CSR Reporting Practices, CSR Disclosure, and the Cost of Equity

Capital

Rivanti Santiara Dewi

Faculty of Economics and Business, Airlangga University, Surabaya, Indonesia

rivantitenti@yahoo.com

Keywords: CSR Reporting Practices, CSR Disclosure, Corporate Social Responsibility, Cost of Equity Capital.

Abstract: The trend regarding the adoption of corporate social reporting (CSR) not only applies to developed

countries but also to developing countries. In developing countries, there has been an increase in both CSR

disclosure and the quality of CSR reporting. The aim of this paper is to investigate the use of CSR reporting

practices in relation to whether they provide greater disclosure of CSR, in addition to determining the effect

of CSR disclosure on the cost of equity capital. CSR practices utilize standalone CSR reports, the Global

Reporting Initiative (GRI) framework, and CSR information assurance. Several criteria were used for the

research sample: (1) manufacturing companies listed on the Indonesian Stock Exchange between 2013 and

2015; (2) companies had published annual reports or sustainability reports; and (3) data for the variables

used was available. The data analysis technique utilized in this research was PLS regression, using WarpPls.

The results show that companies using CSR reporting practices (i.e. standalone reports and GRI adoption)

disclose broader CSR information, and companies that provide an assurance of CSR information do not

disclose sufficient CSR information. Further, CSR disclosure affects the cost of equity capital in that there is

a negative relationship between CSR disclosure and the cost of equity capital.

1 INTRODUCTION

Previously, businesses only paid attention to profits;

however, businesses have changed this perception

by also paying attention to people and the planet.

This has happened in companies throughout the

world, which can be seen from a survey conducted

by KPMG in 2015. In this sense, corporate social

reporting (CSR), especially in the Asia Pacific

region, has increased significantly, with the increase

driven by a surge in reporting in countries such as

India, Taiwan, and South Korea. In addition, the

quality of CSR has also experienced an increase in

the Asia Pacific region. In this regard, the concept of

CSR is not limited to developed countries but is also

being increasingly adopted in developing countries.

CSR activities undertaken by a company are

sometimes focused on those directly related to the

activities of the company and sometimes on those

not directly related to the activities of the company.

CSR activities usually come in the form of donations

to community activities, donations to victims of

natural disasters, and donations to prevent

environmental damage caused by corporate

activities, amongst others.

Under Indonesian law, a CSR report should be

disclosed in the company’s annual report. However,

in the regulations, there is no obligation for the

entity to disclose a standalone report with regards to

sustainability or CSR. Thus, in Indonesia, such

disclosures are still voluntary. If the entity discloses

a standalone report, this will accrue more costs.

Francis et al. (2005) found that firms in industries

with larger levels of external financing had higher

levels of voluntary disclosures, and that an expanded

disclosure policy for these firms led to lower debt

and equity capital costs, indicating that financial

transparency may affect the cost of equity capital.

Companies with better CSR scores experience

better equity financing, while investments in

enhancing responsible employee relations,

environmental policies, and sustainable product

strategies contribute to reducing the cost of

corporate equity (El Ghoul et al., 2011). Dhaliwal et

al. (2014) found a negative relationship between

CSR disclosures and equity capital costs, and this

relationship is more pronounced in stakeholder-

oriented countries. In addition, evidence has also

been found indicating that financial disclosures and

54

Dewi, R.

CSR Reporting Practices, CSR Disclosure, and The Cost of Equity Capital.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 54-60

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

CSR act as a substitute for each other in reducing

equity capital costs.

Several studies have endeavored to determine the

effect of CSR reporting practices on CSR disclosure,

while other studies have examined the influence of

CSR disclosure on the cost of equity. The aim of this

study is to combine the two approaches, i.e. to

determine the effect of CSR reporting practices on

CSR disclosure as well as the effect of CSR

disclosures on the cost of equity capital.

WarpPls 5.0 was used to analyze the data in this

paper, with a study sample of 118 manufacturing

companies in the period 2013–2015. The results

show that companies using a standalone report and

Global Reporting Initiative adoption as their CSR

reporting practices disclose broader CSR

information, and companies that use CSR assurance

are not extensive enough in disclosing CSR

information. Further, CSR disclosure affects the cost

of equity capital in the sense that there is a negative

influence between CSR disclosure and the cost of

equity capital. It is expected that this research can

contribute to the literature by providing empirical

evidence on the use of three CSR reporting

practices, i.e. CSR disclosure in relation to a

standalone report and GRI adoption and CSR

assurance, and their effect on the cost of equity

capital.

The remainder of this paper is organized as

follows. The next section will present the literature

review and hypotheses. This is followed by the

research method in Section 3 and then the analysis,

results, and discussion in Section 4. Finally, the

paper will present conclusions, limitations, and

suggestions for future research.

2 LITERATURE REVIEW AND

HYPOTHESIS

2.1 Legitimacy Theory

Legitimacy theory states that, since a company is

part of society, it must pay attention to social norms.

Ghozali and Chariri (2007) state that underlying the

theory of legitimacy is the corporate social contract

with the community, where the company operates

and uses economic resources. From the perspective

of legitimacy theory, firms will voluntarily report on

their activities if management considers this to

match the results expected in the broader society

(Craig, 2000). With regard to legitimacy theory, all

three practices of CSR are used to demonstrate an

effective commitment to CSR and are therefore

associated with improved disclosure quality or

merely representing efforts to build an image of

commitment to positively influence stakeholder

perceptions (Michelon et al., 2015). Based on the

above, the underlying theory for CSR disclosure is

legitimacy theory, since the purpose of CSR

disclosure is to obtain positive values and legitimacy

from the community.

2.2 Hypotheses

2.2.1 Standalone Reporting and CSR

Disclosure

Trends in CSR disclosure and reporting practices

show an increasing number of standalone reports

(Cho et al., 2011). Companies that publish

standalone CSR reports separate from annual reports

seem to signal the company’s commitment to CSR

issues (Mahoney et al., 2013). In addition, a

standalone CSR report is considered capable of

improving the quality of CSR disclosure (Dhaliwal

et al., 2014). Therefore, the first hypothesis is as

follows:

H1: Standalone reporting is associated with

corporate social responsibility disclosures.

2.2.2 GRI Framework Adoption and CSR

Disclosure

The GRI reporting framework is a standard report

within the framework of sustainability reporting

(Michelon et al., 2015). Following the GRI reporting

framework to compile CSR reports, CSR disclosures

may increase (Mahoney et al., 2013). The majority

of companies who communicate CSR disclosures

have adopted this reporting framework. The GRI

reporting template was created to guide companies

in delivering information about the company and its

quantitative or qualitative financial, environmental,

and social performance indicators. Therefore, the

second hypothesis is as follows:

H2: GRI adoption is associated with corporate

social responsibility disclosures.

2.2.3 Assurance of CSR Information and

CSR Disclosure

The key element used to ensure the credibility of a

sustainability report is external assurance, although

external assurance is insufficient for avoiding

criticisms relating to credibility (Adams & Evans,

2004). Assurance is only limited to the perception of

the company’s social and environmental image (Cho

CSR Reporting Practices, CSR Disclosure, and The Cost of Equity Capital

55

et al., 2014). Therefore, the third hypothesis is as

follows:

H3: Assurance of CSR information is associated

with corporate social responsibility disclosures.

2.2.4 CSR Disclosure and Cost of Equity

Capital

Stakeholder-oriented countries’ CSR disclosures

tend to be more credible due to the presence of more

developed institutions to monitor corporate actions

and enforce CSR-related regulations (Ramanna,

2013). Dhaliwal et al. (2011) provide evidence that

managing a company’s various stakeholders can also

be linked to a reduction in the cost of equity capital.

If a country is truly stakeholder-oriented, this means

that all CSR information is disclosed by means of

formal submission and a current voluntary CSR

report is disclosed, as it is unlikely to provide much

additional information to the market. CSR disclosure

and cost of equity capital have a negative

relationship, and this relationship is more

pronounced in stakeholder-oriented countries;

further, financial disclosures and CSR act as a

substitute for each other in reducing the cost of

equity capital (Dhaliwal et al., 2014). Therefore, the

fourth hypothesis is as follows:

H4: Disclosure of corporate social responsibility

(CSR) has an effect on the cost of equity capital.

3 RESEARCH METHODOLOGY

3.1 Research Setting and Sample

This study used a quantitative approach with PLS

regression using WarpPls to test the hypotheses. The

data used in this research was taken from the firms’

websites, the Indonesian Stock Exchange’s website,

Indonesian banks’ official websites, and the yahoo

finance website. The sample of this study was 354

firms, from which 118 manufacturing companies

listed on the Indonesian Stock Exchange (BEI)

during the study period 2013 to 2015 were derived.

This study used the sampling census method, which

is a sample determination technique wherein all the

members of the population are used as samples

(Sugiyono, 2002). Detail of the sample selection are

outlined in Table 1.

Table 1: Sampling procedure.

Total

Manufacturing companies listed on the

Indonesian Stock Exchange between

2013 and 2015 (143 x 3 years)

429

Excluded :

Manufacturing companies that carried out

IPO and relisting (6 x 3 years)

(18)

Manufacturing companies that did not

publish annual reports or sustainability

reports (7 x 3 years)

(21)

The data for the variables used were

unavailable (12 x 3 years)

(36)

Total Sample 354

3.2 Instruments

CSR reporting practices include companies

producing standalone reports, adopting GRI

reporting frameworks, or having corporate CSR

reports audited.

3.2.1 Standalone Report

The standalone report is a CSR performance report

that is separate from the company's annual report.

Standalone CSR reports are voluntary. Various

names or terms for the standalone CSR report are,

among others, sustainability report, GRI report, and

environmental report. The instrument to measure

this variable was adopted from Michelon et al.

(2015), who used a dummy variable equal to 1 if the

firm released standalone CSR reports and 0 if the

CSR information is in the annual report.

3.2.2 GRI Framework Adoption

GRI is an international standard for sustainability

reporting. Companies that follow the GRI reporting

framework have a higher level of commitment to

CSR than companies that do not follow the GRI

reporting framework. With reference to the GRI

reporting framework, it is expected that the company

will be more transparent to the company’s

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

56

stakeholders, as well as the information the company

discloses being more qualified. As before, the

instrument adopted to measure this variable came

from Michelon et al. (2015), who used a dummy

variable equal to 1 if the document being analyzed

contained a statement disclosing the adoption of

GRI, and 0 otherwise.

3.2.3 Assurance of CSR Information

Assurance of CSR Information is a guarantee of

CSR information that makes the report more

credible and increases stakeholder confidence in the

CSR information provided. Similar to the two

previous variables, the instrument for measuring this

variable was adopted from Michelon et al. (2015),

who used a dummy variable equal to 1 if the

document being analyzed contained an audit

statement, and 0 otherwise.

3.2.4 CSR Disclosure

Disclosure of social responsibility based on the G4

Global Reporting Index consists of the following

categories: economic (9 indicators), environment (34

indicators), labor (16 indicators), human rights (12

indicators), social (11 indicators), and product

responsibility (9 indicators). This CSR disclosure

calculation is performed by giving a score of 1 if one

item is disclosed and a score of 0 if not disclosed.

After that, the score is divided by the number of

expected items. In this sense, the number of items

disclosed is divided by the number of expected

items.

3.2.5 Cost of Equity Capital

Cost of capital is an important concept in the

analysis of capital structure since the cost of capital

arises due to the use of long-term capital in a

company’s capital structure. A high level of CSR

disclosure will not necessarily lower the cost of

equity capital, but the opposite may happen when

the company turns out to have problems, especially

related to finance. In this regard, with a high level of

disclosure, more risky information will be revealed

to investors and they will demand a high return on

investment, which will consequently increase the

cost of equity capital borne by the company (Juniarti

& Yunita, 2005). Ross (as cited in Juniarti & Yunita,

2005) states that there are two approaches in

determining the cost of equity: the Dividend Growth

Model approach and the Security Market Line

(SML) or Capital Asset Pricing Model (CAPM)

approach. However, this research only used the

CAPM approach because the influence of the

disclosure level on the cost of equity is inseparable

from the inherent risk factors, and the use of this

approach is not limited by the constant dividend

growth, so it can be applied to the wider

environment. The CAPM calculation is as follows:

COE

i,t

= R

ft

+ βi (R

Mt

- R

ft

) (1)

Where:

COE = Cost of equity capital

R

ft

= Risk-free rate.

βi = Beta of the security

Rm = Expected return on market

4 RESULT AND DISCUSSION

Descriptive statistics provide a description of the

variables used in a study.

Table 2: Descriptive Statistics of the variables studied.

Mean S.D

Cost of Equity Capital 20.183 294.020

Interval : 0.000 to 0.500

Standalone Report 0.092 0.046

GRI Adoption 0.091 0.046

Assurance of CSR Information 0.092 0.046

Interval : 0.500 to 1.000

Standalone Report 0.477 0.205

GRI Adoption 0.383 0.236

Assurance of CSR Information 0.477 0.205

Table 2 presents the results of the descriptive

statistics in relation to means and standard

deviations. The table shows that the average score

for CSR disclosure is 0.092, with a standard

deviation (SD) of 0.046, with regard to reports that

are not standalone, i.e. which are disclosed inside the

annual report, as well as those with no external

assurance, i.e. they have not been audited. The

CSR Reporting Practices, CSR Disclosure, and The Cost of Equity Capital

57

average score increases to 0.477, with a standard

deviation of 0.205 on the standalone report and

where there is external assurance. The average score

for CSR disclosure is 0.091, with a standard

deviation (SD) of 0.046, for reports that do not use a

GRI reporting framework. For reports using a GRI

reporting framework, the average score increased to

0.383, with a standard deviation (SD) of 0.236. In

addition, the average score for the cost of equity

capital is 20.183, with a standard deviation score of

294.020.

Table 3: Path coefficients and P values.

Standalone

Report

GRI CSR

Path Coefficients

CSR 0.709 0.097

COC -0.039

P Values

CSR <0.001 0.019

COC 0.283

Table 3 presents the result of the path

coefficients and P values. The coefficient for

standalone reports to CSR disclosure is 0.709,

significant at 0.001. GRI adoption has a positive

effect (0.097) on CSR disclosure, with a significant

P value of 0.019 (<0.05). Meanwhile, CSR has a

negative effect (-0.039) on the cost of equity capital,

with a significant P value of 0.283 (<0.05).

Table 4: Latent Variable Coefficient.

Stand

alone

GRI Assure CSR COC

RSquared 0.628 0.004

The coefficient of determination uses R-squared

to show how the percentage of endogenous construct

variance can be explained by the hypothesized

(exogenous) construct. The higher the R-squared,

the better the value (Sholihin & Ratmono, 2013). In

Table 4, the value of R-squared for the CSR

construct is 0.628, indicating that 62.8% of CSR can

be explained by the standalone report, GRI, and

assurance variables.

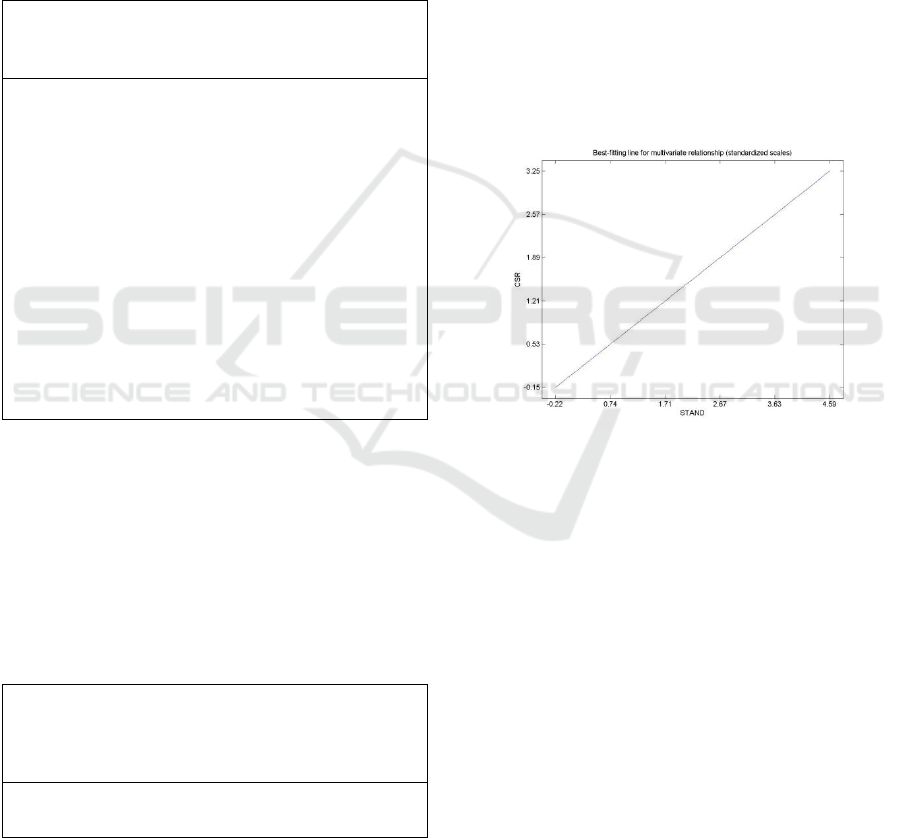

Figure 1 plots the linear relationship between

CSR reporting practices using the standalone report

and CSR disclosure levels. The results show a linear

relationship between the standalone report and CSR

disclosure. In interpreting this finding, companies

that produce CSR reports separately, i.e. either

sustainability reports or CSR reports, will disclose

their CSR activities more widely. Thus, it can be

concluded that H1 is accepted. There is an

association between reporting practices, in the form

of self-reporting, and the extent of CSR disclosure.

This result is consistent with Mahoney et al. (2013)

in regard to the relationship between the standalone

report and CSR disclosure.

Figure 1: Plot of the relationship between Standalone

Report and CSR Disclosure.

The plot of the relationship between GRI

adoption and CSR disclosure is shown in Figure 2.

In this sense, there is a linear relationship between

GRI adoption and CSR disclosure. This result is

consistent with Mahoney (2013). Companies that

adopt the GRI conceptual framework for their

reporting practices tend to disclose their CSR

activities more widely. Thus, it can be concluded

that H2 is accepted.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

58

Figure 2: Plot of the relationship between GRI Adoption

and CSR Disclosure.

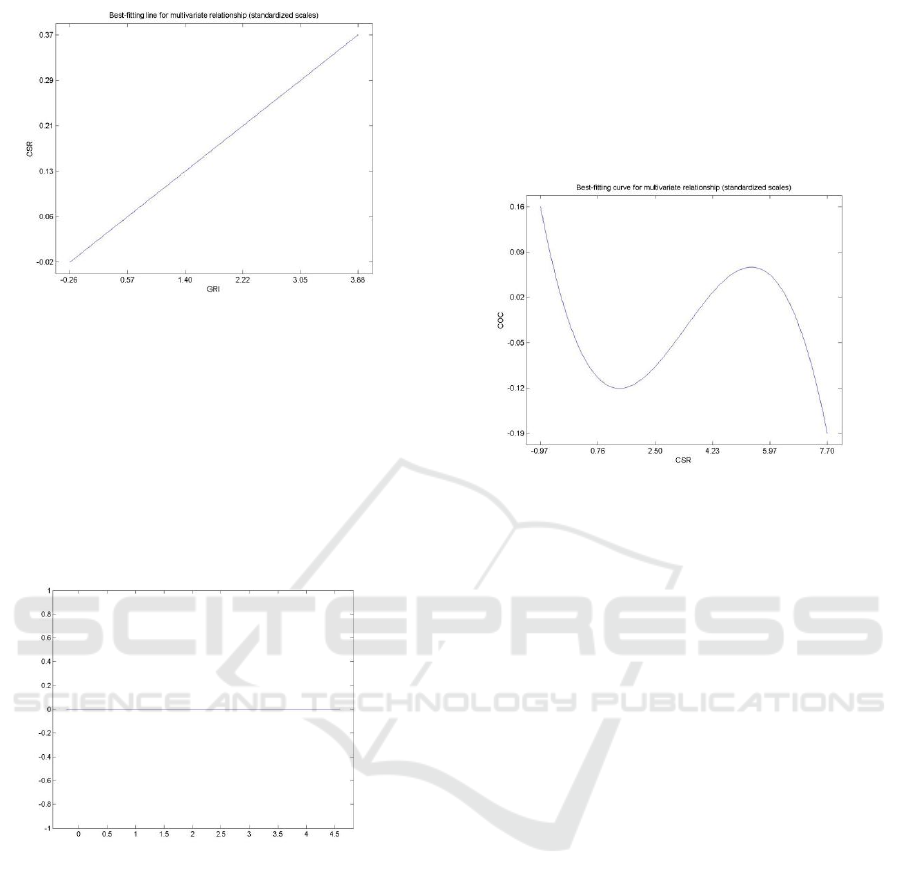

The relationship between CSR assurance and

CSR disclosure is shown in Figure 3. The results

show that, for companies that report their CSR

activities in audits or that are not audited by internal

auditors, there is no association with the extent of

CSR disclosure. In this regard, it can be concluded

that H3 is not accepted.

Figure 3: Plot of the relationship between CSR Assurance

and CSR Disclosure.

The relationship between CSR disclosure and

cost of equity capital is plotted in Figure 4. The first

part of the curve shows a U-shape, illustrating that

the extent of CSR disclosure will initially lower the

cost of equity capital.

At some point, about 4.23 standard deviations for

CSR disclosure, the situation changes. In this sense,

the company begins raising the cost of equity capital

in order to expand its CSR disclosures. This leads to

an increase in the cost of equity capital to CSR

disclosure of approximately 5.97 standard

deviations. After that, an excessive increase in the

cost of equity capital can actually lower the extent of

CSR disclosure. Such results are in accordance with

the results of the path coefficients, i.e. the effect of

CSR disclosure on the cost of equity capital. In

Table 2, the influence of CSR disclosure was

negative, which is also in accordance with the results

in Figure 4, i.e. a high level of CSR disclosure will

lower the cost of equity capital and vice versa.

Figure 4: Plot of the relationship between CSR

Disclosure and Cost of Equity Capital.

5 CONCLUSIONS

This study aimed to investigate the use of CSR

reporting practices as to whether they provide

greater disclosure of CSR, in addition to determining

the effect of CSR disclosure on the cost of equity

capital. Previous research has attempted to examine

the association between CSR reporting practices and

CSR disclosure, while other studies have examined

the effect of CSR disclosure on the cost of equity.

However, this study combined both approaches in

examining the effect of CSR reporting practices on

CSR disclosure, in addition to the impact of CSR

disclosure on the cost of equity capital. This study

analyzed 354 annual reports and sustainability

reports produced by manufacturing companies listed

on the Indonesian Stock Exchange during the period

2013–2015. The study used WarpPLS 5.0 as a data

analysis tool to test the hypotheses.

The analysis results show that CSR reporting

practices in regard to standalone reporting and GRI

adoption were associated with the extent of CSR

disclosure, but CSR assurance was not associated

with the extent of CSR disclosure. This means that

companies reporting CSR activities separate from

annual reports and adopting a GRI conceptual

framework exhibit a much broader level of CSR

disclosure when compared to companies reporting

CSR Reporting Practices, CSR Disclosure, and The Cost of Equity Capital

59

CSR in the company’s annual report, and it is not

guided by the GRI conceptual framework. Another

result from the analysis relates to the CSR disclosure

effect on the cost of equity capital, showing an

opposing relationship between CSR and the cost of

equity capital. In this sense, a high level of CSR

disclosure will lower the cost of equity capital.

The results of this study have important

implications for the practice of CSR reporting and

disclosure. The purpose of CSR disclosure is to

obtain positive values and legitimacy from the

community. In order for the company to obtain

positive values from the community, the company

should thoroughly disclose its CSR practices

through reporting CSR in a separate report and

applying the GRI conceptual framework.

This study has a number of limitations. First,

with regard to the research sample, the study only

examined manufacturing companies in one country.

Second, in measuring the level of CSR disclosure,

there is still an element of subjectivity. Third, the

use of CAPM to measure the cost of equity capital

has the weakness of not reflecting unverifiable risk

estimates. Further research could utilize samples

from various industries or across countries, which

may influence the research results. In addition,

future research could examine other matters that

may affect CSR disclosure, such as the cost of CSR

activities undertaken by the company.

REFERENCES

ADAMS, A. and EVANS, R. (2004). Accountability,

Completeness, Credibility and the Audit Expectations

Gap. The Journal of Corporate Citizenship, 97-115.

CHO et al. (2011). Corporate environmental financial

reporting and financial markets. The Oxford handbook

of business and the natural environment, 519-536.

CHO et al. (2014). CSR report assurance in the USA: an

empirical investigation of determinants and effects.

Sustainability Accounting, Management and Policy

Journal, 5, 130-148.

CRAIG, D. (2000). Financial Accounting Theory, Sydney,

McGraw Hill Book Company.

DHALIWAL et al. (2014). Corporate social responsibility

disclosure and the cost of equity capital: The roles of

stakeholder orientation and financial transparency.

Journal of Accounting and Public Policy, 33, 328-355.

DHALIWAL et al. (2011). Voluntary Nonfinancial

Disclosure and the Cost of Equity Capital: The

Initiation of Corporate Social Responsibility

Reporting. The Accounting Review, 86, 59-100.

EL GHOUL et al. (2011). Does corporate social

responsibility affect the cost of capital? Journal of

Banking & Finance, 35, 2388-2406.

FRANCIS et al. (2005). Disclosure Incentives and Effects

on Cost of Capital around the World. The Accounting

Review, 80, 1125-1162.

GHOZALI, I. and CHARIRI, A. (2007). Teori akuntansi.

Semarang: Badan Penerbit Universitas Diponegoro.

JUNIARTI, J. anf YUNITA, F. (2005). PENGARUH

TINGKAT DISCLOSURE TERHADAP BIAYA

EKUITAS.

MAHONEY et al. (2013). A research note on standalone

corporate social responsibility reports: Signaling or

greenwashing? Critical Perspectives on Accounting,

24, 350-359.

MICHELON et al. (2015). CSR reporting practices and

the quality of disclosure: An empirical analysis.

Critical Perspectives on Accounting, 33, 59-78.

RAMANNA, K. (2013). A Framework for Research on

Corporate Accountability Reporting. Accounting

Horizons, 27, 409-432.

ROSS, A. (1998). Fundamentals of Corporate Finance,

Singapore, McGraw Hill-Irwin.

SHOLIHIN, M. and RATMONO, D. (2013). Analisis

SEM-PLS Dengan WarpPLS 3.0. Yogyakarta: Andi

Yogyakarta.

SUGIYONO, D. (2002). Metode Penelitian Administrasi.

Alfa Beta, Bandung.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

60