The Effect of Accountability, Transparency, and Oversight on The

Value for Money Budget Management Concept

Muntu Abdullah

1

, Vina Olivia P

1

., Andi Basru Wawo

1

, and Agus Widodo Mardijuwono

4

1

Department of Accounting, Faculty of Economics and Business, Universitas Haluoleo, Kendari, Indonesia

4

Department of Accounting, Faculty of Economics and Business, Universitas Airlangga, Surabaya, Indonesia

dula.abdullah@gmail.com, my_aguswidodo@yahoo.com

Keywords: Accountability, Oversight, Transparency, Value for Money Budget Management Concept.

Abstract: The purpose of this research is to determine the partial and simultaneous effects of accountability,

transparency, and oversight on the value for money budget management concept. The research design was

causal-associative and the research method used was a survey questionnaire. The population for the research

were all of the employees who worked at the Financial and Regional Assets Management Agency (Badan

Pengelola Keuangan dan Aset Daerah) of Kendari Municipality, which amounted to 104 individuals. The

sample, which was determined through the use of purposive sampling, was 71 people who were competent

in the field of finance and accounting. The results show that accountability has a partially significant effect

on the value for money budget management concept (t-count 5.535 > t-table 1.667 at a significance level of

0.000 < 0.005), transparency has no significant effect on value for money (t-count 0.148 < t-table 1.667 at a

significance level of 0.883 > 0.05), and oversight partially affects the value for money budget management

concept (t-count 2.759 > t-table 1.667 at a significance level of 0.007 < 0.05). The results of the analysis

show that the variables of accountability, transparency, and oversight simultaneously affect the value for

money budget management concept (F-count 54.630 > F-table at a significance level of 0.000 < 0.05). From

the study, we conclude that this research model can be used to predict because the independent variables

(accountability, transparency, and oversight) simultaneously affect the value for money budget management

concept.

1 INTRODUCTION

Government administration is conducted by

arranging activities as outlined in a government

budget, while budget implementation must be

accounted for in the form of a government

accountability report. The consequences of

economic progress and community development

mean that the implementation of a government

budget is required in order to ensure that the

accountability and transparency of the management

of government finances is enhanced and timely

(Mothe, 2004).

Accountability, transparency, and oversight are

expected to be realized in local financial

management, and the form of accountability,

transparency, and oversight of budget management

with regard to community services is the financial

accountability report.

Accountability relates to the obligation to

demonstrate accountability or to answer for and

explain the performance and actions of a person,

agency, collective leadership, or organization to a

party who has the right or authority to request

information or accountability (Simbolon, 2006). The

activities of governmental and non-governmental

institutions produce information required by

interested parties, and therefore transparency is

needed (Reddel & Geoff, 2004; Sabo & DeRose,

2012). Transparency signifies openness and honesty

to the community based on the consideration that the

community has the right to open and thorough

information relating to the accountability of the

government with regard to the resources entrusted to

it and its compliance with legislation (Hafiz, 2000).

Accountability and transparency require

oversight as a means of linking the targets and

realization of each program, activity, or project that

the government implements. The implementation of

oversight management is one of the most important

Abdullah, M., P, V., Wawo, A. and Mardijuwono, A.

The Effect of Accountability, Transparency, and Oversight on The Value for Money Budget Management Concept.

In Proceedings of the Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study (JCAE 2018) - Contemporary Accounting Studies in

Indonesia, pages 5-8

ISBN: 978-989-758-339-1

Copyright © 2018 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

5

factors for the success of a policy; without

implementation, public policy will be mere

documentation, and therefore oversight is an integral

part of the management of state or regional finances

(Sukrisno, 2005).

2 LITERATURE REVIEW

According to Wasistiono (2003), public services

relate to the provision of services either by

government, private parties on behalf of the

government, or private parties to the public, with or

without payment, in order to meet the needs and

interests of the community. Public services can

therefore be interpreted as providing services to, or

serving the needs of, people or communities who

have an interest in the organization, in accordance

with rules and procedures that have been

established.

Public accountability is the obligation of an

agent holder to provide accountability through

presenting, reporting, and disclosing all activities

and actions to the principal, who has the right and

authority to ask for accountability (Mardiasmo,

2002, p. 20),

According to Andrianto (2007, p. 20),

transparency means real and thorough openness as

well as providing space to all levels of the

community so that they can actively participate in

the process of managing public resources. When

linked to budgets, transparency can be defined as an

openness to communities that includes government

functions and structures, fiscal policy objectives, and

the projections of the public finance sector.

The oversight process relates to the empowered

and effective monitoring, inspection, and evaluation

by the leadership of a unit or organization of work

activities or programs in order to determine

weakness or deficiencies; by so doing, such issues

can be improved by authorities higher up the ladder

so as to achieve previously formulated goals

(Nawawi, 1994, p. 8).

Value for Money (VFM) is an important concept

in public sector organizations. According to

Andrianto (2007, p. 89), the concept of VFM relates

to an appreciation of money, in that every currency

should be properly valued and used as efficiently as

possible. Mardiasmo (2002, p. 4) maintains that

VFM, as a concept of public sector organizational

management, is based on three main elements:

economy, efficiency, and effectiveness, while VFM

is at the core of performance measurement in

government organizations. In this sense, government

performance cannot be judged on the output side

only, but inputs, outputs, and outcomes must be

considered holistically.

3 RESEARCH METHODS

This research utilized a causal-associative research

method, which intended to test hypotheses relating

to the relationship between two or more variables. In

this regard, the present research tested hypotheses

for the relationship between four variables:

Accountability, Transparency, Oversight, and the

Value for Money Budget Management Concept.

3.1 Population and Samples

The population for this research was 104 civil

servants working at the Financial and Regional

Assets Management Agency (Badan Pengelola

Keuangan dan Aset Daerah) of Kendari

Municipality.

The sampling technique used in this research was

purposive sampling, in which a group of subjects is

chosen based on certain characteristics considered to

have a close relationship with the characteristics of a

population that are known beforehand (Margono,

2004, p. 128).

The criteria specified in determining the sample

were: a) civil servants; b) period of work ≥ 2 years;

and c) 71 people who were competent in the field

they handled.

3.2 Operational Definition

The operational definition of a variable is based on

the observable characteristics of that variable. The

operational definition of the variables in this

research are as follows:

3.2.1 Accountability (X1)

Accountability relates to the obligation of a person

or an organizational unit to account for the

management and control of resources and the

implementation of entrusted policies in order to

achieve the objectives or goals that have been set out

in the planning document through the form of

periodic accountability.

3.2.2 Transparency (X2)

Transparency is a principle that ensures public

access or freedom to obtain information relating to

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

6

governance so as to encourage the public to

participate in regional development programs.

3.2.3 Oversight (X3)

Oversight is an activity undertaken by the leader or

supervisor of work units towards all subordinate

employees with the purpose of knowing, assessing,

and evaluating that established activities or work

programs have been implemented in accordance

with applicable legislation.

3.2.4 Value for Money Budget Management

Concept (Y)

The Value for Money budget management concept

refers to the implementation of budget management

that prioritizes the achievement of result and

considers inputs, outputs, and outcomes holistically

in relation to three main elements: the economy,

effectiveness, and efficiency of the performance of

an organizational unit’s programs or activities.

4 RESULTS

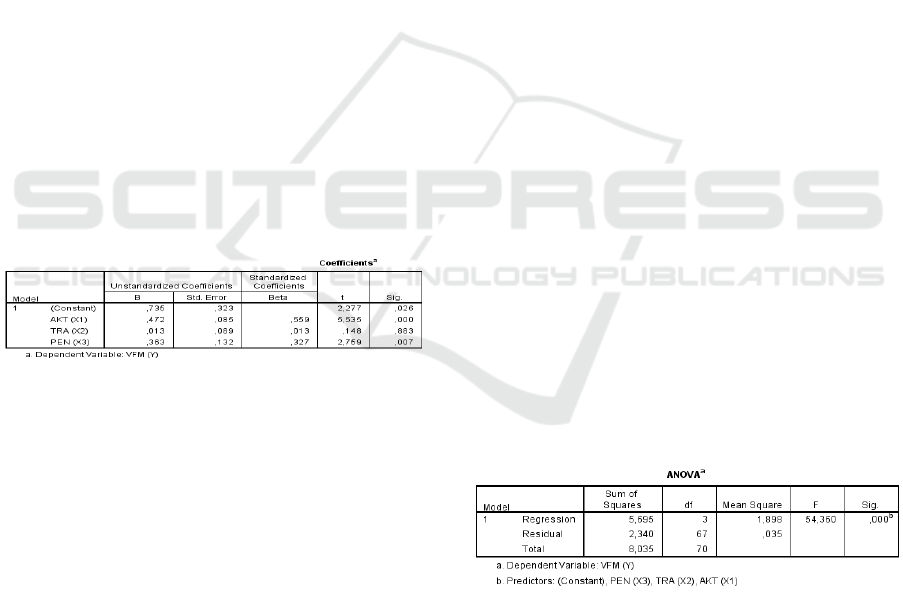

The regression tests results (Table 1) are as follows:

Table 1: Regression test results.

The regression model can be described as follows:

(1)

Listings:

Y = Value for Money

Accountability

= Transparency

= Oversight

4.1 Accountability (X1)

Based on the equation results from the first

regression analysis, relating to the relationship

between the variables Accountability and Value for

Money Budget Management Concept (Y), the tcount

value for accountability at 0.000 significance is

5.535, while the ttable value at α = 0.05 is 1.667.

Thus, it can be see that tcount> ttable (5.535 >

1.667), with a t significance level of 0.000 < α =

0.05. This result shows that accountability has a

partially significant effect on the Value for Money

budget management concept, and therefore H1 is

accepted.

4.2 Transparency (X2)

Based on the equation results from the second

regression analysis, relating to the relationship

between the variables Transparency and Value for

Money Budget Management Concept (Y), the tcount

value for Transparency at 0.883 significance is

0.148, while the ttable value at α = 0.05 is 1.667.

Thus, it can be seen that tcount< ttable (0.148 <

1.667), with a t significance level of 0.883 > α =

0.05. This result shows that transparency has a

partially non-significant effect on the Value for

Money budget management concept, and therefore

H2 is rejected.

4.3 Oversight (X3)

Based on the equation results from third regression

analysis, relating to the variables Oversight and

Value for Money Budget Management Concept (Y),

the tcount value for Oversight at 0.007 significance

is 2.759, while the ttable value at α = 0.05 is 1.667.

Thus, it can be seen that tcount> ttable (2.759 >

1.667), with the t significance level of 0.007 < α =

0.05. This result shows that oversight has a partially

significant effect on the Value for Money budget

management concept, and therefore H3 is accepted.

4.4 Simultant Test (F Test)

For further analysis, an F test was used to test the

effect of the independent variables simultaneously,

and the regression results are as follows:

Table 2: Simultant test results.

Based on Table 5.11 above, the Fcount value is

greater than the Ftable value (54.360 > 2.74), with

significance value = 0.000, which is lower than the

significance level = 5% (0.000 < 0.0.5). Therefore, it

can be concluded that, with a confidence level of

95%, accountability, transparency, and oversight,

when expressed simultaneously, have an effect on

the Value for Money budget management concept,

meaning that H4 is accepted.

The Effect of Accountability, Transparency, and Oversight on The Value for Money Budget Management Concept

7

5 CONCLUSIONS

Based on the results described in the previous

section, the following conclusions have been

obtained:

1. Accountability has a positive and partially

significant effect on the Value for Money

budget management concept.

2. Transparency has a positive and partially non-

significant effect on the Value for Money

budget management concept.

3. Oversight has a positive and partially significant

effect on the Value for Money budget

management concept.

4. Using multiple linear regression data analysis,

accountability, transparency, and oversight

simultaneously have a positive and significant

effect on the Value for Money budget

management concept.

REFERENCES

Andrianto, N. (2007). Good e-Government: Transparansi

dan Akuntabilitas Publik Melalui e-Government.

Malang: Bayumedia Publishing.

Ghozali, I. (2011). Aplikasi Analisis Multivariate dengan

Program SPSS. Semarang: Universitas Diponegoro.

Hafiz, A. (2000). Akuntansi, Transparansi dan

Akuntabilitas Keuangan Publik. Yogyakarta: BPFE

UGM.

Loi, S. (2015). Pengaruh Akuntabilitas Dan Transparansi

Terhadap Kineja Anggaran Berkonsep Value For

Money Pada Pemerintah Kota Medan. Medan:

Universitas HKBP Nommensen. Fakultas Ekonomi.

Mardiasmo. (2002). Akuntansi Sektor Publik. Yogyakarta:

Andi.

Mardiasmo. (2006). Perwujudan Transparansi dan

Akuntabilitas Publik Melalui Akuntansi Sektor Publik:

Suatu Sarana Good Governance. Jurnal Akuntansi

Pemerintahan Vol. 2, No. 1, Mei 2006.

Margono. (2004). Metodologi Penelitian Pendidikan.

Jakarta: Rineka Cipta.

Mothe, J. (2004). The Institutional Governance of

Technology, Society and Innovation. Journal of

Technology In society, 26 p 526-536.

Nawawi, H. (1994). Manajemen Kepegawaian di

Indonesia. Jakarta: Gunung Agung.

Reddel, T. and Geoff, W. (2004). From consultation to

participatory governance? A critical review of citizen

engagement strategies in Queensland. Australian

Journal of Public Administration, 63 (3) 75-87.

Sabo, B. and Tom, D. (2012). Transperancy in the Public

Sector: Its Importance and How Oracle Supports

Governments Efforts.

Setiawan, H. (2016). Analisis Pengaruh Akuntabilitas

Publik, Transparansi Publik dan Pengawasan

Terhadap Kinerja Satuan Kerja Perangkat Daerah di

Kabupaten Bungo. Jurnal Perspektif Pembiayaan dan

Pembangunan Daerah Vol. 4 No. 1.

Simbolon, A. (2006). Akuntabilitas Birokrasi Publik.

Yogyakarta: UGM.

Sukrisno, A. (2005). Peranan Internal Audit Departement,

Enterprises Risk Management, dan Good Coorporate

Governance terhadap Pencegahan Fraud dan

Implikasinya kepada Peningkatan Mutu Lulusan

Perguruan Tinggi di Indonesia. Jakarta: Salemba

Empat.

Wandari, D. (2015). Pengaruh Akuntabilitas,

Transparansi, Ketepatan Waktu dan Pengawasan

Internal Terhadap Kinerja Berkonsep Value for

Money Pada Instansi Pemerintah di Kabupaten

Buleleng. Jurnal Akuntansi Program S1. Vol 3, 1-12.

Wasistiono, S. (2003). Kapita Selekta Manajemen

Pemerintahan Daerah. Bandung: CV. Fokusmedia.

JCAE Symposium 2018 – Journal of Contemporary Accounting and Economics Symposium 2018 on Special Session for Indonesian Study

8