Tax Analysis and Profit Shifting Starbucks Corporation

Yuliana Theresia and Danny Septriadi

Accounting Department of Accounting, Faculty of Economic and Business, University of Indonesia, Jakarta, Indonesia

yuliana.theresia1986@gmail.com, dannysept@yahoo.com

Keywords: Tax Avoidance, Thin Capitalization, Transfer Pricing.

Abstract: This research is an analysis of tax avoidance case and profit shifting Starbucks Corporation. The selected case

analyzed its tax avoidance structure and analyzed whether current tax measures in Indonesia could prevent

tax avoidance structure such as that of Starbucks Corporation. This research aims to analyze the structure of

tax avoidance and transfer pricing conducted by Starbucks Corporation and analyze what regulations can be

applied by Indonesian tax authorities if such cases occur in Indonesia. This research is a qualitative research

with literature study approach. The results of the study found that Starbucks Corporation made profit shifting

by marking up the price of coffee, thin capitalization through high lending rates between group companies,

royalty fees and from this research resulted the conclusion that the existing tax policies and policies in

Indonesia enough to overcome the structure of tax evasion with a scheme like the one done by Starbucks

Corporation but it is necessary to add rules governing rate valuation royalty.

1 INTRODUCTION

This research is important to conduct because it can

provide knowledge about profit shifting schemes

especially with transfer pricing and thin capitalization

scheme as do by multinational company Starbucks

Corporation. This research refers to the previous

research which analyze “Tax Regulation of Thin

Capitalization Transactions in Indonesian Tax Law”.

Previous research has only conducted an analysis of

the thin capitalization regulations in Indonesia and in

some countries while the current research, the

analysis focuses on profit shifting with transfer

pricing, thin capitalization schemes and Indonesian

tax rules that can be applied to prevent the

occurrence.

In the current era of globalization, trade relations

between countries with one another are increasingly

open and no longer recognize national borders. In

some countries, this international trade plays an

important role in increasing Gross Domestic Product.

Within the scope of taxation, this international

transaction raises its own problems. This relates to the

country of source of income, the subject of income

tax, and which country obtains the right to taxation on

that income.

Each country may tax the income from the

transaction. The source country (the country in which

the income is earned) may impose a tax because there

is a close relationship between countries and

transactions that provide income. This is in line with

the logic that the country in which the tax subject

transacts has provided a place, the resources so that

the tax subject can earn income. So this is the reason

why the source country can impose a tax on that

income, which is known as the benefit theory of

taxation. (Darussalam, 2010)

On the other hand, the country in which the tax

subject is established or domiciled, resident may also

impose a tax on income derived from abroad by the

domestic tax subject. State where the tax subject is

established or domiciled, domiciled or resident is

referred to as a domicile country. The relationship of

taxation rights to a country resulting from the related

tax subject matter is named as a personal attachment.

In addition to revenue from international trade, the

state also gets tax revenue from global investment.

Countries compete to get global investment because

the competition between countries is very tight. For

this reason, to win the competition, there are certain

countries that are willing to provide excessive tax

incentives by providing tax free or tax facilities at a

very low rate (low tax rate), the guarantee of

confidentiality of information (secrecy of

information), and the availability of a highly

sophisticated financial infrastructure. This group of

countries is known as tax haven countries.

Theresia, Y. and Septriadi, D.

Tax Analysis and Profit Shifting Starbucks Corporation.

In Proceedings of the Jour nal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 429-437

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

429

Due to the varied tax treaty facilities between

countries, investors are encouraged/ interested in

doing treaty shopping to get the most profitable

incentives for their business. Investors actions can be

categorized as "against the law" because they are

conducted solely to enjoy the benefits of tax facilities

and are contrary to the purpose of providing such

incentives.

In addition to tax treaty, vacancy tax regulations

can also be used by companies to avoid taxes to be

paid. The company takes advantage of this empty gap

by creating sophisticated financial transaction

schemes in the context of tax avoidance.

In international taxation, there are various

schemes commonly used by multinational companies

in order to make tax savings (Anang Mury, 2015, p.

4): (1) transfer pricing; (2) thin capitalization; (3)

treaty shopping; (4) controlled foreign corporation;

and (5) special purpose company.

Many multinational corporations do tax

avoidance by using transfer pricing schemes. Transfer

pricing is usually done with the aim of minimizing the

tax burden of the company, usually multinational

companies apply it by way of determining the

subsidiary in the country where the cost center or

profit center. Usually a subsidiary in a country whose

tax rate is lower that will be profit center and vice

versa. In this way, the company can adjust the tax

burden that will be paid.

Multinational companies do transfer pricing by

conducting transactions between groups of

companies, such as royalty payments, goods/services

sales transactions, debt lending, and so on. The price

of transactions applied to these transactions

sometimes costs below the market price.

The object of research is tax avoidance and profit

shifting conducted by Starbucks with transfer pricing.

For three consecutive years (2008-2010) Starbucks

UK claimed a big loss but different things delivered

to investors in the United States. For 14 years

Starbucks has been doing business in the UK,

Starbucks only paying a total tax of £ 8.6 million.

(Reuters, 2012).

Because of this, Starbucks UK is suspected doing

unaccepted tax avoidance by paying a royalty to

Starbucks Holland called Starbucks Coffee EMEA

BV while Starbucks Coffee EMEA BV's

headquarters is based in the UK, besides that British

Starbucks buys coffee beans from Swiss-based

Starbucks unit which is then roasted and distributed

to Starbucks UK at a price already marked 20%,

and Starbucks UK said to finance all its efforts with

debt loans from other Starbucks subsidiaries, it

causing Starbucks UK to pay substantial interest

expense to the subsidiary. Therefore, Starbucks UK

was showered with criticism and judged to have

committed an immoral act. Tax authorities in the UK

require Starbucks to pay its taxes.

In accordance with the background that has been

described above, then the issues to be raised are as

follows: (1) What is the tax avoidance and profit

shifting structure undertaken by Starbucks

Corporation? (2) How can Indonesia avoid the

possibility of tax avoidance when a case like

Starbucks Corporation happens in Indonesia?

2 LITERATURE REVIEW

The purpose of the company is to get profit as much

as possible so that tax is considered as a burden for

the company. Therefore, many companies, both

domestic and multinational companies will always try

to minimize the tax burden either legal or illegal.

Efforts to minimize this tax can also be called tax

avoidance. Although tax rules have been established,

a regulation usually selects a loop hole that is

ultimately used by tax subjects (multinational

companies) in the interest of its economy.

According to Brian J. Arnold (2015), "Tax

avoidance is a transaction or arrangement by a

taxpayer to minimize the amount of tax to be paid but

in a manner consistent with the legal corridor.

Meanwhile, according to Mohammad Zain

(2008), citing the opinion of Ernest R. Mortenson, tax

avoidance with regards to the arrangement of a

transaction or condition to minimize the tax burden to

be paid by the company with regard to or take into

account the consequences. So tax avoidance is a false

act because it is done in a way that is not contrary to

the law.

Meanwhile, according to Roy Rohatgi in his book

Basic International Taxation (2005, p. 332), tax

avoidance is defined as follows:

"Tax avoidance implies that a tax payer has

arranged his affairs in such a way that his tax

burden is less than it would otherwise have been,

or that no tax is payable because of such

arrangement.

In many countries, tax avoidance schemes can be

divided into 2 (Darussalam, 2010, p. 197): (1)

acceptable tax avoidance or commonly called

defensive tax planning; and (2) unacceptable tax

avoidance or commonly also called aggressive tax

planning.

There are several factors that influence/encourage

the occurrence of profit shifting as quoted from

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

430

Bawono Kristiaji (2015) is the differences of tax rate

and the emergence of tax haven countries.

2.1 Differences of Tax Rate

In this era of globalization, every company competing

for each other's market. This is not just happening to

multinational companies alone, countries also

compete to get capital investment in their respective

countries. Each country needs investment for

development and progress country. In order to

achieve these objectives, every country is trying to

earn its income through tax income. Each country

must have its own taxation provisions with different

tax rates.In order to get an investment, eventually

each country mutually offer low tax rates to attract

foreign investors.In the end this is beneficial for

foreign investors.

Because of this varied tax rate offer, multinational

companies are encouraged to make profit shifting to

countries that offer low tax rates and profitable for the

company so that tax avoidance happens.

2.2 Tax Haven Country (THC)

Another factor that affects the occurrence of profit

shifting is the emergence of tax haven country. The

OECD says that the THC is "a country which imposes

a low or no tax, and is used by corporations to avoid

taxes that otherwise would be payable in high tax

country. According to Barry Larking, the definition

of Tax Haven Country is "a place where tax is levied

at low tax rate or not at all, or where it is hard for

foreign jurisdictions to access information about

citizens taxable income.

According to the OECD, some tax haven country

characteristics are: (1) low-cost or no-tax-only taxes

(no or only nominal taxes); (2) lack of exchange of

information (lack of effective exchange of

information); (3) lack of transparency; (4) no

meaningful economic activity (no substantial

activities). There are several popular ways that

multinational companies can shift their profits by:

2.2.1 Manipulating transfer pricing

Transfer pricing is one of the international tax

issues facing multinational companies today

(paragraph 11 OECD Transfer of TP Guidelines,

2017). According to the OECD, transfer pricing is the

price at which a company transfers/delivers tangible

or intangible goods or services to its affiliated

companies.

According to Gunadi (2007), transfer pricing is

the amount of price on the delivery of goods/services

agreed by both parties in a business transaction in

which case both parties have a special relationship.

According to Carmine Rotorando (2000, p. 2), a

special relationship is a major point for the tax

authorities to be able to distinguish whether a sale

transaction is likely to manipulate transfer rates or

not. A country's tax authority has the authority to

make corrections to transactions that do not reflect

fair prices during which the transactions are related

parties.

2.2.2 Shifting their debts

According to Prof. Dr. Gunadi, 2007, p. 279, thin

capitalization is an act of financing larger subsidiaries

using interest-bearing debt from related companies

rather than funding with share capital.

Thin capitalization is done through a tendency to

finance its subsidiary by granting loans by a parent

company to a subsidiary domiciled in another country

compared to a capital payment on the grounds that the

interest expense on the loan may be deducted from

the taxable income of the subsidiary receiving the

loan. (Hutagaol, 2007)

3 RESEARCH METHODS

The research approach is a case study approach

because it intends to analyze what phenomenon

experienced by the research subject. The unit of

analysis used is single case in single unit. Based on

the purpose, this research is qualitative and

descriptive research which aims to give an analysis

about a problem as clear as possible and provide an

overview of a problem solving or solution to an

existing problem. Based on the benefits, this research

includes pure research oriented to science and is

expected to contribute to education. Methods of data

collection in the form of literature study by reading

books or literature, journals and papers related to the

subject of research problems.

The selection of research with case study

approach is also based on the consideration that the

researcher wants to give an idea how the issue of

transfer pricing for transactions between subsidiaries

in multinational companies and how the solution is

solve if such problems occur in Indonesia.

Data collection methods used by the researcher is

qualitative data with secondary data types derived

from reading books or literatures, journals and papers

related to the subject matter of research that is about

Tax Analysis and Profit Shifting Starbucks Corporation

431

transfer pricing, tax avoidance, and thin

capitalization.

According to Miles and Huberman, there are 3

techniques in analyzing data, namely:

1. Data reduction

Data reduction is the process of selecting and

classifying / categorizing data.

2. Presentation of data

Presentation of data is a way of presenting data,

for example in the form of narration, images,

graphics, charts, and others.

3. Conclusion

The conclusion is the process of concluding from

the analysis that can be used as the solution of the

problem.

4 ANALYSIS AND DISCUSSION

Starbucks has opened its business in the UK since

1998 and has opened 800 outlets, but Starbucks pays

only £ 8.6 million in taxes. The amount is very small,

considering Starbucks is the second largest restaurant

after McDonald's in UK which was followed by KFC

who finished third. The tax paid by McDonald's UK

is £ 80 million, 10 times larger than Starbucks and, by

comparison, KFC pays taxes in the UK £ 36 million.

This is one of the background of the Starbucks tax

case in the UK revealed. (Bergin, 2012). For 3

consecutive years (2008-2010), Starbucks UK

admitted suffered considerable losses. This loss is

caused by enormous operating costs. Starbucks's

operating expenses consist of royalty fees, interest

payments on loans.

In 2008, Starbucks posted a gross profit of £ 77.8

million and net pretax loss on ordinary activities of £

26.3 million, but CEO Schultz told investors in the

United States that units in the UK had profits to fund

Starbucks expansion at other overseas markets. In

2009, Starbucks posted a gross profit of £ 69.7 million

and net pretax loss on ordinary activities of £ 52.2

million, but CFO Alstead told investors in the United

States that a UK unit was "profitable".In 2010,

Starbucks posted a gross profit of £ 76.7 million and

also recognized profit loss after administrative

expenses of £ 25.7 million and net pretax loss on

ordinary activities of £ 34.2 million, but Starbucks

told investors that sales continue to increase. In 2011,

Starbucks still claimed losses, but John Culver (head

of the Starbucks International division) told analysts

that "we are very pleased with the performance of

business units in UK." These statements are in stark

contrast to the financial reports reported by Starbucks

UK.

When the media tried to confirm the statement,

Starbucks issued a statement very different from the

previous statement, the Starbucks stated that the unit

in UK is very disappointing and is trying to improve

the condition of business units in UK.

Table 1. Fact versus Starbucks UK Reports to the UK Tax

Authority

Fact on NASDAQ

Version of Starbucks

UK

Reuters interviewed 46

Starbucks investors in

the US as well as stocks

analysis, it turned out

that Starbucks UK is big

profits. For 3 years

Starbucks reported sales

of up to £ 1.2 billion.

Peter Bocian as

Starbucks CFO at the

time, it was revealed

that the profits from

business units in the UK

so massive, so the funds

can be used to finance

the expansion of

Starbucks in other

countries

Report to UK taxpayer,

Starbucks claimed their

business in Britain was

losing frenzy.

In 2008, they claimed a

loss of up to £ 26

million and in 2009

again lost £ 52 million,

and in 2010 suffered

another loss up to £ 34

million. The total loss

reported by Starbucks

for three years was £

112 million.

According to a report from Reuters and the House

of Common, there are 3 focus points on allegations

against Starbucks UK which stressed that Starbucks

UK has made a substantial payment to the group of

companies to deliberately make losses in the UK that

is (Kleinbard 2013): (1) royalties and license fees

paid to a Dutch affiliate; (2) mark-ups of coffee beans

purchased through other Dutch affiliates and Swiss

affiliates; (3) interest paid on a loan from Starbucks

Group.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

432

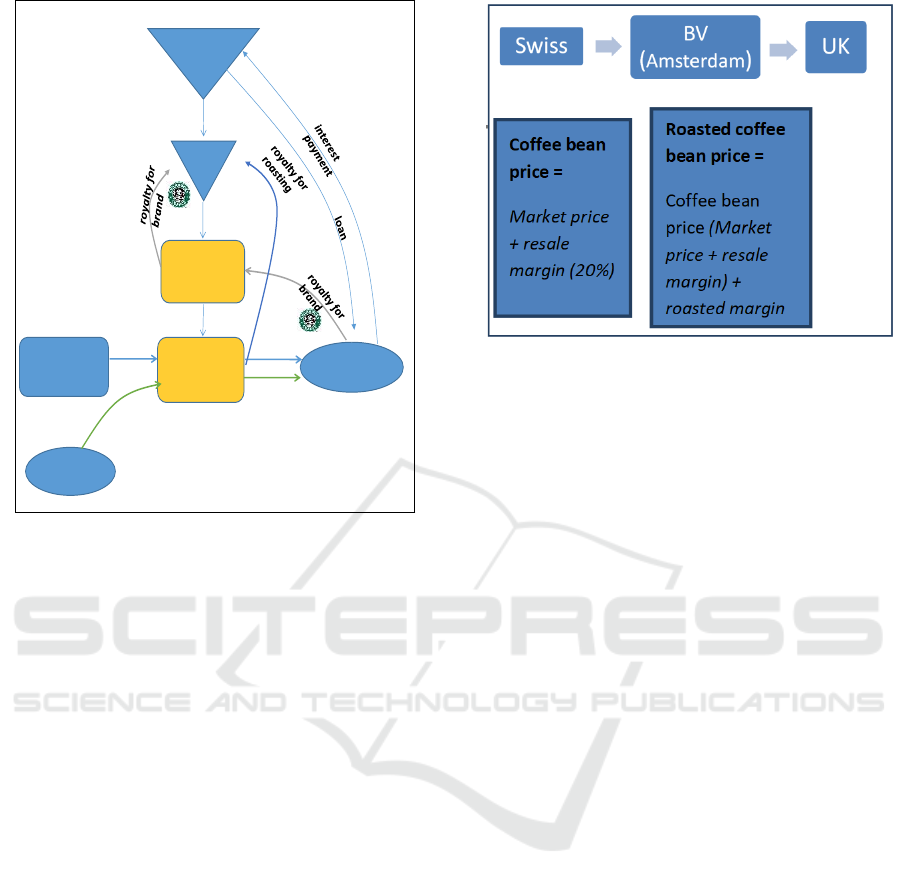

Figure 1. Starbucks Structure

roasted beans

other finished product :

food, tea, cup, etc

Green beans

Alki

(UK)

Starbucks

Coffee EMEA BV

(Netherlands)

Starbucks

Manufacturing

EMEA BV

(Netherlands)

Starbucks Coffee

Trading

(Switzerland)

Starbucks

Coffee Shops

(Inggris)

Third party

vendors

Starbucks

Group

other finished product :

food, tea, cup, etc

Figure 1: Starbuck Structure

4.1 Starbucks UK’s Tax Avoidance and

Profit Shifting Scheme:

One of the factors that cause Starbucks UK losses is

the payment of royalty fees. During running its

business, Starbucks UK has to pay a royalty fee to

Starbucks Coffee BV (Amsterdam) based on a

percentage of total sales. This is one element that

enlarges the nominal loss of Starbucks. The royalty

fee Starbucks UK pays to Starbucks Coffee BV

(Amsterdam) is 6% of total sales, this percentage is

quite high when compared to similar businesses. The

royalty fee paid by McDonald's UK is only 4%.

In addition to royalty fees, there are other factors

that cause losses on Starbucks UK. Starbucks UK

pays other operational costs of buying roasted coffee

beans, coffee beans purchased from SMBV. To

analyze whether the price of coffee beans purchased

by Starbucks UK is reasonable or not, it is necessary

to do value chain analysis as follows:

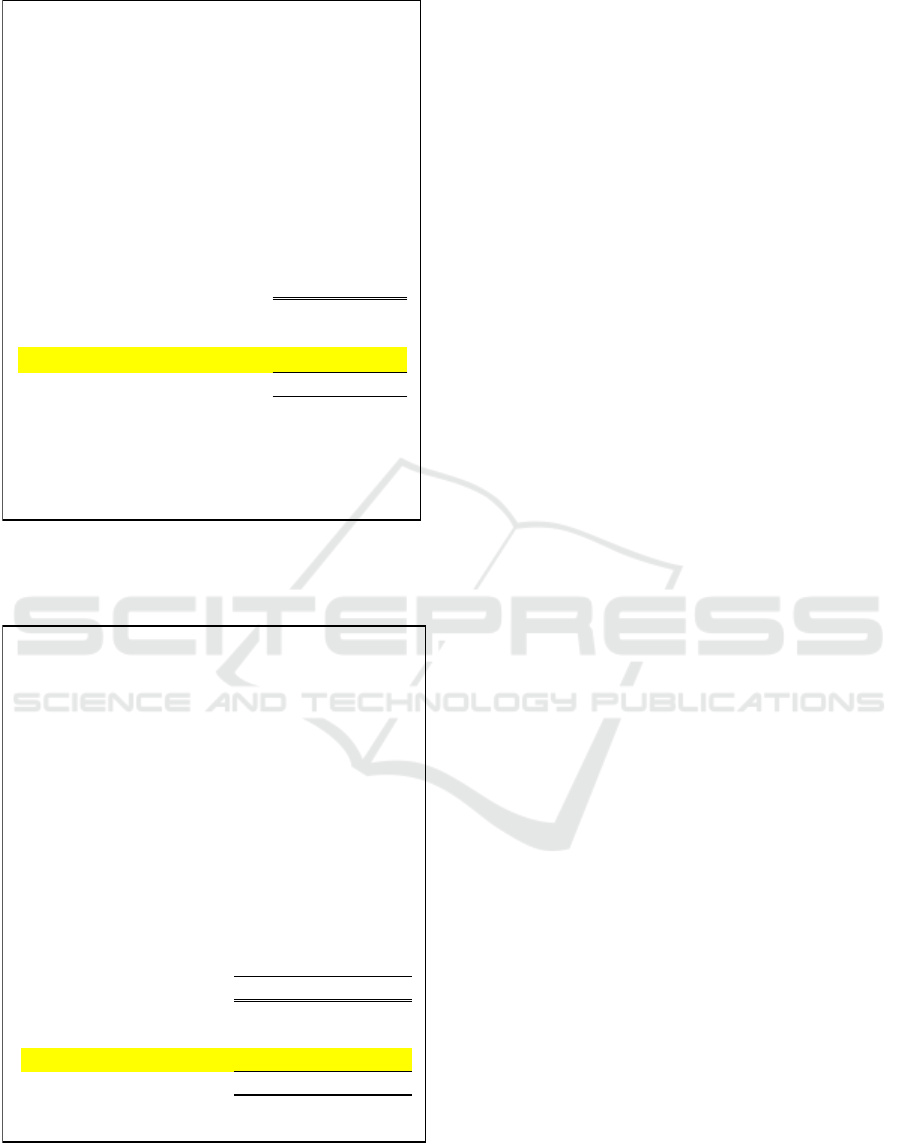

Figure 2: Value Chain Anlysis

From the above value chain analysis, it can be

seen that the coffee beans used by Starbucks UK are

purchased from Starbucks affiliated companies in

Switzerland that have been mark up 20%, then the

coffee beans are roasted by SMBV that located in

Amsterdam which price has been added with the

roasting service fee then distributed to Starbucks UK.

This is the way to make the cost of buying coffee

beans paid by Starbucks UK to be very high and

allegedly there is manipulation of the transfer price of

coffee beans.

Starbucks said the transfer price is in accordance

with the principle of fair price (arm's length). To test

whether the added margin resale at the price of the

beans is reasonable, it is necessary to benchmark

some coffee trader companies. In addition to testing

the margin resale, benchmarking of some similar

companies that provide coffee roasting services is

necessary to see if the mark up is added to normal

roasting services. From benchmarking results can

only be determined whether the price of coffee beans

purchased by Starbucks UK reasonable or not.

The last factor that causes losses to Starbucks UK

is interest payments on loans provided by Starbucks

Group. Starbucks UK further confirmed its loss by

stating that its business operations have been almost

entirely funded by the debt of the Starbucks Group.

The interest charged to Starbucks UK is + 4% from

LIBOR, the interest rate is quite high when compared

to the 2% interest rate of McDonald's.

Tax Analysis and Profit Shifting Starbucks Corporation

433

STARBUCKS COFFEE COMPANY (UK) LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIOD ENDED 28 SEPTEMBER 2008 (continued)

6. INTEREST

Period ended

28 September

2008

Period ended

30 September

2007

£ £

Bank interest receivable 419.553 319.937

Bank interest payable (92.278) (43.511)

Interest payable to group companies (3.900.372) (1.321.916)

Interest payable (3.992.650) (1.365.427)

Interest on borrowings from group companies is calculated at LIBOR (one year rate) plus 4%

as adjusted for changes in LIBOR each fiscal quarter

Figure 3: Details of Interest Expenses paid by Starbucks

UK 2007 - 2008

STARBUCKS COFFEE COMPANY (UK) LIMITED

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIOD ENDED 03 OCTOBER 2010 (continued)

6. INTEREST

Period ended

03 October

2010

Period ended

27 September

2009

£ £

Bank interest receivable 18.130 192.644

Interest receivable from third parties 15.463 -

33.593 192.644

Third party interest payable (31.364) -

Interest payable to group companies (4.630.489) (6.266.908)

Interest payable (4.661.853) (6.266.908)

Figure 4: Details of Interest Expenses paid by Starbucks

UK 2009 - 2010

4.2 The Tax Policy on Starbucks Decided

by the European Commissions to

Obtain State Revenue Optimally

In examining the case of Starbucks Corporation, the

European Commissions (EU) has made several

comparison of Starbucks transactions with similar

companies (Starbucks Co. competitors). The EU

compares the royalty fees paid by SMBV to Alki LP

for a coffee roasting license with several Starbucks

competitors namely Company Y and Alois Dallmayr

Kaffee oHG. Company Y that does the same roasting

activity as Starbucks says it does not pay any royalties

to its group to find out how to process roasting.

Likewise Dallmayr says that royalty payments by

companies that roast coffee beans are unusual (odd),

because usually buyers of roasted coffee beans will

pay to a coffee grill company instead of the other way

around.

Therefore the EU through Article 16 (1) of

Regulation no. 2015/1589 establishes the obligation

of the Commission to order the restoration of

unlawful and inappropriate aid. The provision also

provides that the Member State concerned shall take

all necessary measures to recover any unlawful

assistance which is found to be inappropriate. Article

16 (2) of Regulation No. 2015/1589 provides that

such assistance should be recovered, including

interest from the date of the unauthorized removal to

the effective date of its recovery.

The recovery methods applied to Starbucks are as

follows:

1. The transaction comparison method used to check

whether it is in accordance with the principle of

fairness is the CUP method.

2. According to the comparison of transactions with

the CUP method with several independent

independent companies, it is found that SMBV

does not need to pay the royalty fee to Alki LP for

the coffee roasting license.

3. Upon the above decision, the tax authorities in the

Netherlands shall impose a tax on SMBV profits

without deducting royalty fees (formerly the

Netherlands withholds the SMBV tax after

deducting the royalty fee paid to Alki LP).

Based on the above decision, the Dutch tax

authorities finally made a recovery/refund of € 25.7

million from Starbucks Co which was obtained from

the ruling with the Dutch Government.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

434

4.3 Anti Tax Avoidance Terms in UK and

Netherland

4.3.1 UK

UK has a focus on issues of tax reduction through

debt from shareholders, royalty payments on

intangible assets that can reduce taxes in the UK. For

transfer pricing rule, all transfer pricing methods in

OECD are accepted but the most effective method

according to the UK is the comparable uncontrolled

price (CUP) method.

The UK does not have a financing ratio between

debt and capital so there are no restrictions on interest

reduction. Reduction of interest is limited in terms of

debt and interest rate that has met the fairness/arm's

length (Andrew Casley, 2007 quoted from Fajar

Budiman). This provision regulates loans and debt

payments to affiliated companies. In 2004, the

Government terminated the special provisions of thin

capitalization arrangements and improved the

provision of transfer pricing in order to accommodate

the provision of thin capitalization.

4.3.2 Netherlands

The Netherlands has a General Anti-Avoidance Rule

(GAAR) which is about transfer pricing rules only. In

2002, a provision was applied in the Dutch tax rules

to facilitate the tax authorities to check the transfer

price, whose contents are as follows: "Where an

entity participates, directly or indirectly, in the

management, control or capital of another entity and

conditions are made or imposed between these

entities in their commercial and financial relations

(transfer prices) which differ from conditions which

would be made between independent parties , the

profit of these entities will be done as if the last

mentioned conditions were made. "

The Netherlands uses the 5 methods of transfer

pricing. But the best method of transfer pricing

according to the Netherlands is CUP method, the

resale price method, the cost plus method.

4.4 Anti Tax Avoidance Terms in

Indonesia

Some of the existing anti-profit shifting rules in

Indonesia that can be used to prevent tax avoidance

schemes such as those committed by Starbucks

Corporation are as follows:

4.4.1 Prevention of Thin Capitalization

Transactions

To prevent tax avoidance by multinational

corporations with funding from very large debts,

countries make rules on DER (Debt to Equity Ratio).

In Indonesia, its domestic tax rules set the ratio of

capital and debt ratio of 4:1.

Based on the PMK No. 169/PMK.010/2015

Article 2 paragraph 1 states the ratio between capital

and debt is set at the maximum of 4: 1. This rule can

be regarded as a powerful enough rule to prevent tax

avoidance by thin capitalization scheme. Given a

fixed ratio that can prevent the tax payer from getting

excessive deductions on his taxable income. In the

case of Starbucks, with this rule, Starbucks can not

avoid taxes with this scheme in Indonesia.

4.4.2 Rules to Prevent Manipulation of

Transfer Price of Coffee Beans and

Mark up roasted coffee bean price for

roasting service

Transfer pricing can be prevented by PER-32 / PJ /

2011 through:

1. In article 11, there are already established methods

of pricing transfer which may be used together with

appropriate conditions for applying such methods

2. The most important articles which may prevent the

transfer price manipulation are article 20 and 21. This

article emphasizes that: "Directorate General of

Taxation is authorized to re-determine the amount of

income and deductions to calculate the amount of

taxable income on transactions conducted between

related parties."

Article 11 describes what methods can be used for

fair pricing, when analyzed from several countries, in

this case the UK, the Netherlands, these two countries

choose to apply the CUP method.

In Indonesia, if a case like Starbucks UK happen

in Indonesia, the tax authorities may use the CUP

method to test the fairness of the purchase price of its

coffee beans. CUP method is commonly used for

testing the reasonableness of the prices of industrial

goods or commodity goods. To test it, the tax

authorities can compare product transactions similar

to independent parties.

For the coffee roasting service provided, SMBV

charges the price of coffee beans already in mark-up

by 20%. To test whether the price is reasonable or not

we need to do comparison intra-group service

transactions. Testing steps for intra-group service

transactions are set up in SE-50 / PJ / 2013 and PER-

22 / PJ / 2013 by: (1) Check if the service is properly

Tax Analysis and Profit Shifting Starbucks Corporation

435

provided; (2) Recalculate the fairness of the service

payments

In the case of Starbucks, proper coffee roasting

services have been done, but to recalculate the

fairness of service payments, it must be done by

benchmarking on similar service companies (roasted

services).

4.4.3 Rules to Prevent Transfer Price

Manipulation of Royalty

The fairness of royalty fees can be tested with

Comparable Uncontrolled transactions (CUT) and the

TNMM method. Royalty fees can be compared to

CUT by comparing the percentage of royalty fees of

similar companies whose transactions are conducted

by independent parties. These methods are set out in

PER 32 PJ / 2011.

In addition to comparing the above method, the

transfer price manipulation of royalties can be tested

using Transactional Net Margin Method (TNMM

method) by comparing percentage of operating profit

to sales. A further concern is whether the royalty

payments provide a corresponding rate of return (SE-

50/PJ/2013).

5 CONCLUSIONS

Based on the results of the analysis it can be

concluded that tax avoidance and profit shifting

structures undertaken by Starbucks corporation are:

Starbucks UK manipulates transfer pricing for royalty

payments at a much higher percentage than similar

industries at comparable market levels, performing

thin capitalization schemes with considerable interest

expense. Starbucks recognizes interest expense of +

4% of LIBOR when other similar companies only

charge 2% interest, and manipulates transfer pricing

by marking up the price of coffee beans and roasted

coffee beans at very high price. Mark up on resale

margin and roasting services should be benchmarked

against similar companies to be able to assess whether

the mark up is reasonable.

Rules that can be applied by Indonesian tax

authorities if such cases as Starbucks UK occur in

Indonesia are:

a. The current Thin Capitalization Rule is sufficient

after the issuance of PMK No. 169/

PMK.010/2015 because in this rule the amount of

ratio of capital and debt (DER) is 4:1.

b. To prevent the transfer price manipulation in

royalty payments, the fairness of royalty fees can

be tested with CUT and the TNMM method. This

method is set in PER 32 PJ/2011

c. To prevent impropriety on the sale of coffee

beans, the tax authorities can test it using the CUP

and TNMM methods. To test it, the tax authorities

can compare product transactions similar to

independent parties and compare net margin of

transactions similar to independent parties. Steps

to perform the tests have been made in SE-

50/PJ/2013

d. The current rules on transfer pricing are getting

better and more stringent with the issuance of new

rules on the transfer pricing document

prerequisite of PMK No. 213/PMK03/2016. With

this rule, the tax authorities can see where the

company's largest profit from the report per

country.

The tax rules of transfer pricing and thin

capitalization in Indonesia are sufficient, but a rule

that regulates the rate valuation of royalties and the

clear provisions of what factors should be considered

and compared to be able to get a fair percentage rate

for certain companies royalty.

REFERENCES

Bergin, Tom. “How Starbucks Avoids U.K. Taxes.” Special

Report, London: Reuters, 2012.

Budiman, Fajar. " Thin Capitalization Tax Avoidance Tax

Analysis in Indonesian Tax Law. " Jakarta: University

of Indonesia, 2011.

Commission, European. Commission Decision. Brussels,

2015.

Darussalam, John Hutagaol, Danny Septriadi. “Concepts

and Applications of International Taxation.” Jakarta:

Danny Darussalam Tax Center, 2010

Directorate General of Taxation. "Regulation of the

Director General of Taxation Number PER-32/ PJ/2011

dated November 11, 2011 concerning the

Implementation of Principle of Fairness and Business

Candidate in Transactions between Taxpayers and

Related Parties."

Directorate General of Taxation. "Circular Letter of the

General Tax No. SE 50 / PJ / 2013 dated October 24,

2013 on Technical Guidelines for Examination of

Taxpayers with Related Parties."

Gunadi. International Taxation. Jakarta: Lembaga Penerbit

FEUI, 2007

John Hutagaol, Darussalam, and Danny Septriadi. Capita

Selekta of Taxation. Jakarta: Salemba Empat, 2007.

Kleinbard, Edward D. "Through a Latte, Darkly :

Starbucks's Stateless Income Planning." Tax Notes,

2013: 1515-1535.

Kristiaji, B.Bawono. Incentives and Disincentives of Profit

Shifting in Developing Countries. Tilburg University,

June 2015

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

436

Kurniawan, Anang Mury. International Tax and

Application Examples, Second Edition. Bogor: Ghalia

Indonesia, 2015

Larking, Barry. International Tax Glossary. IBFD, Fifth

Revise Edition.

Matthew B. Miles, A. Michael Huberman, and Johnny

Saldana. Qualitative Data Analysis. California: Arizona

State University, 2014.

OECD. Transfer Pricing Guidelines. 2017.

Republic of Indonesia. "Regulation of the Minister of

Finance of the Republic of Indonesia Number

213/PMK.03/2016 dated December 30, 2016 on

Document Type/Or Additional Information Required to

be kept by Taxpayers Transacting with Related Parties"

Rohatgi, Roy. Basic International Taxation. London: BNA

International Inc., 2005.

Rotorando, Carmine. "The Nation of Assosiated

Enterprises: Treaty issues and Domestic Interpretation

An Overview."International Transfer Pricing Journal,

January/February 2000: 2.

UK Government. "Audited Financial Statement of U.K.

Companies (Starbucks UK)." Unitedof Kingdom,2008-

2010, http://www.companieshouse.gov.uk/.

Tax Analysis and Profit Shifting Starbucks Corporation

437