Study of The Determinants Existence of External Assurance on

Sustainability Reports in Indonesia

Cana Antyanta Dias and B. Basuki

Faculty of Economics and Business, Universitas Airlangga, Surabaya, Indonesia

{cana.antyanta-2013, basuki}@feb.unair.ac.id

Keywords: External Assurance, Firm Size, Industry Affiliation, Profitability, Sustainability of Department,

Sustainability Reports.

Abstract: Due to the growing trend of firms publishing stand-alone sustainability reports, adhering to an

unprecedented demand for disclosure, sustainability reports are now equally as important as financial

reports. Following this occurrence, subjective and partial disclosures with external assurance are required to

assure and maintain credibility of information within sustainability reports. Thus, the purpose of this

research is to obtain empirical evidence related to the determinants that affect the existence of external

assurance on sustainability reports in Indonesia. The sample being tested are 116 companies registered in

the Indonesia Stock Exchange (IDX) during the period 2013–2015, which are issuing stand-alone

sustainability reports. The logistic regression model is employed within hypothesis testing. The result

showed that both Profitability and Industry Affiliation positively and significantly affect the Existence of

External Assurance on Sustainability Reports, meanwhile, Firm Size had positive influence but not

significant. Sustainability Department was also found to be an insignificant determinant to the Existence of

External Assurance on Sustainability Reports.

1 INTRODUCTION

In a modern context, the goal of corporations is to

extend not only to generate profits, but also as a

frontier to incarnate social welfare. To support the

realization of social welfare and cope with ever-

changing social and environmental problems,

corporations should contribute and undertake

sustainable activities, which at the organizational

level, are reflected through the inclusion of

economic, environmental, and social aspects of

companies’ activities as performance indicators to

generate long-term shareholder value (Çalişkan,

2014). Nevertheless, it is difficult to properly assess

the social and environmental performance of

companies because firms lean on financial figures

that are endowed with a limited ability to reflect on

the activities of contemporary business models and

their consequences (Banerjee, 2002; Jones, 2010).

Over the past two decades, companies have paid

more attention to their efforts in recognizing and

measuring environmental issues in financial

reporting, as more stakeholders have voiced further

concerns regarding this issue (Bobe & Dragomir,

2011). Consequently, this has prompted the

inclusion of corporate social responsibility

information in the annual reports from many

corporations. Environmental and social information

could be disclosed as part of a company’s published

annual reports. Furthermore, this information could

be disclosed separately within a stand-alone

sustainability report.

The issuance of stand-alone corporate social

responsibility (CSR) reports has shown a dramatic

growth over the past two decades. KPMG

International surveyed 4,100 companies worldwide

in 2013 and found that 71% of those companies are

engaged in CSR reporting (KPMG International,

2013). However, Cho, et al. (2012) stated that such

practice of voluntary corporate disclosure is subject

to concerns regarding the completeness and

credibility of the information that is being provided.

One way to handle the issue of credibility is by

obtaining third-party assurance (Simnett, et al.,

2009). International evidence has proven the

existence of a growing number of corporations using

third-party assurance for their CSR report. In 2011,

only 45% of the Global 250 corporations published

CSR reports with a third-party assurance and this

had grown to over half by 2013 (KPMG

16

Dias, C. and Basuki, B.

Study of The Determinants Existence of External Assurance on Sustainability Reports in Indonesia.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 16-22

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

International, 2013). There are no formal regulations

to ensure that companies report their non-financial

information separately, so there is no mandate to

include assurance statements within their stand-

alone CSR reports (Simnett, et al., 2009).

Simnett, et al. (2009) identified several findings

in their research, in which they had examined a

sample of 2,113 companies across 31 countries that

produced sustainability reports during the period

2002–2004. They hypothesized that the decision to

assure stand-alone sustainability reports is a function

of company, industry-, and country-related factors.

In contrast to the research by Simnett et al. (2009),

Cho et al. (2014) focused only on firm-related

factors in his research, carried out in the USA due to

the country’s shareholder-oriented characteristics,

which can inhibit the effect of such country-related

factors to drive the demand of sustainability

assurance.

Understanding the need to provide external

assurance for information disclosed within

sustainability reports, this study proposes four

variables, namely profitability, size of the firm,

industry affiliation, and the sustainability of the

department, as determinants of external assurance in

sustainability reports. The research revolves around

the effect of these four proposed determinants

towards external assurance in the reporting of

sustainability.

2 LITERATURE REVIEW

2.1 Theoretical Basis

2.1.1 Legitimacy Theory

Legitimacy is defined as “a generalized perception

or assumption that the action of an entity is

desirable, proper, or appropriate within some

socially constructed system of norms, values,

beliefs, and definitions” (Suchman, 1995, p.574).

Deegan (2002) considered sustainability reporting as

a tool for the communication of the corporation and

society. Sustainability reporting is used by

corporations to justify sustainable activities held by

them and to clarify any incidents that might possibly

have a detrimental effect on their reputations.

Furthermore, Simnett et al. (2009) proposed that

corporations’ decisions to provide assurance on their

reports are driven by their desire to improve the

credibility of the disclosed information, and this is in

line with companies’ objectives to gain legitimacy.

2.1.2 Stakeholder Theory

The stakeholder approach explains the complex

relationships that occur between organizations and

their stakeholders, which are based on the

responsibility and accountability of organizations

(Gray et al. 1996). Liesen et al. (2015) stated that

stakeholders can have contrasting concerns toward

companies’ social and environmental responsibilities

and that sustainability activity can be an effective

method for companies to address these concerns.

They also concluded that sustainability disclosures

and assurance can be one way to reduce stakeholder

pressure and the threat of legitimacy (Liesen et al.,

2015).

2.2 Hypothesis Development

2.2.1 The Influence of Profitability on the

Existence of External Assurance in

Sustainability Reports

Profitability is closely tied with profit, yet it refers to

the relative value of a firm’s ability to generate

return on investment based on employed resources

in comparison to alternative investment. The

relationship between corporate profitability and

social and environmental disclosure is rather

inconclusive. Some argue that profitable firms have

more social constraints and public exposure, so they

must ensure that their profit has not been gained at

the expense of society through the use of

sustainability reports (Gamerschlag et al., 2010). On

the other hand, Neu et al. (1998) argue that

unprofitable firms are more likely to disclose social

information, either to support their poor financial

performance or to guarantee their long-term

competitive advantages caused by current

environmental investments. Branco et al. (2014) and

Kend (2015) found that profitability has

significantly affected the company's demand to

adopt assurance on their sustainability reports. Based

on the preceding explanation, the hypothesis can be

proposed as follows:

H1: Profitability significantly influences the

existence of external assurance on sustainability

reports

2.2.2 The Influence of Firm Size on the

Existence of External Assurance on

Sustainability Reports

Dang and Li (2015) define firm size as a measure of

total assets, sales, and market value of equity within

Study of The Determinants Existence of External Assurance on Sustainability Reports in Indonesia

17

their natural value. In general, large companies face

a greater political risk than small firms. Large

companies experience more pressure from the public

to carry out social responsibility. Therefore, large

companies will be more inclined to assure their

sustainability reports, to increase public confidence

and reduce the possibility of detrimental claims from

society regarding the company. In addition, large

companies have excess resources to undertake

sustainability assurance that is still voluntary. For

example, research conducted by Simnett et al.

(2009) and Branco et al. (2014) have determined

firm size as a firm-level variable that was proven to

have a significant influence on the company’s

demand of sustainability assurance. Based on the

preceding explanation, the hypothesis can be

proposed as follows:

H2: Firm size significantly influences the

existence of external assurance on sustainability

reports

2.2.3 The Influence of Industry Affiliation

on the Existence of External Assurance

on Sustainability Reports

This study defines industry affiliation as a

classification of firms in accordance to their

respective business operations, belonging to a

specific industry. Many previous studies have shown

a relationship between industry classifications and a

firm decision to assure their sustainability reports.

Simnett et al. (2009) and Cho et al. (2014) in their

research have found similar evidence that utilities,

mining, and finance industries are more likely to

have their sustainability reports assured. However,

Cho et al. (2014) grouped several “more sensitive”

industries into a separate classification, namely an

environmentally sensitive industry (ESI) variable.

Based on the preceding explanation, then the

hypothesis can be proposed as follows:

H3: Industry affiliation significantly influences

the existence of external assurance on sustainability

reports

2.2.4 The Influence of the Existence of the

Sustainability Department on the

Existence of External Assurance on

Sustainability Reports

A sustainability department is one which focuses

primarily on ensuring a firm has the ability to

achieve a profitability objective, while also ensuring

that society outreach is not neglected. It represents a

more effective integration of sustainability matters,

which can be the driver for an advanced

sustainability reporting system and continuous

improvement on the level of credibility of this

environmental and social information (Kend, 2015;

Gillet & Martinez, 2011). Ruhnke and Gabriel

(2013) have evidenced a strong and positive

correlation between the existence of a sustainability

department with the decision to assure sustainability

reports. Hence, it is predicted that those companies

that release stand-alone sustainability reports and

have voluntary assurance statements accompanying

those reports, will be more likely to have separate

sustainability departments, as a reflection of their

strong commitments regarding social and

environmental issues. Based on the preceding

explanation, the hypothesis can be proposed as

follows:

H4: A sustainability department significantly

influences the existence of external assurance on

sustainability reports

3 RESEARCH METHODOLOGY

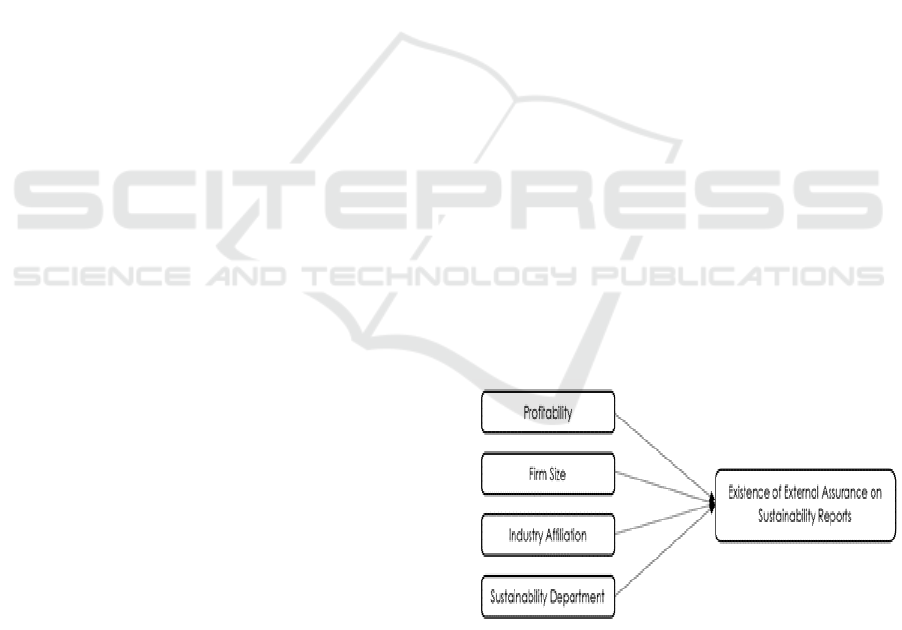

3.1 Conceptual Framework

The following conceptual framework is used in this

study to describe the relationship between

independent variables of profitability, firm size,

industry affiliation, and the sustainability of a

department and external assurance on sustainable

reports.

Figure 1: Conceptual framework.

3.2 Operational Definition and

Measurement of Variables

3.2.1 Existence of External Assurance on

Sustainability Reports

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

18

The existence of external assurance on sustainability

reports is measured by using a dummy variable, in

which it takes the value of 1 in the case of the

presence of an assurance statement in a company’s

stand-alone sustainability report and the value of 0

when such statement does not exist.

3.2.2 Profitability

This research will use the ROA ratio as the

benchmark for a firm’s profitability, as it has been

used extensively in much previous research (Folk

and Per ego, 2010; Haida et al., 2013; Ruhnke &

Gabriel, 2013) as the proxy for profitability. Prior

research (Ruhnke & Gabriel, 2013; Cho et al., 2014)

used earnings before interest and tax to account for

the return, which is the numerator in the ROA

computation, because earnings before interest and

tax (EBIT) is perceived to be as an effective proxy

for the actual return resulting from the investment in

company.

ROA =

(1)

3.2.3 Firm Size

Firm size in this research is obtained using a firm’s

total assets. Therefore, a natural log of the firm’s

total assets is computed to yield a firm size figure.

Firm size = Ln (Assets)

3.2.4 Industry Affiliation

This dummy variable will give the value of 1 if a

company is a member of an industry that is

classified as having significant social and

environmental impact and the value of 0 for

companies not included in that classification. This

research classifies ESI (Environmentally Sensitive

Industries) that consists of mining and extraction,

paper, chemicals, petroleum, metals, utilities

(Batten, 2002), finance (Simnett et al., 2009), and

technology and telecommunication (Zorio et al.,

2013), as industries with a considerable impact on

society and the environment. All industry

classifications will be based on the GICS (Global

Industry Classification Standard) code.

3.2.5 Sustainability Department.

Following what has been applied in research by

Ruhnke and Gabriel (2013), sustainability

department in this research, can be referred to as

sustainability department, CSR committee, and

environmental and social department. Thus, if a

company has one of these three functions, then it’s

sustainability department variable would be scored

as 1.

3.3 Research Model

In line with the preceding explanation, thus, the

model of analysis for this research is as follows:

(2)

Where, for company i:

(0, 1) = Dependent variable (Existence

of external assurance on

sustainability reports)

π

i

= Probability value of Existence

of external assurance on

sustainability reports.

= Constant

= Coefficient

= Profitability, as measured by

the ROA ratio.

= Firm size, as measured by Ln

(assets)

(0, 1) = Industry affiliation (whether

included in a category of

either industry, with or

without significant social and

environmental impact)

(0, 1) = The existence of sustainability

department in a firm

4 RESULTS AND DISCUSSION

4.1 Hypothesis Testing Result

Table 1: Logistic regression result.

Variable

B

Wald

Sig.

Exp (B)

Profitability

7.821

8.512

0.004

2492.111

Firm Size

-0.024

0.014

0.905

0.976

Industry

Affiliation

3.373

11.958

0.001

29.177

Study of The Determinants Existence of External Assurance on Sustainability Reports in Indonesia

19

Sustainability

Department

0.869

2.701

0.100

2.386

Accordingly, the regression equation that can be

created based on the table above is:

(3)

4.1.1 The Influence of Profitability on the

Existence of External Assurance on

Sustainability Reports

The result shows that the coefficient value for

Profitability is positive with a significance level of

0.004 (p < 0.05). Therefore, there is a significant and

positive relationship that exists between profitability

and the existence of external assurance on

sustainability reports. This result is consistent with

research by Ruhnke and Gabriel (2013) and Branco

et al. (2014). According to Ruhnke and Gabriel

(2013), firms with a higher profitability have higher

financial capacity and face less pressure from equity

investors. This provides an incentive for companies

to improve their credibility in terms of sustainability

reporting, so that they can report and demonstrate

their high sustainability performance.

4.1.2 The Influence of Firm Size on the

Existence of External Assurance on

Sustainability Reports

The result of the hypothesis testing demonstrates

that the coefficient value for firm size is negative

with a significance level of 0.905 (p > 0.05).

Therefore, firm size has an insignificant negative

effect on the existence of external assurance on

sustainability reports. The results in this study are

consistent with research conducted by Cho et al.

(2014), as they concluded that the economic and

legal environments of specific countries become

contributing factors of sustainability assurance

decisions.

4.1.3 The Influence of Industry Affiliation

on the Existence of External Assurance

on Sustainability Reports

The result shows that the coefficient value for

Industry Affiliation is positive with a significance

level of 0.001 (p < 0.05). Therefore, industry

affiliation significantly and positively affects the

existence of external assurance on sustainability

reports. This result is in line with research conducted

by Cho et al. (2014) and Branco et al. (2014).

4.1.4 The Influence of a Sustainability

Department on the Existence of

External Assurance on Sustainability

Reports

The result of hypothesis testing shows that the

coefficient value for a sustainability department is

positive with a significance level of 0.100 (p > 0.05).

Therefore, there is an insignificant and positive

relationship that exists between a sustainability

department and the existence of external assurance

on sustainability reports. Prior research has produced

conflicting results regarding the influence of

sustainability department on sustainability

assurance. Research by Ruhnke and Gabriel (2013)

is contrary to this research, as well as research

conducted by Kend (2015). There is an allegation

that this sustainability department just acts as a

symbol to signal the company’s attention toward

sustainability. Moreover, the rare existence of

sustainability departments in Indonesia does not

guarantee a company's performance in the context of

sustainability, including the decision about whether

to assure its sustainability report, as such decisions

can be made immediately by senior managers.

5 CONCLUSIONS

Based on the above discussion, the following

conclusions can be made: First, profitability, as the

first determinant in hypothesis testing, indicates a

positive and significant effect on the existence of

external assurance on sustainability reports. It

implies that firms in which business operates

profitably or have higher financial capacity are more

likely to provide external assurance through

sustainable reports to ensure that profit does not

come at the expense of social welfare. Moreover,

firm size, the second determinant, is proven to have

a negative and insignificant effect on the existence

of external assurance on sustainability reports. It

asserts that engagement towards external assurance

of a sustainable report is not contingent to its size.

Furthermore, variables of industry affiliation had

positive and significant effects on the existence of

external assurance on sustainability reports. It

emphasizes that industry affiliation plays a

significant and important role in driving managerial

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

20

decisions to provide sustainable reports. Lastly,

results suggested that the sustainability department

had a positive but not significant effect on the

existence of external assurance on sustainability

reports. A sustainability department drives a firm’s

policy to meet its profit objectives, develop social

outreach, and encourage firms to engage in external

assurance of sustainability reporting.

REFERENCES

Akisik, O. and Gal, G. (2011). Sustainability in

Businesses, Corporate Social Responsibility, and

Accounting Standards: An Empirical

Study. International Journal of Accounting &

Information Management, 19(3): 304-324.

Banerjee, B. (2002). Organisational Strategies for

Sustainable Development: Developing a Research

Agenda for the New Millennium. Australian Journal

of Management, 27(1): 105-117.

Bobe, M. and Dragomir, V. (2010). The Sustainability

Policy of Five Leading European Retailers.

Accounting and Management Information

Systems, 9(2): 268.

Branco et al. (2014). Factors Influencing the Assurance of

Sustainability Reports in the Context of the Economic

Crisis in Portugal. Managerial Auditing

Journal, 29(3): 237-252.

Brigham, F. and Houston, J. (2012). Fundamentals of

Financial Management. Boston: Cengage Learning.

Çalişkan, A. (2014). How Accounting and Accountants

May Contribute in Sustainability? Social

Responsibility Journal, 10(2): 246-267.

Cho et al. (2012). Do Actions Speak Louder than Words?

An Empirical Investigation of Corporate

Environmental Reputation. Accounting, Organizations

and Society, 37(1): 14-25.

Cho et al. (2014). CSR Report Assurance in the USA: An

Empirical Investigation of Determinants and

Effects. Sustainability Accounting, Management and

Policy Journal, 5(2): 130-148.

Deegan, C. (2002). Introduction: The Legitimising Effect

of Social and Environmental Disclosures - A

Theoretical Foundation. Accounting, Auditing &

Accountability Journal, 15(3): 282-311.

Freeman, E. (2010). Strategic Management: A Stakeholder

Approach. New York: Cambridge University Press.

Gamerschlag et al. (2010). Determinants of Voluntary

CSR Disclosure: Empirical Evidence from Germany.

Review of Managerial Science, 5(2): 233–262.

Gardiner et al. (2003). Research: Big Business, Big

Responsibilities. Corporate Governance: The

International Journal of Business in Society, 3(3): 67-

77.

Ghozali, I. (2011). Aplikasi Analisis Mulitivariate Dengan

Program Ibm Spss 19. Semarang: Badan Penerbit

Universitas Diponegoro.

Gillet, C. and Martinez, I. (2011). Decision of

Sustainability Assurance: Impact of Governance and

Consequences on the Financial Market in the French

Context. Working paper, EAA, Rome.

Gray et al. (1996). Accounting & Accountability: Changes

and challenges in corporate social and environmental

reporting. London: Prentice Hall.

GRI. (2013). The External Assurance of Sustainability

Reporting - Research and Development Series.

Amsterdam: GRI.

Haider et al. (2013). Stakeholder Influence on the

Adoption of Assurance in Sustainability Reporting:

Evidence from Japan. In Proceedings of the Seventh

Asia Pacific Interdisciplinary Research in Accounting

Conference, The APIRA Conference Committee,

Kobe.

Jones, J. (2010). Accounting for the Environment:

Towards a Theoretical Perspective for Environmental

Accounting and Reporting. Accounting Forum, 34(2):

123-138.

Kend, M. (2015). Governance, Firm-Level Characteristics

and Their Impact on the Client’s Voluntary

Sustainability Disclosures and Assurance

Decisions. Sustainability Accounting, Management

and Policy Journal, 6(1): 54-78.

Kolk, A. and Perego, P. (2010). Determinants of the

Adoption of Sustainability Assurance Statements: An

International Investigation. Business Strategy and the

Environment, 19(3): 182-198.

KPMG International. (2013). The KPMG Survey of

Corporate Responsibility Reporting 2013: Executive

Summary. Swiss: KPMG International.

Liesen et al. (2015). Does Stakeholder Pressure Influence

Corporate GHG Emissions Reporting? Empirical

Evidence from Europe. Accounting, Auditing &

Accountability Journal, 28(7): 1047-1074.

Neu et al. (1998). Managing Public Impressions:

Environmental Disclosures in Annual

Reports. Accounting, organizations and society, 23(3):

265-282.

Niresh, A. and Velnampy, T. (2014). Firm Size and

Profitability: A Study of Listed Manufacturing Firms

in Sri Lanka. International Journal of Business and

Management, 9(4): 57-64.

Patten, M. (2002). The Relation between Environmental

Performance and Environmental Disclosure: A

Research Note. Accounting, Organizations and

Society, 27(8): 763-773.

Pflugrath et al. (2011). Impact of Assurance and Assurer's

Professional Affiliation on Financial Analysts'

Assessment of Credibility of Corporate Social

Responsibility Information. Auditing: A Journal of

Practice & Theory, 30(3): 239-254.

Ruhnke, K. and Gabriel, A. (2013). Determinants of

Voluntary Assurance on Sustainability Reports: An

Study of The Determinants Existence of External Assurance on Sustainability Reports in Indonesia

21

Empirical Analysis. Journal of Business

Economics, 83(9): 1063-1091.

Simnett et al. (2009). Assurance on Sustainability Reports:

An international comparison. The Accounting

Review, 84(3): 937-967.

Suchman, C. (1995). Managing Legitimacy: Strategic and

institutional approaches. Academy of management

review, 20(3): 571-610.

Sudjoko and Soebiantoro, U. (2007). Pengaruh Struktur

Kepemilikan Saham, Leverage, Faktor Intern dan

Faktor Ekstern terhadap Nilai Perusahaan. Jurnal

Manajemen dan Kewirausahaan, 9(1).

Tulsian, M. (2014). Profitability Analysis (A comparative

study of SAIL & TATA Steel). IOSR Journal of

Economics and Finance (IOSR-JEF), 3(2): 19-22.

World Economic Forum. (2016). The Global Risks Report

2016, 11th Edition. Geneva: World Economic Forum.

Zadek et al. (2004). The Future of Sustainability

Assurance - ACCA Research Report. London:

Association of Chartered Certified Accountants

(ACCA).

Zorio et al. (2013). Sustainability Development and the

Quality of Assurance Reports: Empirical

Evidence. Business strategy and the

environment, 22(7):484

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

22