Designing a Budgeting Information System for Meal and Book

Expenses Based on the Financial Information System for an Islamic

Boarding School

Case Study at Al-Amin Islamic Boarding School in Mojokerto

Debby Ratna Daniel

1

,Ivana Laksmono

2

, Kafani Irawan

3

Department of Accountancy, Airlangga University, Surabaya, Indonesia

debby-r-d@feb.unair.ac.id, {ivanalaksmono88, kafaniirawan}@gmail.com

Keywords: Budgeting Culture, Budgeting System, Ethnography, Financial Information System, Internal Control,

Islamic Boarding School, Meal and Book Expenses, Selection Of Vendors.

Abstract: An Islamic boarding school is an educational establishment under the leadership of a kyai, reserved for the

santri. Based on data from the Indonesia Ministry of Religious Affairs, the number of Islamic boarding

schools in Indonesia reached 27,230 at the end of 2011. Al-Amin Islamic Boarding School is one of the

boarding schools whose leadership does not depend on a kyai. The management of this boarding school uses

a budgeting system that covers educational costs, infrastructure costs, and welfare costs for the asatidz and

santri. The problems found in the current budgeting system are inadequate funds for meal expenses and a

lack of cash inflow due to the accounts receivable from the santri’s parents; funds are difficult to collect

because of the parents’ professions, i.e. farmers, food material sellers, etc. This research used a qualitative

method with an ethnographic approach to analyze the typical and current budgeting culture. The results of

this research show that there are some weaknesses in the current system. The weaknesses are an inadequate

budgeting system, a small selection of vendors, and weaknesses in internal control. Therefore, Al-Amin

Islamic Boarding School needs to implement a budgeting information system for meals and book expenses

based on a financial information system.

1 INTRODUCTION

The number of Islamic boarding schools in

Indonesia reached 28,961 in 2014 (Indonesia

Ministry of Religious Affairs, 2014). Al-Amin is an

Islamic boarding school located in Mojokerto. Based

on the Decree of Al-Amin Financial Management

Guidelines Letter number PPSA/003/OT-SK/2013,

expenditure costs are divided into three categories:

routine expenses (stuffs, energies, and services),

activity expenses, and construction expenses.

According to the expenditure data, around 37% of

expenses at Al-Amin were used for meals, and

around 10% were used for the santri’s books during

2016. In addition, there were problems related to

expenses such as an inadequate financial

information system, especially for budgeting for

meal and book expenses, and the inability of the

santri’s parents to paying the meal and book

expenses.

Meal expenses are one factor that determines the

monthly amount of i’anah (contribution to education

coaching) that must be paid by the santri’s parents.

However, this expense is determined by the Al-

Amin Cooperative before the start of the academic

year, which means that changes are only

implemented at the start of the next academic year.

In fact, the bills that must be paid by the Al-Amin

Cooperative for meals expense are always changed

every month. This fluctuation caused the difficulty

of the accuracy of funds allocation in terms of

operational activity (Table 1). Furthermore, the

different amounts charged for meals between Al-

Amin and the Al-Khadijah Cooperative lead to

difficulty in predicting the liquidity of the available

funds. On the other hand, book expenses are only

determined by the Al-Amin Cooperative for both

female and male santri. This expense is negotiated

by the Al-Amin Cooperative with other institutions

such as book publishers or shops, and uses a profit-

sharing system of 10% from the total revenue (for

Daniel, D., Laksmono, I. and Irawan, K.

Designing a Budgeting Information System for Meal and Book Expenses Based on the Financial Information System for an Islamic Boarding School - Case Study at Al-Amin Islamic Boarding

School in Mojokerto.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 159-166

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

159

Al-Amin) in each of the odd mid-term semesters

(after the start of the new academic year).

Additionally, the Al-Amin Cooperative is only a

negotiator in the billing system. The cash that is paid

by the santri’s parents for books is directly accepted

by the cooperation treasurer (Table 2). The period of

payment is up to three months after the bill is

received by the santri’s parents.

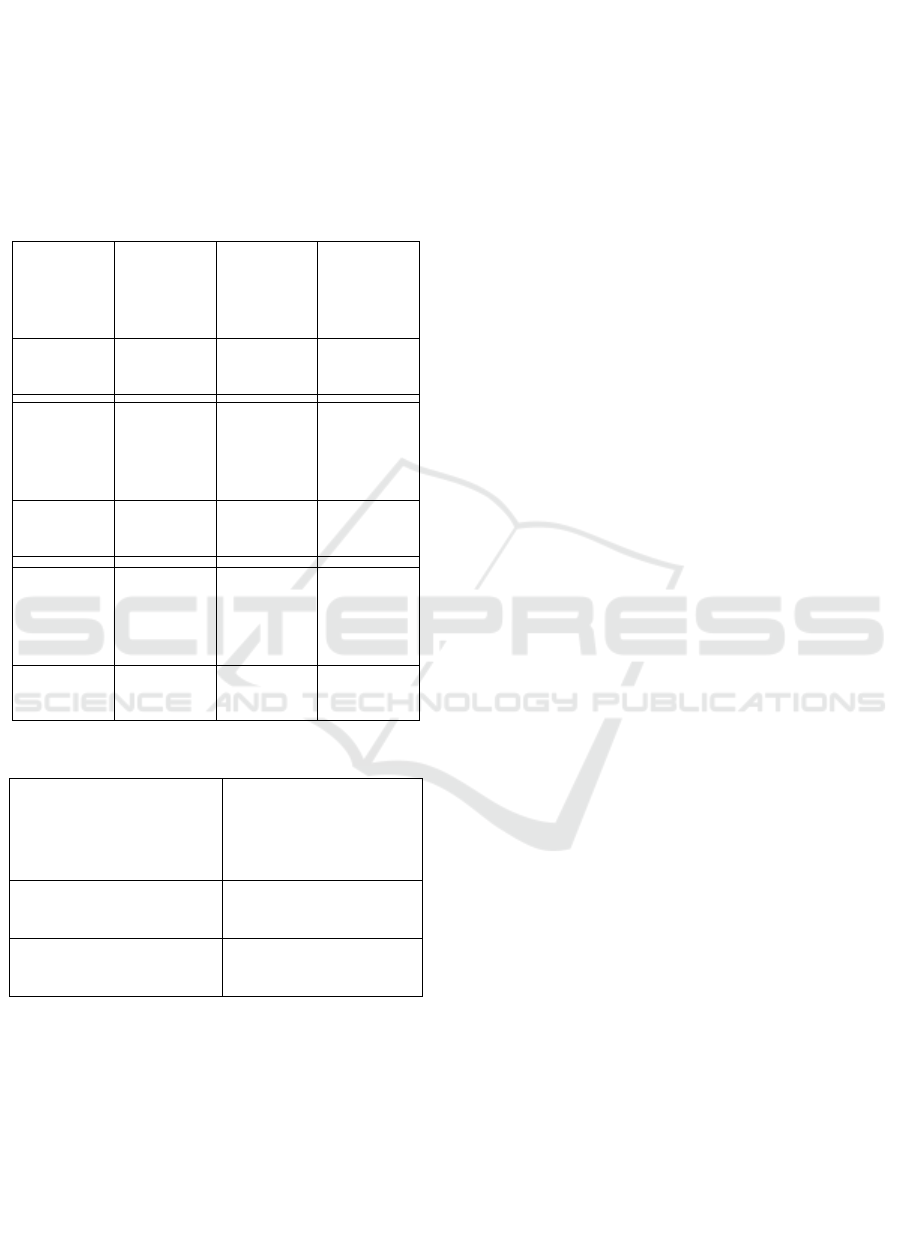

Table 1: Actual expenses for meals in 2016

January

(in rupiah)

February

(in rupiah)

March

(in rupiah)

April

(in rupiah)

172,374,900 176,470,800 188,641,280 183,011,200

May

(in rupiah)

June

(in rupiah)

July

(in rupiah)

August

(in rupiah)

108,381,000 209,305,800 110,569,750 209,305,800

September

(in rupiah)

October

(in rupiah)

November

(in rupiah)

December

(in rupiah)

184,846,800 195,832,800 198,467,550 123,778,800

Table 2: Cash paid by wali santri for books, 2016

Year

Amount

(in rupiah)

2016 535,993,000

2015 458,446,500

To conclude, optimal budgeting for meal and

book expenses through the implementation of a

financial information system is expected to improve

the current system at Al-Amin Islamic Boarding

School. Budgeting can be an essential tool to

manage the financial system of an Islamic boarding

school in order to provide benefits for all

organizations involved, such as helping with fund

management, assisting in setting goals, evaluating

performance, and motivating for future thinking. In

addition, the system becomes a medium for

communication and coordination. Therefore, this

research has applied an ethnographical approach to

develop the financial information system for the

budgeting process for meal and book expenses at Al-

Amin Islamic Boarding School. Further research on

the internal control of the financial system can be

conducted to develop an accurate financial report.

2 LITERATURE REVIEW

2.1 Previous Research

In supporting this current research, we used three

local journals and an international journal as

guidelines or references to construct an effective

budgeting system at Al-Amin Islamic Boarding

School. The three local journals were published by

the following:

1. Rahayu et al. (2015), who suggest that the

cultural values of an institution should be

implemented as a basis in the funds budgeting

system, especially for school operational funds

(SOA).

2. Ribka and Daniel (2016), who explain that the

organizational structure and types of leadership

affect the accountability practices and financial

transparency in religious institutions.

3. Basri and Nabiha (2016), who describe the role

of accounting in non-profit organizations as an

instrument for internal and external stakeholders

that can be used to manage and monitor

development in accordance with the

organization’s mission.

In addition, the international journal used in this

research was written by Starck and Bailes in 1996.

They state that all administrators in an institution

should know and understand the budgeting process,

budgeting techniques, and the various types of

budget.

2.2 Financial Information System

A financial information system (FIS) is a part of a

computer-based information system (CBIS) that

provides financial information for organizations

(McLeod and Shell, 2011). A CBIS consists of three

input subsystems (accounting information system,

internal audit, and financial intelligence) and three

output subsystems (forecasting, funds management,

and budgeting or controlling). The central function

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

160

of a financial system is to facilitate the allocation

and deployment of economic resources, over time

and space, in an uncertain environment (Karyotis &

Onochie, 2017).

2.3 Cash Receipt Information System

A cash receipt information system is an

organizational structure designed to provide

information flow and reports that consist of certain

activities in order to support routine activities

relating to billing and payment acceptance, to

support financial problem solving, and to help create

internal and external financial reports in accordance

with the applicable standards (Gellinas and Dull

2008). It is designed to protect an organization from

abuse, including fraud, so that cash can be collected

and used in line with the organization’s mission

(Pasaribu, 2017).

2.4 Cash Disbursement Information

System

Gellinas and Dull (2008) define the cash

disbursement information system as a designed

system that executes certain functions, such as

accounts payable and the cashier department,

supporting decision making in account payable and

the cashier department, and providing internal and

external reports.

2.5 Internal Control

An internal control refers to organizational rules and

procedures used to safeguard assets and to detect

fraud, waste, and abuse (Park et al., 2016).

Moreover, good internal control consists of five

components: 1) control environment, 2) risk

assessment, 3) information system and

communication, 4) control activities, and 5)

monitoring.

2.6 Database Processing System

The main feature of a relational database

management system (RDBMS) is the use of key

fields that allow connection between one table and

another. This means that the developer does not need

to specify the hierarchy (as in network databases).

Instead, the “key” fields identify one row and can be

either surrogate or business-logic-driven. This

allows the user to change the structure of certain

tables (or to add columns, which are frequently

called attributes) without changing the whole design

(Tromifov et al., 2017). They also implied that this

system will integrate all independent files and has

the ability to meet the needs of different activities.

Furthermore, there are other reasons for creating this

system: 1) using an entity-relationship model, 2)

identifying entities, and 3) identifying the

relationships between all entities.

2.7 Public Sector Accounting

International public-sector accounting is

operationalized to provide accurate and

comprehensive accounting information with a view

to demonstrating appreciable levels of

accountability, stewardship, and credibility

(Ademola et al., 2017). When managing a public

fund, budgeting can be planned to predict the cash

receipts and disbursements. In addition, the

characteristics of public-sector budgeting can be

explained as follows: a budget must be declared in

financial and non-financial units; a budget must

cover a specific time; a budget contains

commitments and the ability of management; a

budget proposal has been reviewed and agreed by

related parties; and a budget can only be changed in

special circumstances.

3 RESEARCH METHOD

This research used a qualitative approach by

applying an ethnography method to find descriptive

information about the budgeting system at Al-Amin

Islamic Boarding School. Ethnography investigates

societies and cultures by examining the human,

interpersonal, social, and cultural aspects in all their

complexity (Shagrir, 2017). The design of this

research was adopted from the ethnography steps of

Spradley’s (1997) Development Research Sequence.

The steps are as follows:

1. Determining the informants by using five

minimum requirements: 1) full enculturation, 2)

direct involvement, 3) unknown cultural

situation, 4) sufficient time, and 5) non-analytics.

2. Interviewing the informants and paying attention

to five elements: 1) explicit purpose, 2)

Designing a Budgeting Information System for Meal and Book Expenses Based on the Financial Information System for an Islamic

Boarding School - Case Study at Al-Amin Islamic Boarding School in Mojokerto

161

ethnographical explanation, and 3)

ethnographical questions.

3. Making ethnographical notes, including field

notes, image recording devices, artifacts, and

other instruments, in order to describe the

cultural situation. In addition, ethnographical

notes should contain a short report, an expanded

report, field research journals, and analysis and

interpretations.

4. Asking descriptive questions that can be selected

from five types: grand tour questions, mini tour

questions, example questions, experience

questions, and original language questions.

5. Analyzing the ethnographical interviews by

applying the following sequences: 1) identifying

the problem, 2) collecting cultural data, 3)

analyzing the cultural data, 4) formulating an

ethnographical hypothesis, and 5) writing the

ethnography.

6. Making sure the domain analysis consists of

certain elements, such as a cover term, a

semantic relationship, included terms, and

boundaries.

7. Asking structural questions based on certain

principles, such as concurrence, explanation,

repetition, context, and cultural framework.

8. Carrying out a taxonomic analysis by applying

the following steps: 1) choosing the domain, 2)

identifying the substitute framework, 3)

searching the subset, 4) looking for the large

domain, and 5) making a temporary taxonomy.

9. Asking contrasting questions in order to find

different symbols.

10. Conducting a component analysis that is related

to the cultural symbols.

11. Finding the cultural theme.

12. Writing the ethnography.

4 ANALYSIS

4.1 Determining the Informants

In this research, we selected informants from Al-

Amin Islamic Boarding School as follows:

1. Ustad Najib is the Head of the Association and

Social Secretariat Office, and has the authority to

organize the fund of the santri’s parents or other

parties, managing expenses over one million

rupiah, controlling the staffing system, managing

meal expenses, and building cooperation with

outside parties.

2. Ustad Abu Abbas is the Head of the Caregiver

Board Secretariat Office and the Coordinator of

the Al-Amin Cooperative, and has the authority

to compile all budgets for book procurement

proposed by madrasah and pesantren.

3. Ustad Imaddudin is the Head of Madrasah

Aliyah (senior high school) and Al-Amin

Pesantren Cooperative (Al-Amin Koppontren),

and is responsible for authorizing the proposed

budgets for book procurement.

4. Ustad Agung is one of the teachers at Al-Amin

Islamic Boarding School, and is responsible for

creating the budgets for book procurement, along

with other teachers.

4.2 Informant Interviews

In the process of interviewing the informants, we

selected related staff who have been actively

involved with Al-Amin Islamic Boarding School for

the past three years. The detailed explanation of the

interview process is as follows:

1. The first informant was Ustad Najib, who was

interviewed twice, on August 16, 2016, and

December 28, 2016. The interview took place in

the Secretariat Office of the Association

(Mojokerto). Ustad Najib talked about the

general budget system for meal and book

expenses.

2. The second informant was Ustad Abu, who was

interviewed on November 20, 2016. The

interview resulted in a specific description

related to the budgeting system for meal and

book expenses.

3. The third informant was Ustad Imaddudin, who

was interviewed on December 25, 2016, in the

Madrasah Aliyah office. He discussed the

budgeting process for book expenses.

4. The fourth informant was Ustad Agung, who was

interviewed on December 28, 2016. He

explained the components of the book expenses

budget.

4.3 Ethnographical Notes

This field research was conducted during the period

of April 2016 to October 2017. At the beginning of

the process, we conducted an initial survey of the

budgeting system at Al-Amin Islamic Boarding

School. Then, the research topic of budgeting for

meal and book procurement expenses was

determined based on the results concerning the

percentage of spending costs, as mentioned in the

introduction section. Later, participatory observation

by Kafani Irawan has been done through joining as a

member of the finance department on April 4, 2016.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

162

Results obtained from the field research included

information on: organizational structure, vision and

mission, the process of cash receipt and

disbursement, transaction recording, general

budgeting, the meal expenses budget, and the book

procurement expenses budget. Furthermore, a

number of primary and secondary informants were

selected in order to investigate in-depth information

relating to the budgeting system for meal and book

procurement expenses.

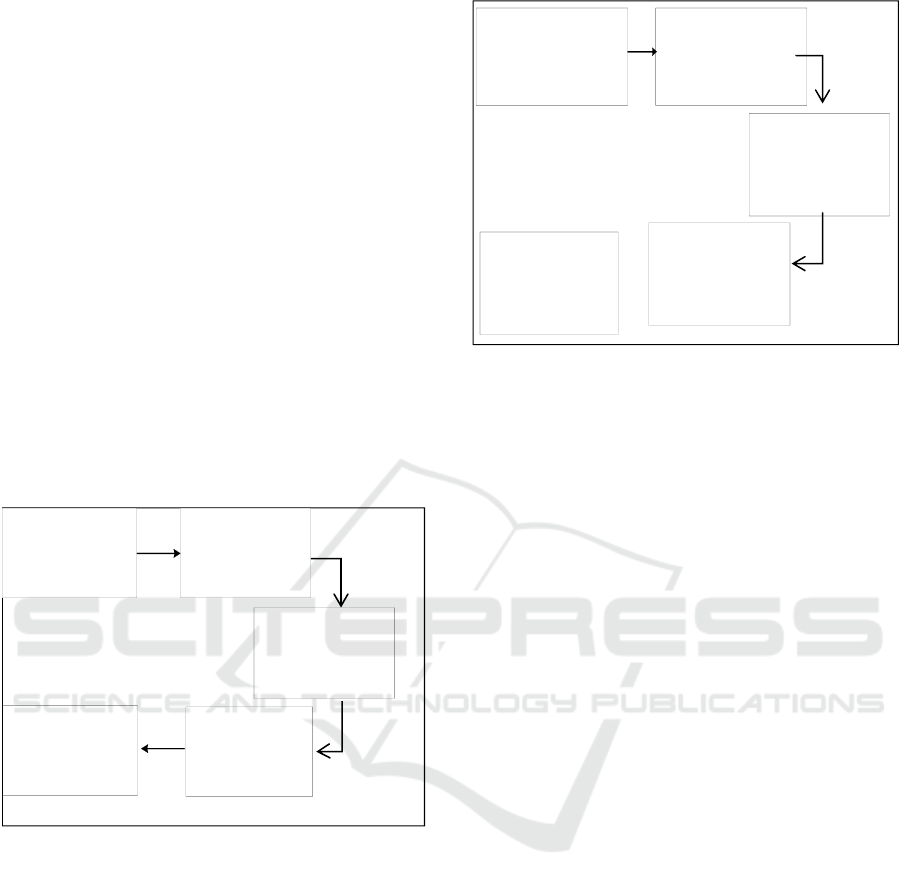

4.4 Descriptive Questions

The descriptive questions were asked in an attempt

to understand the culture of budget making for meal

and expenses based on the procedures of cash

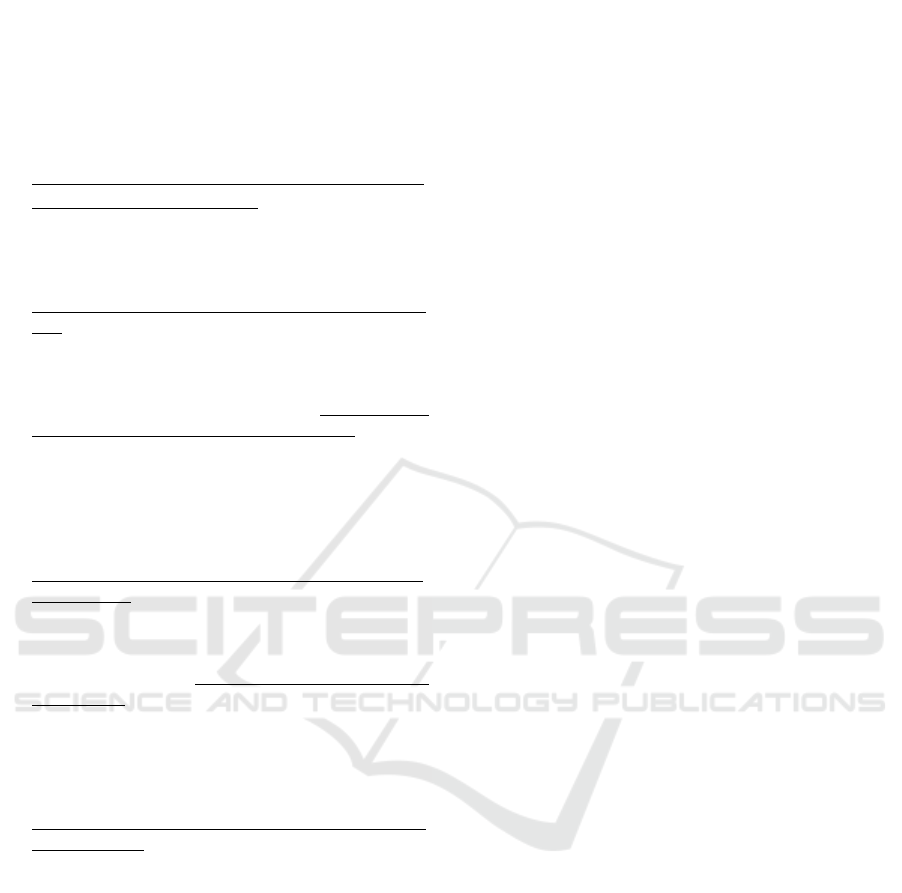

receipt (Figure 1.1) and cash disbursement (Figure

1.2), and also the personnel involved in the process.

In addition, we were able to obtain more detailed

information from the related parties and the selected

informants on the culture applied to compose a

budget over a certain period.

Figure 1: General description of cash receipt procedure

(Internal Process, 2016).

Figure 2: General description of cash disbursement

procedure (Internal Process, 2016).

4.5 Analysis of the Ethnographical

Interviews

All of the directions that were given by all of the

informants must be followed in order to describe the

business process and environmental management of

Al-Amin Islamic Boarding School, in particular for

meal and book procurement expenses. For meal

expenses, the cash disbursement process begins

when all bills are received from the supplier (orally

passed on to the treasurer) and the repayment of all

bills will be transferred from the PPSA account at

BPRS Mojokerto to the bank account of the Al-

Amin and Al-Khadijah Cooperative. On the other

hand, the cash disbursement process for book

procurement expenses was not found because of the

direct management of Al-Amin Cooperative without

the involvement of Al-Amin Islamic Boarding

School.

4.6 Domain Analysis

The domain of this research encompassed the overall

components in the budgeting process for meal and

book expenses, including the budgeting report, the

budgeting procedure and database, the cash

disbursement process, the cash receipts process, and

the relationship between all terms used.

4.7 Structural Questions

The structural questions helped to obtain all

knowledge from the informants in order to sharpen

the information on why the budgeting process for

meals always fluctuates and why there is no budget

Santri's parents come

to the Front Office

Department for paying

book and meal cost

Front Office staff will

Give the amount of bills

that must be paid of

f

Santri's parents pay the

b

ills according to their

financial ability

Front Office staff will

receive the payment

Santri's parents accep

t

the receipt for payment

as a legal tool

payment

Cooperative

management will inform

the treasurer of Islamic

Boarding School about

the number of bills

The treasurer will report

orally to the Head of

Association and Social

Secretariat Office

The Head o

f

Association and Social

Secretariat Office will

p

ublish the repayment

of the standing

instruction

The Head o

f

Association and

Social Secretaria

t

Office will send the

standing instruction

to BPRS Mojokerto

BPRS Mojokerto will

transfer to the

Cooperative Account

b

ased on the standing

instruction

Designing a Budgeting Information System for Meal and Book Expenses Based on the Financial Information System for an Islamic

Boarding School - Case Study at Al-Amin Islamic Boarding School in Mojokerto

163

for book expenses. In obtaining further information,

we learned that the process for meal budgeting is

started from the analyze of entire budget

components. Payments for meals are transferred on

the tenth of each month by the treasurer to the

account of the Al-Amin and Al-Khadijah

Cooperative. In contrast, book expenses do not have

a budget because this is managed by the treasurer of

the Al-Amin Cooperative.

4.8 Taxonomic Analysis

The process of taxonomic analysis consisted of two

steps, which are explained in detail in the following:

1. The first step is to determine the domain of the

research. The domain is the budgeting

information system for meal and book expenses.

2. The second step is to identify the proper

substitution framework for analysis. This

research used an accounting information system

framework using a financial information system

approach in an attempt to analyze the existing

budgeting system for meal and book expenses.

4.9 Contrasting Questions

The contrasting questions were put to the highest

authority at Al-Amin Islamic Boarding School, who

was responsible for the book and meal expenses

budget. These questions covered the existing

budgeting systems and procedures, the use of

documents, the implemented technologies, the aims

and values of the existing system, the related staff,

the sources use, and contingency.

4.10 Component Analysis

The components of the meal expenses budget, i.e.

material costs and labor costs, that were analyzed in

this research describe the connection between the

condition of the current budgeting system and the

culture within Al-Amin Islamic Boarding School.

On the other hand, there is no component for the

book expenses budget because the management of

book procurement was the responsibility of the Al-

Amin Cooperative. The contrasting conditions for

the meal and book expenses budgets were

formulated to draw up suggested procedures for the

meal and book expenses budget.

4.11 Finding the Cultural Theme

The current cultural theme of the budgeting system

for meal and book expenses at Al-Amin Islamic

Boarding School is the Gotong Royong culture. This

is inspired by Islamic values, as stated in the holy

book of the Quran. This cultural theme will be

implemented as a basis for the new system.

4.12 Writing an Ethnography

The Al-Amin Islamic Boarding School was

established based on the initial ideas of K.H.

Mas’Ud Yunus in 1998, to change the orphanage

into a formal education institution, namely,

Madrasah Tsaniwiyah and Madrasah Aliyah, in an

attempt to prepare young Muslim generations of

Nahdlatul Utama in Indonesia to have a quality, a

noble personality, self-reliant, a soul of independent,

and many advantages for homeland and nation.

Then, the idea was developed and approved by

Bambang Prayitno, the leader of the orphanage.

Next, a meeting of the founders and committee

members was held to build the Al-Amin Education

and Social Foundation (YPSA), which became the

Al-Amin Education and Social Association (PPSA)

in 2008. Then, an organizational structure was

formed, combining the national education

curriculum and the Islamic boarding school. Finally,

all santri activities and soft-skills training were

facilitated.

Based on the research, Al-Amin Islamic

Boarding School accommodates all the needs of the

santri, including meals and books. Amount of meal

expenses were determined at the beginning of

boarding school curriculum. This amount always

fluctuates into tens of millions of rupiah each month

because of the imbalance between the funds

receiving and spending. The imbalance occurred due

to the irregular meal system, which means that meal

expenses cannot be calculated clearly. In addition,

the two cooperatives (Al-Amin and Al-Khodijah)

never explained the bills for meals transparently and

give formal documents as a legal payment tool. On

the other hand, there is no budget determination for

book expenses because the management of this

budget has been passed to the Al-Amin Cooperative.

The cost estimation only can be accepted when the

Al-Amin Cooperative gives confirmation. Although

the management of Al-Amin Islamic Boarding

School is not involved in book expenses, they must

help to ensure payment from the santri’s parents as a

requirement to take the examination.

In conclusion, the different conditions of the

meal and book budgets can be traced to the cash

receipts and disbursement at Al-Amin Islamic

Boarding School. The cash receipts for meal

expenses are divided into two systems: the receipt

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

164

system represented by BPRS Mojokerto and the

direct receipt system by the PPSA Secretariat. The

cash disbursement for meal expenses uses only

spoken information from the treasurer of the PPSA

Secretariat. In contrast, cash receipts and the

disbursement of book expenses were not found

because of the direct management by the treasurer of

the Al-Amin Cooperative, who also acts as the

treasurer of the PPSA Secretariat.

5 CONCLUSION &

RECOMMENDATIONS

5.1 Conclusion

Based on the results of the analysis and the

implemented theory in this research, there are some

conclusions, which can be summarized as follows:

1. The current budgeting system for meal expenses

still has weaknesses in certain aspects, including:

the internal control aspect, e.g. the lack of a

separation function for the determinant and the

implementer; the uncertainty of management in

the function; confusion between the main task

and the function; the effectiveness aspect, e.g.

the lack of direction in the budgeting process;

and the efficiency aspect, e.g. the absence of a

vendor list as a reference to set the budget, which

can lead to inefficiency in future budgets.

2. The existing cash receipts system has the

following deficiencies: an absence of segregated

duties for the cashier and bookkeeper; the

possibility of corruption in the future because

there are no policies on the cash amount that can

be carried or the party who has the right to issue

cash; no periodical review of cash receipts; and

the income received is never deposited into the

right account.

3. The cash disbursement system running at this

time faces a number of threats, including: fraud

and misstated financial statements as an effect of

the lack of supporting documentation on cash

disbursement transactions; unpredicted

fluctuation that causes doubts about running

other activities; and high meal costs that would

increase the load of santri parents.

5.2 Recommendations

Based on the conclusions of this research, the

following recommendations are suggested:

1. A financial information system with strong

internal control and a complete database should

be implemented as a guide for: budget setting,

fund management, and forecasting.

2. Organization restructuring should be carried out,

with new positions added, i.e. accounting, which

will provide benefits such as the separation of the

cashier and bookkeeper, and an increase in

effectiveness.

3. Payment in the form of “natura”, e.g. rice, red

onions, white onions, etc., could help to supply

the raw foods needed and act as a payment tool

for santri meal and book expenses.

4. The development of a food distribution system

for the santri, such as fingerprint usage to

mitigate the risk of increasing shopping costs.

This system will detect which santri take meals

out of their quota and this will be recorded as an

account receivable to be billed as an additional

i’anah.

5. The use of a costing method in meal production

will be helpful to calculate meal expenses

independently.

REFERENCES

Basri, H. and Nabiha, A. K..(2016).Accounting System

and Accountability Practices in an Islamic Setting: A

Grounded Theory Perspective, Social Science &

Human 24 (S), 59-78.[Online]. Available at:

https://www.researchgate.net/.../311346937_Accounti

ng_system_and_accountability_pr... _...[Accessed 25

December 2017].

Bastian, I., 2005, Akuntansi sektor publik: Suatu

pengantar .Jakarta: Erlangga.

Bodnar,G.H.and Hopwood,W.S.(2008). Accounting

information systems.New Jersey:Pearson.

Gelinas, U.J. and Dull, R.B., 2008, Accounting

information systems.Canada: Thomson South-

Western.

Indonesia Ministry of Religious Affairs.(2011).Analisis

dan interpretasi data pada pondok pesantren,

Madrasah Diniyah, Tamanic Pendidikan Al-Qur’an

(TPQ) tahun pelajaran 2011-2012.[Online]. Available

at:

http://www.pendis.kemenag.go.id/file/dokumen/pontre

nanalisis.pdf [Accesed 24 June 2016)

Karyotis,C. and Onochie, J.(2017).Ten Challenges to

Have A Sustainable Financial System in Finance and

Economy for Society: Integrating Sustainability,

Finance and Economy for Society,179-198.[Online].

Available at:

https://www.emeraldinsight.com/doi/abs/10.1108/S20

43-905920160000011009 _...[Accessed 25 December

2017].

Designing a Budgeting Information System for Meal and Book Expenses Based on the Financial Information System for an Islamic

Boarding School - Case Study at Al-Amin Islamic Boarding School in Mojokerto

165

Mcleod, R.Jr. and Schell, G.P.(2001). Management

information systems.New Jersey: Pearson Education.

Ademola,O. et al (2017).Impact of International Public

Sector Accounting Standards (IPSAS) Adoption on

Financial Accountability in Selected Local

Government of Oyo State, Nigeria. Asian Journal of

Economics, Business and Accounting 3(2),1-

9.[Online]. Available at:

https://www.researchgate.net/.../publication/...Impact_

of_International_Public_Sector_...[Accessed 25

December 2017].

Park, Y. J., Matkin, D. S. T. and Marlowe, J.(2016).

Internal Control Deficiencies and Municipal

Borrowing Costs [Online]. Available at:

http://onlinelibrary.wiley.com/doi/10.1111/pbaf.12120

/full [Accessed 25 December 2017].

Ribka, J. and Daniel, D.R.(2016). Persepsi manajemen dan

anggota jemaat terhadap praktik akuntabilitas dan

transparansi keuangan dalam lembaga gereja Kristen

[Online]. Available at: https://e-

journal.unair.ac.id/JEBA/article/view/5819 [Accessed

25 December 2017].

Rahayu, S. et al (2015).Budgeting of School Operational

Assistance Fund Based on The Value of Gotong

Royong. Social and Behavioral Sciences: 2

nd

Global

Conference on Business and Social Science,364 –

369.[Online]. Available at:

https://www.sciencedirect.com/science/article/.../S187

70428150538 [Accessed 25 December 2017].

Spradley, J.P.(1997). Metode etnografi pengantar: Dr.

Amri Marzali MA.Yogyakarta: Tiara Wacana.

Shagrir, L. (2017).Journey to Etnograpic Research

[Online].Available at: http://www.springer.com/978-3-

319-47111-2 [Accessed 25 December 2017]

Tromifov, S., Szumilo, N. and Wiegelmann, T.(2017).

Practice Briefing Optimal Database Design for the

Storage of Financial Information Relating to Real

Estate Investments. Journal of Property, Investments

and Finance,535-546.[Online].Available at:

https://www.emeraldinsight.com/doi/abs/10.1108/JPIF

-05-2016-0029 [Accessed 25 December 2017]

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

166