Analysis of System Design of SIPKD (Regional Financial

Management System) and SIM PAD (Locally-Generated Revenues

Management Information System) Integration in Order to Fulfill the

Need for Preparing an Accrual-Based Financial Statements

Case Study in The Provincial Government of Jakarta

Masithoh Titania and Machmudin Eka Prasetya

Magister of Accounting, Faculty of Economics and Business, Universitas Indonesia, Jakarta, Indonesia

msth.titania@gmail.com, machmudin.prasetya@yahoo.com

Keywords: Analysis of System Information Design, FAST Method, SIM PAD, SIPKD, System Integration.

Abstract: This research aims to determine the needs of information systems required by The Provincial Government

of Jakarta in related to the management of retribution revenue and other locally-generated revenues, to find

out what is required by SIM PAD and SIPKD in the framework of the management of retributions and other

locally-generated revenues, and to analyze the integration of SIM PAD and SIPKD in order to create an

integration model for the two systems in order to facilitate the preparation of accrual-based financial

statements. This research is a qualitative research with case study method at The Provincial Government of

Jakarta. The result of this research shows that the problem in managing the retribution revenue and other

locally-generated revenues is that the systems being used are not fully integrated, thus causing the reporting

of the revenues-LO, receivable, and allowance for doubtful account for retribution and other locally-

generated revenues still being done manually and not in accordance with the accrual base accounting cycle.

Therefore, this research will produce a design for integration plan within SIM PAD and SIPKD in order to

produce accurate and reliable data, in result to meet the need for accrual-based government accounting

standard implementation.

1 INTRODUCTION

2016 is a challenging year for government financial

management, especially in the case of financial

statements, as in accordance with the mandated

Government Regulation Number 71 Year 2010

(hereinafter referred to as PP 71 Year 2010) that the

deadline for accrual government-based accounting

implementation is at the time of preparation of

financial statements fiscal year 2015. Prior to 2015

government agencies are still permitted to use

Government Regulation Number 71 of 2010

Appendix II, which is cash-based toward accruals

similar to Government Regulation No. 24 Year 2005

(hereinafter referred to as PP 24/2005). The adoption

of accrual-based government accounting has had a

major impact on government financial reporting that

previously used the cash-based toward accruals,

particularly in recognition for each accrual-based

account. In addition to the issue of recognition the

number of reports should be presented also increased

from the previous 4 (four) reports into 7 (seven)

reports. The additional three new reports are

Statement of Operational Activities (LO), Statement

of Changes in Surplus Budget Balance, and

Statement of Changes in Equity.

Implementation of accrual-based government

accounting is of course a challenge for the

Provincial Government of Jakarta, the main problem

in the spotlight is the problem of information

systems. In 2017 the Provincial Government of

Jakarta has several independent systems in

accordance with their designation. These systems are

not integrated because of their development by

different work units. These stand-alone systems

make the preparation of financial statements more

difficult and longer because data from each of these

systems should be reconciled with existing data in

SIPKD as the main system of financial management

392

Titania, M. and Prasetya, M.

Analysis of System Design of SIPKD (Regional Financial Management System) and SIM PAD (Locally-Generated Revenues Management Information System) Integration in Order to Fulfill

the Need for Preparing an Accrual-Based Financial Statements - Case Study in The Provincial Government of Jakarta.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 392-399

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

in the Provincial Government of DKI Jakarta. In

addition to making it difficult and time consuming,

with no integration of the system the preparation of

financial statements to be incompatible with the

appropriate accounting cycle.

Two systems that become the object of this

research is SIPKD (Regional Financial Management

System) and Locally-Generated Revenues

Management Information System (SIM PAD), some

of the things underlying are:

1) Reporting of Retribution and other locally-

generated revenue-LO account and retribution

and other locally-generated receivable account,

do not go through the appropriate accounting

cycle. The revenue-LO and receivable account is

journalize only in reporting period, not at the

time of the transaction occurred and only for

account that have balance at the end of accouting

period.

2) Reporting of Retribution Revenue-LO account

and Retribution Receivable account do not use

SIPKD. as described in the preceding point, the

journal process is only made at the end of the

accounting period, so in SIPKD the data for that

account is only available during the reporting

period and is only available for accounts that

have balance at the period.

Satrio, et al (2016) in their research states that

one of the obstacles in the application of accrual-

based accounting is the problem of information

systems that do not support accrual based accouting

and not fully integrated with each other. Kusuma

(2016) also in their research stated that Constraints

in the implementation of accrual-base government

accounting standard is the preparation of financial

statement still done manually using microsoft excell

because there is no special software for accrual

based government accounting standard.

Based on these matters, this research aims to

analyze the needs of information systems required

by the Provincial Government of Jakarta related to

the management of retribution and other locally-

generated revenues and to analyze design of SIM

PAD and SIPKD integration to create an integration

model for both systems so as to facilitate the

preparation of accrual based financial statements

through the appropriate accounting cycle and

generate more reliable data.

This research will analyze current condition of

SIM PAD and SIPKD. this study does not just

extend the current finding of the information system

requirements for the needs of accrual-based

government accounting standard, but also propose

an appropriate system development model for the

needs of accrual-based governement accounting

standard in terms of retribution and other locally-

generated revenues management. In creating the

integration and development model for SIM Pad and

SIPKD researchers will use FAST Method and

middleware.

2 LITERATURE REVIEW

2.1 Information System

The system is one or more components that are

interconnected and interact to achieve the goal. Most

systems consist of small sub-system components

that support a large system. Each sub-system is

created to achieve one or more organizational or

company goals. While information is data that has

been prepared and processed to give meaning to

improve decision making process. Increasing the

quantity and quality of information will make users

make better decisions. (Romney and Steinbart,

2012).

Information system is an arrangement of people,

data, processes and information technology that

interact to collect, process, store, and provide as

output the inforation neededto support an

organization (Whitten and Bentley, 2007).

Organizations or companies need the help of

information systems that can assist in running

company or organization activities. Information

systems also help in management's decision-making.

this is also applies to government entities.

Permana, et al (2016) and Sophian (2016) in

their research stated information systems have a

significant influence in the implementation of

accrual-based government accounting standard. the

higher the readiness of information systems will

affect the readiness of accounting accrual-based

accounting

2.2 Middleware

Middleware is a generic term used to described

software that mediates with other software and

allows for communication between disparate

applications in a heterogeneous system (Connolly

and Begg, 2014). Hurwitz (1998) defines six main

type of middleware:Asynchronous Remote

Procedure Call (RPC), synchronous RPC,

publish/subscribe, message-oriented middleware

Analysis of System Design of SIPKD (Regional Financial Management System) and SIM PAD (Locally-Generated Revenues Management

Information System) Integration in Order to Fulfill the Need for Preparing an Accrual-Based Financial Statements - Case Study in The

Provincial Government of Jakarta

393

(MOM), Object Request Broker (ORB) and SQL-

oriented data access.

Al Jaroodi, et al (2010) stated in their paper that

currently midlleware is essential component for

almost any tipe of of distributed environment and

network applications. Starting from the hardware

infrastructure and run-time support all the way up to

the applications, middleware solutions provide

endless possibilities to support applications

requirements both functional and non-functional.

They believe that in the near future we will have

more generic middleware solutions that will provide

clean interfaces, dynamic functionalities and

adaptive operating criteria to support a wide range of

networked applications and operating environments

Al-Jaroodi, et al (2011), stated in their research that

middleware can play an important role in facilitating

the design, development and implementation of

service-oriented systems and furthermore,

middleware approaches will provision non-

functional requirements like performance,

scalability, reliability, flexibility and quality of

service (QoS) assurance.

2.3 Framework for the Application of

System Thinking (FAST)

In analyzing and designing the development and

integration of SIM PAD and SIPKD, we used the

FAST (Framework for the Application of System

Thinking) method. The Framework for the

Application of System Thinking is a compilation of

best practices found in many reference and

commercial methods. FAST is a flexible framework

to support different types of strategies and projects

(Bentley and Whitten, 2007).

The stages in the FAST methodology are as follows:

1. Scope Definition

The first phase of the FAST methodology is

scope definition, this phase has the dual function

of first answering the question "is this problem

worth calculating?", And secondly assuming the

problem is worth taking into account, it sets the

size and constraints of the project.

2. Problem Analysis

The second phase is problem analysis, in this

phase studying the current system and analyzing

the findings to give the project team a better

understanding of the problems that triggered the

project.

3. Requirement Analysis

In this phase the project team determine and

prioritizing business needs, in order to generate a

system requirements analysis report, system

analysts should be close to the user system to

identify their needs and priorities.

4. Logical Design

In this phase the project team changes the form

of business needs from the form of words to the

image form known as the system model to

validate the completeness and consistency of the

business needs.

5. Decisions Analysis

The objectives of this phase are to (1) identify

technical solution candidates, (2) analyze

solutions of candidates for feasibility tests, and

(3) recommend candidate systems as target

solutions to be designed.

6. Physical Design and Integration

The purpose of this phase is to change the

business needs (partly represented by the system

model) into physical design specifications that

will guide the development of the system.

7. Construction and Testing

There are two objectives of this phase: (1) to

build and perform system tests that meet

business needs and physical design

specifications; and (2) implementation of

interfaces between the new system and the

current system.

8. Installation and Delivery

In the last phase performed by the team is to

provide a good transition from the old system to

the new system.

9. System Operation and Maintenance

After the system operates, it is necessary to

support system (support system) continuously.

From the nine FAST stages that described above,

this study is limited to only the fourth stage of FAST

Method.

Ariyani (2014) and Firdaus (2016) in their

research using FAST methodolgy for their research,

because FAST methodology is an agile method that

provide alternatives routes and strategies to

accommodate different types of project, technology

goals, developer skills and development paradigms.

3 RESEARCH METHODOLOGY

3.1 Research Methods

This research is a qualitative research with a

descriptive analysis. This approach is chosen to

address the research purposes that has been

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

394

described about what is the requirement of

retribution and other locally-generated revenues

system that must be fulfilled by The Provincial

Government of Jakarta in order to implement the

accrual based accounting and how does the design of

integration of SIM PAD and SIPKD help The

Provincial Government of Jakarta in preparing the

accrual bases financial report more efficient and

reliable.

This research is single case study with one unit

of analysis. Object in this research is regional

finance management board (BPKD) of The

Provincial Government of Jakarta. This research

focuses on the management of retribution and other

locally-generated revenues in order fulfill the needs

for preparing an accrual based financial statement.

We took a case study of the phenomena in BPKD

Provinsi DKI Jakarta as regional finance

management board. The selection of case study

method based on problems occur in BPKD Provinsi

DKI Jakarta that requires direct involvement of

researchers in this research.

This study uses primary data sources obtained

directly from BPKD. The use of primary data

sources aims to support the objectives of this study

which are to understand how the systems works and

to propose an design of integration between the two

systems.. We used several research instrument to

support data collection process as follows:

1. Interview

We conducted interview with the revenues

division, treasury division, information system

division and accounting division. The interview

aims to obtain an understanding how SIM PAD

and SIPKD works and to obtain the information

about user requirement and expectations.

2. Document Analysis

We analyzed several internal documents in the

form of certain government accounting standard,

governor regulation about retribution and other

locally-generated revenues management, and

structure of SIM PAD and SIPKD. This method

aims to obtain an overview of accrual based

government accounting standard and the

retribution and other locally-generated revenues

management process.

3.2 Data Analysis

This study uses a deductive approach, data analysis

produce a conclusion that originated from the theory

or model or main framework used as the basis of

conclusions. We use qualitative descriptive method

to elaborate, describe and compare the data obtained

during the research. We use the data collected to

analyze the integration design of SIM PAD and

SIPKD. This analysis will generate information on

how the two systems works and what development

is needed for both systems in order to fulfill the

needs for preparing the accrual based financial

report . We also developed a design for integration

between SIM PAD and SIPKD using FAST Method.

The results of interviews, document analysis will

generate scope definition, problem analysis and

system requirement as the basis to develop the

integration design.

4 RESULT

4.1 Scope Definition and Problem

Analysis

To analyze information system needs in order to

better management of retribution and other other

locally-generated revenues and reporting in

accordance with accrual based government

accounting standards, the researchers performs

scope definition, problem analysis and system

requirement in FAST method.

In the scope definition stage, we do PIECES

framework analysis proposed by James Wetherbe

(Whitten and Bentley, 2007), it is called as PIECES,

because the letters of each of the six categories of

PIECES, the categories are Performance,

Information, Economics, Control, Efficiency and

Service. The result of the PIECES framework

analysis is the problem statement. After the scope

definition process is completed and the problem

statement and scope of system development have

been determine then the researcher performs the

problem analysis. we conduct the analysis of

problem related to the system that currently used

SIM PAD and SIPKD. The following is the

identification of the problems and consequences that

arise from the currently unintegrated SIM PAD and

SIPKD.

The following is the identification of the

problems and consequences that arise from the

currently unintegrated SIM PAD and SIPKD.

Analysis of System Design of SIPKD (Regional Financial Management System) and SIM PAD (Locally-Generated Revenues Management

Information System) Integration in Order to Fulfill the Need for Preparing an Accrual-Based Financial Statements - Case Study in The

Provincial Government of Jakarta

395

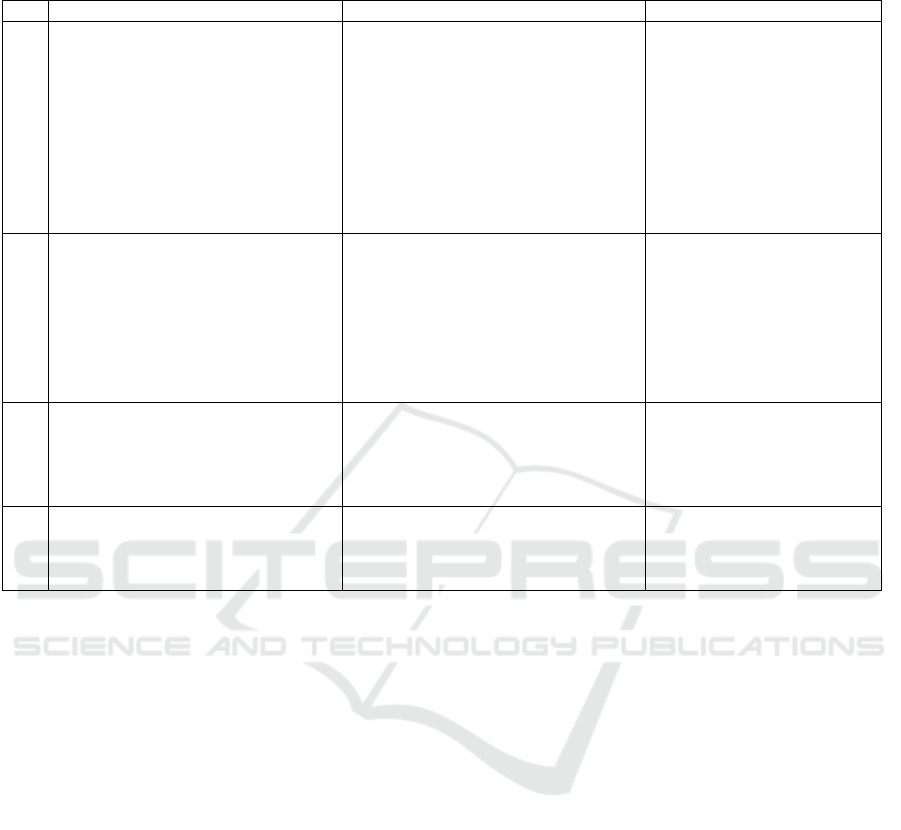

Table 1 List of Problems, Impact and Solutions

No

Problem

Impact

Solution

1

The reporting of revenues-LO

accounts, accounts receivable for

retribution and other locally-

generated revenues is done manually.

• The reporting process becomes

longer, because reconciliation is

required for each account and each

SKPD (work unit).

• The process of preparing the

financial statements is inconsistent

with the appropriate accounting

cycle.

• Unable to generate financial reports

at any time

Integrated SIM PAD with

SIPKD so that data for

revenues-LO account,

receivables and allowance for

doubtful account for

retribution and other locally-

generated revenues are

transferred from SIM PAD to

SIPKD

2

Calculation and reporting for

allowance for doubtful account

retribution and other locally-

generated revenues is done manually

using ms excel.

• The value of the account that goes

into the financial statements is

potentially miscalculated and

incorrect input

• Unable to present account

allowance for doubtful account

retributions and other locally-

generated revenues at any time

Additional menu is required

for the calculation of

allowance for doubtful

account retributions and

other locally-generated

revenues.

3

The menu for payment validation on

SIPKD does not suitable with

SIMPAD

Unable to validate payment from SIM

PAD to SIPKD

A new user interface is

required to validate payment

data with the data in bank

statement.

4

There is no database for revenues-LO

at SIPKD to accommodate the

assignment and payment data from

SIMPAD

Reporting of revenues-LO accounts is

done manually

An additional database for

revenues-LO and additional

menus in SIPKD should be

created.

4.3 Requirement Analysis

After the current problem is known and understood,

the next step is to conduct the requirement analysis

to make the system able to overcome the problem.

These requirements include the system's ability to do

the following:

1. The system can generate revenues-LRA account,

revenues-LO account, accounts receivable, and

allowance for doubtful account retribution and

other locally-generated revenues in the financial

statements of the Provincial Government of

Jakarta.

2. The system can simplify the process of preparing

financial statements from previously done with

the manual process, to be more effective and

efficient.

3. The system can generate operational reports

every month, not only during the financial

reporting period

4. The system can generate revenue report data for

retribution and other PAD more accurate and

complete

4.4 Logical Design

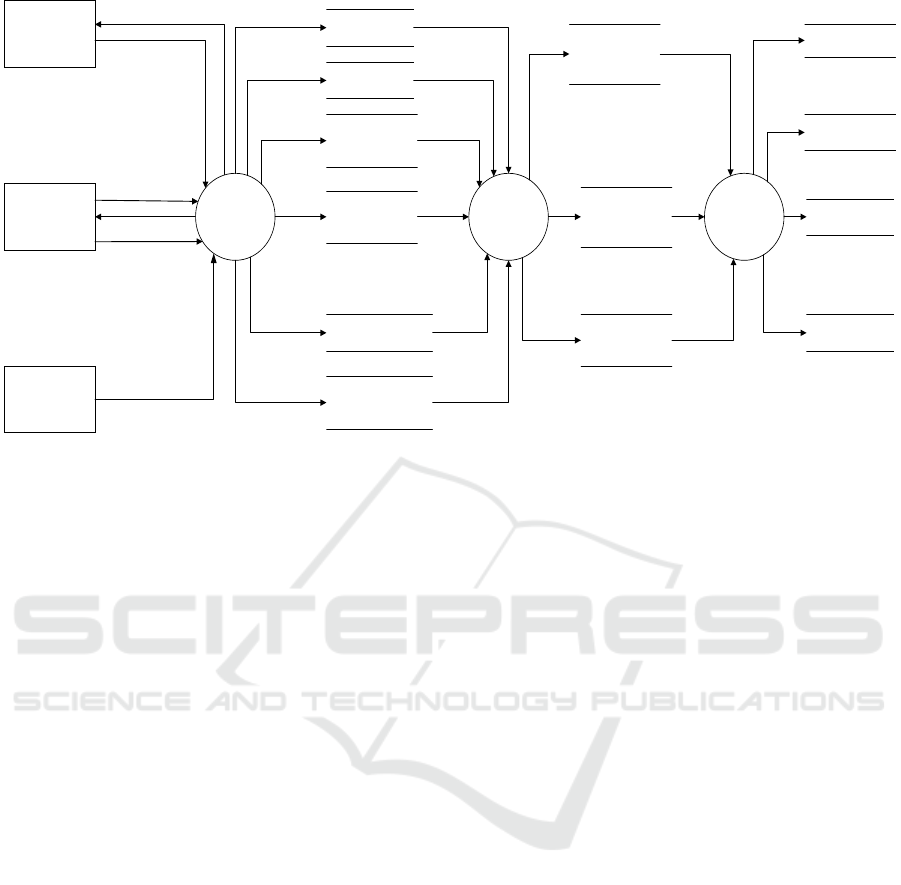

The integration between SIMPAD and SIPKD is

done through a middleware application in charge of

translating data from SIMPAD into a format

readable by SIPKD and then sending it to SIPKD on

daily basis. Diagram of system integration between

SIM PAD and SIPKD can be seen in figure 1.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

396

Retribution and Other

Locally-Generated

Revenues Payer

Permit and

deposit submission

SKRD/STS

Bank

SKRD/STS Data

NTPD

Sistem Kependudukan

dan Catatan Sipil

Civil Registration Data

SIM PAD

Credit Note &

Bank Statement

Middleware

Receivable and

Allowance for Retribution

Receivable

Receivable and

Allowance for Other

Locally-Generated

Revenues Receivable

Retribution Payment After

Validation

Other Locally-Generated

Revenues Payment After

Validation

Receivable and

Allowance for Retribution

and Other Locally-

Generated Revenues

Receivable

SIPKD

Other Locally-Generated

Revenues Charge

Retribution Charge

Retribution & Other

Locally-Generated

Revenues Charge Data

Retribution & Other

Locally-Generated

Revenues Payment Data

Revenues-LO Journal

Revenues-LRA Journal

Adjustment Journal

General Ledger

Figure 1 Diagram of System Integration Between SIM PAD and SIPKD

Based on figure 1, the following is Mapping data

transfer that is done from SIMPAD to SIPKD

through middleware:

1. Data transfer from retribution charge record and

other locally-generated revenues charge record in

SIM PAD into retribution and other locally-

generated revenues charge record in SIPKD.

2. Data transfer from retribution payment record

and other locally-generated revenues payment

record in SIM PAD into retribution and other

locally-generated revenues payment record in

SIPKD

3. Data transfer from receivable and allowance for

receivable retribution record and receivable and

allowance for receivable other locally-generated

revenues record in SIM PAD into receivable and

allowance for receivable retribution and other

locally-generated revenues record in SIPKD.

In addition to integration design, we also propose

a system development both in SIM PAD and

SIPKD. Development on SIM PAD is an additional

menu and database for receivable and allowance for

receivable retribution and other locally-generated

revenues, receivable write-off process and validation

for retribution and other locally-generated revenues

payment to replace the manual input data for

payment of retribution and other locally-generated

revenues. While development in SIPKD is an

additional process which is automatic journal for

revenues-LO, revenues-LRA, receivable and

allowance for receivable account to replace manual

journal process.

4.5 Advantage of The Proposed

Integration and Development Model

The integration and development model of SIM

PAD and SIPKD that has been described has several

features that can assist The Provincial Government

of Jakarta in terms of the management of retribution

and other locally-generated revenues and reporting

in the financial statements in accordance with the

appropriate accounting cycle and more reliable

account data.

The first advantage is that there is no need to do

manual data input on retribution payments and other

other locally-generated revenues data because the

data is transferred from SIM PAD to SIPKD so as to

minimize error during input and increase efficiency

because there is no need to input one by one. The

second advantage is retribution and other locally-

generated revenues charges data generated by SIM

PAD can be transferred to SIPKD, which is

currently unavailable in SIPKD and the data can

then be used as a basis for doing a revenue-LO

journal.

Based on the first and second advantages, it

relates to the third advantage of not having to do

manual journals for revenue-LO recognition and

revenue-LRA, since the journal will be

automatically performed by the system based on the

Analysis of System Design of SIPKD (Regional Financial Management System) and SIM PAD (Locally-Generated Revenues Management

Information System) Integration in Order to Fulfill the Need for Preparing an Accrual-Based Financial Statements - Case Study in The

Provincial Government of Jakarta

397

charge and payment data of retribution and other

locally-generated revenues that have been

transferred from SIM PAD to SIPKD. Retribution

and other locally-generated charge data will serve as

the basis for revenue-LO journal, while payment

data will serve as the basis for revenue-LRA journal.

This automated journal has several advantages: time

efficiency because the journal does not need to be

done manually and one by one, minimize journal

errors that can occur in manual journals, it does not

need much human resources to do journal

considering the large number of retribution and other

locally-generated revenues transactions.

The last advantage is that there is no need to

calculate and journal the allowance for bad debts by

manual. One of the proposed developments in SIM

PAD is the addition of menus and databases for

calculation of receivables and allowance for

retribution and other locally-generated revenues

receivables. The allowance data of these receivables

will then be sent to SIPKD, which this data will

serve as the basis for SIPKD to perform adjustment

entries for allowance for retribution and other

locally-generated revenues receivables at the end of

the accounting period. This process has several

advantages that minimize miscalculation of

allowance for receivable account that has been done

manually and also the advantages of the automatic

journal as mentioned in the third advantage above.

5 CONCLUSIONS

Based on the results of the analysis and discussion

that has been discussed in the previous section, some

conclusions obtained are as follows:

1. To meet the needs of accrual-based government

accounting standard implementation, it is

necessary to integrate the SIM PAD and SIPKD.

Such integration is required for data on

retribution and other locally-generated revenues

to flow into SIPKD and can be used in SIPKD

for accrual based financial reporting. With the

data flowing it will eliminate the manual process

that has been done so as to minimize errors that

may occur.

2. In order to integrate SIM PAD with SIPKD,

some adjustments are required to fit the

accounting needs of government-based accruals.

Such adjustments need to be made on either the

SIM PAD or SIPKD, the adjustments are as

follows:

a. There should be additional database and

menu to calculate the allowance for doubtful

account retribution and other locally-

generated revenues either on SIPKD or SIM

PAD.

b. There needs to be a new menu for validation

of retribution and other locally-generated

payment in SIM PAD to replace the current

manual validation menu.

c. There needs to be a new database in SIPKD

to accommodate the charged and payment of

retribution and other locally-generated

revenues data sent from SIM PAD.

d. It is necessary to make changes to the menus

and databases to conduct and retain revenue-

LO, revenues-LRA and allowance for

doubtful account journals.

ACKNOWLEDGEMENTS

The first author would like to acknowledge the

Provincial Government of Jakarta who supported her

study and Regional Financial Management Board

(BPKD) of The Provincial Government of Jakarta as

research subject.

REFERENCES

Bentley, Lonnie D. and Jeffrey L. Whitten. 2007. System

Analysis and Design for The Global Enterprise (7

th

Edition). New York: McGraw-Hill Companies.

Romney, Marshall B. and Paul J. Steinbart. 2012.

Accounting Information Systems (12

th

Edition). USA:

Pearson Education Limited.

Connolly, Thomas. And Begg Carolyn. 2014. Databse

System: A Practical Approach to Design,

Implementation and Management: Global Edition.

Pearson Education Limited

Peraturan Pemerintah Nomor 71 Tahun 2010 Tentang

Standar Akuntansi Pemerintahan

Peraturan Gubernur Nomor 204 Tahun 2016 Tentang

Kebijakan Akuntansi Pemerintah Daerah Khusus

Ibukota Jakarta

Peraturan Gubernur Nomor 108 Tahun 2017 Tentang

Pelaksanaan Penerimaan Pendapatan Daerah Secara

Elektronik

Peraturan Gubernur Nomor 188 Tahun 2015 Tata Cara

Pemberian Keringanan, Pengurangan dan Pembebasan

Retribusi Daerah

Peraturan Gubernur Nomor 254 Tahun 2016 Tentang

Organisasi dan Tata Kerja Badan Pengelola Keuangan

Daerah

Peraturan Daerah Provinsi DKI Jakarta Nomor 12 Tahun

2017 Tentang Organisasi Perangkat Daerah

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

398

Al-Jaroodi, Jameela. And Nader, Mohamed. 2011.Service

Oriented Middleware:A Survey.Journal of Network

and Computer Applications. Available at Elsevier:

www.elsevier.com/locate/jnca

Ariyani, Lidya. (2014). Analisis Sub Sistem Informasi

Rekam Media RSUD Pasar Rebo Dalam Rangka

Memenuhi Kebutuhan Sistem Jaminan Kesehatan

Nasional. Tesis, Magister Akuntansi, Universitas

Indonesia.

Firdaus, Muhammad Iqbal. (2016). Rancangan Sistem

Informasi Tilang Elektronik Terintegrasi Berbasis

Automatic Number Plate Recognition (ANPR) (Studi

Kasus Pelanggaran Jalur Bus Transjakarta). Tesis,

Magister Akuntansi, Universitas Indonesia.

Permana, Ida Bagus Gede Bayu. And Wiratmaja, I Dewa

Nyoman. 2016.Pengaruh Sumber Daya Manusia,

Komitmen Organisasi, Sistem Informasi pada

kesiapan penerapan laporan keuangan pemerintah

daerah berbasis akrual. Available at E-Jurnal

Akuntansi Universitas Udayana: www.ojs.unud.ac.id

Sophina, Mohammad Dimas. 2016. Pengaruh Kompetensi

Sumber Daya Manusia dan Sistem Informasi

Akuntansi Terhadap Penerapan Standar Akuntansi

Pemerintah Berbasis Akrual. Skripsi. Fakultas

Ekonomi. Universitas Pasundan.

Satrio, M Dimas. Yuhertiana, Indrawati. And Hamzah,

Ardi. 2016. Implementasi Standar Akuntansi

Pemerintahan Berbasis Akrual di Kabupaten Jombang.

Jurnal Akuntansi dan Keuanga Vo.18 ISSN 1411-0288

print/ISSN 2338-8137 online

Kusuma, Ririz Setiawati. 2013. Analisis Kesiapan

Pemerintah Dalam Menerapkan Standar Akuntansi

Pemerintah Berbasis Akrual.Skripsi. Fakultas

Ekonomi. Universitas Jember

http://www.jakarta.go.id/v2/news/2013/11/latar-belakang-

2013-2017#.WZ54LilLfIV. accessed on 24 Agustus

2017

http://www.beritajakarta.id/visi_misi. accessed on 24

Agustus 2017

http://bpkd.jakarta.go.id/profil. accessed on 24 Agustus

2017

Analysis of System Design of SIPKD (Regional Financial Management System) and SIM PAD (Locally-Generated Revenues Management

Information System) Integration in Order to Fulfill the Need for Preparing an Accrual-Based Financial Statements - Case Study in The

Provincial Government of Jakarta

399