The Effect of Trust, Perceived Risk and Security on the Adoption of

Mobile Banking in Morocco

Younes Lafraxo

1

, Fadoua Hadri

1

, Hamza Amhal

2

and Amine Rossafi

3

1

Faculty of Law, Economics and Social Sciences, Department for Management Science,

Daoudiate, B.P. 2380, Marrakech, Morocco

2

Moroccan School of Engineering Science, 5 Lotissement Bouizgaren, Marrakech, Morocco

3

Ecole des Ponts Business School, 12 boulevard Copernic, cité Descartes, Champs-sur-Marne, Paris, France

Keywords: Mobile Banking Adoption, UTAUT, Perceived Risk, Trust, Security, Morocco.

Abstract: This short paper shows an acceptability model developed based on UTAUT (Unified Theory of Acceptance

and Use of Technology) and three additional factors namely “Perceived risk”, “Security” and “Trust”. The

model was tested using 460 responses obtained from the almost 720mobile banking application users from

five banks such as CIH, BP, AWB, CM, SGMB in Marrakech, Morocco. The first replies analysis, reveals

that Performance expectancy, Effort Expectancy, Social influence and Security in Mobile banking show a

significant positive impact on the users’ behavioural intention to accept mobile banking services. However,

Trust, facilitating conditions and Perceived risk in the mobile application does not influence positively the

behavioural intention. Note also that the resulting model of this study, still in progress, explains almost 62%

of users’ intention to use mobile banking.

1 INTRODUCTION

Nowadays, Banks get an opportunity of serving their

customers without location and time restrictions.

Thanks to internet, emerging innovative and novel

technologies allows customers to use their mobile

phones to remotely access banking networks. Users

can explore anytime and anywhere almost all the

banking services; from reaching account information

to making payments.

This new era of mobile banking helps traditional

banks to improve their service quality and reduce

service costs.

In the context of banking services, disruptive and

innovative technology development is changing

financial services operations. Mobile banking is the

latest and fastest raising areas.

It allows bank clients to use a smartphone or

portable computing device to perform banking tasks

such as monitor account balances, bill payments,

money transfer, or find ATM locations. The

phenomenon is so important that IS professionals

have described it as one of the most promising and

important developments in the field of mobile

commerce and banking business (Lin, 2011).

Most banks have deployed Internet banking

systems in an attempt to reduce costs while

improving customer service (Martins, 2014).

Trust is essential for Mobile Banking adoption

and usage. MB technology has the potential to

improve people's quality of life and to bring

efficiency to banks (Malaquias, 2016).

There is a pressing need to understand the main

factors affecting mobile banking user acceptance.

The increasing number of mobile banking studies

and articles published in the last years has made the

research process on this important subject more

complex (Baptista, 2016).

Increasingly, banks in Morocco seem to be more

motivated to integrate the Mobile banking channels

in their operational systems. Important financial and

technical resources have been devoted in this regard

to implement mobile banking applications within

their systems and start marketing them.

The developed model is based on UTAUT

(Venkatesh, 2003); which three additional factors

were integrated: “Trust”, “Perceived Risk” and

“Security”. The analysis of the received responses

reveals the first results obtained. It shows factors

that influence mobile users located in Marrakech

Lafraxo, Y., Hadri, F., Amhal, H. and Rossafi, A.

The Effect of Trust, Perceived Risk and Security on the Adoption of Mobile Banking in Morocco.

DOI: 10.5220/0006675604970502

In Proceedings of the 20th International Conference on Enterprise Information Systems (ICEIS 2018), pages 497-502

ISBN: 978-989-758-298-1

Copyright

c

2019 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

497

with regard to their acceptability of using mobile

banking.

2 THEORETICAL

BACKGROUND

The question of the technology adoption has led to

research work, particularly in the field of

information systems. The Model of Technology

Acceptance Model (TAM), developed by Davis in

1986, is one of the major axes of this work. The

TAM, which allows to study the sight utility as well

as the usability caught by the user, was updated with

a second version, the TAM 2 (Venkatesh and Davis,

2000), and a third, the TAM 3 (Venkatesh and Bala,

2008). Venkatesh and his co-authors (2003),

including Davis, have drawn inspiration from the

TAM and have studied several models to identify

recurrent determinants. They considered the findings

of several studies conducted for more than ten years

and analysed 8 theoretical models as well as the

determining factors influencing the intention of use

and the individual's actual use of information and

communication technologies. These factors and their

relationships were grouped into a unified theory of

the acceptance and use of these technologies with a

model known by the acronym UTAUT (Unified

Theory of Acceptance and Use of Technology). The

UTAUT model is considered the most robust. So, it

has been corroborated by several studies (Venkatesh

and al., 2016). Since its inception, this model has

proved able to predict the factors that influence the

behavioural intentions of users, and so to help them

to actually accept technologies (Venkatesh and al.,

2003, p. 425 in Bennani and al., 2013). Originally,

this model was developed to explain user acceptance

of technology. It explains about 62% of the intention

to use the technology. Note that these explanatory

models were applied in banking areas, in particular

to study the question of the acceptability of mobile

banking.

2.1 Mobile Banking

First of all, we need to understand that mobile

banking, as an instance of a mobile commerce

application by which financial institutions enable

their customers to carry out banking activities via

mobile devices (Oliveira,2014). Thus, mobile

banking, users can access banking services such as

account management, information inquiry, money

transfer, and bill payment (Luarn and Lin, 2005). In

IT business value literature, mobile banking has

received considerable attention by both academia

and practice (Gu, Lee, and Suh, 2009; Kim et al.,

2009; Luarn and Lin, 2005; Medhi, Ratan, and

Toyama, 2009; Zhou, Lu, and Wang, 2010). This

has led to diverse studies and complex research

related to adopt Mobile banking that have been

conducted to a better understanding adopting

determinants.

Mobile Banking includes mobile accounting

(e.g. check book requests, blocking lost cards,

money transfers or insurance policies subscription),

mobile brokerage (selling and purchasing financial

instruments), and mobile financial information

services (balance inquiries, statement requests, credit

card information, branches and ATM locations,

foreign exchange rates or commodity prices)

(Tiwari, 2007).

2.2 Mobile Banking in Relation with

UTAUT Modified

Several studies have been done about adopting

mobile banking using UTAUT like in Taipei Taiwan

downtown a street questionnaire was conducted to

investigate what makes an individual adopt mobile

banking using the UTAUT, as a result usage is

positively affect by facilitating conditions (β = 0.56)

and behaviour intention (β = 0.72). The model

explains 65.1% of variation in usage, so it is

suggested to use Social influence, performance

expectancy for the mobile banking adoption (Yu,

2012). Thail and Bhatiasevi (2015) examined an

extended framework of UTAUT on mobile banking

adoption. The study integrated perceived cost

perceived convenience and perceived credibility in

the existing framework of UTAUT (Afshan, 2016).

There was a study done in Iran for 361 bank

customers agree on usefulness, perceived risk and

trust are some of various factors influencing the

adoption of mobile banking in that country

(Hanafizadeh and al, 2014).

Since mobile banking is rather new to m-

Commerce, user experience is residual. Moreover,

not every customer may consider its adoption.

Hence two UTAUT moderators, voluntariness and

experience, are not considered in this study.

However, the two other moderators, gender and age,

are taken into account to remain as close as possible

to UTAUT.

Luo and al. (2010) and Riffai, Grant, and Edgar

(2012) concluded that performance expectancy is a

key factor for a user to accept the mobile banking

technology. Performance expectancy implies that the

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

498

user realizes gains from the use of mobile banking.

It bears resemblance to the perceived usefulness

construct from TAM (Kim et al., 2009; Martins,

Oliveira and Popovic, 2014; Miltgen, Popovic and

Oliveira, 2013). The value to customers from mobile

banking can be more than those available from

Internet based or brick-and-mortar based services.

All the researchers agree on three main factors

that effects the adoption of mobile banking; such as

Perceived risk, Security and Trust.

By integrating the unified theory of acceptance

and usage of technology (UTAUT), this research

proposes a mobile banking user adoption model. We

found that performance expectancy, social influence,

and other moderators have significant effects on user

adoption. In addition, we also found a significant

effect of trust.

2.2.1 Perceived Risk

According to Bauer (1960) and Ostlund (1974), the

negative consequences that may arise from

consumers’ actions lead to an important well-

established concept in consumer behaviour:

perceived risk. Many authors have studied the

impact of risk on the adoption of Mobile banking

and some of them will be discussed. Many authors

have studied the impact of risk on the adoption of

Mobile banking, building upon the premise that

purchasing Internet banking services is perceived to

be riskier than purchasing traditional banking

services (Cunningham and al., 2005). The resistance

to Internet banking and their connections to values

of individuals and concluded that both functional

and psychological barriers arise from service,

channel, consumer, and communication. ATM

services are still preferred by customers, because of

their old routine and the Internet’s insecurity,

inefficiency, and inconvenience. Besides the fear of

possible misuse of changeable passwords and the

lack of proof provided by an official receipt.

Additionally, non-users also complain about the lack

of social dimension, that is, the absence of a face-to-

face encounter, as at a branch.

2.2.2 Security

Compared with Internet banking that builds on wired

networks, mobile banking that builds on wireless

networks will be more vulnerable to security attacks

and interceptions (Crabbe and al., 2009; Kim and al.,

2009). This may result in users’ anxiety about

mobile banking security and severely influence their

effort expectancy. Mobile banking can use wireless

encryption technologies to enhance its security and

provide reliable, secure, and real-time services to

users.

2.2.3 Trust

Trust has been widely examined and proven to be a

crucial factor predicting customer’s perception and

intention toward Mobile banking.

In his study to examine the factors predicting

customers’ initial trust in Mobile banking, Zhou

(2011) confirmed trust as key factor determining the

likelihood of customers using Mobile banking.

In addition, Viruses and Trojan horses may exist

in mobile terminals; so, these problems increase

users' concern about payment security, and decrease

their trust in mobile banking, which, in turn, can

affect their usage intention and behaviour (Zhou,

2012).

Also, the initial trust model (ITM) shows the

relationship between initial trust in mobile banking

and usage intentions of it (Kim and al., 2009).

Examining the role of initial trust in the adoption

of Technology and how it is crucial, ITM has gained

separate attention in electronic commerce literature

due to the presence of high uncertainty and risks

associated with the domain (Afshan, 2016).

3 HYPOTHESIS AND RESEARCH

MODEL

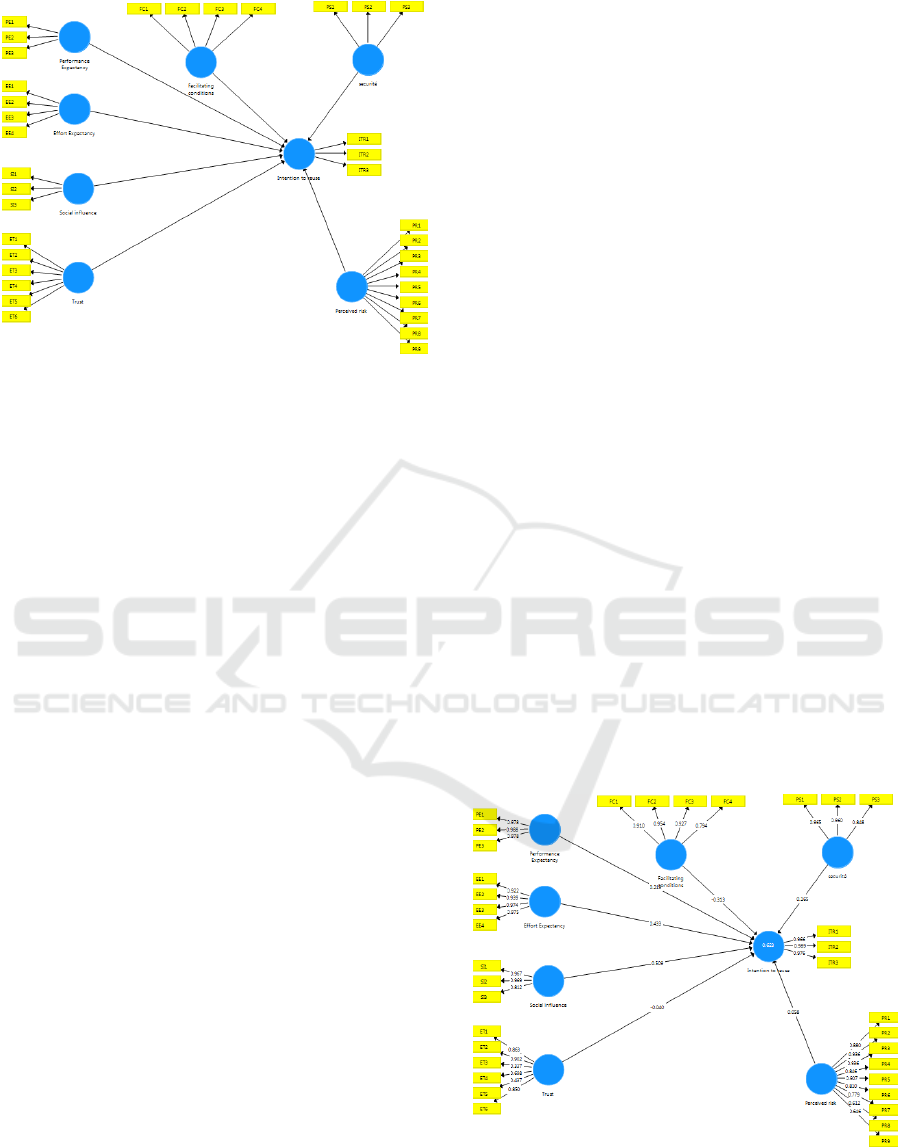

Based on the UTAUT modified, considering

‘Perceived risk’, ‘Security’ and ‘Trust’, the

additional hypothesis and the research model are as

follows:

Performance Expectancy (PE) influences

positively Intention to reuse(ITR);

Effort Expectancy (EE) influences positively

Intention to reuse;

Social influence (SI) influences positively

Behavioural Intention;

Facilitating conditions(FC) influences

positively Intention to reuse;

Trust (ET) in ITM influences positively

Intention to reuse;

Security (PS) influences positively Intention to

reuse;

Perceived risk PR) influences negatively

Intention to reuse.

The Effect of Trust, Perceived Risk and Security on the Adoption of Mobile Banking in Morocco

499

Figure 1: Research model.

4 METHODOLOGIES

4.1 Data Collection

Our target population was a group of Mobile

banking application users form Marrakech (a

representative panel of Moroccan users). Almost 720

individuals were requested to respond to a structured

questionnaire. We were able to collect data from 460

participants from which we received full responses

retained for analysis, representing 63,8% of initial

panel target. The data collection process took place

in May 2016.

4.2 Data Analysis and Results

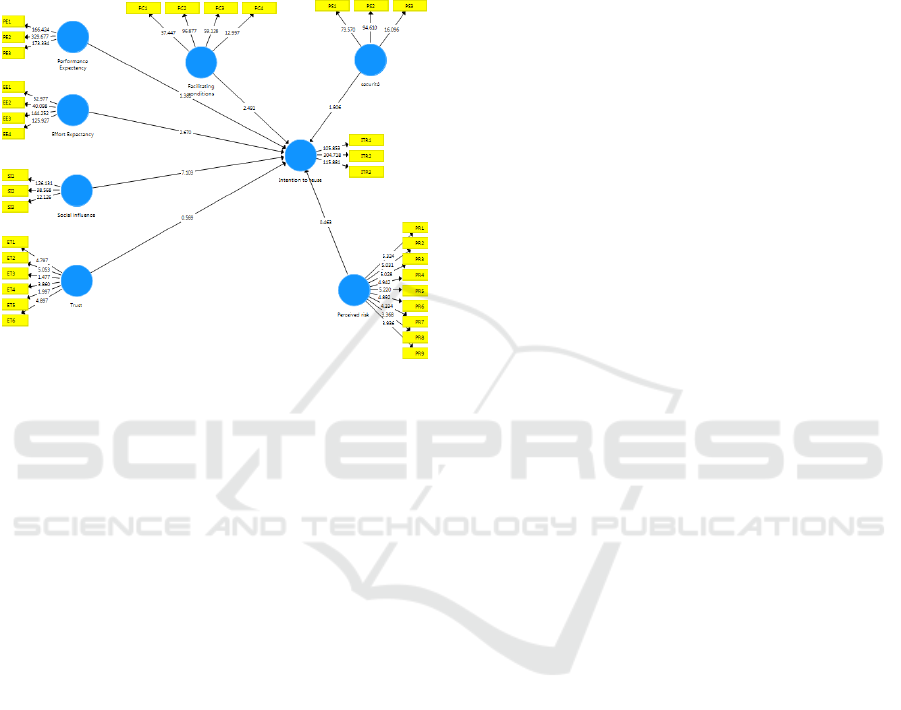

Thanks to the Partial Least Squares (PLS),

appropriate to validate predictive models using

purposeful latent, with minimal theoretical

foundation, using Smart PLS software for the

purpose to produce measurement model, the

structural model and their respective values.

4.3 Measurement Model and

Structural Model

Assessment of the measurement model is performed

by both of convergent and discriminant validities.

The first one indicates the degree to which

theoretically similar constructs are highly correlated

with each other. As for the discriminant validity, it

indicates the degree to which a given construct is

different from other constructs. Convergent validity

includes reliability of construct measurement. This

reliability was assessed by the composite reliability

and internal consistency. This later was assessed by

the Cronbach’s Alpha coefficient. It is verified when

the alpha is above 0,7.

Moreover, internal consistency of the scales is

verified, because their Cronbach’s Alpha exceeded

threshold value and confirmed a satisfactory

reliability. Furthermore, convergent validity is

measured by the factor loadings of the items on the

model’s constructs. An observed principle for

convergent validity is to retain items with loadings

of 0.70 or more. (Barclay and al., 1995).

Discriminant validity is assured when the AVE

value is above the threshold value of 0,5 and square

root of the AVE is larger than all other cross

correlations (Gefen and Straub, 2005). All constructs

items loadings should be greater than 0,7 (Fornell

and Larcker, 1981). Composite reliability greater

than 0,8 and AVE greater than 0,5. The research

model (Figure 1) considered in this work has

sufficient discriminant validity. All constructs had a

composite reliability greater than 0,8 and

Cronbach’s alpha greater than 0,7 indicating

acceptable level of reliability. In this study, all

constructs had item loadings greater than0,7.

Composite reliability values greater than 0,8 and

AVE values greater than 0,5. Concerning the

discriminant validity, all of the constructs had AVE

scores greater than 0,5 indicating that the proposed

model has sufficient discriminant validity (Fornell

and al., 1981). All constructs had a composite

reliability greater than 0,8 and Cronbach’s alpha

greater than 0,7 indicating that nearly all constructs

had an acceptable level of reliability (Fornell and al.,

1981).

Figure 2: Measurement model.

The structural model provides information about

the model’s predictive power given by R

2

values and

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

500

information about path significance. We use

bootstrapping to determine the significance levels

for loadings weights and path coefficients. Results

show that the proposed model explained almost 62%

of total users’ intention to use mobile banking. They

reveal all the β are greater than 2 with β = 1,775,

described in the figure below.

Figure 3: Structural model.

Figure 3 above reproduces the relationships

existing between the latent constructs, to draw

attention to the importance of the significance (T-

values) of the structural relationships obtained after

adjustment of the structural model. The significance

of the coefficients was estimated by bootstrapping.

In Moroccan Mobile Banking application, the

result obtained shows that They reveal that β

between ‘Intention to reuse’ and constructs ‘Social

influence’ (7.103); ‘Effort Expectancy’ (2.670);

‘Facilitating conditions’ (2.491); ‘Security’ (1.906)

are greater than 1.7.

5 CONCLUSION

This short paper is result of research work, which is

still in progress. Its objective is to share with

researchers the primary results already obtained.

Thus, it reveals the factors that influence the mobile

banking adoption by mobile users in Morocco, also

their intention toward the acceptability to use mobile

banking and the effect of perceived risk, trust and

security. The research work shows several factors

such as Performance expectancy, effort expectancy,

social influence and security have a significant

positive impact on the users’ behavioural intention

to use mobile banking services. However, Trust,

facilitating conditions and Perceived risk in the

mobile application does not influence positively this

behavioural intention. Knowing that UTAUT is

considered as a strong model because it explains

about 62% of the mobile users’ intention to use the

technology and thanks to the current significant

results of this ongoing study, this model can be

considered as another strong contribution to enrich

research of factors influencing mobile banking

adoption.

These outcomes would definitely help Moroccan

banks to invest in mobile banking.

REFERENCES

Al-Jabri, I. M., and Sohail, M. S. 2012. Mobile banking

adoption: application of diffusion of innovation

theory. Journal of Electronic Commerce Research.

Barclay D., Chan Y., Huff S., and Copeland D. 1997.

Business Strategic Orientation, Information Strategic

Orientation and strategic alignment. Information

Systems Research.

Bennani A, Sidmou ML, Lafraxo Y, OUMLIL R 2013.

L’acceptation des systèmes d’Information dans

l’enseignement supérieur : Quel modèle pour le

contexte marocain ? IBIMA 22th,

Bhatiasevi, V. 2015. An extended UTAUT model to

explain the adoption of mobile banking. Information

Development.

Carolina Martinsa, Tiago Oliveiraa, AleˇsPopoviˇc 2014.

Understanding the Internet banking adoption: A

unified theory of acceptance and use of technology

and perceived risk application. International Journal

of Information Management.

Chen, C. 2013. Perceived risk, usage frequency of mobile

banking services. Managing Service Quality.

Crabbe M, Standing C, Standing S and Karjaluoto, H

2009. An adoption model for mobile banking in

Ghana. International Journal of Mobile

Communications, 7(5), 515–543.

Cruz, P., FilgueirasNeto, L. B., Munoz-Gallego, P., and

Laukkanen, T. 2010. Mobile banking rollout in

emerging markets: evidence from Brazil. International

Journal of Bank Marketing.

Cunningham, L. F., Gerlach, J. H., Harper, M. D., Young,

C. E. 2005. Perceived risk and the consumer buying

process: Internet airline reservations. International

Journal of Service Industry Management.

Featherman, M. S., and Pavlou, P. A. 2003. Predicting e-

services adoption: A perceived risk facets perspective.

International Journal of Human-Computer Studies.

Fettke, P. 2006. State-of-the-Art des State-of-the-Art

eineUntersuchung der for schungsmethode “Review”

innerhalbder Wirtschaftsinformatik from the UTAUT

model. Journal of Electronic Commerce Research.

Fornell, C., and Larcker, D. F. 1981. Evaluating Structural

Equation Models with Unobservable Variables and

The Effect of Trust, Perceived Risk and Security on the Adoption of Mobile Banking in Morocco

501

Measurement Error. Journal of Marketing Research.

Gefen, D and Straub, D. 2005. A practical guide to

factorial validity using PLS-graph: Tutorial and

annotated example. Communications of the

Association for Information Systems.

Gonçalo Baptista, Tiago Oliveira 2016. A weight and a

meta-analysis on mobile banking acceptance research.

Computers in Human Behavior.

Gu, J.-C., Lee, S.-C., and Suh, Y.-H. 2009. Determinants

of behavioral intention to mobile banking. Expert

Systems with Applications.

Ha, K.-H., Canedoli, A., Baur, A. W., and Bick, M. 2012.

Mobile banking e insights on its increasing relevance

and most common drivers of adoption. Electronic

Markets.

Hanafizadeh, P., Behboudi, M., Koshksaray, A. A., and

Tabar, M. J. S. 2014. Mobile-banking

initial acceptance of Mobile Banking in Pakistan.

International Journal of Scientific and Engineering

Research.

Kim, G., Shin, B., and Lee, H. G. 2009. Understanding

dynamics between initial trust and usage intentions of

mobile banking. Information Systems Journal, 19(3),

283-311

Kim, S., Lee, K. H., Hwang, H., Yoo, S., 2016. Analysis of

the factors influencing professionals’ adoption of

mobile electronic medical record (EMR) using the

unified theory of acceptance and use of technology

(UTAUT) in a tertiary hospital, BMC Medical

Informatics and Decision Making.

Koenig-Lewis, N., Palmer, A., and Moll, A. 2010.

Predicting young consumers' take up of

Koufaris, M., and Hampton-Sosa, W. 2004. The

development of initial trust in an online company by

new customers. Information and Management.

Laforet, S., and Li, X. 2005. Consumers' attitudes towards

online and mobile banking in China. International

Journal of Bank Marketing.

Lee, M.-C. 2009. Factors influencing the adoption of

internet banking: an integration of TAM and TPB with

perceived risk and perceived benefit. Electronic

Commerce Research and Applications.

Lin, H. F. 2011. An empirical investigation of mobile

banking adoption: The effect of innovation attributes

and knowledge-based trust. International Journal of

Information Management.

Luarn, P., and Lin, H. H. 2005. Toward an understanding

of the behavioral intention to use

Luo, X., Li, H., Zhang, J., and Shim, J. P. 2010.

Examining multi-dimensional trust and multi-faceted

risk in initial acceptance of emerging technologies: An

empirical study of mobile banking services. Decision

Support Systems.

Mishra, V., and Bisht, S. S. 2013. Mobile banking in a

developing economy: a customer-centric model for

policy formulation. Telecommunications Policy.

mobile banking services. International Journal of Bank

Marketing.

Rodrigo F. Malaquias, YujongHwang 2016. An empirical

study on trust in mobile banking: A developing

country perspective. Computers in Human Behavior.

SaharAfshan, Arshian Sharif 2016. Acceptance of Mobile

Banking Framework in Pakistan. Telematics and

Informatics

Tiago Oliveira, Miguel Faria, Manoj Abraham Thomas,

Aleˇs Popoviˇc 2014. Extending the understanding of

mobile banking adoption: When UTAUT meets TTF

and ITM. International Journal of Information

Management

Tiwari, R. 2007. In S. Buse (Ed.), The mobile commerce

prospects: A strategic analysis of oportunities in the

banking sector. Hamburg, Deutschland: Hamburg

University Press.

Venkatesh, V., Bala, H., 2008. Technology Acceptance

Model 3 and a Research Agenda on Interventions.

Decision Sciences.

Venkatesh, V., Davis, F. D., 2000. A Theoretical

Extension of the Technology Acceptance Model: Four

Longitudinal Field Studies. Management Science.

Venkatesh, V., James Y. L. Thong, and Xin Xu. 2012.

"Consumer acceptance and use of information

technology: Extending the Unified Theory of

Acceptance and Use of Technology." MIS Quarterly

36, no. 1: 157-178. Business Source Complete.

Venkatesh, V., James Y. L. Thong, and Xu Xin. 2016.

"Unified Theory of Acceptance and Use of

Technology: A Synthesis and the Road Ahead."

Journal of The Association for Information Systems

17, no. 5: 328-376. Business Source Complete.

Venkatesh, V., Michael G. Morris, Gordon B. Davis and

Fred D. Davis. 2003. User Acceptance of Information

Technology: Toward a Unified View. MIS Quarterly

Xue, M., Hitt, L. M., and Chen, P. 2011. Determinants

and outcomes of Internet banking adoption.

Management Science.

Yu, C. S. 2012. Factors affecting individuals to adopt

mobile banking: Empirical evidence

Yu, C.-S. 2012. Factors affecting individuals to adopt

mobile banking: Empirical evidence from the UTAUT

model. Journal of Electronic Commerce Research.

Zhou, T. 2011a. An empirical examination of initial trust

in mobile banking. Internet Research.

Zhou, T. 2011b. Understanding mobile Internet

continuance usage from the perspectives of UTAUT

and flow. Information Development.

Zhou, T. 2012. Examining mobile banking user adoption

from the perspectives of trust and flow experience.

Information Technology and Management.

Zhou, T. 2012. Understanding users’ initial trust in

mobile banking: An elaboration likelihood

perspective. Computers in Human Behavior.

Zhou, T. 2013. An empirical examination of continuance

intention of mobile payment services. Decision

Support Systems, 54, 1085–1091.

Zhou, T., Lu, Y., and Wang, B. 2010. Integrating TTF and

UTAUT to explain mobile banking user adoption.

Computers in Human Behavior.

ICEIS 2018 - 20th International Conference on Enterprise Information Systems

502