than the profit-

oriented rational customers.

Then, on the variable of BI rate to sharia saving,

it has a significant and negative influence. This is

because the rise in the interest rates will increase the

deposit interest rates and conventional bank lending

so that people tend to choose conventional banks as

a place to store their funds. According to the

classical economic view, saving is a function of the

interest rate. A high interest rate will encourage

people to save and sacrifice consumption. But unlike

Islamic banks that use the profit-sharing system for

mudharabah deposit savings and deposit bonuses for

wadi'ah contracts people prefer conventional banks

compared to sharia banks because the profit in

conventional banks is greater.

According to Sudarsono, the rise in BI rate is

responded to by the massive rate increase in

conventional banks. However, the increase in the

interest rate does not directly affect the sharia bank.

Sharia banks use a system of sale and purchase (ba'i)

where the margin payment is based on the fixed rate

of contract provisions and does not change at any

time as the interest. In Islamic banks the interest rate

is still a benchmark for determining the margin rate

and sharia ratio. Meanwhile, an increase in interest

rates will lower the public interest in depositing

funds in sharia banks because the margin level is

lower than the interest rate deposits in conventional

banks. Islamic banks will be more profitable for

investors because the margin charged is lower.

Increased interest and outflow for financing will

result in sharia banks increasing financing deposit

ratio (FDR) and while the savers will run to

conventional banks whose profits are higher, bank

deposit funds are reduced and rising as well as

exiting will increase the risk of liquidity of sharia

banks. To overcome this situation, sharia banks need

to increase the rate of bonus fee/profit sharing for

demand deposits, savings, and time deposits.

And in the last variable inflation has a significant

and negative effect on sharia savings in the long

term. This means that the increase in inflation can

cause a decrease in sharia savings. The results of this

study are in harmony with the research of Sukmana

(2017), Siaw and Peter (2015) which explains that

when the economy is in high inflation conditions,

then the economic actors either house the company's

willingness will be forced to disburse their spending

to buy goods for production by borrowing money

from the bank, thereby reducing the amount of

savings in the banking.

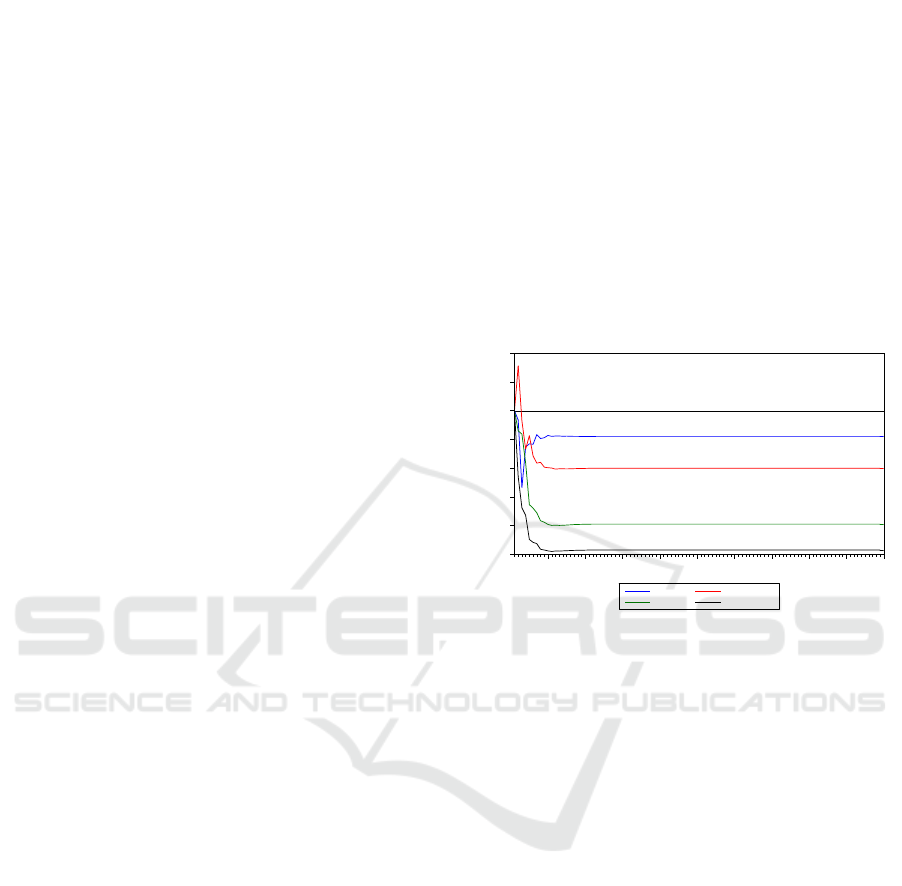

3.1 Impulse Response Function

Impulse response analysis is performed to see the

response trace of the dependent variable to the

shocks on error terms in the VAR system for some

future periods. Based on the IRF results in the sharia

savings model below, it explains that third-party

funds in sharia banks as a whole responded

negatively when there was a shock on macro-

economic variables consisting of inflation, BI rate,

Rupiah to US dollar (exchange rate) and the amount

of money in circulation (M2).

Figure 3.1 Impulse Response Function Sharia Saving

Model

Based on Figure 3.1 above, first, when there is a

shake on the variable M2 (the amount of money in

circulation), the saving in sharia banks responds

negatively in the 1st period to the 11th period. The

response of saving began to stabilize in the 15th

period. Second, when a shock occurs at the Rupiah

exchange rate against the US dollar, saving responds

positively in the 1st period to the 3rd period, and

changed to negative in 7th period. The Rupiah

exchange rate variable against US dollar found a

stability point in the 25th period. Third, when there

is a shock on the variable inflation, the amount of

saving in sharia banks responds negatively and

reaches the point of stability in the 17th period. And

finally, in the event of shocks to the BI rate variable,

saving responds negatively and reaches the point of

unity in the 18th period.

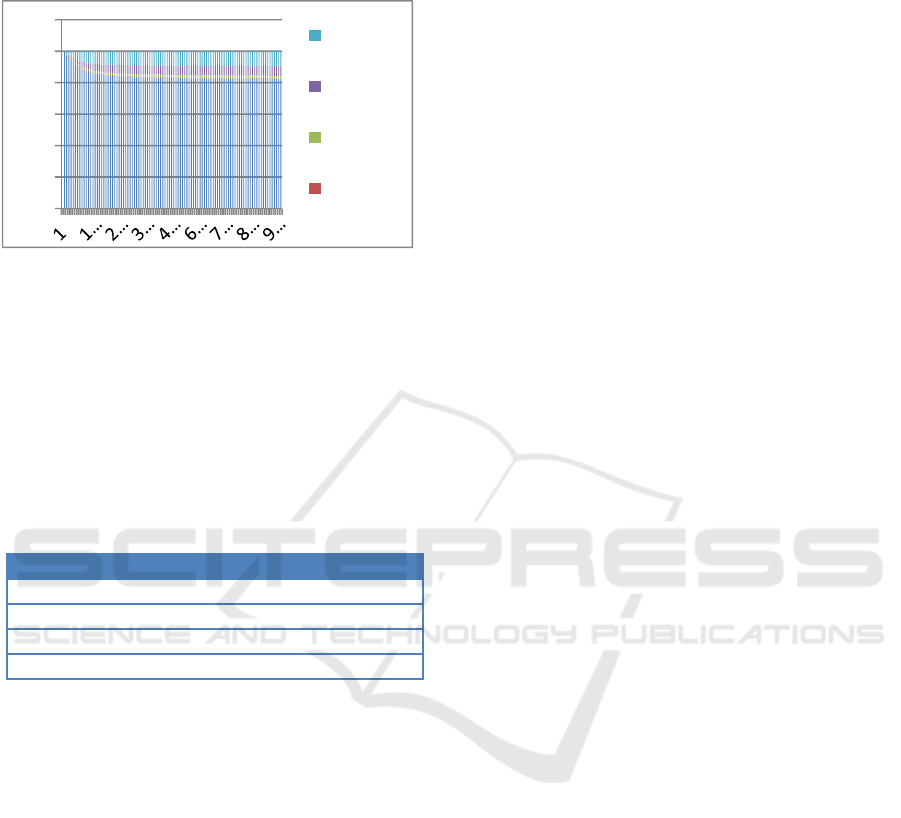

3.2 IDFEVD

After performing an Impulse Response Function

(IRF) analysis, the next step will be analysis using

Forecast Error Variance Decomposition (FEVD).

According to Ascarya (2009), FEVD is used to

predict the contribution of each variable's shocks to

ICPS 2018 - 2nd International Conference Postgraduate School

108

changes in a particular variable. This analysis was

conducted to predict the shock contribution of each

macro-economic variable to sharia bank savings.

Figure 3.2 Forecast Error Variance Decomposition Sharia

Saving Model

It can be seen in Figure 3.2 above that the

behavior of sharia savings is most influenced by

sharia savings itself with 82% contribution. Then

followed by inflation variable which contributed

9.5%, Bi rate with the contribution of 6.2%, Rupiah

exchange rate to US dollar with the contribution of

1.6% and the last variable amount of money in

circulation (M2) with the contribution of 0.37%.

Table 3.1 The Contribution of Macro-economic Variables

Shocks to Sharia Bank Savings

Sharia Banking Saving 82%.

Inflation 9,5 %,

BI rate 6,2 %

Exchange Rate 1.6 %

M2 0.37%.

Based on Table 4.1 it can be concluded that

the variable that most contributes to sharia savings is

the sharia savings variable itself and the second is

the inflation variable, the third BI rate, the fourth

exchange rate and the last is Money supply (M2)

4 CONCLUSIONS

Based on the results of the research above, it can be

concluded that in the short term there are two

variables that affect the sharia savings

significantly which are the variable of the amount of

money in circulation (M2) and the variable of

the exchange rate of Rupiah to the US dollar

(exchange rate). While the BI rate and inflation

variables have no effect on sharia savings. And in

the long run, the macro-economic variables

are the total money supply (M2), Rupiah exchange

rate to US dollar (exchange rate), BI Rate and

inflation signifies sharia savings significantly.

Based on the IRF, it explains that first, when

there is a shock to the M2 variable (the money

supply in circulation), the sharia bank's third-party

funds respond negatively in the 1st period to 11th

period. The third party fund response starts to

stabilize during the 15th period. Rupiah exchange

rate against US dollar, third-party

funds responded positively on the 1st period to the

3rd period and turned to negative in the 7th period.

The rupiah exchange rate variables against the US

dollar experience a stability point in the period of

25. Third, when there is a shock on the inflation

variable, third-party funds of sharia banks respond

negatively and reach the point of stability in the

period 17. Finally, in the event of shocks to BI rate

variables, third-party funds respond negatively and

reach a point of parity in the period of 18.

FEVD explained that the behavior of sharia

saving is mainly influenced by the sharia saving

itself with 82% contribution. Then followed by

inflation variable, which contributed 9.5%, Bi rate

with contribution of 6.2%, Rupiah exchange rate to

US dollar with contribution of 1.6% and the last

variable amount of money in circulation (M2) with

contribution of 0.37%.

REFERENCES

Adim, Muhammad Abdul, Raditya,2016, Pengaruh

Kebijakan Monter Dan Makro Terhadap Dana Pihak

Ketiga Bank Syariah Di Indonesia, Jurnal ekonomi

Syairah dan Terapan Vol 4No 8

Antonio, Muhammad Syafi‟i. 2001. Bank Syariah: Dari

Teori Ke Praktik. Jakarta: Gema Insani

Athukorala,P-C and Sen,K (2003) “Determinant of private

saving in India “, World Development, Vol. 32

No.3pp.491-503

Deliarnov,2016, Ilmu Pengetahuan Sosial Ekonomi, PT

Gelora Aksara Pratama

Haron, Sudin dan Wan Nursofinza Wan Azmi ,2015, “

Determinant of Islamic and Conventional Deposit in

the Malaysian Banking System”. Managerial Finance,

Vol 34 No 9 Emeral Group Publishing

Karim, Adiwarman A. 2008. Ekonomi Makro Islam.

Jakarta : Rajawali Pers

Loayza, Nand and Shankar, R.(2000)” Private saving in

India”, The World Bank Economic Review

Vol,14No.3pp571-94

Manurung, Mandala. 2004. Uang, Perbankan, dan

Ekonomi Moneter. Jakarta : FE- Universitas Indonesia

Muhammad, Nur Rianto. Dasar-Dasar Ekonomi Islam “

Era Adicitra Intermedia Solo 2011 hal. 28

Mutteaqien, Abida, 2013, Analisis Pengaruh PDB, Inflasi,

Tingkat Bunga dan Nilai Tukar terhadap Dana Pihak

Ketiga Bank Syariah

0

20

40

60

80

100

120

INFLASI

LN_BI

LN_KURS

LN_M2

Determinant of Saving in Islamic Bank: Case Study in Indonesia

109

Nopirin. 1989. Ekonomi Moneter. Yogyakarta: BPFE-

Yogyakarta

Partadiredja, Ace. 1985. Pengantar Ekonomika.

Yogyakarta : BPFE-Yogyakarta

Pohan, Aulia 2008, Potret Kebijakan Moneter Indonesia.

Jakarta : Rajawali Pers, RajaGrafindo Persada

Qin, D (2003) “Determinant of household saving in China

and their role in Qquasi-money supply “ Economic of

Transition. Vol 11No3,pp 513-37

Rianto, Muhammad Nur, 2011. Dasar-Dasar Ekonomi

Islam. Solo : Era Adicitra Intermedia

Siamat, Dahlan. 2005 “ Manajemen Lembaga Keuangan “

Jakarta: FEUI

Sudarsono, Heri. 2009 “ Dampak Krisis Keangan Global

Terhadap Perbankan Indonesia Perbandingan antara

Bank Konvensional dan Bank Syariah”. Volume III,

No. 1, Juli 2009. FE-Universitas Islam Indonesia.

Yogyakarta

Widarjono, Ekonometrika: Pengantar dan

Aplikasinya, Yogyakarta: UUP STIM YKPN,

2013, hal. 331.

ICPS 2018 - 2nd International Conference Postgraduate School

110