The Potential Benefits of Global Value Chain Inclusion on

Indonesian Cassava Farmers

Rachmaniar Rachmat

Faculty of Social and Political Science, Universitas Airlangga

Keywords: cassava, Global Value Chain (GVC), ICT (information and communication technology), Indonesia cassava

farmers, internet adoption

Abstract: Indonesia is a tropical country that is very rich in biodiversity (flora and fauna). Judging from the potentials

(the land, climate, natural resources, and human resources), Indonesia should be able to thrive to become an

advanced agricultural country. But reality speaks differently. For instance, in Southeast Asia region,

Indonesia is still losing the competition in the agricultural industry. One of Indonesia's agricultural products

that are being neglected by the government is cassava. So Thailand, taking advantage of cassava’s global

market, transformed into the biggest cassava exporter in the world. Vietnam is also starting to smash in the

global cassava market seriously. While cassava is abundant in Indonesia, most farmers do not know where

to sell their crops. This situation is then taken advantage by cukong (food mafia) to play with the crops’

price by connecting farmers to the market/buyers and eventually put these farmers in the cukong’s mercy.

Farmers are put at disadvantages since they get much lower than the standard price for their products. There

is a power asymmetry in crops supply chain network. By using literature review method, this paper aims to

analyze the potential benefits for Indonesian cassava farmers in the Global Value Chain (GVC) Inclusion.

This paper uses a startup agriculture company which specializes in selling cassava products, Ladang Lima

(Pasuruan/Surabaya), as a case study. The conclusion of this paper supports internet adoption (ICT in

agriculture) that provides access to domestic and global market, enabling financial investment, and access to

technology.

1 INTRODUCTION

Cassava is one of non-rice staple food that has an

important role in supporting the food security of a

region. Cassava is also a source of carbohydrates

which used for animal feed ingredients and

industrial raw materials. Therefore, the development

of cassava is very important to diversify local food

consumption, for the development of processing-

industry, agro-industry, as a source of foreign

exchange through export, and as an effort to support

food security and food self-sufficiency (Outlook

Kementrian Pertanian, 2016).

There are four strategic food crop commodities

in Indonesia: rice, corn, soybeans, and sugar cane

(Muslim, 2016). Even so, cassava remains an

important commodity with an increasing national

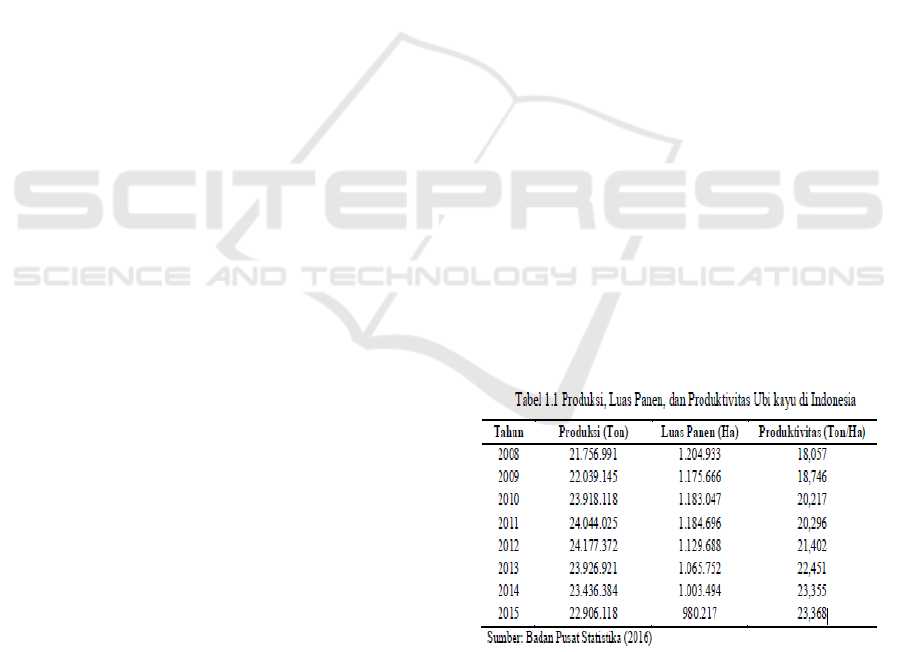

production rate. From the table below, it can be seen

that Indonesian cassava production in 2015

surpassed 22 million tons (BPS, 2016). Cassava’s

production number is stable with the total production

in Indonesian (2010-2016) averaging at 20 million

tons/year.

Source: BPS, 2016

However, although domestic cassava production

continues to increase, Indonesia keeps importing

cassava every year. Noted, in the period of 2000-

2106 Indonesia imported processed-cassava an

average of 271,681 tons per year, with the value of

USD 100.63 million. In contrast to the value of

Rachmat, R.

The Potential Benefits of Global Value Chain Inclusion on Indonesian Cassava Farmers.

DOI: 10.5220/0010276100002309

In Proceedings of Airlangga Conference on International Relations (ACIR 2018) - Politics, Economy, and Security in Changing Indo-Pacific Region, pages 289-296

ISBN: 978-989-758-493-0

Copyright

c

2022 by SCITEPRESS – Science and Technology Publications, Lda. All rights reserved

289

imports, for the national production level that

reaches millions of tons/year, the amounts of

Indonesian cassava exports is very small. In the

period of 2000-2016, the average number of

Indonesian cassava exports was only 42.251 tons per

year, with the value of USD 13.1 million (Muslim,

2016). The large amount of cassava production is

still largely absorbed by the domestic market for

consumption and industry. The Ministry of

Agriculture (2016) notes that there is a cassava

surplus of about 1 million tons per year. From the

small export value numbers, it is concluded that

Indonesia is not an important actor in the world’s

cassava global value chain (GVC). The role of

Indonesia in cassava’s GVC is low.

The problem of "large production but small

exports" is not only owned by Indonesia. Other

countries such as Nigeria and Brazil, which have

large domestic cassava’s production numbers, also

have a small export value. For example, Indonesia is

only able to export approximately 3% -5% of

national cassava products, while Thailand is able to

export around 60% of their national cassava

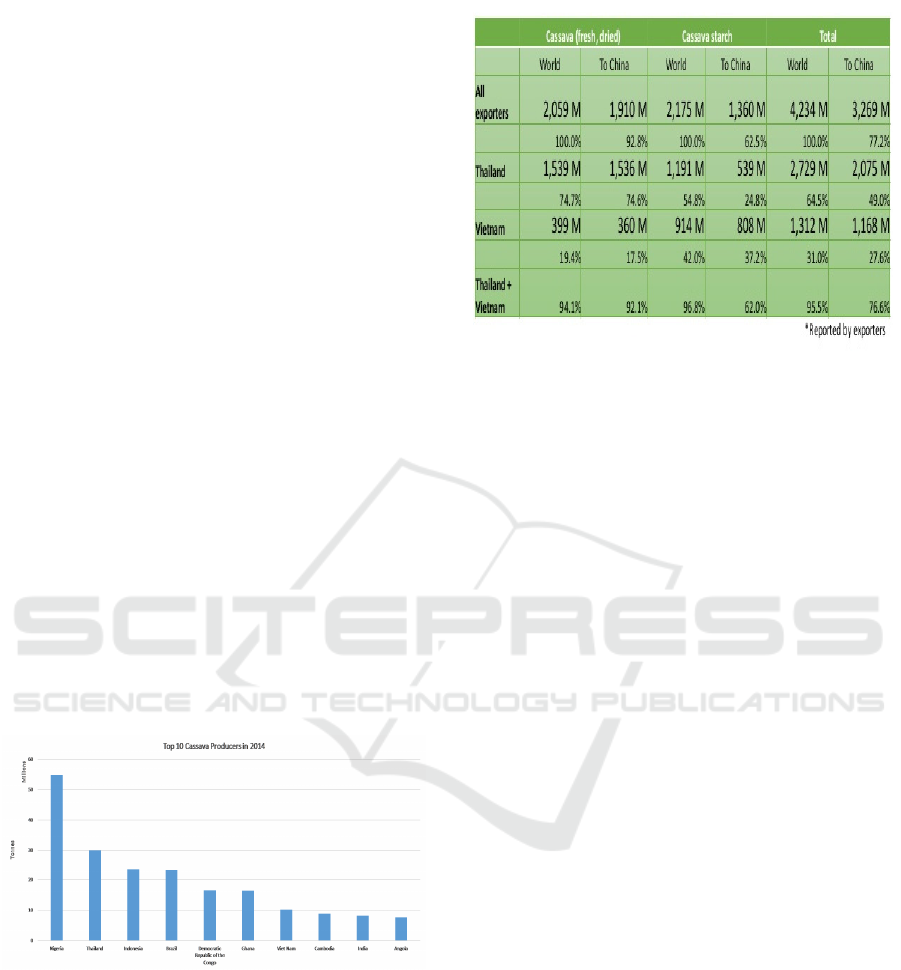

production (Dirgantoro, 2017). Below is the table of

largest cassava producers reported by FAO (Food

and Agricultural Ogranization) in 2015. Nigeria is

ranked first with total cassava production per year

reaches above 50 million tons, followed by

Thailand, Indonesia and Brazil. Nigerian cassava

production in 2010-2016 averages 40 million

tons/year (FAO, 2015), but for the biggest exporter

of cassava products, Thailand is ranked first.

Source: FAO, 2015

Source: Comtrade 2015

There are several problems faced by Indonesian

cassava farmers, which are: 1) inequity in terms of

the fair distribution of the economic gains in the

value chain amongst different players; farmers

operate individually rather than as a cooperative,

making it difficult to exert the pressure (bargaining

power) on local traders and exporters, and better

control of the price, 2) power imbalances in

participation with local farmers and exporters having

many alternatives (many suppliers to choose from)

compared to farmers (limited pool of people to sell

to), 3) economic empowerment of farmers is low,

due to inadequate information on market prices,

limited time to sell a raw product before it spoils and

lack of access to credit to make a larger investment

in the farm, this results in farmers having the lowest

bargaining power and smallest economic gain

compared to other players in the value chain, 4)

capacity to value add is low in communities, and

poor knowledge and skills in processing means most

farmers are selling cassava raw, and there are no

government initiatives to improve processing

knowledge and skills, 5) limited access to market-

related information, 6) technological limitations.

The purpose of this paper is to explain the

potential benefits of global value chain inclusion for

Indonesian cassava farmers. One of the downsides

faced is the difference (gap) price of fresh cassava

from farmers with the same product in the

international market, due to the asymmetry of power

especially in terms of supply (supply side). Of

course, there are some things that should be in the

government's attention before the development of

technology and communication (ICT), through

internet adoption, will be able to improve the

welfare of farmers, especially for cassava farmers.

ACIR 2018 - Airlangga Conference on International Relations

290

2 METHODS

This paper uses literature review method. The type

of research is descriptive research. This paper uses a

global value chain perspective and the presence of

internet innovation/ internet adoption in the food

supply chain network in reducing asymmetry with

new benchmark standards from the growing global

cassava market.

3 RESULTS

In the modern era, businesses do not recognize

boundaries. To raise participation in the global

market, Indonesia needs to conduct economic

activities openly, ie through export activities and

imports of goods. Based on this, many business lines

are currently adopting a business model called

Global Value Chain or GVC (Richie & Cendani,

2017).

The growing GVC business model today offers a

competitive advantage that is the efficiency of

corporate activities. It is put into practice by

specialization and risk-sharing between the owners

of capital. If the investor is willing to take a high

risk, the company can also boost its production level

(Gereffi & Luo, 2014). GVC can also embrace some

disadvantaged countries to join the world supply

chain so that there is no need to wait for decades to

build their own country (Richie & Cendani, 2017).

Below are the graphics of GVC participation rate

of several countries

Source: researchgate.net, 2009

Source: Departemen Pengembangan UMKM Bank

Indonesia, 2016

From the data above, it can be seen that until

2009 Indonesia's participation in GVC is still

relatively low compared to another ASEAN

countries such as Malaysia, Philippines, Singapore,

and Thailand. This is caused by the lagging of

Indonesia in several aspects such as logistics,

economic openness, and the reliability of

communication technology. The lack of

standardizations and specifications of Indonesian

products in line with international markets has also

resulted in poor performances of Indonesian

businesses in meeting global consumption demand.

For cassava, Indonesia's position in the world

cassava trade chain is very small. The exported

products are mainly derived-cassava-products such

as starch, chips, and pellets. The problem faced is

the absence of standardization of cassava products.

The government does not socialize or facilitate the

knowledge transfer and technology needed to

support the farmers. This caused the quality of

cassava yields to be varied. The quality of cassava

that does not meet the international standard become

the main factor of fresh cassava from Indonesia

unable to penetrate the global market. In addition,

farmers also do not have the access to information

and technology to develop their products. This

limited information and technology make the

majority of farmers to sell their cassava to the

cukong (food mafia) who are willing to buy directly

from them. Despite the fact that these mafias play

the crops’ price to stay at a low level. For example,

the price of fresh cassava in the global market in

2017 is around Rp. 2500/kg, but the price of fresh

The Potential Benefits of Global Value Chain Inclusion on Indonesian Cassava Farmers

291

cassava from farmers (in Indonesia) is only Rp.

700/kg. The highest price of cassava is only Rp.

970/kg (Dirgantoro, 2017). This significant price

difference is clearly detrimental to farmers whose

crops are priced very low.

To address this, farmers need to produce

processed-cassava which has a higher selling value

than fresh cassava or to sell to consumers without

going through intermediaries/cukong. In this case,

farmers need knowledge about cassava market

conditions, cassava prices elsewhere, what processed

products are currently sought by consumers, how to

process derivative products and technology to

process them. They also need a platform that is able

to connect producers directly to consumers while

observing market opportunities. In this case, ICT

(information and technology communication) came

in to provide wider market access to farmers. The

platform used for ICT inclusion is e-commerce.

One cassava company that is able to apply ICT

inclusion in Global Value Chain is Ladang Lima.

Ladang Lima is a startup company from Pasuruan

that has successfully exported processed-cassava

products to United Kingdom since 2016. The

company is innovating by processing cassava into

versatile flour, as well as launching cakes and flour

products "premix" while continuing to strengthen the

distribution of their products nationwide. In 2017

Ladang Lima successfully export their products to

UK and United States of America (USA). The

company is processing fresh cassava into cassava

flour which can be cooked for pastry and pasta

(ladanglima.com, 2018).

Ladang Lima has a factory, covering an area of

3.3 hectares, and a 100 hectares of cassava

cultivation farm in Pasuruan (cooperate with local

farmers). It is a cassava farmer union managed by

businessmen. Approximately 60% of their products

are channeled directly to consumers through online

sales (internet) and the rest goes into the industrial

sector. The company managed to hook investor from

Lima Ventura Co. and plans to use the additional

capital to increase the marketing capacity and

standardization of products to be ready for monthly

export. The market targeted is the European and US

markets. Export targets to Europe and the US are

planned to run smoothly by 2019. One of their main

goals is to support local cassava farmers’

sustainability.

4 DISCUSSION

4.1 Global Value Chain (GVC)

Value Chain is a model developed by Prof. Michael

Eugene Porter from Harvard Business School. This

model describes a business process from raw

material acceptance, processing, to products ready to

be marketed to consumers. This includes innovation,

research, development, feasibility trials, marketing,

etc. The resulting product value is an aggregate of

all values added in the process. Global Value Chain

is a value chain that processes through integration of

various countries by exploiting the comparative

advantage of each country (Swadeshi, 2017).

With the exploitation of comparative advantage,

each stage of production in GCV can be done with a

specialization that enables the company to make

efficiency. In addition, the risks involved in the

production process are also shared between the

owners of capital so that they are willing to take

greater risks to increase the production rate in large

quantities (Gereffi & Luo, 2014).

The core of Global Value Chain (GVC) is the

value chain itself. All the activities in a value chain

can be done by a single company or divided among

a number of them. They can be placed within a

single geographical location or spread over wider

areas/countries. So Global Value Chain (GVC) is an

international fragmentation of production chains.

Studies analyzing the trade flows of intermediate

products between nations show that Global Value

Chains (GCVs) are ubiquitous (Mudambi & Puck,

2016). They are operationalized through business

strategies that incorporate significant amounts of

offshoring and offshore-outsourcing (Contractor et

al, 2010). In globalization era, the majority of

developing countries are increasing their

participating in GVC. GVC participation in

developing countries is important for economic

growth. Domestic value added from GVC trade can

be very significant to local economies.

GVC gives us an understanding on the nature of

the interaction between demand side and supply side

in a specific sector and provides the analysis tool in

developing an intervention to include small farmers

in the value chain (Zylberberg, 2013). The author

will use GVC perspective in identifying the

opportunities for cassava farmers to increase their

value chain by producing a higher value of product

and processes as well as an effective tool for farmer

empowerment.

ACIR 2018 - Airlangga Conference on International Relations

292

4.2 Governance in Global Value Chain

The value chain governance is divided into

producer-driven chains with the barriers to entry are

capital and proprietary knowledge due to the

existence of high technology; and buyer-driven

chains in which the key barrier to entry is marketing

costs, product design and market information

(Gereffi et al, 1994).

The degree of standardization of product and

process as a basis to divide the supply relationship is

divided into three types: 1) commodity suppliers,

depend on generalized assets and often produce

standard products, do not connect directly to the

customers, price is the key factor, and suppliers

could switch easily, 2) captive suppliers, depend on

dedicated assets, high connectivity with customers

and tend to be found within symbiotic supplier

networks, 3) turn-key suppliers, relatively

independent stance toward their customers, high

level of competence, ability to serve any type of

customers and/or businesses (Sturgeon et al, 2001).

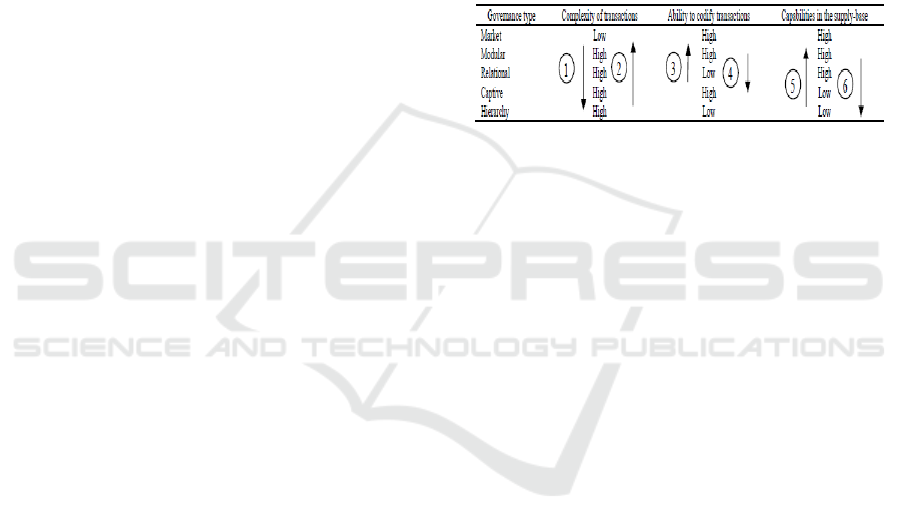

Gereffi et al (2005) use three key determinants of

value chain patterns: 1) the complexity of

transaction, 2) the ability to codify information, and

3) the capability of supplier. Based on those

variables, there are five types of value chain

governance structures:

1) The market, involve transaction that is relatively

simple, typical spot market; repeated transaction

and low switching cost for both parties

2) The modular, made by order to customers’

specification, use generic machinery that limits

transaction-specific investment and makes

capital outlays for components and materials on

behalf of customers

3) The relational, exist when buyers and sellers

rely on complex information which creates

mutual dependence and high level of asset

specificity, such linkages require trust and

generate mutual reliance regulated through

reputation, social and spatial proximity, and

family and ethnic ties

4) The captive, small suppliers are transactionally

dependent on much larger buyers and faces

significant switching cost (captive). Such

network is frequently characterized by a high

degree of monitoring and control by the lead

firm

5) The hierarchy, characterized by vertical

integration and dominated by a managerial

control such as headquarters to subsidiaries and

affiliates

Gereffi (2011) identifies some dynamics of

global value chain governance, such as 1) shifting

from market governance to relational by increasing

complexity of transactions and reduces supplier

competence in relation to new demands, 2) shifting

from relational governance to market by reduce the

complexity of transactions and greater ease of

codification, 3) better codification of transactions to

shift from relational to modular, 4) the other way

around by de-codification of transactions, 5)

increasing supplier competence to shift from captive

to modular, 6) the other way around by decreasing

supplier competence.

Table of dynamics in GVC governance (Gereffi, 2011)

With reference to Indonesia cassava value chain,

all five archetypes of governance in the global value

chain exist in Indonesia cassava value chain as well

as opportunities to upgrade the linkage and benefit

according to the dynamics in global value chain

governance.

4.3 Potential Upgrading in the Dynamic of

Global Value Chain Governance

Kaplinsky (2000) uses GVC framework to explain

that inequality has expanded in spite of increasing

integration of developing countries into the world

economy due to these issues of governance and

power symmetry. Humphrey et al (2010) states that

small-holders are generally at a disadvantage when

participating in GVCs for a multitude of reasons

such as lack of information about market

opportunities and technology, and they generally

work through intermediaries and see marginal

benefits from inclusion into value chains and not

become a part of high-value activities concentrated

in developed countries. To grab the potential gains

for the farmers, the governance of the chain need to

be changed due to a very fragmented production of

small farmers and the varied of intermediaries

quality in agricultural market (Humphrey et al,

2011).

Small-holders tend to participate in buyer-driven

value chains, the power asymmetries present in these

trading relationships hamper possibilities for

upgrading into higher value-added activities

The Potential Benefits of Global Value Chain Inclusion on Indonesian Cassava Farmers

293

(Zylberberg, 2013). It causes a shifting from market

governance to more relational, reduced the power

asymmetries substantially but pushed the

intermediaries on the supply side to produce more

from their own farms rather than purchased from

small farmers (Gereffi et al, 2005). It needs an

innovative smallholder-based business model as a

viable path out of poverty in countries with low

labor costs, suitable climatic conditions, and basic

infrastructural capacities (Zylberberg, 2013).

Global Value Chain or global production

network is a revolutionary production system in the

21st century where the production and distribution

of goods are jointly organized by several countries.

In GVC, one production stage of a unified

production process is conducted in one country

while the next stage is done in another. GVC is

possible because of the communications technology

revolution (ICT) and logistics and the declining

inter-state trade barriers that make goods and

services move almost unimpeded from one country

to another.

The level of state participation in GVC is largely

determined by three things: communication

technology (ICT), logistics, and economic openness

(trade and investment rules). Indonesia still lags

behind in those 3 aspects. In addition, there are other

obstacles in the form of high-interest rates, relatively

high labor costs compared to neighboring countries,

limited access to the internet facilities, poor logistics

performance, and complicated licensing process. For

the food and beverage industry, many companies are

constrained by the fulfillment of international

standards, different specifications of goods between

countries and difficulties to obtain local raw

materials in accordance to the global demand.

4.4 Potential Contribution from ICT

Inclusion

The utilization of ICT in agribusiness could

contribute in the areas such as access to a better

technology in production system management,

access to the market, and access to financial

institutions (FAO, 2013). The role of the internet in

the competition will reduce the competitive

advantage by making information widely available;

reducing the barrier to entry such as physical stores,

sales force, and channel distribution; and creating a

virtual market for more buyers and sellers (Porter,

2011).

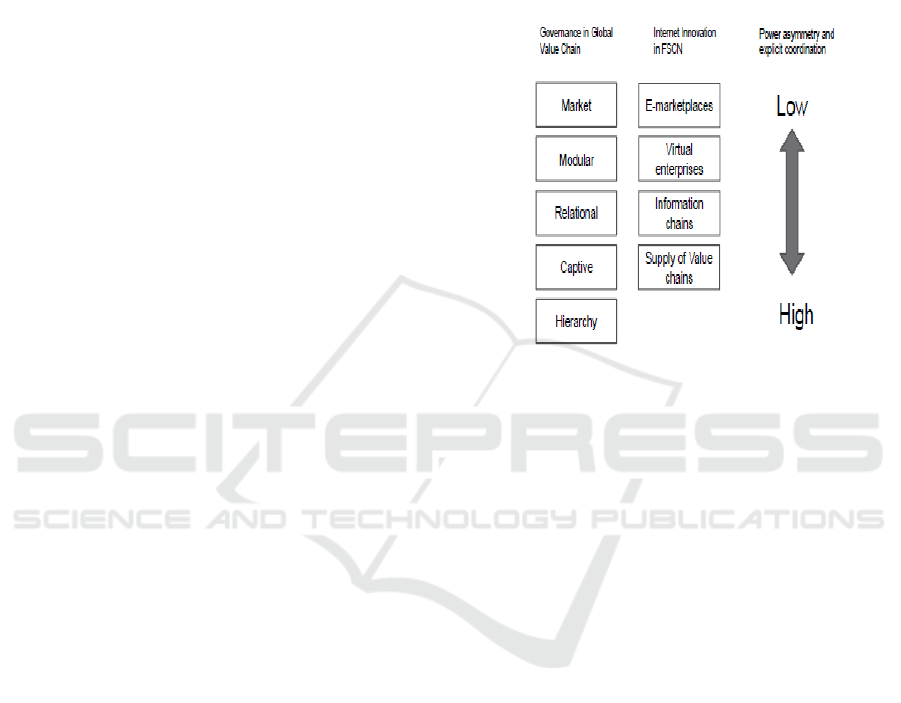

Combination of global value chain governance

reference with internet innovation in food supply

chain network provides an opportunity for the

supply side (farmers) to get the benefit on the global

value chain inclusion with internet adoption by

lowering the degree of power asymmetry. In

addition, we need to commoditizing a generic

specification of product in the virtual market.

Below is the figure of combination between

GCV governance and internet innovation (Gereffi,

2005 & Van der Vorst, 2005)

Consequently, by providing product at a basic

level (raw products), the farmers will be located at

the bottom of the value chain. Even though there is a

possibility of utilizing internet for beneficiary of

farmers, there are some issues in ICT adoption by

small-holders. Stuart (2004) states that the success

factor in information technology adoption is

government projects related to the development of

broadband infrastructures such as e-government and

e-procurement. While Aleke et al (2010), based on

the results of their research, stated that to ensure the

success of the diffusion of an ICT adoption, a

balance must be maintained between the work done

during the design of information and communication

technology with social factors such as language and

lifestyle. Sangha et al (2010), which examine the

role of ICT in the agriculture sector in India, states

that the barriers in adopting information and

communication technology (ICT) by farmers are the

lack of training, inadequate infrastructure, and

equipment costs.

5 CONCLUSIONS

Participation in cassava global value chain does not

automatically improve the cassava smallholders’

quality of life, but there is a room for improvement

by riding the dynamic of global value chain

governance. Information and communication

ACIR 2018 - Airlangga Conference on International Relations

294

technology could help farmers to improve the level

of complexity of transaction as well as increase

farmers’ ability to codify transaction by giving them

access to virtual market and the latest technology &

information about market needs.

A widely broadband infrastructure is a necessity

to create an ICT ecosystem for the farmer

communities (Stuart, 2004). Sangha (2010) adds the

importance of device penetration on the market.

Aleke (2010) adds the right application should be in

place to complete ICT ecosystem. Broadband

infrastructure deployment in farming area (rural)

could face a profitability problem, decreasing trend

of internet device price will automatically push the

device penetration, and there are a lot of internet

application in the market that provides the related

info on technology (from cultivation to after-harvest

processing) and last but not least is an adequate

training to use it (Sangha, 2010) and induction of

local context into the application (Aleke, 2010).

Given the potential of cassava value chain, there is

an opportunity for small farmer to shift their selling

product to a more advanced product along the value

chain by adopting the proper technology.

Government and business communities could help

them in technology adoption process and the form of

farmer association could strengthen their position in

many aspects.

It is concluded that global value chain (GVC)

inclusion increases domestic value added, especially

on the selling side, which holds across all income

levels. The results highlight the importance of policy

for economic upgrading through global value chain

integration. Although a causal evidence cannot be

claimed, all the assessed policy areas are

consistently shown to mediate the effects of global

value chains and magnify the gains for domestic

value added (Kummritz et al, 2017).

E-commerce is an alternative to promote

inclusive and integrated Global Value Chain. It can

be one of the best method to fix GVC. In order to do

that, we need to solve the problem from grassroots

level, because producers—in this case farmers—are

the center of gravity of fixing GVC. This will also

help the government to build the national economy

through villages. Fixing GVC can only be achieved

if every country can manage the National Value

Chains (NVC) within their own country.

For next research, a value chain analysis is

needed. Value chain analysis (VCA) is a detailed

description of a full range of activities and services

required to bring a raw product from its initial state

to a marketable commodity for delivery to final

customers (Kaplinsky & Morris, 2000). It is a simple

and systematic way of evaluating an existing chain

and assessing if a chain is viable. VC analysis allows

anyone to do a VC awareness to provide some

information to address the misinformation/

misconception and allow people to see where the

weak links are along the chain so the focus is on

those whilst capitalizing on strengths. VC analysis is

not only for farmers and retailers but also for policy-

makers. So it is more than just about analysis. It

should also lead to action and interventions,

preferably by the government.

REFERENCES

researchgate.net, (2009). GVC Participation Index for

Selected Non-OECD Economies. [online] Available at:

https://www.researchgate.net/figure/GVC-

participation-index-for-selected-non-OECD-

economies-2009_fig1_272498512 [accessed 7 June

2018]

ladanglima.com, (2018). About. [online] Available at:

http://www.ladanglima.com. [accessed 8 June 2018]

Aleke, B., Ojiako U., and Wainwright D. W. (2011). ICT

Adoption in developing countries; perspective from

small-scale agribusiness. Journal of Enterprise

Information Management, 24(1), pp. 68-84

Ant. (2017). Cuma Kantongi Skor 43.5, Indonesia Harus

Manfaatkan Peluang Global Value Chain. [online]

economy.okezone.com. Available at:

https://economy.okezone.com/read/2017/11/20/320/18

16999/cuma-kantongi-skor-43-5-indonesia-harus-

manfaatkan-peluang-global-value-chain [accessed 6

June 2018]

Bappenas. (2015). Strategic Direction for Indonesia.

Realising the Potential for Growth and Jobs. p 7

Canadian Trade Commissioner Service/CTCS. (2013).

Applying Global Value Chain: An Introduction for

SMEs

CIDP (Coconut Industry Development for the Pacific).

(2017). Workshop Report. Pacific Coconut Sector

Value Chain Workshop: Pacific Community

Contractor, F. J., Kumar, V., Kundu, S. K. and Pedersen,

T. (2010). Reconceptualizing the firm in a world of

outsourcing and offshoring: The organizational and

geographical relocation of high-value company

functions. Journal of Management Studies, 47, pp.

1417-1433

Dirgantoro, Kokok. (2017). Bodo Amat, Pokoknya

Indonesia Sampai Impor Singkong Itu Salah

Pemerintah. [online] mojok.co. Available at:

https://mojok.co/kokok-dirgantoro/esai/impor-

singkong/ [accessed 6 June 2018]

Gereffi, G and Luo, X. (2014). Policy Research Working

Paper. Risks and Opportunities of Participation in

Global Value Chain. P. 3

Gereffi, G. (2011). Global value chains and international

competition. The Antitrust Bulletin, 1(56), pp. 37-55

The Potential Benefits of Global Value Chain Inclusion on Indonesian Cassava Farmers

295

Gereffi, G., Humphrey, J., and Sturgeon, T. (2005). The

Governance of Global Value Chain. Review of

International Political Economy, 12(1), pp. 77-104

Humphrey, J., and Navas-Aleman, L. (2010). Value

Chains, Donor Intervention and Poverty Reduction: A

Review of Donor Practice. IDS Research Report, 63

Kaplinsky R. and Morris M. (2000). A Handbook for

Value Chain Research. Report for IDRC, 113 pp

Kaplinsky, R. (2000). Globalisation and uniqualisation:

What can be learned from value chain analysis. The

Journal of Development Studies, 37(2), pp. 117-146

Kummritz, Victor, et al. (2017). Economic Upgrading

through Global Value Chain Participation: Which

Policies Increase the Value Added Gains? Policy

Research Working Paper. World Bank Group: Trade

and Competitiveness Global Practice Group

Mangubhai Sangeeta, et al. (2016). Value Chain Analysis

of the Wild Caught Sea Cucumber Fishery in Fiji.

Wildlife Conservation Society and the Fiji Department

of Fisheries. Report No. 02/16. Suva, Fiji, 66 pp

Mudambi, Ram and Jonas Puck. (2016). A Global Value

Chain Analysis of the ‘Regional Strategy’ Perspective.

Journal of Management Studies, 53(6), pp. 1076-1093

Muslim, Ahmad. (2016). Skripsi: Prospek Ekonomi Ubi

Kayu di Indonesia. Fakultas Ekonomi Universitas Al

Azhar Indonesia

Nabhani, et al. (2015). Can Indonesia Cocoa Farmers Get

Benefit on Global Value Chain Inclusion? A Literature

Review. Asian Social Science, 11(18), pp 288-294

Richie and Cendani, Cindy. (2017). Memacu Laju UMKM

Indonesia: Strategi Menapaki Global Value Chain.

[online] kumparan.com. Available at:

https://kumparan.com/cindy-chyntia/memacu-laju-

umkm-indonesia-strategi-menapaki-global-value-

chain-1509120963055 [accessed 6 June 2018]

Sangha, A. S., and Rakshit, S. K. (2010). Role of ICT in

the Agriculture Sector: A Study of Progressive

Farmers, Malwa Region, Punjab India. Proceeding of

the AFITA 2010 International Conference

Stuart, L. (2005). Farmer Adoption of ICT in New

Zealand. The Business Review Cambridge, 3(2), pp.

191-197

Swadeshi, Noah Ikkyu. (2017). Apa itu Global Value

Chain (GVC). [online] himiespa.feb.ugm.ac.id.

Available at: http://himiespa.feb.ugm.ac.id/apa-itu-

global-value-chain-gvc/ [accessed 8 June 2018]

UN Conference on Trade and Development. (2013).

Global Value Chains and Development: Investment

and Value Added Trade in the Global Economy. A

preliminary analysis

Van der Vorst, J., Beulens, A., and van Beek, P. (2005).

Innovation in Logistics and ICT in Food Supply Chain

Network. Innovation in Agri-Food System, 10, pp.

245-292

Widaningsih, Roch. Outlook Komoditas Pertanian Sub

Sektor Tanaman Pangan: Ubi Kayu. 2016. Pusat Data

dan Sistem Informasi Pertanian Kementrian Pertanian

Yulianto, Agus. (2018). Startup yang Ekspor Singkong

Hingga ke Inggris. [online] republika.co.id. Available

at:

https://www.republika.co.id/berita/ekonomi/korporasi/

18/02/12/p41pl8396-starup-yang-ekspor-singkong-

hingga-ke-inggris [accessed 6 June 2018]

Zylberberg, E. (2013). Bloom or bust? A global value

chain approach to smallholder flower production in

Kenya. Journal of Agribusiness in Developing and

Emerging Economies, 3(1), pp. 4-26.

ACIR 2018 - Airlangga Conference on International Relations

296